When President Donald Trump Launched His Official Memecoin On January 17, 2025 - Just Tthree Days Before His Second Inauguration - The Token Achieved Something Remarkable And Troubling In Equal Measure.

Within hours of its debut, the TRUMP token skyrocketed to nearly $50 per coin, achieving a market capitalization that peaked at approximately $15 billion. The frenzy was immediate and intense. Small investors from Arkansas to North Carolina bought in, viewing the token as both a political statement of support and a potential financial windfall.

But the euphoria was short-lived. Within weeks, the token had collapsed to around $7, wiping out more than $12 billion in market value. According to analysis by blockchain forensics firm Chainalysis commissioned by the New York Times, approximately 813,294 cryptocurrency wallets collectively lost around $2 billion in the 19 days following the token's launch. Meanwhile, the Trump family and its partners accumulated nearly $100 million in trading fees from the venture, with the Trump Organization and affiliated entities controlling roughly 80 percent of the coin's total supply.

The Trump family's massive stake in a meme token known for its volatile status has raised concerns among financial experts about both ethics and investor protection. "In terms of investors, of course there's a huge red flag," Leonard Kostovetsky, associate professor of finance at Baruch College's Zicklin School of Business, told Fortune in January. "All of these memecoins don't really have any value beyond just what other people are willing to pay for them. They're pure bubbles."

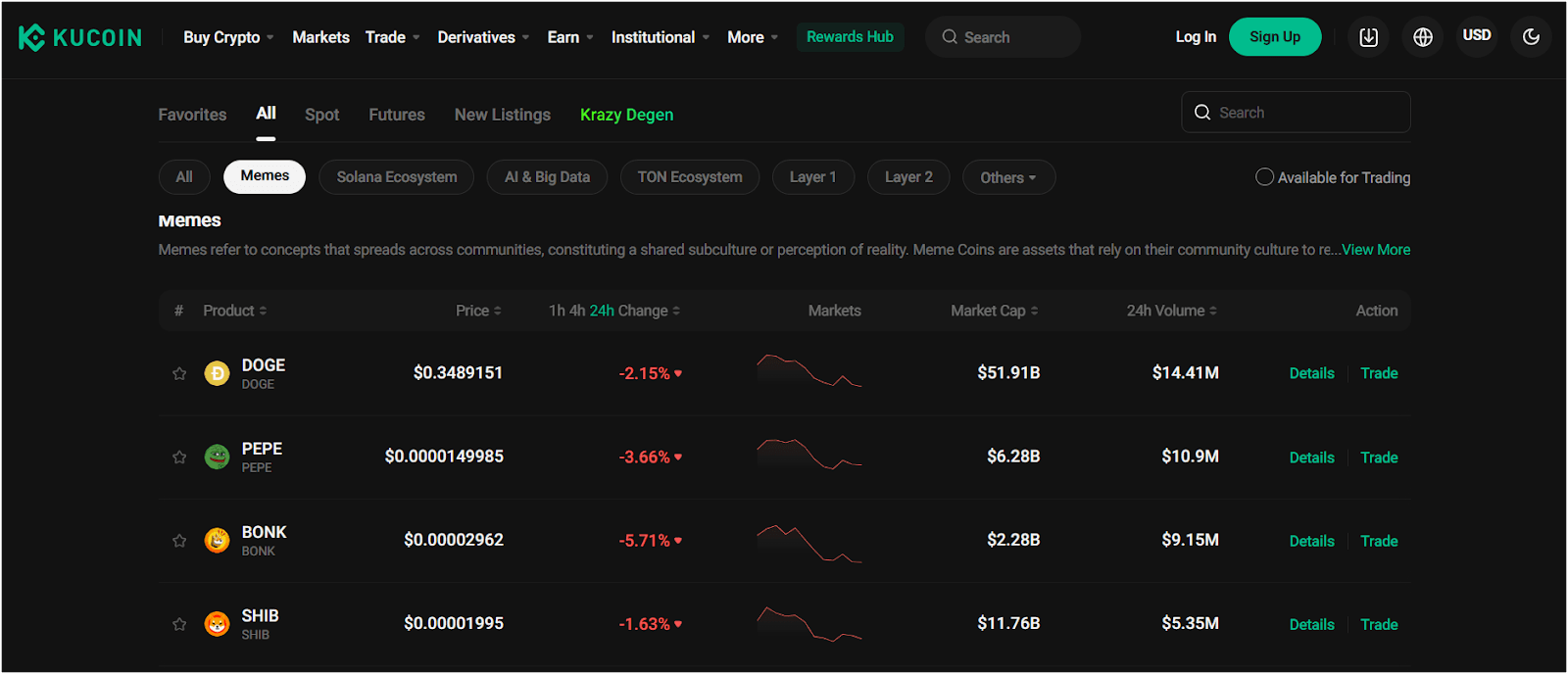

The Trump coin story mirrors a pattern that crypto market observers have witnessed repeatedly over the past five years. From Dogecoin's Elon Musk-fueled ascent in 2021 to the PEPE token mania of 2023 and the BONK surge on Solana, memecoins have followed a predictable lifecycle: explosive launch, viral adoption, celebrity or community endorsement, peak euphoria, and then a grinding decline that leaves the majority of holders underwater. Yet despite countless iterations of this cycle, memecoins persist as one of crypto's most enduring phenomena.

The Trump coin episode also raised unprecedented questions about conflicts of interest when political power intersects with crypto speculation. Timothy Massad, former chairman of the Commodity Futures Trading Commission and currently a Harvard senior fellow, argued that the structure created dangerous incentives. "I think there is a huge risk of conflicts of interest and corruption by virtue of the President and people associated with him selling crypto assets," Massad told BeInCrypto in March 2025. "It creates the potential for ongoing conflicts, because people who might want to curry favor with the administration could buy the coins."

This raises fundamental questions about the nature of these assets and their place in the evolving crypto ecosystem. Are memecoins merely speculative chaos - pump-and-dump schemes dressed up in internet culture? Or do they represent something more substantive: a new form of digital social capital, community building, and cultural expression that happens to have financial characteristics? As regulatory frameworks mature and the crypto industry enters its second decade, the answers to these questions will help determine whether memecoins evolve into sustainable community assets or fade as a cautionary tale about the intersection of finance and virality.

From Doge to Donald: Tracing the Evolution of Memecoins

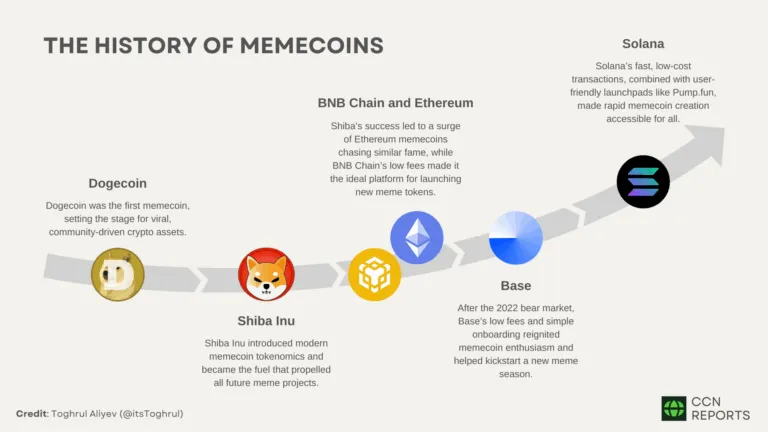

To understand where memecoins are headed, we must first understand where they came from. The origin story begins with Dogecoin, created in 2013 by software engineers Billy Markus and Jackson Palmer as a lighthearted parody of Bitcoin. Featuring the Shiba Inu dog from the popular "Doge" internet meme, the token was never intended to be taken seriously. It had no whitepaper promising revolutionary technology, no venture capital backing, and no roadmap toward utility. It was, quite literally, a joke.

For years, Dogecoin remained exactly that - a curiosity traded by enthusiasts for pennies, often used to tip content creators on social media. But in early 2021, something changed. Tesla CEO Elon Musk began tweeting about Dogecoin, calling it "the people's crypto" and posting memes that sent the token's price into orbit. During what many consider the first true memecoin supercycle, Dogecoin rose from under a penny to over seventy cents, driven largely by Musk's tweets and widespread retail adoption. Suddenly, a joke had created real millionaires - and sparked a gold rush.

The success of Dogecoin spawned an entire ecosystem of dog-themed tokens. Shiba Inu, launched in August 2020 and marketing itself as the "Dogecoin killer," rode the same wave to extraordinary heights. By October 2021, Shiba Inu had achieved a market capitalization exceeding $40 billion, making early investors wealthy beyond their wildest expectations. The formula was clear: combine an internet meme with accessible blockchain technology, add community enthusiasm and celebrity endorsement, and watch speculation do the rest.

But the memecoin phenomenon didn't stop with dogs. As crypto cycles have evolved, so too have the themes and narratives driving these tokens. The 2023 market saw the emergence of PEPE, a token based on Matt Furie's cartoon frog character that had become ubiquitous in internet culture. PEPE surged more than 2.5 percent in a single 24-hour period during its peak, outperforming the broader memecoin sector, demonstrating that the appetite for these assets extended far beyond canine mascots.

The Solana blockchain, with its high transaction speeds and low fees, became a particular hotspot for memecoin launches. BONK, a dog-themed token distributed through airdrops to Solana users, exemplified how blockchain-specific communities could rally around tokens as both financial assets and cultural symbols of their chosen ecosystem. Each successful memecoin launch validated the model and inspired hundreds of imitators, creating a self-perpetuating cycle of creation, speculation, and usually, collapse.

By 2024 and into 2025, memecoins had evolved again, this time incorporating political themes and artificial intelligence narratives. Tokens themed around political figures - not just Trump but also Biden, various senators, and international leaders - exploded in popularity during election cycles. The Trump coin itself represented the apex of this trend: a sitting president lending his name and image to a speculative digital asset that explicitly disclaimed any utility or long-term value proposition.

Throughout these evolutionary phases, one constant has remained: memecoins have always been driven more by social dynamics than by technological innovation or fundamental value. They exist at the intersection of internet culture, financial speculation, and community identity. Understanding this DNA is essential to predicting their future trajectory.

The Mechanics of Memecoin Mania: Tokenomics, Trading, and Tribal Dynamics

To understand why memecoins behave the way they do, we must examine their underlying economic structure and the trading infrastructure that enables their explosive volatility. Unlike established cryptocurrencies like Bitcoin or Ethereum, which have evolved complex ecosystems of miners, validators, developers, and institutional holders, memecoins typically launch with intentionally simple structures designed to maximize speculation.

The tokenomics - the economic design of the token - usually follow a familiar pattern. A large total supply, often in the billions or trillions of tokens, creates the psychological appeal of owning "millions" of something for a small initial investment. This abundance also facilitates the low per-unit prices that make memecoins accessible to retail investors with limited capital. The initial distribution often heavily favors insiders, with creators and early participants receiving substantial allocations. As was evident with the TRUMP token, data showed that the Trump Organization affiliated firm and related entities controlled 80 percent of the supply, creating an inherent imbalance of power that would define the token's trajectory.

This concentration of supply in the hands of a few wallets - often called "whales" - is both a feature and a bug of memecoin economics. On one hand, it allows creators to maintain influence over their projects and theoretically align incentives with long-term success. On the other hand, it creates the perfect conditions for what crypto traders call a "rug pull": a scenario where insiders dump their holdings onto unsuspecting retail buyers, crashing the price and walking away with profits while leaving the community holding worthless tokens.

The trading venues for memecoins have evolved significantly from the early days. While Dogecoin and Shiba Inu eventually secured listings on major centralized exchanges like Coinbase and Binance, most new memecoins launch on decentralized exchanges, or DEXs. Platforms like Uniswap on Ethereum, PancakeSwap on BNB Chain, and Jupiter on Solana allow anyone to create a trading pair and provide initial liquidity without the scrutiny and listing requirements of centralized venues. This accessibility is a double-edged sword: it democratizes token creation but also enables scams and low-quality projects to proliferate.

DEX trading is characterized by extremely low liquidity in the early stages, meaning that relatively small buy or sell orders can cause dramatic price swings. This volatility creates opportunities for savvy traders but devastating losses for those who buy at inflated prices. The memecoin trading ecosystem has also developed its own infrastructure of bots - automated programs that snipe new token launches, execute complex trading strategies, and sometimes manipulate prices through wash trading or coordinated buying.

Social media platforms have become the de facto trading floors for memecoins. Telegram groups, Discord servers, Reddit communities, and Twitter/X feeds serve as the primary venues where tokens are promoted, price movements are discussed, and community sentiment is shaped. This psychological shift - from financial transaction to cultural belonging - is what differentiates meme coins from traditional cryptocurrencies, as the metric that matters most is community traction rather than revenue or technological innovation.

The role of community cannot be overstated in memecoin dynamics. Unlike traditional assets where value derives from cash flows or utility, memecoin value is almost entirely social. The strength, enthusiasm, and cohesion of the holder community directly influence price movements. This creates feedback loops: rising prices attract new community members, which creates more buying pressure, which attracts even more members. When the cycle reverses - as it inevitably does - the same dynamics operate in reverse, with declining prices causing community fracture and selling pressure that accelerates the decline.

Understanding these mechanics helps explain why memecoins can experience thousand-percent gains followed by ninety-percent crashes in a matter of days or weeks. They exist in a state of perpetual instability, balanced precariously between community enthusiasm and market reality. Yet this very volatility is part of their appeal, particularly to younger traders who view traditional finance as inaccessible or rigged and see memecoins as a democratized form of speculation where anyone can participate.

The Sociology of Speculation: Why People Buy Memecoins

If memecoins lack fundamental value, utility, or technological innovation, why do people continue to buy them? The answer lies not in financial analysis but in psychology and sociology. Memecoins tap into powerful human drives that extend far beyond the desire for profit, though profit-seeking certainly plays a role.

At the most basic level, memecoins appeal to the fear of missing out, or FOMO - a psychological phenomenon that has been amplified to extreme levels by social media. When a token's price is climbing rapidly and social media feeds fill with stories of life-changing gains, the psychological pressure to participate becomes overwhelming. Fear of missing out, herd behavior, and the allure of quick profits have turned meme coins into a high-stakes game of social influence, with retail investors often young and tech-savvy drawn to these tokens. This dynamic creates cascading buying frenzies where rational analysis takes a backseat to emotional impulse.

But FOMO alone cannot explain the staying power of memecoin communities. More fundamentally, these tokens serve as vehicles for identity formation and tribal belonging in an increasingly digital world. Being part of a community like PEPE, LADYS, or SAMO is a source of pride, with being a whale in these tokens considered a badge of honor that is openly discussed, as holders are connected not just by a desire to profit but by strong social bonds and mutual agreements.

The accessibility and simplicity of memecoins compared to more technical cryptocurrency projects is also central to their appeal. Murad Mahmudov, a former Goldman Sachs analyst and prominent crypto influencer, has argued that memecoins represent the ideal entry point for mainstream crypto adoption. "People will first experience crypto through trading memecoins on exchanges," Mahmudov stated in a December 2024 interview with LBank exchange. "Memecoins are easy to understand, no whitepaper, technology, or restaking. It appeals to all demographics as memes are a universal language."

This social dimension is particularly important for younger generations who have come of age during economic uncertainty, rising inequality, and the fragmentation of traditional community structures. For many Generation Z crypto participants, memecoin communities fill a void left by declining participation in organized religion, civic organizations, and even in-person friendships. The shared language, inside jokes, and collective mission of "taking a token to the moon" create genuine social bonds that transcend mere financial interest.

Cultural evolution has given birth to what some observers call memecoin cults - semi-religious entities founded on social contracts and shared beliefs, where members don't need to know the price or chart to believe but simply need to share the idea and feel the community's support. This framing, while perhaps dramatic, captures something real about how these communities function. The language of faith, mission, and collective purpose permeates memecoin culture in ways that would seem absurd in traditional financial markets but make perfect sense in the context of online tribal dynamics.

The entertainment value of memecoins should not be underestimated either. For many participants, buying memecoins is less about traditional investing and more akin to gambling or fantasy sports - a form of entertainment with the added possibility of profit. The constant price action, community drama, celebrity endorsements, and viral moments create an ongoing spectacle that is inherently engaging. These tokens thrive on the playful and unpredictable side of crypto, where value is driven more by online buzz, viral moments, and community energy than by technology or utility, with volatility being part of their charm.

There is also an element of generational wealth transfer at play. Many younger memecoin enthusiasts view these tokens as one of the few available paths to significant wealth in an economy where home ownership feels unattainable and traditional investment vehicles offer modest returns. Memecoins, with their potential for ten-fold or hundred-fold gains, represent lottery-ticket upside in a system that otherwise seems stacked against them. This perspective - accurate or not - drives continued participation despite repeated warnings from regulators and countless examples of failed projects.

The parallels to the meme stock phenomenon of 2021, when retail traders on Reddit's WallStreetBets forum drove up shares of GameStop and AMC, are striking. Both movements share a populist, anti-establishment ethos, a belief in collective action over institutional expertise, and a willingness to embrace risk in pursuit of outsized returns. Both also demonstrate how social media has fundamentally altered market dynamics by enabling rapid coordination among dispersed individuals.

Critics might dismiss memecoin buyers as irrational or naive, but that analysis misses the complexity of what is actually happening. For many participants, memecoins serve multiple simultaneous purposes: they are speculative investments, yes, but also social clubs, political statements, forms of entertainment, and expressions of identity. Understanding this multifaceted appeal is essential to predicting whether memecoins will endure or fade.

How Governments Are Responding to Memecoin Mania

As memecoins have grown from niche curiosity to mainstream phenomenon, they have inevitably attracted regulatory attention. Governments and financial authorities worldwide face a challenging question: how should memecoins be classified and regulated, if at all? The answers emerging from different jurisdictions reveal competing philosophies about market freedom, investor protection, and the proper role of regulation in digital asset markets.

In the United States, the Securities and Exchange Commission has taken a surprisingly hands-off approach to pure memecoins. In February 2025, the SEC's Division of Corporation Finance released staff guidance stating that typical meme coins - cryptocurrencies inspired by internet memes, pop culture, or trending jokes - do not constitute securities under federal law, meaning transactions in these tokens need not be registered under the Securities Act of 1933. This determination marked a significant shift in the regulatory landscape.

The SEC's analysis applied the famous Howey Test, which defines securities as investments in a common enterprise with profits derived from the efforts of others. The SEC concluded that memecoins do not meet these criteria because those who purchase them are not financing a structured project, and there is no reasonable expectation of profit linked to the efforts of third parties, as their price is driven exclusively by speculation without a team working to ensure future profits.

This regulatory clarity came with important caveats. The staff emphasized that simply labeling a product as a memecoin will not excuse an offering that in economic reality involves a security, as the SEC will look to the substance of the transaction, meaning assets advertised as meme coins but entailing profit-sharing, ongoing development efforts, or other investment features remain subject to the full scope of securities regulation. The guidance applies only to genuine memecoins with no utility, no development roadmap, and no promises of returns.

Importantly, while the SEC will not regulate meme coins or combat fraud related to memecoin transactions, the statement stressed that market participants will not be protected from deceptive activities under federal securities laws, meaning purchasers and holders have no cause of action for misconduct or fraud under federal securities laws. This creates a regulatory void: memecoins are legal to create and trade, but buyers have limited recourse if they fall victim to scams.

The political dimension of memecoin regulation became particularly acute with the launch of Trump's token. US Democrats announced plans to introduce the Modern Emoluments and Malfeasance Enforcement Act, which would prevent senior government officials and their families from launching meme coins, with Representative Sam Liccardo stating that the Trump family's issuance of meme coins financially exploits the public for personal gain and raises concerns about insider trading and foreign influence. However, with Trump's return to the presidency and appointments of crypto-friendly officials, the likelihood of such legislation passing appears remote.

Across the Atlantic, the European Union has taken a more comprehensive regulatory approach through its Markets in Crypto-Assets Regulation, or MiCA. MiCA entered into force in June 2023 and began full application by December 2024, creating a unified legal framework that covers all crypto assets operating in the European Union regardless of where providers are registered. Unlike the US approach that exempts memecoins from securities regulation, MiCA applies broad requirements around transparency, disclosure, and consumer protection to virtually all crypto asset service providers.

Under MiCA, crypto asset service providers must publish whitepapers, secure licenses from their National Competent Authority, maintain robust operational resilience including data security and service continuity measures, and follow strict anti-money laundering protocols. While memecoins themselves may not be directly regulated as securities, the platforms that list them and facilitate their trading must comply with these extensive requirements. This creates a practical barrier to memecoin proliferation in Europe, as compliant exchanges may be reluctant to list tokens that carry high fraud risks.

The regulatory divergence between the US and EU approaches reveals competing visions for how to balance innovation with investor protection. The American approach emphasizes market freedom and caveat emptor - let the buyer beware - while accepting that some participants will lose money to scams. The European approach prioritizes consumer protection and systematic risk mitigation, even if that means constraining market experimentation.

Other jurisdictions are still determining their approaches. Asian markets, particularly Singapore and Hong Kong, have generally taken middle paths that attempt to encourage blockchain innovation while implementing safeguards against obvious fraud. The diversity of regulatory responses creates arbitrage opportunities, where memecoin projects can forum-shop for favorable jurisdictions, but it also fragments the global market in ways that may ultimately limit growth.

Looking ahead, the regulatory treatment of memecoins will likely evolve in response to high-profile failures and political pressure. The Trump coin collapse, with its massive investor losses and allegations of insider trading, could catalyze new enforcement actions or regulatory initiatives. Recent hints from the SEC about stricter oversight for social media-driven tokens add another layer of uncertainty for the sector. However, the fundamental challenge remains: how do you regulate assets that are explicitly designed to have no fundamental value and exist primarily as social phenomena? Traditional regulatory frameworks built around securities, commodities, and currencies struggle to classify these hybrid social-financial instruments.

How Trading Platforms Navigate the Memecoin Dilemma

While regulators debate frameworks, cryptocurrency exchanges face immediate practical decisions about which memecoins to list and under what circumstances. These platforms serve as crucial gatekeepers, and their listing policies significantly influence which tokens gain legitimacy and liquidity. The evolution of exchange practices around memecoins reveals the ongoing tension between profit maximization and risk management.

Major centralized exchanges like Binance, Coinbase, Kraken, and OKX have developed increasingly sophisticated listing frameworks. When the TRUMP token launched, major crypto exchanges including Coinbase and Binance quickly announced plans to list it, with Binance opening trading on the morning of January 19. This rapid listing of a high-profile but highly risky token illustrated how exchanges weigh various factors: trading volume potential, customer demand, regulatory risk, and reputational considerations.

The contrast with earlier political memecoins was stark, as the MAGA Political Finance fan token had trouble getting listed on major exchanges, with some platforms saying it was too political, but Trump's official memecoin faced no such barriers. This suggests that exchanges are willing to list controversial tokens when backed by sufficiently prominent figures, likely calculating that the trading volume and user acquisition potential outweigh reputational risks.

The listing process at major exchanges has become more rigorous over time as platforms have learned painful lessons from rug pulls and scams. Binance conducts significant due diligence on projects applying for listing, examining factors including the strength of the development team and clear vision, community support with large engaged user bases, and high trading volume across multiple exchanges. However, these standards are applied inconsistently, particularly for memecoins that can generate enormous trading volumes and thus substantial fee revenue for exchanges.

Most memecoins are not accepted by major centralized exchanges for not meeting safety and value standards, and are instead only available for trading on decentralized exchanges like PancakeSwap. This creates a two-tier system: a small number of memecoins that achieve mainstream exchange listings gain legitimacy and access to retail capital, while the vast majority remain confined to DEXs where they trade with minimal liquidity and oversight.

Coinbase, as a US publicly traded company subject to strict regulatory oversight, has generally taken a more conservative approach to memecoin listings than its international competitors. Coinbase prioritizes tokens with strong compliance records, US-friendly regulatory positioning, and public audits or regulatory disclosures. Yet even Coinbase has increasingly embraced memecoins, recognizing that these tokens drive substantial trading activity from retail users.

The mechanics of how tokens get listed on major exchanges have become an object of intense speculation and analysis among traders looking to identify the next big opportunity. Patterns show that Binance tends to lean into memecoin hype, while Coinbase focuses on assets it believes can clear SEC scrutiny, and following trending tokens listed on one major exchange often signals potential listings on others. This creates predictable price movements around listing announcements, with tokens often experiencing significant pumps when listed on tier-one exchanges.

However, listings are not permanent. Binance periodically reviews tokens and may apply risk labels or even delist projects that demonstrate instability, though coins like BONK and PEPE have seen such labels removed as they demonstrated growth and stability. This dynamic listing and delisting based on performance creates ongoing uncertainty for memecoin holders and reinforces the speculative nature of these assets.

The exchange listing game has become so central to memecoin economics that some projects explicitly design their launches around the goal of achieving tier-one exchange listings as quickly as possible. Teams coordinate social media campaigns, recruit influencers, and sometimes engage in wash trading to artificially inflate volume statistics - all to meet the criteria that exchanges use in their evaluation processes. This creates a perverse dynamic where appearances matter more than substance, rewarding projects that excel at marketing and manipulation rather than building genuine utility.

Analytics and compliance firms have emerged to serve exchanges navigating these challenges. Companies like Chainalysis, Elliptic, and CipherTrace provide blockchain forensics services that help exchanges identify suspicious activity, track token holder concentration, and assess rug pull risks before listing decisions. Yet even with these tools, exchanges continue to list tokens that subsequently collapse, either because the analytical tools have limitations or because the profit potential outweighs the identified risks.

The exchange industry's approach to memecoins ultimately reflects a pragmatic calculation. These tokens generate massive trading volumes during their hype cycles, which translates directly to fee revenue for platforms. The risks of listing dubious projects - regulatory scrutiny, user losses, reputational damage - must be weighed against the competitive pressure to capture this lucrative trading activity. In practice, most exchanges have decided that the rewards justify the risks, particularly when legal disclaimers can shield them from liability for user losses.

Can Memecoins Evolve Into Something Sustainable?

As the memecoin phenomenon enters its second decade, a crucial question emerges: can these tokens evolve beyond pure speculation into assets with genuine utility and sustainability? Or are they inherently transient, destined to cycle through periods of mania and collapse until broader market fatigue sets in?

There are emerging signs that some memecoin projects are attempting to build sustainable ecosystems that extend beyond mere speculation. The most successful memecoins have begun adding utility features while maintaining their cultural appeal. Dogecoin, for instance, has been integrated as a payment method by various merchants and has been accepted at Tesla for certain products, giving it at least nominal utility beyond speculation. Shiba Inu has developed an entire ecosystem including a decentralized exchange called ShibaSwap, NFT collections, and even metaverse ambitions, attempting to transform from a simple memecoin into a broader blockchain platform.

More recent projects have launched with utility baked in from the start. Some memecoins now offer staking mechanisms that provide yield to holders, governance features that give token holders voting rights on project decisions, and integration with decentralized finance protocols that enable lending, borrowing, or liquidity provision. These features attempt to address the criticism that memecoins are valueless by creating actual use cases beyond mere holding and trading.

Projects like BRETT on Coinbase's Base blockchain have attracted over 860,000 holders with fixed supply and airdrop strategies creating a defensible tokenomics model, while Pudgy Penguins has leveraged its NFT ecosystem to create a hybrid of cultural appeal and utility, with its 300 percent price surge driven not just by speculation but by a growing network of merchandise, games, and social media engagement. These examples suggest that memecoins can evolve into broader cultural brands with revenue streams beyond token appreciation.

The concept of "community tokens" represents perhaps the most promising evolution of the memecoin model. Rather than being pure speculation vehicles, community tokens could serve as membership credentials, governance mechanisms, and value-capture systems for online communities. Imagine a popular content creator whose token grants holders access to exclusive content, voting rights on creative decisions, and a share of advertising revenue. This would blend the viral appeal and community dynamics of memecoins with tangible utility and sustainable economics.

As one analysis of the memecoin supercycle noted, successful memecoin communities function almost like cults or religions for Generation Z, addressing not just financial challenges but providing belonging and purpose, with members voluntarily creating better marketing content than paid teams at traditional altcoin projects. If this social energy could be channeled toward projects with actual products or services, the result might be sustainable businesses rather than pure speculation bubbles.

However, significant obstacles stand in the way of memecoin evolution. First, the very characteristic that makes memecoins appealing - their simplicity and lack of pretense - is compromised when utility is added. Part of the memecoin ethos is a rejection of the technobabble and false promises of traditional blockchain projects. Adding genuine utility risks turning memecoins into just another class of utility tokens, losing the cultural distinctiveness that drives community formation.

Second, the economics of memecoins work against sustainability. A 2025 analysis warned that 70 percent of memecoins fail to retain value beyond six months, with rug pulls and scams costing investors over $6 billion in 2025 alone. The concentration of supply among insiders, the thin liquidity, and the speculative psychology of memecoin trading create structural instabilities that make long-term survival difficult regardless of utility additions.

Third, regulatory pressure may increase rather than decrease over time. While current US policy exempts pure memecoins from securities regulation, tokens that add utility features like governance or revenue sharing may inadvertently transform themselves into securities, triggering registration requirements and compliance burdens. This creates a regulatory catch-22: remaining a simple memecoin means avoiding regulation but also avoiding sustainability; adding utility means potentially becoming more sustainable but also potentially triggering regulatory obligations.

Despite these challenges, there is reason to believe some form of memecoins will persist. The underlying dynamics that drive their creation - the democratization of token launching, the power of viral marketing, the appeal of community belonging - are not going away. What may change is the market's sophistication and selectivity. Just as the internet boom of the late 1990s eventually evolved from indiscriminate speculation to more discerning investment focused on companies with actual business models, the memecoin market may mature toward projects that combine cultural appeal with genuine value creation.

Looking toward 2026 through 2030, several scenarios seem plausible. In the optimistic scenario, a small number of memecoins successfully transition into sustainable community-owned platforms with real products and services. These survivors might pioneer new models of creator economies, community governance, and social-financial integration. The vast majority of memecoins would still fail, but the few successes would validate the category and demonstrate that viral community energy can be channeled into lasting enterprises.

In the pessimistic scenario, mounting regulatory pressure, investor exhaustion, and continued high-profile failures gradually erode interest in memecoins. New token launches generate less excitement, trading volumes decline, and capital rotates toward other crypto sectors or traditional assets. Memecoins become seen as a historical curiosity of the 2020s, much like the ICO boom of 2017 is now viewed - a speculative mania that briefly captured attention before fading.

The most likely scenario probably falls between these extremes. Memecoins will persist as a permanent feature of crypto markets, but in a more mature and stable form. The explosive mania cycles may become less frequent and intense as participants learn from repeated boom-bust cycles. Projects with strong communities, transparent tokenomics, and at least modest utility claims will achieve moderate longevity. The sector may settle into a pattern where a few major memecoins like Dogecoin maintain stable communities, while a constant churn of new tokens provides speculative opportunities for risk-tolerant traders who understand the game they are playing.

What Trump Coin Teaches Us About the Future

The Trump coin collapse, with its billions in investor losses and uncomfortable questions about conflicts of interest, serves as both cautionary tale and revealing case study. It illustrates in concentrated form all the key dynamics of the memecoin phenomenon: the power of celebrity endorsement, the FOMO-driven buying cascades, the extreme concentration of supply among insiders, the rapid cycle from euphoria to despair, and the ultimate transfer of wealth from retail participants to those who understood the game.

What makes the Trump coin story particularly significant is not that it collapsed - that is par for the course in memecoin markets - but rather the scale and speed of the wealth destruction and the political dimensions that made the episode impossible to ignore. When a sitting US president launches a token that wipes out $12 billion in retail investor wealth within weeks while his family collects $100 million in fees, it forces a broader reckoning about what memecoins represent and whether they serve any socially beneficial purpose.

For critics, the Trump coin debacle validates longstanding concerns that memecoins are simply wealth transfer mechanisms that exploit financially unsophisticated participants through viral marketing and FOMO psychology. The lack of utility, the insider token allocation, the explicit disclaimers that the token should not be viewed as an investment - all of these characteristics scream caveat emptor. From this perspective, the appropriate policy response is aggressive enforcement against fraud and market manipulation, combined with education campaigns warning retail investors about the extreme risks of memecoin speculation.

For defenders and participants, the Trump coin collapse is simply the latest iteration of a familiar cycle that everyone who enters crypto markets should understand. Memecoins are high-risk, high-volatility assets that have made some participants extraordinarily wealthy while wiping out others. This is not a secret; it is the defining characteristic of the asset class. The appropriate policy response, from this view, is not paternalistic regulation but continued education combined with personal responsibility. Adults should be free to speculate on memecoins if they choose, fully aware of the risks.

The truth, as usual, lies somewhere between these poles. Memecoins do serve certain legitimate purposes: they democratize participation in token creation and trading, they provide community formation mechanisms for the internet age, and they serve as accessible entry points into crypto for people intimidated by the technical complexity of other tokens. At the same time, the sector is rife with manipulation, information asymmetries, and wealth extraction that harms vulnerable participants.

The evolution of memecoins will ultimately depend on how these competing dynamics resolve. If projects can successfully add utility and sustainability while maintaining cultural appeal and community energy, memecoins may transform into a genuinely new class of social-financial assets. If regulatory pressure intensifies and investor sophistication improves, the worst scams and most exploitative practices may be curbed even as the legitimate uses persist. If neither of these things happens, memecoins will likely continue in their current form - a Wild West of speculation that periodically produces spectacular gains and devastating losses in equal measure.

For investors contemplating participation in memecoin markets, the lessons are clear. Understand that these are among the riskiest assets in an already risky crypto sector. The vast majority of participants lose money, and the gains of the few come directly from the losses of the many. If you choose to participate, limit exposure to amounts you can afford to lose completely, be deeply skeptical of all marketing claims, and recognize that timing and luck matter more than analysis. Most importantly, never confuse community enthusiasm with fundamental value, and always remember that viral momentum can reverse with shocking speed.

For the crypto industry more broadly, memecoins represent both opportunity and threat. On one hand, they demonstrate crypto's unique ability to blend technology, culture, and finance in novel ways that resonate with younger generations. They prove that blockchain technology enables new forms of social coordination and value creation that simply were not possible before. On the other hand, the frequent rug pulls, scams, and spectacular failures associated with memecoins reinforce negative perceptions of crypto as lawless and predatory, potentially hindering mainstream adoption of more legitimate blockchain applications.

The coming years will reveal whether memecoins can evolve beyond their current form into something more constructive and sustainable. The raw ingredients are present: genuine community energy, viral marketing capabilities, and technological platforms that enable instant global coordination. What remains to be seen is whether these ingredients can be combined into recipes that create lasting value rather than just transferring it from the many to the few. The Trump coin collapse suggests the challenge is formidable, but the persistent appeal of memecoins suggests the experiment will continue regardless. In crypto's chaotic ecosystem of innovation and speculation, memecoins remain both symptom and symbol of an industry still figuring out what it wants to become.