In October 2025, JPMorgan Chase announced plans to develop cryptocurrency trading services for clients while explicitly stating that custody services would not be offered in the near term. The declaration, delivered by Scott Lucas, the bank's global head of markets and digital assets, marked a decisive break from Wall Street's decade-long ambivalence toward digital assets.

For an institution that once dismissed Bitcoin as fraudulent, this represents more than policy evolution. It signals the arrival of a new era in institutional finance, one where the world's largest banks no longer question whether to engage with crypto, but rather how to do so without compromising their risk frameworks or regulatory standing.

Lucas told CNBC that JPMorgan intends to engage in cryptocurrency trading activity, but custody services remain off the table for the foreseeable future due to questions around risk appetite and regulatory exposure. This careful bifurcation of services reveals a sophisticated strategy: provide clients access to crypto markets while outsourcing the most operationally complex and legally ambiguous element of the business.

The announcement arrives at a pivotal moment. Bitcoin has surged beyond previous all-time highs, spot exchange-traded funds have brought billions in institutional capital into digital assets, and the U.S. regulatory environment has shifted from hostility to cautious accommodation under the Trump administration's second term. JPMorgan's move is both response and catalyst, simultaneously reflecting institutional demand and legitimizing it further.

Background: From Crypto Skepticism to Institutional Adoption

Jamie Dimon's Evolution

In September 2017, JPMorgan CEO Jamie Dimon called Bitcoin a fraud at the Delivering Alpha conference, stating it was worse than tulip bulbs and predicting it would eventually blow up. Dimon also said he would fire any JPMorgan trader caught trading Bitcoin, calling them stupid for violating company rules.

The remarks came as Bitcoin surged from around two thousand dollars to nearly twenty thousand dollars within months, capturing global attention and testing the patience of traditional financial executives who viewed the cryptocurrency as speculative mania reminiscent of historical bubbles.

By January 2018, Dimon had softened his stance, telling Fox Business that he regretted making the fraud comment and acknowledging that blockchain technology was real. Yet his fundamental skepticism of Bitcoin as an asset persisted. As recently as April 2024, Dimon continued calling Bitcoin a fraud and Ponzi scheme, distinguishing it from cryptocurrencies that enable smart contracts, which he acknowledged might have value.

This evolution from outright dismissal to grudging acknowledgment to active participation mirrors the broader journey of institutional finance. What changed was not Bitcoin itself, but the infrastructure around it: regulated custodians, exchange-traded funds, clearer regulatory pathways, and mounting client demand that banks could no longer ignore.

Early Blockchain Experiments

Even as Dimon criticized Bitcoin, JPMorgan was quietly building blockchain capabilities. The bank launched JPM Coin in 2019, a permissioned digital token designed to facilitate instantaneous payment transfers between institutional clients. Unlike public cryptocurrencies, JPM Coin operated on a private blockchain controlled entirely by JPMorgan, representing dollars held in designated accounts at the bank.

This initiative evolved into Kinexys, JPMorgan's blockchain division formerly known as Onyx. Kinexys has processed hundreds of billions of dollars in transactions, primarily for wholesale payments and securities settlement, demonstrating that JPMorgan believed in distributed ledger technology even while remaining hostile to decentralized cryptocurrencies.

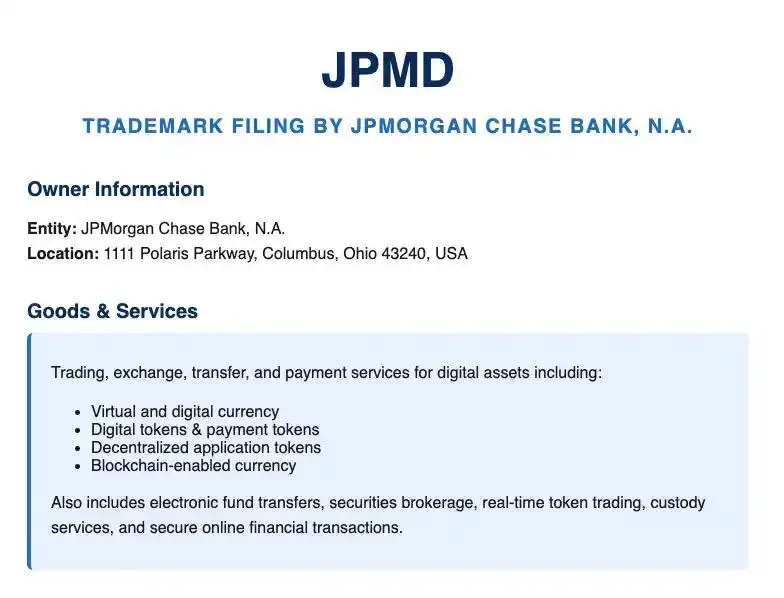

In June 2025, JPMorgan announced the launch of JPMD, a deposit token on Coinbase's Base blockchain, marking the first time the bank placed deposit-based products on a public blockchain network. JPMD is a permissioned USD deposit token designed for live institutional payments on Base, the Ethereum Layer 2 blockchain built by Coinbase.

Naveen Mallela, global co-head of Kinexys, told CNBC that JPMD would provide an alternative to stablecoins, offering potential interest-bearing features and better fungibility with existing deposit products that institutions use. The token represents a bridge between traditional banking infrastructure and public blockchain rails, allowing JPMorgan to experiment with crypto-adjacent technology without fully embracing the speculative asset class Dimon had long criticized.

Wall Street's Broader Journey

JPMorgan's evolution parallels the transformation across Wall Street. Goldman Sachs, Morgan Stanley, and Citigroup have all moved from skepticism to selective participation. Citibank announced plans to launch crypto custody services by 2026, with Biswarup Chatterjee, Citi's global head of partnerships and innovation, stating the bank has been building custody infrastructure for two to three years.

BNY Mellon launched its Digital Asset Custody platform in October 2022, becoming the first global systemically important bank to offer custody services for Bitcoin and Ether. In September 2024, BNY Mellon received SEC approval to custody crypto assets for exchange-traded funds without recording them as balance-sheet liabilities, a significant regulatory breakthrough.

The shift reflects changing client demand. Institutional investors, family offices, and high-net-worth individuals increasingly hold digital assets and expect their primary banking relationships to accommodate these holdings. The approval of Bitcoin spot ETFs in January 2024 provided regulatory validation and created infrastructure that made crypto exposure palatable to institutions that would never directly purchase tokens on exchanges.

What JPMorgan Announced: The Facts

Trading Without Custody

Scott Lucas confirmed that JPMorgan plans to offer crypto trading services but explicitly stated that custody is not on the horizon near-term. Lucas noted that CEO Jamie Dimon made clear at investor day that the bank would be involved in trading, but custody remains off the table due to questions around risk appetite and regulatory considerations.

This distinction is crucial. Trading facilitation allows JPMorgan to connect clients with crypto markets, execute buy and sell orders, and potentially provide liquidity, all while outsourcing the technical and legal complexities of actually holding the private keys that control digital assets.

Lucas described JPMorgan's approach as an "and" strategy, pursuing multiple blockchain opportunities concurrently rather than choosing between traditional finance and digital innovation. The bank aims to integrate crypto trading capabilities alongside its existing services, treating digital assets as another tradable instrument class rather than a wholesale departure from conventional banking.

Reliance on Third-Party Custodians

JPMorgan will rely on third-party custodians for asset storage rather than holding crypto directly. Lucas indicated the bank is currently exploring what the right custodians would look like and assessing market infrastructure before committing to any partnerships.

Potential custody partners include established institutional custodians such as Coinbase Custody, BitGo, Anchorage Digital, and Fidelity Digital Assets. These firms specialize in the technical requirements of private key management, including multi-signature wallets, hardware security modules, and insurance coverage against theft or loss.

By outsourcing custody, JPMorgan transfers operational risk, regulatory burden, and technical complexity to specialized providers. This allows the bank to enter the crypto trading market without the years of infrastructure development and regulatory navigation that custody services require.

Crypto-Backed Lending Plans

JPMorgan is planning to offer crypto-backed loans, allowing clients to use cryptocurrency holdings as collateral for borrowing, pending regulatory approval. These loans would enable clients to access liquidity against Bitcoin or Ethereum holdings without triggering taxable events from asset sales.

Crypto-collateralized lending has become a significant market segment, with specialized firms originating billions in loans annually. The model involves overcollateralization to account for price volatility, typically requiring borrowers to pledge significantly more value in crypto than they receive in loan proceeds.

For JPMorgan, crypto-backed loans represent a natural extension of its lending business. The bank already provides loans secured by stocks, bonds, real estate, and other traditional assets. Adding digital assets as eligible collateral aligns with client demand and creates revenue opportunities through interest income and fees.

The JPMD Deposit Token

In June 2025, JPMorgan launched JPMD on Coinbase's Base blockchain, marking the first time a commercial bank placed deposit-based products on a public blockchain network. The token represents dollar deposits at JPMorgan and is available exclusively to institutional clients through a permissioned system.

JPMD differs fundamentally from stablecoins. Naveen Mallela told Bloomberg that deposit tokens are based on fractional banking and are more scalable than stablecoins, potentially offering advantages including interest-bearing features and deposit insurance coverage.

Stablecoins like USDC or USDT are backed one-to-one by reserves held outside the banking system. Users do not have legal claims on underlying deposits; they hold tokens whose value is maintained through reserve backing. Deposit tokens, by contrast, represent actual deposit accounts at regulated banks, complete with legal protections and potential interest accrual.

JPMorgan stated that JPMD is intended to enhance the global digital payments ecosystem by bringing trusted financial infrastructure onto public blockchain, enabling 24/7 transactions that cost less than a cent. The token allows institutional clients to move funds between parties on Base with near-instant settlement, eliminating the delays inherent in traditional wire transfers or ACH payments.

Terminology Clarifications

Deposit Token vs. Stablecoin: Deposit tokens represent tokenized commercial bank deposits with legal claims on underlying funds, potential interest earnings, and regulatory protections. Stablecoins are token-based representations of value backed by reserves, operating outside traditional banking frameworks with no guaranteed legal claim.

Public vs. Permissioned Blockchains: Public blockchains like Ethereum allow anyone to participate, view transactions, and run nodes. Permissioned blockchains restrict access to approved participants. Base is a public blockchain, but JPMorgan's JPMD implementation uses permissioned access, meaning only whitelisted institutional clients can transact with the token.

Custody and Private Key Management: Cryptocurrency custody involves holding the cryptographic private keys that grant control over digital assets. Unlike traditional custody where assets are held in accounts, crypto custody is custodying the keys themselves. Loss of private keys means permanent loss of access to assets, making custody the highest-risk element of crypto infrastructure.

How JPMorgan Plans to Offer Crypto Trading

Operational Architecture

JPMorgan's crypto trading infrastructure will likely mirror its traditional trading operations, with added complexity for digital asset settlement and custody coordination. The bank will maintain client accounts in its core banking systems, with crypto holdings tracked through partnerships with external custodians.

When clients wish to trade, JPMorgan will execute transactions either on public exchanges, through over-the-counter desks, or via its own internal matching engine. Settlement will occur through the custodian, with the bank serving as the interface layer between clients and the underlying infrastructure.

This model offers several advantages. Clients interact with JPMorgan's familiar banking interface rather than navigating crypto-native platforms. The bank provides unified reporting, consolidated tax documentation, and integration with existing portfolio management tools. Clients avoid the operational complexity of managing private keys, interfacing with multiple platforms, or maintaining separate relationships with custodians.

Risk Management Rationale

JPMorgan's decision to defer custody reflects a deliberate approach to reducing direct operational exposure while preserving client market access. By outsourcing custody, the bank avoids several categories of risk.

Operational Risk: Custody requires specialized technical infrastructure including cold storage systems, multi-signature protocols, hardware security modules, and comprehensive key management procedures. These systems must operate continuously without failure, as loss of private keys means irretrievable loss of assets. Building and maintaining this infrastructure requires significant investment and specialized expertise.

Regulatory Risk: Custody triggers heightened regulatory scrutiny. Banking regulators have traditionally required institutions holding customer assets to maintain robust internal controls, regular audits, and demonstrated operational competence. For digital assets, these requirements are amplified by the nascent regulatory framework and ongoing policy evolution.

Liability Risk: Custodians bear responsibility for asset security. If private keys are compromised, assets stolen, or systems fail, the custodian faces potential liability for losses. Insurance exists but remains expensive and imperfect. By delegating custody to specialists, JPMorgan transfers this liability.

Capital Requirements: Regulators including the Basel Committee have issued guidance on crypto-assets, stating they are not legal tender and are not backed by any government or public authority, which shapes how banks approach custody, capital, and risk management. Banks holding crypto may face capital adequacy requirements that make custody economically unattractive compared to facilitating trades without holding assets directly.

Target Client Segments

JPMorgan will likely prioritize institutional clients for initial crypto trading access. This includes hedge funds, family offices, corporate treasuries, and high-net-worth individuals. These clients typically have existing relationships with JPMorgan, represent significant revenue opportunities, and often have prior exposure to digital assets through other channels.

Retail clients will probably gain access later, if at all. Retail crypto trading presents operational challenges, lower revenue per client, and greater regulatory scrutiny around investor protection. JPMorgan already serves retail clients through its acquisition of Chase, but extending crypto services to that customer base would require different infrastructure, compliance frameworks, and risk management approaches.

Trading Pairs and Asset Selection

Initial trading offerings will likely focus on Bitcoin, Ethereum, and regulated stablecoins. These assets have the deepest liquidity, most established regulatory treatment, and greatest institutional demand.

Bitcoin and Ethereum together represent the majority of crypto market capitalization and have achieved a degree of mainstream acceptance that altcoins lack. Both have spot ETFs, futures markets, and widespread custody solutions. Regulatory clarity, while imperfect, is greater for these assets than for most alternatives.

Stablecoins like USDC serve as settlement instruments and on-ramps for trading. JPMorgan may also integrate its own JPMD token for client transactions, creating an internal clearing mechanism that reduces reliance on external stablecoins.

Technology Stack and Integration

JPMorgan's deposit tokens and blockchain settlement capabilities will likely integrate with the bank's internal trading and clearing systems. The bank has invested heavily in blockchain infrastructure through Kinexys, which already processes institutional payments on private ledgers.

The decision to pilot JPMD on Base, Coinbase's Ethereum Layer 2 network, reflects strategic calculation. Base offers lower transaction fees and faster processing than Ethereum mainnet while maintaining compatibility with Ethereum's ecosystem. Base has become the most popular Ethereum Layer 2 network by total value locked, with nearly four billion dollars secured across applications.

By building on Base, JPMorgan aligns with Coinbase, its likely custody partner and a major infrastructure provider. This integration could enable seamless trade execution, settlement, and custody coordination through interconnected systems.

Why JPMorgan Is Delaying Custody

Regulatory Barriers

In July 2025, federal banking regulators including the Federal Reserve, OCC, and FDIC issued a joint statement highlighting legal, regulatory, and risk management considerations that banks must address when holding crypto-assets for customers. While the statement created no new obligations, it underscored the heightened scrutiny applied to crypto custody.

In May 2025, the OCC issued Interpretive Letter 1184, reaffirming that national banks may provide cryptocurrency custody and execution services, including through sub-custodians, so long as banks comply with applicable law and engage in safe and sound practices. This guidance clarified permissibility but did not eliminate the operational and compliance burdens.

Custody involves direct responsibility for safeguarding customer assets. Banks must demonstrate adequate internal controls, cybersecurity measures, disaster recovery capabilities, and operational resilience. For digital assets, these requirements extend to novel technical domains including cryptographic key management, blockchain monitoring, and smart contract security.

The regulatory landscape remains in flux. A Presidential Working Group issued recommendations in August 2025 urging Congress to enact market structure legislation and calling on the SEC and CFTC to use existing authorities to provide regulatory clarity for digital assets. The House of Representatives passed the Digital Asset Market Clarity Act in July 2025, which seeks to define boundaries between SEC and CFTC jurisdiction. Until this legislation becomes law and regulations are finalized, banks face uncertainty about future requirements.

Capital Adequacy and Balance Sheet Treatment

One of the most significant barriers to bank-provided custody has been accounting treatment. The SEC's Staff Accounting Bulletin 121 previously required companies holding customer cryptocurrencies to record them as liabilities on balance sheets, creating capital constraints that made custody economically unattractive for banks.

In January 2025, the SEC rescinded SAB 121 and issued SAB 122, which restored technology neutrality and allowed application of traditional accounting principles to crypto-assets under custody. This change significantly reduced the balance sheet impact of custody, making it more feasible for banks to consider offering services.

However, capital requirements remain complex. The Basel Committee on Banking Supervision has proposed frameworks for banks holding crypto exposures, generally requiring high capital charges that reflect the perceived risk of digital assets. These requirements make crypto custody less capital-efficient than traditional asset custody.

Operational Complexity

Industry practitioners note that custody integrations are operationally complex, requiring standardized APIs for execution while keeping custody connectors modular to separate signing, settlement, and reconciliation. Implementations commonly require hardware security modules, segregated client ledgers, and formalized runbooks to satisfy auditors and regulators.

Building this infrastructure from scratch requires significant investment. Banks must hire specialized talent with expertise in cryptography, blockchain development, and information security. They must develop or license key management software, integrate it with existing core banking systems, and establish operational procedures for a technology fundamentally different from traditional asset custody.

The technical risks are substantial. Caroline Butler, head of custody at BNY Mellon, noted that custodying the key that represents the asset means effectively custodying code, leaning more on emerging technologies than traditional custody software would naturally accommodate.

Liability and Insurance Considerations

Custodians bear responsibility for asset security. If keys are compromised, assets stolen, or operational failures result in losses, the custodian faces potential liability. While insurance exists for crypto custody, coverage remains limited, expensive, and subject to exclusions.

Traditional custody benefits from centuries of legal precedent, established insurance markets, and well-understood risk models. Crypto custody lacks this maturity. The risk of catastrophic loss from technical failure, insider threat, or external attack remains elevated compared to traditional assets.

For JPMorgan, the liability risk may outweigh the revenue opportunity, at least in the near term. By outsourcing to specialized custodians who accept this risk as their core business, the bank protects itself while still serving client needs.

Strategic Sequencing

JPMorgan's approach reflects strategic sequencing: build trading capabilities first, custody later. This allows the bank to begin generating revenue, establish client relationships, and understand market dynamics before committing to the more complex custody infrastructure.

Trading provides immediate monetization through spreads, commissions, and order flow. It requires less infrastructure investment than custody and faces lighter regulatory scrutiny. By starting with trading, JPMorgan can assess demand, refine operational processes, and build institutional knowledge that will inform eventual custody decisions.

The Coinbase Connection

Deepening Partnership

JPMorgan's decision to launch JPMD on Coinbase's Base blockchain signals a deepening strategic relationship between the traditional banking giant and the largest U.S. crypto exchange. Coinbase provides critical infrastructure that JPMorgan leverages rather than building independently.

Jesse Pollak, creator of Base and VP of Engineering at Coinbase, stated that Base offers sub-second, sub-cent, 24/7 settlement, making fund transfers between JPMorgan institutional clients nearly instant. This technical capability allows JPMorgan to offer blockchain-based services without maintaining its own public blockchain infrastructure.

The relationship extends beyond JPMD. Coinbase operates Coinbase Prime, an institutional custody and trading platform serving major financial institutions. JPMorgan may use Coinbase as one of its third-party custodians for client crypto trading services.

Additionally, Coinbase has integrated with Chase accounts, allowing consumers to link their bank accounts directly to Coinbase for funding crypto purchases. This consumer-facing integration complements the institutional relationship, creating multiple touchpoints between the two firms.

Hybrid TradFi-DeFi Strategy

Lucas described JPMorgan's roadmap as an "and" strategy, expanding traditional services while experimenting with blockchain infrastructure. This hybrid approach represents the emerging consensus among major financial institutions: digital assets and decentralized finance are not replacements for traditional finance but complementary systems that can be bridged.

By partnering with Coinbase rather than competing, JPMorgan acknowledges that crypto-native firms possess technical expertise, regulatory relationships, and market positioning that would take years to replicate. Rather than reinventing infrastructure, the bank leverages existing capabilities through strategic partnerships.

This model may become standard for Wall Street's crypto engagement. Banks provide client relationships, regulatory expertise, capital markets infrastructure, and trust that comes from centuries of operation. Crypto firms provide technical platforms, custody capabilities, and connection to decentralized protocols. Together, they create integrated offerings neither could deliver independently.

Coinbase as Infrastructure Provider

For Coinbase, partnerships with institutions like JPMorgan represent validation and revenue diversification. The exchange has positioned itself as infrastructure for the traditional financial system's crypto engagement, not just a consumer trading platform.

Coinbase Custody manages billions in institutional assets. Base has attracted hundreds of decentralized applications and billions in total value locked. These capabilities make Coinbase an indispensable partner for banks entering crypto markets.

The relationship benefits both parties. JPMorgan gains tested infrastructure and regulatory compliance frameworks developed through Coinbase's years of engagement with U.S. regulators. Coinbase gains credibility, client referrals, and potential integration opportunities that strengthen its competitive position against emerging rivals.

Crypto-Backed Loans and Deposit Tokens

Mechanics of Crypto-Collateralized Lending

Bitcoin-backed lending allows borrowers to deposit Bitcoin as collateral to receive loans in conventional currency or stablecoins without liquidating holdings. The model appeals to long-term holders who want liquidity without triggering tax events or missing potential price appreciation.

Bitcoin serves as particularly suitable collateral because it is standardized, fully digital, tradable 24/7, and highly liquid, enabling real-time valuation and rapid response to market movements. These characteristics reduce default risk compared to illiquid or difficult-to-value collateral.

Lenders typically apply loan-to-value ratios between 40 and 60 percent, meaning a borrower pledging one hundred thousand dollars in Bitcoin might receive a loan between forty and sixty thousand dollars. This overcollateralization provides buffer against price volatility. If Bitcoin's price falls significantly, the lender can issue margin calls requiring additional collateral or loan repayment to restore the original LTV ratio.

Implementing bitcoin-backed lending requires robust systems for real-time collateral monitoring and clear protocols for margin calls or liquidation. Lenders may also require overcollateralization as a precondition for granting loans, erring on the side of caution given crypto's volatility.

Interest rates for crypto-backed loans vary widely depending on platform, loan terms, and market conditions. Rates range from low single digits on some decentralized platforms to high teens on centralized lenders, with factors including custody model, rehypothecation practices, and platform-specific incentives affecting pricing.

Use Cases for Corporate Clients and Funds

For corporate treasuries holding Bitcoin, crypto-backed loans provide working capital without triggering balance sheet recognition of gains or losses. A company holding Bitcoin acquired at lower prices can borrow against current values without realizing taxable events.

Hedge funds and investment firms use crypto-backed loans for leverage, allowing them to maintain long positions while accessing capital for other opportunities. Family offices with concentrated crypto wealth can diversify without selling holdings that they believe will appreciate further.

By August 2024, institutional investors including Goldman Sachs and Morgan Stanley had purchased collective hundreds of millions in spot bitcoin ETFs, indicating growing institutional confidence in bitcoin as a portfolio diversifier. As institutional holdings grow, demand for crypto-backed lending infrastructure increases correspondingly.

Risk Models and Volatility Management

Bitcoin's price volatility presents significant challenges in collateral valuation, requiring lenders to implement robust real-time monitoring and establish clear liquidation protocols. During periods of extreme volatility, rapid price declines can trigger cascading margin calls and forced liquidations.

Lenders manage this risk through conservative LTV ratios, automated monitoring systems, and pre-agreed liquidation procedures. Most platforms specify margin call thresholds, liquidation triggers, and timeframes for borrowers to restore required collateralization levels.

Platforms typically allow initial LTV ratios up to 75 percent, with borrowers able to deposit additional collateral initially to lower LTV, reduce interest rates, and minimize margin call risk. Liquidation fees, typically ranging from 2 to 5 percent, incentivize borrowers to maintain adequate collateral.

Deposit Tokens: Definition and Mechanics

Deposit tokens are digital representations of commercial bank deposits managed with blockchain technology, differing from stablecoins in that they represent actual deposit claims against regulated banks rather than reserve-backed tokens.

Each JPMD deposit token represents a deposit claim against JPMorgan, backed by the same liquidity frameworks as traditional banks rather than 1:1 dollar reserves like stablecoins. This structure provides institutional clients with balance sheet treatment certainty, potential interest earnings, and deposit insurance protection.

Deposit tokens offer several advantages over stablecoins for institutional users. They integrate seamlessly with existing banking relationships, enabling firms to maintain deposits with trusted counterparties while accessing blockchain-based settlement. They may bear interest, unlike most stablecoins. They benefit from deposit insurance and regulatory oversight that stablecoins lack.

JPMD's Role as Regulatory-Friendly Alternative

The JPMD launch coincided with Senate passage of the GENIUS Act, which established regulatory clarity that essentially provided banks a green light to explore tokenized deposits without legal uncertainty surrounding stablecoins.

JPMD's proposed structure uses individual crypto wallets with distinct bank accounts to separate the bank's funds from custodial assets, ensuring customer digital assets are safeguarded and segregated from JPMorgan's own assets in the event of insolvency.

For institutions hesitant to hold stablecoins issued by non-bank entities, deposit tokens from major banks provide familiar counterparty relationships and risk profiles. Treasurers comfortable with JPMorgan credit risk can treat JPMD similarly to other dollar deposits, with the added benefit of blockchain-based programmability and instant settlement.

JPMorgan positioned deposit tokens as superior alternatives to stablecoins for institutional clients, citing scalability advantages from fractional banking foundations. While stablecoins must maintain full reserves, deposit tokens leverage traditional banking's fractional reserve system, potentially enabling greater capital efficiency.

The Regulatory Landscape

U.S. Federal Framework Evolution

The U.S. regulatory approach to crypto has undergone dramatic transformation. During the Biden administration, regulators pursued enforcement actions against crypto firms, banks faced pressure to limit industry engagement, and agencies issued guidance warning about crypto risks.

The OCC under Biden-era leadership issued Interpretive Letter 1179, which imposed requirements for national banks to notify supervisors and obtain non-objection before engaging in crypto-asset activities. In March 2025, under the Trump administration's second term, the OCC rescinded IL 1179 through IL 1183, signaling a more accommodative and pro-innovation posture.

The May 2025 OCC Interpretive Letter 1184 reaffirmed that national banks may provide cryptocurrency custody and execution services through sub-custodians, confirming these activities as permissible under existing banking authority. This guidance removed significant uncertainty that had deterred bank participation.

In July and August 2025, the SEC and CFTC launched coordinated initiatives to modernize digital asset regulations, with SEC Chair Paul Atkins announcing "Project Crypto" and CFTC Acting Chair Caroline Pham unveiling a "Crypto Sprint" to implement recommendations from a White House working group.

These initiatives aim to establish fit-for-purpose regulatory frameworks tailored to digital assets rather than forcing crypto into frameworks designed for traditional securities and commodities. The goal is providing clarity that enables innovation while maintaining investor protection.

Legislative Developments

Congress has advanced multiple bills addressing digital assets, including the GENIUS Act for stablecoins passed by the House and Senate in mid-2025, and the Digital Asset Market Clarity Act passed by the House in July 2025.

The CLARITY Act seeks to define boundaries between SEC and CFTC jurisdiction, classifying tokens as either digital commodities or investment contract assets and expanding CFTC oversight. The bill addresses longstanding regulatory friction where both agencies claimed jurisdiction over crypto markets, creating uncertainty for industry participants.

The GENIUS Act establishes federal regulatory frameworks allowing major U.S. financial institutions to enter digital assets, requiring stablecoin issuers to maintain full reserve backing and adhere to strict transparency and auditing requirements. This legislation provides banks with clearer authority to engage with stablecoins and deposit tokens.

The White House Presidential Working Group's July 2025 report called for expansion of American digital asset markets, abandonment of regulation-by-enforcement in favor of focusing on bad actors, and revamp of bank regulatory and tax policies. The report's recommendations have driven regulatory agency actions and congressional legislation throughout 2025.

Basel Committee Guidelines

The Basel Committee on Banking Supervision noted that crypto-assets are not legal tender and are not backed by any government or public authority, shaping how banks approach custody, capital, and risk management. The committee's guidance generally requires banks to hold significant capital against crypto exposures, reflecting perceived risks.

For banks holding crypto assets directly, capital requirements can approach or exceed 100 percent of exposure, making such holdings extremely capital-intensive. These requirements discourage banks from accumulating large crypto positions on their balance sheets, though they don't prohibit custody services where assets are held on behalf of clients rather than owned by the bank.

The regulatory treatment of custody remains nuanced. If structured appropriately, with proper segregation between bank assets and customer assets, custody may not require the same capital charges as proprietary holdings. However, banks must still maintain adequate capital to cover operational risks, potential liability, and business continuity.

SEC, CFTC, and OCC Positions

The SEC under Chair Atkins has shifted from an enforcement-heavy approach to prioritizing rule clarity and capital formation, directing staff to lead in promoting digital asset innovation within U.S. borders. This represents a fundamental change from the previous administration's approach, which industry participants often characterized as hostile.

The CFTC, under Acting Chair Pham's leadership, has proposed utilizing exemptive authority to extend regulatory frameworks to non-security spot crypto assets, aligning with the regime contemplated by the CLARITY Act. This would give the CFTC clear jurisdiction over cryptocurrency commodities like Bitcoin while preserving SEC authority over crypto securities.

The OCC's interpretive letters throughout 2025 have consistently affirmed bank authority to engage in crypto activities including custody and trading, provided they comply with applicable law and maintain safe and sound practices. The emphasis on safety and soundness rather than categorical prohibition reflects the agency's evolution toward technology-neutral regulation.

Why Custody Triggers Different Requirements

Custody requires banks to hold customer assets securely, creating fiduciary responsibilities that trading facilitation does not. The July 2025 joint statement from federal banking regulators highlighted legal, regulatory, and risk management considerations specific to crypto-asset safekeeping.

These considerations include technical competence in cryptographic key management, robust cybersecurity to defend against sophisticated attacks, business continuity planning for novel operational risks, and legal clarity on the treatment of customer assets in bankruptcy or insolvency scenarios.

Trading facilitation, by contrast, involves executing transactions on behalf of clients without holding assets. The bank may provide market access, order routing, price discovery, and settlement coordination, but does not take custody of the underlying assets being traded. This limits liability, reduces operational complexity, and faces lighter regulatory requirements.

This distinction helps explain the sequencing: build trading first, custody later, as emphasized in industry observations about JPMorgan's strategy. Trading generates revenue immediately with manageable risk, while custody requires substantial upfront investment before revenue can be realized.

Market Impact: How Wall Street Is Rewriting Crypto Integration

Institutional Liquidity Inflows

JPMorgan's entry into crypto trading signals that institutional liquidity will increasingly flow through traditional banking channels rather than exclusively through crypto-native platforms. This has profound implications for market structure, price discovery, and cryptocurrency's integration into mainstream finance.

When the world's largest bank by assets offers crypto trading, it legitimizes digital assets in ways that dedicated crypto firms cannot. Institutional investors who maintain primary relationships with JPMorgan can now access crypto markets through trusted channels, eliminating concerns about counterparty risk, regulatory uncertainty, or unfamiliar platforms.

This development may accelerate institutional adoption. Chief investment officers, treasurers, and portfolio managers comfortable with JPMorgan's risk management, regulatory compliance, and operational capabilities can allocate to crypto without navigating unfamiliar territory. The bank's imprimatur reduces perceived risk and simplifies approval processes within institutional bureaucracies.

The impact on liquidity could be substantial. Even small percentage allocations from institutional portfolios represent enormous capital. If pension funds, sovereign wealth funds, and corporate treasuries can access crypto through existing banking relationships, allocation constraints may ease significantly.

Competitive Pressure on Other Banks

JPMorgan's announcement comes as competitors including Citibank pursue their own crypto initiatives, with Citi targeting 2026 for custody service launches. Goldman Sachs, Morgan Stanley, and other major banks have also signaled increasing engagement with digital assets.

This creates competitive dynamics that may accelerate Wall Street's crypto adoption. Banks risk losing market share if competitors offer comprehensive crypto services while they abstain. Institutional clients increasingly expect their banks to accommodate digital asset holdings, and those who cannot may lose relationships to those who can.

The competition extends beyond services to talent acquisition. Banks building crypto capabilities must hire from a limited pool of experts combining financial services experience with blockchain technical knowledge. As demand intensifies, compensation for these specialized professionals rises, increasing the cost of entering the market and benefiting banks that built capabilities early.

Market positioning matters. JPMorgan, as the first major money-center bank to announce comprehensive crypto trading plans, captures first-mover advantages including brand association with crypto innovation, early client relationships, and operational learning that will inform future product development.

Hybrid Financial Infrastructure

JPMorgan's hybrid approach, combining traditional banking with blockchain infrastructure, exemplifies the emerging financial architecture. Rather than parallel systems, the future appears to involve integrated platforms connecting fiat and blockchain rails.

This integration enables novel capabilities. Clients could hold dollars in traditional accounts and crypto in custodian wallets, trading between them instantly through unified interfaces. Settlement could occur on-chain for crypto trades and through traditional clearing for securities, with the bank coordinating across systems.

Deposit tokens like JPMD represent a critical bridge technology. They bring traditional bank deposits onto blockchain infrastructure, enabling programmability, instant settlement, and smart contract integration while maintaining the legal framework and trust of established banking.

Smart contracts could automate processes currently requiring manual intervention. Lending agreements might automatically liquidate collateral if LTV ratios breach thresholds. Trade settlements could occur instantaneously rather than requiring multi-day clearing cycles. Compliance checks could be embedded in transaction logic rather than performed after the fact.

Price Impact and Market Dynamics

The arrival of major bank liquidity could affect crypto price dynamics in multiple ways. Increased institutional participation typically reduces volatility as professional investors with long-term perspectives dilute speculative retail flows. However, concentrated institutional flows could also create new volatility sources if large allocations move in correlated fashion.

Market structure may evolve toward greater integration with traditional financial markets. Currently, crypto trades 24/7 on global exchanges with minimal circuit breakers or trading halts. As institutional participation grows, pressure may mount for market structure reforms including coordinated trading hours, better price discovery mechanisms, and systemic risk management.

Correlation between crypto and traditional assets has increased as institutional investors treat digital assets as risk-on allocations similar to growth stocks. Further institutional integration through banks may intensify these correlations, reducing crypto's portfolio diversification benefits while increasing its legitimacy as an asset class.

The long-term price impact remains uncertain. Bulls argue that institutional access through trusted banks removes remaining barriers to massive capital inflows, potentially driving prices significantly higher. Skeptics note that much institutional demand has already been satisfied through ETFs and existing platforms, meaning bank offerings may simply redistribute existing flows rather than creating new ones.

Case Study: Lessons From Early Adopters

BNY Mellon's Custody Service

BNY Mellon, the world's largest custodian bank, launched its Digital Asset Custody platform in October 2022 with select clients able to hold and transfer Bitcoin and Ether. The bank invested significant resources in building the platform, partnering with specialized firms including Fireblocks for custody technology and Chainalysis for blockchain security and compliance.

A survey sponsored by BNY Mellon found that 91 percent of institutional investors were interested in investing in tokenized products, with 41 percent already holding cryptocurrency in portfolios and an additional 15 percent planning to add digital assets within two to five years.

In September 2024, BNY Mellon obtained SEC non-objection for a custody structure using individual crypto wallets, ensuring customer assets are safeguarded and segregated from the bank's assets without requiring balance-sheet liability recognition. This regulatory breakthrough significantly reduced the capital burden of offering custody, making the service economically viable.

BNY Mellon's experience demonstrates that building custody capabilities requires years of development, substantial investment, and careful regulatory navigation. The bank's first-mover advantage came at the cost of operating in regulatory uncertainty and building infrastructure largely from scratch.

Standard Chartered's Zodia Markets

Standard Chartered has pursued crypto engagement through multiple initiatives including Zodia Markets, a cryptocurrency brokerage and trading platform, and Zodia Custody, a digital asset custody provider. The bank's strategy has involved partnerships, acquisitions, and organic development across multiple jurisdictions.

Standard Chartered launched a digital asset custody facility in the Dubai International Financial Centre in May 2024, demonstrating willingness to operate in jurisdictions with clearer regulatory frameworks even while major markets remain uncertain.

Standard Chartered's approach illustrates a geographical diversification strategy. By building capabilities in Singapore, Dubai, the UK, and other jurisdictions with relatively clear crypto regulations, the bank positions itself to serve institutional clients globally while limiting exposure in markets where regulatory uncertainty remains elevated.

Swiss and Singapore Banks

Switzerland and Singapore have established themselves as crypto-friendly banking centers through clear regulatory frameworks and supportive government policies. Banks in these jurisdictions have offered crypto custody and trading for years, providing models that U.S. banks can study.

Swiss banks including SEBA Bank and Sygnum Bank operate under specific licenses allowing comprehensive crypto services. They offer custody, trading, lending, staking, and tokenization services to institutional and high-net-worth clients, demonstrating the breadth of offerings possible under accommodative regulatory regimes.

Singapore's regulatory framework, overseen by the Monetary Authority of Singapore, provides clarity while maintaining strong investor protection and anti-money laundering requirements. Banks operating under this framework have demonstrated that comprehensive crypto services can coexist with prudential regulation and financial stability.

The success of these banks indicates that demand for integrated crypto-traditional banking services is strong among sophisticated clients. However, their experiences also reveal challenges including operational complexity, regulatory compliance costs, and the need for continuous adaptation as markets and regulations evolve.

Outcomes and Lessons

Early adopters have generally found crypto services to be profitable, though not transformatively so. Custody fees, trading commissions, and lending interest generate revenue, but volumes remain small relative to traditional business lines. The strategic value lies more in client retention, competitive positioning, and option value for future growth.

Regulatory friction has been substantial but manageable. Banks that invested in regulatory engagement, built robust compliance frameworks, and operated transparently with regulators have navigated the uncertainty successfully. Those that moved without regulatory coordination or attempted to exploit ambiguities faced more significant challenges.

Operational resilience has proven essential. Digital asset systems must operate continuously without the business-day breaks that characterize traditional markets. Technical failures, security breaches, or operational disruptions can have immediate and severe consequences. Banks successful in crypto have invested heavily in redundancy, monitoring, and incident response capabilities.

The lesson for JPMorgan and other late entrants is that crypto services require sustained commitment, operational excellence, and regulatory sophistication. Quick entries or half-measures are unlikely to succeed in a market where clients expect bank-grade reliability combined with crypto-native capabilities.

Risks and Criticisms

Conflicts With Decentralization Ethos

Bitcoin was designed as peer-to-peer electronic cash, eliminating the need for trusted intermediaries. When major banks become gatekeepers for crypto access, they reintroduce precisely the centralized control that cryptocurrencies were meant to circumvent.

Critics argue that bank-mediated crypto access represents a fundamental betrayal of cryptocurrency's founding vision. If individuals must interact with digital assets through banks rather than directly, the permissionless and censorship-resistant properties that make crypto valuable are compromised.

Banks can monitor transactions, freeze accounts, impose terms and conditions, and selectively deny service in ways that self-custody wallets cannot. While this may satisfy regulatory requirements and reduce risk, it also empowers the same institutions that crypto sought to disintermediate.

The counterargument holds that adoption requires accommodation with existing systems. Most people lack the technical sophistication or risk tolerance for self-custody. Banks provide security, convenience, and legal protections that crypto-native solutions struggle to match. Broadening access through trusted intermediaries may be the only path to mainstream adoption.

Regulatory Capture and Surveillance

Bank involvement in crypto markets intensifies regulatory visibility and potential surveillance. Banks must comply with anti-money laundering regulations, know-your-customer requirements, sanctions screening, and financial surveillance that crypto users operating through decentralized platforms can avoid.

This creates two-tier access. Sophisticated users maintaining self-custody and transacting through decentralized exchanges enjoy privacy and autonomy. Institutional and retail users accessing crypto through banks face the same monitoring and control mechanisms that govern traditional finance.

Government authorities gain enhanced ability to track, monitor, and potentially restrict crypto transactions when they flow through regulated banks. This could undermine cryptocurrency's use cases for financial privacy, censorship resistance, and protection against authoritarian control.

Privacy advocates warn that bank-intermediated crypto represents normalization of surveillance infrastructure. As more crypto activity flows through compliant channels, opportunities for private, autonomous financial activity diminish.

Third-Party Custodian Dependencies

JPMorgan's reliance on third-party custodians introduces operational dependencies and counterparty risk. If custodian platforms face technical failures, security breaches, or solvency issues, JPMorgan clients could suffer losses despite having no direct relationship with the custodian.

History provides cautionary examples. Multiple crypto custodians and exchanges have collapsed, been hacked, or experienced operational failures resulting in customer losses. While insurance and bankruptcy protections exist, recovery is often incomplete and lengthy.

This risk is particularly acute given the nascent state of crypto infrastructure. Unlike traditional custody with centuries of legal precedent and established operating procedures, crypto custody remains a relatively young industry with limited track records. Even well-capitalized, professionally managed custodians face novel risks including smart contract vulnerabilities, key management failures, and insider threats.

JPMorgan transfers this risk to custodians, but cannot fully insulate itself or its clients. Reputational damage from custodian failures could still affect the bank, even if legal liability rests elsewhere. Clients may struggle to distinguish between failures attributable to JPMorgan versus failures attributable to custodians.

Containment Versus Innovation

Some critics view Wall Street's crypto engagement as containment rather than genuine innovation. By channeling crypto adoption through traditional banks, established financial institutions may be co-opting and neutering technologies that threatened to disrupt them.

Banks can influence product development, standards setting, and regulatory frameworks in ways that favor their interests over those of crypto-native participants. They may steer the industry toward permissioned blockchains, centralized custody, and regulatory regimes that cement incumbent advantages rather than enabling decentralized alternatives.

The integration of crypto into traditional finance might represent the ultimate success of the existing system in absorbing and domesticating a potential disruptor. Rather than cryptocurrencies transforming finance, finance might transform cryptocurrencies into just another asset class, stripped of revolutionary potential.

The optimistic view holds that banks legitimizing crypto enables broader adoption that ultimately benefits the entire ecosystem. Even if banks capture significant market share, crypto-native alternatives can coexist, serving different market segments and use cases. The technology's inherent properties ensure that decentralized options remain available for those who value them.

The Bigger Picture: Future of Bank-Crypto Convergence

When Custody Might Be Added

JPMorgan's statements suggest custody remains under review rather than permanently off the table, with timing dependent on regulatory clarity and risk assessment. As the regulatory framework stabilizes, operational standards mature, and competitive pressures intensify, the calculus may shift.

Several factors could trigger JPMorgan's entry into custody. Congressional passage of comprehensive crypto legislation would provide legal certainty. Further regulatory guidance from the OCC, SEC, and CFTC clarifying custody requirements would reduce compliance uncertainty. Competitive pressure from banks offering integrated custody and trading could threaten market share. Client demand for consolidated services through single banking relationships could create compelling business case.

The timeline remains uncertain. Industry observers speculate that custody offerings could emerge within two to three years if regulatory progress continues. However, setbacks including regulatory reversals, market crises, or operational failures at other banks could delay or derail JPMorgan's custody plans indefinitely.

Integration of Tokenized Real-World Assets

Beyond cryptocurrencies, tokenization of traditional assets represents a potentially transformative application of blockchain technology. Securities, real estate, commodities, and other assets can be represented as tokens on blockchains, enabling fractional ownership, instant settlement, and programmable terms.

JPMorgan has experimented with tokenized assets through initiatives including tokenized repo transactions and securities settlement. The bank views blockchain as enabling technologies that will transform financial services, with deposit tokens and real-world asset tokenization as key applications.

As tokenized assets proliferate, the distinction between crypto and traditional assets may blur. A tokenized Treasury bond shares more characteristics with a deposit token than with Bitcoin, yet all exist on blockchain infrastructure and require similar custody and trading capabilities.

This convergence could position banks as essential infrastructure for tokenized finance. Their expertise in traditional assets, custody relationships, regulatory compliance, and balance sheet strength make them natural intermediaries for tokenized real-world assets even if their role in native cryptocurrencies remains limited.

Institutional DeFi and Programmable Money

Decentralized finance protocols have demonstrated novel capabilities including automated market making, lending pools, yield aggregation, and complex derivatives trading without traditional intermediaries. While current DeFi primarily serves crypto-native users, institutional variants could emerge that combine decentralized protocols with bank-grade compliance and oversight.

Programmable money, enabled by smart contracts and blockchain infrastructure, allows financial logic to be embedded in assets themselves. Payments could automatically execute based on conditions. Loans could self-liquidate if collateral values fall. Compliance requirements could be encoded in token logic rather than enforced through manual processes.

JPMorgan's deposit tokens represent a step toward programmable money, bringing traditional bank deposits onto blockchain infrastructure where smart contract logic can operate. Future evolution might include more sophisticated automation including interest accrual, automatic tax withholding, compliance-embedded transfers, and integration with decentralized protocols.

The vision of institutional DeFi involves banks providing legal entity wrapping, fiat on-ramps, custody, and compliance overlay while DeFi protocols provide permissionless market access, automated execution, and composable financial primitives. This hybrid model could capture benefits of both systems while mitigating weaknesses.

Legitimization or Redefinition

JPMorgan's engagement raises fundamental questions about whether banks are legitimizing cryptocurrency or redefining it into something fundamentally different. When Bitcoin flows through bank intermediaries, settles through centralized custodians, and faces the same regulatory oversight as traditional assets, does it retain the properties that made it revolutionary?

The crypto-native perspective holds that bank-intermediated crypto is not really crypto at all. Self-custody, censorship resistance, and permissionless access are not optional features but essential characteristics. Assets held by banks and accessed through traditional channels may be denominated in Bitcoin, but they operate according to traditional financial logic.

The pragmatic view holds that multiple models can coexist. Purists can maintain self-custody and transact through decentralized protocols. Mainstream users can access crypto through banks accepting the tradeoffs of convenience and security for reduced sovereignty. Different use cases require different solutions, and no single model serves all needs.

Banks may legitimize crypto by providing safe, regulated access that enables broader adoption. Or they may redefine it into a bank-compatible asset class that retains price exposure but abandons transformative potential. The answer likely involves elements of both, with the balance determining whether crypto becomes a genuinely new financial paradigm or merely the newest asset class for traditional financial institutions to trade.

Final thoughts

JPMorgan's pivot from calling Bitcoin fraudulent to building crypto trading infrastructure marks the end of an era when traditional finance and cryptocurrency existed as separate, often hostile domains. The distinction between TradFi and crypto is dissolving as banks build blockchain capabilities and crypto firms adopt banking functions.

CEO Jamie Dimon's evolution from Bitcoin's harshest critic to architect of JPMorgan's blockchain strategy exemplifies the transformation occurring across Wall Street. The journey from denying Bitcoin's legitimacy to designing blockchain-based deposits and planning crypto trading services reflects not ideological conversion but pragmatic recognition that client demand, competitive pressure, and technological potential have made engagement imperative.

The decision to offer trading while deferring custody reveals sophisticated risk management. JPMorgan captures revenue opportunities and strengthens client relationships while avoiding the highest-complexity operational and regulatory challenges. By partnering with specialized firms rather than building all capabilities internally, the bank achieves faster time-to-market and reduced execution risk.

This modular approach may become the dominant model for Wall Street's crypto integration. Banks provide client access, regulatory expertise, and integration with traditional banking services. Crypto-native firms provide custody, blockchain infrastructure, and protocol access. Together, they create hybrid offerings that neither could deliver alone.

The broader trend is unmistakable: the world's largest banks are not merely joining crypto markets but actively reshaping them. Whether this represents the victory of decentralized technology in penetrating traditional finance or the victory of traditional finance in domesticating disruptive technology remains an open question.

From denying Bitcoin's legitimacy to designing blockchain-based deposits and planning multi-asset crypto trading, the evolution of institutions like JPMorgan signals fundamental transformation in global finance. The infrastructure being built today will shape how trillions of dollars interface with blockchain technology for decades to come.

The question facing the industry is whether this marks the dawn of institutional decentralized finance - where banks provide compliant on-ramps to permissionless protocols - or the corporatization of crypto's open ideals, where disruptive technology is absorbed into existing power structures and stripped of revolutionary potential.

JPMorgan's strategy suggests the answer lies somewhere between. By engaging selectively, partnering strategically, and advancing cautiously, the bank seeks to capture crypto's opportunities while managing its risks. Whether this balanced approach succeeds in creating sustainable competitive advantage, or whether it proves inadequate in a market demanding bolder vision, will define the next chapter in the convergence of traditional and decentralized finance.