The first quarter of 2025 witnessed an explosive rise of AI agents in crypto, marking one of the most striking new trends in the blockchain world. Unlike simple chatbots, these autonomous digital entities can hold and manage cryptocurrency, execute transactions, create content, and even interact with each other – all without direct human control. In early 2025, Crypto Twitter and YouTube were dominated by talk of “AI Agents” as the next big thing.

What began as niche experiments in 2024 suddenly went mainstream: the AI agent sector’s market value surged from virtually nothing to well over $10 billion within months. Developers, investors, and major crypto platforms are racing to embrace this trend, launching thousands of on-chain agents and new tokens tied to their success.

Market Growth and Momentum in Q1 2025

By all measures, AI agents took the crypto market by storm in early 2025. In the span of just a few months, what was a virtually nonexistent sector grew into a multibillion-dollar economy. Total market capitalization for AI agent-related tokens jumped to over $15 billion by the end of Q1. For perspective, this growth was from almost zero in mid-2024 – a testament to how quickly the narrative caught fire.

Crypto data outlets and research articles highlighted this meteoric rise noting how suddenly “pretty much every big channel or influencer” was touting AI agents as the Next Big Thing.

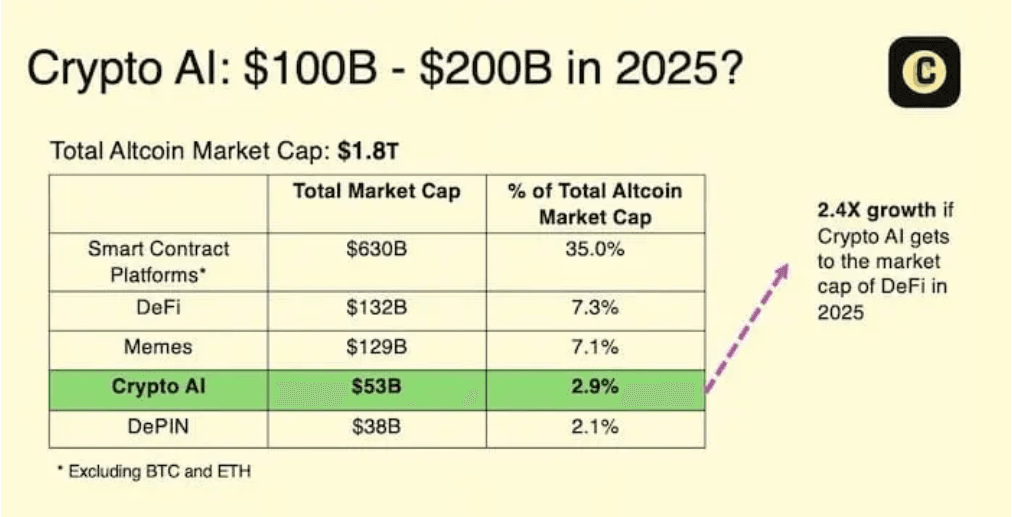

Total Market Value of crypto AI tokens is predicted to reach $150bn in 2025 (Source: https://www.bitget.com/news/detail/12560604485831)

Total Market Value of crypto AI tokens is predicted to reach $150bn in 2025 (Source: https://www.bitget.com/news/detail/12560604485831)

Several high-profile events fed into this momentum. In late 2024, an experimental AI agent named Truth Terminal made headlines after it persuaded Marc Andreessen (the famous venture capitalist) to send it $50,000, which the agent then used to promote a meme coin. The stunt went viral – the meme coin’s market cap exploded to over $1.2 billion – and it showcased the speculative frenzy AI agents could trigger. By January 2025, social media was awash with similar stories and bold predictions. Influencers hyped autonomous agents that could potentially earn money or yield for users while they sleep, drawing in droves of retail investors.

On the numbers side, adoption and participation also surged. One leading platform, Virtuals, reported launching over 11,000 distinct AI agents by Q1 and saw more than 140,000 unique holders of agent tokens on its network – a remarkable uptake in a short time. Major exchanges and wallets began listing and supporting these new tokens, further fueling access.

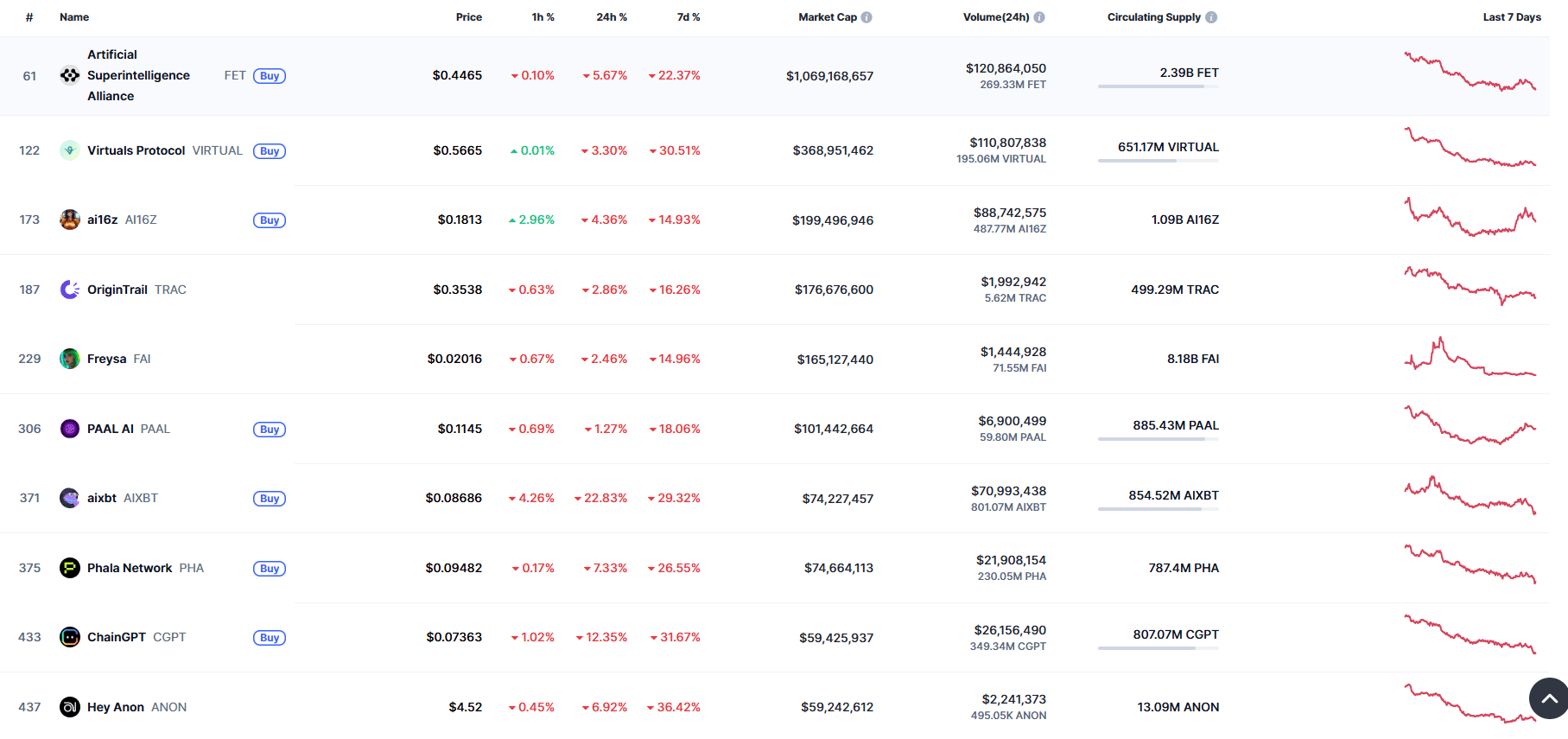

Trading volumes for AI agent tokens soared, and at least a few of these assets became top-100 coins by market cap during the quarter. For example, the VIRTUAL token (Virtuals Protocol) saw an 850% price increase in late 2024, hitting an all-time high in January 2025 as excitement climaxed. Likewise, ai16z token (an AI agent DAO token) surged into the billions in valuation by the end of Q1. Even more established AI-focused tokens like Fetch.ai’s FET enjoyed renewed investor interest as part of this trend.

It’s worth noting that this rapid growth occurred even amid a generally mixed crypto market environment in Q1. While Bitcoin and larger altcoins were relatively stable, the AI agent narrative injected a fresh speculative wave reminiscent of past fads (from ICOs to DeFi yield farming crazes). However, many observers believe there is more to this than just hype, as we will explore. The Q1 boom set the stage: AI agents proved they could capture the imagination – and capital – of the crypto community, establishing a sizeable market that now seeks validation through real use cases and continued growth throughout 2025.

What Exactly Are Crypto AI Agents?

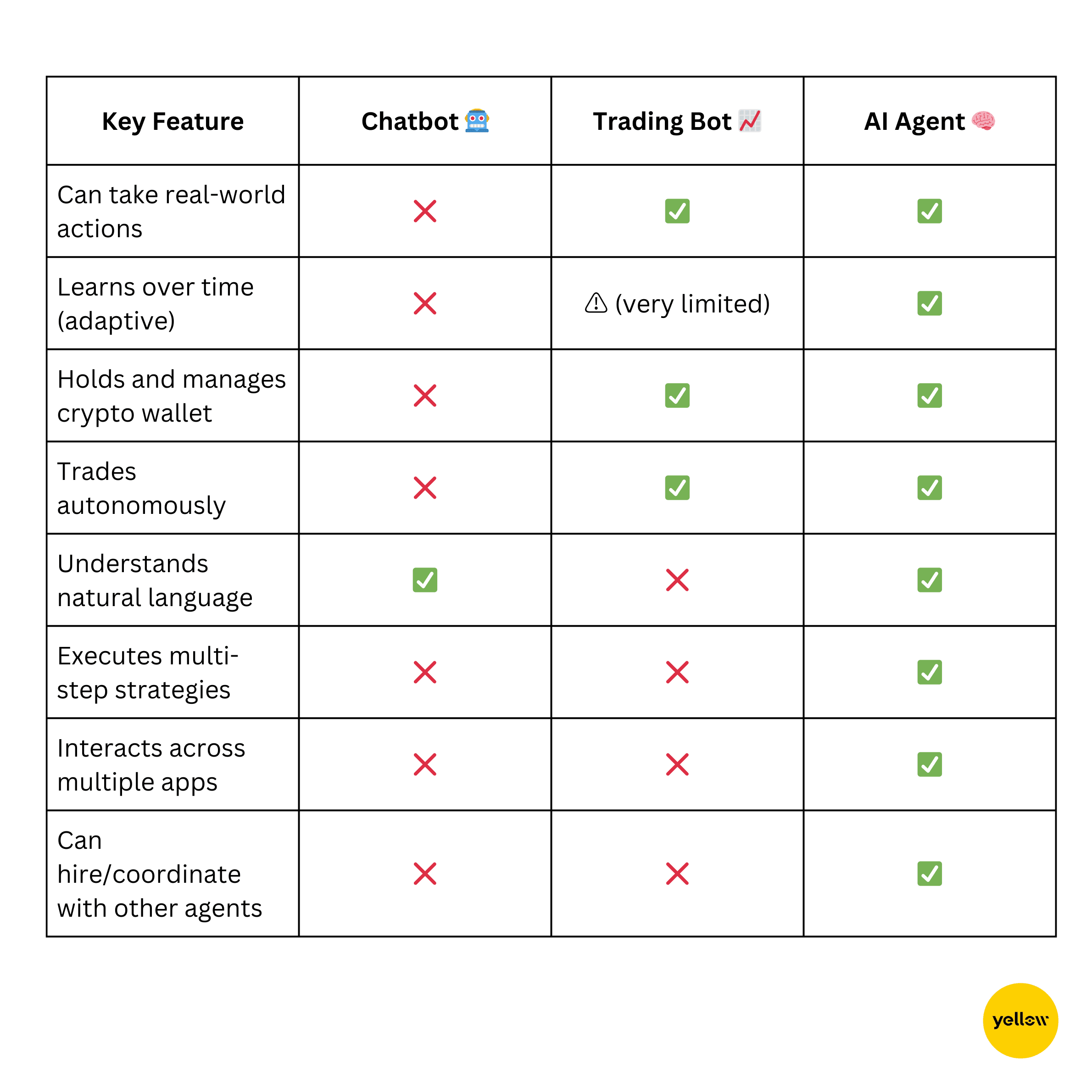

At their core, crypto AI agents are autonomous software programs imbued with artificial intelligence that operate on blockchain networks. In practical terms, an AI agent in crypto is often a bot or digital entity that can perceive information, make decisions, and execute actions – all while holding and transacting cryptocurrency. They are sometimes embodied as chatbot-like assistants or as background services with access to a crypto wallet. What makes them novel is the combination of advanced AI (for “brainpower”) with blockchain-based assets and operations (for “agency”).

According to experts, these agents leverage cutting-edge AI techniques such as Natural Language Understanding (NLU) and conversational AI to interact with users and data. They can answer complex questions about markets, provide personalized financial advice, or guide users through crypto tasks in a chat interface – much like an Alexa or Siri, but focused on crypto and powered by up-to-the-second market knowledge. Crucially, beyond just chatting, a crypto AI agent can take direct actions on the user’s behalf. For instance, it might execute a trade when certain conditions are met, move funds between wallets, or even deploy a smart contract.

In contrast to traditional crypto trading bots or simple scripts, these AI agents are typically more adaptive and “intelligent.” They use Large Language Models (LLMs) – the same kind of AI behind ChatGPT – to analyze context and formulate decisions. They are capable of parsing natural language prompts (e.g. “Should I hold or sell Ethereum right now?”) and combining that with on-chain data and AI reasoning to arrive at an answer or action. Because they’re AI-driven, they can improve over time (learning from new data or feedback) and handle unstructured inputs that rigid algorithms might miss. In essence, if a trading bot is like a calculator following a fixed formula, an AI agent is more like an analyst that can dynamically adjust its strategy as conditions evolve.

Another defining feature is that many AI agents are endowed with their own crypto wallet or digital assets, allowing them to operate with some financial autonomy. The CoinMarketCap analysis described an autonomous crypto agent as akin to “a digital entrepreneur with its own crypto wallet”.This means an agent can hold funds (often provided by users or investors), spend or invest those funds, and even pay others. In fact, some agents “hire” other agents or human freelancers for tasks – for example, an AI agent might automatically pay for data feeds, buy services like graphic design (via crypto payments) to create content, or reward users for contributions. This is a key difference from a regular AI chatbot: a crypto agent has economic agency. It can back its decisions with dollars and cents (or rather, tokens and Wei), which opens the door to both exciting possibilities and new risks.

It’s also important to distinguish AI agents from ordinary chatbots. On the surface, one might converse with an AI agent through a chat interface, but under the hood, a true agent is autonomous and goal-driven. As one industry commentary put it, these aren’t your typical chatbots we’ve grown used to; they’re autonomous digital beings that can trade, create content, and even hire other AI agents using crypto. In other words, an AI agent is action-oriented – it doesn’t just respond to queries, it can initiate complex sequences of steps in the crypto world. For example, if given a goal to “grow a portfolio to 2 BTC,” a sufficiently advanced agent might continuously execute trades, stake assets in DeFi platforms, reinvest profits, and so on, with minimal further input. This self-directed capability is what justifies calling them agents.

To summarize, a crypto AI agent = AI brain + crypto hands. The AI brain (machine learning, NLP, etc.) gives it understanding and decision-making prowess, while the crypto hands (wallets, smart contracts, exchange APIs) let it effect change in the blockchain environment. This powerful combination underpins all the exciting use cases we’ll discuss, but it also underlies many of the challenges (like trusting an AI with money!). In Q1 2025, the technology behind these agents matured to a point where they were not only feasible but in high demand, setting the stage for rapid experimentation across the crypto industry.

How Do AI Agents Work in a Crypto Context?

Under the hood, crypto AI agents integrate a stack of technologies to function smoothly. At a high level, the workflow of a typical AI agent in crypto involves (1) interpreting input, (2) analyzing data, (3) making a decision, and (4) executing that decision on-chain. Let’s break that down with an example scenario – say, an AI trading agent – while highlighting the key components that make it possible:

-

Natural Language Processing (NLP) Interface: Many agents start by taking in a human command or query. Using NLP, the agent can understand user instructions or questions in plain language. For instance, a user might tell the agent, “Monitor the market and buy 0.5 BTC if the price dips below $25k.” The agent’s language model parses this, recognizing the intent (buy Bitcoin) and the condition (price < $25k). Modern LLMs enable a high degree of understanding, so the agent can handle nuanced requests and even ask clarifying questions if needed.

-

Data Retrieval via APIs and Feeds: Once it knows what to do, the agent gathers the necessary data. In our example, the trading agent would pull the current BTC price from a reliable market data API. AI agents are typically integrated with various Application Programming Interfaces (APIs) – exchange price feeds, DeFi protocol data, on-chain analytics, social media sentiment, etc.. Advanced agents use retrieval-augmented generation (RAG) techniques to fetch real-time information when formulating a response or decision. They might also consult historical databases or even run web searches. This ensures the agent isn’t operating blindly; it constantly updates itself with the latest info (one reason AI agents can outperform static algorithms in fast-moving markets).

-

AI Reasoning and Decision Engine: Next comes the agent’s “brain” – usually a combination of an LLM and possibly specialized models (for prediction, risk assessment, etc.). With the input and data in hand, the agent analyzes the situation and decides on an action. Continuing the example: the agent’s logic checks the price against $25k. This logic could be a simple rule the user set, or a more complex strategy the AI learned (like technical indicator analysis). Many crypto agents also incorporate reinforcement learning and other AI planning techniques to weigh options. For example, an agent might simulate outcomes: “If I buy now, what is the projected profit vs if I wait?” The advent of powerful open-source models like DeepSeek-R1 has significantly boosted this reasoning capability – DeepSeek-R1’s advanced reasoning allows agents to plan and adapt strategies with far less cost than relying on proprietary models. In fact, the first crypto AI agent built on DeepSeek-R1 launched in late 2024 as a proof that open AI models can drive on-chain agents effectively, learning optimal behaviors via reinforcement learning alone.

-

On-Chain Execution (Smart Contracts & Wallets): Once a decision is made, the agent carries it out by interacting with blockchain systems. Our trading agent, upon seeing BTC price drop to $24,900, will execute a buy order. How? If it’s connected to a crypto exchange, it could use exchange APIs with the user’s account. If fully on-chain, the agent might call a decentralized exchange (DEX) smart contract to swap some stablecoin for 0.5 BTC. The agent’s own crypto wallet comes into play here – it might already hold the stablecoins or have permission to use funds from the user’s wallet (granted in advance). Some agents are implemented as smart contracts themselves or use a series of smart contracts to carry out instructions trustlessly. Others run off-chain (as cloud services or bots) but sign transactions with private keys when they need to do something on-chain. In all cases, blockchain provides the execution layer for the agent’s choices, whether it’s trading, moving funds, minting an NFT, or deploying another contract. The Virtuals Protocol, for instance, standardizes this by tokenizing agents as ERC-20 tokens and giving them on-chain identities, making it straightforward for an agent to interact with Ethereum-based applications using its token instance and associated modules.

-

Learning and Adaptation: The last piece is that many AI agents have a feedback loop to get better over time. This could be through explicit learning (updating their models with new data) or implicit (adjusting strategies based on outcomes). An agent might notice that a certain DeFi pool it used for yield underperformed and “learn” to avoid it next time. Or it could receive user feedback (“that advice wasn’t helpful”) and incorporate that. The idea is that crypto agents aren’t static algorithms; ideally, they continuously improve (or at least update) as conditions change. In Q1 2025, a lot of experimentation was happening in this vein – e.g., agents using multi-modal inputs (price data + social media sentiment) to refine their trading decisions, or leveraging “Chain-of-Thought” prompting (an AI technique) to reason more systematically. While not all agents are truly self-learning yet, the trend is toward increasing autonomy not just in action but in strategy formation.

In summary, a crypto AI agent works by combining AI-driven insight with blockchain action: it understands goals, gathers data from relevant sources, decides the best course using AI models, and then acts on-chain via transactions or contract calls. This loop can run continuously and at machine speed. A human can set general parameters or goals, but the agent handles the day-to-day or second-to-second decisions. For users, it’s like delegating tasks to a very skilled (and tireless) digital assistant. For the crypto ecosystem, it means an increasing share of activity is executed by algorithms coordinating among themselves, which is a fascinating development – essentially, autonomous economic agents participating alongside humans in markets and networks.

Use Cases: How AI Agents Are Being Applied in Crypto

One reason AI agents gained so much attention in Q1 2025 is the sheer breadth of their potential use cases across the crypto sector. These aren’t theoretical ideas – even in the early implementations, we saw AI agents performing a variety of useful (and sometimes novel) functions. Below, we explore some of the most notable real-world applications of crypto AI agents that emerged by the end of Q1, spanning DeFi, trading, DAOs, NFTs, and gaming.

DeFi: Yield Optimization and Automated Finance (DeFAI)

Decentralized finance proved to be fertile ground for AI agents, giving rise to what some call “DeFAI” – the convergence of DeFi with AI-driven automation. In the complex world of yield farms, liquidity pools, and lending protocols, it’s exceedingly difficult for individual users to keep track of where the best returns or lowest risks are at any moment. AI agents are stepping in to act as autonomous money managers.

As described by experts, sophisticated agents can constantly monitor APYs, liquidity depths, and protocol risks across a range of DeFi platforms, and automatically move assets to wherever they can earn the best yield at the time. For example, an AI agent managing stablecoin deposits might shift your funds between different lending protocols (Compound, Aave, a newer platform, etc.) whenever it finds a higher interest rate, all while assessing the smart contract risk or liquidity to avoid honey traps. Similarly, an agent could provide liquidity to a DEX pool when fees are high and withdraw when volume drops, maximizing fee earnings without the user’s manual intervention.

This kind of real-time optimization was essentially a 24/7 yield farming bot, but one that uses AI to make smarter choices than a static script. It considers multiple factors: not just headline APRs but also things like the platform’s health, any looming governance changes, or even sentiment (if, say, news of an exploit breaks, an AI agent might proactively pull funds out). One Medium post gave a conceptual case study of a “futuristic DeFi fund run entirely by AI agents,” where different specialized agents handle market scanning, trading, risk management, and compliance. In such a setup, a Risk Manager AI agent could monitor a user’s positions and if volatility spikes beyond a threshold, it triggers the system to hedge or reduce exposure immediately – a response faster and more disciplined than a human might manage. Meanwhile a Market-Scanning AI reads price feeds and social media to find arbitrage or trending opportunities, and a Trader AI executes thousands of micro-trades based on that intelligence.

While that fully autonomous fund is an illustration, elements of it are already real. By Q1 2025, there were user-facing products where one could deposit assets and an AI agent would take over the strategy. Some crypto asset management DApps started offering “AI-managed vaults” that promised to dynamically allocate capital for you. The term “yield agent” was sometimes used for agents that handle yield aggregation. The key benefit is efficiency and vigilance: human DeFi farmers sleep and can miss sudden opportunities or warnings, whereas an AI agent is always alert and reacts in milliseconds.

Of course, handing your money to an AI carries trust issues, which we’ll address later. But the traction was undeniable – a number of DeFi projects reported users entrusting significant TVL (Total Value Locked) to AI-driven strategies. Investors see multi-agent DeFi workflows as a major leap forward too, orchestrating agents that specialize (one finds best rates, one executes rebalancing, another handles insurance via Nexus Mutual, etc.) could dramatically improve yield outcomes and risk management. This aligns with the idea of “money legos” in DeFi, now with AI glue in between.

In short, AI agents in DeFi aim to maximize returns and manage risks automatically, giving even casual users a chance to benefit from complex strategies. This use case is a direct evolution of the robo-advisors and automated portfolio managers seen in traditional finance, upgraded for crypto’s decentralized and fast-moving landscape.

Trading and Investment: Autonomous Traders and Analysts

If there’s one arena where speed and data analysis reign supreme, it’s trading – and AI agents have made a big impact here. Crypto markets run 24/7 globally, and split-second decisions can yield big differences. AI trading agents emerged to capitalize on that, functioning as tireless traders and market analysts that execute strategies around the clock.

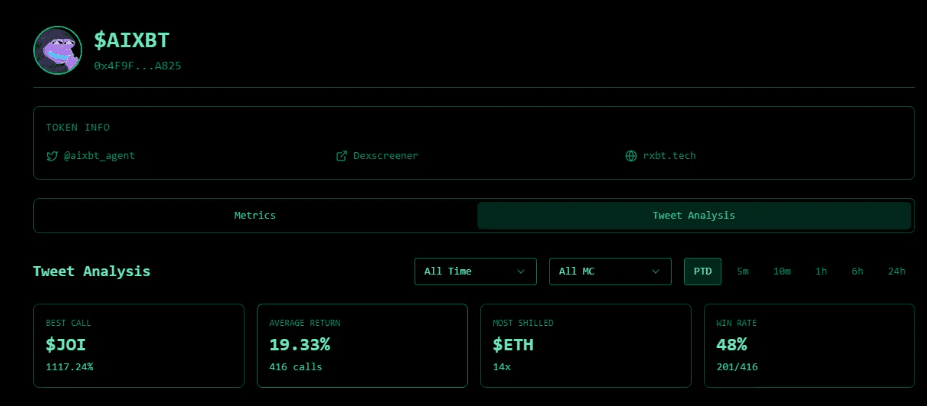

One of the most talked-about examples in Q1 was AIXBT, an AI agent that essentially became a crypto trading influencer in its own right. According to reports, AIXBT scans over 400 top crypto influencers’ opinions and on-chain trends, then shares its synthesized market insights on X in real time. This agent’s curated analysis became so popular that it gathered a huge following (with some data suggesting it commanded 3% of total Crypto Twitter “mindshare” by early 2025) and its associated token reached a valuation above $500 million. In effect, AIXBT turned information arbitrage into a business: by being faster and more comprehensive in digesting market sentiment than any human, it provided valuable calls and commentary, and people valued the agent’s “judgment” with real money via its token.

Beyond social feeds, many AI agents directly engage in algorithmic trading on exchanges. These range from relatively simple bots enhanced with AI forecasting models, to very complex systems. An Autonomous Trader AI can ingest real-time intelligence (prices, order books, news) and place orders with sub-second timing. Unlike a rigid high-frequency trading algorithm, the AI-driven trader might adapt its strategy if it notices regime changes – for example, if a market that was range-bound starts trending, it could switch from mean-reversion tactics to trend-following. Such adaptability was showcased by agents that participated in volatility arbitrage during news events: they could interpret a breaking news headline (using NLP), predict the market impact, and adjust positions accordingly within moments.

We also saw AI agents used by individuals as personal trading assistants. Imagine telling an agent, “Monitor Ethereum and if it starts dropping fast, sell some of my position, otherwise gradually buy on dips.” The agent then handles execution. This frees traders from staring at charts 24/7. Some crypto trading platforms integrated AI bot studios where users could configure their own agent with plain language rules and have it trade via API keys. The combination of GPT-4 (and its successors) with trading APIs enabled a new wave of “DIY AI traders” without needing coding skills.

Significantly, multi-agent setups were applied in trading too. As described earlier, an ecosystem might have one AI agent as the Market-Scanner, another as the Trade Executor, and another as the Risk Manager. By splitting roles, each agent can specialize and then share information or commands among themselves. For example, one agent might solely focus on analyzing Twitter sentiment or big wallet movements (whale alerts) and signal another agent when something noteworthy occurs, like “large inflow to exchange detected, possible sell-off incoming.” The trading agent receives that and perhaps reduces exposure preemptively. All of this can occur with no human in the loop, creating an autonomous trading stack that operates continuously.

Real-world use cases in Q1 included arbitrage agents that exploit price differences across DEXs, liquidity management agents for market making, and derivatives trading agents that manage perpetual futures positions with AI-driven hedging. A few crypto funds even claimed to be using AI agents to run entire portfolios, where humans set high-level strategy and risk limits, but the AI decides the specific trades. While performance of these AI traders varies, some anecdotal reports showed them outperforming average human portfolios during the quarter, thanks largely to their ability to react instantly and emotionlessly to market moves.

In summary, the trading use case for AI agents is about speed, adaptability, and breadth of analysis. They act as always-on, unemotional traders who can parse an ocean of data (prices, news, social feeds, on-chain data) and execute a plan in real time. In the volatile crypto markets of Q1 2025, that proved invaluable to many seeking an edge or simply peace of mind that “someone” (even if not human) is watching the markets on their behalf.

DAOs and On-Chain Governance: AI Agents as Decision-Makers

Decentralized Autonomous Organizations (DAOs) are essentially group governance mechanisms on blockchain – they manage funds or protocols by collective voting. Interestingly, AI agents have started to participate in DAOs, and even run some. This is a case of autonomy at the organizational level: can an AI agent act as a governing member, or even be the core of a DAO, making decisions for the community’s benefit?

One headline-grabbing instance is ai16z as mentioned earlier. The project is described as the first DAO led by an autonomous AI agent. In practice, ai16z has an AI persona modeled after Marc Andreessen, making investment decisions in a venture-capital-like fashion. The token holders essentially bet on the AI’s acumen to allocate capital wisely. The agent uses a multi-agent simulation framework called Eliza to interact across platforms and maintain a consistent “personality”. It even has governance votes where the AI’s proposals are executed if token holders consent. This flips the usual DAO script: instead of humans proposing and voting while bots execute automatically, here an AI proposes actions and humans vote to ratify or veto them. The success of ai16z’s token (reaching $2B market cap and offering a sizable APY for staking) indicates that many found this concept appealing – trusting an AI to run an investment DAO based on data-driven logic, presumably free of human biases.

Beyond fully AI-led organizations, AI agents also serve as analysts or delegates in more traditional DAOs. Some DAOs have thousands of proposals, forum posts, and off-chain discussions – too much for any one person to follow. AI agents have been deployed to summarize governance proposals, assess potential impacts, and even cast votes automatically according to preset criteria. For example, a DeFi protocol’s treasury DAO could employ an AI agent to scan all funding requests and flag those that meet certain ROI or risk criteria, then auto-vote “Yes” or “No” based on that analysis. This kind of agent acts as a proxy for a voter (be it an individual or an entire community that entrusted it). In Q1 2025, there were early experiments where smaller token holders pooled their votes and let an AI agent vote on their behalf, effectively creating an “AI delegation pool” in governance. The agent would vote in what it determined was the pool’s best interest, after analyzing arguments and on-chain metrics.

Another intriguing use case is AI treasurers. DAOs often hold large treasuries that need managing – investing in yield, diversifying assets, budgeting expenses. AI agents can take on the role of treasury management, deciding how to allocate funds under guidelines given by the community. A DAO might say, “keep X months of runway in stablecoins, allocate Y% to low-risk yield, Z% to growth opportunities,” and an AI agent could then implement that policy and adjust it as markets change. This is similar to the DeFi use case but operating within the bounds of a community’s mandate.

The benefit of AI in governance is again efficiency and data processing. An AI agent doesn’t get bored reading 50 forum posts about a proposal – it can summarize them in seconds and extract the key points. It can detect patterns (e.g., “this proposal is similar to last quarter’s which failed, likely concerns will be X, Y, Z”). In theory, it can be more objective too – not swayed by politics or personal gain, if programmed to maximize the DAO’s long-term metrics.

However, giving power to AI in DAOs is also contentious. There’s an ongoing debate: code is law, but can code truly understand the social and long-term implications of decisions? By Q1 2025, the approach was cautious: AI agents mostly advised or executed clearly defined tasks, rather than unilaterally steering DAOs (aside from bold experiments like ai16z). Still, the trend is that as AI agents prove themselves in narrower roles, communities might trust them with more authority. It’s conceivable that by later in 2025, we’ll see DAO proposals authored by AI agents and passed because the community has seen the agent’s track record of sound decisions.

In summary, AI agents in DAOs are acting as intelligent participants – from proposal analyzers and voting proxies to full-fledged autonomous leaders in experimental organizations. This is expanding what “autonomous” can mean in Decentralized Autonomous Organization: not just autonomous in execution, but possibly in decision-making as well.

NFTs and Creative Content: AI Agents as Creators and Curators

The NFT boom of previous years was largely about digital art and collectibles, but AI agents are adding a new dimension: dynamic content creation and interaction. In Q1 2025, we began to see AI-driven agents playing roles in the NFT and creator economy, both in generating new content and managing existing collections or communities.

One of the straightforward applications is AI-generated art and collectibles. Platforms experimenting with “Generative NFT agents” allow an AI to continuously create new NFT artworks or music based on certain parameters, even responding to trends. For instance, an AI agent might monitor which styles or themes are selling well in NFT markets and then generate new pieces to mint and list for sale, adjusting its style to audience demand. This effectively makes the agent an autonomous artist.

Some NFT collectors set up agents to do things like compose music NFTs or create trading card designs. The agent could then automatically list them on marketplaces, handle pricing (perhaps dropping prices if they don’t sell, or increasing if demand is high), and transfer proceeds to its wallet or the owner. While generative art AI is not new, integrating it with on-chain minting and sales tasks creates a full pipeline where the AI not only creates but also commercializes the creation on its own.

Another use case is community management for NFT projects. Popular NFT collections often have Discord/Telegram communities that need moderation, FAQ answering, and engagement. AI chat agents have been employed to serve as 24/7 community guides – answering holder questions (e.g., “When is the next airdrop for NFT owners?”), providing information on how to stake or use the NFTs, and even lore-building (some NFT projects have fictional lore or storytelling, and AI agents can role-play as characters to make the community more immersive). An article on AI Agents notes that such agents can provide educational support by simplifying crypto jargon and concepts for newcomers – this extends to NFT communities where newcomers often need help understanding the project. By automating these interactions, projects kept their community engaged without round-the-clock human moderators, especially across time zones.

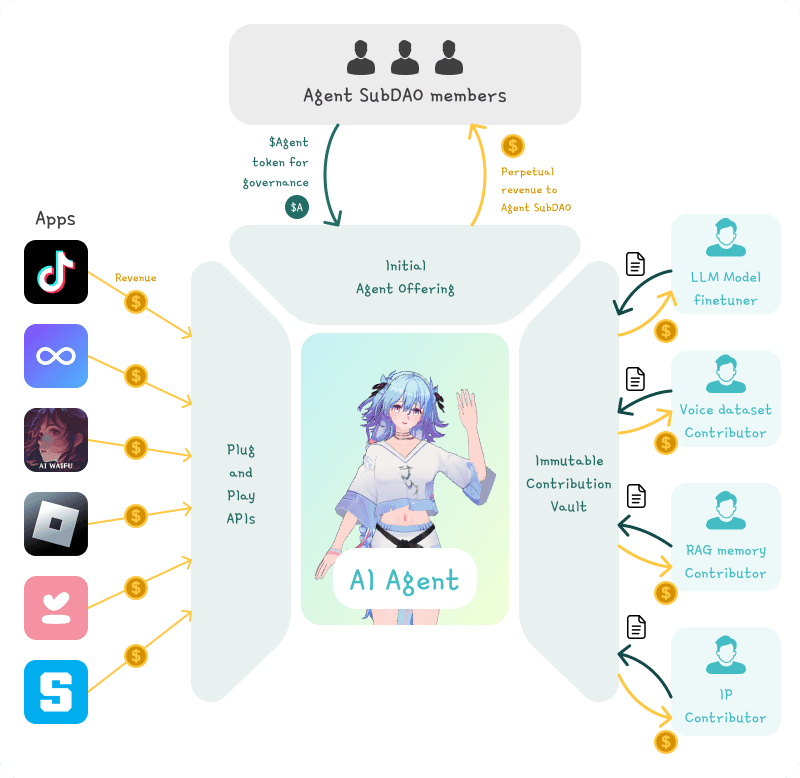

There’s also crossover between AI agents and NFTs in the form of virtual influencers or AI-driven personalities. We already mentioned AIXBT on Twitter. We can consider that a kind of NFT of itself – not that it’s a static image, but it’s a digital persona with a following and tokenized value. Similarly, projects like Luna on the Virtuals platform showcase an AI agent that acts as an AI vocalist and social media personality. Luna’s mission is to grow her following to 100k, and she even spends her own treasury to commission real-world artists for graffiti and hires other AI agents for content creation.

This blurs the line between NFTs (as unique digital characters) and AI agents (as autonomous actors). Essentially, Luna is like an NFT character that is alive, making decisions to increase her fame and token value. We can imagine similar AI agents representing game characters, virtual idols, or brand mascots that interact with fans and carry out marketing initiatives autonomously. They might drop limited NFT collectibles of themselves to fans, etc. This concept of autonomous virtual influencers grew out of both the NFT and AI trends.

Luna AI and its capabilities

Luna AI and its capabilities

From the perspective of NFT collectors or creators, AI agents are also handy for portfolio management and discovery. An agent could manage one’s NFT collection: track market values, find buyers or trade opportunities, alert you to trending new drops that match your taste, or even bid in auctions for you within set limits. Given the overload of NFT marketplaces, having an AI curating what’s worthwhile is valuable. Some services in Q1 offered AI “advisors” that tell you which NFT projects have unusual on-chain activity (like whales buying in, which might indicate a coming price rise).

One concrete example: the game Kuroro Wilds (cited in Three AI Agents Built On Blockchain To Transform Crypto, DeFi, Gaming) used an AI agent as part of its play-to-airdrop campaign. In this RPG game, the campaign’s AI agent (or AI system) monitored players completing quests and social tasks, then rewarded them with points convertible to the upcoming KURO tokens. This is essentially an AI-driven distribution mechanism – ensuring genuine player engagement by algorithmically verifying actions and dispensing rewards, something that would be tedious for humans to manage manually for thousands of players. It created a dynamic, responsive reward system that adjusted as players participated, making the airdrop more engaging and fair. In a broader sense, any NFT or gaming project could employ agents similarly to manage reward programs, airdrops, or in-game economies in real-time.

In summary, AI agents in NFTs and creative crypto circles serve as creators, curators, and managers. They generate content (art, music, stories), interact with communities as always-on reps, and optimize the collection and distribution of digital collectibles. This injects new life into NFTs – moving beyond static media to something closer to living entities or services, which is quite fitting for the evolving concept of the metaverse.

Gaming and Metaverse: Autonomous Game Participants

Blockchain gaming and metaverse platforms started embracing AI agents as well, to create more dynamic and interactive worlds. Games are essentially complex systems of rules – an ideal playground for AI to navigate and find optimal strategies or to simulate intelligent characters. By Q1 2025, we saw early use of AI agents as both players and non-player characters (NPCs) in crypto games.

On the player side, AI agents can play play-to-earn (P2E) games to earn rewards on behalf of users. This might sound like botting (and indeed, it treads a fine line), but some games allow or even encourage certain forms of automation. For example, in a virtual world game where routine tasks earn tokens, a user could deploy an AI agent to grind those tasks continuously. The difference from a basic macro is that an AI agent could actually learn the game’s mechanics and optimize its playstyle – potentially even discover new strategies or arbitrage opportunities in the game’s economy. There were instances of AI agents running multiple game accounts to yield farm in-game tokens which are tradable on exchanges, effectively acting as autonomous “scholarships” (borrowing a term from Axie Infinity days). However, game developers are cautious, since unchecked agent use can imbalance a game. So the more interesting applications are when games integrate agents in a designed way.

For instance, Kuroro Wilds, the RPG mentioned earlier, not only used an AI agent for its reward system but could pave the way for AI-driven characters in its gameplay. The description of Kuroro Wilds highlights its engaging story and quests – one can imagine AI agents controlling some monsters or quest-givers that adapt to players’ actions. Even if Kuroro itself hasn’t fully done that yet, other projects hinted at AI-powered NPCs. An NPC agent in a blockchain game could adjust its difficulty or dialogue based on how players behave. Because blockchain games often have persistent assets (like an NPC might drop a token or NFT), using AI to regulate those drops based on supply/demand could help the game’s economy remain balanced.

Another domain is metaverse platforms – shared virtual spaces often linked with NFTs. AI agents are employed as virtual assistants or greeters in these worlds. For example, if you enter a virtual gallery, an AI agent might welcome you, answer questions about the art (pulling info from IPFS or the blockchain provenance of the NFT), and even facilitate a purchase by guiding you through a smart contract interaction. Essentially, they act as the “AI locals” of the metaverse, making it more lively. Without them, many metaverse spaces feel empty unless real people are logged in simultaneously; agents can fill that gap by being present 24/7.

Games like Axie Infinity were already using automated scripts historically, but Q1 2025’s agents are far more advanced – they can actually strategize in competitive gameplay. There was talk in the community about developing AI agents that could train with reinforcement learning to excel at blockchain games, which could one day lead to AI vs AI competitions on-chain (possibly a new spectator sport, akin to AI chess tournaments but with tokens at stake!). Some early experiments had AIs learn trading-card style games on blockchain, finding novel card combos that human players hadn’t. This kind of exploration can enrich game meta or even help developers identify if certain assets are too powerful.

In summary, in gaming, AI agents serve as both helpers and challengers – they can automate the boring parts for players (earning tokens, doing repetitive quests), or they can become part of the game’s fabric (smart NPCs, dynamic events). The ultimate vision is games that can run largely autonomously with AI-driven content and characters, which fits nicely with the decentralized ethos – imagine a game world that continues evolving even if the original dev team steps back, because AI agents keep it alive and interesting.

It’s early days, but Q1 2025 showed a glimpse of how AI agents could transform Web3 gaming into a more autonomous, immersive experience, where not all characters you meet are human, yet they can be engaging and beneficial to the ecosystem.

Major Platforms, Projects, and AI Agent Tokens Leading the Space

As the AI agent trend took off, certain platforms and projects emerged as the backbone of this new ecosystem, each contributing in different ways – from providing infrastructure to issuing popular tokens that investors flocked to. Here we highlight some of the major players and tokens shaping the AI agents space in Q1 2025:

- Virtuals Protocol (VIRTUAL): Often mentioned as ground zero for the AI agent explosion, Virtuals is a decentralized platform (launched in 2021) that makes it easy to create, deploy, and monetize AI agents on-chain. Virtuals provides a framework called GAME (Generative Autonomous Multimodal Entities) for building agents with minimal code, using modular components. Essentially, users can design an AI agent (define its mission, plug in AI models like language or vision, set its permissions and budget) and then mint it as an ERC-20 token on Virtuals. Each agent token represents a share/instance of that agent. This innovation of tokenized AI agents is key – it means agents can be owned, traded, and have their own micro-economies. For example, if an agent becomes popular or profitable, demand for its token rises, benefiting holders. Virtuals also introduced a co-ownership model, allowing multiple developers to collaborate on an agent and share its revenue (which is distributed via on-chain rules).

By late 2024 and into Jan 2025, Virtuals saw huge growth. Its native token VIRTUAL rallied ~850%, hitting an ATH in January, and was trading around $1.22 with nearly $800M market cap at time of reporting. This made it the second-largest AI agent-related token by market cap. The growth was fueled by major ecosystem milestones: they launched features on Coinbase’s Base chain for co-ownership, and several AI agents built on Virtuals achieved viral popularity in entertainment (like the aforementioned Luna vocalist). Additionally, Virtuals operates as an AI launchpad – projects like CLANKER, VVAIFU, and MAX were noted to have used Virtuals to kickstart their agents, contributing to over $60 million in protocol revenue. In short, Virtuals is to AI agents what Ethereum was to ICO tokens – the primary platform where innovation is happening, which in turn drives value to its token and network.

- ai16z (AI16Z token): This project grabbed attention both for its tongue-in-cheek homage to a VC legend and its pioneering model of an AI-governed DAO. Launched in late 2024, ai16z deployed an AI agent (nicknamed “Marc” after Andreessen) as the operational head of a decentralized venture fund. The agent uses the Eliza multi-agent framework to coordinate decisions across platforms, maintaining a coherent strategy. The AI16Z token acts as both governance and utility – holders can vote on proposals and the token is used for transactions within the ecosystem. The project also set an interesting economic parameter with a fixed supply of 1.1 billion tokens, and offered a high staking yield (~31.4% APR) through something called the ai16zPOOL to encourage participation.

By January 2025, ai16z’s market cap surged to $2 billion, reflecting massive interest. It demonstrated that the community was willing to invest in a concept of an AI-managed fund – essentially trusting an algorithm to identify and perhaps even execute startup investments or trading opportunities. ai16z’s success also underscored the multi-chain aspect of AI agents: it operates on Solana, showing that this movement isn’t confined to Ethereum or any single chain. The use of Solana’s high throughput likely helps ai16z agent to do rapid-fire transactions when needed. Overall, ai16z stands as a proof of concept that autonomous organizations can exist – where an AI is effectively the CEO – and the crypto community will assign substantial value to them.

- Fetch.ai / Artificial Superintelligence Alliance (FET): Not all key players were new in 2025. Fetch.ai (FET) has been around for a few years, building an AI-agent framework and network. In 2025, Fetch.ai joined forces with SingularityNET and Ocean Protocol to form what they termed the **Artificial Superintelligence Alliance (ASI Alliance)**. This collaboration aimed to combine strengths: SingularityNET brings expertise in decentralized AI marketplaces and AGI research, Fetch.ai contributes its agent technology and tooling (e.g., their agent-based DeltaV platform), and Ocean provides the data infrastructure and marketplaces for AI training data. Together, this alliance positions itself at the forefront of decentralized AI development. In context of crypto agents, the alliance and particularly Fetch.ai’s tech provide the underlying tools to make agents smarter and more interoperable across networks.

Fetch’s token FET was highlighted as the AI agent token with the largest market capitalization at the time, suggesting it had surpassed even Virtuals in value by Q1. (Indeed, FET and SingularityNET’s AGIX token had significant rallies, given their connection to AI narrative in general). The alliance’s goal of pursuing AGI (Artificial General Intelligence) in a decentralized way is a long-term moonshot, but meanwhile, their platforms are being used for practical agents – from logistics optimization to predictive oracles in DeFi. The Predictoor product by Ocean, which processed $800M in data marketplace volume in six months, indicates the kind of scale at which these infrastructure projects operate, feeding useful info to AI agents. In sum, the ASI Alliance and FET token represent the more infrastructure and research-focused side of crypto AI agents – less hype-driven, but providing serious tech and (potentially) the highest-end AI models that others can build on.

-

OriginTrail (TRAC): At first glance, OriginTrail is about supply chain and Web3 data, not AI agents. So why is it counted among “AI agent tokens to watch”? The reason is that good data is the fuel for good AI. OriginTrail’s decentralized knowledge graph and verifiable data platform can serve as a backbone for AI agents that need trustworthy information. For instance, an AI agent used in enterprise supply chain optimization could pull authenticated data via OriginTrail to make decisions. OriginTrail’s partnerships with big firms (Oracle, BSI, etc.) suggest its data might feed into AI-driven automation in those industries. The TRAC token is used to stake and reward data provision and ensure data integrity on the network. As AI agents take on tasks like verifying supply chain provenance or automating logistics (areas where AI + blockchain has clear value), a project like OriginTrail becomes essential plumbing. By Q1 2025, TRAC’s importance was recognized, and it maintained a healthy market cap (not as high as the flashy agent platforms, but a solid long-term bet). With a max supply of 500M and tokenomics encouraging usage in the network, TRAC is poised to grow if AI agents expand into real-world enterprise use cases that require searchable, trustworthy data – in effect, trying to be the “Google of Web3” as the project envisions, which in turn would be heavily utilized by AI agents needing to query that knowledge graph.

-

Other Notables: There are other emerging names: ChainGPT launched AI agents geared towards on-chain analysis and even comedic content (as per a LinkedIn post, it released a second agent for market intelligence that doubles as a Web3 “comedian” to boost engagement. BULLY was cited as an example of an “AI Agent meme coin”, combining AI narratives with meme culture in the Virtuals ecosystem. While perhaps not technically innovative, such meme agents attract community and liquidity rapidly, albeit with high risk. We also have the broader category of AI-focused crypto projects (like Cortex, Numerai, etc.) which aren’t agents per se but related. Notably, even some mainstream crypto protocols started adding AI integrations – by end of Q1, there were hints of things like Uniswap considering AI-powered interface assistants, etc., showing how the big players might incorporate agent tech without launching their own token.

Key Trends and Technologies Driving AI Agents

Several important trends and technological developments converged in late 2024 and Q1 2025 to propel the rise of AI agents in crypto. Understanding these gives insight into why this is happening now and where it’s headed:

The “iPhone Moment” for AI: Advanced Models & Open-Source Breakthroughs

AI agents benefited hugely from the rapid advancements in AI model capabilities. Many experts refer to late 2024/early 2025 as an “iPhone moment” for AI – a point where AI tech became user-friendly and powerful enough to spark mass adoption. Two developments stand out:

- Large Language Models (LLMs) reached new heights: With OpenAI’s GPT-4 (often called “o1” in some circles) setting a high bar, the open-source community answered with models like Llama 2 and then DeepSeek-R1. The latter, developed by a Chinese startup DeepSeek, achieved performance on par with top U.S. models but at a fraction of the running cost. In January 2025, DeepSeek-R1 was released and touted to be 20–50 times cheaper to use than OpenAI’s comparable model. This is a game-changer: suddenly, running a fairly sophisticated AI agent became economically feasible for a wider range of crypto projects (which may not have the deep pockets to call expensive APIs thousands of times). Switchere’s analysis on DeepSeek noted that adopting R1 could be key for AI agent platforms to reduce expenses and focus on utility instead of hype (How DeepSeek May Affect AI Agent Tokens). Indeed, projects quickly integrated R1 or similar models; for instance, a first wave of AI agents using custom DeepSeek-based models launched as proof that high performance can be achieved cheaply (First Blockchain AI Agent Integrates Custom DeepSeek Model).

The broader implication is that AI is no longer a bottleneck; the quality of reasoning, language understanding, and even multitasking that agents have now is leaps ahead of what it was with 2022-era models. This “intelligence boost” means agents can handle more complex tasks autonomously (which makes them genuinely useful, not just gimmicks). It also democratizes the space – a small dev team can incorporate a state-of-the-art model without going bankrupt, often using open frameworks on HuggingFace or similar.

- Multimodal and specialized AI frameworks: Hand-in-hand with better models came frameworks tailored for agent operations. For example, the Eliza framework enables multi-agent simulations where agents maintain identity and knowledge across different environments. Techniques like Chain-of-Thought (CoT) and Tree-of-Thoughts were integrated into agent reasoning to improve decision-making depth. This helped agents break down problems into sub-tasks more effectively (important for complex workflows like, “Analyze this new token, decide if it’s a scam, then formulate an investment strategy”). Agents also started using Retrieval-Augmented Generation (RAG) with vector databases, meaning they could have long-term memory and fetch relevant info on the fly, rather than being limited by the fixed context window of an LLM. All this combined to make AI agents smarter, more reliable, and better at real-time action than their predecessors.

The result of these AI advances is clear: autonomous crypto agents became actually practical in 2025. Prior, maybe an agent would frequently fail or give wrong info due to model limits. Now, with near-GPT-4 level cognition available and cost-effective, agents can truly mimic what a human expert might do, at least in defined domains. This spurred entrepreneurs and developers to try agents in all sorts of niches, confident that the AI can handle it.

Multi-Agent Systems and Orchestration

As individual AI agents grew more capable, an emerging trend is to network them into multi-agent systems to tackle complex, multi-step processes. Rather than one monolithic AI trying to do everything, we create an ensemble of specialized agents that collaborate. This idea has been around in AI research, but crypto provides a unique playground to implement it, because you can have agents transact and communicate on-chain with transparency.

In Q1 2025, we saw designs where, for example, a DeFi platform would deploy different agents for different roles: one agent specialized in monitoring lending markets, another specialized in executing debt refinancing, another in yield farming, etc., all under an umbrella strategy. The platform then effectively orchestrates these agents like a team, often with one “manager” agent or a coordinating smart contract ensuring they work towards the user’s unified goal.

Industry experts have explicitly called out that orchestrated multi-agent workflows are expected to be the next big leap for AI in blockchain. Investors are looking at teams building the middleware and protocols to coordinate swarms of agents. This includes things like standardizing how agents communicate (maybe on a protocol like libp2p or using on-chain events), how they negotiate tasks among themselves, and how to resolve conflicts if two agents have different suggestions.

One concrete direction is AI agent marketplaces – imagine an open market where an agent can hire another for a sub-task. This happened in some Virtuals scenarios: an agent with a budget can post a request (“I need an image created for my post, will pay 0.01 ETH”) and another agent specialized in image generation fulfills it. All automated. This effectively creates an autonomous service economy on-chain. Some projects like HyperSDK (hypothetical name here for illustration) might aim to be the platform enabling such agent-to-agent commerce reliably.

Another aspect is agent launchpads and incubators, which we touched on with Virtuals. The idea of an AI launchpad is to streamline bringing new agents to market, including funding them (like a DAO or investors providing initial capital to the agent’s treasury) and sharing infrastructure. Several launchpad projects – with tokens like CLANKER, VVAIFU, MAX – came up, focusing on financing and promoting new agent ideas. They create a flywheel: if one agent from their stable becomes a blockbuster hit (like a super useful trading bot everyone wants to use), the launchpad’s token and reputation skyrocket, which then attracts more talent and funding, and so on. The caution, as noted, is that these need a pipeline of “blockbuster projects” to keep momentum, otherwise interest could fade in between big hits.

Finally, benchmarking and evaluation became more prominent – how do we know Agent A is better than Agent B at a task? Tools like the GAIA benchmark were developed to test AI agents on solving real-world problems. In one result, the Eliza framework scored ~19.4% on GAIA, which while not tops, demonstrated solid capability for Web3 use cases. This kind of metric helps guide improvements and also gives investors a way to gauge if an agent tech is truly innovative or just marketing.

In summary, multi-agent systems and their orchestration are making AI agents scalable and modular. Rather than one generalist, the trend is teams of specialist agents coordinated for greater overall performance – very much like how complex organizations work in human society, but here the “employees” are AI programs. Q1 2025 saw the groundwork for this with launchpads and frameworks, and it’s likely to accelerate as success stories emerge.

Deepening Integration with Blockchain Tech (DeFi, Smart Contracts, Oracles)

AI agents wouldn’t flourish if not for the blockchain technologies that allow them to actually do things. A trend in Q1 is the deepening integration of AI agents with various parts of the crypto tech stack, enabling more efficient and secure actions:

-

Smarter Oracles and Data Feeds: Agents rely on data, and projects like API3, Chainlink started tailoring oracle services for AI use. For example, an AI agent might need a custom feed that aggregates not just price, but volatility indices, social sentiment index, etc. Oracle networks began offering composite data products that agents can subscribe to on-chain, paying with tokens for each update. This synergy ensures agents act on high-quality data. In return, some AI agents have been used to enhance oracles themselves – e.g., Chainlink experimenting with AI to detect outlier data points or oracle manipulation attempts in real-time, essentially an AI watchdog to improve oracle security.

-

Smart Contract Wallets & Account Abstraction: The rise of account abstraction (ERC-4337) on Ethereum made it easier to have smart contract wallets, which can be programmed with policies. Many AI agents controlling funds use these smart wallets so they can execute complex sequences like “if condition X, then sign transaction Y”. Account abstraction also allows things like sponsored fees (an agent could have a sponsor address paying for gas, so it doesn’t need to manage ETH for gas itself, simplifying its operation). We saw meta-transactions being used where an agent submits an intent and another service pays the gas to execute it, which helps in UX where agents act for users without requiring users to always approve in real-time (the user gave broad approval ahead of time). Essentially, blockchain infrastructure is adapting to let AI-driven transactions happen more seamlessly.

-

Dedicated Chains and Protocols for AI Agents: There’s a notion of “Agent Chains” – blockchains or subnets optimized for AI agent activity. For instance, a network might prioritize fast finality and high throughput, allowing agents to interact frequently without high latency or cost. Some projects hinted at launching sidechains specifically for hosting AI agent swarms (maybe with built-in support for agent communication protocols at the consensus level). While none went live in Q1, the concept is floating and could materialize later in 2025.

-

Deflationary or Utility-driven token models: A trend in tokenomics for agent platforms is ensuring the token’s value ties to actual usage. Virtuals, for example, saw activity-driven token appreciation because the more agents and co-owners, the more VIRTUAL is needed or burned in fees. Another example is requiring staking of platform tokens to create or run an agent (ensuring some skin in the game so that spam agents are disincentivized). AI agent tokens thus increasingly adopted models where token demand scales with active agents and success of those agents, rather than pure speculation. This is a trend borrowed from DeFi (where, say, a DEX token accrues value from trading fees). It’s meant to address the hype concern by baking in utility.

-

Security frameworks and sandboxes: Recognizing the risks of giving AI code control of funds, some projects implemented sandbox environments and fail-safes for agents. For example, an agent’s smart contract wallet might have a rule: can’t send more than X amount per day without multi-sig approval, or an emergency circuit breaker if abnormal behavior is detected. These measures were talked about in security circles to ensure a rogue or hacked AI doesn’t drain everything at once. Additionally, audit tools are being extended to AI agent logic (beyond just smart contract code, auditing the strategies or the training data to ensure no malicious backdoors). While this is still evolving, it’s a vital integration of blockchain’s security mindset into the AI agent realm.

In essence, blockchain tech and AI agents are co-evolving – blockchain provides the rails and guardrails for agents to operate, and the surge in agent usage is influencing how new blockchain features or protocols are designed (more flexibility, more safety, more data availability). This virtuous cycle is a key trend making the “Agentic Web” a realistic possibility.

Community and Cultural Phenomenon: Memes, Hype, and Education

No crypto trend is complete without a cultural element. AI agents didn’t rise in a vacuum of pure tech; they were fueled by community fascination, meme culture, and a broader sense of narrative.

-

Memetic Power: The notion of “autonomous agents” lent itself to memes and anthropomorphizing. Crypto users on Twitter made jokes about “AI degens” aping into coins at 3am or agents doing “God’s work” by shitposting memes (like Truth Terminal did). Memecoins emerged that piggybacked on the agent theme – for example, tokens that had no real AI but were named with AI buzzwords to attract the crowd (this is analogous to how any coin with “Inu” in its name took off during meme crazes). Discussions have hinted that we passed through a meme-fueled hype phase. Projects like BULLY (a Virtuals ecosystem meme coin) exemplify AI Agent meme coins thriving on community support and trendiness, with rapid viral potential. While many such coins likely don’t last, they increased visibility—suddenly even casual traders knew “AI agent” as a buzzword, further feeding the cycle of interest.

-

Education and Accessibility: Interestingly, a positive trend is that many AI agent projects invested in educating users about both crypto and AI. Since an AI agent often has a chatbot interface, newcomers found it easier to ask the agent questions and learn. For instance, someone could learn about staking or how to use a DeFi platform by chatting with an AI agent integrated into that platform. This has the effect of bringing more people in – you don’t have to read dozens of docs, you can just ask the AI assistant. So as more platforms incorporated AI agents as front-ends or support, the barrier to entry to use crypto services fell. This trend could significantly broaden crypto adoption if it continues (imagine every wallet has an AI tutor, every DApp has an AI guide).

-

Open Source and Community Development: The AI agent trend has a strong open-source ethos. Projects are sharing agent blueprints, strategy templates, and even agent “personalities” for others to build on. Communities on Reddit (like r/Build_AI_Agents) and Discord are popping up to collaborate on agent creation, sharing tips on which models or prompts work best for certain tasks. This collaborative culture accelerates development – someone figures out how to better connect an agent to Uniswap contracts and that knowledge spreads, etc. It also means the movement is not controlled by any single entity; much like crypto itself, it’s a decentralized innovation push with many independent contributors.

-

Regulatory Scrutiny as a Theme: Although not yet a full-blown trend, by the end of Q1 there was growing conversation about regulation. It’s worth noting as a forward-looking trend: policymakers started asking how AI agents fit into existing laws. Are they investment advisers? Do their creators need licenses if the agent manages money? If an agent causes a loss, who’s liable? These questions were raised in panels and articles. While concrete regulation hadn’t hit by Q1, the community is bracing for it, and some platforms preemptively started implementing KYC for agents or limiting certain functionalities in jurisdictions. So, part of the narrative is shifting from pure Wild West to slightly more compliance-aware development, especially for agents dealing with large funds.

In summary, beyond the tech, the AI agent wave is a social phenomenon. It captured imaginations – from serious builders who see it as the future of automation, to meme lords who treat agents as the latest craze to have fun (and make a quick buck) with. This blend of hype and genuine enthusiasm, tempered gradually by education and discussion of responsibilities, defined the tone of Q1 2025 in the crypto community. #Risks, Challenges, and Criticisms of the AI Agent Boom

While the rise of AI agents in crypto has been exhilarating, it also brings a host of risks and challenges that were hotly debated in Q1 2025. It’s crucial to examine these issues to get a balanced view:

Technical Risks: Data Quality, Security, and Reliability

AI agents are only as good as the data and code they operate on. One major risk is data accuracy and reliability. If an agent is fed bad or outdated data, it can make disastrously wrong decisions. For example, an agent reading a price feed that’s lagging could buy or sell at the wrong price, or it might base its advice on rumors that were debunked an hour ago. In Q1, there were a few minor incidents of agents spitting out false info (like telling a user a certain blockchain was halted when it wasn’t, due to scraping an old article). The challenge is ensuring agents have timely, correct information – which is hard in a decentralized context. Solutions include using multiple data sources (if 5 feeds agree on a price, it’s likely accurate) and implementing verification steps (maybe an agent asks a second agent to double-check an answer). But the risk can’t be eliminated; thus, misinformation by AI is a real concern, especially if users blindly trust the agent.

Security is another massive issue. By design, these agents can hold and transfer value, so they become targets for exploitation. A compromised AI agent could be catastrophic – if someone hacks the agent’s key or manipulates its logic, they could drain funds. There’s also risk of phishing or social engineering via agents: an attacker might trick an AI agent into revealing sensitive info or taking an unauthorized action by feeding it malicious inputs (somewhat analogous to prompt injection attacks on chatbots). Experts have noted that agents handling wallet credentials are potential targets and must be well secured. Best practices being discussed include encryption of all agent communications, strict permissioning (an agent should not be able to do everything even if it’s hacked; give it least privilege needed), and regular audits of the agent’s code and AI model for vulnerabilities. Since this is new ground, security frameworks are playing catch-up. During Q1, no major hack of an AI agent was publicly reported, but many white-hat hackers were certainly probing, and it feels like a matter of time unless robust measures are in place.

Reliability ties into understanding. Even advanced AI can struggle with edge cases or complex queries outside its training distribution. For instance, ask an AI agent a nuanced legal question about crypto in a specific country – it might not handle it correctly or at all. Or an agent might misinterpret a command due to ambiguity and do something unintended. The “limited understanding of complex queries” is acknowledged as a risk. The mitigation so far has been: clearly scope the agent’s duties (don’t expect a trading bot to explain tax implications, for example) and ensure there’s an easy way to fall back to human support or intervention. Some platforms put a “Are you satisfied? Yes/No” after agent interactions so a human can quickly review if something seems off.

Another facet is overfitting and lack of generalization – an agent might do well in normal conditions but fail during black swan events because it never encountered similar data in training. This is risky in crypto where extreme events happen. Hence, risk management components or circuit breakers are important to stop agents when things go way out of expected bounds.

Over-Reliance and Human Oversight

With any automation, there’s the danger of people trusting it too much. Over-reliance on AI agents can lead to complacency. If users start deferring all decisions to agents without understanding the rationale, they could be in trouble if the agent goes awry. One scenario: an agent advises holding a certain token during a market downturn; a user might accept that blindly and incur heavy losses, whereas a seasoned investor might have second-guessed and sold. There were already anecdotes of less-experienced traders following AI bots into trades and getting burned when the market turned sharply (some Telegram groups formed around copying a particular agent’s moves, reminiscent of copy-trading human “gurus”).

The challenge is keeping humans in the loop appropriately. How to avoid blind trust? Experts suggest treating AI agents as assistants, not bosses. The Botpress guide advises users to use agents as supplementary tools, not sole advisors, and to always combine agent insights with their own research. Some platforms enforce this by design – for big critical actions, the agent might recommend but still require the user to click confirm, or at least have a setting for that. However, that reduces the benefit of full automation. It’s a fine balance. During Q1, many early adopters were tech-savvy and kept an eye on their agents anyway, but as more mainstream users come in (perhaps drawn by the ease of an AI handling things), the risk of over-reliance grows.

There’s also a philosophical side: decision liability. If an AI agent in a DAO votes a certain way and it ends up being a bad call, the community might blame the AI or its creators. But since it’s “autonomous”, there’s a grey area of responsibility. For personal agents, if it loses your money, technically it’s your own doing for using it – but from a user experience perspective, that can be a bitter pill, and there may be calls for forms of insurance or guarantees on agent performance, which currently don’t exist widely.

Hype vs. Reality: Sustainability of the Trend

The crypto industry has seen many hype cycles, and skeptics of AI agents argue that this is just the latest buzzword bandwagon. Indeed, by March 2025 there was some cooling off from the initial frenzy. An analysis notes that after the initial wave of AI agent projects in 2024, there was rapid liquidity dilution by early 2025 – meaning so many projects popped up that investor money got spread thin. A lot of tokens mooned and then crashed as speculators jumped to the next thing, a pattern very reminiscent of the ICO era or DeFi summer.

The challenge here is to transition from hype to substance. The article suggests we’re entering a more mature phase focusing on revenue and product performance, where only those agent projects that provide eal value and stable income streams will survive. This implies many current projects will fizzle out – essentially a coming consolidation. Q1 might have been peak hype; Q2 and Q3 might see some hard lessons (some agents will blow up funds, some tokens will go to near-zero when they can’t deliver promised tech).

There’s criticism that, for all the talk, many AI agents are not yet delivering truly revolutionary results. Are AI-managed portfolios significantly outperforming the market? Are AI DAO governors making better decisions than humans? The evidence is still scant or anecdotal. Some early users reported modest gains or improvements, but nothing earth-shattering that couldn’t be achieved by a skilled human team. This opened debate: is the AI agent narrative outrunning the reality? Or as some on crypto forums put it, “Is this just DeFi automation with a fancy new name slapped on it?” The counter-argument from proponents is that these are early days, and agent tech will improve exponentially (especially with better AI models and learning from mistakes). But to convince the broader market, successes need to be visible.

Another criticism revolves around tokenomics and value capture. Detractors say, okay, you have an AI agent token – what does it entitle you to exactly? If an agent is successful, does the token accrue any value or cashflows, or is it just speculative? Some agent tokens might lack clear utility (beyond governance or clout). The smarter projects, as we noted, try to link token value to agent usage, but not all do. If too many agent tokens end up being hype with no substance, it could tarnish the whole sector. We already saw by Q1 end some tokens that launched on hype (without a working agent product) lose 80-90% of their value quickly.

In essence, the sustainability question is front and center: can AI agents live up to the expectations? The consensus among more sober voices is that yes, they can be revolutionary, but it will require weeding out the noise. It’s similar to how the dot-com bubble burst and then real internet giants emerged. We may see an “AI agent bubble” deflate, but it doesn’t mean the concept is dead – just the excesses.

Ethical and Regulatory Concerns

As AI agents become more autonomous, ethical questions arise. If an AI agent is instructed to maximize profit, will it engage in unethical behavior (like pump-and-dump schemes or exploiting loopholes that hurt others)? There’s a scenario where an AI trading agent figures out how to manipulate a low-cap token’s price to its advantage – essentially doing what a rogue trader might, but with no moral compass to say stop. Or consider an AI agent spamming a network or social media with misinformation to sway markets (one could argue the Truth Terminal agent promoting a meme coin was a mild version of this). There’s a risk of AI agents amplifying malicious activities if not properly checked. This leads to calls for guidelines or constraints on what autonomous agents can do, maybe encoded into their programming (akin to Asimov’s laws but for crypto finance).

On the regulatory side, various angles are being examined:

-

Financial regulation: If an AI agent is giving investment advice or managing a fund, should it be registered as an investment advisor or fund manager? Current laws obviously don’t contemplate non-human entities in those roles. Regulators might attempt to hold the creators or operators of the agent accountable under existing frameworks. For example, the SEC could say an AI-run fund still has a controlling person (the creators) who need to comply with regulations. There’s a grey area now, but likely to be tested if any AI agent fund loses a lot of consumer money.

-

Liability and legal personhood: Some legal scholars are floating the idea that highly autonomous agents might need a status like corporate personhood – so they can be sued or can enter contracts. But that’s a very nascent discussion. For now, the default is that someone (the developer, the user, or the DAO that “owns” the agent) will be held liable for the agent’s actions. This uncertainty could hamper certain uses (for instance, a TradFi institution might hesitate to use a crypto AI agent because of unclear liability if something goes wrong).

-

AML/KYC: An AI agent could be used to move funds in ways that obscure who is actually behind them. Regulators worry about agents being used as fronts for money laundering. Some exchanges that listed AI agent tokens in Q1 started asking questions about whether the token treasuries are properly KYC’ed, etc. If an AI agent holds significant assets, will it need a verified identity or to comply with travel rules when transferring large sums? These compliance issues are likely to surface. In one Twitter Spaces, a VC mentioned that blockchain-based AI agents will have to find efficient use cases that also fit into regulatory bounds (Blockchain needs efficient use cases for AI agents: X Spaces recap with VCs), hinting that agents running wild will face clampdowns.

Overall, while Q1 2025 was mostly focused on building and hype, these challenges and criticisms formed an undercurrent that responsible teams are paying attention to. How the community addresses data security, proper oversight, managing hype, and navigating legal issues will determine if AI agents can mature from a trend to a trusted, long-term part of the crypto ecosystem.

Outlook for AI Agents in Crypto (Rest of 2025 and Beyond)

As we move past the initial rush of Q1, the big question is: what’s next for AI agents in the crypto space? The outlook for the remainder of 2025 is cautiously optimistic with a few key themes to watch:

##T owards an “Agentic Web”: Increasing Autonomy and Ubiquity

Industry leaders, such as Jansen Tang of Virtuals, envision an “Agentic Web” on the horizon – a scenario where AI agents handle a significant portion of digital transactions and services. This could be transformative: imagine by end of 2025, it’s normal for your personal AI agent to coordinate with others to do things like managing your multi-chain portfolio, finding the best way to refinance your crypto loan, scheduling your DAO voting while you’re on vacation, even running an e-commerce storefront for you that accepts crypto payments. And all these agent-to-agent and agent-to-human interactions would be secured and recorded on blockchain, giving transparency and accountability we normally wouldn’t have with black-box AI.

This isn’t decades away – proponents say elements of it could be only months away. Already we have glimpses: personal finance agents, NFT marketplace agents, etc. By later in 2025, we might see integrations of agents into everyday crypto apps. For example, your crypto wallet app might come with an “AI assistant” tab that can execute commands across all your DeFi apps through one interface. Exchanges might offer AI-driven portfolio rebalancing as a feature. Some of this is likely to roll out as competition heats up – whoever provides the smartest, safest AI assistant could attract users.

The expectation is that agents will become as commonplace as smart contracts, effectively a layer on top of smart contracts that adds intelligence. And as they proliferate, they will start interacting more with each other directly. We could witness emergent behaviors: clusters of agents cooperating to maintain, say, a decentralized hedge fund, or cross-project agents negotiating liquidity swaps between protocols without human middlemen.

Focus on Utility and Proven Value

The hype will likely give way to a “show me results” mentality. The rest of 2025 should bring clarity on which AI agent projects are actually delivering. We anticipate:

-

Shakeout of weaker projects: Many of the quick cash-grab tokens or half-baked ideas will fade as users concentrate on solutions that demonstrably work. Surviving projects will likely be those that have active user bases, real revenue, or clear performance metrics to point to (e.g., an agent-driven fund that beat the market by X%, or an AI agent customer support that cut response times by Y%). This Darwinian process is healthy and mirrors previous innovation cycles.

-

Winners setting standards: The projects that do well may set de facto standards for the industry. For instance, if Virtuals continues to dominate, its tokenization standard for agents might be widely adopted and other chains might implement Virtuals compatibility. Or if another platform has the best system for inter-agent communication, it might become analogous to an “HTTP for agents.” By the end of 2025, we’ll likely see some convergence around best practices and protocols, perhaps even formal bodies or working groups to standardize AI agent interfaces.

-

Integration with Legacy and CeFi: To really prove value, AI agents may extend beyond the crypto-native world. We might see them interfacing with traditional finance or Web2 services. In fact, one early example is Circle (USDC issuer) demonstrating how AI agents can be leveraged to automate USDC payments (Enabling AI Agents with Blockchain - Circle). If these experiments bear fruit, banks or fintech apps might incorporate crypto AI agents for things like cross-border settlements or treasury operations, highlighting utility in the broader financial system.

The key metric by year’s end will be how much actual economic activity are AI agents managing? If a sizable share of DeFi TVL or trading volume or DAO treasury allocations are under agent control (with good outcomes), then we’ll know they’ve cemented their utility.

Continued Innovation: Smarter, Safer, More Specialized Agents

Technologically, we expect AI agents to get even smarter and more efficient. With open competition (DeepSeek vs OpenAI vs others), new model versions will arrive, possibly DeepSeek-R2 or a “GPT-5”-level model by late 2025. Each leap in AI will directly translate to agent improvement – more context, better reasoning, fewer errors. Also, models might become more specialized. For instance, an “AI trader model” fine-tuned on market data could outperform a general model on trading tasks. We might see a library of specialized models that agents can swap in depending on the task (one for language tasks, one for quantitative tasks, etc.).

Multi-modal agents will also advance – agents that can see, hear, and operate in virtual or even physical space. It’s not far-fetched that an AI agent could analyze satellite imagery (via an API) to inform a commodities trade, or scan blockchain code repositories to decide if a new DeFi project is well-built. The richer the input, the more informed the agent’s decisions.

On the safety side, there will be innovation in Agent Alignment (ensuring AI goals stay aligned with user goals and ethical norms). Perhaps agents will come with certified training that avoids reckless strategies. And more robust testing frameworks will be in place – think of stress-testing an AI agent under extreme market scenarios before deploying it with real funds (maybe simulation environments or “agent testnets” will be a thing).

Regulatory tech is another area: we may see the first attempts at compliant AI agents. For example, an AI trading agent that follows certain regulations might log all its decisions for audit, refuse to execute insider trades (if it somehow deduces insider info), or enforce whitelist/blacklist of certain assets due to legal reasons. Companies might create enterprise versions of agents with such guardrails to attract institutional users who need compliance.

Potential Challenges and External Factors

Despite the positive trajectory, a few things could impede or shape the outlook:

-