The cryptocurrency market moves at breakneck speed, driven largely by news and online hype. A single tweet or breaking headline can send prices soaring or plunging within minutes. In fact, research shows an influential tweet – such as one from Elon Musk – can instantly raise Bitcoin’s price by up to 16.9% or crash it by 11.8%, underscoring how powerful social media news can be in crypto.

For traders and investors, staying on top of the nonstop news cycle is both vital and exhausting. Crypto trades 24/7 across global time zones, meaning while you sleep, headlines from the other side of the world could be moving Bitcoin’s price. Every hour, hundreds of new articles and thousands of social posts flood the ecosystem. Important information can be lost in this “news tsunami,” and missing a single critical story could mean missing a big market move – or worse, holding a coin as it tanks on negative news.

How can anyone possibly sift through all this noise fast enough to trade on it? This is where modern artificial intelligence (AI) steps in. Today’s AI platforms are transforming raw news flow into actionable insights, giving everyday crypto enthusiasts tools that were once reserved for Wall Street quants. AI-driven systems can read and understand thousands of news sources and tweets per second, gauge the market’s mood, and even forecast how a piece of news might impact token prices, all in real time.

In this article, we’ll explore how you can leverage AI to decode crypto news, anticipate market reactions, and turn the frenzy of crypto “hype cycles” into a measurable trading edge – no coding required. We’ll maintain an unbiased, fact-based view, drawing on reliable sources and research to separate genuine advantages from mere buzz. By the end, you’ll understand how AI can be your around-the-clock analyst, helping you stay ahead of the curve in the fast-moving crypto market.

News and Hype: The Lifeblood of Crypto Markets

Crypto runs on news and sentiment. More than perhaps any other financial market, cryptocurrencies are heavily influenced by the narratives and emotions swirling around them. Traditional fundamentals often take a back seat to investor sentiment, enthusiasm, and fear. In fact, one study found that movements in cryptocurrency prices are “mainly driven by investor enthusiasm, regardless of the market news direction”. In other words, it’s not just what the news is – it’s how excited or fearful it makes the crowd. A coin might rally on a rumor of a partnership, only to crash later on solid but less exciting news. This dynamic has given rise to the adage “buy the rumor, sell the news,” reflecting how speculation and hype often lead reality in crypto markets.

Headlines can trigger extreme volatility. We’ve all seen how a single tweet or breaking news story can whip crypto prices around. Elon Musk’s Twitter activity is a prime example: when he tweets positively about crypto (even with a meme or one-word post), prices often surge; a critical or offhand remark can send them tumbling. Academic analysis confirms this outsized effect – Musk’s individual tweets have been shown to cause significant abnormal returns in Bitcoin, sometimes boosting BTC by nearly 17% or knocking it down 12%. The content of the tweet (positive or negative) matters, but so does the volume of attention it generates. Intriguingly, researchers found that the sheer volume of Twitter mentions can predict Bitcoin’s direction better than the tone of those tweets. In other words, when the crowd starts obsessively talking about a coin (even if not all talk is positive), it often heralds a price move. This reflects the “any publicity is good publicity” phenomenon – increased attention can translate to inflows of capital as more traders notice the asset.

Crypto news comes from all directions. Unlike stock markets, where a relatively small set of official reports (earnings, economic data) drive moves, crypto markets react to a sprawling array of news sources. Regulatory announcements, exchange listings, security breaches, macroeconomic shifts, technological developments, influencer endorsements – all of these hit the crypto newswire daily. A comment by a government official on crypto regulation in Asia, a hack on a DeFi protocol in Europe, or a new partnership announced on a project’s blog can all become market-moving news within the same day.

Social media platforms (Twitter/X, Reddit, Telegram) further blur the line between “news” and community chatter, often acting as early warning systems for trends (or as amplifiers of rumors).

During bull markets, even lighthearted stories or memes can fuel speculative frenzies (think of Dogecoin’s rally fueled by memes and celebrity tweets). During bear markets, fear-laden headlines can spark panicked sell-offs. The net effect is a market highly reactive to information – and misinformation – in real time.

Hype cycles drive booms and busts. Crypto has become famous for its rapid hype cycles: phases where a narrative catches fire and asset prices explode upward, followed by sharp corrections when the hype fades. We saw this with the ICO boom in 2017, the DeFi summer in 2020, the NFT mania in 2021, meme coins like DOGE and PEPE, and more recently the excitement around “AI tokens” in 2023–2024. In each case, a theme captured investors’ imagination, leading to staggering short-term returns – but inevitably, reality and profit-taking set in, and those parabolic gains evaporated just as quickly. For example, in early 2021, Dogecoin – a meme-based coin with no inherent utility – skyrocketed by over 20x in a few months largely due to social media hype and endorsements, only to crash back down. The pattern is so common that a crypto market cycle often is a hype cycle.

What’s crucial for traders is that narratives and hype aren’t just background noise – they are tradable signals. If you can identify when a narrative is starting to catch on, you might position yourself to ride the wave early. Equally important, if you can detect when euphoria is peaking, you can take profits or avoid buying the top. As one analysis put it, “in crypto, narratives are often the fuel that turns good ideas into short-term trading frenzies”. A recent case in 2025 involved a token called “LaunchCoin,” which promised easy token creation via social media. LaunchCoin surged by 3,500% (a 35× gain) at its hype peak, captivating influencers and traders alike. But within weeks, it had retraced to about 20× its launch price and losing momentum. The comedown was a classic hype cycle cooldown, similar to how “meme tokens like $DOGE and $PEPE [exploded, then cooled]” and how NFT collectibles dominated conversation in 2021 then faded by 2022. These examples underscore that timing the rise and fall of market sentiment is a critical skill.

Yet, timing sentiment shifts is easier said than done. Hype is not measured in fundamentals or financial statements – it lives in tweets, Reddit threads, and rapidly spreading news stories. By the time an average trader realizes a narrative has reached fever pitch, it may be too late; the early gains are gone, and they could be buying into a top. Likewise, recognizing the subtle early signs of a narrative catching fire (before everyone is talking about it) is like finding a needle in a digital haystack. This is precisely the kind of challenge where AI can give traders an edge.

Information Overload: Why Traders Need AI

The deluge of crypto information is overwhelming for any human to process manually. News and rumors don’t sleep, and they respect no single language or region. A Bitcoin investor in New York might wake up to find that overnight trading was roiled by a regulatory statement from Beijing or a major exchange hack in Seoul. “While you read this sentence, hundreds of financial news articles are being published… By the time you’ve read the headline and decided how to react, the opportunity – or the damage – is already done,” observes one AI trading firm, highlighting the impossibility of keeping up through traditional means. The fear of missing out (FOMO) on important news keeps many traders glued to their screens at all hours, yet staying constantly vigilant is unsustainable (and mentally exhausting).

Consider the 24/7 nature of crypto markets. Unlike equities that have set trading hours, crypto never stops. Important developments can happen anytime: a major partnership announcement on a Sunday, a sudden ban on crypto trading by a government on a holiday, or a viral social media post at 3 AM. Human traders need to eat, sleep, and live their lives; the market does not.

This asymmetry means human reaction will always have blind spots – moments when you simply aren’t watching. In those gaps, fast-reacting algorithms (and other traders in different time zones) may have already acted on the news before you even become aware of it. By the time you catch up, the price may have moved dramatically. In volatile markets, hours or even minutes can make the difference between a profitable trade and a missed opportunity or loss.

Volume of data is another issue. It’s not just one news feed to monitor – it’s dozens. Crypto news comes from specialized media (Cointelegraph, Coindesk, etc.), general financial outlets (Reuters, Bloomberg), project blogs, developer updates, regulatory press releases, exchange announcements, and the wild world of social media (Twitter/X, Reddit, Discord communities).

During major events, this firehose of information turns into a flood. For example, when a popular crypto project faces a crisis (say a security breach or a controversial fork), countless posts and articles appear across platforms, some with vital details and others just adding noise. Separating fact from rumor, signal from fluff, in real time is an enormous challenge. Important clues – maybe a developer’s tweet hinting at an exploit, or a pattern of large transfers picked up by on-chain sleuths and discussed on forums – can be lost amid the cacophony.

Cognitive bias plays a role as well. Human traders can get tunnel vision or become biased by the narratives they’ve already heard. One might downplay a piece of bearish news because they’re emotionally committed to a coin, or overreact to fear on social media and sell at the worst time. Emotions and biases make it hard to objectively assess every new development, especially under pressure. AI, in contrast, has no emotions – it treats a glowing press release and a damning hack report with equal, dispassionate attention, scoring them based on data. This isn’t to say AI is infallible (we’ll discuss its limitations), but removing emotional bias is a big potential advantage when reacting to news.

In summary, the modern crypto trader faces an impossible information challenge: too much data, moving too fast, in too many places at once. Missing a single critical headline could mean being on the wrong side of a sudden 30% price swing. No wonder many traders feel they’re always one step behind the market’s twists and turns.

Enter AI – the idea is to let machines do the heavy lifting of reading and reacting to news at scale and speed. As Forbes noted in mid-2025, it’s now often cheaper and faster to let AI monitor the market around the clock and flag only the news that matters. With the right AI tools, you don’t need an army of analysts or an absence of need for sleep – you can have a tireless digital assistant digesting the world’s crypto information for you. Let’s explore exactly how these AI platforms work and how they turn the chaos of news into clear trading signals.

AI Platforms: Decoding the News Flow in Real Time

Imagine having a personal market analyst who never sleeps, reads every news article and tweet about your investments, and instantly tells you the market’s mood. That, in essence, is what modern AI-driven news sentiment platforms promise to do. They transform an infinite stream of raw news into organized, actionable intelligence. At the core is natural language processing (NLP) – the branch of AI that enables machines to read and interpret human language. Thanks to major advances in NLP (from models like GPT-4 and others), AI can now read thousands of articles and social media posts per minute, understand context, and even gauge sentiment with a high degree of nuance.

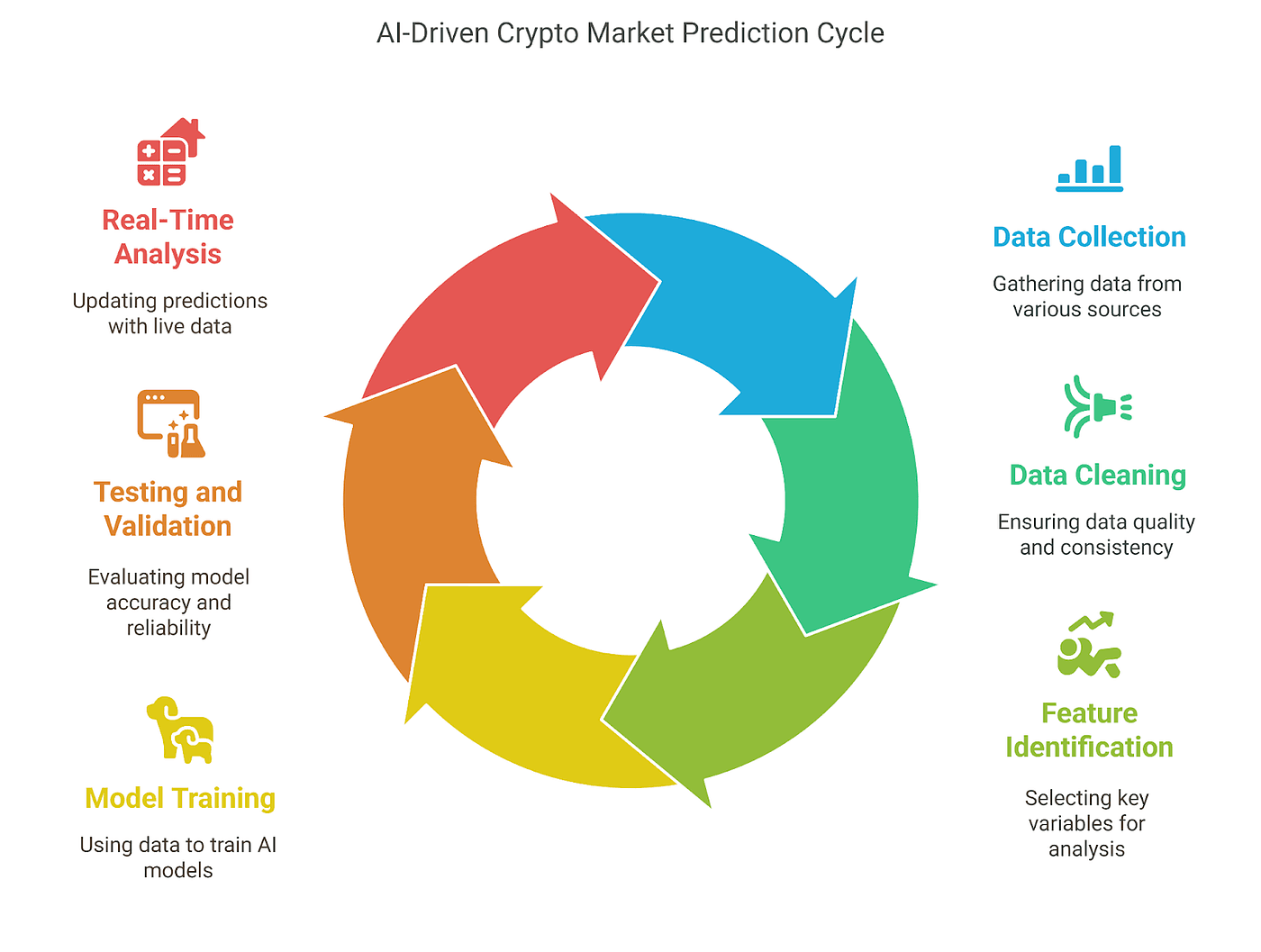

So how does an AI “read” the news? The process typically involves several stages:

-

Data Collection: The AI system first gathers data from an array of sources. This includes scanning crypto news websites, general financial news outlets, social media platforms (Twitter/X, Reddit, Telegram channels), forums, and even analyst reports. Top platforms might monitor thousands of sources globally – from major publications to niche blogs – ensuring nothing relevant slips through. For instance, the AI might ingest everything from a Reuters breaking news alert on Bitcoin, to a tweet by a blockchain developer, to a Reddit post on r/CryptoCurrency, all in parallel. This comprehensive sweep builds a real-time picture of what’s being said about the market.

-

Language Understanding: Next, NLP algorithms parse each text, much like a human would read and comprehend it. But beyond simply reading, the AI looks for key entities and context: Which coin or project is this news about? Is the tone positive, negative, or mixed? What are the key themes (e.g. regulation, technology upgrade, hack, adoption news)? Modern AI doesn’t just scan for keywords – it actually attempts to understand context and intent. For example, it can tell the difference between “Ethereum hit by negative news” versus “Ethereum hit a new all-time high,” despite both containing the word “hit.” It recognizes sarcasm or negation in text to some extent, and it can weigh the credibility of the source (a tweet from an unknown account is not the same as a report from the Wall Street Journal). Crucially, AI tries to determine if a given piece of news is market-moving or not. A sophisticated system will identify truly critical developments – say, “SEC approves first Bitcoin ETF” – versus routine or minor updates that might not affect prices much. This context awareness is what separates AI analysis from simplistic keyword alerts.

-

Sentiment Analysis: For each item of news or social post, the AI assigns a sentiment score or label. This usually ranges on a spectrum from very negative (bearish) to very positive (bullish), with neutral in between. But it’s not just binary; advanced systems provide a degree of confidence and intensity. For example, an AI might output: “Overall news sentiment on Ethereum today: Bullish (confidence: 80%, strength: strong). Key drivers: upcoming network upgrade and institutional investment news”. This condenses hundreds of articles into a simple pulse-check on market mood. Importantly, the AI looks at aggregate sentiment: one negative article might not outweigh ten positive ones, and vice versa. It can thus present a net sentiment after reading everything. Some platforms even produce a real-time sentiment index number (similar to a Fear & Greed Index, but more granular) that updates as news flows in.

-

Signal Aggregation: Beyond just saying “news is positive or negative,” AI platforms distill insights further. They often highlight the most impactful news items of the day – effectively curating the top market-moving stories you need to know. For instance, if 50 articles came out about Bitcoin, the AI might flag that two of those are “critical developments” (say, a major bank announcing crypto services, and a major hack on a Bitcoin exchange) which are likely driving market sentiment. The rest might be classified as secondary or noise. This helps a trader focus on what actually matters, ignoring the chatter. Additionally, AIs can provide summaries of the positives and negatives. One AI sentiment tool offers a balanced summary: a list of bullish developments and bearish developments affecting an asset. This means you see both sides of the story at a glance – for example, “Positive factors: high-profile partnership announced, rising user adoption. Negative factors: regulatory investigation in progress, large token unlock coming”. Such balanced intelligence prevents one from being blindsided by only hearing one side (over-exuberant hype or doom-and-gloom), which is “critical for risk management,” as experts note.

Within seconds, a well-designed AI platform can go from raw news articles to a concise dashboard of insights. Imagine opening an app, typing in a cryptocurrency ticker, and instantly seeing: “Sentiment: Bearish 🔻 (Confidence: High). Key News: (1) Exchange XYZ hacked for $100M – negative. (2) Central Bank official hints at crypto ban – negative. (3) New partnership with major retailer – positive, but overshadowed. Net effect: strongly negative sentiment today.” This kind of output is incredibly powerful. It condenses hours of reading and analysis into a snapshot. And it’s not just for one asset – you could do this for any coin or even the whole market.

Example: An AI-driven market sentiment tool analyzing news for a cryptocurrency. The platform aggregates thousands of sources to deliver an overall sentiment rating (bullish, bearish, or mixed) along with confidence levels and key drivers. Such AI systems parse news content in real time, separating truly impactful developments from noise to give traders a clear picture of market mood.

Notably, AI doesn’t just tally up news sentiment blindly; it also accounts for source impact and credibility. For instance, a report from a highly respected source or an official announcement will be weighted more heavily than an unverified social media rumor. AI can learn which sources have historically moved markets (e.g., a tweet from a famous trader might reliably cause a stir, whereas dozens of random tweets might not). It can also detect repetition – if 100 outlets are all echoing one original news story, a human might feel overwhelmed by volume, but the AI knows it’s essentially one piece of news replicated, not 100 independent events.

In the crypto realm, some AI platforms even blend on-chain data or market data with news sentiment to enrich their analysis. They might note, for example, that despite very bullish news sentiment on a coin, on-chain activity or trading volume isn’t picking up, suggesting caution. Or conversely, bearish news sentiment combined with a surge of coins moving to exchanges could be a red flag of an impending sell-off. The combination of off-chain news and on-chain analytics is a cutting-edge approach some advanced tools are taking to leave no stone unturned.

Real-world example: During a volatile period in 2024, suppose there’s a swirl of news around a major altcoin. An AI sentiment agent scans everything and concludes: “Overall sentiment on Altcoin XYZ is strongly bearish today. Critical development: a respected crypto outlet reported a security vulnerability in XYZ’s code, triggering negative coverage. Other factors: high social media fear with many mentions of ‘scam’ and ‘hack’ (emotional signal: fear). Confidence in bearish sentiment: very high.”*

A trader equipped with this information early could decide to reduce exposure or hedge that position, potentially avoiding a significant loss as the broader market digests the news. Meanwhile, a trader relying only on their own reading might learn of the vulnerability later or underappreciate its significance until the price already fell. This illustrates how AI’s rapid, wide-ranging comprehension can directly translate to a trading advantage in reacting to news.

To sum up, AI platforms act as news sentiment radars, tirelessly scanning the horizon and alerting you to storms or clear skies ahead. They decode the mood of the market in real time, something virtually impossible to do at scale manually.

By doing so, they set the stage for the next step: using those decoded signals to forecast actual price movements and inform trading strategy.

From Sentiment to Signals: Forecasting Token Impact with AI

Identifying the sentiment and key news is half the battle – the next challenge is predicting what that means for price and volatility. This is where AI truly shines as a strategy tool. Modern AI systems don’t just tell you the news sentiment; they can learn from historical patterns to forecast how similar news might impact a coin’s price. In essence, they try to answer: Given this news and sentiment context, is this asset likely to go up or down (and by how much)? This turns raw information into a trading signal – a suggestion to buy, sell, or maybe avoid (if the signals are mixed or unclear).

One approach uses machine learning models trained on historical data. Researchers and quant traders feed models with years of crypto market data, including price movements and sentiment indicators derived from news and social media. These models, whether they be neural networks, tree-based algorithms, or hybrid systems, learn the complex relationships between sentiment shifts and subsequent price changes. For example, a model might learn that when overall sentiment on Ethereum turns sharply positive and is accompanied by high tweet volume, a short-term price bump often follows – unless technical indicators are extremely overbought, in which case it might be a false hype signal. These relationships are often nonlinear and nuanced, the kind which AI is better at capturing than simple human if-then logic.

A 2024 academic study highlighted this, noting that investor sentiment influences crypto volatility in a nonlinear fashion – linear models didn’t improve forecasts by adding sentiment, but advanced machine learning did, capturing the subtle effects and improving accuracy in the majority of cases. In fact, models like LightGBM, XGBoost, or LSTM neural networks showed significantly enhanced predictive power when they incorporated sentiment data, outperforming traditional volatility models over half the time.

Case study – predicting Bitcoin with sentiment: A team of researchers at Florida International University built a system combining 55 different sentiment-related signals from news and social media to predict Bitcoin’s price direction. These signals – provided by MarketPsych, a financial sentiment data firm – included categories like emotional tone (fear, joy, anger in news), sentiment around price forecasts, factual mentions, slang/buzz (like “to the moon”), and general sentiment. The AI model then analyzed how these signals, along with trading data (price momentum, volume, etc.), could forecast the next day’s Bitcoin price.

The results were impressive: by focusing on the most predictive signals and combining them, the AI was able to increase prediction accuracy and even outperform the market. In their tests, trading portfolios guided by these sentiment signals beat the baseline market return by up to 39.6% on a risk-adjusted basis. The most powerful signals turned out to be emotional ones – “fear is more predictive than FOMO, which in turn is more predictive than [simple] relevance,” the researchers noted. In plain language, this suggests that when the news is fearful, it’s a stronger predictor (likely of price drops or volatility) than even the “hype” of missing out. The AI effectively learned to gauge when fear in the news reached a tipping point that often precedes a sell-off, and when positive buzz reached a level that precedes rallies.

Another example: AI can recognize event patterns. It might learn that exchange listing news for a smaller altcoin tends to produce, say, a 20–30% price pop within 24 hours (as traders rush in on increased accessibility and liquidity). Conversely, news of a token unlock (increasing supply) might consistently lead to price drops in the subsequent days, as seen with Pi Network’s token unlock causing price decline. Armed with this knowledge, an AI-driven system can flag a trade signal: “Project ABC listing on Binance announced – historically, such news is bullish for similar assets; short-term buy signal with high confidence.” Or in the negative case: “Token XYZ unlocking 10% of supply tomorrow – historically a bearish event; consider selling or shorting, moderate confidence.” Of course, these signals are probabilities, not guarantees, but they are drawn from pattern recognition across many instances.

AI can also factor in broader market context automatically, something even diligent traders might overlook. For instance, an AI might temper a bullish news signal on an altcoin if the overall market (say Bitcoin and Ethereum) is in a downward trend or risk-off mode. It “knows” that good news for a small coin may not overcome a strongly bearish overall climate. Conversely, in a roaring bull market, even modest good news can have amplified impact (as everyone’s already inclined to buy). This contextual understanding echoes the advice human analysts give: news-based signals work best when combined with broader market context (e.g., Bitcoin’s trend or altcoin momentum). AI can quantitatively incorporate that context.

One increasingly accessible avenue for traders is using large language models (LLMs) like ChatGPT itself to interpret news and generate trade ideas. ChatGPT, for instance, has proven surprisingly adept at analyzing news headlines and providing a reasoned take on whether it’s bullish or bearish news for a coin. With a well-crafted prompt, you can feed ChatGPT a piece of news and ask for an analysis and even a suggested action. For example, a trader might prompt: “Here’s a headline: ‘Major Partnership for Cardano with Fortune 500 Company.’ ChatGPT, is this a buy signal for ADA and why or why not?” The AI, drawing on its trained knowledge and logical reasoning, could respond with something like: “This partnership is likely bullish for Cardano (ADA) because it increases real-world adoption and credibility. Similar past partnerships in crypto have led to short-term price increases due to investor excitement. However, I would consider the broader market – if we are in a strong uptrend, the effect could be amplified. On the other hand, if the market is bearish overall, ADA might not pump as strongly. It’s a potential buy signal, but one should also watch ADA’s technical indicators (if it’s overbought) and confirm that the news is confirmed and substantial.”

This kind of qualitative analysis is fast and flexible, giving even non-technical traders a starting point for decision-making. In Cointelegraph’s example, a user asked ChatGPT about a bearish headline for Pi Network, and ChatGPT’s analysis correctly identified it as a likely sell signal, explaining the reasons (increased supply, weak demand, etc.). It even balanced the view by noting long-term holders might see an oversold opportunity, showing nuance.

Example: A large language model (ChatGPT) analyzing a crypto news headline and suggesting a trade signal. In this case, the AI was asked about a news report (“Pi Network price nears all-time lows as supply pressure mounts”) and it responded with a brief analysis, leaning toward a sell signal due to bearish factors (increased token supply, weak demand, oversold technicals). AI tools like ChatGPT can interpret news in plain English, providing fast, no-coding insights for traders – though any AI-generated suggestion should be verified against other data before acting on it.

Combining multiple indicators: The real power of AI comes when it fuses news sentiment with other data – technical indicators, on-chain metrics, trading volume, etc. AI doesn’t have the cognitive limit of focusing on just one thing; it can digest a multidimensional input. For instance, an AI model might take in: “News sentiment = very bullish, Social media buzz = surging (high tweet volume), Technical trend = price above 50-day moving average and volume rising, On-chain = large holders accumulating.” Individually, each of these is a positive sign; collectively, the AI could recognize a strong buy scenario with all signals aligning.

One 2025 study noted that transformer-based AI models (akin to GPT) that merge social sentiment data with technical analytics outperformed legacy models, yielding higher returns and lower risk – they even reduced drawdowns by anticipating volatility shifts through real-time sentiment cues. This means AI not only aims for profit but can help manage risk by warning when sentiment is turning and volatility might spike (so you can tighten stop-losses or take some profit).

It’s worth noting that AI-driven forecasting is probabilistic. No system will be right 100% of the time. The goal is to tilt the odds in your favor – to have an edge. If an AI model can be correct on, say, 60% of its trade signals and cut losses quickly on the 40% that are wrong, it can generate profitable strategies over time. The FIU research, for example, mentioned improving risk-adjusted returns; another peer-reviewed study found a neural network strategy returned 1640% over a multi-year backtest versus 223% for a simple buy-and-hold Bitcoin approach (albeit that sounds extreme and likely assumes ideal conditions). Even accounting for trading costs, the AI approach vastly outperformed, illustrating the potential upside of using AI-informed strategies. However, results like that involve complex setups and retrospective data; real-world performance will vary and requires constant monitoring.

Human plus AI – a winning combo: In practice, the best results often come when human experience and intuition are combined with AI’s data-crunching. AI might flag a dozen coins with extremely bullish sentiment today; a seasoned trader then applies a filter: which of these have good technical chart patterns? Which have upcoming events that align with the sentiment? The human can verify if the “story” behind the sentiment makes sense (is it sustainable news or just hype?). Meanwhile, the AI might also warn the human of something they overlooked – perhaps a coin they thought was solid fundamentally is getting a lot of negative press suddenly, prompting a reevaluation.

AI can even be used in simulations and strategy testing: traders now use language models like ChatGPT to simulate scenarios (“What if the Fed announces a rate hike – how might that affect crypto prices short-term?”) or to generate trading rules in plain language which the AI can turn into code for backtesting. These workflows, once the domain of programmers, are becoming accessible to non-coders through AI’s translation of natural language to actionable output. It’s a bit beyond the scope of news analysis, but it shows how AI can accelerate strategy development from idea to execution.

In summary, AI turns news into forecasts by learning from the past and reading the present. It can output concrete trade signals – like “bullish signal, consider long position” or “bearish outlook, consider reducing exposure” – based on the synthesis of sentiment and data. This doesn’t make trading foolproof (risks remain, and black swan events can defy any prediction), but it gives traders a powerful, fact-based starting point for decision-making. Rather than guessing or going purely on gut feeling, you have an analytical assist that crunches far more information than you ever could manually. The next section will delve into how this applies to those wild hype cycles we discussed, and how AI can help you ride the waves of crypto euphoria and panic with more finesse.

Turning Hype Cycles into Trading Edges

Hype cycles – those explosive surges of interest and the inevitable cooldowns – are often seen as a double-edged sword. On one hand, if you catch a hype wave early, the gains can be life-changing. On the other hand, if you get in at the top of the hype, the crash can be devastating. The key is timing, and timing is all about detecting when a narrative is heating up and when it’s burning out. AI, with its pulse on both news and social sentiment, is uniquely positioned to quantify hype and give traders measurable signals amid the mania.

Early detection of hype: Before a coin’s price goes parabolic, usually its social and news mentions go parabolic first. The crowd starts chattering excitedly, influencers pick up the story, and media outlets write about the “next big thing.” AI algorithms track these metrics in real time: the frequency of a coin’s mentions on Twitter or Reddit, the sentiment of those mentions, and how both metrics are changing over time. A sudden and sustained surge in mention volume can be a telltale sign that a coin or sector narrative is entering a hype phase. Recall the earlier research we cited: even modest improvements in sentiment can trigger outsized price moves in crypto.

The Nodiens report (July 2025) demonstrated that during a late-2024 rally, coins like Hedera and Cardano turned a relatively small mood uptick (+3% to +9% in their sentiment indices) into major price gains (+9% to +21%).

That’s a roughly 3-to-1 amplification of mood into price movement. This “sentiment leverage” is gold for traders – it means if you can spot a sentiment upswing early, you might ride a disproportionately large price jump. AI can catch that upswing by monitoring sentiment indices or mood metrics for dozens of assets simultaneously, something a human can’t efficiently do. For example, an AI might alert: “Sentiment for Token XYZ has jumped significantly in the past 48 hours from neutral to strongly positive, and social buzz (mentions) are up 5x normal levels.” If historically such patterns preceded price rallies, that’s a strong alert to investigate going long on XYZ before the rest of the market catches on.

Following the smart money vs. the crowd: Sometimes hype is pure grassroots (retail FOMO), but often there are bigger players involved. AI tools can be tuned to watch for signs of “whale” activity or institutional moves in the context of news. For instance, if a usually quiet project suddenly has a flurry of positive news and social media hype, AI might also scan blockchain data for unusually large transactions (whale accumulations) or order book changes. Some advanced platforms note explicitly they help “spot whale movements and their market impact” amid the sentiment shifts. An early whale buy-in combined with rising hype can be a very bullish combo – it suggests informed money is positioning ahead of or during the hype. Conversely, if hype is high but whale wallets are distributing (selling into the pump), an AI could flag that divergence: hype cycle may not be sustainable.

Identifying the peak of euphoria: One of the hardest things as a trader is knowing when a bubble is about to burst. Everyone’s euphoric, the gains look endless – until they suddenly aren’t. AI can look for quantitative signs of peak hype. These might include: sentiment going from extremely positive to starting to soften, an initial negative news piece appearing after a long run of positive press, or engagement metrics plateauing. The Token Metrics example earlier is illustrative: their AI-driven model detected declining momentum and engagement for LaunchCoin weeks before the wider market realized the top was in, even as social media was still buzzing with positivity.

Essentially, the data (volume, momentum indicators, sentiment strength) showed cracks forming in the rally despite the hype, giving savvy traders an early warning. An AI could output something like: “Alert: Coin ABC – sentiment still bullish but weaker than last week; trading volume not rising commensurately with social mentions; possible hype peak forming.” Those who heed such a signal might start taking profits or tightening stop-losses, rather than getting greedy and holding through the reversal.

Additionally, AI can detect when narratives begin to rotate. Crypto often moves in themes – one month everyone’s hot on DeFi tokens, next month it’s all about metaverse gaming coins, then AI-related tokens, and so forth. As one theme’s trades get crowded and fizzle, another takes off. AI can map this by tracking sentiment and capital flows across sectors. For example, after the “social token” narrative (like LaunchCoin) cooled in mid-2025, data showed attention shifting to other areas: “capital exited social tokens and we saw attention shift toward AI tokens, DeFi lending protocols, and real-world asset platforms”, as an industry report noted.

A trader using AI would ideally catch that rotation: the system might highlight that sentiment and volume are rising in AI-related tokens while plateauing in social tokens. This is a cue to rotate your own portfolio – perhaps trim positions in the fading narrative and add exposure to the emerging one. Some advanced platforms provide filters to find trending bullish signals by sector or theme (AI, DeFi, meme coins, etc.), which is essentially a way to identify which narrative is gaining momentum each day or week. Even without a specialized platform, a trader can manually query an AI like ChatGPT to summarize the market narratives: e.g., “What crypto themes are gaining a lot of positive attention this week?” and it could answer with something like, “AI-focused crypto projects and certain Layer-2 networks are seeing increased buzz,” based on the news it’s read.

Measuring fear in downturns: Hype cycles aren’t only about the upside; the flip side is panic and capitulation on the way down. AI sentiment analysis works both ways – it can signal when fear and negativity are peaking, which sometimes is a contrarian buy signal. For instance, if a coin has crashed and the news is extremely negative (everyone writing obituaries for it, social media full of doom), an AI might detect that all the weak hands have likely sold. Some investors use the classic “Fear & Greed Index” as a rough gauge for the overall market – extreme fear often precedes a bottom.

AI can create a much more sophisticated, real-time fear index for a specific asset or sector. If sentiment is extremely bearish but starts to rebound from an absolute low (say, going from “utterly pessimistic” to just “very pessimistic”), that shift might indicate the worst is over. There have been instances in crypto where those who bought when sentiment was in the gutter (and everyone thought you were crazy to buy) ended up catching the bottom. AI could help quantify those moments so you can act when rational analysis says the crowd’s fear is overdone.

In practical terms, turning hype into an edge means formulating rules or signals around the data. For example: “If social media mentions of a coin triple within 24 hours and sentiment is >80% positive, and the coin’s price hasn’t moved up more than 10% yet, that’s a potential buy – the hype is building but not fully priced in.” Conversely, “If a coin’s sentiment stays extremely positive but starts to dip day-over-day while price is still climbing, consider that a warning of a top.” An AI can be configured to alert you to these conditions automatically. Traders can then combine those alerts with technical analysis (is the price at a known resistance? is volume declining on the last push up?) to make final decisions.

One concrete tool in many traders’ arsenal is the “social volume vs price” divergence check – if price is flat or rising only slightly, but social volume (buzz) is exploding, it may indicate a lot of talk before action, which could presage a sharp move upward (once people start buying on the talk). But if price has been skyrocketing and social volume is also skyrocketing to an extreme, it could mean everyone who’s going to buy is talking about it (peak hype), and any falter could cause a rapid drop. AI charts can visualize this in real time: some sentiment analytics platforms show graphs of sentiment and volume against price. Traders watch for inflection points – like sentiment rolling over while price is still up, or sentiment surging when price has yet to react.

Let’s revisit an example: LaunchCoin’s life cycle. Early on, AI might have flagged its rise: social media mentions spiked, narrative sentiment very bullish, price starting to climb – a strong momentum buy signal. At the height, perhaps the AI noted an anomaly: sentiment was still high but no longer rising, and trading volume started to wane despite Twitter remaining euphoric. That loss of momentum is exactly what was observed; as one analysis described, “the sharp retrace from its peak indicated a critical shift: interest was waning, even if believers remained vocal… Today’s pullback reflects narrative fatigue — a critical turning point for traders”. An AI detecting “narrative fatigue” would have been invaluable to get out near the top.

Another interesting note from the Nodiens report was that they categorized assets by how sentiment-driven they were. Some assets (“Sentiment-Leverage Leaders”) had strong correlation between mood and price – those are prime candidates for a news/sentiment strategy, since riding hype there can pay off big. Others (“Divergents”) could rise despite negative sentiment – meaning they had other factors (maybe strong fundamentals or whale support) that overpowered public sentiment. Knowing which type of asset you’re dealing with helps: AI might tell you “Coin XYZ is heavily sentiment-driven historically, so current hype likely equals price momentum” versus “Coin ABC often moves opposite to crowd sentiment, perhaps due to insider accumulation – be cautious interpreting sentiment at face value.” This nuance is part of deep AI models or at least the interpretation a skilled user can derive from AI outputs.

In short, AI can turn the art of reading hype into a more systematic science. It provides early indicators of hype emergence, metrics for hype intensity, and warnings for hype demise. By quantifying the unquantifiable (enthusiasm, greed, fear), AI gives traders a way to navigate the boom-bust cycles with more foresight. Instead of getting swept up emotionally, you can set rules – take profit when X sentiment peak signal hits, or buy when extreme fear abates – and let the data guide you. Many traders find that having these data-driven rules helps counteract the psychological biases that otherwise lead them to buy high and sell low during wild swings.

Of course, execution matters – acting on these signals requires discipline and risk management. Which brings us to how traders can practically integrate AI tools into their workflow, and what considerations to keep in mind.

No Coding Required: AI Tools at Every Trader’s Fingertips

One of the most exciting developments in the past couple of years is that AI-powered trading insights are no longer limited to hedge funds or PhD quants. Regular crypto enthusiasts – even those with no background in programming or data science – can now access AI tools to analyze news and market sentiment. The barrier to entry has dropped dramatically, thanks to user-friendly platforms and conversational AI interfaces.

Chatbots and assistants: As demonstrated earlier, you can literally use ChatGPT or similar AI chatbots as your personal market analyst. All it takes is typing in a question or prompt in plain English. For instance, “ChatGPT, summarize today’s major crypto news and tell me if the market sentiment is leaning bullish or bearish,” or “Given the latest news on Ethereum’s upgrade and current market trends, what’s your outlook on ETH’s price action this week?” The AI will output a coherent analysis based on the information it was trained on or provided with. OpenAI’s ChatGPT, Google’s Bard, and Anthropic’s Claude are examples of LLMs that people have started using in this fashion. Even domain-specific chatbots are emerging: for example, Grok (an AI assistant launched in 2024) has been mentioned alongside ChatGPT in crypto circles. Vitalik Buterin, the co-founder of Ethereum, recently highlighted the potential of AI tools like ChatGPT and Grok for assisting crypto participants, noting that these AIs can provide “valuable insights and responses” that help traders stay informed on market conditions. Such endorsements underscore that even industry veterans see value in leveraging AI assistants for market analysis.

Importantly, these chatbot tools typically require no coding or complex setup. If you can use a web browser and chat interface, you can use them. Some are integrated into messaging apps or trading platforms directly.

For example, by 2025, there are trading bots on platforms like TradingView or Telegram where you can ask in natural language about a coin’s sentiment or even ask the bot to execute a trade when certain conditions (which you describe in words) are met. One platform, Capitalise.ai, famously lets users create automated trading scenarios using everyday English (“Buy BTC if sentiment is very positive and price crosses above $30,000” etc., then test and deploy that) – truly code-free automation.

Sentiment dashboards: There are also specialized crypto sentiment websites and dashboards that anyone can use. These typically present real-time charts of sentiment scores, buzz metrics, and maybe a feed of relevant news. For example, tools like LunarCrush, Santiment, The TIE, StockGeist.ai (to name a few) provide various sentiment and social indicators for hundreds of cryptocurrencies. A user can visit such a site, type in a coin, and see things like sentiment trend (bullish/bearish over the last day/week), social volume trend, top keywords in recent posts about the coin, etc.

Many of these services freemium models – basic data is free, advanced features for paid users. The key point: you don’t have to build a neural network yourself; you can harness one via an interface. For instance, StockGeist provides real-time sentiment monitoring for many coins, labeling them bullish, neutral, or bearish based on the tone of recent social and news posts. Messari, a popular crypto research firm, introduced an “AI news” feature that uses AI to summarize and analyze news for users.

AI-enhanced trading platforms: Major trading and data platforms are integrating AI features too. Reuters and Bloomberg, the giants of financial data, have started incorporating crypto sentiment and AI indices into their terminals. Even retail-focused platforms like TradingView have begun adding AI-driven analytics (for example, TradingView in 2024 added a feed of news with sentiment tags powered by an AI algorithm). Crypto exchanges and brokerages are not far behind – some have chatbots for customer service that double as market info bots, and others are exploring AI-driven advisory features (though regulatory constraints mean they must be careful not to cross into “financial advice” territory).

An example of integration: some users pair ChatGPT with real-time data plugins or APIs. While ChatGPT on its own doesn’t browse current news by default, OpenAI has provided plugins and the newer versions can have browsing enabled (as of 2025) so it can fetch up-to-date info. If you enable, say, a news plugin or connect it to a crypto news API, you can ask: “Hey ChatGPT, check the latest crypto headlines and give me any that might impact XRP price, then analyze them.” The AI will fetch current data and do what you asked. Similarly, people connect ChatGPT to trading APIs to create semi-automated agents. One enthusiast described a setup where ChatGPT would pull sentiment data from an API, technical indicators from another, and then output a trading suggestion – all without the user writing code, just orchestrating via natural language and available tools. This underscores how accessible building a personalized “AI trading assistant” has become.

For those not inclined to tinker, even just following some AI-curated indices can help. For example, in late 2024 a “Crypto Fear & Greed Index 2.0” was launched on some sites which is AI-powered, combining more inputs than the older basic index. There are also AI-based token indexes that algorithmically pick a basket of trending coins. While one must be cautious with such products, they reflect the trend of AI doing the heavy analytical lifting in packaged forms.

Educational and strategy support: Another underrated aspect is how AI tools educate and guide users. ChatGPT and peers can explain trading concepts, summarize on-chain metrics, or even warn you of risks if prompted. They can help novices understand why certain news is significant. For instance, a beginner could ask, “Why is everyone concerned about the Mt. Gox Bitcoin unlock news?” and the AI would give a historical explanation and potential market impact. This informative tone helps traders not just copy signals but learn the rationale. Many AI tools also produce plain-language reports – e.g., “Today’s Market Sentiment Report: Market is moderately bullish. Positive drivers: XYZ adoption news. Negative drivers: regulatory uncertainty in US…” – which make it easier to digest than raw data tables.

No free lunch: It must be said that while these tools are powerful, they’re not a magic money machine. The accessibility of AI means many traders can use similar tools, which could theoretically arbitrage away some of the edge. For example, if an AI signals a bullish trade, lots of algorithmic traders might jump on it, moving the price quickly (making it harder for slower movers to profit). However, crypto markets are still very heterogeneous, and not everyone uses the same tools or reacts at the same speed, so opportunities persist, especially in smaller caps or during volatile news events where human hesitation still abounds.

Another important note: be mindful of the sources and quality of AI output.

Some free AI-driven content (like certain auto-generated news articles) might not be accurate – always verify critical info from original sources. Use reputable AI platforms or cross-check what the AI tells you. For instance, if ChatGPT summarizes a news event, one should double-check the key facts in that summary via a trusted news site if planning a big trade on it.

Finally, consider the security aspect when integrating AI with trading. If you use any AI trading bot that executes trades via API keys to your exchange account, secure those keys and use read-only keys if just analyzing. There have been scams and hacks in the crypto space masquerading as AI tools – stick to well-known providers and never give an unvetted AI tool direct access to manage funds. AI can enhance your strategy, but you remain in control of your capital.

Risks and Limitations of AI-Driven Strategies

While AI offers exciting capabilities, it’s not a crystal ball or a substitute for due diligence. Traders must be aware of the limitations and risks when relying on AI for investment decisions. Here are some key considerations (in an informative, cautionary tone):

-

Accuracy and “garbage in, garbage out”: AI predictions are only as good as the data and patterns they’re based on. If the market enters a regime that has little precedent, AI can falter. For example, an AI trained on the mostly bull market data might not foresee a black swan event or a paradigm shift (like an unprecedented regulation that changes everything). Moreover, AI can misinterpret misinformation as real news – especially if scraping social media where rumors abound. If false news starts trending, AI might initially flag extremely bearish sentiment, prompting trades, only for the news to be debunked later. Human judgment is needed to validate critical news (at least from multiple reputable sources) before acting. Always verify the inputs your AI is using; if you feed it biased or incomplete information, you’ll get a biased or flawed outcome.

-

Overreliance and complacency: It’s tempting to hand over decisions to the “smart” AI, but blindly following AI-generated signals is dangerous. As Cointelegraph wisely noted, “AI is a tool, not a guarantee”. One should always verify AI insights with other research, charts, and risk management before executing trades. There have been instances where GPT-based models sound very confident in a prediction or analysis that turns out to be incorrect. This is known as the AI’s propensity to hallucinate – basically, to generate a convincing-sounding answer that isn’t grounded in fact. A study mentioned that in high-stakes strategy tasks, people using GPT-4 without caution sometimes performed worse (23% worse in one finding) than those who didn’t use it, likely because they trusted the AI too much. The lesson is clear: treat AI recommendations as one input, not gospel.

-

Lack of real-time reactivity (for some AI): Unless properly connected, models like ChatGPT do not have live data streaming in. If you ask ChatGPT (the base model without browsing) about “current” market conditions, it might only rely on its training data which isn’t up-to-the-minute. This means if something big happened seconds or minutes ago, it won’t know. There are versions with plugins and other AI tools that are real-time, but latency and data feed quality are considerations. In ultra-fast markets, even a few minutes delay can matter. Dedicated sentiment platforms often update by the second – those are more reliable for split-second traders. But for most swing traders, minute-level is fine.

-

Technical issues and downtime: AI platforms and bots can encounter glitches. There might be times the API is down, the model outputs an error, or data isn’t updating. If you were leaning heavily on an AI alert to trigger a trade and it fails to fire due to a tech issue, you could miss out or be left exposed. Always have a basic plan that doesn’t solely rely on an AI tool functioning perfectly. Redundancy (multiple data sources) is wise if you’re serious. Additionally, some AI trading bots require maintenance – prompt changes, retraining for new data, etc. A noted incident involved an AI trading tool pushing an untested update that caused erroneous outputs. This reminds us that these systems are complex and can have bugs.

-

Security and privacy: If you use AI platforms, be aware of what data you share. If you’re plugging in your proprietary trading strategy or sharing sensitive info with a third-party AI service, there’s a potential data leak risk. From a funds perspective, if you integrate trading APIs, protect your keys. Use 2FA on exchange accounts as an extra layer in case anything gets compromised. And avoid AI bots that promise absurd returns or ask you to deposit crypto into unknown wallets – scammers might use the AI hype to lure victims.

-

Market impact and crowding: As AI becomes more popular, many participants could start reacting to the same signals. If everyone’s AI says “buy now,” who are they buying from, and how long before the edge erodes? In traditional markets, we saw something akin to this with high-frequency trading and news algos – when a news headline hits, lots of algos trade on it, making the price jump almost instantly, which leaves little room for slower actors. In crypto, there’s still plenty of inefficiency, especially in smaller cap coins and emerging news. But over time, if sentiment-AI trading is ubiquitous, its signals may get “priced in” faster. This doesn’t negate AI’s usefulness, but strategies may need to evolve continuously. AI might also potentially create feedback loops – e.g., AI sees others are bearish and becomes bearish, exacerbating a sell-off. Diversity of strategies and human oversight can mitigate such herding effects.

-

Ethical and regulatory aspects: While not a direct trading risk, note that regulators are increasingly watching AI usage in trading. Using AI is legal, but if an AI-driven strategy were to inadvertently facilitate market manipulation (say it decides to post fake news to drive sentiment – a far-fetched but not impossible scenario if an agent is autonomous), that would be problematic. Always use AI within the bounds of market rules – e.g., using it to quickly parse public info is fine; using it to try to front-run non-public info is not.

-

Complex scenarios and qualitative factors: Some market moves are driven by very qualitative factors that AI might not fully grasp, especially if they involve human decisions outside of historical patterns. For instance, geopolitical events or sudden policy changes can defy the “mood” logic. Also, crypto markets sometimes rally or dump for reasons that are arguably irrational (like meme stocks, except in crypto form, where a movement has no clear news or sentiment reason). AI might scratch its head (figuratively) in such cases or give a misleading signal because it expects a rational catalyst that isn’t there or it misattributes cause and effect. > Human intuition and experience still count – for example, understanding that a coin pumping 100% on a meme has no fundamental support and will likely crash, even if AI says sentiment is euphoric (AI would be right about sentiment, but you as a human might know it’s a bubble to be cautious of).

Risk management is paramount. No matter how good an AI strategy is, crypto remains volatile and risky. Traders should use basic risk controls: position sizing (don’t bet too big on one AI signal), stop-loss orders to protect against sudden crashes, and diversification of strategies. AI can assist in some of this – e.g., it can recommend a stop-loss level by analyzing volatility, or it can watch multiple positions at once – but the trader must decide their risk appetite. As one guide recommended, never trade more than you can afford to lose – AI can guide you, but it’s not foolproof. Implementing stop-losses and take-profits is still essential. AI might tell you the trend is strong, but unexpected news can hit at any time.

Finally, maintain a critical mindset. Continuously evaluate how well the AI’s suggestions align with reality and your own analysis. Treat it as a junior analyst: helpful, quick, but needing supervision. Over time, you’ll learn in what situations your AI tool is reliable and when it tends to err. For instance, you may notice it does great in trending markets but lags in choppy, range-bound markets. You can then adjust your reliance accordingly.

Final thoughts

The marriage of AI and crypto trading has ushered in a new era of possibility for individual investors and traders. By leveraging AI to decode the never-ending flow of crypto news and social chatter, market participants can gain a clearer, faster understanding of what’s driving prices. Instead of drowning in information overload, you can have at your fingertips a distilled snapshot of market sentiment – bullish or bearish, euphoria or fear – drawn from thousands of sources. Modern AI platforms essentially transform news into data, and data into actionable signals. They forecast how a headline or a hype trend might translate into price movement, giving traders a precious head start in forming strategy.

Crucially, this can be done without writing a single line of code, in accessible interfaces, leveling the playing field between hobbyist traders and big institutions. The scenarios we’ve explored show that with the right prompts or tools, anyone can ask an AI questions like an expert analyst. Whether it’s ChatGPT outlining why a piece of news might be a buy signal, or a dashboard flashing a sentiment heatmap across the market, AI brings sophisticated analysis to your screen in seconds. It can warn you of a surging narrative before it peaks, or alert you to gathering storm clouds of negative sentiment so you can manage risk proactively.

However, as we’ve emphasized, AI is not a magic wand or a replacement for sound judgment. It offers augmented intelligence – it amplifies your ability to process information and make informed decisions, but it doesn’t remove the need for human oversight. The best outcomes often arise when human intuition and domain knowledge combine with AI’s computational power. Think of AI as an assistant that can tirelessly monitor the market’s pulse and whisper insights in your ear, while you remain the decision-maker with a finger on the trigger.

Going forward, the influence of AI in crypto is likely to grow even more. We may see increasingly sophisticated sentiment models, AI-driven funds, and tools that integrate every facet of crypto data (news, technicals, on-chain, derivatives) into one coherent analysis. Traders who adapt to and embrace these technologies – using them ethically and intelligently – could gain a significant edge in a market where information is both an asset and a weapon.

In the spirit of an informative-analytical yet unbiased tone, it’s clear that AI can be a powerful ally in navigating crypto’s turbulence. It helps cut through hype and fear by quantifying them, turning what used to be gut feeling into something a bit more scientific. Yet, caution and continuous learning remain your allies. By staying curious and cautious – verifying AI-derived ideas, testing strategies on small scales, and keeping an eye on the ever-evolving market conditions – you can harness AI’s strengths while mitigating its weaknesses.

In sum, turning crypto news into an investment strategy with AI is about working smarter, not just harder. It means letting modern algorithms do what they excel at (scanning, crunching, finding patterns), so that you can do what humans excel at (big-picture thinking, strategic decision-making, creative problem-solving). As the crypto landscape heads into the future, one characterized by rapid innovation and equally rapid information flow, the traders who thrive will likely be those who combine the best of both worlds – human insight and artificial intelligence. By doing so, they’ll be able to convert the frenzy of the news cycle and the ebb and flow of hype into real, measurable trading edges in their favor.