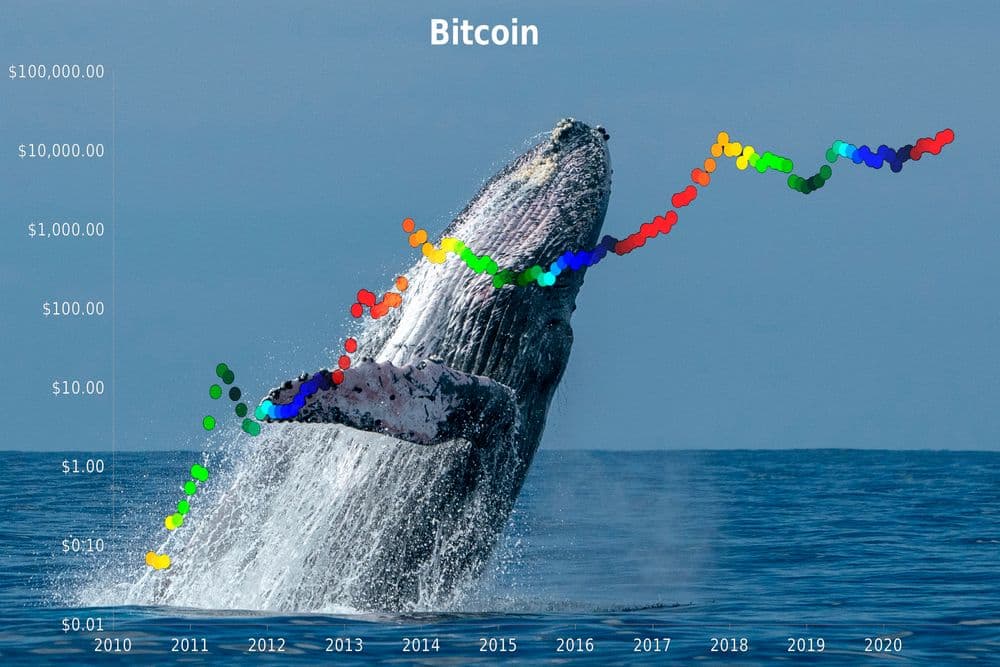

Cryptocurrency markets operate under unique dynamics where concentrated wealth distribution enables a select few to wield disproportionate influence over price movements. Four bitcoin wallets owned 3.56% of all the bitcoin in circulation in August 2024 according to BitInfoCharts. The top 113 wallets held more than 15.4% of all bitcoin.

This concentration of holdings among "whales" creates a market environment where individual transactions can trigger cascading effects across the entire crypto ecosystem.

The interplay between whale movements and market sentiment has become increasingly sophisticated, with modern traders relying on advanced blockchain analytics to decode these large-scale transactions. Understanding whale behavior patterns provides critical insights into market timing, liquidity flows, and sentiment shifts that traditional technical analysis often misses.

Crypto whales encompass multiple categories of large holders, each with distinct behavioral patterns and market impact mechanisms. Bitcoin whales typically control holdings exceeding 1,000 BTC, while Ethereum whales hold 10,000 ETH or more. However, whale classification extends beyond simple token quantities to include market context and relative influence.

Institutional whales - including MicroStrategy, Tesla, and various Bitcoin ETFs - operate with different motivations than individual high-net-worth whales. MicroStrategy's corporate treasury strategy involves systematic Bitcoin accumulation regardless of short-term price fluctuations, creating predictable buying pressure. Conversely, individual whales often respond to market conditions with more reactive trading patterns.

Exchange whales represent another critical category, controlling vast reserves used for market making and liquidity provision. These entities can trigger significant price movements through rebalancing operations, often misinterpreted by markets as directional trades.

Advanced Whale Tracking: Tools and Methodologies

Modern whale monitoring extends far beyond simple transaction alerts. Sophisticated analytics platforms like Glassnode, CryptoQuant, and Santiment employ multiple data layers to interpret whale behavior patterns.

Exchange flow analysis remains the primary methodology for whale tracking. If many whales start transferring their holdings to exchanges, it might indicate an upcoming sell-off. Conversely, large transfers to private wallets may suggest whales are preparing to hold, indicating long-term confidence in a particular cryptocurrency. However, modern analysis incorporates additional variables including timing patterns, wallet clustering, and cross-chain movements.

Dormant whale reactivation presents particularly compelling signals. Bitcoin's blockchain often holds surprises, and 2024 brought an interesting one: several old wallets that had been inactive for over 10 years became active again. These wallets, untouched for so long, suddenly moved large amounts of Bitcoin. These reactivations often precede major market movements, as dormant whales typically activate during significant market transitions.

Between May 1-7, 2025, approximately 7,000 BTC moved to major exchanges, with the following breakdown: Binance received 2,400 BTC from Ceffu custody and 1,100 BTC from unidentified wallets · Coinbase Institutional saw inflows of 1,800 BTC, including transfers from Cumberland and Three Arrows, demonstrating the scale and complexity of modern whale movements.

Whale Exchange Flow Dynamics

Exchange inflows and outflows represent the most critical whale indicators for short-term price prediction. The Bitcoin Exchange Whale Ratio measures the proportion of large transactions among total exchange inflows, with elevated ratios typically preceding price volatility.

The price of Bitcoin has been moving mostly sideways over the past week, briefly flirting with the $87,000 level on Thursday, March 20. During this period, Bitcoin Exchange Whale Ratio Hits New 2025 High, suggesting increased whale activity during lateral price action.

Bearish Whale Patterns

Large-scale exchange inflows create immediate selling pressure through multiple mechanisms. Direct market sells from whales can absorb substantial buy-side liquidity, triggering stop-losses and margin liquidations. Additionally, exchange inflows signal future selling intent, prompting preemptive selling by retail investors.

The May 2021 Bitcoin correction exemplified this pattern when whale deposits to exchanges preceded a $20,000 price decline. Similar patterns emerged during the March 2020 crash, where whale selling intensified the broader market panic.

Recent data shows whale inflows often coincide with options expiry dates and futures settlement periods, suggesting sophisticated timing strategies. Whales frequently deposit assets ahead of high-volatility events, capitalizing on elevated implied volatility premiums.

Bullish Whale Signals

Exchange outflows indicate reduced available supply for immediate selling, creating bullish supply-demand dynamics. Glassnode's data shows significant accumulation by entities holding over 10,000 BTC. This accumulation pattern typically precedes sustained price appreciation phases.

The October 2020 Bitcoin rally followed massive exchange outflows as institutional whales withdrew holdings to cold storage. This pattern repeated throughout 2024-2025, with sustained outflows supporting Bitcoin's climb above $100,000.

Modern whale accumulation strategies involve dollar-cost averaging across multiple exchanges and timeframes, reducing market impact while building positions. This sophisticated approach makes whale accumulation less obvious but more sustainable for long-term price support.

Altcoin Whale Dynamics: Amplified Market Impact

Altcoin markets demonstrate more pronounced whale influence due to lower liquidity and market capitalization. Recent whale activity demonstrates this amplified impact across multiple tokens.

Crypto whales bought 44.52 million JasmyCoin (JASMY) tokens this week, valued at $1.38 million. XRP whale holdings grew by 150 million tokens, highlighting confidence in XRP's possible rebound. Polygon whales added 5.11 million tokens, indicating confidence despite being 65% off its ATH.

Meme Coin Manipulation

Meme coins present extreme examples of whale market manipulation. The SHIBA INU case study remains instructive: a single whale's $44 million purchase triggered 30% price appreciation within days. This pattern repeats across numerous meme coins, where whale accumulation can create 100%+ price movements.

Dogecoin whale patterns show similar influence, with major holders controlling significant portions of total supply. Whale movements in DOGE often coincide with social media events and celebrity endorsements, amplifying price volatility through combined fundamental and technical pressures.

DeFi Token Whale Strategies

Crypto whales drive rallies in AAVE, VIRTUAL, and ONDO with millions in new purchases. See why these altcoins are gaining momentum. DeFi whale strategies often involve governance token accumulation for protocol influence, creating additional utility beyond speculative trading.

AAVE whale accumulation demonstrates sophisticated DeFi strategies, where large holders accumulate tokens for yield farming, governance participation, and protocol fee capture. These multi-layered incentives create more complex whale behavior patterns compared to simple speculative trading.

Psychological Market Impact: Whale Alert Psychology

Whale Alert notifications create immediate psychological market responses, often triggering automated trading algorithms and retail investor panic. The mere announcement of large transfers can move markets before actual trades occur.

Social media amplification multiplies whale alert impact, with Twitter and Telegram channels broadcasting whale movements to millions of followers. This information cascade creates self-fulfilling prophecies where whale movement announcements trigger the very market movements they predict.

Experienced traders exploit whale alert psychology through contrarian strategies, buying when whale sells are announced and selling during whale accumulation periods. This contrarian approach capitalizes on retail overreaction to whale movements.

Market Manipulation Strategies: Whale Tactics Exposed

These strategies can include coordinated buying or selling, strategic placement of orders to manipulate market prices, and leveraging their significant holdings to create price swings. Understanding these strategies helps smaller investors navigate the market more effectively.

Wash Trading and Volume Manipulation

Sophisticated whales employ wash trading across multiple exchanges to create artificial volume and price momentum. This strategy involves trading between controlled accounts to inflate perceived market activity and attract retail following.

Cross-exchange arbitrage represents another whale manipulation technique, where large holders exploit price differences between exchanges through coordinated trading. These arbitrage operations can create temporary price distortions and false breakout signals.

Stop-Loss Hunting

Whale stop-loss hunting involves deliberately triggering retail stop-loss orders through strategic market orders. Large sells can push prices below technical support levels, triggering cascading stop-losses that whales can exploit for favorable re-entry prices.

Futures market manipulation amplifies this strategy, where whales use leverage to move spot prices with smaller capital requirements. Coordinated spot and futures trading can create significant price distortions across timeframes.

Institutional Whale Evolution: 2024-2025 Trends

Institutional adoption has fundamentally altered whale dynamics, introducing more predictable and regulated trading patterns. Bitcoin ETFs represent a new whale category with transparent holdings and regulated trading windows.

Corporate treasury adoption creates another institutional whale class, with companies like MicroStrategy implementing systematic accumulation strategies. These institutional whales provide price support through consistent buying regardless of short-term volatility.

Government whale activities add regulatory complexity, with nation-state actors entering cryptocurrency markets. El Salvador's Bitcoin purchases and other sovereign wealth fund activities create new whale patterns with geopolitical implications.

Multi-Blockchain Strategies

Modern whales operate across multiple blockchains, requiring sophisticated tracking across Ethereum, Binance Smart Chain, Solana, and other networks. Cross-chain whale strategies involve arbitrage, yield farming, and diversification across different blockchain ecosystems.

Bridge transactions reveal whale movement patterns between chains, often indicating strategic positioning for upcoming protocol launches or token migrations. These cross-chain flows provide early signals for ecosystem rotation and capital allocation trends.

Whale Seasonality and Timing Patterns

Whale trading exhibits seasonal patterns aligned with institutional calendar cycles, tax considerations, and market structure events. Quarter-end rebalancing often triggers large whale transactions as institutional players adjust portfolio allocations.

Options expiry and futures settlement create predictable whale activity spikes, with large holders positioning ahead of high-volatility events. Understanding these timing patterns helps predict whale activity windows and potential market impact.

Risk Management: Trading Around Whale Activity

Successful whale-aware trading requires sophisticated risk management strategies that account for sudden liquidity changes and extreme price movements. Position sizing becomes critical when whale activity can trigger 10-20% price swings within minutes.

Diversification across different whale-influence levels helps manage concentration risk. Assets with distributed ownership provide stability against whale manipulation, while whale-concentrated assets offer higher volatility trading opportunities.

Future Whale Oversight

Since the start of 2025, several major corrections have followed large inflows to exchanges from whale wallets — a pattern onchain analysts flagged as early as February. Regulatory bodies increasingly monitor whale activities for market manipulation and systemic risk.

Future regulations may require whale transaction disclosure, similar to traditional financial market requirements. This regulatory evolution could fundamentally alter whale behavior patterns and market dynamics.

Machine Learning and Whale Prediction

Artificial intelligence and machine learning applications increasingly predict whale movements through pattern recognition and behavioral analysis. These advanced systems process multiple data streams including blockchain transactions, social sentiment, and macroeconomic indicators.

Predictive whale models help institutional traders position ahead of major whale movements, creating a technological arms race in whale detection and prediction capabilities.

Whale-Aware Market Navigation

Understanding whale psychology, technical patterns, and manipulation strategies provides crucial advantages in navigating volatile crypto markets.

Successful crypto market participation requires acknowledging whale influence while developing strategies that account for both whale manipulation and genuine market signals. As institutional adoption grows and regulations develop, whale dynamics will become more complex but potentially more predictable.

The future of crypto trading lies in sophisticated whale analysis combined with traditional technical and fundamental analysis. Traders who master whale pattern recognition while maintaining strong risk management will best navigate the continuing evolution of cryptocurrency markets dominated by concentrated wealth holders.