In October 2025 [Grayscale Investments marked a watershed moment[(https://yellow.com/research/grayscale-gdlc-etf-approval-the-complete-analysis-of-the-first-multi-crypto-fund-launch) In The Institutional Adoption Of Cryptocurrency. The World's Largest Digital Asset Investment Platform Announced That Its Ethereum Trust ETF (ETHE), Ethereum Mini Trust ETF (ETH), And Solana Trust (GSOL) Had Cecome The First U.S.-listed Spot Crypto Exchange-Traded Products To Enable Staking.

For an industry accustomed to navigating regulatory headwinds, this development represented more than a product enhancement. It signaled a fundamental shift in how U.S. regulators view one of blockchain's most essential mechanisms for network security and passive income generation.

The announcement came after years of regulatory tension, enforcement actions, and false starts. Just two and a half years earlier, in February 2023, the Securities and Exchange Commission had forced crypto exchange Kraken to pay a $30 million penalty and shut down its U.S. staking operations, citing violations of securities law.

SEC Chair Gary Gensler had warned the entire industry that staking-as-a-service constituted unregistered securities offerings, effectively drawing a red line that chilled innovation and pushed staking activity offshore. Now, suddenly, that red line had been erased. Grayscale's launch was not just about adding a feature to existing products. It represented the culmination of regulatory evolution, technological maturation, and mounting institutional pressure that has transformed staking from a compliance liability into an acceptable mainstream investment strategy.

This article explores the forces that enabled Grayscale's historic achievement, the regulatory framework that made it possible, the operational complexities institutions must navigate, and what this development means for the future of crypto asset management. Understanding this transition requires examining the intersection of policy, technology, and market dynamics - and recognizing that what happened on October 6, 2025, was years in the making.

Why Staking Was a Regulatory Sticking Point

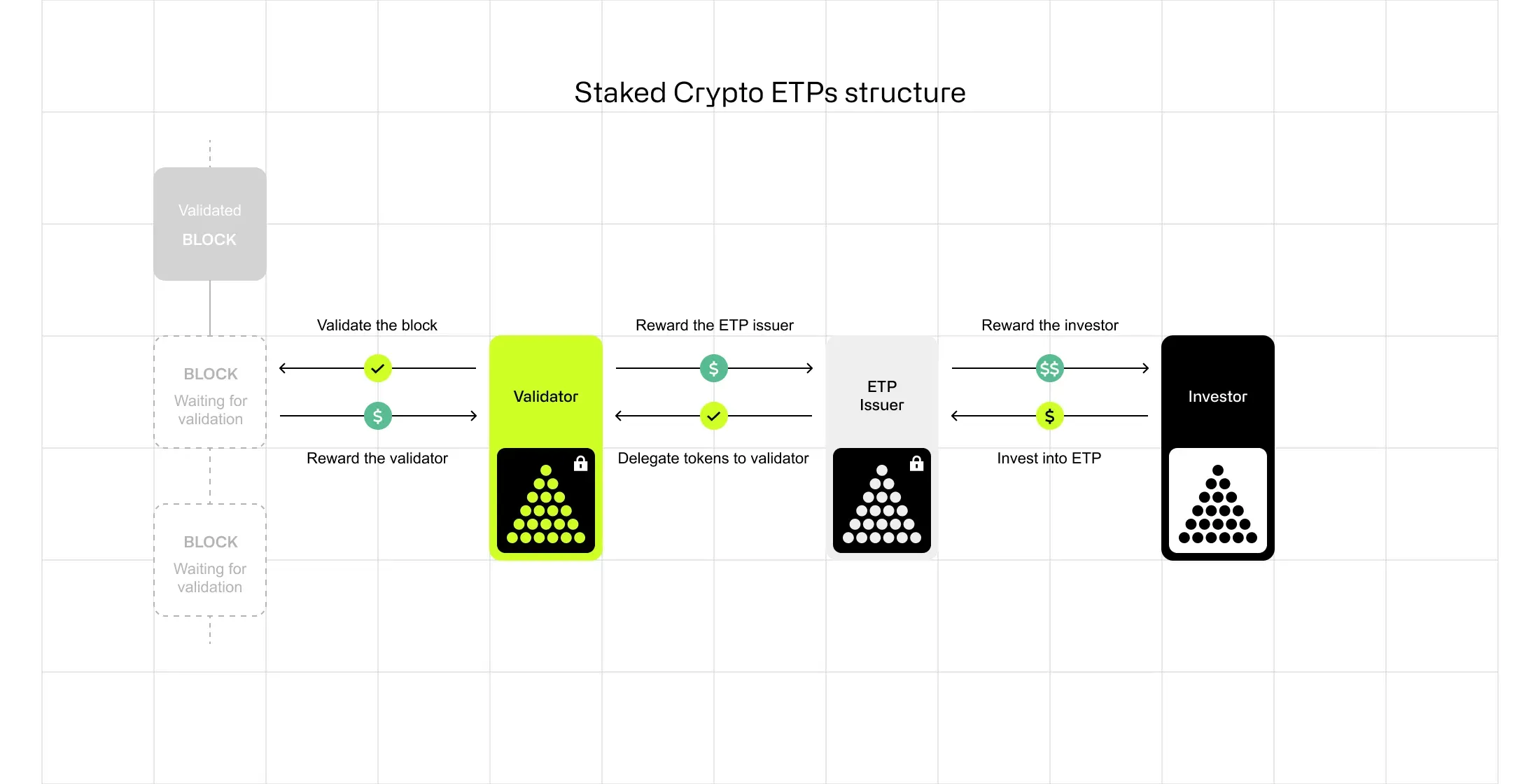

To understand the significance of Grayscale's October 2025 launch, we must first grasp what staking is and why regulators viewed it with such suspicion. Staking is the process by which participants in proof-of-stake blockchain networks commit their cryptocurrency tokens as collateral to validate transactions and secure the network. Unlike proof-of-work systems like Bitcoin, which rely on computational puzzle-solving, proof-of-stake networks like Ethereum and Solana select validators based on the amount of cryptocurrency they have locked up, or "staked," in the protocol. Validators who follow the rules earn rewards in the form of newly minted tokens and transaction fees. Those who attempt to manipulate the system risk having their staked assets reduced or "slashed" as a penalty.

For individual token holders, staking offers a way to earn passive yield - typically ranging from 2% to 8% annually depending on the network - while contributing to blockchain security. The mechanism has become central to how modern blockchain networks operate. Ethereum transitioned from proof-of-work to proof-of-stake in September 2022 through an upgrade known as "The Merge," and approximately 28% of all circulating ETH is now staked.

Solana, which launched as a proof-of-stake network in 2020, has more than 50% of its circulating supply actively staked. These high participation rates reflect both the economic incentives and the technical necessity of staking for network functionality.

Yet from the SEC's perspective prior to 2025, staking presented a regulatory problem. The Commission's concerns centered on three interrelated issues: securities classification, custody risks, and yield disclosures. When intermediaries - exchanges, custodians, or investment platforms - offered to stake customer assets on their behalf in exchange for a share of the rewards, the SEC viewed this arrangement through the lens of the Howey Test, the Supreme Court precedent that defines an investment contract. Under Howey, an arrangement constitutes a security if it involves an investment of money in a common enterprise with an expectation of profits derived from the efforts of others.

The SEC argued that when customers transferred tokens to a platform like Kraken and expected to receive staking rewards generated through the platform's validator operations, they were participating in an investment contract.

The customer was investing money (cryptocurrency), pooling it with others in a common enterprise (the platform's staking infrastructure), expecting profits (staking rewards), derived from the efforts of others (the platform's validator management, node operation, and technical expertise). SEC Chair Gary Gensler articulated this view publicly in September 2022, stating that staking through an intermediary "looks very similar - with some changes of labeling - to lending."

The Commission's February 2023 enforcement action against Kraken crystallized these concerns into regulatory doctrine. According to the SEC's complaint, Kraken had been offering staking services to retail investors since 2019, advertising returns as high as 21% annually. The platform pooled customer crypto assets and staked them on various proof-of-stake networks, distributing rewards to customers while retaining a commission. The SEC charged that these activities constituted unregistered securities offerings because Kraken failed to provide the disclosures required under the Securities Act of 1933, leaving investors without adequate information about risks, fees, and the platform's operations.

The settlement required Kraken to immediately cease all staking services in the United States and pay $30 million in penalties. In televised interviews following the announcement, Gensler issued a stern warning to the broader industry. "Those other platforms should take note of this and seek to come into compliance," he told CNBC, adding that companies offering staking needed to "do the proper disclosures and registration." When asked whether staking services generally violated securities laws, Gensler suggested that platforms could theoretically register their staking programs with the SEC, though he provided little guidance on how to do so or what such registration would entail.

The Kraken settlement sent shockwaves through the crypto industry. Coinbase's CEO Brian Armstrong publicly questioned whether the SEC's approach would ban staking entirely for American retail investors. Commissioner Hester Peirce, one of the SEC's most crypto-friendly voices, issued a scathing dissent, calling the settlement "paternalistic and lazy."

She criticized the agency for shutting down a program that had "served people well" rather than working to develop a registration framework that would allow staking to continue with proper disclosures. "Most concerning," Peirce wrote, "is that our solution to a registration violation is to shut down entirely a program that has served people well."

The enforcement action created immediate operational challenges for crypto platforms and asset managers. Several exchanges curtailed or geographically restricted their staking offerings. When spot Ethereum ETF applications began flooding into the SEC in early 2024, issuers initially included staking provisions in their proposals. BlackRock's iShares Ethereum Trust filing, for example, contemplated the possibility of staking the ETF's ETH holdings to generate additional returns for shareholders.

However, as the SEC review process unfolded, it became clear that staking remained a third rail. By the time Ethereum ETFs finally launched in July 2024, every issuer had amended their filings to explicitly state that they would not engage in staking. BlackRock's approved filing contained language affirming that the trust would not "directly or indirectly, engage in any action where any portion of the Trust's ETH becomes subject to the Ethereum proof-of-stake validation or is used to earn additional ETH or generate income."

This created an awkward situation. Ethereum ETFs offered investors exposure to ETH's price movements through a regulated, traditional brokerage account - a significant achievement. Yet they deliberately excluded the yield component that is intrinsic to how modern Ethereum operates. It was akin to launching a dividend stock ETF while prohibiting the fund from collecting dividends. Industry observers recognized this as a compromise born of regulatory necessity rather than investment logic. Robbie Mitchnick, BlackRock's head of digital assets, publicly stated in March 2025 that Ethereum ETFs were "less perfect" without staking capabilities. The question was not whether staking would eventually be permitted, but when - and what would need to change to make it possible.

The Turning Point: What Changed in 2025

The path from the February 2023 Kraken enforcement action to Grayscale's October 2025 staking launch was neither straight nor certain. It required shifts in SEC leadership, evolving legal interpretations, industry pressure, and ultimately, formal guidance that redrew the boundaries of what the agency considered to be securities activities. The transformation unfolded across multiple dimensions: political, legal, and operational.

The political dimension began with the 2024 U.S. presidential election and its aftermath. While the SEC is nominally an independent agency, changes in presidential administrations inevitably influence regulatory priorities. Gary Gensler had been appointed SEC Chair by President Joe Biden in April 2021 and had quickly established a reputation as crypto's most formidable regulatory adversary. Under his leadership, the SEC brought enforcement actions against major exchanges, challenged the securities status of numerous tokens, and maintained a generally skeptical posture toward crypto innovation. However, following the transition to a new administration in January 2025, pressure mounted for a recalibration of the SEC's approach.

By spring 2025, several factors converged to create momentum for regulatory change. The successful launch of spot Bitcoin ETFs in January 2024 had demonstrated institutional appetite for crypto exposure through traditional investment vehicles. Those Bitcoin ETFs collectively attracted more than $35 billion in assets under management within their first year, representing one of the most successful ETF launches in history.

Ethereum ETFs followed in July 2024, though their inability to offer staking yields dampened investor enthusiasm - they attracted only about $2.4 billion in net inflows through early 2025, according to data from Farside Investors. Industry participants argued publicly and in regulatory filings that the prohibition on staking placed U.S. products at a competitive disadvantage relative to European and Asian offerings that already incorporated yield generation.

Congressional sentiment also shifted. Multiple bills aimed at providing regulatory clarity for digital assets made progress through committee processes. While comprehensive crypto legislation remained politically challenging, the general thrust was toward establishing clearer frameworks rather than maintaining enforcement-by-examination. The Commodity Futures Trading Commission began coordinating more openly with the SEC on jurisdictional questions, reducing some of the inter-agency friction that had complicated previous policy initiatives.

The legal dimension involved a fundamental reassessment of how staking activities fit within securities law. This reassessment culminated in a groundbreaking statement issued on May 29, 2025, by the SEC's Division of Corporation Finance. Titled "Statement on Certain Protocol Staking Activities," the document represented the clearest regulatory guidance the crypto industry had received on staking since the Kraken settlement two years earlier.

The statement analyzed staking through the lens of the Howey Test and concluded that certain categories of staking - specifically those the document termed "Protocol Staking Activities" - did not constitute securities transactions requiring registration.

The Division's analysis focused on the fourth prong of the Howey Test: whether participants have a reasonable expectation of profits derived from the entrepreneurial or managerial efforts of others. The statement concluded that in properly structured staking arrangements, rewards are derived from the administrative or ministerial act of validating network transactions according to algorithmic rules, not from entrepreneurial decision-making by third parties.

The Division identified three acceptable staking models. Self-staking (also called solo staking) occurs when a token holder runs their own validator node, maintaining complete control over their assets and technical operations. Self-custodial staking involves delegating validation rights to a third-party node operator while retaining ownership and control of the underlying tokens. Custodial staking allows a custodian to take custody of tokens and stake them on behalf of the owner, provided the custodian acts purely as an agent following the owner's instructions rather than exercising discretionary control.

Critically, the statement addressed "ancillary services" that platforms might offer alongside staking. These included slashing insurance (protecting against penalties for validator misbehavior), early unbonding (allowing withdrawals before the protocol's natural unstaking period), modified reward payment timing, and aggregation services (pooling assets to meet minimum staking thresholds).

The Division concluded that these services, when offered in connection with Protocol Staking Activities, remained administrative or ministerial in nature and did not convert staking into an investment contract. This was significant because it meant that institutional custodians could offer sophisticated risk management and operational conveniences without triggering securities registration requirements.

Commissioner Hester Peirce, in her statement accompanying the Division's guidance, praised the clarity it provided. "Today, the Division of Corporation Finance clarified its view that certain proof-of-stake blockchain protocol 'staking' activities are not securities transactions within the scope of the federal securities laws," Peirce wrote.

She noted that previous regulatory uncertainty had "artificially constrained participation in network consensus and undermined the decentralization, censorship resistance, and credible neutrality of proof-of-stake blockchains." Her endorsement signaled that the guidance had support from at least some commissioners, though dissenting views from other commissioners suggested the policy remained contested internally.

The May 2025 statement was not the end of the SEC's guidance. On August 5, 2025, the Division of Corporation Finance issued a follow-up statement addressing liquid staking - a variation in which users receive tradable tokens (liquid staking tokens or LSTs) representing their staked assets. Liquid staking had become increasingly popular because it solved a fundamental problem: when users stake tokens directly through protocols, those assets are typically locked for a period during which they cannot be transferred or sold.

Liquid staking protocols issue receipt tokens that can be traded immediately, allowing users to maintain liquidity while still earning staking rewards. The August statement clarified that these arrangements, too, fell outside securities regulation when properly structured, as the receipt tokens represented ownership of the deposited assets rather than deriving value from managerial efforts.

These statements did not mean the SEC had abandoned all scrutiny of staking. The Division was careful to limit its guidance to activities involving "Covered Crypto Assets" - tokens that are intrinsically linked to the operation of public, permissionless networks and do not have inherent economic rights or claims to future income of a business enterprise.

The guidance did not extend to arrangements where platforms exercised discretion over when or how much to stake, guaranteed returns, or combined staking with other financial services like lending. Platforms that bundled staking with yield farming, proprietary trading strategies, or re-hypothecation of customer assets remained potentially subject to securities laws. Nevertheless, the boundaries were now clearer than they had been at any point since proof-of-stake networks emerged as viable alternatives to proof-of-work.

Beyond the formal guidance, operational realities also shifted. In early 2025, the SEC quietly dropped staking-related allegations from its ongoing litigation against Coinbase, effectively retreating from the broad position Gensler had staked out in the Kraken settlement. While the agency did not issue a public explanation, market participants interpreted this as a signal that internal thinking had evolved. Bloomberg Intelligence analyst James Seyffart noted in April 2025 that staking approval for Ethereum ETFs could come "as early as May," though he cautioned that the process might extend through the end of the year as the SEC worked through procedural questions and potential tax implications with the IRS.

By summer 2025, the dam had broken. Major ETF issuers including BlackRock, Fidelity, Franklin Templeton, 21Shares, VanEck, and Grayscale all filed amendments seeking approval to add staking capabilities to their Ethereum products. The filings were remarkably similar in structure, reflecting careful coordination with the SEC's guidance.

Each specified that staking would occur through institutional custodians and diversified validator networks, that rewards would flow to the fund's net asset value, and that the arrangements would comply with the Protocol Staking framework outlined in the Division's May statement. The SEC extended review deadlines multiple times through September and early October, suggesting intensive behind-the-scenes discussions about operational details, disclosure requirements, and accounting treatment.

Grayscale emerged from this review process first - not because it had any special regulatory advantage, but because its products were not structured as registered investment companies under the Investment Company Act of 1940. ETHE and ETH, though traded on exchanges, are technically commodity trusts exempt from '40 Act registration.

This meant they operated under a slightly different regulatory framework than traditional ETFs, potentially allowing for faster implementation of staking once the underlying securities-law questions were resolved. On October 6, 2025, Grayscale announced that staking was live across its Ethereum and Solana products, managing a combined $8.25 billion in assets. The company noted it had already staked more than 40,000 ETH, representing a significant commitment of capital to validator infrastructure.

Grayscale's Implementation: How the Staking ETPs Actually Work

Grayscale's launch was not merely about flipping a regulatory switch. It required sophisticated operational infrastructure, careful selection of custodial partners, and transparent communication with investors about how staking would affect fund performance and risk profiles. The company's approach offers a template for how institutional staking products can be structured within the regulatory framework established by the SEC's 2025 guidance.

At the core of Grayscale's staking operations are three distinct layers: custody, validation, and reward distribution. The custody layer involves institutional-grade digital asset custodians that hold the ETH and SOL backing the trusts.

While Grayscale has not publicly disclosed all its custodial partners for the staking program, industry standards suggest these are likely qualified custodians such as Coinbase Custody, Anchorage Digital, or BitGo - the three institutions that dominate institutional crypto custody in the United States. These custodians maintain private key management systems, cold storage protocols, insurance coverage, and regulatory compliance infrastructure designed to protect billions of dollars in digital assets.

The validation layer determines how staked assets actually participate in blockchain consensus. Rather than operating its own validator nodes, Grayscale works with what it describes as "a diversified network of validator providers." This approach serves multiple purposes. From a risk management perspective, distributing stake across numerous validators reduces exposure to any single point of failure.

If one validator experiences downtime or technical issues, the impact on overall staking rewards is minimized. From a decentralization perspective, spreading stake among many validators supports network health by avoiding excessive concentration of validation power. From a compliance perspective, using established, institutional-grade validators with proven track records addresses potential concerns about operational risk and security.

Validator selection is not random. Institutional staking requires validators that meet stringent criteria for uptime (validators must be online and responsive to validate blocks), security (validator infrastructure must be protected against attacks), and regulatory compliance (validators must operate transparently and often under regulated entities). On Ethereum, validators must maintain at least 32 ETH staked and face slashing penalties if they validate conflicting transactions or remain offline for extended periods.

On Solana, validators compete for stake delegation based on performance metrics including vote credits (successful votes on finalized blocks) and commission rates. Grayscale's selection process likely involves ongoing monitoring of validator performance, periodic rebalancing of stake distribution, and contractual arrangements that define responsibilities and liabilities.

The reward distribution layer addresses how staking yields flow to investors. In Grayscale's model, staking rewards are not distributed as cash dividends or additional shares. Instead, they accrue to the trust's net asset value. This means that as the trust's ETH or SOL holdings earn staking rewards, the total assets under management increase, which in turn increases the value of each outstanding share proportionally.

For example, if ETHE holds 1 million ETH and generates a 3% annual staking yield, the trust would accumulate approximately 30,000 additional ETH over the course of a year. This additional ETH increases the NAV per share, benefiting all shareholders without requiring distributions or creating immediate tax events.

This accrual approach has several advantages for institutional investors. It simplifies accounting by avoiding the complexity of tracking numerous small distributions. It potentially defers tax liabilities, as shareholders only realize gains when they sell shares rather than on an ongoing basis as rewards are earned.

It also eliminates the need for reinvestment decisions - rewards automatically compound within the trust structure. However, it also means that the trust's management fee (Grayscale charges 0.25% annually for ETH and 2.5% for ETHE) is calculated on a larger and growing asset base, which effectively captures a portion of staking rewards as management fees.

Grayscale has been transparent about the risks and limitations of staking. The company published an educational report titled "Staking 101: Secure the Blockchain, Earn Rewards" concurrent with its staking launch. The report explains how staking works, why networks require it, and what participants should understand about yields and risks.

Key disclosures include the acknowledgment that staking yields are variable and depend on network conditions, validator performance, and the total amount of assets staked across the network. If network-wide staking participation increases significantly, yields for all stakers decrease proportionally as rewards are distributed across a larger pool.

The report also addresses slashing risk - the possibility that validators could lose a portion of staked assets due to protocol violations. While properly managed institutional validators have extremely low slashing rates, the risk is not zero. Technical failures, configuration errors, or coordinated attacks could result in penalties.

Grayscale's use of multiple validators helps mitigate this risk, as does the selection of established providers with strong operational track records. Some institutional custodians offer slashing insurance as an ancillary service, though the availability and cost of such insurance varies by provider and network.

Liquidity considerations are another important aspect of Grayscale's staking implementation. Unlike direct staking through protocols, where users must wait for an "unbonding period" (approximately 27 hours for Ethereum, one epoch or 2-3 days for Solana) before staked assets become liquid, Grayscale's ETF structure maintains continuous liquidity for investors. Shareholders can sell their ETHE or ETH shares on the exchange at any time during market hours, receiving the current market price.

The trust handles the operational complexity of managing staked and liquid asset pools to meet redemption demands. This is possible because not all trust assets need to be staked simultaneously - Grayscale can maintain a buffer of unstaked tokens to handle routine redemptions while keeping the bulk of assets staked to maximize yield.

Peter Mintzberg, Grayscale's Chief Executive Officer, framed the launch in terms of the company's longstanding positioning as a crypto innovation leader. "Staking in our spot Ethereum and Solana funds is exactly the kind of first mover innovation Grayscale was built to deliver," Mintzberg said in the October announcement. "As the #1 digital asset-focused ETF issuer in the world by AUM, we believe our trusted and scaled platform uniquely positions us to turn new opportunities like staking into tangible value potential for investors."

The statement reflected confidence that Grayscale's early move would attract assets from investors who had been waiting for yield-enhanced crypto products, potentially helping the company recapture market share it had lost to competitors like BlackRock and Fidelity in the spot Bitcoin ETF race.

Institutional Custody and Risk Management in the Staking Era

The operational complexities of staking at institutional scale extend far beyond simply locking tokens in a protocol. For custodians, asset managers, and the validators they work with, enabling staking within the regulatory framework requires sophisticated risk management, technological infrastructure, and compliance processes that go significantly beyond what retail staking platforms provide. Understanding these operational realities helps explain why institutional staking took years to emerge despite being technically possible from the moment proof-of-stake networks launched.

Custodial responsibility begins with the fundamental tension between security and accessibility. Traditional custody of digital assets follows the principle "not your keys, not your coins" - whoever controls the private keys effectively owns the assets.

Cold storage, where private keys are kept entirely offline on hardware devices or in secure facilities disconnected from any network, provides maximum security against hacking but makes assets inaccessible for real-time transactions. Hot wallets, which maintain private keys online for rapid transaction signing, enable operational flexibility but create attack surfaces that sophisticated hackers continually probe.

Staking complicates this security model because actively validating requires ongoing interaction with blockchain networks. Validators must sign attestations and propose blocks on regular schedules - every 12 seconds for Ethereum, continuously with rotating leadership for Solana. This necessitates hot wallet infrastructure that can sign validation messages without manual intervention. Yet institutional custodians must maintain the security standards their clients expect, including multi-party computation (where no single entity holds complete private keys), hardware security modules, and air-gapped signing ceremonies for certain operations.

The solution that has emerged involves segregation of responsibilities and tiered security architectures. Custodians like Anchorage Digital, which holds the distinction of being the only federally chartered crypto bank in the United States, maintain client assets in cold storage while delegating validation rights to carefully vetted node operators. The node operator receives the authority to sign validation messages on behalf of the staked tokens without gaining custody of the underlying assets.

This is accomplished through blockchain-level mechanisms that separate validation capabilities from ownership. On Ethereum, for example, validators have withdrawal credentials (which control asset ownership) and signing keys (which control validation operations). The custodian retains control of withdrawal credentials while the node operator manages only the signing keys needed for validation.

BitGo, which secures approximately 20% of all on-chain Bitcoin transactions by value and serves as custodian for numerous crypto ETFs, approaches institutional staking through what it calls a "100% cold storage" model combined with qualified custody structures. The company emphasizes that client assets remain protected by insurance policies (up to $250 million) even during active staking. BitGo's staking-as-a-service offering integrates with its existing custody infrastructure, allowing institutions to stake from the same wallets and accounts they use for holdings, with unified reporting and risk management. The platform supports both self-custody staking (where clients retain control of private keys) and qualified custody staking (where BitGo Trust Company serves as custodian under its New York state trust charter).

Coinbase Custody, which serves as custodian for many of the spot Bitcoin and Ethereum ETFs launched in 2024, has built extensive staking capabilities across multiple proof-of-stake networks. The platform supports native staking for Ethereum, Solana, Cardano, Polkadot, Cosmos, Avalanche, and numerous other networks. Coinbase Custody Trust Company is a fiduciary under New York state banking law and a qualified custodian for purposes of SEC rules, a status that provides regulatory certainty for institutional clients.

The custody platform maintains SOC 1 Type II and SOC 2 Type II audits conducted by Deloitte & Touche, providing third-party verification of control effectiveness. For staking specifically, Coinbase offers multiple models including traditional staking (with standard network unbonding periods), liquid staking (issuing receipt tokens), and dedicated validator options for large institutions that want control over their validation infrastructure.

Insurance represents a critical component of institutional risk management that distinguishes institutional staking from retail offerings. While blockchain protocols do not inherently insure participants against losses, institutional custodians have worked with insurance providers to develop coverage specifically for digital asset custody and staking operations. Coverage typically includes protection against theft of private keys, employee malfeasance, infrastructure failures, and certain types of hacking attacks. Insurance does not, however, generally cover market risk (price declines) or protocol-level slashing that results from validator misbehavior.

Slashing risk management involves both validator selection and technical safeguards. Slashing occurs on proof-of-stake networks when validators violate protocol rules - either through malicious behavior (such as signing conflicting attestations, sometimes called "double signing") or through operational failures (such as extended periods of downtime).

The penalties vary by network and severity. On Ethereum, minor slashing for downtime results in small penalties, while malicious slashing (provably signing conflicting attestations) can result in losing a substantial portion of staked ETH and forced ejection from the validator set. Solana's slashing implementation is currently less severe, though the protocol design allows for stricter penalties to be activated through governance decisions.

Institutional validators mitigate slashing risk through redundant infrastructure, extensive testing, and careful key management. Best practices include running backup validator nodes that can take over if the primary node fails, implementing "slashing protection" software that prevents validators from signing conflicting messages even under failure scenarios, and maintaining comprehensive monitoring to detect and respond to issues before they escalate.

Some validators offer slashing insurance as an ancillary service, effectively guaranteeing to reimburse clients for losses that occur due to the validator's operational failures. This insurance is distinct from custodial insurance and is typically provided by the validator or a specialized insurer working with validators.

Accounting and tax treatment of staking rewards remains an evolving area with significant implications for institutional investors. The fundamental question is whether staking rewards should be treated as income when received or whether they represent capital gains only when eventually sold. For many institutional investors, particularly regulated funds and corporate treasuries, this distinction affects reported earnings, tax liabilities, and financial statement presentation.

The IRS provided initial guidance in 2023 indicating that cryptocurrency received as staking rewards generally constitutes income at the time of receipt, valued at fair market value. This applies to direct staking rewards. However, the tax treatment becomes more complex for staking within trust structures like Grayscale's ETFs.

Because the trusts are grantor trusts for tax purposes, and because rewards accrue to NAV rather than being distributed, the precise tax timing and character of income has been subject to ongoing discussion between the industry and regulators. The SEC's Division of Corporation Finance acknowledged these complications in its May 2025 statement, noting that the IRS would need to provide clarity on certain aspects.

For institutional investors, the tax question influences product design and investment decisions. If staking rewards are immediately taxable as income, funds must ensure they have sufficient liquid assets to meet tax obligations even though rewards remain invested in the trust. If rewards are treated as increases in cost basis (taxable only upon sale), the accounting is simpler but may not reflect the economic reality that rewards represent compensation for validating transactions. Different investors may prefer different treatments depending on their tax status - tax-exempt entities like endowments and pension funds may be relatively indifferent, while taxable corporate investors may strongly prefer deferral.

Comparative Analysis: How the U.S. Approach Differs from Europe and Asia

Grayscale's October 2025 staking launch was groundbreaking in the U.S. context, but it was not unprecedented globally. European and Asian crypto ETPs had incorporated staking capabilities for years, reflecting different regulatory frameworks and policy priorities. Understanding these international differences illuminates both why U.S. institutions faced such prolonged obstacles and what competitive pressures ultimately helped drive regulatory change.

Europe's crypto regulatory landscape is shaped primarily by the Markets in Crypto-Assets Regulation (MiCA), which took effect in stages throughout 2024. MiCA established the first comprehensive regulatory framework for crypto assets across the European Union, creating uniform rules for issuers, trading platforms, and service providers. Unlike the U.S. approach, which relies heavily on applying existing securities laws developed for stocks and bonds, MiCA created crypto-specific categories and requirements.

The regulation distinguishes between asset-referenced tokens (stablecoins backed by reserves), e-money tokens (stablecoins equivalent to fiat currency), and utility tokens (all other crypto assets). Service providers including exchanges, custodians, and investment platforms must obtain authorization and comply with conduct-of-business rules, but the framework explicitly recognizes that many crypto activities fall outside traditional securities regulation.

For staking specifically, European regulators never took the broad position that staking-as-a-service constitutes securities offerings. Instead, staking has been treated primarily as an operational service that platforms provide, subject to general duties of care and disclosure but not requiring securities registration. This permissive approach allowed European crypto ETPs to incorporate staking from their inception. As early as 2021, 21Shares - a major European ETP issuer - launched products that included staking yields. The company's Solana Staking ETP (ticker ASOL), for example, has provided investors with both price exposure and staking rewards since its launch.

The 21Shares approach involves partnering with institutional custodians and validator networks, similar to what Grayscale now does in the U.S., but it benefited from operating in a regulatory environment where staking's legitimacy was never in serious question. The company has emphasized that staking aligns ETP returns more closely with the actual economic performance of the underlying blockchain networks.

"As institutional adoption of cryptoasset ETPs accelerates and regulatory clarity strengthens across Europe, we remain committed to expanding our product offerings to meet growing investor demand," said Mandy Chiu, Head of Financial Product Development at 21Shares, in March 2025 when the company expanded its Nordic offerings to Nasdaq Stockholm.

ETC Group, VanEck Europe, and CoinShares have similarly offered staking ETPs in European markets. These products trade on regulated European exchanges including Deutsche Börse's Xetra, SIX Swiss Exchange, and Euronext, making them accessible to retail and institutional investors across the EU. The products generally charge management fees in the range of 0.2% to 1% annually and distribute staking rewards through NAV appreciation similar to Grayscale's model. Because MiCA establishes clear custody requirements, transparency standards, and investor protection rules, these products operate within a regulatory framework that provides legitimacy without imposing prohibitive restrictions.

The regulatory clarity in Europe has had measurable competitive effects. European crypto ETPs collectively managed more than $15 billion in assets as of mid-2025, and staking-enabled products represent a substantial portion of that total. Institutional investors based in Europe, particularly pension funds and asset managers subject to UCITS (Undertakings for Collective Investment in Transferable Securities) regulations, can access staking yields through regulated investment vehicles.

This meant that when U.S. ETFs launched without staking capabilities in 2024, they were offering an inferior product compared to what was already available to European investors. Industry participants argued that this put U.S. capital markets at a disadvantage and deprived American investors of yield opportunities available to their European counterparts.

Asia's approach varies significantly by jurisdiction. Singapore, which has positioned itself as a crypto-friendly financial hub, allows regulated crypto funds to offer staking under the supervision of the Monetary Authority of Singapore (MAS). The MAS has taken a balanced approach, requiring licensing and compliance for crypto service providers while generally avoiding blanket prohibitions. Hong Kong, seeking to compete with Singapore for crypto business, launched a regulatory regime in 2023 that permits licensed platforms to offer staking services to retail investors. The Hong Kong Securities and Futures Commission requires platforms to disclose staking risks clearly and maintain adequate systems and controls, but treats staking as a permissible activity rather than a securities offering requiring prospectus registration.

Switzerland, often categorized separately due to its unique position outside the EU, has been particularly progressive. The Swiss Financial Market Supervisory Authority (FINMA) established early guidance recognizing that payment and utility tokens do not generally constitute securities.

Swiss crypto banks like Sygnum and SEBA Bank have offered institutional staking services since 2020, working within Switzerland's banking regulations while leveraging the country's established expertise in wealth management and custody. These institutions serve international institutional clients, creating yet another competitive pressure on U.S. providers who were prohibited from offering equivalent services domestically.

The competitive dynamics became particularly visible when VanEck, a U.S.-based asset manager, announced plans in September 2025 to file for a Hyperliquid staking ETF in the U.S. while simultaneously preparing a Hyperliquid ETP for European markets. The dual-track strategy reflected the reality that European approval processes were faster and more certain, even though the U.S. market is larger.

As Kyle Dacruz from VanEck noted, launching in Europe first would establish proof of concept and market demand while U.S. regulatory processes continued. This type of regulatory arbitrage - where U.S. firms develop products offshore to serve international clients - has been a recurring theme in crypto markets and represented one of the strongest arguments for U.S. regulatory modernization.

The contrast between U.S. and international approaches stems from fundamental differences in regulatory philosophy. U.S. securities regulation developed primarily through the Securities Act of 1933 and Securities Exchange Act of 1934, laws written during the Great Depression to address stock market manipulation and corporate fraud.

These laws rely heavily on disclosure-based regulation: the government does not approve investments as "good" or "safe," but rather requires issuers to provide sufficient information for investors to make informed decisions. The challenge with applying this framework to crypto is determining which crypto activities constitute securities offerings requiring disclosure and which are something else entirely - commodities, services, or sui generis digital phenomena that don't fit existing categories.

European regulators, starting with a relatively clean slate through MiCA, could design categories that better fit crypto's realities. By treating most crypto assets as distinct from securities and establishing clear rules for service providers, MiCA reduced regulatory uncertainty even while imposing substantial compliance burdens. The trade-off is that MiCA requires authorization and ongoing supervision for activities that might be permissionless or minimally regulated in the U.S., but it provides clarity about what is allowed.

The SEC's 2025 shift toward permitting staking represents a middle path: staking is not a free-for-all, but neither is it categorically prohibited. The Division of Corporation Finance's guidance establishes principles for determining when staking falls outside securities regulation, effectively allowing activities that are passive, algorithmic, and non-discretionary while potentially restricting arrangements involving active management, guaranteed returns, or combinations with other financial services.

This principles-based approach provides flexibility but also leaves gray areas that will likely require ongoing clarification through additional guidance, no-action letters, or enforcement actions.

Looking forward, international coordination on crypto regulation appears likely to increase. The Financial Stability Board, an international body that monitors the global financial system, has called for coordinated crypto standards to address cross-border regulatory arbitrage.

As major jurisdictions including the U.S., EU, U.K., Singapore, Hong Kong, and Japan all develop crypto frameworks, pressures toward harmonization will grow - both from industry participants seeking consistency and from regulators concerned about risks migrating to less-regulated markets. The global nature of blockchain networks makes them inherently difficult to regulate on a purely national basis, suggesting that international standards may eventually emerge, particularly for custody, staking, and other operational aspects of crypto investment products.

Market Impact and Institutional Adoption Trajectories

Grayscale's staking launch did not occur in a vacuum. It arrived at a moment when institutional allocation to crypto assets had already accelerated dramatically, when the success of Bitcoin ETFs had validated the ETF structure for digital assets, and when institutional investors were increasingly viewing crypto not as a speculative asset class but as a legitimate portfolio component with distinct risk-return characteristics. Understanding the market impact of staking-enabled ETPs requires examining both the direct effects on fund flows and asset prices and the broader implications for how institutions think about crypto allocation.

The yield component of staking creates a fundamental shift in the investment proposition. Bitcoin ETFs offer pure price exposure: investors profit if BTC appreciates and lose if it declines, with no cash flow or yield component.

This makes Bitcoin comparable to gold or other commodities - a store of value whose returns depend entirely on capital appreciation. Ethereum and Solana ETPs without staking offer the same pure price exposure. However, once staking is enabled, the investment proposition transforms into something more akin to dividend-paying stocks or interest-bearing bonds. Investors receive both potential price appreciation and ongoing yield, creating multiple sources of return.

Current staking yields provide context for this transformation. Ethereum's network staking yield as of October 2025 was approximately 3% annually. This yield is determined by several factors: network issuance (new ETH created to reward validators), the total percentage of ETH that is staked network-wide (higher staking participation dilutes rewards across more participants), transaction fees (validators receive a share of priority fees and MEV), and validator uptime.

Approximately 28% of Ethereum's circulating supply was actively staked, meaning that the 3% annual yield was available to roughly 34.4 million ETH actively participating in validation. For institutional investors, a 3% yield on an asset with the potential for price appreciation represented a meaningful enhancement, particularly when compared to money market rates that had declined below 3% as central banks moderated interest rate policies.

Solana's staking yields are considerably higher, ranging from 6% to 8% depending on validator selection and network conditions. Solana's inflation schedule begins at 8% annually and decreases by 15% each year until reaching a long-term rate of 1.5%, with the current inflation rate at approximately 4.7% as of 2025.

More than 50% of Solana's circulating supply is actively staked, reflecting both the ease of staking SOL (no minimum balance requirements) and the attractive yields. For institutional investors considering Solana allocation, the 6-8% staking yield significantly improves the risk-adjusted return profile compared to non-staking products. At Grayscale's current management fee of 2.5% for GSOL, net staking yields would range from 3.5% to 5.5% - still competitive with many traditional fixed-income alternatives.

These yields matter because they change how institutions model portfolio allocation. Modern portfolio theory suggests that investors should allocate capital across assets to optimize the risk-return tradeoff. In a traditional portfolio, stocks provide growth potential but with high volatility, while bonds provide stability and income with lower expected returns. Gold and other commodities serve as inflation hedges but generate no cash flow.

Where does crypto fit? Without yield, crypto's role is primarily as a speculative growth asset or portfolio diversifier whose returns are largely uncorrelated with traditional assets. With staking yield, crypto begins to resemble an emerging market growth equity with a dividend - higher volatility than developed market stocks but with income generation that provides some downside cushion and return even in periods when prices are flat.

Several institutional investment research firms have published analyses suggesting that staking-enabled crypto products could attract material allocations from traditional portfolio managers. Bloomberg Intelligence analysis in mid-2025 suggested that even a 1-2% allocation to staking Ethereum from U.S. pension funds, endowments, and family offices could drive tens of billions in additional demand. The analysis noted that pension funds facing persistent deficits and low-yield environments have been searching for sources of yield enhancement, and that crypto staking - despite its volatility and emerging status - offers yields competitive with private credit, emerging market debt, and other alternative income sources.

The AUM impact on Grayscale specifically could be substantial. The company entered October 2025 with approximately $35 billion in total assets under management across its product suite, making it the largest digital asset investment platform globally.

However, Grayscale had faced significant competitive pressure from BlackRock, Fidelity, and other ETF issuers whose spot Bitcoin products gained dominant market share through lower fees and stronger distribution relationships with wealth management platforms. By being first to market with staking-enabled ETPs, Grayscale created a differentiation point that could attract yield-seeking investors and potentially reverse some of the market share losses.

Early indications suggested positive reception. While Grayscale did not disclose specific inflow data in the immediate days following its October 6 launch, market observers noted that share prices of ETHE and ETH traded near or slightly above their net asset values - a positive signal that demand exceeded supply. This contrasted with periods earlier in 2025 when Grayscale's products occasionally traded at discounts to NAV due to redemption pressure. The Solana Trust (GSOL), pending its conversion to a fully listed ETP, similarly showed positive trading dynamics.

The competitive landscape would soon expand beyond Grayscale. BlackRock, Fidelity, Franklin Templeton, 21Shares, Bitwise, VanEck, and other major issuers all had pending amendments seeking approval to add staking to their Ethereum ETFs.

Bloomberg analyst James Seyffart predicted in September that these approvals would come in waves through Q4 2025, with regulatory delays suggesting the SEC was working through operational and disclosure details rather than reconsidering the fundamental permissibility of staking. Once these amendments are approved, the market would likely see rapid standardization, with staking becoming an expected feature of Ethereum ETFs rather than a unique differentiator.

This standardization raises questions about competitive dynamics. In the Bitcoin ETF market, issuers competed primarily on fees (with expense ratios ranging from 0.19% to 0.25%) and distribution partnerships (with BlackRock and Fidelity's relationships with major wealth management platforms proving decisive).

In a staking-enabled Ethereum ETF market, issuers would compete on net yields after fees, validator quality and diversification, liquidity management, and operational transparency. Funds with lower management fees would deliver higher net staking yields to investors. Funds with better validator selection and risk management would experience less downtime and fewer slashing events, marginally increasing yields. Funds with deeper liquidity buffers could maintain continuous secondary market trading without having to unstake assets to meet redemptions, avoiding the forgone yield during unbonding periods.

Beyond ETFs, staking's approval has implications for other institutional crypto products. Separately managed accounts (SMAs) for high-net-worth individuals and family offices could now incorporate staking strategies, allowing for more customized risk management and tax optimization. Hedge funds that had avoided staking due to regulatory uncertainty could now offer staking-enhanced strategies. Crypto lending products could differentiate between staking yield (protocol-based and relatively low-risk) and lending yield (counterparty-dependent and higher-risk), allowing for more sophisticated portfolio construction.

The participation rate effects on blockchain networks themselves represent another important impact. When institutional capital flows into staking, it increases the economic security of the underlying networks. Security in proof-of-stake systems is roughly proportional to the value of staked assets - the higher the economic cost of attacking the network (requiring substantial stake to control validation), the more secure the network becomes.

Ethereum's transition to proof-of-stake in September 2022 succeeded in part because the network quickly attracted substantial stake, reaching over $40 billion in staked ETH within months. Institutional participation through ETFs further increases this security by directing capital to validation rather than allowing it to sit idle on exchanges.

However, there are valid concerns about centralization effects. If a few large ETF providers control substantial portions of staked ETH or SOL, they effectively gain influence over network governance and consensus. While the validators are technically distributed (Grayscale works with multiple validators, and each validator operates independently), the economic control rests with the ETF issuer who selects validators and could theoretically direct how stake is allocated. Blockchain communities have debated whether limits should be placed on any single entity's stake to preserve decentralization, though no consensus has emerged on where such limits should be set or how they would be enforced.

The Next Wave of Institutional Crypto Innovation

Grayscale's October 2025 staking launch represents a milestone, but it is better understood as an inflection point than a conclusion. The regulatory framework that enabled staking is still evolving, the operational infrastructure is maturing, and the next generation of crypto investment products is already taking shape. Understanding where institutional crypto is heading requires examining the innovations on the horizon and the barriers that remain.

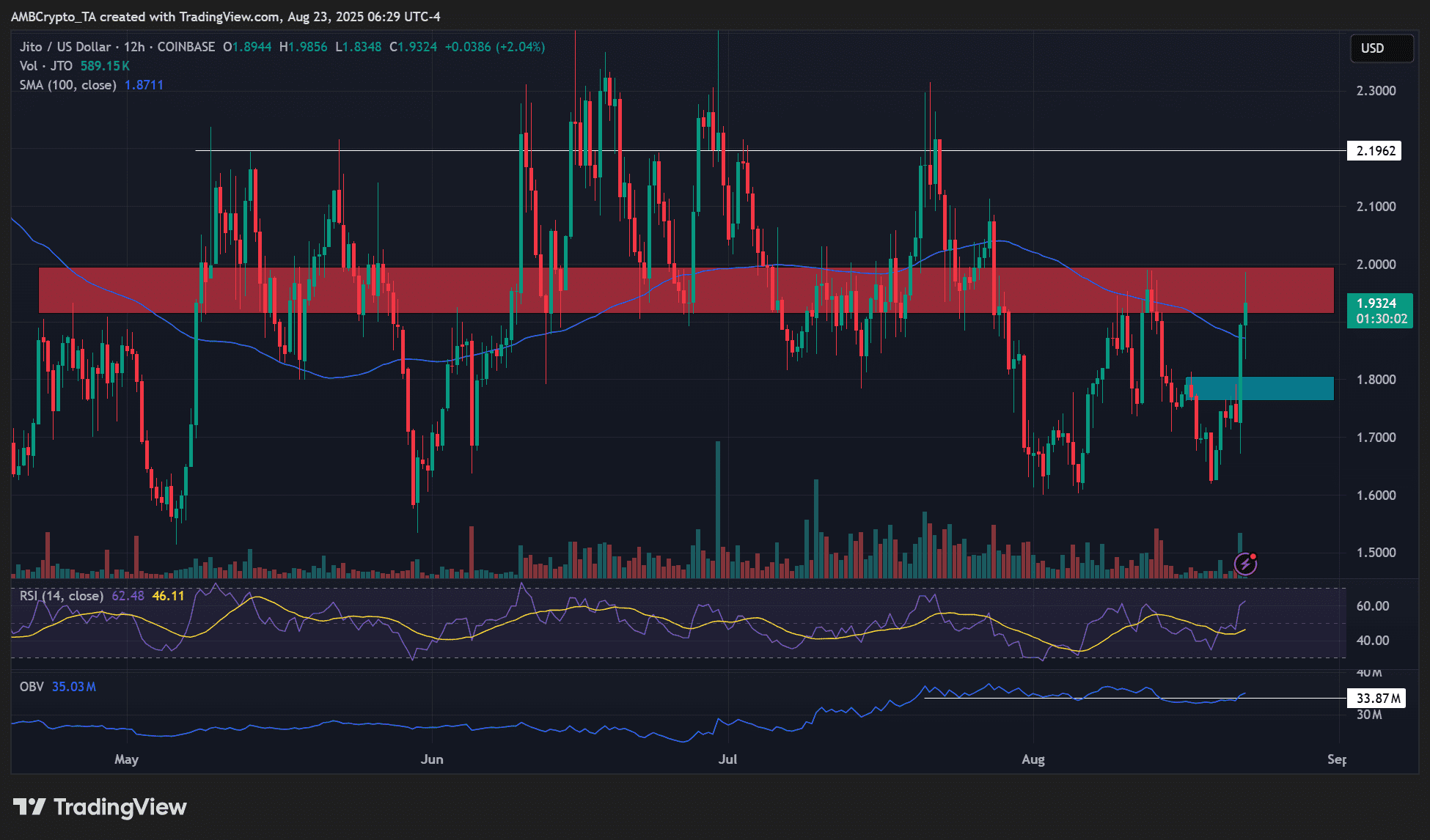

Liquid staking derivatives represent the most immediate frontier. Traditional staking locks assets for network-defined periods, creating liquidity trade-offs for investors. Liquid staking protocols address this by issuing receipt tokens that can be traded while the underlying assets remain staked. Lido Finance's stETH (staked ETH), Rocket Pool's rETH, and Jito's jitoSOL are examples of liquid staking tokens that have gained adoption in decentralized finance. The SEC's August 2025 statement clarifying that liquid staking receipt tokens are not securities opened the door for institutional products based on these assets.

VanEck has already filed for a spot ETF based on jitoSOL, Jito's liquid staking token for Solana. If approved, this would create a multi-layered yield product: investors would gain exposure to SOL's price movements, SOL's staking yield, and potentially additional yields from Jito's MEV optimization.

MEV (maximal extractable value) refers to profit that validators can earn by strategically ordering, including, or excluding transactions in the blocks they produce. Jito's technology allows validators to capture MEV more efficiently and distributes a portion to stakers, creating yields that can exceed standard staking by several percentage points. An ETF structure around jitoSOL would package these multiple yield sources into a single investment vehicle, though with additional complexity and risk compared to native staking.

Restaking - the practice of using already-staked assets to secure additional protocols - represents another innovation gaining institutional attention. EigenLayer, a protocol built on Ethereum, allows stakers to "restake" their ETH to provide economic security for other applications and networks beyond Ethereum itself. In exchange, restakers earn additional rewards from the protocols they secure.

BitGo and other institutional custodians have begun offering restaking services, and several fund managers have expressed interest in creating restaking-focused products once the regulatory treatment is fully clarified. Restaking introduces additional risks (securing multiple protocols creates multiple potential slashing events) but offers enhanced yields, creating another risk-return trade-off for institutional investors to evaluate.

Cross-chain staking products could emerge as markets mature. Rather than requiring separate allocations to Ethereum, Solana, Cardano, Polkadot, and other proof-of-stake networks, multi-asset funds could provide diversified exposure to staking yields across multiple blockchains. Such products would need to address technical complexity (each network has different staking mechanisms, reward structures, and unbonding periods) and concentration risk (diversification requires research to ensure the underlying networks are truly independent rather than vulnerable to common failure modes).

The crypto ETF landscape is moving in this direction: Grayscale's Digital Large Cap Fund (GDLC), approved in September 2025, provides exposure to five cryptocurrencies including Bitcoin, Ethereum, XRP, Solana, and Cardano. Once staking approval extends to XRP and Cardano products, multi-asset staking funds become feasible.

Options and structured products on staking ETFs represent another layer of innovation that could accelerate institutional adoption. Traditional equity markets feature extensive options markets that allow investors to hedge positions, generate additional income through covered call strategies, or implement sophisticated arbitrage and volatility strategies. BlackRock's Ethereum ETF has had exchange-listed options since the SEC approved them in April 2025.

As staking becomes standard, options strategies could be tailored to staking-enhanced products. For example, an institutional investor might hold a staking Ethereum ETF, earn 3% annual staking yield, and write call options to generate additional premium, creating a covered call strategy that potentially doubles the effective yield in range-bound markets.

The approval of generic listing standards for crypto ETFs in September 2025 could accelerate product innovation. Previously, each crypto ETF required a separate 19b-4 filing - an exchange rule change proposal that the SEC reviewed on a case-by-case basis, often taking months and requiring extensive back-and-forth.

Generic listing standards, similar to those that exist for equity ETFs, would allow exchanges to list certain categories of crypto ETFs without individual SEC review, provided the products meet pre-defined criteria for liquidity, custody, and market surveillance. If fully implemented, this could dramatically reduce the time and cost of launching new crypto ETF products, leading to an explosion of offerings covering various cryptocurrencies, staking strategies, and risk profiles.

Tax innovation may follow product innovation. The current tax treatment of staking rewards - as income when received - creates complexity for investors. Future products might incorporate tax-optimized structures, such as offshore vehicles for international investors or retirement account wrappers for U.S. investors. The precedent exists in traditional finance: real estate investment trusts (REITs), master limited partnerships (MLPs), and closed-end interval funds all feature tax structures designed to optimize specific investment strategies. As crypto asset management matures, similar specialized structures will likely emerge.

Regulatory challenges remain despite recent progress. The SEC's May and August 2025 guidance on staking was issued by the Division of Corporation Finance, representing staff views rather than Commission-wide policy. While staff statements carry significant weight, they do not have the force of law and can be revised or overruled. Future administrations might adopt different interpretations. Congress could pass legislation that either codifies current practices or imposes new restrictions. International regulatory developments, particularly if major jurisdictions adopt approaches inconsistent with U.S. policy, could create pressure for further changes.

Custody and operational risk will remain central concerns as institutional staking scales. The more assets are staked, the more attractive they become as targets for sophisticated attacks. Nation-state actors, organized cybercriminal groups, and rogue insiders all pose threats to institutional crypto infrastructure.

While custody technology continues to advance - with innovations like multi-party computation, threshold signatures, and hardware security modules providing ever-stronger protection - the fundamental challenge of securing private keys while maintaining operational accessibility persists. Major security breaches, if they occur, could trigger regulatory backlash and erode institutional confidence.

Network evolution represents both opportunity and risk. Ethereum continues to upgrade through its roadmap of scaling solutions, potentially changing staking mechanisms, reward structures, or validation requirements. Solana has experienced network outages in the past, raising questions about stability even as the network has improved significantly.

Other proof-of-stake networks compete for institutional attention, each with different technical characteristics, governance structures, and risk profiles. Institutions investing in staking products are effectively making long-term bets on which blockchain networks will maintain relevance, security, and developer activity - predictions that are inherently uncertain in a rapidly evolving technology landscape.

Expert Perspectives: What Industry Leaders Are Saying

The emergence of staking-enabled crypto ETPs has prompted extensive commentary from industry participants, analysts, and market strategists. These perspectives help contextualize the significance of developments like Grayscale's launch and illuminate different views on where institutional crypto is heading.

James Seyffart, ETF analyst at Bloomberg Intelligence, has been among the most closely followed observers of the crypto ETF landscape. Throughout 2025, Seyffart provided regular updates on the approval process for staking amendments, often serving as an early signal for when SEC decisions were likely.

In April 2025, he predicted that staking approval for Ethereum ETFs could come "as early as May but would likely take until the end of 2025," noting that the SEC was using its maximum 90-day review periods for multiple filings. Seyffart emphasized that the sheer volume of applications - eventually exceeding 96 crypto ETF filings across various assets - indicated "a maturing asset class" and suggested that institutional demand was driving regulatory accommodation rather than the reverse.

Seyffart's colleague Eric Balchunas has similarly highlighted the competitive dynamics of the crypto ETF market. Balchunas noted that the SEC's delays on staking approvals through Q3 2025 appeared to be strategic, allowing the agency to finalize generic listing standards before opening the floodgates to staking-enabled products. "They've been punting and punting," Balchunas explained in September, "and we expect them to keep putting everything off until the generic listing standards are done." This observation proved prescient: the generic standards were approved in late September, and Grayscale's staking launch came just days later.

Robbie Mitchnick, BlackRock's head of digital assets, has been an outspoken advocate for staking capabilities in Ethereum ETFs. In March 2025, Mitchnick stated publicly that Ethereum ETFs were "less perfect" without staking, arguing that the inability to capture native network yields created an artificial handicap compared to direct ETH ownership.

BlackRock's July 2025 filing seeking approval for staking in its iShares Ethereum Trust (ETHA) reflected this view. While BlackRock was not first to launch staking (that distinction went to Grayscale), the firm's commitment signaled that major traditional asset managers viewed staking as essential rather than optional for institutional Ethereum products.

Institutional custody providers have emphasized risk management and operational excellence in their commentary. Mike Belshe, CEO of BitGo, noted when announcing BitGo's role as custodian for several crypto ETFs that "100% cold storage as a leading independent custodian" differentiated BitGo's approach. Belshe's emphasis on cold storage security even while enabling staking highlights the technical sophistication required to offer institutional-grade services.

Nathan McCauley, co-founder and CEO of Anchorage Digital, similarly positioned his firm's federal bank charter as creating regulatory certainty: "Our federal charter - which supersedes state-by-state regulation and positions us as a qualified custodian - makes us a natural choice for ETF custody diversification."

Commissioner Hester Peirce, who has consistently been the SEC's most crypto-friendly voice, praised the May 2025 staking guidance while acknowledging its limitations. "Today, the Division of Corporation Finance clarified its view that certain proof-of-stake blockchain protocol 'staking' activities are not securities transactions within the scope of the federal securities laws," Peirce wrote.

She characterized the guidance as "welcome clarity for stakers and 'staking-as-a-service' providers in the United States" but noted that questions remain about edge cases and hybrid arrangements. Peirce's dissent in the 2023 Kraken settlement, where she called the SEC's approach "paternalistic and lazy," established her as an advocate for regulatory frameworks that enable innovation rather than foreclose it through enforcement.

Industry organizations have highlighted competitive concerns relative to international markets. The Blockchain Association, a leading U.S. crypto industry trade group, argued throughout 2024 and early 2025 that regulatory uncertainty around staking was driving institutional activity to European and Asian jurisdictions.

The Association pointed to the success of European staking ETPs as evidence that U.S. markets were losing competitiveness. This argument appears to have resonated: the SEC's 2025 guidance came amid broader discussions about keeping U.S. capital markets attractive for innovation.

Academic researchers focusing on crypto markets have examined the economic effects of institutional staking. Coin Metrics, a blockchain data analytics firm, published research in December 2024 showing that Ethereum's staking participation rate had stabilized around 28% of circulating supply, with institutional entities representing a growing proportion of total stake.

The research suggested that institutional participation through ETFs could push staking rates higher, potentially to 35-40% of supply, which would improve network security but also increase the opportunity cost of holding unstaked ETH. Solana's staking economics were noted to be different: the 50%+ staking rate reflects Solana's design choices (no minimum balance requirements, short unbonding periods) and higher nominal yields.

Investment advisors and wealth managers have expressed cautious interest in staking products. A survey conducted by CoinDesk in summer 2025 found that approximately 60% of registered investment advisors (RIAs) were "interested" or "very interested" in recommending staking-enabled crypto ETFs to clients, but 40% cited concerns about volatility, regulatory uncertainty, and the novelty of the asset class.

The survey suggested that staking yields made crypto products more palatable to conservative clients who typically focus on income generation, but that advisors remained wary of allocating substantial client assets to crypto despite the yield enhancement.

Critics of institutional crypto products have raised concerns about centralization effects and systemic risk. Nic Carter, a venture capitalist and crypto researcher, has written extensively about the risks of excessive concentration in ETF-driven staking. Carter argues that if a handful of large ETF providers control significant portions of network stake, they gain influence over blockchain governance and create potential points of failure.

"We could end up with the crypto equivalent of BlackRock and Vanguard controlling corporate America," Carter wrote in a September 2025 essay, referring to the debate about the market power of large index fund providers in traditional equity markets. Carter's concerns are shared by some blockchain developers who worry that institutionalization could compromise the decentralization ethos that initially motivated proof-of-stake designs.

A New Chapter in Institutional Crypto, Not the Final One

Grayscale's October 6, 2025 launch of the first U.S. spot crypto ETPs with staking represents a genuine milestone in the maturation of digital asset markets. After years of regulatory ambiguity, enforcement actions that shut down pioneering staking services, and false starts in the ETF approval process, institutional investors can now access yield-generating blockchain assets through familiar, regulated investment vehicles. The significance extends beyond any single product or company. Staking has moved from regulatory red line to acceptable investment feature, opening pathways for innovation that were foreclosed as recently as 2023.

Yet recognizing this milestone requires also acknowledging its limitations. Grayscale's launch occurred within a framework established by SEC staff statements rather than formal regulations or legislation. These staff views, while influential, can be revised by future administrations or overruled by commissioners.

The guidance itself is carefully circumscribed, applying to specific categories of staking arrangements while leaving questions about other structures unresolved. Tax treatment remains somewhat uncertain, particularly for innovative products like liquid staking derivatives. Operational risks including cybersecurity, slashing, and network stability continue to challenge even sophisticated institutional operators.

BlackRock, Fidelity, and other major ETF providers have pending applications to add staking to their Ethereum products, and their eventual approval will likely make staking a standard feature rather than a differentiator. The real competition will shift to operational excellence: which providers can offer the highest net yields through better validator selection, lower fees, and superior risk management. As generic listing standards take effect, the number of crypto ETF products will likely expand dramatically, covering various cryptocurrencies, staking strategies, and risk-return profiles.

International dynamics will continue to influence U.S. policy. European and Asian markets have demonstrated that staking-enabled products can operate successfully within appropriate regulatory frameworks, creating pressure for U.S. markets to remain competitive. At the same time, U.S. regulatory decisions influence global markets - the May and August 2025 SEC guidance on staking will likely inform how other jurisdictions approach similar questions. International coordination on crypto standards appears increasingly likely as regulators recognize the challenges of regulating inherently borderless, globally accessible blockchain networks.

The institutional adoption trajectory for crypto appears to be accelerating rather than decelerating. Bitcoin ETFs attracted more than $35 billion in their first year. Ethereum ETFs, initially hampered by the lack of staking, will likely see renewed inflows as staking becomes standard.

Solana ETFs, when they launch with staking capabilities, will offer yields potentially exceeding 6% annually - attractive in any market environment but particularly compelling when traditional fixed-income yields are modest. Other proof-of-stake networks including Cardano, Polkadot, Avalanche, and Cosmos are already the subject of ETF applications, and each brings distinct staking mechanisms, yield profiles, and risk characteristics.

Beyond ETFs, institutional adoption will manifest in other forms. Separately managed accounts, direct holdings with professional custody, hedge fund strategies incorporating staking alpha, and structured products leveraging crypto derivatives will all expand the ways institutions access staking yields.

Pension funds, endowments, insurance companies, corporate treasuries, and sovereign wealth funds are at various stages of evaluating crypto allocations. The addition of staking yields to the investment proposition - creating a "digital dividend" analogous to equity dividends or bond coupons - makes crypto assets more familiar and potentially more acceptable to conservative allocators who have been skeptical of purely price-driven returns.

The risks remain real and significant. Price volatility has not disappeared - staking yields of 3-8% annually provide modest cushions against short-term price swings but are overwhelmed by the 30%, 50%, or 70% corrections crypto markets have experienced cyclically. Regulatory risks persist: what one administration permits, another might restrict.

Operational risks require constant vigilance: the growing sophistication of cyberattacks means that custody and validation infrastructure must continuously evolve. Network risks include the possibility that specific blockchains could lose relevance as technology evolves, or that governance disputes could split networks and strand investor capital.

Nevertheless, the trajectory appears clear. Staking has transitioned from regulatory taboo to acceptable institutional practice. The infrastructure - custody, validation, risk management, accounting, tax treatment - is maturing rapidly. The products - ETFs, ETPs, funds, accounts - are proliferating. The investor base - once limited to crypto natives and risk-seeking hedge funds - now includes major traditional asset managers serving mainstream institutional clients.

Grayscale's historic launch is better understood not as an ending but as an opening: the beginning of a new phase in which institutional crypto investment incorporates the yield-generating mechanisms that are fundamental to how modern blockchain networks operate. The journey from Kraken's February 2023 settlement to Grayscale's October 2025 launch took only two and a half years, but it represented a transformation in regulatory thinking, market infrastructure, and institutional acceptance.

The next chapters of this story - what innovations emerge, which networks dominate institutional allocation, how regulators respond to challenges - remain to be written. What is clear is that institutional investors are no longer shut out from participating in blockchain validation economics, and that this participation will shape both crypto markets and traditional finance in ways that are only beginning to emerge.