The Bitcoin ecosystem stands at a critical inflection point. For over a decade, Bitcoin has been primarily viewed as "digital gold" - a store of value secured by the world's most robust proof-of-work network.

However, the emergence of sophisticated Layer 2 solutions, particularly the groundbreaking BRC2.0 protocol with its EVM integration, challenges this narrow perception. The central question facing the Bitcoin community is whether Layer 2 solutions can transform Bitcoin into a fully functional programmable platform while preserving its core security and decentralization properties.

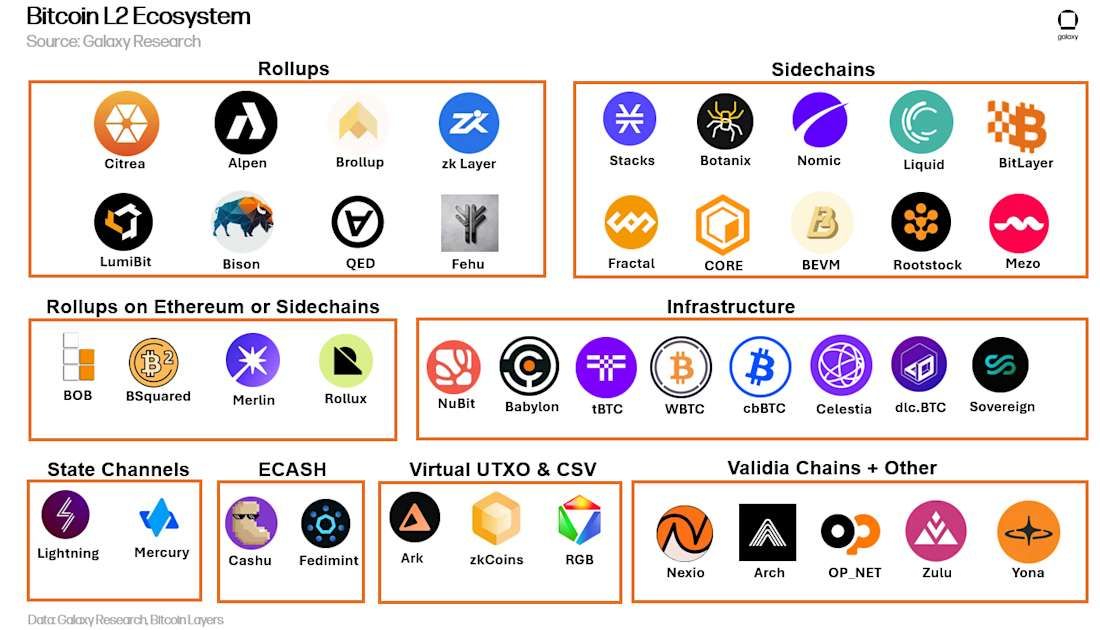

Recent developments suggest we're witnessing a paradigm shift. Galaxy Digital projects that $47 billion in Bitcoin liquidity could flow into Layer 2 networks by 2030, representing a dramatic evolution from Bitcoin's current role. The Bitcoin Layer 2 ecosystem has exploded from just 10 projects in 2021 to 75 active projects by 2024 - a sevenfold increase accompanied by $447 million in venture capital funding. Yet significant questions remain about technical feasibility, security trade-offs, and whether Bitcoin can compete with Ethereum's mature Layer 2 ecosystem.

This analysis examines whether Bitcoin Layer 2 solutions can achieve "full functionality" - defined as supporting Turing-complete smart contracts, high transaction throughput, programmable composability, mature developer ecosystems, and comprehensive DeFi capabilities. Using BRC2.0's revolutionary EVM integration as a key case study, we'll explore both the transformative potential and fundamental limitations of Bitcoin's scaling solutions.

Defining full functionality in blockchain ecosystems

Understanding whether Bitcoin Layer 2 can be "fully functional" requires a precise definition of what constitutes a complete blockchain ecosystem. Based on analysis of mature blockchain platforms and industry standards, a fully functional ecosystem encompasses four critical dimensions.

Core technical capabilities form the foundation. This includes Turing-complete smart contracts capable of executing complex, automated agreements with arbitrary computation, high transaction throughput processing 1,000+ transactions per second with sub-second finality, programmable composability enabling smart contracts to seamlessly interact and build upon each other, and native asset standards supporting fungible, non-fungible, and semi-fungible tokens.

Developer infrastructure represents the second pillar. Mature development tooling including IDEs, debuggers, testing frameworks, and deployment tools must exist alongside extensive documentation providing comprehensive guides, APIs, and educational resources. An active developer ecosystem with thousands of contributors and virtual machine compatibility through standardized execution environments proves essential for long-term sustainability.

The financial ecosystem dimension encompasses DeFi primitives like decentralized exchanges, lending/borrowing protocols, synthetic assets, and derivatives. Multi-billion dollar Total Value Locked (TVL) with efficient price discovery, institutional infrastructure including custody solutions and compliance tools, and diverse financial products from insurance protocols to structured products complete this requirement.

Finally, user experience and adoption metrics matter significantly. This includes intuitive wallet interfaces, seamless onboarding processes, mainstream payment integration, and demonstrated real-world usage beyond speculation.

Current analysis reveals that Ethereum Layer 2 solutions achieve approximately 85-90% of this full functionality definition, with mature ecosystems like Arbitrum and Optimism processing billions in smart contract interactions daily. The question becomes: can Bitcoin Layer 2 solutions reach similar levels?

Current Bitcoin Layer 2 landscape analysis

The Bitcoin Layer 2 ecosystem has evolved into a diverse collection of scaling approaches, each pursuing different technical strategies and trade-offs. Understanding this landscape provides crucial context for evaluating Bitcoin's path toward full functionality.

Lightning Network: The payment layer foundation

The Lightning Network represents Bitcoin's most mature Layer 2 solution, operating through bidirectional payment channels using multisignature transactions. Each channel creates a local two-party consensus maintained off-chain with the ability to settle on Bitcoin's base layer.

Lightning's technical architecture employs sophisticated cryptographic mechanisms. Hash Time-Locked Contracts (HTLCs) enable secure multi-hop payments through onion routing, while time-lock mechanisms with penalty systems prevent double-spending. The network has demonstrated remarkable growth, expanding from 0.2 TPS in August 2021 to 2.5 TPS by August 2023 - a 1,212% increase.

The network's theoretical capacity exceeds 42.5 million TPS across 85,000+ channels, though real-world performance differs significantly. Current network capacity stands at 5,630 BTC with average transactions of 44.7k satoshis ($11.84). Lightning has achieved integration with over 300 million users through major exchanges, with McDonald's, Walmart, OKX, and Binance implementing Lightning for cost savings.

However, Lightning faces critical limitations for achieving full blockchain functionality. The solution remains payment-focused, lacking programmable smart contract capabilities. Channel liquidity limitations affect payment routing, requiring active channel management from users. Academic research reveals that adversaries controlling just 2% of nodes can compromise payment privacy, while replacement cycling attacks and time-dilation vulnerabilities require careful security considerations.

Liquid Network: The federation approach

Liquid Network takes a dramatically different approach through a Strong Federation model, replacing Bitcoin's proof-of-work with collective actions of geographically distributed functionaries. Fifteen specialized servers serve dual roles as block signers and watchmen, requiring 2/3+ functionary signatures for block validation.

This architecture enables consistent 1-minute block intervals with 2-block confirmation guarantees, providing 2-3 minute transaction finality. Liquid supports confidential transactions by default, native asset issuance for tokenized fiat and securities, and atomic swaps for cross-asset exchanges.

The federation trade-off becomes apparent in centralization risks. Security depends on honest behavior from 2/3+ functionaries, creating potential single points of failure. If 1/3+ functionaries go offline, block production halts entirely. While geographic distribution and Hardware Security Module (HSM) protection provide resilience, Liquid sacrifices Bitcoin's trustless model for improved performance and user experience.

Liquid's capabilities remain limited for full functionality. While supporting asset issuance and atomic swaps, programmability remains restricted compared to general-purpose smart contract platforms. The federation model creates censorship risks higher than Bitcoin mainnet, though emergency recovery procedures with timelock mechanisms provide some protection.

Stacks: Smart contracts through Proof-of-Transfer

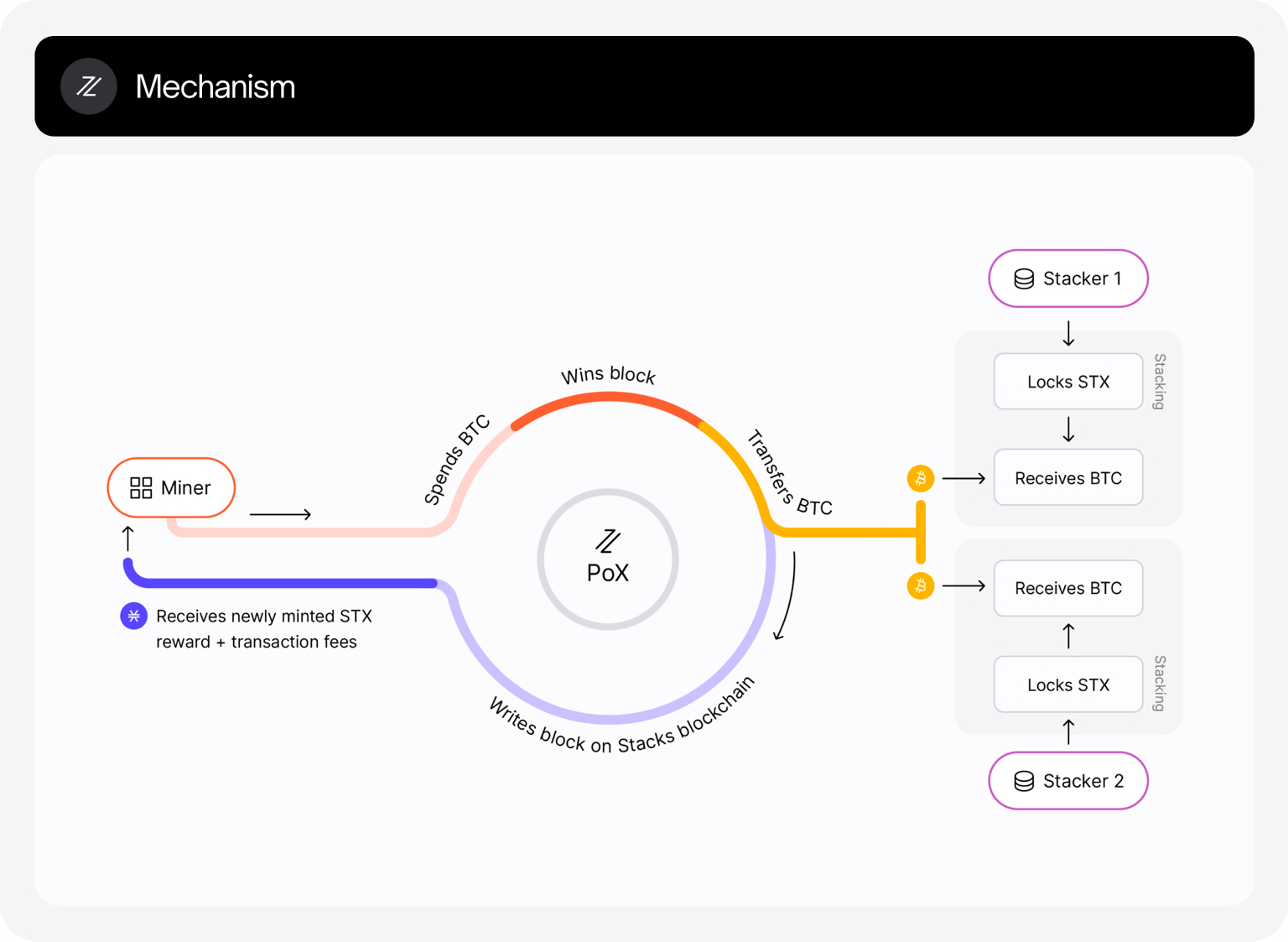

Stacks blockchain represents perhaps the most ambitious attempt at bringing full smart contract functionality to Bitcoin through its innovative Proof-of-Transfer (PoX) consensus mechanism. Miners spend BTC to mine STX tokens, creating economic alignment while anchoring all Stacks blocks to Bitcoin's blockchain.

Stacks' technical innovation centers on the Clarity programming language - a decidable, non-Turing complete language enabling complete static analysis and predictable execution costs. Unlike compiled bytecode systems, Clarity source code publishes directly on-chain with built-in overflow protection, reentrancy prevention, and mandatory response handling.

The architectural design provides Bitcoin-level security for historical data after approximately 150 Bitcoin confirmations (~25 hours), while enabling 5-second fast blocks between Bitcoin settlements. This dual-layer security model combines STX staking for recent blocks with Bitcoin's full hashrate for finalized transactions.

Smart contract capabilities on Stacks include native token support, composition-based architecture through traits, direct Bitcoin state access, and comprehensive DeFi primitives. The ecosystem supports lending protocols, decentralized exchanges, and synthetic asset creation, with TVL growing from $7 million to over $50 million.

However, Stacks faces performance constraints inherent to its Bitcoin dependency. Learning curves exist for developers familiar with Solidity, and execution performance lags behind EVM-based chains. The upcoming Nakamoto Release promises improvements through faster block times and enhanced settlement mechanisms, while Clarity WASM compilation could provide significant performance gains.

Emerging protocols: RGB and Taproot Assets

Two next-generation protocols represent potentially transformative approaches to Bitcoin scaling: RGB and Taproot Assets (formerly Taro). Both utilize client-side validation models that store contract data off-chain while using Bitcoin's blockchain purely for commitments.

RGB Protocol employs a sophisticated architecture where all contract data resides off-chain with Bitcoin serving as a commitment layer. Single-use seals leverage Bitcoin's UTXO model for anti-double-spending, while smart contracts follow Directed Acyclic Graph (DAG) state transitions with schema-defined evolution rules.

RGB's capabilities appear remarkable - unlimited off-chain transaction capacity with Bitcoin-level security, complete transaction privacy through client-side validation, complex tokenization scenarios including stablecoins and NFTs, and native Lightning Network compatibility. The recently released RGB v0.10 includes significant architectural improvements, though production deployment remains limited.

Taproot Assets pursues similar goals through Bitcoin's Taproot upgrade, utilizing Sparse-Merkle Trees and Merkle-Sum Trees for efficient verification. Each token backs by a Bitcoin UTXO with embedded metadata, enabling batch operations where multiple assets can be created and transferred in single Bitcoin transactions.

Both protocols share fundamental advantages - minimal on-chain footprint, Bitcoin security inheritance without protocol changes, and Lightning Network integration for multi-asset channels. However, significant challenges remain: alpha-stage development, specialized wallet requirements, and dependency on broader Taproot adoption across Bitcoin's ecosystem.

BRC2.0 revolution: EVM integration breakthrough

The September 2025 launch of BRC2.0 at Bitcoin block 912,690 represents perhaps the most significant development in Bitcoin Layer 2 evolution. Developed by Best in Slot, original BRC20 creator "domo," and Layer 1 Foundation, BRC2.0 transforms Bitcoin from a simple store of value into a programmable platform capable of executing Ethereum-compatible smart contracts.

Technical architecture and implementation

BRC2.0's revolutionary approach integrates a custom EVM engine directly into Bitcoin Layer 1 through indexer upgrades. The system uses revm, a Rust-based EVM implementation, transforming traditional "calculator-style" indexers into Turing-complete execution environments capable of running sophisticated smart contracts.

The implementation details reveal elegant engineering. Smart contracts execute directly on Bitcoin L1 without bridges or intermediaries, maintaining Bitcoin's security guarantees while adding programmability. The system implements standard Ethereum JSON-RPC methods (eth_* functions), providing 100% Solidity toolchain compatibility for developers.

Gas mechanisms use inscription byte length to determine limits, with 12,000 gas per byte creating dynamic pricing based on Bitcoin's existing fee market. Contract deployment occurs through inscription-based mechanisms, storing bytecode in witness data rather than OP_RETURN for efficiency.

BRC2.0 includes specialized precompiled contracts for Bitcoin integration: BRC20_Balance queries for non-module BRC20 balances, BIP322_Verifier for Bitcoin signature verification, BTC_Transaction for retrieving Bitcoin transaction details, BTC_LastSatLoc for tracking satoshi locations in Ordinals, and BTC_LockedPkScript for calculating timelock scripts.

Capabilities and real-world applications

The functional scope of BRC2.0 appears comprehensive. Full Solidity compatibility enables migration of existing Ethereum projects from platforms like Base, Polygon, and mainnet Ethereum. Advanced features include proxy contracts, modular architectures, and backward compatibility making existing BRC20 tokens (ORDI, SATS) programmable.

Early application categories demonstrate diverse use cases: DeFi protocols including AMMs, lending platforms, and yield farming; NFT marketplaces with programmable trading and staking; token launchpads supporting ICO-style launches with complex tokenomics; SocialFi applications for social tokens and community rewards; and Ordinal Lockers enabling time-locked NFT staking from 1 hour to 1 year.

Infrastructure support has rapidly materialized. UniSat Wallet integrated BRC2.0 support in version 1.7.3, providing universal address compatibility across Taproot, SegWit, and Legacy formats. Developer tools maintain full Ethereum compatibility including Web3.js, Ethers.js, and Hardhat, minimizing learning curves for Ethereum developers.

The two-phase rollout demonstrates careful deployment strategy. Phase 1 introduced 6-character programmable tickers at Block 909,969, while Phase 2 provides full BRC20 compatibility starting Block 914,888. Bitcoin Signet testnet deployment began March 31, 2025, enabling extensive testing before mainnet launch.

Constraints and technical limitations

Despite revolutionary capabilities, BRC2.0 faces fundamental constraints inherited from Bitcoin's base layer. The 10-minute block time creates significant latency challenges for real-time applications, while throughput remains bounded by Bitcoin's ~7 TPS base capacity. Storage costs exceed Ethereum alternatives due to on-chain inscription requirements.

Indexer dependency persists as a centralization concern. While contract execution occurs on Bitcoin L1, state management still requires off-chain indexers for practical accessibility. This creates potential points of failure and raises questions about long-term decentralization.

Scalability bottlenecks appear in network utilization data. Average Bitcoin block size increased from 1.5-2MB to 3-3.5MB following meta-protocol adoption, approaching capacity limits. During peak inscription activity, transaction fees can exceed $30, making small-value interactions economically unfeasible.

Security considerations include reorganization handling up to 10 blocks and witness data storage requirements. While eliminating bridge risks associated with traditional Layer 2 solutions, BRC2.0 still depends on indexer implementations for security-critical operations.

Comparative analysis: Bitcoin vs Ethereum Layer 2 ecosystem

Understanding Bitcoin Layer 2's potential requires direct comparison with Ethereum's mature Layer 2 ecosystem, which represents the current gold standard for blockchain scalability and functionality.

Smart contract capabilities comparison

Ethereum Layer 2 solutions demonstrate comprehensive smart contract functionality across all major platforms. Arbitrum, Optimism, Polygon, Base, and StarkNet provide full Turing completeness with unlimited computational complexity, seamless EVM compatibility enabling trivial contract porting, and advanced features including proxy contracts, multi-signature wallets, and complex DeFi protocols. These platforms handle billions in smart contract interactions daily with proven reliability.

Bitcoin Layer 2 smart contracts present a mixed landscape. Most solutions offer restricted programmability compared to Ethereum standards. While EVM-compatible networks like Rootstock and emerging BRC2.0 provide Solidity compatibility, significant technical hurdles exist for developers transitioning from Ethereum. Bitcoin's UTXO model and limited scripting language create fundamental constraints on native smart contract complexity.

Stacks offers innovative approaches through Proof-of-Transfer consensus and Clarity language, but with reduced functionality compared to Ethereum standards. Lightning Network remains payment-focused with minimal programmability, while RGB and Taproot Assets show promise but remain largely experimental.

Quantitative assessment suggests Bitcoin Layer 2s achieve approximately 30-40% of Ethereum Layer 2 smart contract functionality, primarily constrained by base layer limitations and ecosystem maturity.

Developer experience and ecosystem maturity

The developer experience gap between ecosystems proves substantial. Ethereum Layer 2s benefit from comprehensive tooling including Hardhat, Truffle, Remix, and specialized L2 development frameworks. Documentation quality remains consistently high with extensive tutorials, API references, and community resources. Over 4,000 monthly active developers work across major Ethereum L2s, creating a robust knowledge base and collaborative environment.

Bitcoin Layer 2 development presents challenges in tooling maturity and documentation completeness. While basic frameworks exist, they significantly lag Ethereum alternatives in sophistication and community support. The estimated 200-500 active developers across all Bitcoin L2s represents roughly 8-10x fewer development resources than Ethereum's ecosystem.

However, positive trends emerge in Bitcoin development. Tools like Bitcoin Dev Kit (BDK), Hiro Systems' APIs serving 350M+ monthly requests, and comprehensive libraries like NBitcoin and libbitcoin demonstrate growing infrastructure. Educational initiatives including Stacks Primer courses, LearnWeb3 programs, and developer competitions signal increasing ecosystem investment.

The learning curve remains steep for Bitcoin L2 development. Developers must adapt to unique consensus mechanisms, programming paradigms like Clarity, and Bitcoin-specific constraints. While BRC2.0's Solidity compatibility reduces barriers, overall developer experience significantly trails Ethereum standards.

Performance and scalability metrics

Ethereum Layer 2 performance demonstrates consistent real-world capabilities across major platforms. Arbitrum averages ~40 TPS with 4,000 TPS theoretical capacity, Optimism provides ~25 TPS with 2,000 TPS theoretical, Polygon achieves ~2,000 TPS real-world with 7,000+ theoretical, Base sustains ~150 TPS with 2,000 theoretical, and StarkNet processes ~200 TPS with millions theoretical.

Bitcoin Layer 2 performance varies dramatically by solution approach. Lightning Network offers 1 million TPS theoretical capacity but remains limited to payment channels, achieving 2.5 TPS real-world payment processing. Rootstock provides ~20 TPS real-world with 300+ theoretical, while Stacks manages ~5-10 TPS real-world with ~1,000 theoretical capacity.

Finality times reveal significant differences. Ethereum L2s typically achieve finality in 13 minutes to 1 hour depending on solution architecture, while Bitcoin L2s range from instant Lightning payments to 25+ hours for full Bitcoin-level security in Stacks implementations.

Cost structures show Ethereum L2s achieving 90-95% fee reductions compared to mainnet following EIP-4844, with average transaction costs of $0.001-$0.10. Bitcoin L2s present variable fee models: Lightning Network near-zero fees (~$0.00003), but other solutions like Rootstock/Stacks maintaining higher fees (~$0.10-$1.00) due to consensus overhead and bridge costs.

DeFi ecosystem development comparison

The DeFi functionality gap represents perhaps the most significant difference between ecosystems. Ethereum Layer 2s collectively maintain $45+ billion Total Value Locked across 500+ DeFi protocols, supporting sophisticated products including synthetic assets, algorithmic stablecoins, complex derivatives, and institutional-grade protocols like Aave ($13.89B TVL) and Uniswap ($4.96B volume).

Bitcoin Layer 2 DeFi remains nascent with ~$2-3 billion TVL across all solutions and approximately 50-100 DeFi applications. Most protocols provide basic DEX functionality and simple lending/borrowing, lacking the sophisticated financial products common in Ethereum DeFi. Limited institutional infrastructure and enterprise-grade compliance tools constrain growth.

However, emerging opportunities suggest potential for rapid expansion. Galaxy Digital's projection of $47 billion Bitcoin liquidity flowing to L2s by 2030 represents massive growth potential. BRC2.0's EVM compatibility could enable direct migration of proven Ethereum DeFi protocols, while Bitcoin's superior security model might attract institutional capital seeking lower-risk yield opportunities.

The institutional adoption difference proves stark. Ethereum DeFi protocols regularly handle billion-dollar institutional flows with mature custody solutions, compliance frameworks, and regulatory clarity. Bitcoin L2 DeFi lacks comparable institutional infrastructure, though projects like Stacks with SEC-compliant STX tokens and regulated custodians signal progress.

Security models and trade-offs analysis

Security represents the fundamental consideration in evaluating Bitcoin Layer 2 functionality, as Bitcoin's primary value proposition stems from its unparalleled security model. Understanding how different L2 approaches preserve, modify, or compromise these security guarantees proves crucial for assessing their viability.

Lightning Network security architecture

Lightning Network's security model directly inherits Bitcoin's proof-of-work guarantees through its channel-based architecture. Hash Time-Locked Contracts (HTLCs) provide cryptographic commitments ensuring payment atomicity, while time-lock mechanisms with penalty systems prevent double-spending through economic disincentives.

Watchtower mechanisms address the critical challenge of online monitoring requirements. Third-party monitoring services can prevent fraud when primary nodes operate offline, though this introduces additional trust assumptions. Onion routing protects payment privacy through multi-hop routing with cryptographic hashes, though academic research reveals vulnerabilities.

Identified security vulnerabilities require careful consideration. Replacement cycling attacks, discovered by Antoine Riard in 2023, affect HTLC security through transaction-relay jamming mechanisms. Wormhole attacks demonstrate that adversaries controlling just 2% of network nodes can learn sensitive payment information, compromising privacy guarantees. Time-dilation attacks exploit vulnerabilities in time-lock mechanisms requiring proper channel management practices.

Despite vulnerabilities, Lightning demonstrates resilience with 99.7% payment success rates across over 300,000 analyzed transactions. Real-world performance shows consistent growth from 0.2 TPS in August 2021 to 2.5 TPS by August 2023, indicating practical security sufficiency for payment use cases.

Federation and consortium models

Liquid Network's federation approach trades Bitcoin's trustless model for improved performance through collective governance. Fifteen geographically distributed functionaries control block signing and transaction validation, requiring 2/3+ signatures for consensus. This model enables 60-second block times with 2-block finality guarantees.

Security trade-offs become apparent in centralization risks. Malicious attacks remain possible if functionaries collude, while censorship risks exceed Bitcoin mainnet levels. The federation model creates potential single points of failure - if 1/3+ functionaries go offline, block production halts entirely.

Risk mitigation strategies include Hardware Security Module (HSM) protection for private keys, geographic and geopolitical distribution of functionaries for resilience, emergency recovery procedures with timelock mechanisms, and three-day PAK (Peg-out Authorization Key) update windows enabling attack detection.

Economic security depends on consortium member incentives rather than cryptoeconomic guarantees. While ~65 member organizations provide governance diversity, security ultimately relies on institutional trust rather than mathematical proofs, representing a fundamental departure from Bitcoin's model.

Stacks Proof-of-Transfer consensus

Stacks implements novel security through Proof-of-Transfer, where miners spend BTC to mine STX tokens, creating economic alignment between networks. All Stacks blocks anchor to Bitcoin's blockchain, providing layered security guarantees.

The dual-layer security model offers Bitcoin-level security for historical data after approximately 150 Bitcoin confirmations (~25 hours), while STX staking secures recent blocks. This approach provides mixed security budgets combining STX capital with Bitcoin's full hashrate for finalized transactions.

sBTC peg mechanisms managed by Stackers with STX collateral enable permissionless participation while introducing slashing risks for dishonest behavior. The upcoming sBTC integration promises to reduce counterparty risks compared to federated alternatives, though staking requirements create capital efficiency challenges.

Performance implications of security architecture include dependency on Bitcoin block times for final settlement, though 5-second fast blocks between Bitcoin settlements provide improved user experience. The consensus mechanism remains experimental compared to Bitcoin's battle-tested proof-of-work, introducing unknown long-term stability risks.

Client-side validation approaches

RGB and Taproot Assets represent fundamentally different security models through client-side validation, where all contract execution occurs off-chain with Bitcoin serving purely as a commitment layer. This architecture provides theoretical unlimited scalability with Bitcoin-level security inheritance.

Security advantages include complete transaction privacy since third parties cannot track asset history, unlimited off-chain transaction capacity without base layer congestion, and single-use seals leveraging Bitcoin's UTXO model for anti-double-spending guarantees.

However, security challenges emerge in client-side validation requirements. Users must maintain complete asset histories for validation, creating significant storage and bandwidth requirements. Complexity in validation software implementation could introduce vulnerabilities, while specialized wallet support requirements limit accessibility.

Development status remains largely experimental. RGB v0.10 represents significant progress with architectural improvements, while Taproot Assets secured $70 million in funding from Lightning Labs. However, production deployment remains limited, making real-world security assessment difficult.

BRC2.0 security considerations

BRC2.0's security model combines Bitcoin Layer 1 guarantees with EVM execution environments through indexer implementations. Smart contracts execute directly on Bitcoin without bridges or intermediaries, eliminating cross-chain bridge vulnerabilities common in traditional Layer 2 solutions.

Inherited security includes Bitcoin's proof-of-work consensus for transaction ordering and inclusion, witness data storage providing tamper-evident contract code, and reorganization handling up to 10 blocks ensuring consistency during chain reorganizations.

New security considerations arise from indexer dependencies for state management and contract execution. While contracts execute on Bitcoin L1, practical accessibility requires off-chain indexers, creating potential centralization points. Implementation bugs in indexer software could compromise contract security despite Bitcoin base layer integrity.

Risk mitigation includes open-source indexer implementations enabling community verification, multiple competing indexer services providing redundancy, and standardized JSON-RPC interfaces enabling easy indexer switching. However, long-term decentralization of indexer infrastructure remains an open question.

Scalability and performance deep dive

The scalability question represents perhaps the most critical factor determining whether Bitcoin Layer 2 can achieve full functionality. Bitcoin's base layer processes approximately 4.4 TPS with 10-minute block times, creating fundamental bottlenecks that Layer 2 solutions must overcome to support mainstream adoption.

Theoretical vs real-world performance

Lightning Network demonstrates the largest gap between theoretical and practical performance. With theoretical capacity exceeding 42.5 million TPS across 85,000+ channels, real-world performance achieves only 2.5 TPS for actual payment processing. This discrepancy stems from liquidity distribution challenges, routing complexity, and channel management requirements.

Network growth shows promising trends despite performance gaps. From August 2021 to August 2023, Lightning achieved 1,212% growth in transaction processing, while network capacity increased to 5,630 BTC. Channel count has stabilized around 85,000, suggesting infrastructure maturation rather than speculative growth.

Payment success rates provide crucial performance metrics. IEEE research analyzing over 300,000 transactions reveals 99.7% payment success rates, indicating reliable functionality for payment use cases. Average transaction values of 44.7k satoshis ($11.84) suggest adoption for micro-payments and routine transactions rather than large value transfers.

Routing efficiency represents a critical bottleneck. Multi-hop payments require adequate liquidity across routing paths, creating network effects where connectivity and liquidity distribution directly impact performance. Current data shows 1:8 ratio of non-custodial to custodial wallets, indicating most users rely on managed Lightning services rather than self-sovereign channels.

Network congestion and fee dynamics

Bitcoin's base layer congestion directly impacts all Layer 2 solutions requiring on-chain settlement. The emergence of Ordinals and BRC-20 tokens drove average transaction fees from $1.5 in 2022 to $9.5 in 2024, with peak fees exceeding $30 during high inscription activity periods.

Block space utilization has increased dramatically following meta-protocol adoption. Average block sizes grew from 1.5-2MB to 3-3.5MB, approaching Bitcoin's 4MB capacity limits. This scarcity creates economic pressure favoring Layer 2 adoption but also increases costs for Layer 2 operations requiring on-chain transactions.

Lightning Network benefits from reduced on-chain footprint after initial channel establishment. Opening and closing channels require base layer transactions, but unlimited off-chain payments occur without additional Bitcoin network load. However, liquidity rebalancing and watchtower operations still require periodic on-chain activity.

Liquid Network experiences minimal congestion impact due to its federated model with 1-minute block times. The Strong Federation approach enables consistent performance regardless of Bitcoin mainnet congestion, though at the cost of decentralization and trustless operation.

Data availability challenges

Bitcoin's limited block space creates data availability bottlenecks for sophisticated Layer 2 solutions. Galaxy Research estimates that Bitcoin rollups require $459K-$2.3M monthly revenue to achieve economic sustainability, primarily due to data availability costs on Bitcoin's constrained base layer.

Current utilization patterns reveal growing demand for block space. Ordinals and meta-protocols represent significant portions of Bitcoin transactions, with BRC-20 tokens accounting for substantial network activity. This competition for block space drives up costs for all Layer 2 solutions requiring data availability.

Alternative approaches attempt to address data availability challenges. RGB and Taproot Assets use client-side validation to minimize on-chain footprint, storing only commitments rather than full contract data. However, this approach creates complexity in wallet implementations and user experience challenges.

BRC2.0's approach stores contract data in witness data rather than OP_RETURN, providing more efficient space utilization. However, complex smart contracts still require significant witness data, creating scalability constraints during network congestion periods.

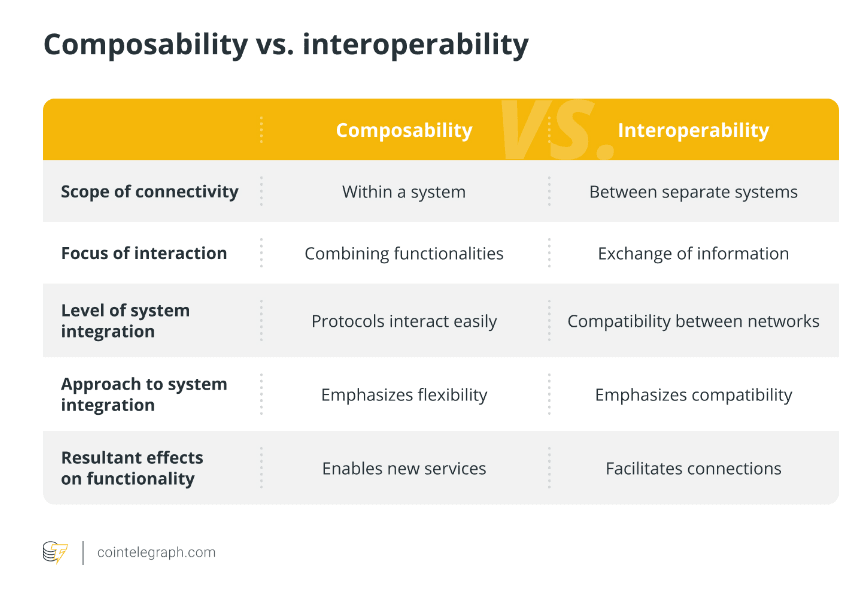

Layer 2 interoperability and composability

Cross-Layer 2 communication remains limited in Bitcoin's ecosystem compared to Ethereum's mature interoperability solutions. Ethereum Layer 2s benefit from protocols like LayerZero enabling seamless asset transfers, standardized ERC token compatibility, and cross-L2 arbitrage opportunities.

Bitcoin Layer 2 isolation creates liquidity fragmentation and limits composability potential. Assets locked in Lightning channels cannot easily interact with Stacks smart contracts or Liquid Network assets. This siloed approach reduces the network effects crucial for DeFi ecosystem development.

Emerging solutions attempt to address interoperability challenges. RGB and Taproot Assets promise Lightning Network integration for multi-asset channels, while BRC2.0's EVM compatibility could enable standardized asset protocols across Bitcoin Layer 2s. However, practical implementations remain early-stage with limited production deployment.

Atomic operations across Bitcoin Layer 2s face technical challenges due to different consensus mechanisms and security models. While Lightning enables atomic swaps with other blockchains, complex multi-layer operations requiring coordination between Lightning, Stacks, and Liquid networks lack mature infrastructure.

Ordinals and meta-protocols: The unexpected revolution

The emergence of Ordinals protocol in January 2023 fundamentally transformed Bitcoin's utility and sparked intense debate about appropriate block space usage. This unexpected development provides crucial insights into Bitcoin's potential for programmability and the demand for Bitcoin-native applications.

Ordinals technical architecture

Ordinal theory establishes a foundation for tracking individual satoshis through sequential numbering based on mining order. The inscription mechanism enables arbitrary data attachment up to 4MB using Taproot and SegWit witness data, creating completely on-chain digital artifacts with superior immutability compared to off-chain storage solutions.

The commit-reveal process utilizes two-phase inscription through Taproot scripts, supporting diverse data formats including images, audio, video, text, and executable code. Ownership models tie inscription ownership to satoshi ownership, creating straightforward transfer mechanisms through standard Bitcoin transactions.

Recursive inscriptions enable self-referential content and complex interactive applications, while parent-child provenance systems support hierarchical relationships for inscription collections. This architecture creates Bitcoin-native NFTs with guaranteed permanence and censorship resistance.

BRC-20 token evolution

The original BRC-20 standard emerged in March 2023 as an experimental fungible token system built on Ordinals. Created by developer "domo," BRC-20 operates through JSON data inscribed onto individual satoshis with three core operations: Deploy, Mint, and Transfer.

Market adoption exceeded expectations with over $3 billion in asset value traded since launch. BRC-20 tokens generated 5,636 BTC ($633 million) in on-chain volume over six months in 2025, with volume double that of Runes and five times traditional Ordinals activity. The first token, ORDI, became a flagship asset demonstrating market demand.

Critical limitations of original BRC-20 included restriction to basic token operations, network congestion during peak activity, dependence on off-chain indexers for balance tracking, and lack of programmability preventing DeFi applications. These constraints drove development of more sophisticated successors.

Network impact and controversy

Ordinals and BRC-20 activity significantly impacted Bitcoin network dynamics. Transaction fees spiked to over $30 during peak inscription periods in May 2023, causing controversy among Bitcoin traditionalists preferring the network's role as a settlement layer for large value transfers.

Block space competition intensified as Ordinals transactions competed with traditional Bitcoin payments. Average block sizes increased substantially, approaching capacity limits and driving fee market development. This created economic incentives for miners through increased fee revenue while challenging small value Bitcoin transactions.

Cultural resistance emerged from Bitcoin maximalists arguing that block space should preserve for monetary transactions rather than "arbitrary data." However, technical legitimacy of Ordinals inscriptions using standard Bitcoin protocols made blocking them difficult without protocol changes.

Innovation acceleration resulted from Ordinals demonstrating previously untapped demand for Bitcoin-native applications. The success sparked development of competing protocols like Runes for more efficient token implementation and exploration of Bitcoin's programmability potential.

Meta-protocol ecosystem development

The broader meta-protocol ecosystem has expanded beyond Ordinals to include various application-layer protocols built on Bitcoin. Alkanes represents 1/3 of meta-protocol transactions in Q3 2024, offering WASM-based alternatives to Ethereum-style smart contracts.

Indexing infrastructure has matured with multiple competing services providing transaction history tracking, balance management, and application interfaces. Companies like Best in Slot, Hiro Systems, and OKLink provide comprehensive API services supporting meta-protocol applications.

Wallet integration has improved significantly from early command-line tools to user-friendly interfaces. UniSat Wallet leads consumer adoption with millions of users, while Xverse, Leather, and OKX Wallet provide additional options for mainstream users.

Developer tools continue expanding with Ordinals API services, inscription tools, and marketplace infrastructure enabling easier application development. The ecosystem demonstrates growing sophistication in both technical capabilities and user experience.

Smart contract capabilities on Bitcoin Layer 2s

The question of smart contract functionality represents a crucial component in determining whether Bitcoin Layer 2 can achieve full functionality. Unlike Ethereum's native smart contract platform, Bitcoin's limited Script language creates fundamental challenges that different Layer 2 approaches attempt to overcome through various technical strategies.

Current state assessment

Ethereum compatibility has emerged as a key strategy for Bitcoin Layer 2 solutions seeking to tap into existing developer ecosystems and proven contract implementations. Rootstock (RSK) provides full EVM compatibility through merged mining with Bitcoin, supporting 40+ protocols and over 70,000 active accounts. However, developer adoption remains limited compared to Ethereum Layer 2s due to network effects and liquidity constraints.

BRC2.0's breakthrough in September 2025 represents the most significant advancement in Bitcoin smart contract capabilities. By integrating EVM functionality directly into Bitcoin Layer 1 through indexer upgrades, BRC2.0 enables 100% Solidity compatibility while maintaining Bitcoin's security model. Early applications include DeFi protocols, NFT marketplaces, token launchpads, and social finance applications.

Stacks blockchain offers an alternative approach through its purpose-built Clarity language. As a decidable, non-Turing complete language, Clarity enables complete static analysis and predictable execution costs while providing native Bitcoin state access and composition-based architecture. The ecosystem supports comprehensive DeFi primitives including lending protocols, DEXs, and synthetic assets.

Lightning Network remains primarily payment-focused with limited programmability. While supporting basic conditional payments through HTLCs and time-locks, Lightning lacks general-purpose smart contract capabilities. Recent developments in Lightning Service Authentication Tokens (L402) enable API monetization, but complex application logic remains outside Lightning's scope.

Programming paradigms and limitations

Account-based vs UTXO models create fundamental architectural differences affecting smart contract design. Ethereum's account-based model naturally supports stateful contracts with persistent storage, while Bitcoin's UTXO model requires different approaches for state management and contract interaction patterns.

Bitcoin Script limitations constrain native smart contract development through restricted opcodes, lack of loops and complex control structures, limited arithmetic operations, and absence of external data access. These constraints necessitate Layer 2 solutions for sophisticated programmability, though they also contribute to Bitcoin's security and auditability.

State management challenges affect all Bitcoin Layer 2 solutions. RGB and Taproot Assets use client-side validation requiring users to maintain complete contract histories, creating scalability and user experience challenges. Stacks maintains global state through its blockchain while anchoring to Bitcoin for security, while BRC2.0 relies on indexer implementations for state tracking.

Composability limitations restrict the "DeFi Legos" paradigm common in Ethereum ecosystems. Bitcoin Layer 2 solutions often operate in isolated environments with limited cross-layer interaction capabilities. While BRC2.0's EVM compatibility could enable composability within its ecosystem, broader Bitcoin Layer 2 interoperability remains challenging.

Development ecosystem maturity

Developer tooling for Bitcoin smart contracts lags significantly behind Ethereum alternatives. While BRC2.0 provides full Ethereum toolchain compatibility including Web3.js, Ethers.js, and Hardhat, other Bitcoin Layer 2 solutions require specialized development environments with steeper learning curves.

Documentation quality varies across platforms. Stacks provides comprehensive resources including Clarinet development environment, educational courses, and active developer communities. However, emerging solutions like RGB and Taproot Assets have limited documentation and fewer educational resources, creating barriers for developer adoption.

Community size represents a significant constraint. Estimated 200-500 active developers across all Bitcoin Layer 2s pale compared to Ethereum's thousands of monthly active developers. This smaller ecosystem limits knowledge sharing, reduces tool development, and slows innovation cycles.

Funding and incentives show positive trends with Code for STX competitions, Rootstock's $2.5 million grant program, and increasing venture capital interest in Bitcoin Layer 2 development. However, total ecosystem funding remains substantially below Ethereum Layer 2 investment levels.

Future potential and scalability

Technical innovations continue expanding Bitcoin smart contract possibilities. BitVM enables zero-knowledge proofs on Bitcoin without soft forks, potentially enabling more sophisticated off-chain computation with on-chain settlement. Citrea's ZK-rollup implementation specifically for Bitcoin launched in February 2024, demonstrating alternative scaling approaches.

Cross-chain compatibility improvements could dramatically expand Bitcoin smart contract utility. Atomic swaps, cross-chain bridges, and interoperability protocols might enable Bitcoin Layer 2s to interact with broader DeFi ecosystems while maintaining Bitcoin security benefits.

Performance improvements through planned upgrades could address current limitations. Stacks' Nakamoto Release promises faster block times and improved Bitcoin settlement, while Clarity WASM compilation could provide significant execution speed improvements. RGB and Taproot Assets development continues with enhanced wallet integrations and user experience improvements.

Market potential suggests significant room for growth. With only 0.13% of Bitcoin's $1.4 trillion market cap currently locked in Layer 2 applications compared to 10% for Ethereum, substantial capital could flow into Bitcoin smart contract platforms given appropriate infrastructure and user experience improvements.

Regulatory landscape and decentralization concerns

The regulatory environment surrounding Bitcoin Layer 2 solutions presents both opportunities and challenges that could significantly impact their path toward full functionality. Understanding these dynamics proves crucial for assessing long-term viability and mainstream adoption potential.

Current regulatory framework

Federal oversight in the United States involves multiple agencies with sometimes overlapping jurisdictions. The SEC treats certain digital assets as securities, requiring compliance with securities laws and potentially affecting token-based Layer 2 solutions. The CFTC classifies Bitcoin as a commodity, providing clearer regulatory treatment for Bitcoin-based derivatives and Layer 2 applications.

State-level regulations create a complex patchwork of requirements. New York's BitLicense demands comprehensive KYC procedures, capital requirements, and operational compliance for Bitcoin-related businesses. Wyoming's crypto-friendly legislation and Texas's supportive stance demonstrate varying state approaches that could influence Layer 2 development and deployment strategies.

International frameworks add additional complexity for globally accessible Layer 2 solutions. EU's MiCA regulation establishes comprehensive cryptocurrency rules affecting European operations, while emerging frameworks in jurisdictions like the UK and Singapore could impact global Layer 2 adoption patterns.

Compliance challenges vary by Layer 2 architecture. Lightning Network's payment focus aligns well with existing money transmission regulations, though privacy features create potential conflicts with KYC requirements. Smart contract platforms like Stacks and BRC2.0 face greater regulatory uncertainty due to their programmability and potential for complex financial products.

Decentralization vs compliance tensions

Lightning Network demonstrates relatively strong decentralization through permissionless participation and distributed node operations. However, major routing nodes and custodial Lightning services introduce centralization points that could become regulatory targets. The 1:8 ratio of non-custodial to custodial wallets suggests most users rely on managed services, potentially creating compliance choke points.

Liquid Network's federation model creates clear regulatory interfaces through its consortium of 65+ member organizations. While this facilitates compliance with traditional financial regulations, it also creates centralization risks and potential censorship capabilities that conflict with Bitcoin's censorship-resistant ethos.

Stacks blockchain presents interesting regulatory dynamics through its SEC-compliant STX token and regulated Proof-of-Transfer mechanism. This compliance-first approach could facilitate institutional adoption while potentially constraining innovation and global accessibility.

BRC2.0's approach as a meta-protocol operating on Bitcoin Layer 1 creates regulatory ambiguity. While avoiding some Layer 2-specific compliance issues, the EVM compatibility and DeFi capabilities could trigger securities regulations for applications built on the platform.

Institutional considerations

Custody requirements for Bitcoin Layer 2 assets create significant compliance challenges. Lightning Network requires active channel management and online key storage, complicating institutional custody solutions. Qualified custodians must develop specialized infrastructure to support institutional Lightning adoption while meeting regulatory requirements.

Risk management frameworks must evolve to address Layer 2-specific risks. Smart contract risk in platforms like Stacks and BRC2.0, federation risk in Liquid Network, and channel management risk in Lightning Network require new risk assessment methodologies and insurance products.

Institutional investment shows growing interest despite regulatory uncertainty. BlackRock and Fidelity Bitcoin ETF approvals signal mainstream acceptance, while venture capital investment of $447 million in Bitcoin Layer 2 projects demonstrates institutional confidence in long-term regulatory clarity.

Compliance infrastructure development includes SOC 2 Type 2 attestations, segregated custody solutions with $250M+ insurance coverage, and automated compliance systems for transaction monitoring and reporting. These developments facilitate institutional adoption while potentially creating centralization pressures.

Long-term regulatory outlook

Regulatory clarity appears to be improving gradually. Strategic Bitcoin Reserve discussions in the United States and innovation sandbox programs in various jurisdictions suggest growing government recognition of Bitcoin infrastructure value. However, privacy-focused features in Layer 2 solutions could face increasing scrutiny.

Global coordination on cryptocurrency regulation could impact Bitcoin Layer 2 development. FATF Travel Rule requirements for cross-border transactions might affect Lightning Network privacy features, while coordinated CBDC development could create competitive pressures on Bitcoin Layer 2 adoption.

Innovation balance between regulatory compliance and technological advancement remains crucial. Regulatory capture risks exist if compliance requirements favor centralized solutions over decentralized alternatives, potentially undermining Bitcoin's core value propositions.

Industry self-regulation initiatives could shape regulatory outcomes. Standards development for Bitcoin Layer 2 security, best practices for custody and compliance, and industry association formation could influence regulatory approaches and reduce uncertainty for developers and users.

Expert opinions and market analysis

Industry experts and research firms provide crucial insights into Bitcoin Layer 2 potential, offering perspectives that balance technical possibilities with market realities and regulatory constraints.

Technical expert assessments

Willem Schroé, CEO of Botanix Labs, emphasizes the transformative potential for Bitcoin holders: "Bitcoin 'hodlers' can earn passive, low-lift yield without selling their BTC. L2 programmability allows Bitcoiners to participate in DeFi-like ecosystems while still securing their assets on Bitcoin's base layer." This perspective highlights how Layer 2 solutions could unlock dormant Bitcoin capital for productive use cases while maintaining security benefits.

Rena Shah, COO of Trust Machines, addresses the paradigm shift in Bitcoin perception: "What the Bitcoin L2 space has now done is highlight that Bitcoin shouldn't be overlooked as a productive asset. For years, Bitcoin has largely been viewed as a store of value, but Bitcoin L2s are changing that by introducing programmability and financial utility without compromising security." This view reflects growing consensus that Bitcoin's potential extends beyond simple store of value applications.

Technical limitations remain acknowledged by experts. Lightning Network faces acknowledged challenges in channel management complexity, liquidity distribution requirements, and user experience barriers that limit mainstream adoption. Academic research revealing 2% node control compromising network privacy demonstrates ongoing security considerations requiring continued development.

Emerging solutions like BitVM receive cautious optimism from technical experts. While enabling zero-knowledge proofs on Bitcoin without soft forks, the two-party limitation and extensive pre-signature requirements constrain practical applications to specific use cases like trust-minimized BTC bridging for rollups.

Investment firm analysis and projections

Galaxy Digital's comprehensive research projects $47 billion in Bitcoin liquidity flowing to Layer 2 networks by 2030, representing a massive market opportunity. The firm estimates 2.3% of total BTC supply could be locked in L2s by 2030, assuming $100,000 Bitcoin prices and continued ecosystem development.

Venture capital trends demonstrate substantial institutional confidence. $447 million in total Bitcoin Layer 2 funding since 2018, with 39% ($174 million) raised in 2024 alone, indicates accelerating investment interest. Q2 2024 saw Bitcoin L2s capture 44% of all Layer 2 venture capital investment across cryptocurrency markets.

Christopher Calicott from Trammell Venture Partners notes: "Serious people no longer question whether bitcoin will remain 15 or 20 years into the future. With four consecutive years of growth at the earliest stage of bitcoin startup formation, the data now confirm a sustained, long-term venture category trend." This assessment reflects institutional confidence in Bitcoin's permanence and growth potential.

Economic sustainability analysis reveals challenges alongside opportunities. Galaxy Research estimates that Bitcoin rollups require $459K-$2.3M monthly revenue to achieve economic viability, primarily due to data availability costs on Bitcoin's constrained base layer. This creates high barriers to entry but also suggests significant market opportunity for successful solutions.

Market dynamics and competitive landscape

Ecosystem growth metrics demonstrate rapid expansion. Bitcoin Layer 2 projects increased sevenfold from 10 in 2021 to 75 by 2024, while pre-seed Bitcoin-native transactions jumped 50% in 2024 alone. This growth indicates strong developer interest and market demand for Bitcoin scaling solutions.

Competition with Ethereum creates both challenges and opportunities. Ethereum Layer 2s maintain $45+ billion TVL compared to $2-3 billion for Bitcoin Layer 2s, representing a substantial functionality gap. However, Bitcoin's superior security model and $1.4 trillion market cap provide competitive advantages for attracting security-conscious capital.

Cultural adoption barriers persist within Bitcoin communities. HODLer mentality and preference for simple store of value use cases create resistance to complex DeFi applications. However, institutional interest and yield generation opportunities could drive gradual cultural shifts toward productive Bitcoin usage.

Regulatory positioning varies among Layer 2 approaches. Lightning Network's payment focus aligns well with existing regulations, while smart contract platforms face greater uncertainty. Stacks' SEC-compliant approach demonstrates one path for regulatory compliance, though potentially at the cost of innovation flexibility.

Future timeline and probability assessments

Short-term outlook (1-2 years) focuses on infrastructure development and user experience improvements. BRC2.0's EVM compatibility could enable rapid migration of existing Ethereum applications, while Lightning Network continues expanding merchant adoption and exchange integration. Wallet improvements and better developer tooling should reduce adoption barriers.

Medium-term projections (3-5 years) envision substantial ecosystem maturation. Interoperability solutions between different Bitcoin Layer 2s, institutional custody infrastructure, and regulatory clarity could drive mainstream adoption. TVL growth to $10-20 billion appears achievable given appropriate technological and regulatory developments.

Long-term potential (5-10 years) includes scenarios where Bitcoin Layer 2s achieve significant portions of Ethereum Layer 2 functionality. $47 billion TVL projections from Galaxy Digital represent substantial market opportunity, while technological innovations like BitVM-based rollups could provide new scaling paradigms.

Risk factors include regulatory crackdowns on privacy features, technical challenges in achieving Ethereum-level functionality while maintaining Bitcoin security, cultural resistance within Bitcoin communities, and competition from improving Ethereum Layer 2 solutions and alternative blockchain platforms.

Expert consensus suggests Bitcoin Layer 2s will achieve meaningful functionality but likely remain specialized solutions rather than general-purpose platforms. Payment-focused applications through Lightning Network, institutional DeFi through compliant platforms like Stacks, and Bitcoin-native applications through protocols like BRC2.0 represent the most probable success scenarios.

Conclusion: The path to full functionality

After examining the technical architectures, security models, performance metrics, and market dynamics across Bitcoin's Layer 2 ecosystem, a nuanced picture emerges regarding the central question: Can Layer 2 be fully functional on Bitcoin?

Current state assessment

Bitcoin Layer 2 solutions currently achieve approximately 25-35% of what constitutes "fully functional" compared to mature blockchain ecosystems like Ethereum Layer 2s. This assessment stems from quantitative analysis across key functionality dimensions: smart contract capabilities (30-40% of Ethereum L2s), developer ecosystem maturity (8-10x fewer resources), DeFi functionality (15-20x less TVL), and infrastructure sophistication (significant gaps in tooling and user experience).

However, rapid innovation is closing these gaps. BRC2.0's September 2025 launch represents a watershed moment, bringing full EVM compatibility directly to Bitcoin Layer 1 while maintaining security guarantees. Lightning Network has demonstrated 1,212% growth in transaction processing, while ecosystem funding reached $447 million with 39% arriving in 2024 alone.

Technical constraints remain significant. Bitcoin's 10-minute block times create latency challenges for real-time applications, while 4MB block space limits create data availability bottlenecks. Galaxy Research estimates Bitcoin rollups require $459K-$2.3M monthly revenue for economic sustainability, indicating high barriers to entry despite massive market opportunity.

BRC2.0 as transformative catalyst

BRC2.0 represents the most significant breakthrough in Bitcoin programmability since Lightning Network's inception. By integrating EVM functionality directly into Bitcoin Layer 1 through indexer upgrades, BRC2.0 eliminates bridge risks while enabling 100% Solidity compatibility. Early applications demonstrate comprehensive functionality including DeFi protocols, NFT marketplaces, and complex smart contracts.

The paradigm shift from "digital gold" to "programmable money" appears underway. UniSat Wallet's rapid BRC2.0 integration, existing Ethereum project migrations, and growing developer interest signal market validation. However, fundamental limitations persist: 10-minute block times, indexer dependencies, and storage cost constraints create ongoing challenges for achieving full Ethereum-level functionality.

Market response validates BRC2.0's potential while highlighting constraints. Early DeFi applications achieve basic functionality but lack the sophistication of mature Ethereum protocols. Transaction costs during network congestion exceed $30, making small-value interactions economically unfeasible. Long-term success depends on addressing scalability bottlenecks and improving user experience.

Security trade-offs and implications

Different Layer 2 approaches involve distinct security compromises. Lightning Network maintains Bitcoin's trustless model but requires active channel management and online monitoring. Liquid Network trades decentralization for performance through its federation model. Stacks provides Bitcoin-anchored security but introduces staking risks through STX collateral requirements.

BRC2.0's security model eliminates bridge risks while introducing indexer dependencies for practical functionality. This represents a reasonable compromise - contracts execute on Bitcoin L1 with full security guarantees, but state management requires off-chain infrastructure creating potential centralization points.

Academic research reveals ongoing vulnerabilities across solutions. Lightning Network faces replacement cycling attacks and wormhole vulnerabilities, while federation-based solutions like Liquid create censorship risks and single points of failure. However, 99.7% payment success rates and consistent growth demonstrate practical security sufficiency for many use cases.

Market dynamics and adoption potential

Galaxy Digital's projection of $47 billion in Bitcoin liquidity flowing to Layer 2s by 2030 represents massive market opportunity. Currently, only 0.13% of Bitcoin's $1.4 trillion market cap operates in Layer 2 applications compared to 10% for Ethereum, suggesting enormous untapped potential.

Institutional interest continues growing with $174 million in 2024 funding representing 39% of all-time Bitcoin Layer 2 investment. Traditional crypto VCs previously skeptical of Bitcoin applications now actively deploying capital, while Bitcoin ETF approvals signal mainstream institutional acceptance.

Cultural barriers within Bitcoin communities remain significant. HODLer mentality and preference for store of value applications create resistance to complex DeFi participation. However, yield generation opportunities and security benefits of Bitcoin-anchored applications could drive gradual cultural shifts.

Regulatory outlook and compliance considerations

Regulatory clarity shows gradual improvement with innovation sandbox programs and strategic Bitcoin Reserve discussions indicating government recognition of Bitcoin infrastructure value. However, privacy-focused features and DeFi capabilities face potential scrutiny as adoption grows.

Compliance infrastructure development includes institutional-grade custody solutions, automated monitoring systems, and standardized security frameworks. Stacks' SEC-compliant approach demonstrates one path for regulatory alignment, while Lightning Network's payment focus aligns well with existing money transmission frameworks.

Global coordination on cryptocurrency regulation could significantly impact Bitcoin Layer 2 development trajectories. FATF Travel Rule requirements might affect Lightning privacy features, while CBDC competition could create market pressures requiring enhanced functionality to maintain competitiveness.

Timeline to full functionality

Based on current development trajectories, Bitcoin Layer 2s may achieve 70-80% of Ethereum Layer 2 functionality within 3-5 years, contingent on several critical developments:

Technical breakthroughs including successful BitVM implementation, zero-knowledge proof integration, and improved interoperability protocols could dramatically enhance capabilities. Ecosystem development requiring 10x growth in developer adoption and tooling maturity appears achievable given current investment levels and growth rates.

Market adoption depends on cultural shifts toward productive Bitcoin usage and institutional infrastructure development. Infrastructure scaling through data availability solutions and economic sustainability improvements remains crucial for long-term viability.

Regulatory clarity and competitive positioning against improving Ethereum Layer 2 solutions will significantly influence adoption timelines and ultimate success probabilities.

Final thoughts

Bitcoin Layer 2 solutions can become substantially functional, achieving 70-80% of comprehensive blockchain platform capabilities within 3-5 years. However, true parity with Ethereum Layer 2s remains unlikely due to fundamental Bitcoin base layer constraints and ecosystem maturity gaps.

BRC2.0's EVM integration represents a breakthrough enabling sophisticated applications while maintaining Bitcoin security benefits. Combined with Lightning Network's proven payment scaling, institutional-grade solutions like Liquid Network, and innovative approaches like RGB and Taproot Assets, Bitcoin Layer 2s offer compelling alternatives for specific use cases.

Success will be selective rather than universal. Expert consensus suggests only 3-5 dominant platforms will emerge from the current field of 75+ projects. Lightning Network for payments, BRC2.0 for EVM-compatible applications, Stacks for Bitcoin-native smart contracts, and institutional solutions for compliance-focused use cases represent the most probable winners.

The question is not whether Bitcoin Layer 2 can be fully functional, but rather how much functionality is sufficient to unlock Bitcoin's massive dormant capital for productive use cases. Current evidence suggests Bitcoin Layer 2s will achieve substantial functionality while maintaining unique security and decentralization properties that provide competitive advantages in specific market segments.

Bitcoin's transformation from purely "digital gold" to "programmable money" appears inevitable. The combination of massive untapped capital, superior security guarantees, growing institutional interest, and rapid technical innovation creates compelling conditions for Bitcoin Layer 2 success. However, achieving true parity with Ethereum's comprehensive functionality remains a multi-year endeavor requiring continued innovation across technical, economic, and adoption fronts.

The Bitcoin Layer 2 revolution has begun. While full functionality may remain elusive, substantial functionality appears within reach, potentially unlocking trillions of dollars in dormant value while preserving Bitcoin's foundational properties of security, decentralization, and censorship resistance.