Circle Internet Group's recent announcement about exploring reversible USDC transactions through its new Arc blockchain has ignited the most contentious debate in cryptocurrency since the block size wars.

Circle President Heath Tarbert's admission that the company is "thinking through whether or not there's the possibility of reversibility of transactions" while maintaining "settlement finality" represents either the pragmatic evolution needed for mainstream adoption or a fundamental betrayal of crypto's core principles.

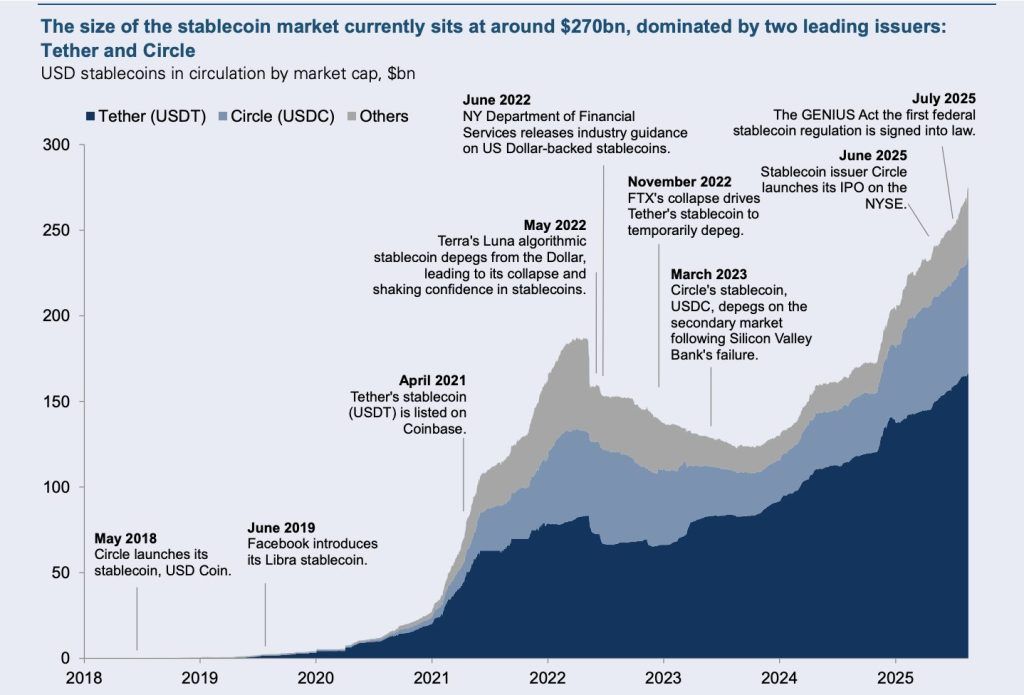

The stakes could not be higher. With USDC's $65 billion market capitalization and Goldman Sachs projecting $77 billion in growth by 2027, Circle's experiment with reversible stablecoins may determine whether blockchain technology becomes a bridge to traditional finance or sacrifices its revolutionary potential for institutional comfort. This tension between immutability and user protection crystallizes the crypto industry's existential question: can decentralized money maintain its censorship resistance while satisfying institutional compliance demands?

The controversy emerges at a pivotal moment for stablecoins. The 2024 market processed $27.6 trillion in transactions - surpassing Visa and Mastercard combined by 7.68% - while President Trump's GENIUS Act created the first comprehensive federal framework for stablecoin regulation. Circle's Arc blockchain, launching in testnet this fall with mainnet deployment by year-end, proposes a "counter-payment" layer that enables transaction reversals similar to credit card refunds while preserving base-layer finality. This hybrid approach challenges a decade of blockchain orthodoxy that viewed immutability as cryptocurrency's defining feature.

Bitcoin and Ethereum established immutability as crypto's cornerstone

Transaction immutability emerged as cryptocurrency's foundational principle through Bitcoin's original design and Ethereum's smart contract architecture. Bitcoin achieves what researchers call "an enviable level immutability compared to other forms of digital money," with transactions becoming practically irreversible after 3-6 blocks - roughly 30-60 minutes. Ethereum follows similar patterns, reaching practical finality after approximately 12 blocks or 2-3 minutes.

This immutability represents what monetary theorists describe as "the 7th property of money" - a revolutionary addition to the traditional six characteristics of durability, portability, divisibility, uniformity, limited supply, and acceptability. Unlike traditional digital payments that remain reversible for months through chargeback mechanisms, blockchain transactions achieve cryptographic finality that no single entity can unilaterally overturn.

The philosophical foundation stems from the cypherpunk movement of the 1990s, where figures like Eric Hughes declared "Privacy is necessary for an open society" and "Cypherpunks write code." This ethos, rooted in cryptographic resistance to centralized control, directly influenced Bitcoin's creation through the cypherpunk mailing list where Satoshi Nakamoto first published the Bitcoin whitepaper in 2008. The movement advocated for "widespread use of strong cryptography and privacy-enhancing technologies as a route to social and political change" with "principles of decentralization, individual autonomy, and freedom from centralized authority."

Bitcoin's immutability serves multiple crucial functions beyond mere technical permanence. It eliminates counterparty risk by ensuring completed transactions cannot be reversed by banks, governments, or intermediaries. It creates predictable settlement finality that enables complex financial applications without trust in third parties. Most importantly, it provides censorship resistance that protects users from arbitrary freezing or seizure of funds by powerful institutions.

Ethereum expanded these concepts through smart contracts - self-executing programs that operate according to predetermined rules without possibility of interference once deployed. This "code is law" philosophy assumes that immutable rules executed by decentralized networks provide more reliable governance than human institutions prone to corruption or coercion.

The economic implications of immutability extend far beyond technical architecture. Research demonstrates that blockchain's value proposition fundamentally depends on being "costly to attack and difficult to remove." This creates what economists call credible commitment - a mechanism that prevents future policy reversals even when they might seem beneficial. Without immutability, blockchain systems lose their primary advantage over existing centralized alternatives.

Circle's Arc blockchain introduces controlled reversibility through counter-payment layers

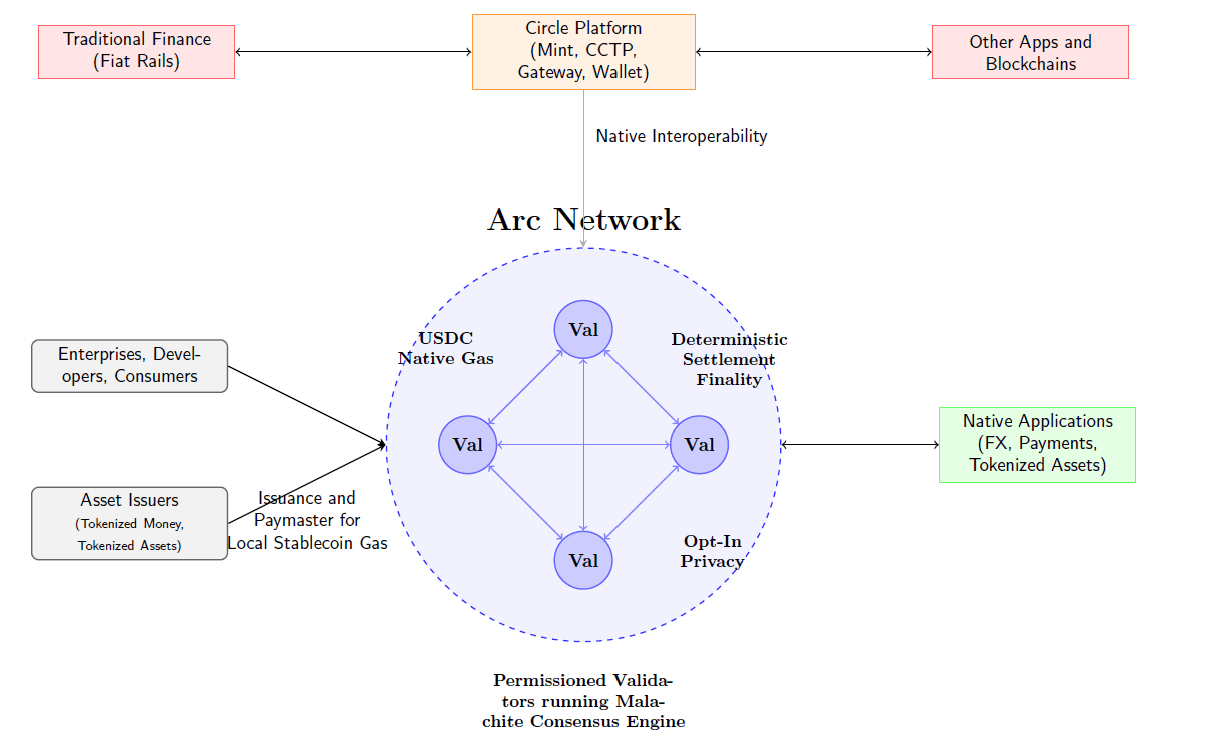

Circle's Arc blockchain represents the most sophisticated attempt yet to reconcile blockchain immutability with traditional finance requirements. The Layer-1 network, launching in testnet fall 2025 with mainnet deployment by year-end, uses a novel architecture that maintains deterministic finality at the base layer while enabling optional transaction reversals through higher-level mechanisms.

The technical implementation centers on the Malachite consensus engine, acquired from Informal Systems in August 2025. This Byzantine Fault Tolerant system delivers sub-second finality under 350 milliseconds with 20 validators, scaling to 10,000 transactions per second with 4 validators in high-performance configurations. Unlike probabilistic finality systems that require waiting for multiple confirmations, Arc provides immediate, non-probabilistic settlement that Circle argues satisfies both blockchain purists and institutional requirements.

Arc's most controversial innovation lies in its "counter-payment" layer - an off-chain dispute resolution mechanism that operates above the immutable base blockchain. Heath Tarbert describes this as enabling "the possibility of reversibility of transactions" while maintaining "settlement finality," creating what he acknowledges as "an inherent tension between being able to transfer something immediately, but having it be irrevocable."

The system works through conditional reversibility requiring bilateral agreement. Unlike traditional chargeback systems where one party can unilaterally reverse transactions, Arc's reversals demand consent from all involved parties. This approach aims to address fraud and disputes while preventing the arbitrary reversals that plague traditional payment systems. All reversals occur through transparent, auditable processes conducted off-chain to avoid compromising the base layer's immutability.

USDC serves as Arc's native gas token, eliminating the need for volatile cryptocurrencies to pay transaction fees. This provides institutions with predictable, dollar-denominated fee structures through sophisticated mechanisms including "fee smoothing" using exponentially weighted moving averages and "base fee ceiling mechanisms" to prevent infinite fee escalation during network congestion.

Arc incorporates opt-in privacy features designed for enterprise use cases. The system can encrypt transaction amounts while keeping addresses visible, enabling confidential corporate treasury operations while maintaining compliance capabilities. This selective disclosure approach uses EVM precompiles with pluggable cryptographic backends, allowing different privacy requirements for various use cases.

The platform provides native support for Circle's full product suite, including the Circle Payments Network, multiple stablecoins (USDC, EURC, USYC), Circle Mint, Wallets, Contracts, Cross-Chain Transfer Protocol, and Circle Gateway. This integration creates a comprehensive financial infrastructure optimized specifically for stablecoin operations rather than general-purpose blockchain applications.

Target applications include cross-border payments with automated local currency offramping, stablecoin FX perpetuals for leveraged currency trading, onchain credit systems integrating identity and cash flow history, capital markets settlement with delivery-versus-payment mechanisms, and agentic commerce enabling AI-mediated marketplace transactions. Circle has announced strategic partnerships with Fireblocks for institutional custody, over 100 financial institutions in the pipeline, and integration with traditional payment infrastructure providers FIS and Fiserv.

The validator structure initially uses Proof-of-Authority with known institutional validators meeting operational and compliance standards, eventually migrating to permissioned Proof-of-Stake with qualified entities. This controlled approach prioritizes regulatory compliance over maximal decentralization, representing a fundamental philosophical departure from Bitcoin's permissionless consensus model.

Critics argue this architecture recreates traditional finance centralization with blockchain characteristics rather than true decentralized innovation. However, Circle defends the approach as necessary pragmatism for institutional adoption, pointing to the $65 billion USDC market capitalization and growing regulatory clarity as validation of their strategy.

Crypto community responds with fierce resistance to "anti-crypto" reversibility

The announcement of reversible USDC transactions triggered immediate and vociferous opposition from the cryptocurrency community, with critics denouncing the proposal as fundamentally "anti-crypto" and a betrayal of blockchain's core principles.

The backlash was swift and uncompromising. Prominent crypto figure Aaron Day declared: "USDC is announcing reversible transactions. We've lost the plot. USDC is fiat on a surveillance ledger. This isn't crypto, it's tyranny." Another community member characterized USDC as aiming "to be the first stablecoin to be fully centralized and controllable 1000%," while others warned that Circle "is going to kill any advantage and kill USDC's use in DeFi."

ZachXBT, the influential blockchain investigator, highlighted Circle's inconsistencies, criticizing that "Circle does not even proactively freeze addresses tied to North Korean or exploiter groups" - questioning whether reversibility serves genuine security purposes or merely regulatory theater. This critique gained particular resonance given Circle's historically slow response to freezing stolen funds despite their new emphasis on transaction reversibility.

The philosophical objections run deeper than mere technical concerns. Arthur Azizov of B2 Ventures noted that "traditional financial institutions are increasingly shaping the narratives in the crypto sector" while "the cypherpunk ethos is retreating from the limelight." This observation captures the community's fear that reversible stablecoins represent not just technical compromise but cultural capitulation to institutional pressure.

The "CypherMonk" manifesto warns that "as these technologies go mainstream, we risk becoming obsessed with 'code as law' rather than the ideals that motivate us." This sentiment reflects deeper concerns about crypto's evolution from revolutionary technology to corporate-controlled infrastructure that merely digitizes existing financial power structures.

Technical objections focus on practical implementation challenges, particularly what critics call the "hot potato problem." If hackers convert USDC to other assets quickly through decentralized exchanges, reversing the original USDC transaction might harm innocent liquidity providers and DEX users rather than stopping criminals. As one analyst noted: "How can you reverse USDC if the hacker has already swapped? Going to fuck LPs over? Exchanges?"

Community members argue that reversible transactions would "make decentralized finance centralized again" and eliminate "the freedom we have today." This criticism highlights fundamental tensions between DeFi's permissionless, self-custodial model and reversible stablecoins' reliance on centralized decision-making authorities.

The emphasis on "consumer surveillance and officially registered accounts runs contrary to the value proposition of decentralized finance," which promises permissionless access to censorship-resistant financial systems. Critics worry that reversible stablecoins could become vehicles for political censorship and social control, particularly given governments' increasing interest in regulating cryptocurrency transactions.

However, some voices defended Circle's approach as necessary evolution. Andrei Grachev of Falcon Finance argued that complete irreversibility "certainly does not reflect how financial systems operate at an institutional scale" and that "reversibility is not a flaw. Instead, it can be a functional feature when designed with clear rules, user consent and onchain enforcement." Supporters point to precedents like the Sui blockchain's successful $162 million fund recovery from the Cetus exploit as evidence that controlled reversibility can work in practice without compromising broader system integrity.

The debate highlights contrasting visions for crypto's future. Traditional crypto advocates view immutability as non-negotiable, arguing that compromising this principle destroys blockchain's primary value proposition. Institutionalists counter that ideological purity must yield to practical requirements for mainstream adoption and regulatory compliance.

This cultural tension manifests in what researchers describe as the "immutability paradox" - blockchain's greatest strength may also be its greatest risk. As one developer noted: "If you make a system truly immutable, you risk locking in its flaws. If you make it upgradeable, you reintroduce trust, in the very humans the system was supposed to transcend." The controversy also reveals regulatory pressures, particularly conflicts with GDPR's "right to be forgotten" which directly contradicts blockchain immutability. Research shows that "blockchain's immutability conflicts with GDPR's assumptions that data can be modified or erased to meet legal obligations," creating compliance challenges that reversible systems could potentially address.

The community response suggests that for many crypto users, compromising immutability crosses a red line. As one commentator noted, this could determine whether "decentralization can survive, or will it die in the face of institutional dominance?" The outcome may define whether cryptocurrency remains true to its cypherpunk roots or evolves into digitized traditional finance with blockchain characteristics.

Traditional finance demands reversibility for consumer protection and regulatory compliance

Traditional financial institutions' enthusiasm for reversible stablecoin transactions stems from deep-seated institutional requirements and regulatory frameworks that have developed over decades to protect consumers and maintain systemic stability. These requirements create fundamental incompatibilities with blockchain immutability that Circle's Arc blockchain attempts to resolve.

Banks operate under extensive regulatory frameworks mandating transaction reversibility capabilities. The Bank Secrecy Act requires suspicious activity reporting and customer due diligence with ongoing monitoring for unusual activity. OFAC sanctions compliance demands immediate blocking of sanctioned entity funds with detailed audit trails for potential releases. Consumer protection laws including Regulation E (Electronic Fund Transfer Act) and Regulation Z provide chargeback and dispute resolution mechanisms that consumers have come to expect as basic financial rights.

The operational benefits for traditional institutions are substantial. Established payment systems provide banks with dispute resolution mechanisms for customer complaints, risk management capabilities to halt suspicious transactions, simplified regulatory reporting through transaction reversibility, and consumer protection through chargeback mechanisms that build customer trust and loyalty.

Treasury Secretary Scott Bessent has emphasized that stablecoins should serve to "cement dollar dominance globally" while operating within traditional regulatory frameworks. This perspective views reversible stablecoins not as compromise but as enhancement - providing digital efficiency while maintaining consumer protections that have proven essential for financial system stability.

The GENIUS Act, signed by President Trump in July 2025, explicitly requires all stablecoin issuers to possess "technical capability to seize, freeze, or burn payment stablecoins when legally required." This federal mandate reflects policymakers' view that consumer protection and law enforcement capabilities are non-negotiable requirements for mainstream financial infrastructure.

International regulatory convergence supports this approach. The European Union's MiCA regulation, Japan's Payment Services Act integration, Singapore's comprehensive virtual asset framework, and Switzerland's early cryptocurrency regulations all emphasize consumer protection and transaction reversibility for regulated stablecoins. This global alignment suggests that reversible features may become standard requirements for institutional stablecoin adoption.

Traditional finance argues that immutable systems create unacceptable consumer vulnerability. Unlike crypto-native users who understand the risks of irreversible transactions, mainstream consumers expect financial systems to provide error correction and fraud recovery mechanisms. Banks point to the billions in fraudulent transactions reversed annually through existing payment systems as evidence that reversibility serves essential consumer protection functions.

The regulatory compliance benefits of reversible systems extend beyond consumer protection. Enhanced AML/CFT compliance through real-time transaction intervention, simplified audit trails for regulatory investigations, improved dispute resolution through established mechanisms, and reduced regulatory burden through alignment with existing frameworks create compelling institutional incentives for reversible stablecoin adoption.

Federal regulators have explicitly endorsed this direction. The Federal Reserve's analysis emphasizes stablecoins' "potential risk to financial stability because of their vulnerability to runs" and recommends comprehensive federal frameworks ensuring issuer oversight. The CFTC views properly structured stablecoins as commodities requiring consumer protection mechanisms. The SEC's April 2025 guidance creating "Covered Stablecoin" categories explicitly supports properly regulated issuers meeting consumer protection standards.

Congressional testimony reveals bipartisan support for consumer-protective stablecoin regulation. The GENIUS Act passed with 308-122 House support including 18 Senate Democrats crossing party lines, reflecting unusual bipartisan consensus that digital dollar infrastructure must include traditional financial safeguards.

International coordination reinforces these requirements. The Bank for International Settlements' guidance on settlement finality acknowledges that "well-designed and subject to appropriate oversight" stablecoins can support beneficial payments while requiring consumer protection mechanisms. The Treasury Department's coordination with international bodies aims to establish global standards ensuring reversible features for regulated stablecoin systems.

Traditional institutions argue that immutable blockchain systems fail to meet basic fiduciary responsibilities. Banks' duty to customers includes protecting against fraud, providing error resolution, and maintaining funds availability during disputes. Immutable systems make these responsibilities impossible to fulfill, creating legal and ethical conflicts that reversible stablecoins resolve.

This institutional perspective views Circle's Arc blockchain as pragmatic evolution rather than philosophical compromise, enabling digital efficiency while preserving essential consumer protections that decades of financial system development have proven necessary.

Trump administration champions dollar-backed stablecoins while establishing federal oversight framework

The Trump administration has positioned itself as the most crypto-friendly government in U.S. history while simultaneously establishing comprehensive regulatory frameworks that benefit both institutional adoption and American dollar dominance globally. This dual approach creates favorable conditions for Circle's reversible stablecoin experiment while maintaining strict oversight requirements.

President Trump's Executive Order 14178, "Strengthening American Leadership in Digital Financial Technology," issued January 23, 2025, establishes core policy priorities including promoting "development and growth of lawful and legitimate dollar-backed stablecoins worldwide," providing regulatory clarity through technology-neutral regulations with well-defined jurisdictional boundaries, explicitly prohibiting Central Bank Digital Currencies, and protecting blockchain development and self-custody rights.

The administration's Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, established March 6, 2025, signals unprecedented government-level cryptocurrency adoption. This policy shift reflects Trump's acknowledgment that crypto support serves both economic and political purposes, stating "I also did it for the votes" while emphasizing stablecoins' role in reinforcing U.S. dollar global dominance and driving Treasury securities demand.

Key administration appointments demonstrate pro-innovation leadership. David Sacks serves as Special Advisor for AI and Crypto, Bo Hines directs the Presidential Council of Advisers for Digital Assets, and Paul Atkins chairs the SEC with explicitly crypto-friendly policies. These appointments ensure regulatory coordination favoring innovation while maintaining oversight requirements.

The GENIUS Act represents the administration's signature cryptocurrency achievement. Passed during "Crypto Week" (July 14-18, 2025) with the Anti-CBDC Surveillance Act and Digital Asset Market Clarity Act, the legislation creates dual federal-state oversight with the Treasury Department as primary regulator, mandates 100% backing with liquid assets, establishes licensing requirements for permitted payment stablecoin issuers, provides consumer protection through priority claims in insolvency proceedings, and requires technical capability to seize, freeze, or burn stablecoins when legally required.

The administration views stablecoins as strategic tools for American financial hegemony. Treasury Secretary Scott Bessent emphasizes using stablecoins to "cement dollar dominance globally" by increasing international demand for dollar-denominated assets and Treasury securities. This perspective treats reversible stablecoins not as compromise with crypto principles but as enhancement of American financial power projection through digital channels.

Political motivations align with policy outcomes. Trump's crypto industry support during the 2024 election generated substantial political capital and financial backing. The administration leverages this support to advance policies that benefit American financial institutions while maintaining regulatory control. The resulting framework favors compliant, regulated issuers like Circle over international competitors operating outside U.S. oversight.

Congressional passage required significant political maneuvering. The GENIUS Act needed 18 Senate Democrats to cross party lines despite attempts to bar presidential crypto profits and concerns about conflict of interest. The bipartisan support reflects recognition that stablecoin regulation serves national economic interests beyond partisan politics.

Federal agency coordination ensures comprehensive implementation. The Working Group on Digital Asset Markets includes Treasury Secretary (Chair), Attorney General, Commerce Secretary, SEC and CFTC Chairmen, Federal Reserve officials, and banking regulators. This structure enables coordinated policy development and enforcement across traditional jurisdictional boundaries. The administration explicitly supports reversible transaction capabilities as necessary infrastructure features. Treasury's August 2025 Request for Comment on "innovative or novel methods, techniques, or strategies that regulated financial institutions use, or could potentially use, to detect illicit activity involving digital assets" signals government interest in controllable digital payment systems.

International coordination amplifies American influence. The Treasury Department works with international bodies to establish global standards favoring American-regulated stablecoin issuers. This approach uses regulatory clarity as competitive advantage, enabling Circle and other compliant issuers to expand internationally while foreign competitors face regulatory uncertainty.

The administration frames crypto regulation as America First policy. By establishing comprehensive frameworks for dollar-backed stablecoins while prohibiting government digital currencies, Trump positions private stablecoin innovation as patriotic alternative to foreign government digital currencies. This narrative justifies regulatory requirements as necessary tools for maintaining American financial leadership. Enforcement priorities reflect political realities. The administration selectively enforces existing regulations while providing clarity for compliant actors, creating incentives for institutional adoption of approved stablecoin models. This approach benefits Circle's regulated approach while maintaining pressure on non-compliant competitors.

The administration's strategy successfully balances crypto industry support with traditional financial system stability, creating political conditions favoring Circle's reversible stablecoin experiment while ensuring government oversight capabilities remain intact.

Goldman Sachs projects trillion-dollar stablecoin markets driven by institutional adoption

Goldman Sachs' research division has issued the most bullish institutional projection for stablecoin growth, forecasting USDC expansion of $77 billion through 2027 representing 40% compound annual growth while identifying trillion-dollar market potential driven by the massive $240 trillion global payments market. This institutional endorsement provides crucial credibility for Circle's reversible transaction experiment.

Goldman's "Stablecoin Summer" research identifies massive untapped opportunity in the global payments market, breaking down the $240 trillion annual volume into consumer payments ($40 trillion), business-to-business payments ($60 trillion), and person-to-person disbursements. Currently, most stablecoin activity remains crypto-trading focused rather than mainstream payments, suggesting enormous potential for expansion into traditional use cases that institutions prefer.

The economic mechanics favor stablecoin growth through treasury demand. Bank for International Settlements research demonstrates that 2-standard deviation stablecoin inflows lower 3-month Treasury yields by 2-2.5 basis points, creating beneficial feedback loops where stablecoin growth supports government debt markets. Each stablecoin issued increases demand for backing assets, primarily U.S. Treasuries, aligning private innovation with government fiscal needs.

2024 market performance validates Goldman's optimism. Stablecoins processed $27.6 trillion in annual transactions, surpassing Visa and Mastercard combined by 7.68%. Supply grew 59% reaching 1% of total U.S. dollar supply, with 70% of transaction volume automated and reaching 98% on emerging networks like Solana and Base. These metrics suggest stablecoins are transitioning from experimental technology to essential financial infrastructure.

USDC specifically demonstrates institutional preference patterns. Despite Tether's larger market capitalization ($165 billion vs. Circle's $74 billion), USDC captures 70% of total stablecoin transfer volume, suggesting institutional users prefer Circle's compliance-focused approach over Tether's trader-optimized model. This volume preference supports Goldman's projection that regulated stablecoins will capture institutional growth.

Regulatory clarity accelerates institutional adoption. The GENIUS Act's federal framework and SEC guidance creating "Covered Stablecoin" categories eliminate regulatory uncertainty that previously constrained institutional participation. Circle's full regulatory compliance contrasts with competitors facing enforcement uncertainty, creating competitive advantages that Goldman's analysis incorporates into growth projections.

Circle's financial performance supports aggressive growth targets. Q2 2025 results showed $658 million revenue with 53% year-over-year growth, USDC circulation growth of 90% year-over-year to $61.3 billion, reserve income of $634 million representing 50% year-over-year increase, and adjusted EBITDA of $126 million with 52% year-over-year growth. These metrics demonstrate operational scalability supporting Goldman's expansion forecasts.

International expansion creates additional growth vectors. Circle achieved MiCA compliance in Europe with EURC, becoming the only major compliant stablecoin in EU markets after Tether chose non-compliance. This regulatory arbitrage creates market opportunities that Goldman's analysis factors into global growth projections.

Institutional partnership pipelines validate market demand. Circle announced relationships with over 100 financial institutions, partnerships with traditional payment infrastructure providers FIS and Fiserv, integration with Corpay for cross-border solutions, and cooperation with Standard Chartered/Zodia Markets for institutional trading. These partnerships provide distribution channels supporting Goldman's growth assumptions. Arc blockchain infrastructure addresses institutional requirements that Goldman identifies as adoption barriers. Dollar-denominated gas fees, deterministic finality, built-in FX engines, and regulatory compliance features create institutional-grade infrastructure that current blockchain platforms lack. Goldman's analysis suggests these capabilities could accelerate adoption beyond current market expectations.

Competitive positioning favors Circle's institutional strategy. While Tether earned $13 billion in 2024 compared to Circle's $156 million, Tether's trader-focused approach limits institutional penetration. Circle's compliance-first model accepts lower profitability for broader institutional access, aligning with Goldman's thesis that regulated stablecoins will capture mainstream growth. Economic incentives support Goldman's projections. Federal Reserve research on stablecoin "runs" suggests properly regulated systems with reversibility mechanisms could achieve systemic importance without threatening financial stability. This creates policy conditions supporting massive scale expansion that Goldman incorporates into trillion-dollar market projections.

Technology adoption patterns favor institutional stablecoins. Historical analysis of financial technology adoption shows institutions prioritize compliance and reversibility over decentralization and immutability. Goldman's research suggests stablecoins following this institutional preference pattern will capture disproportionate growth from mainstream financial system integration. Cross-border payment disruption drives adoption. Stablecoin technology reduces remittance costs by 60% compared to traditional methods in markets like Nigeria while providing near-instant settlement versus days for wire transfers. Goldman's analysis identifies these efficiency gains as drivers for institutional adoption across international payment corridors.

Goldman's trillion-dollar market projection reflects institutional recognition that compliant, reversible stablecoins represent inevitable evolution toward digitized traditional finance rather than revolutionary decentralized alternatives, providing economic validation for Circle's approach.

Privacy features balance institutional confidentiality with regulatory transparency requirements

Circle's Arc blockchain introduces sophisticated privacy mechanisms designed specifically for institutional use cases while maintaining the regulatory compliance capabilities that traditional financial institutions require. This approach represents a middle ground between cryptocurrency's privacy-maximizing technologies and the transparency demands of institutional oversight.

Arc's selective disclosure architecture enables "confidential but compliant" transactions through encrypted transaction amounts while keeping addresses visible. This design allows corporations to conduct private treasury operations and business payments without revealing sensitive financial information to competitors or unauthorized observers, while ensuring regulatory authorities retain oversight capabilities when legally required.

The technical implementation uses EVM precompiles with pluggable cryptographic backends, providing flexibility for different privacy requirements across various use cases. Unlike privacy-maximizing cryptocurrencies that obscure all transaction details, Arc's approach enables surgical privacy protection for specific data elements while preserving auditability and compliance functionality.

Enterprise use cases drive privacy feature development. Corporate treasury operations require confidentiality for inter-company transfers to prevent competitors from analyzing business relationships and financial flows. Banking operations need privacy for settlements between financial institutions to maintain client confidentiality and competitive positioning. Capital markets demand discretion for large-scale transactions that could move prices if publicly observable. Supply chain finance requires protected vendor payment information to prevent supply chain intelligence gathering.

Arc's privacy model contrasts sharply with existing cryptocurrency privacy technologies. Zero-knowledge proof systems like those used in Zcash or privacy coins like Monero aim for maximum privacy protection, often creating regulatory compliance challenges. Circle's approach deliberately balances privacy with oversight requirements, enabling institutional adoption while satisfying regulatory frameworks that demand transaction visibility when legally required.

Regulatory compatibility drives design decisions. GDPR's "right to be forgotten" conflicts with blockchain immutability, but Arc's privacy features could potentially address these concerns through selective data encryption rather than immutable public records. AML/CFT compliance requires transaction monitoring capabilities that Arc maintains through controlled privacy mechanisms rather than complete anonymization. The privacy implementation supports graduated disclosure levels based on user requirements and regulatory jurisdiction. Basic transactions can operate with full transparency, while institutional users can opt into amount encryption for sensitive commercial operations. This granular approach enables compliance with varying international regulatory requirements without compromising functionality.

Circle's privacy philosophy differs from cypherpunk approaches that view surveillance resistance as fundamental human rights. Arc's privacy features serve commercial confidentiality rather than political protection, focusing on business use cases rather than censorship resistance. This institutional orientation reflects Circle's broader strategy of bridging traditional finance and blockchain technology. Compliance-first privacy design maintains regulatory oversight capabilities. Unlike privacy coins that prevent external monitoring, Arc's privacy features include mechanisms for authorized access by regulatory authorities. This "privacy with accountability" model enables institutional adoption while satisfying government oversight requirements that pure privacy systems cannot meet.

The technical architecture enables selective revelation for dispute resolution. Arc's reversible transaction mechanisms require access to transaction details for legitimate dispute resolution, creating natural integration points between privacy features and reversal capabilities. This design supports institutional requirements for both confidentiality and dispute resolution without requiring complete privacy sacrifice. Competitive advantages emerge from regulatory-compliant privacy. While privacy-maximizing cryptocurrencies face increasing regulatory scrutiny and potential bans, Arc's measured approach positions Circle to capture institutional users requiring confidentiality within regulatory frameworks. This creates market differentiation from both transparent public blockchains and completely private systems.

International regulatory frameworks influence privacy feature design. MiCA in Europe, GENIUS Act in the United States, and similar regulations globally require balance between user privacy and regulatory oversight. Arc's architecture enables compliance across multiple jurisdictions through configurable privacy levels rather than one-size-fits-all approaches. Privacy features address institutional security concerns beyond regulatory compliance. Corporate financial flows provide competitive intelligence that privacy protection helps secure. Treasury operations revealing working capital positions could disadvantage companies in negotiations or market positioning. Banking settlement information could enable front-running or market manipulation if publicly observable.

The integration with traditional financial infrastructure requires privacy considerations that pure public blockchains cannot provide. Banks cannot operate with completely transparent transactions due to client confidentiality requirements and competitive concerns. Arc's privacy model enables blockchain integration while preserving necessary business confidentiality. Circle's approach represents pragmatic evolution of blockchain privacy toward institutional requirements rather than maximal privacy protection, creating tools for commercial confidentiality within regulatory frameworks rather than surveillance resistance technologies favored by cryptocurrency purists.

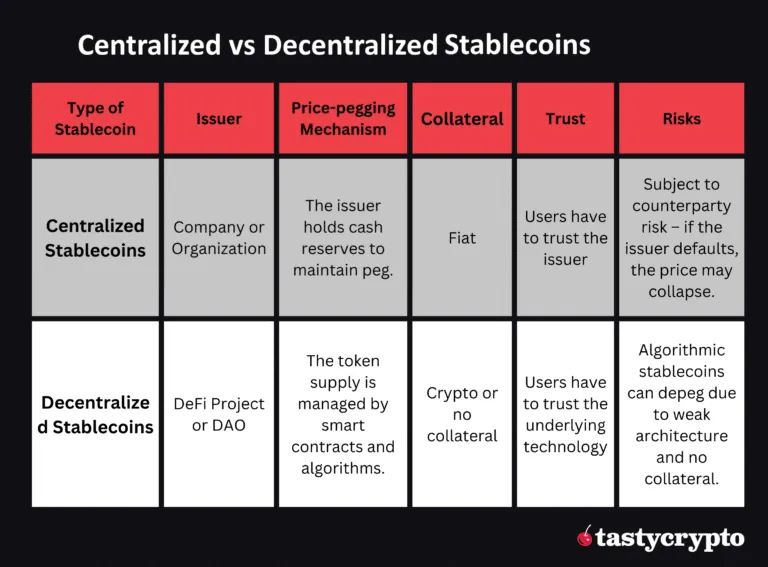

Decentralized stablecoins maintain immutability principles despite institutional pressure

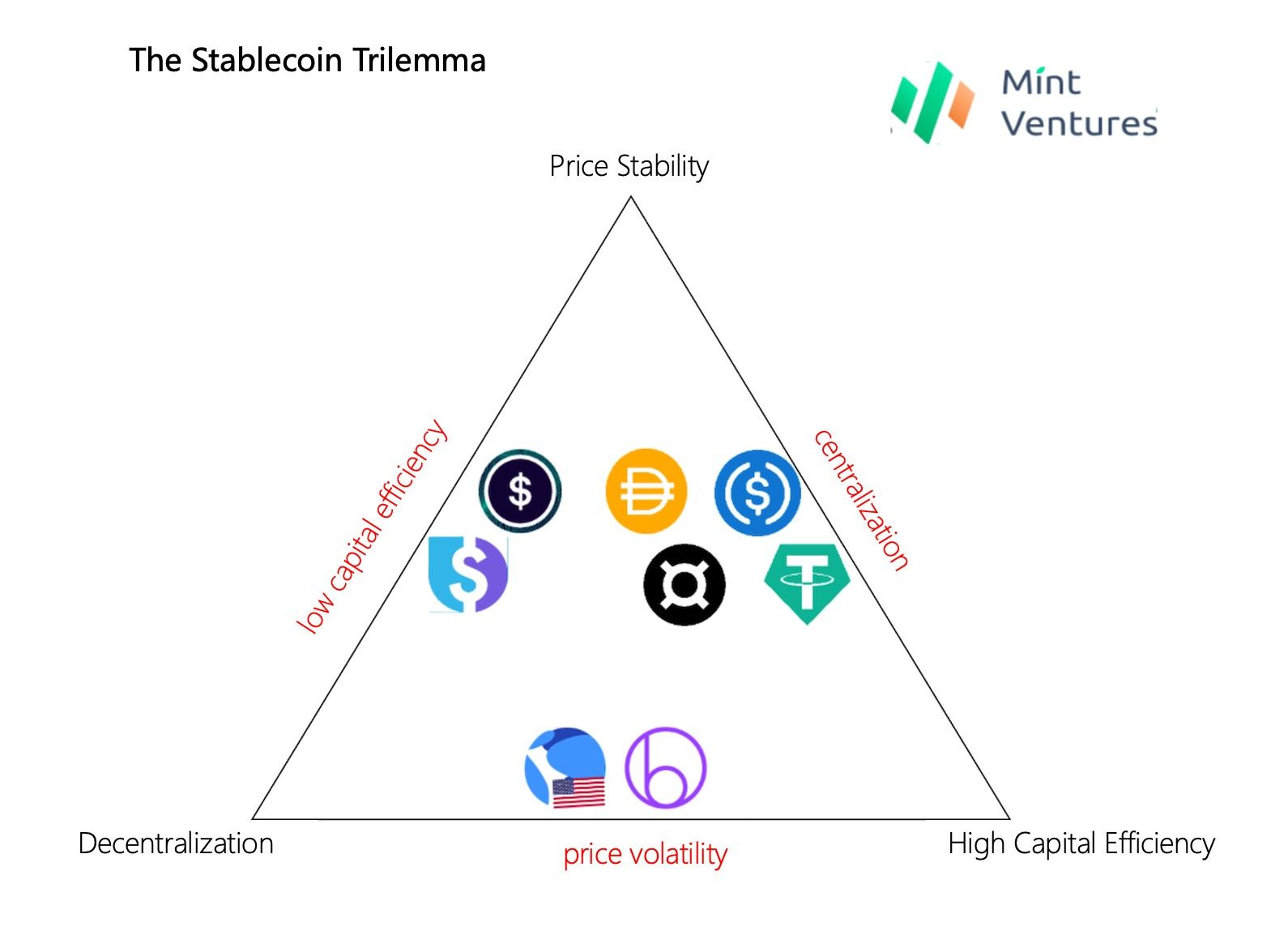

Decentralized stablecoin protocols represent the philosophical counterpoint to Circle's reversible transaction experiment, maintaining blockchain's original immutability principles even as institutional pressure mounts for controllable alternatives. These systems demonstrate alternative approaches to stability and governance that preserve cryptocurrency's censorship resistance while serving major portions of the DeFi ecosystem.

MakerDAO's DAI exemplifies the immutable approach with approximately $3.4-3.5 billion market capitalization maintained through over-collateralization with Ethereum-based assets. The protocol's governance through MKR token holders provides decentralized control over stability parameters without enabling transaction reversals. DAI successfully maintained its 1:1 USD peg despite an 80% ETH price decline during its first year, demonstrating that immutable systems can achieve stability through economic mechanisms rather than centralized control.

The DAO's governance model contrasts sharply with Circle's institutional approach. MKR holders vote on collateral types, stability fees, and protocol parameters through on-chain governance rather than corporate decision-making. This distributed control prevents any single entity from reversing transactions or freezing funds, maintaining the censorship resistance that cryptocurrency advocates view as fundamental to the technology's value proposition.

Recent controversy within MakerDAO illustrates the community's commitment to immutability. The proposed transition to Sky Protocol's USDS token faced significant community resistance specifically because it included freeze functions that many users viewed as compromising DAI's immutable principles. This rejection demonstrates that even economically rational upgrades may be rejected when they compromise core philosophical commitments.

FRAX Protocol represents innovation within immutable frameworks through its hybrid fractional-algorithmic design combining collateral backing with market-driven seigniorage mechanisms. The protocol maintains dynamic collateralization ratios based on market conditions (currently 96% USDC backing, 4% burned FXS tokens) while preserving transaction immutability. FRAX's broader ecosystem includes decentralized exchanges, lending protocols, and liquid staking offerings that create multiple use cases without requiring centralized control.

The technical architecture of decentralized stablecoins enables immutability through algorithmic governance. Automated market operations, liquidation mechanisms, and stability fee adjustments occur through smart contracts rather than human intervention. This automation eliminates discretionary decision-making that could enable transaction reversals while maintaining system stability through economic incentives. Decentralized stablecoin users actively choose immutability over convenience. Despite Circle's USDC offering better regulatory clarity and institutional integration, DAI and other decentralized alternatives maintain substantial market share among users who prioritize censorship resistance over compliance features. This user preference suggests significant market segments will resist reversible alternatives.

DeFi protocol integration favors immutable stablecoins because transaction finality enables complex automated operations without counterparty risk. Lending protocols, yield farming, automated market makers, and other DeFi applications require predictable transaction outcomes that reversible systems could potentially disrupt. The $200+ billion DeFi ecosystem largely depends on immutable stablecoins for operational reliability.

Governance token mechanisms provide decentralized oversight without enabling transaction reversals. Token holders can modify protocol parameters, add collateral types, and adjust fee structures through transparent on-chain voting rather than centralized corporate control. This distributed governance maintains community oversight while preserving transaction immutability. Economic incentives align community interests with protocol stability. Governance token holders benefit from protocol success through token appreciation and fee collection, creating market-driven incentives for responsible parameter management. These economic mechanisms replace institutional oversight with decentralized market forces that maintain stability without requiring centralized control.

Cross-chain expansion of decentralized stablecoins demonstrates continued demand for immutable alternatives. DAI operates across multiple blockchain networks, FRAX has expanded to various chains, and new decentralized stablecoin protocols continue launching despite regulatory pressures favoring centralized alternatives. This expansion suggests robust market demand for immutable options. Technical innovation continues within immutable frameworks. Liquity's LUSD uses algorithmic liquidations without governance tokens, providing stability through purely economic mechanisms. Olympus DAO's OHM experiments with reserve-backed models that maintain decentralization. These innovations demonstrate that immutable stablecoins can evolve technically without compromising philosophical principles.

Community resistance to centralized alternatives strengthens over time. As traditional financial institutions increase involvement in cryptocurrency through regulated stablecoins, crypto-native users increasingly value alternatives that maintain original blockchain principles. This cultural preservation creates persistent demand for immutable stablecoins regardless of institutional preferences. Interoperability between immutable and reversible systems remains possible through bridge technologies and atomic swap mechanisms that enable users to choose transaction finality models based on specific use cases. This technical compatibility suggests market segmentation rather than winner-take-all competition between approaches.

The philosophical commitment to immutability extends beyond technical implementation to community values, governance structures, and development roadmaps that prioritize censorship resistance over institutional adoption. These deep cultural commitments suggest decentralized stablecoins will persist as alternatives regardless of regulatory or institutional pressures favoring reversible systems. Decentralized stablecoins thus represent the preservation of cryptocurrency's original vision within evolving market conditions, maintaining immutable principles through economic mechanisms and distributed governance rather than institutional compliance and centralized control.

Tether maintains market dominance through trading-focused strategy and regulatory arbitrage

Tether's strategic approach to stablecoin markets contrasts sharply with Circle's institutional compliance model, maintaining overwhelming market dominance through trader-focused services, aggressive international expansion, and selective regulatory engagement that prioritizes market access over comprehensive compliance.

Tether's market position remains formidable with $165 billion market capitalization compared to Circle's $74 billion USDC circulation, despite Circle's active efforts to gain market share through regulatory compliance. Tether's business model generates substantially higher profits - $13 billion in 2024 versus Circle's $156 million - through more aggressive investment strategies including Bitcoin holdings, commercial loans, and gold reserves that regulatory frameworks increasingly restrict.

The competitive battle reflects different philosophical approaches to stablecoin utility and governance. While Circle actively lobbies for stricter regulations favoring U.S.-based, audited issuers, Tether utilizes political connections and market positioning to resist restrictive legislation. Treasury Secretary nominee Howard Lutnick's role as CEO of Cantor Fitzgerald - Tether's primary banking partner - provides Tether with high-level political access that could influence regulatory outcomes.

Geographic market segmentation benefits Tether's strategy. EU MiCA regulation created regulatory advantages for Circle's compliance model, leading to EURC becoming the dominant compliant stablecoin in European markets after Tether chose non-compliance. However, Tether's continued operation in non-regulated jurisdictions maintains global market access that Circle's compliance-focused approach cannot match. This regulatory arbitrage enables Tether to serve crypto-native users while Circle pursues institutional markets.

Trading volume patterns favor Tether's approach. USDT captures 79.7% of stablecoin trading volume on average, demonstrating strong preference among crypto traders for Tether's model over Circle's institutional focus. Ethereum-based USDT reserves surged 165% year-over-year, indicating continued growth in Tether's core market segment despite regulatory pressures and compliance concerns.

Enforcement activity demonstrates different risk tolerance levels. Tether has blacklisted 1.5 billion tokens across 2,400+ addresses compared to Circle's 100 million across 347 addresses, suggesting more aggressive enforcement of regulatory requirements. However, critics argue that both issuers respond slowly to freezing stolen funds, questioning whether reversibility mechanisms would improve security outcomes or merely create compliance theater.

Tether's reserve structure provides higher yields but creates regulatory vulnerabilities. The company's investment approach includes riskier assets that generate superior returns compared to Circle's conservative cash and Treasury bill strategy. However, these investments face increasing regulatory scrutiny as governments demand full collateralization with liquid assets, potentially forcing reserve restructuring that could reduce profitability. Network distribution strategies reflect different market priorities. Tether operates across multiple blockchain networks with particular strength on Tron and emerging networks where transaction costs remain low for retail users. Circle's multi-chain expansion through Cross-Chain Transfer Protocol focuses on institutional networks and regulated environments, creating complementary rather than directly competitive market positioning.

International expansion approaches diverge significantly. Tether's strategy emphasizes emerging markets, particularly in Latin America, Asia, and Africa where regulatory frameworks remain developing and dollar access is limited. Circle's expansion focuses on regulated jurisdictions with established financial infrastructure, targeting institutional customers rather than retail users seeking dollar access. The competitive dynamics suggest market bifurcation rather than winner-take-all outcomes. Tether's trader-focused, yield-maximizing approach serves crypto-native users prioritizing efficiency over compliance. Circle's institutional-grade, reversible transaction model targets traditional finance integration. These different value propositions create distinct market segments with limited direct competition.

Political developments could reshape competitive positioning. The Trump administration's crypto-friendly policies benefit both issuers but may favor different aspects of their strategies. Tether's political connections through Lutnick could provide regulatory protection, while Circle's compliance model aligns with the administration's emphasis on dollar-backed stablecoin promotion and Treasury demand generation. Market evolution trends suggest continued coexistence. Rising yield-bearing stablecoin adoption (414% surge reaching 3% of stablecoin markets) creates opportunities for both issuers' approaches. Tether's higher-yield strategy could capture yield-seeking users, while Circle's regulatory compliance could access institutional yield opportunities through traditional finance integration.

Technological differentiation becomes increasingly important. Tether's focus on low-cost transactions across diverse networks serves retail users prioritizing accessibility. Circle's Arc blockchain with reversible transactions, privacy features, and institutional integration serves enterprise users prioritizing compliance and risk management. These technical differences support market segmentation rather than direct competition. Long-term sustainability depends on regulatory evolution. Tether's model assumes continued regulatory arbitrage opportunities and international market access despite compliance costs. Circle's approach assumes regulatory requirements will expand globally, creating competitive advantages for early compliance. The success of each strategy depends on regulatory trajectory and institutional adoption rates.

The Tether-Circle competition thus represents broader tensions in cryptocurrency evolution between maintaining crypto-native principles and achieving mainstream institutional adoption, with market outcomes likely depending on regulatory developments and user preference evolution rather than technical superiority of either approach.

Systemic risks emerge from centralization, censorship, and trust vulnerabilities

Circle's reversible stablecoin experiment introduces unprecedented systemic risks to cryptocurrency infrastructure through centralization mechanisms, censorship vulnerabilities, and trust dependencies that could fundamentally undermine blockchain's value propositions and create new attack vectors for malicious actors.

Centralization risks concentrate power in ways antithetical to blockchain design principles. Arc's permissioned validator set chosen by Circle creates single points of failure where corporate decisions or external pressure could compromise network integrity. Unlike Bitcoin's global distributed mining network or Ethereum's proof-of-stake validators, Arc's institutional validators could face coordinated coercion from governments, regulators, or other powerful entities seeking to control transaction reversals.

The authority to determine transaction reversals creates unprecedented power concentration in Circle's corporate structure. While traditional blockchains distribute consensus across thousands of participants, reversible systems require centralized arbitration for disputed transactions. This arbitration power could become a tool for political control, corporate censorship, or discriminatory enforcement that undermines cryptocurrency's promise of neutral, permissionless finance.

Technical attack vectors multiply with reversible transaction mechanisms. Security researchers have identified nearly 200 blockchain-specific vulnerabilities, with approximately half undocumented in public databases. Adding reversibility layers creates additional smart contract complexity and potential failure points including reentrancy attacks on reversal mechanisms, oracle manipulation affecting reversal triggers, governance token attacks targeting reversal decisions, and novel time-based exploits during reversal windows.

"Reversal gaming" represents entirely new attack classes where malicious actors could exploit reversal mechanisms for double-spending or transaction manipulation. Unlike traditional blockchain attacks that require enormous computational resources or capital, reversal gaming could exploit social engineering, legal manipulation, or bureaucratic processes to achieve unauthorized transaction changes.

Government and corporate censorship abuse becomes systematically possible through reversible stablecoin infrastructure. The Federal Reserve Bank of New York's analysis of Tornado Cash sanctions demonstrates how easily blockchain systems face compliance pressure. Reversible stablecoins would be exponentially more susceptible to government-mandated reversals, corporate pressure for politically motivated changes, sanctions enforcement through transaction manipulation, and authoritarian applications enabling political transaction censorship and retroactive punishment through fund seizure.

Analysis of government surveillance systems, particularly in authoritarian contexts, demonstrates how centralized financial controls enable oppression. Reversible stablecoins could facilitate social credit system integration, political opposition defunding, and retroactive punishment mechanisms that transform financial infrastructure into tools of social control.

Trust dependencies undermine blockchain's fundamental value proposition. Blockchain technology's primary innovation eliminated the need to trust centralized intermediaries through cryptographic verification and distributed consensus. Reversible systems reintroduce trust requirements where users must rely on corporations, governments, and arbitrators to make fair, consistent, and non-political reversal decisions.

Moral hazard creation represents significant economic risk. Financial analysis identifies that "giving users the sense that transfers can be undone creates moral hazard" that could reduce transaction certainty and encourage riskier behavior. This psychological shift may reduce user diligence in transaction verification, increase fraud attempts by bad actors expecting reversibility, and undermine the careful security practices that blockchain systems require.

Systemic risk cascades could amplify throughout interconnected DeFi protocols. Research demonstrates how "a failure of a major stablecoin could trigger cascading liquidations across interconnected protocols." Reversible stablecoins could amplify these risks through uncertainty about transaction finality affecting automated protocols, reversal decisions creating unexpected market volatility, and loss of institutional confidence in cryptocurrency infrastructure reliability.

Implementation complexity creates multiple failure modes similar to those observed in algorithmic stablecoin collapses. Complex reversal decisions could deadlock governance systems or be captured by malicious actors. Smart contract bugs in reversal mechanisms could be exploited for large-scale theft. Oracle failures providing data for reversal triggers could be manipulated by sophisticated attackers. Legal and regulatory weaponization risks emerge from reversible infrastructure. Once reversal capabilities exist, governments and corporations may pressure for increasingly broad usage covering political dissent, competitive disputes, or ideological disagreements rather than genuine fraud cases. The precedent of transaction reversibility could expand government financial surveillance and control beyond current capabilities.

Privacy violations become systematic through reversal mechanisms. Investigating transaction disputes requires examining private financial information, potentially compromising user privacy for unrelated parties involved in complex transaction chains. This surveillance capability could be abused for non-financial monitoring and control purposes. Market fragmentation and user confusion could destabilize broader cryptocurrency adoption. If some stablecoins allow reversals while others remain immutable, users may make incorrect assumptions about transaction finality, leading to losses and reduced confidence in cryptocurrency systems generally. This confusion could slow mainstream adoption rather than accelerating it.

International regulatory conflicts could create operational chaos as different jurisdictions demand conflicting reversal requirements. Circle might face situations where reversing transactions to comply with one government creates violations in another jurisdiction, creating impossible compliance situations that threaten operational viability. Long-term trust erosion represents the greatest systemic risk. Cryptocurrency's success depends on users' confidence that the system operates according to transparent, predictable rules rather than arbitrary human judgment. Introducing reversibility mechanisms, even with safeguards, signals that these systems can be changed retroactively, potentially undermining confidence in all blockchain-based financial infrastructure.

These systemic risks suggest that reversible stablecoin experiments, while potentially solving some institutional adoption challenges, could create far larger risks to cryptocurrency's foundational value propositions and long-term viability as trustless, censorship-resistant financial infrastructure.

Future scenarios range from market bifurcation to regulatory capture

The long-term implications of Circle's reversible stablecoin experiment extend far beyond single company strategy, potentially reshaping the entire cryptocurrency ecosystem through market segmentation, regulatory evolution, and technological precedent-setting that could determine whether blockchain technology maintains its decentralized foundations or evolves toward institutionally controlled infrastructure.

Market bifurcation represents the most likely near-term outcome with institutional capital flowing toward reversible stablecoins for regulatory compliance while crypto-native users gravitate toward immutable alternatives for censorship resistance. This division would create parallel financial ecosystems serving different user bases with distinct values and requirements. McKinsey research suggests "early coexistence" between TradFi-compatible reversible systems, crypto-native immutable protocols, and hybrid models offering conditional reversibility with strict governance mechanisms.

The institutional adoption pathway could accelerate mainstream integration if Goldman Sachs' $77 billion USDC growth projection materializes alongside regulatory requirements mandating consumer protection features. EU MiCA regulations and U.S. GENIUS Act requirements already create framework precedents that could spread globally, effectively mandating reversibility for regulated stablecoin operations. This regulatory forcing function could make reversible features standard requirements rather than optional innovations.

Technical interoperability solutions could enable ecosystem coexistence through bridge protocols supporting both immutable and reversible stablecoins, atomic swap mechanisms allowing users to choose finality models based on specific transactions, and universal stablecoin standards accommodating different settlement characteristics. These solutions could prevent winner-take-all competition by enabling users to access both system types as needed.

Regulatory capture scenarios pose significant risks to cryptocurrency's foundational principles. Success of reversible stablecoins could establish precedent for broader blockchain control mechanisms including programmable compliance features in all cryptocurrency applications, government backdoors in smart contract systems, and centralized governance override capabilities across decentralized protocols. This precedent could transform blockchain technology from trustless infrastructure into government-controllable financial surveillance systems.

International regulatory conflicts could create operational complexity as different jurisdictions establish competing requirements for transaction reversibility, privacy protection, and surveillance access. Circle and similar issuers might face impossible compliance situations where satisfying one government's reversal demands creates violations in another jurisdiction, potentially fragmenting global stablecoin markets along regulatory boundaries.

Technological evolution precedents suggest broader industry transformation. Circle's approach could inspire similar "practical" compromises with blockchain principles across the ecosystem. Other cryptocurrency applications might adopt centralized override mechanisms, compliance-focused governance structures, and institutional-friendly features that prioritize regulatory approval over decentralization. This trend could fundamentally alter blockchain technology's value proposition.

Economic incentive realignment could reshape developer and user behavior. If institutional capital flows predominantly to compliant, reversible systems, developers may focus innovation on regulated protocols rather than censorship-resistant alternatives. Users seeking financial services might accept reversibility trade-offs for institutional integration benefits, gradually shifting ecosystem incentives away from decentralization priorities.

Cultural transformation risks accompany institutional adoption success. Cryptocurrency's cypherpunk origins emphasized individual sovereignty, privacy protection, and resistance to centralized authority. Mainstream success through institutional compliance could erode these cultural values, transforming cryptocurrency from revolutionary technology into digitized traditional finance with blockchain characteristics rather than fundamental alternatives to existing systems.

Network effects could determine long-term outcomes. If major institutions adopt reversible stablecoins for business operations, smaller users might be pressured to use compatible systems for interoperability. Conversely, if privacy-focused and DeFi applications maintain immutable requirements, institutional systems could face adoption limitations that reduce their competitive advantage.

Failure scenarios remain significant possibilities. Technical implementation challenges, governance failures, security vulnerabilities, or loss of community trust could cause reversible stablecoin experiments to collapse. These failures might discredit institutional crypto adoption attempts while validating immutable alternatives, potentially strengthening rather than weakening decentralized systems.

Hybrid evolution could produce compromise solutions combining elements of both approaches. Time-limited reversibility windows providing fraud protection without permanent controllability, opt-in reversal mechanisms requiring explicit user consent, or layered architectures maintaining base-layer immutability while enabling higher-level dispute resolution could satisfy both institutional requirements and crypto principles.

Global geopolitical factors could influence adoption patterns. Countries seeking financial sovereignty might prefer immutable stablecoins resistant to foreign government control, while nations prioritizing international integration might mandate reversible systems compatible with traditional banking. These geopolitical preferences could create regional adoption patterns that fragment global cryptocurrency markets.

Technological advancement could render current trade-offs obsolete. Zero-knowledge proofs, advanced cryptographic protocols, or novel consensus mechanisms could potentially provide consumer protection without sacrificing decentralization. These innovations could make current reversibility debates temporary challenges rather than permanent feature requirements.

The ultimate outcome likely depends on user preference evolution rather than technical or regulatory factors alone. If mainstream users prioritize convenience and institutional protection over sovereignty and censorship resistance, reversible systems could dominate through market demand. However, if users value blockchain's original promises of financial independence and trustless operation, immutable systems could maintain competitive advantage despite institutional pressure.

The next 24-36 months will prove critical as Circle's Arc blockchain launches, regulatory frameworks solidify, and market participants vote with capital allocation between reversible and immutable alternatives. The cryptocurrency ecosystem's future structure - centralized or decentralized, compliant or resistant, institutional or sovereign - hangs in the balance of this fundamental choice between blockchain principles and mainstream adoption requirements.

The defining choice between crypto principles and institutional adoption

Circle's reversible USDC experiment represents cryptocurrency's most consequential crossroads since Bitcoin's creation, forcing the ecosystem to choose between preserving its foundational principles of immutability and censorship resistance or compromising those values for institutional adoption and regulatory approval. This choice will determine whether blockchain technology fulfills its revolutionary potential as trustless, sovereign financial infrastructure or evolves into digitized traditional finance with programmable control mechanisms.

The technical innovation behind Arc blockchain demonstrates sophisticated engineering that addresses legitimate institutional concerns through deterministic finality, enterprise privacy features, and dollar-denominated transaction costs. Circle's approach acknowledges that pure immutability creates genuine challenges for error correction, fraud recovery, and consumer protection that traditional financial institutions cannot ignore. The company's success in achieving regulatory compliance and maintaining $65 billion in USDC circulation validates institutional demand for controlled, auditable digital dollar infrastructure.

However, the crypto community's visceral negative reaction reflects deeper concerns about sacrificing cryptocurrency's core value propositions for mainstream acceptance. The cypherpunk movement that birthed Bitcoin sought to create alternatives to centralized financial control, not more efficient versions of existing systems. Reversible transactions, regardless of sophisticated implementation, reintroduce the trust dependencies and centralized authority that blockchain technology was designed to eliminate.

The regulatory landscape clearly favors systems enabling transaction control through the GENIUS Act's reversibility requirements, MiCA's compliance frameworks, and international regulatory convergence around consumer protection mandates. Traditional financial institutions operate within these frameworks successfully and view reversible capabilities as essential risk management tools rather than philosophical compromises. The Trump administration's support for dollar-backed stablecoins creates political conditions favoring Circle's institutional approach.

Market forces suggest bifurcation rather than winner-take-all outcomes. Goldman Sachs' trillion-dollar market projections validate institutional stablecoin demand while decentralized alternatives like DAI maintain strong user bases among sovereignty-focused users. The $27.6 trillion in annual stablecoin transactions demonstrates massive scale that could support multiple approaches serving different market segments with distinct value propositions.

The systemic risks of centralized reversibility mechanisms cannot be dismissed through technical safeguards alone. History demonstrates that financial control tools, once created, inevitably expand beyond their original purposes through political pressure, regulatory mission creep, and authoritarian abuse. Reversible stablecoins could become infrastructure for financial surveillance and political control that transforms cryptocurrency from liberation technology into oppression tools.

Yet institutional adoption challenges are equally real. Irreversible transactions create unacceptable risks for banks, corporations, and consumers accustomed to error correction and fraud protection mechanisms. Without addressing these concerns through technical innovation or regulatory adaptation, cryptocurrency may remain a niche technology rather than global financial infrastructure capable of serving billions of users.

The philosophical stakes extend beyond stablecoin markets to cryptocurrency's cultural identity and long-term trajectory. Success of reversible systems could establish precedent for broader compromises with decentralization principles, gradually transforming blockchain technology into government-controllable infrastructure. Failure could validate purist positions while limiting mainstream adoption potential that crypto evangelists have long promised.

Multiple coexistence scenarios remain possible depending on technological development, regulatory evolution, and user preference changes. Bridge protocols could enable interoperability between immutable and reversible systems. Time-limited reversibility could provide consumer protection without permanent controllability. International regulatory fragmentation could create geographic market segmentation serving different sovereignty preferences.

The next 18 months will prove decisive as Circle's Arc blockchain launches, competing approaches mature, and institutions make fundamental technology choices that could lock in ecosystem direction for decades. The outcome will likely determine whether cryptocurrency achieves its original vision of trustless, censorship-resistant money or evolves into regulated digital infrastructure serving traditional financial system objectives.

This choice ultimately reflects broader tensions between individual sovereignty and collective security, innovation and stability, global access and regulatory compliance that define modern financial system evolution. Circle's experiment tests whether these tensions can be resolved through technical innovation or represent fundamental trade-offs requiring explicit value choices. The cryptocurrency community faces its defining moment. The decision to embrace institutional-friendly compromise or maintain purist principles will determine whether blockchain technology becomes the foundation for a new financial paradigm or merely improves efficiency within existing power structures. The stakes are nothing less than the future of money itself.

Circle's reversible USDC initiative may succeed in bridging traditional and decentralized finance, enabling mainstream adoption while preserving essential blockchain capabilities. Alternatively, it may represent the moment cryptocurrency lost its revolutionary soul in pursuit of institutional approval. History will judge whether this pragmatic evolution or philosophical betrayal proves correct, but the choice made in this critical period will echo through decades of financial system development to come.

The reverberations of this decision extend far beyond stablecoin markets to the fundamental question of whether human societies can create truly decentralized, censorship-resistant financial infrastructure or whether all monetary systems inevitably centralize under institutional and government control. Circle's experiment will provide crucial evidence for answering this existential question that shapes civilization's financial future.