Stablecoins have surged to more than $300 billion in circulation and now process more annual transactions than Visa and Mastercard combined, mounting an unprecedented challenge to the traditional banking system. These digital tokens pegged to the dollar enable instant, round-the-clock money transfers without bank middlemen—a capability that's forcing financial institutions worldwide to confront an uncomfortable question about their future relevance. As regulators from Washington to London scramble to contain the risks, the clash between this parallel financial system and centuries-old banking is intensifying, with trillions of dollars and the architecture of global finance hanging in the balance.

Stablecoins have exploded from niche crypto tokens into a massive global asset class in just a few years. These digital coins pegged to traditional currencies – primarily the U.S. dollar – now have over $300 billion in circulation, up from virtually nothing a decade ago. In 2024 alone, stablecoins facilitated an astonishing $27.6 trillion in transactions, even surpassing the annual volumes of Visa and Mastercard combined. Yet behind these headline figures lies a potential financial revolution that is both exciting and unsettling: stablecoins are encroaching on functions long dominated by banks.

Their rapid growth raises a stark question for the future of finance – will these private digital dollars complement the banking system, or ultimately compete it out of existence?

Regulators and bankers worldwide are paying close attention. Stablecoins started as a convenient bridge between fiat money and cryptocurrencies, but their soaring popularity has begun to bleed into mainstream finance. They offer the ability to send dollars (or other fiat value) instantly, 24/7, across borders, without using a bank as intermediary.

That promise of fast, low-cost transactions is alluring to businesses and individuals – and potentially threatening to traditional banks that profit from payment fees and custody of deposits. Financial authorities from London to Washington have voiced concerns that stablecoins could move money outside the regulated banking system, undermining banks’ role in payments and credit creation.

Bank of England Governor Andrew Bailey has even cautioned banks against issuing their own stablecoins, and European Central Bank President Christine Lagarde warned that privately issued stablecoins pose risks to monetary policy and financial stability. As stablecoins push further into the mainstream, incumbent banks face a choice: innovate and adapt, or watch this new form of digital money erode their turf.

What Are Stablecoins? Top Stablecoins and Their Growth

Stablecoins are a category of cryptocurrency designed to maintain a stable value by pegging 1-to-1 to an asset like a national currency. Most are pegged to fiat currencies such as the U.S. dollar, meaning one token is meant to be redeemable for one dollar. To uphold that peg, stablecoin issuers back their coins with reserves of real assets – typically cash, short-term government bonds, or other highly liquid investments. In essence, a stablecoin acts as a digital IOU for fiat money held in reserve. This structure allows users to transact in a cryptocurrency token that has the price stability of traditional money, unlike volatile assets like Bitcoin.

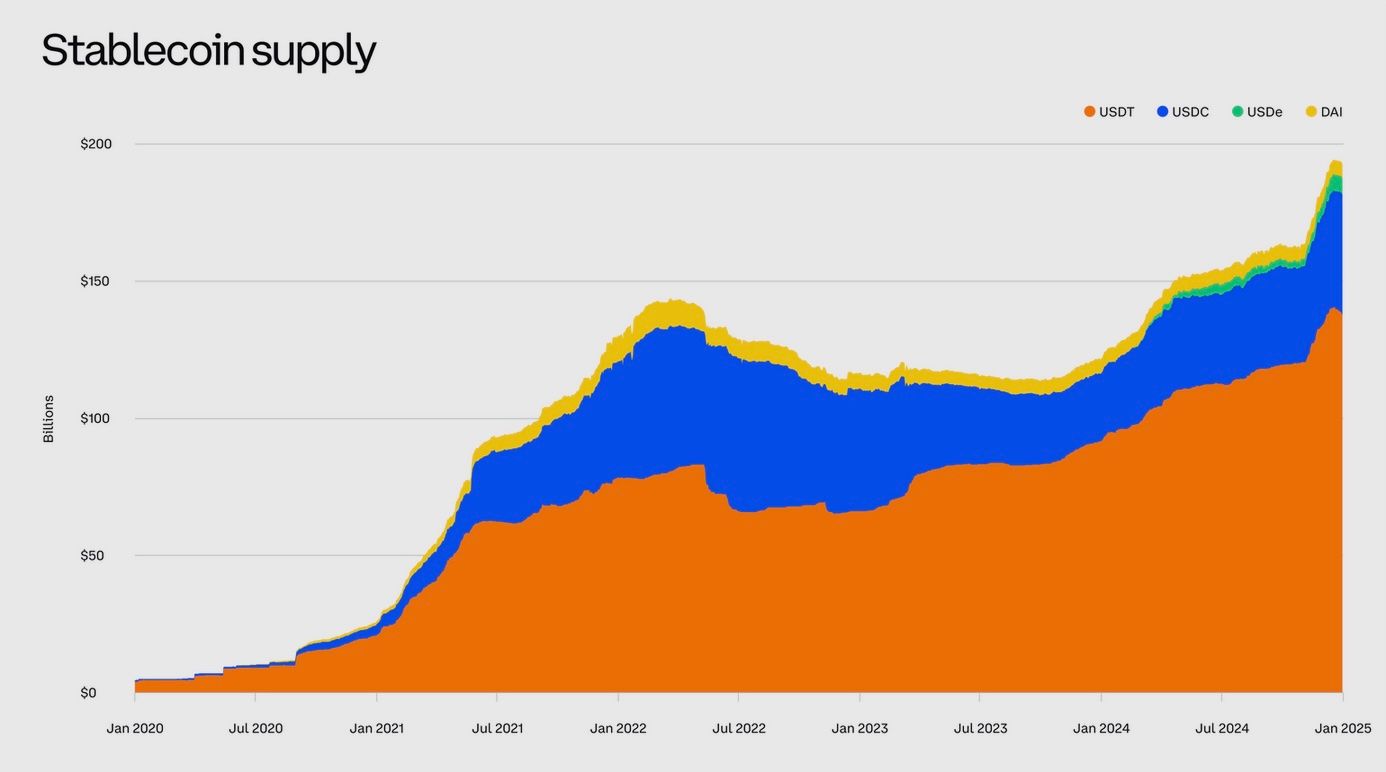

Stablecoins originated in the mid-2010s as tools for crypto traders seeking a safe parking place between trades. Rather than cash out to a bank account (which can be slow and incur fees), traders could swap into a dollar-pegged token on a crypto exchange to stay in the digital realm. Over the past several years, however, stablecoins have outgrown their crypto-only niche. Today their use cases are expanding to include remittances, payments, and as a store of value in countries with unstable currencies. The total value of U.S. dollar stablecoins has surged from just a few billion a few years ago to roughly $250–300 billion in 2025 – an increase so dramatic that policymakers report the stablecoin market “more than doubled in the past 18 months” alone. Notably, dollar-linked tokens dominate this sector: over 99% of all stablecoin value is pegged to USD, underscoring the dollar’s first-mover advantage in this digital arena.

Let's take a look at some of the leading stablecoins today.

Tether (USDT)

Launched in 2014, Tether's USDT is by far the largest stablecoin. It has a market capitalization around $180 billion (accounting for well over half of all stablecoins in circulation) and is issued by a private company now based in El Salvador. USDT’s reserves are held largely in U.S. Treasury bills and cash equivalents, and Tether’s growth has been striking – the company’s latest disclosures showed it earned $13.7 billion in profit in 2024 and now holds about $98 billion in U.S. Treasuries to back its tokens. Originally popular on crypto exchanges, USDT is increasingly used globally as a de facto dollar substitute in countries with volatile currencies.

USD Coin (USDC)

The second-largest stablecoin, USDC is issued by Circle (a U.S. fintech firm) in partnership with Coinbase. USDC’s circulation peaked around $50 billion and currently stands near $25–30 billion. Marketed as a more transparent and regulated stablecoin, USDC publishes regular attestations of its reserves (held in cash and short-term Treasuries) and has secured relationships with U.S. banks and custodians. It is widely used in the crypto industry and by some payment firms, prized for its compliance measures. Circle has also launched Euro Coin (EUROC) pegged to the euro, though non-USD stablecoins remain relatively small.

Dai (DAI)

An innovator in decentralized finance, DAI is a stablecoin issued not by a company but by the MakerDAO protocol on Ethereum. It maintains its $1 peg through an over-collateralized system of crypto assets (like Ether) locked in smart contracts. DAI’s supply is on the order of $5 billion. Its decentralized nature means no single entity holds its reserves, attracting users who value censorship-resistance – though its stability mechanisms make DAI more complex, and it has gradually introduced real-world assets into its collateral mix to bolster confidence.

Ripple USD (RLUSD)

A newer entrant, RLUSD was launched by fintech firm Ripple in late 2024 and has rapidly gained ground. Backed 1:1 by dollars and Treasuries, RLUSD’s circulating supply surpassed $500 million within seven months of launch, placing it among the top 20 stablecoins globally. This growth has been fueled by institutional adoption: for example, Ripple secured BNY Mellon as the custodian for RLUSD’s reserves, leveraging one of the world’s largest custodial banks to enhance trust and compliance. Ripple is positioning RLUSD for enterprise uses and cross-border payments, and even some regulated banks (such as Amina Bank in Switzerland) have begun offering custody and trading of RLUSD – a sign of the blurring lines between stablecoin providers and traditional finance.

Euro and Other Currency Stablecoins

A variety of stablecoins peg to currencies like the euro, British pound, or Japanese yen, though their footprints remain modest compared to dollar tokens. For instance, Stasis Euro (EURS) and Circle’s EUROC each have market caps in the low hundreds of millions. In 2023, France’s Societe Generale became the first major bank to issue a stablecoin (a dollar-backed token called “CoinVertible”), but it has only about $30 million in circulation so far. Nonetheless, Europe is laying groundwork for growth: the EU’s new MiCA regulation provides a single license regime for euro-denominated stablecoins across 27 countries, and a consortium of nine European banks (including ING and UniCredit) recently announced plans to launch a euro stablecoin together. These efforts reflect a recognition that digital money innovation isn’t confined to dollars, even if USD stablecoins currently loom largest.

Real World Usability

Despite the proliferation of stablecoins, it’s important to note how they are used today. Studies find that roughly 90% of stablecoin transaction volume still comes from crypto-market activity – trading between digital assets – while only about 6–10% of volume is for real-world payments for goods and services.

In other words, stablecoins’ “real economy” usage is still in its infancy, and their penetration into everyday commerce is limited. Total stablecoins outstanding are also tiny relative to traditional money supplies – on the order of 1% of U.S. M2 money stock. For now, stablecoins serve largely as digital liquidity in crypto markets and as a convenient cross-border transfer tool for a subset of users. But if adoption continues on its upward trajectory, stablecoins could evolve from a supporting role to a central one in global finance. That prospect has banks both excited and alarmed in equal measure.

Why Stablecoins Could Threaten Traditional Banks

Commercial banks have long been the gatekeepers of money, benefiting from the float of customer deposits and the fees from processing payments. Stablecoins potentially challenge both of those roles. By offering a dollar-denominated asset outside the banking system, stablecoins invite people and businesses to hold value in digital tokens instead of bank accounts. And by enabling peer-to-peer, internet-based transactions, stablecoins can bypass the bank-centric payments network.

This paradigm shift raises multiple threat vectors for banks.

Drain on Bank Deposits

Banks rely on deposits as their core funding to make loans. If users shift large sums into stablecoins, it could siphon off deposits that banks would otherwise use to lend to the economy. In the eyes of bank regulators, this is a prime concern. Sarah Breeden, Deputy Governor of the Bank of England, recently cautioned that significant outflows of deposits into stablecoins could lead to a “precipitous drop in credit” available to businesses and households if banks cannot quickly replace that funding.

In other words, if millions of customers pulled cash from savings accounts to buy stablecoins, banks might have to scramble for other funding (like expensive wholesale borrowing) or cut back on lending – a scenario that could constrict economic activity. This is one reason the BoE has floated the idea of capping how much stablecoin one can hold (for example, £10,000–£20,000 per person initially) until the sector is proven safe. No other major jurisdiction has such limits yet, but the very suggestion underscores banks’ fear of deposit flight.

Reduced Fee Income from Payments

Stablecoins enable near-instant, borderless transactions often for mere pennies in network fees, which contrasts sharply with traditional bank wires or cross-border remittances that incur higher charges and take days. If stablecoins become widely used for payments, banks and card networks could lose revenue.

For example, sending $100 to a friend overseas via stablecoin can be far cheaper and faster than using a bank transfer or services like Western Union. Already, crypto-savvy users in emerging markets use dollar stablecoins to send money abroad or make online purchases, avoiding bank currency conversions and fees. As stablecoin infrastructure improves and integrates with user-friendly apps, it could erode the dominance of bank-mediated payment channels, especially for cross-border and high-value transfers, where banks historically enjoyed fat margins.

Competition for Customers and “Financial Data”

A future where salaries, invoices or e-commerce are settled in stablecoins is a future where customers might not need a traditional checking account for daily finances – they could transact from a digital wallet. That implies banks risk losing the customer relationship and the valuable data that comes with it.

Big stablecoin issuers or wallets could gain tremendous economic power. U.S. regulators noted that a widely adopted stablecoin and its wallet could “wield huge economic power” and potentially wall in users, making it harder for them to switch services. This echoes how tech giants captured market power: by owning the platform through which users transact. If a private stablecoin (say, one issued by a consortium of big tech or finance firms) became a dominant medium of exchange, it might control transaction data and access in ways that bypass banks entirely.

“Shadow Bank” Risks and Runs

Stablecoin issuers perform a bank-like function – taking in funds and holding reserves to back a monetary liability – but historically they’ve operated outside the full banking regulatory perimeter. This raises financial stability concerns. Bank lobbyists point out that if a stablecoin issuer invests heavily in bank deposits (to earn yield on reserves) but isn’t subject to the same oversight, it could pose new risks. The Bank Policy Institute, an association of major banks, has warned that stablecoins could become a new source of runs on the banking system.

Their logic: If issuers placed a lot of their reserve assets as uninsured deposits across various banks, a sudden wave of redemptions (a run on the stablecoin) would force those issuers to withdraw funds en masse from banks, potentially upending those banks’ liquidity. In a recent analysis, BPI likened this dynamic to the 2008 run on money market funds that nearly froze bank funding markets.

They noted that such a stablecoin-driven liquidity crunch “closely resembles the dynamics that led to the global financial crisis” – a chilling comparison that bank executives surely do not take lightly.

Disintermediation and Credit Crunch

Even outside a acute “run” scenario, the growth of stablecoins could gradually disintermediate banks in normal times. If people trust that a regulated stablecoin is as good as a bank deposit for holding money, they might keep more cash in stablecoins (earning perhaps some yield via crypto platforms) and less in low-yield bank accounts.

Analysts estimate that if stablecoins are largely backed by safe government securities (Treasury bills) instead of bank loans, then dollars that flowed into stablecoins are funding government debt, not being lent out by banks to businesses and consumers.

One prominent estimate suggested that in a scenario where stablecoin adoption surged, bank deposits could decline by as much as 20% – a dramatic contraction of the traditional banking sector’s balance sheet. Even more conservative assumptions still foresee a “substantial decline in deposits” as likely if stablecoins keep growing. For banks, fewer deposits mean less fuel for credit creation, or having to raise funds via pricier channels, squeezing profit margins. The net effect could be a contraction in banks’ role in financial intermediation.

How Big Is the Threat?

It’s worth emphasizing that today’s stablecoin footprint is not yet an existential threat to banking.

Even around $300 billion in stablecoins is small next to the trillions in U.S. bank deposits. And as noted, the vast majority of stablecoin usage so far is in the crypto trading realm, not competing with everyday retail banking. Many skeptics argue that at current scale stablecoins present “no material threat” to financial stability or bank deposit franchises.

However, the trajectory has bankers wary.

Policymakers have noticed that stablecoin market value leapt 500% in a year at one point, and could grow much larger with new use cases. In the U.S., officials have openly mused that if stablecoins started paying interest, they could attract significantly more demand away from bank deposits.

Projections by Wall Street research vary widely – from a moderate scenario of $500 billion in stablecoins by 2028, up to optimistic cases of $2–3 trillion in stablecoins within this decade.

At those levels, stablecoins would begin to encroach on the lower end of money supply measures and the traditional deposit base. It’s this potential for rapid scale-up – and the difficulty of reining it in once it takes off – that keeps bank CEOs and central bankers up at night.

They fear a kind of uber-“narrow bank” future where vast pools of money sit in stablecoins (fully backed by safe assets, yes, but outside the loan-making channels of banks), leaving banks less relevant to the flow of funds in the economy.

How Banks Are Responding to the Stablecoin Challenge

Facing the dual prospects of disruption and opportunity, many banks are no longer dismissing stablecoins – they are engaging with the technology and shaping strategies to coexist with or counter it.

Here’s how traditional banks are responding to the rise of stablecoins.

Launching Their Own Digital Cash Tokens

A number of major banks have decided that if stablecoins are here to stay, they would rather issue or control them than be disintermediated. In an unprecedented collaboration, ten of the world’s largest banks – including Bank of America, JPMorgan Chase, Goldman Sachs, Citi, Barclays, Deutsche Bank, and others – announced in October 2025 that they are jointly exploring a new stablecoin that would be pegged to major currencies like the dollar, euro, and pound.

This consortium aims to create blockchain-based tokens fully backed by G7 currencies, effectively a bank-operated stablecoin network. The project (still in early stages) is intended to meet customer demand for digital assets while ensuring any stablecoin remains under robust regulatory and risk management standards that banks must follow.

The very formation of this group is telling: it’s a defensive play to “get to grips with” digital assets on banks’ own terms.

Earlier, a few individual banks tested the waters with proprietary tokens.

JPMorgan’s “JPM Coin” launched in 2019 as an internal settlement coin for corporate clients, essentially a tokenized deposit used to instantly transfer value within JPMorgan’s network.

By 2023–24, JPMorgan expanded these efforts, rolling out what it calls “JPMorgan Deposit Tokens” for cross-border payments among institutional clients.

These are not public stablecoins tradable on exchanges, but rather digital dollars that live on a permissioned blockchain run by the bank – a sort of private stablecoin only usable by the bank’s customers. Other banks like BNY Mellon, HSBC, and Wells Fargo have run pilots or joined consortia experimenting with tokenized deposits and interbank payment coins. This signals that big banks envision a future where money on ledger (blockchain-based representations of deposits) could become common for settlement – potentially offering the speed of stablecoins but within the regulated banking fold.

Embracing Regulatory Clarity and Competing on Trust

Until recently, U.S. banks trod cautiously around stablecoins, in part due to unclear rules. But momentum shifted with the passage of the U.S. “Stablecoin Bill” (sometimes dubbed the GENIUS Act) in 2025, which for the first time provides a federal framework for banks to issue payment stablecoins under oversight. With legal green lights appearing, bank CEOs have become markedly more upbeat about participating.

On a second-quarter 2025 earnings call, Jamie Dimon, CEO of JPMorgan, told analysts: “We’re going to be involved in both JPMorgan deposit coin and stablecoins – to understand it, to be good at it.” This pragmatic approach – getting involved rather than resisting – shows banks know they can’t ignore customer demand for digital dollar tokens.

Jane Fraser, CEO of Citigroup, echoed this sentiment, saying Citi is “looking at the issuance of a Citi stablecoin” and highlighting that the bank is already live in four countries with “tokenized deposit” systems for 24/7 cross-border payments. In her view, innovations like stablecoins and deposit tokens are “a good opportunity for us” and align with Citi’s goal to enable real-time global transactions for clients.

Such public statements from top bankers would have been unthinkable a few years ago; now they’re practically expected, as shareholders and regulators alike want to hear that banks have a digital asset game plan.

One edge banks are leaning into is trust and safety.

Unlike standalone crypto companies, banks are highly regulated and generally enjoy public trust with money.

Banks can leverage that by issuing stablecoins that are seen as safer, fully insured or compliant alternatives. For example, a bank-issued stablecoin could potentially come with FDIC insurance up to certain limits (if structured as tokenized deposits), something no current crypto-native stablecoin offers.

Even short of that, banks can assure that their coins are 100% reserved in cash at the central bank or in insured bank accounts, and subject to regular audits by regulators – addressing concerns about the opacity of some existing stablecoin issuers. In the competitive stablecoin arena, a “regulated bank coin” might attract institutions or users who have so far held back due to counterparty risk fears.

Partnering and Providing Services to Stablecoin Firms

Not all banks want to launch their own coin – many are instead finding ways to earn revenue from the stablecoin ecosystem. A clear example is banks acting as custodians or trustees for stablecoin reserves. In mid-2025, BNY Mellon – America’s oldest bank – was chosen by Ripple to custody the reserve assets backing the new RLUSD stablecoin.

In this role, BNY holds the U.S. dollar deposits and Treasury bills that collateralize RLUSD tokens, providing an extra layer of oversight. This is a mutually beneficial arrangement: the stablecoin issuer gets to advertise a blue-chip bank safeguarding its funds, and the bank earns fees for its custodial service (and keeps a foothold in the digital asset space).

Similarly, U.S. Bank and State Street have provided custody for reserve assets of some stablecoin operators. Even Silvergate Bank (a now-defunct bank that had been crypto-focused) at one point held the reserves for Circle’s USDC. This service-provider approach allows banks to profit from stablecoins’ rise without necessarily issuing one themselves.

Banks are also eyeing roles as market makers and settlement agents for stablecoins.

Payment giants Visa and Mastercard have begun integrating stablecoin settlement in their networks (e.g. allowing crypto platforms to settle card payments in USDC). Many of those flows still involve partner banks on the back-end. For instance, Visa’s USDC settlement pilot in 2021 enlisted an anchor bank to receive and convert the USDC to dollars. As those card networks expand stablecoin support, they’ll bring more banks into the plumbing – ensuring banks aren’t cut out of the fees entirely.

Upgrading Infrastructure and Competing on Speed

A defensive but important response from banks is to make traditional payments faster and cheaper, closing the gap that stablecoins exploit.

The launch of new real-time payment systems like FedNow in the United States and the continued expansion of instant bank transfer schemes globally are partly aimed at nullifying the “slow and costly” critique of bank payments. If sending money via your bank becomes as instant as sending a stablecoin, the incentive to leave the banking system diminishes. Banks are investing in modernizing their core systems, adopting technologies like blockchain for back-office settlement (even for non-crypto assets), and exploring interoperability between legacy networks and blockchain networks.

Some banks have joined projects to enable atomic settlement of tokenized assets against cash (for example, settling a stock trade instantly with a tokenized dollar). All these efforts are meant to ensure that even if the form of money changes (from paper to digital tokens), banks remain the key intermediaries facilitating the movement.

Lobbying and Shaping Regulation

Finally, banks are heavily engaged with regulators to shape the rules of the game.

The banking industry has, on one hand, lobbied for strict oversight of non-bank stablecoin issuers – arguing that anything functioning like money in the economy should face bank-like regulation to ensure a level playing field. This push is evident in proposals that stablecoin issuers be insured depository institutions or subject to equivalent standards. Banks feel this would prevent an exodus of deposits to lightly regulated entities.

On the other hand, banks also advocate for clarity that they can participate in stablecoins.

The recent U.S. legislation, for example, explicitly allows banks to issue payment stablecoins with 1:1 reserves, which was supported by banking groups who want explicit authorization to compete in this space. In the EU and UK as well, banks are at the table as new rules (like MiCA in Europe or stablecoin guidance in Britain) are formulated, ensuring their concerns about financial stability and fair competition are heard. In short, banks are leveraging their influence to lean into stablecoins under safe conditions – ideally carving out a big role for themselves in any future stablecoin-driven financial system.

It’s clear that the largest banks do not intend to simply watch from the sidelines.

As JPMorgan’s Jamie Dimon put it, fintech innovators “are very smart – they’re trying to figure out a way to create bank accounts and get into payment systems… We have to be cognizant of that. The way to be cognizant is to be involved.” That ethos now prevails on Wall Street. From building their own coins, to backing startups, to upgrading infrastructure, banks are mobilizing to meet stablecoins on their own turf.

The endgame could be a convergence – where the line between a “stablecoin” and a “bank deposit” blurs, and customers simply choose between different flavors of digital dollars, some issued by tech upstarts, others by household-name banks.

Banks Adopting Stablecoins: Boosting the Trend or Containing It?

As banks increasingly adopt stablecoin technology or even stablecoins themselves, an intriguing dynamic emerges: will banks’ involvement accelerate the stablecoin movement, or will it tame it and keep banks central? Industry experts are divided, but several trends and opinions stand out:

On one side, banks’ adoption of stablecoins could legitimize and propel these digital assets into mainstream use. When globally trusted institutions like Citi or Goldman Sachs embrace stablecoin platforms, it sends a signal to the market (and to customers) that stablecoins are not just fringe crypto toys, but a valid part of modern finance.

For example, when Citi’s CEO touts their “Citi Token Services” and plans for a Citi-branded stablecoin, many multinational corporate clients might feel more comfortable experimenting with stablecoins for treasury operations or cross-border trades. Similarly, if a consortium of 10 major banks issues a new “G7 stablecoin”, it could quickly gain traction among those banks’ millions of customers and correspondents. In this sense, banks could act as a catalyst, dramatically expanding stablecoin adoption by plugging it into existing financial networks and distribution channels.

A stablecoin integrated into your familiar banking app, with the bank’s assurance behind it, might attract users who would never have set up a crypto wallet on their own.

Moreover, banks could help stablecoins reach use cases that have been elusive so far. Today, as noted, only a small fraction of stablecoin volume is real-economy payments.

Banks might change that by incorporating stablecoins into point-of-sale payments, e-commerce checkouts, or remittance services that they offer.

For instance, a bank could allow its customers to seamlessly convert deposit balances into a stablecoin to send abroad, and the recipient’s bank on the other end could auto-convert it to local currency. This kind of bank-mediated stablecoin payment could dramatically increase the share of stablecoin transactions used in commerce and remittances, fulfilling stablecoins’ promise as a universal payment medium. In effect, banks would be boosting stablecoins by leveraging their trust and network advantages to drive usage beyond the crypto niche.

However, banks’ deep involvement could also ensure that stablecoins don’t diminish banks’ role but rather extend it into the digital realm. If most people end up using bank-issued or bank-managed stablecoins, then banks retain control (or at least partnership) in this new money format. We might see a future where stablecoins are ubiquitous, yet behind each major stablecoin stands a consortium of banks handling reserves, compliance, and convertibility. In that scenario, stablecoins would not “kill” banks so much as become another product offered by banks.

Much like banks adapted to online banking and mobile payments (which disintermediated some functions but ultimately were integrated into banking services), they could adapt to stablecoins by folding them into the banking ecosystem. Some analysts thus see stablecoins as a new chapter for banks, not a death knell. A report by Goldman Sachs earlier dubbed the surge of tokenization as “stablecoin summer” and noted some banks feel threatened, but others see an opportunity to reduce costs and modernize payments by using stablecoin tech under their own brands.

There are also voices urging perspective: at current scale, stablecoins are still tiny relative to global finance. The total value of all stablecoins is a rounding error in the $400+ trillion world of traditional assets. A commentary in the IMF’s magazine by economist Hélène Rey acknowledged stablecoins’ rapid growth but called for calm, noting that their share of global transactions is around 1%, and that they remain “a rounding error” next to the vast bond and forex markets.

Rey did warn about future risks (she famously listed the “hollowing out of the banking system” as one potential consequence if dollar stablecoins proliferate unchecked), but she and others suggest that appropriate regulations can integrate stablecoins without imploding banks. In fact, regulators are counting on banks to play a key role in whatever shape stablecoins take – whether as issuers, intermediaries or gatekeepers for convertibility.

To the extent that banks themselves drive stablecoin adoption, the overall impact on banks’ relevance could be neutral or even positive. If, say, JP Morgan issues a huge volume of JPM Coins that are used worldwide for settlements, JP Morgan hasn’t been disintermediated – it’s still at the center, just using new rails.

Likewise, many regional and smaller banks could benefit by connecting to stablecoin networks to offer faster, cheaper international payments to their customers, rather than losing those clients to fintechs. There’s precedent in the history of finance: when money market funds arose in the 1970s and pulled deposits from banks, banks responded by issuing their own competitive products (and regulators adjusted rules); ultimately banks survived, even though the product mix changed. Stablecoins could follow a similar pattern, with banks adjusting and perhaps co-opting the innovation.

Of course, there is a counter-scenario that worries bank executives: that a few non-bank stablecoin issuers become so dominant that they effectively turn into new digital banks with massive user bases, and that these newcomers diminish the importance of traditional banks in the payments landscape. Imagine a future where hundreds of millions of people hold most of their money in an e-wallet provided by a tech company or fintech, with a stablecoin balance instead of a bank balance. In that world, banks could recede into a behind-the-scenes role, mainly providing back-end settlement, compliance, or last-mile conversion to cash – important, but far less visible and less influential than today. Some see this as a real possibility if, for instance, a big tech firm like Apple, Amazon, or Alibaba issued a widely accepted stablecoin, leveraging their user networks. That could diminish banks’ customer interface role in global finance, making banks more like utilities. Banks’ push to issue their own stablecoins can be viewed as an effort to prevent that outcome by staying at the forefront of digital currency issuance.

For now, the jury is still out.

We are in a period of experimentation and jockeying. Some banks are clearly boosting the stablecoin sector – e.g., when major banks publicly discuss stablecoins as the next evolution of money, it validates the concept and invites broader adoption. Their pilots and products will likely increase stablecoin usage (albeit in a more regulated form).

Other banks remain cautious, engaging only when necessary and hoping that if they give customers fast digital alternatives (like instant bank payments), the demand for outside stablecoins might stall. Multiple experts have pointed out that stablecoins currently complement banks by filling needs banks haven’t met (like 24/7 instant USD transfers globally), but they don’t yet replace core lending or deposit functions. As banks move to fill those gaps themselves (through things like real-time payments), stablecoins might find it harder to break away.

In short, banks adopting stablecoins creates a paradox: banks may help stablecoins become mainstream, yet by doing so ensure they themselves remain integral in the stablecoin-based system.

The balance of power between incumbent banks and upstart issuers will depend on who delivers the most convenient, trusted service to end-users. If banks can make using a digital dollar token as easy and safe as using one’s bank card or app today, they stand to gain more than they lose. If instead non-bank stablecoins innovate faster and scale globally before banks catch up, they could marginalize some banking activities.

The next few years, with regulatory frameworks solidifying and bank-led initiatives launching, will be critical in determining whether stablecoins are ultimately controlled by the old guard or the new.

Stablecoins and Fiat Money: Rivals or Reinforcements?

One of the most fascinating hypotheses about stablecoins is that, rather than destroying or replacing fiat money, they might actually strengthen fiat’s dominance – especially the U.S. dollar’s.

It’s a counterintuitive idea.

How could an innovation initially conceived to bypass banks and national currencies end up entrenching the supremacy of those currencies?

Yet mounting evidence suggests that dollar-pegged stablecoins are acting as ambassadors for the dollar, spreading its use to new frontiers and bolstering demand for dollar-denominated assets.

The reasoning starts with the observation that stablecoins are overwhelmingly tied to existing fiat currencies, not novel units. A stablecoin’s value and utility derive entirely from the credibility of the currency it mirrors. In practice, the U.S. dollar underpins the vast majority of stablecoins – around 99% by market share.

Thus, when someone in, say, Argentina or Nigeria opts to hold a stablecoin, they are in effect choosing the U.S. dollar (just in digital form) over their local money.

This contributes to what economists call “dollarization”: the adoption of USD as a store of value or medium of exchange in place of weaker local currencies. Dollar stablecoins have made dollarization easier than ever – you no longer need a U.S. bank account or a stack of $100 bills under the mattress; a smartphone and a stablecoin wallet suffice to access dollars. As a result, every time a citizen in Turkey or Nigeria buys USDT, they reinforce the dollar’s role as the de facto currency for trade and savings in that context. Over time, this expands the dollar’s reach into economies where U.S. banks have little presence but where stablecoins circulate among ordinary people and businesses.

Importantly, stablecoins also spur demand for U.S. dollar assets because of how they are structured. To maintain a stablecoin’s peg, issuers hold large reserves of dollar-based assets – mainly U.S.

Treasury bills and bonds. In effect, stablecoin users worldwide collectively fund a portfolio of U.S. government debt held by the issuers. Take Tether and Circle, the two largest dollar stablecoin issuers: together they reportedly own well over $100 billion in short-term U.S. Treasuries, placing them among the top foreign holders of U.S. debt. In fact, IMF data shows that the Treasury holdings of just Tether and Circle now exceed the U.S. debt held by major countries like Saudi Arabia. Stablecoins have thus been dubbed a “Trojan horse for U.S. debt” – quietly ensuring continued global buying of Treasuries. For the U.S. Treasury, this is a boon: a new class of buyers for its bonds, potentially helping finance America’s deficits at the lowest possible cost. For context, in 2024 Tether alone issued tens of billions of new USDT, investing much of the proceeds into T-bills; one might say stablecoin users indirectly financed a chunk of the U.S. government’s short-term borrowing needs.

Far from challenging the primacy of the U.S. dollar, stablecoins seem to be buttressing it. A senior U.S. lawmaker recently argued that “the best way for us to maintain dollar dominance worldwide is to spread stablecoins globally.” This sentiment now has high-level backing: the U.S. Congress and White House have come around to the view that well-regulated stablecoins could cement the dollar’s leadership in the digital economy, especially as geopolitical rivals promote alternatives.

The fact that over 80% of stablecoin transactions occur outside U.S. borders but in U.S. dollars speaks volumes. It means the dollar is extending its influence through private digital tokens into regions where people might distrust local banks or face currency controls, but will readily use a dollar token. As one Reuters commentary put it, rather than facilitating “de-dollarization,” the rise of stablecoins has coincided with a resurgence of global dollar dominance – a revival of the dollar’s “exorbitant privilege” in a new high-tech wrapper.

Economist Hélène Rey noted the flip side of this in her analysis: if dollar-backed stablecoins take off, they reduce demand for other countries’ currencies and bonds, effectively boosting the U.S. dollar at their expense. She observed that these stablecoins could become a “digital pillar strengthening the U.S. dollar’s privilege.”

In practical terms, a merchant in South America might start invoicing all exports in USDC instead of the local currency; a family in Lebanon might hold savings in USDT because banks are unstable; an exchange in Asia might use only USD stablecoins as quote currency. In aggregate, such behavior tightens the dollar’s grip on global trade and finance, even without direct involvement of U.S. banks or the Federal Reserve.

Stablecoin proponents often highlight this outcome to U.S. policymakers: rather than viewing stablecoins as a threat, they say, think of them as a strategic asset in the digital geopolitics of currency.

By embracing dollar stablecoins (and creating sensible guardrails for them), the U.S. could export its currency and debt more effectively. Indeed, we’ve seen a subtle shift in narrative from U.S. officials in 2025. Whereas a few years ago regulators were mostly fearful of stablecoins, now there’s an understanding that if the U.S. doesn’t foster dollar stablecoins, someone else’s currency could fill that void. The emergence of China’s digital yuan, for example, has likely nudged U.S. lawmakers to lean into the competitive advantage that privately-driven dollar tokens already have.

Even for national currencies beyond the dollar, there’s an argument that stablecoins might complement, not kill, fiat. Consider the euro: various European firms are issuing euro stablecoins, and the EU will regulate them under MiCA. Some analysts argue that euro stablecoins, if widely used in crypto markets or emerging digital networks, could extend the euro’s international role slightly (currently the euro is underrepresented in online commerce and commodity trading). It’s unlikely euro stablecoins will rival dollar ones soon, but they could ensure the euro isn’t absent from the next generation of finance. Likewise, for smaller economies, a stablecoin linked to their local currency – if well-designed – might actually bolster confidence in that currency by providing easier access and programmability, rather than undermining it. Much depends on how governments harness the technology.

To be clear, there are voices of caution.

Some economists warn that while stablecoins boost the reach of major fiat currencies, they might also erode monetary control in countries that see their citizens prefer a foreign stablecoin. If Argentines flock to USD stablecoins, Argentina’s central bank loses some efficacy of its monetary policy (a digital dollarization effect).

But from the perspective of the fiat currency being adopted (the U.S. in this case), that’s a net positive for influence. For the global user, stablecoins can be viewed as enhancing fiat by making it more accessible: a farmer in a remote area can hold U.S. dollars on a phone even if no dollar bank exists nearby. Stablecoins didn’t invent a new currency – they are riding on the strength of existing money, especially the dollar, and arguably reinforcing it by embedding it into new technologies and markets.

There is an ironic twist here.

Cryptocurrency emerged in part from distrust in fiat currency (recall Bitcoin’s origins during the 2008 bank crisis). Yet the breakout success of crypto has been the stablecoin – whose entire premise is pegging to fiat currencies managed by central banks. In a way, the crypto movement has inadvertently amplified fiat’s dominance by digitizing it. As one Reuters columnist dryly noted, it would be “ironic if crypto – born from skepticism about dollar stability – ends up reinforcing the greenback’s dominance.” But that is exactly what seems to be happening.

Stablecoins have unlocked new demand for dollars.

Some estimates say over 200 million people worldwide have now used or held dollar stablecoins, a user base that simply didn’t exist a few years ago. They’ve also created a new pipeline for U.S. dollar investment via reserves.

For American banks and the U.S. government, this dynamic is not entirely unwelcome. If stablecoins boost global dollarization, that can support U.S. influence and make U.S. assets more in-demand. We see this in how the U.S. Treasury has not opposed stablecoins as vehemently as it might have – likely recognizing the benefit of an extra buyer for its debt. The conversation has shifted toward managing the risks (ensuring issuers are sound, reserves are safe, transactions can be monitored for illicit activity) while preserving the macroeconomic benefits of stablecoins carrying the dollar banner.

In summary, stablecoins are proving to be more symbiotic with fiat currencies than antagonistic – at least for strong currencies like the dollar.

They rely on fiat value, and in scaling up, they propagate the use of that fiat. This suggests that stablecoins won’t trigger the demise of major sovereign currencies; if anything, they may extend the life of those currencies in the digital realm. Of course, this assumes a cooperative regulatory environment.

If governments harness stablecoins (or issue central bank digital currencies as an alternative), fiat money could emerge in an even more dominant form – circulating digitally with the same trust backing as before. If instead there were a breakdown of trust in the underlying fiat (for example, high inflation undermining the dollar’s value), stablecoins would suffer simultaneously, since they are only as good as the assets they represent. In that sense, stablecoins and fiat are joined at the hip: one’s strength feeds the other, and one’s weakness would also transmit to the other.

So far, the relationship has been mutually reinforcing, especially for King Dollar.

Conclusion: Will Stablecoins Kill Banks?

After examining the evidence, the notion that stablecoins will outright “kill” banks appears overstated.

Stablecoins are undeniably shaking up the financial sector – they introduce a new way to hold and move money that challenges some traditional bank functions. In areas like international payments and digital asset trading, stablecoins have carved out a significant niche that banks can no longer ignore. However, rather than a zero-sum displacement of banks, what we’re witnessing is a period of adjustment and integration. Banks are adapting by entering the stablecoin space themselves and leveraging their strengths (trust, compliance, scale) to remain relevant.