Cryptocurrency and blockchain technology have steadily seeped into the strategies of the world’s most recognizable companies. In 2025, what once seemed a niche tech experiment has become a bona fide business tool for retail giants, luxury labels, automakers, social media platforms and more. From coffeehouse loyalty programs to high-end car purchases, big brands are exploring crypto in various forms across the globe.

A recent survey even found that 60% of Fortune 500 companies are actively working on blockchain initiatives. Many companies see digital assets as a way to engage customers, streamline payments, or gain an innovative edge. This comprehensive explainer will dive into how major brands are using crypto today – highlighting real-world examples, the motivations behind them, and the challenges encountered – all in an informative, analytical tone.

Not every foray has been a resounding success. Starbucks, for instance, launched an NFT-based rewards program with much fanfare, only to quietly wind it down within two years. On the other hand, Elon Musk’s Tesla helped put crypto on the corporate map by accepting Bitcoin for cars (a move later reversed) and embracing Dogecoin for merchandise. Across industries, similar stories abound: global brands experimenting with crypto payments, tokenized loyalty perks, NFTs for marketing, and even holding Bitcoin in treasury. While approaches differ, the common thread is that crypto is no longer solely the domain of fintech startups or cyberpunk enthusiasts – it’s now part of boardroom discussions at household-name companies.

In this article we examine several key arenas of brand crypto adoption: loyalty and rewards programs, accepting crypto as payment, brands issuing their own digital tokens or stablecoins, the boom (and bust) of branded NFTs and metaverse plays, and the role of financial and tech giants in bringing crypto to the masses. Throughout, we’ll provide context on why these companies jumped on the crypto bandwagon, how consumers have responded, and what roadblocks remain. The goal is a factual, unbiased deep dive into the state of big-brand crypto usage in 2025 – spanning Starbucks Rewards to Tesla token payments and far beyond.

Brewing Loyalty with Blockchain: Starbucks and the Tokenized Rewards Trend

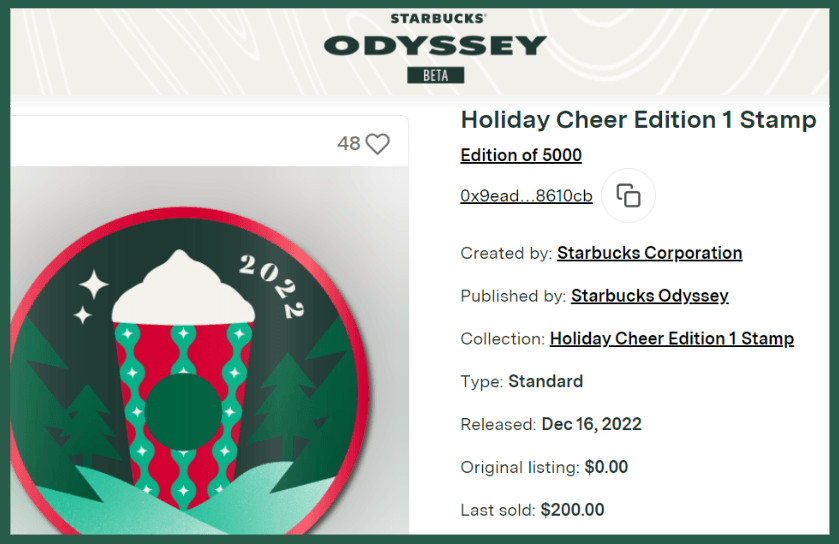

One of the most prominent attempts to merge crypto tech with a beloved consumer loyalty program came from Starbucks. In late 2022, the coffee chain rolled out “Starbucks Odyssey,” an extension of its popular Starbucks Rewards program that used blockchain-based tokens (NFTs) to gamify customer engagement. The idea was to let Starbucks customers earn collectible “stamps” as NFTs on the Polygon network by completing quizzes, making purchases, or engaging in online activities, and then redeem these for exclusive perks. It was an ambitious Web3 experiment by a mainstream brand known for innovation in loyalty marketing.

A Starbucks Frappuccino cup. The coffee giant ventured into crypto by launching a blockchain-based loyalty program called Odyssey in 2022, issuing NFT “stamps” to reward customer engagement. Despite initial excitement in tech circles, the Odyssey pilot was short-lived. On March 15, 2024, Starbucks announced it would shutter the Odyssey beta by month’s end. The company did not publicly cite a specific reason, saying only that it was “preparing for what comes next” in evolving its loyalty efforts. However, analysts pointed to a few likely factors. For one, Starbucks had launched Odyssey just as the frothy NFT market of 2021–22 was cooling dramatically. By 2023, average consumers were far less enthused about buying or earning NFTs than they had been during the hype peak. “Starbucks was simply too late to the NFT trend, given that the value of NFTs had already plummeted by the time of launch,” one marketing analysis noted. More fundamentally, Odyssey may have violated a cardinal rule of customer loyalty programs: keep it simple. Starbucks Rewards’ classic formula of “buy coffee, earn stars, get free drinks” is straightforward and wildly successful. In contrast, Odyssey introduced a complex dual system of NFT stamps and “Odyssey Points,” with various ways to obtain and trade them. For the average Starbucks patron, the value proposition became murky. As one loyalty expert observed, “Customers want easy, seamless experiences… [Odyssey] was a lot of hoops to jump through”.

While Starbucks’ NFT experiment didn’t go as planned, it wasn’t a complete loss. The company managed to test novel ways of “driving community and loyalty” and has said it is grateful for the learnings, hinting that the concept may return in a refined form later. Indeed, Starbucks wasn’t alone in probing blockchain for loyalty. Airline giant Lufthansa launched a similar NFT-based loyalty program called Uptrip in 2023, also on Polygon, letting passengers collect digital trading card NFTs for flights and trade them in for perks like lounge access or bonus miles. The airline reported over 20,000 early users who collected more than 200,000 digital cards during a soft launch. Other travel and hospitality brands have eyed tokenized rewards as well, seeing potential to increase engagement or even allow point exchanges between programs via blockchain. The broader vision is that one day your airline miles, hotel points, or coffee shop rewards might live as interoperable tokens in your digital wallet, increasing liquidity and utility. For example, in El Salvador – which adopted Bitcoin as legal tender – Starbucks’ local stores even accepted Bitcoin payments directly for coffee purchases, blurring the line between loyalty currency and actual currency.

Crucially, any such innovation must add value for customers without confusing or alienating them. The lesson from Starbucks Odyssey is that novelty alone isn’t enough – a crypto-powered loyalty program has to be as intuitive as the traditional systems consumers know. Simplicity and clear benefits remain paramount. As enthusiasm for NFTs cooled, some companies scaled back similar projects; GameStop, for instance, closed its NFT marketplace in 2023 amid wider cutbacks. Even Meta (Facebook/Instagram) abruptly ended its short-lived NFT features by 2023 after initially integrating them. Still, loyalty and marketing remain fertile ground for blockchain. Reddit’s Collectible Avatars (free NFT profile pictures on Polygon) quietly onboarded millions of users to Web3 by rebranding NFTs as just “digital collectibles.” And brands like Nike – which acquired digital fashion studio RTFKT – have built thriving communities around collectible NFT sneakers and apparel, blending loyalty with direct revenue. Nike’s various NFT drops (from CryptoKicks sneakers to virtual jerseys) have generated over $185 million in revenue for the company, making it the most successful brand in the NFT space by far. For comparison, other fashion leaders like Dolce & Gabbana, Tiffany & Co., Gucci and Adidas each made on the order of $10–25 million from their NFT initiatives in 2022 – a fraction of Nike’s haul, but still significant. These figures underscore that with the right strategy, NFTs can become a meaningful new channel for brand engagement and sales.

In summary, loyalty programs have proven to be an intriguing, if challenging, application for crypto. Starbucks’ high-profile foray showed both the promise (deepening fan engagement with exclusive rewards) and the pitfalls (complexity and waning interest) of tokenized loyalty. As we move forward, brands may incorporate blockchain in more behind-the-scenes ways – for instance, using tokens under the hood while presenting a familiar interface to users. The key will be delivering clear value. If customers can barely notice the “crypto” and simply enjoy new benefits or flexibility, brand loyalty could indeed be one avenue where crypto quietly goes mainstream.

Paying with Cryptocurrency: From Teslas to Big Macs

Perhaps the most straightforward way brands have embraced crypto is by accepting digital currencies as payment for goods and services. The movement started slowly – a few tech-forward companies like Microsoft and Overstock began taking Bitcoin back in the mid-2010s – but gained major momentum in 2021 when Tesla made a splash with Bitcoin. In February 2021, Tesla revealed it had bought $1.5 billion in Bitcoin and planned to accept BTC for its electric vehicles, fueling a crypto market frenzy. True to word, Tesla briefly enabled Bitcoin payments for new cars that spring. However, this bold experiment was soon paused: CEO Elon Musk halted Bitcoin payments in May 2021, citing concerns over the environmental impact of Bitcoin mining. The reversal illustrated a core challenge for crypto payments – volatility and ESG concerns – which have made many blue-chip companies hesitant to adopt Bitcoin for everyday commerce.

Yet Tesla did not abandon crypto altogether. In a lighter-hearted pivot, Musk’s company turned to Dogecoin, the meme-inspired cryptocurrency, as a payment option for Tesla merchandise. In January 2022, Tesla began accepting Dogecoin for items in its online shop – everything from a “Giga Texas” belt buckle to the novelty Cyberwhistle. The announcement sent Dogecoin’s price up 14% and demonstrated Musk’s unique influence over crypto markets. On Tesla’s website, prices for select merch were listed in DOGE, and users could connect a Dogecoin wallet to pay. “Tesla only accepts Dogecoin,” the company clarified, warning that any other crypto sent to its addresses would be lost. This playful integration (Dogecoin started as a joke, after all) resonated with Tesla’s tech-savvy fanbase – an analyst noted that Dogecoin-priced goods were selling out even faster than those priced in dollars, calling it “an illustration of crypto's continued penetration of corporate culture”. As of 2025, Tesla’s Dogecoin experiment is still ongoing – you can buy a t-shirt or mug with DOGE – but the company has not resumed Bitcoin payments for vehicles, nor expanded to other cryptocurrencies. In fact, Tesla disclosed in 2022 that it sold about 75% of its Bitcoin holdings (while retaining some), indicating a cautious stance toward crypto on its balance sheet. Musk, however, remains a vocal crypto proponent personally, and has hinted that in the future Twitter (now renamed X under his ownership) could integrate crypto payments – possibly another avenue where Tesla’s influence may show up in fintech.

Tesla’s mixed journey aside, many other household-name brands have dipped their toes into crypto payments. Perhaps surprisingly, a luxury automaker has been among the most aggressive: Ferrari. In late 2023, Ferrari announced it had started accepting cryptocurrency for its high-end sports cars in the U.S., and planned to roll out crypto payments to European dealers in 2024. The decision came “in response to requests from the market” – in other words, Ferrari’s wealthy clients asked to pay in crypto. “Many of [our] clients have invested in crypto,” explained Ferrari’s marketing chief, noting that some are young entrepreneurs who built fortunes in crypto, while others are traditional investors seeking portfolio diversification. Through payment processor BitPay, Ferrari buyers can now purchase a car with Bitcoin, Ethereum, or USDC stablecoins. Importantly, the prices are still denominated in fiat (no crypto price fluctuation), and BitPay instantly converts the crypto to euros or dollars for the dealer, shielding Ferrari from volatility. “No fees, no surcharges if you pay through cryptocurrencies,” Ferrari emphasized, as they wanted the experience to be as seamless as a normal sale. The company also addressed environmental concerns head-on: Ferrari noted that major coins are becoming more energy-efficient (Ethereum’s move to proof-of-stake, etc.) and said accepting crypto does not compromise its carbon neutrality goals for 2030. In essence, Ferrari identified a genuine customer demand – crypto-rich buyers – and found a way to serve it within regulatory and sustainability guardrails. By mid-2024, the iconic prancing horse logo was posted at some dealerships alongside notices that Bitcoin and Ethereum are accepted here. It’s a striking image of crypto’s normalization that a person can walk into a showroom and drive out in a six-figure Ferrari paid for with cryptocurrency.

A barber shop in El Salvador advertises that Bitcoin is accepted for haircuts. After El Salvador made Bitcoin legal tender in 2021, global brands like McDonald’s and Starbucks had to begin accepting Bitcoin at their outlets in the country. Beyond headline-grabbing cases like Tesla and Ferrari, everyday retail and food brands have also warmed to crypto payments, often through third-party facilitators. Fast-food giants including McDonald’s, Subway, and Starbucks started accepting Bitcoin in El Salvador in 2021 due to that nation’s Bitcoin Law, which required all businesses to take BTC alongside the U.S. dollar. Videos of Salvadorans buying Big Macs or lattes with lightning-fast Bitcoin transactions went viral, highlighting that even conservative multinationals can adapt when local regulations demand. In other countries, adoption has been voluntary: Starbucks in the U.S. partnered with Bakkt in 2021 to let customers convert crypto to load their Starbucks Card (indirectly spending crypto on coffee), and some Subway sandwich franchises in Europe now accept Bitcoin via Lightning Network. In 2022, several luxury fashion houses like Gucci and Balenciaga announced select boutiques would take crypto payments, largely targeting high-net-worth clientele and partnering with payment providers (e.g. BitPay) to handle conversion. AMC Theatres, a well-known movie chain, rolled out online crypto payments for tickets and concessions, allowing Bitcoin, Ether, Dogecoin, and other coins via a mobile wallet app integration. Even e-commerce players have inched forward: Shopify enables thousands of independent merchants to accept crypto by integrating with gateways, and Overstock.com (a pioneer since 2014) still accepts and holds various cryptos.

Still, it’s important to stress that crypto payments in 2025 remain a niche slice of overall transactions. The majority of big brands do not yet accept Bitcoin or other tokens directly for mainstream sales. Volatility is one barrier – no CFO wants to see yesterday’s $50,000 car payment in Bitcoin turn into $40,000 or $60,000 by quarter’s end. Regulatory uncertainty is another, especially in the U.S., where rules on treating crypto in commerce and handling taxes are complex. And consumer demand, while growing, is not overwhelming; most shoppers still find credit cards or mobile payments more convenient than fumbling with a crypto wallet QR code at checkout. The patchy adoption so far tends to follow either (a) marketing PR opportunities – e.g., accepting Dogecoin garnered Tesla free headlines and endeared it to crypto fans – or (b) genuine use-case fits, such as serving crypto-heavy customer segments (Ferrari’s case) or enabling cross-border customers to pay easily. In the latter category, stablecoins are emerging as a compelling tool. A stablecoin like USDC or USDT (tied 1:1 to the dollar) removes the volatility issue while still offering the advantages of crypto – fast, irreversible, low-fee transactions globally. We’re now seeing payment processors and credit card networks integrate stablecoin support, heralding a future where crypto works behind the scenes. For example, Visa has been piloting USDC stablecoin settlements with merchant acquirers, even leveraging faster blockchains like Solana to improve speed. Mastercard likewise has partnered with crypto firms (such as a collaboration with MoonPay) to allow crypto-to-fiat conversion within its network. These efforts are largely invisible to end customers but indicate that payment giants are preparing for a world where stablecoins and CBDCs could be routine in commerce. In markets with high inflation or unstable banking, stablecoins are already used by millions for everyday purchases via local fintech apps – a trend global brands cannot ignore if they want to tap those consumer bases.

In summary, paying with crypto has gone from a quirky publicity stunt to a realistic option in certain contexts by 2025. You likely still can’t pay your Netflix or Amazon bill in Bitcoin directly, but you can buy a airline ticket on AirBaltic with crypto, purchase electronics on Newegg or Rakuten using Bitcoin, or book a hotel via agencies like Expedia (through partners) accepting crypto. As regulatory clarity improves and stablecoin usage grows, more companies are expected to integrate crypto payments, especially online where the technical integration is simplest. The endgame may not be everyone paying for coffee in Bitcoin, but rather crypto operating under the hood – for instance, a customer pays in dollars as usual, but the merchant might receive an instant stablecoin settlement that avoids card fees. In effect, crypto could streamline payments infrastructure while the front-end experience remains familiar. Brands that have begun accepting crypto today are gaining early insight into this new payments landscape, positioning themselves for a time when digital currencies could be as unremarkable a payment method as Apple Pay or PayPal.

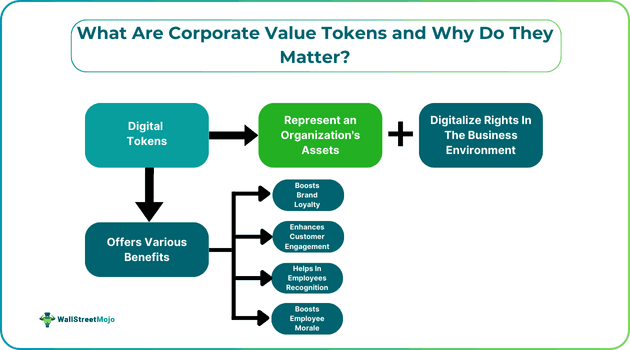

Big Brands Issuing Coins: Corporate Tokens and Stablecoins

While some companies are content to accept existing cryptocurrencies, others have taken a step further – creating or considering their own crypto tokens. This can be a delicate endeavor, raising regulatory eyebrows (as Facebook’s ill-fated Libra project demonstrated), but 2025 has seen a few notable moves on this front. The most high-profile example is PayPal, the American fintech giant, which in August 2023 launched its very own U.S. dollar-pegged stablecoin called PayPal USD (PYUSD). This marked the first time a major U.S. financial brand issued a stablecoin. PayPal’s coin is issued in partnership with Paxos (a regulated blockchain company), fully backed by cash reserves, and designed for seamless use in PayPal’s network. The idea is that PayPal’s 400+ million users could eventually send, spend, or transfer money instantly using PYUSD – for example, a customer might use PYUSD to pay a merchant, who instantly converts it to local currency, with lower fees and faster settlement than traditional card processing. As of 2025, PayPal’s stablecoin is still gaining traction, but it signals a broader trend: trusted consumer brands leveraging stablecoins to enhance payments.

Other tech behemoths have stablecoin ambitions too. According to a June 2025 report, at least four Silicon Valley titans – Apple, Google, X (Twitter), and Airbnb – have been exploring stablecoin integration as a way to lower transaction fees and improve cross-border payments. Each is at a different stage: Google appears furthest along, reportedly already facilitating some stablecoin payments internally. Airbnb has been in talks with payment processors about using stablecoins to cut the hefty fees it and its hosts pay to credit card networks. And Elon Musk’s X (formerly Twitter) has been quietly obtaining money transmitter licenses across U.S. states, laying groundwork for a payments feature that could include crypto – Musk has openly mused about using Dogecoin or other crypto within X’s envisioned “everything app”. Apple, famously secretive, hasn’t announced anything public, but insiders suggest Apple is evaluating how stablecoins might reduce the ~3% interchange fees on its App Store and Apple Pay transactions. The attraction is clear: stablecoins could allow near-instant settlement of payments at virtually no cost, saving companies and consumers billions in fees. Stablecoins have arguably become crypto’s first mainstream use case, with global stablecoin market capitalization soaring 90% from January 2024 to mid-2025 (from $131 billion to about $249 billion in circulation). When Stripe – one of the largest online payment processors – acquired a stablecoin startup in late 2024 for $1+ billion, Fortune called it the “starting gun” for Silicon Valley to take stablecoins seriously.

That said, regulators are watching closely when Big Tech and big finance dabble in issuing currency-like tokens. In the U.S., Congress has been debating the “Stablecoin GENIUS Act” (Guiding and Establishing National Innovation for U.S. Stablecoins Act) to lay down rules for stablecoin issuers. Lawmakers have expressed unease at the notion of tech giants effectively creating private money that could compete with the dollar’s role. There’s talk of adding provisions to ban Big Tech firms from issuing their own stablecoins, forcing them instead to use regulated third-party coins like USDC or USDT. Memories of Facebook’s Libra (later Diem) project loom large – in 2019, Facebook unveiled plans for a global stablecoin governed by a consortium, but backlash from central banks and politicians was swift and severe. By early 2022, the Diem project was wound down without launch, serving as a cautionary tale. Apple and Google have no desire to repeat that political firestorm. Thus, their approach seems to be to partner or use existing coins rather than launch an “AppleCoin” outright. Airbnb’s CEO Brian Chesky once hinted at crypto integration after thousands of customers requested it, but any proprietary token from Airbnb would raise securities questions, so supporting established crypto assets is the likely route.

Outside of stablecoins, some brands have toyed with bespoke tokens for customer use. For instance, fashion brand LVMH (Louis Vuitton Moët Hennessy) helped develop a private blockchain (Aura) to track luxury goods and considered tokenizing those products, though not a public crypto per se. Fan tokens issued by sports teams (like FC Barcelona’s $BAR or Paris Saint-Germain’s $PSG tokens on the Socios platform) show how brands can create their own digital assets to monetize fan engagement globally. These fan tokens often grant holders voting rights on minor club decisions or access to VIP perks, effectively functioning as a cross between loyalty points and mini cryptocurrencies. By 2025, dozens of major sports brands – from European football clubs to Formula 1 teams – have launched such tokens. The reception has been mixed: while they do generate revenue and engagement, critics argue that fan tokens are highly volatile and many fans don’t fully understand the financial risk (especially when teams underperform and token prices drop). Nonetheless, they represent a new way brands are minting value from their communities via crypto.

It’s worth noting another form of corporate crypto asset: the NFT membership or “digital twin” token. We touched on loyalty NFTs earlier with Starbucks, but beyond loyalty, some brands have issued NFTs tied to physical products or VIP memberships. For example, Porsche released NFT digital art linked to its iconic 911 model (though a poorly received launch in early 2023 highlighted the importance of understanding the NFT community’s expectations). Budweiser and Coca-Cola have both dropped limited-edition NFTs for marketing campaigns – Budweiser sold NFT beer can designs, and Coca-Cola auctioned NFTs with special experiences attached, often for charity. These aren’t fungible “coins” per se, but they indicate brands creating digital assets unique to their identity. In the realm of metaverse and gaming, tokens and virtual currencies have also been used by brands: e.g., Nike’s RTFKT might issue tokens within a virtual sneaker game, or Starbucks may yet return with a more refined blockchain-based reward token after Odyssey, perhaps one not even marketed as an NFT to users.

Lastly, we should mention how corporations are increasingly stockpiling existing cryptocurrencies on their balance sheets, effectively issuing themselves a crypto exposure. This isn’t creating a new coin, but it’s a significant trend of brands treating crypto as a strategic asset. We saw the beginning with Tesla’s big Bitcoin buy in 2021. Now in 2025, public companies hold a record amount of crypto: by Q1 2025, publicly traded firms held over 688,000 BTC combined (over 3% of all Bitcoin), a 16% increase from the previous quarter. These include not just crypto-centric firms but retailers like GameStop, which in May 2025 disclosed a purchase of 4,710 BTC (over $500 million worth at the time) as part of its new corporate investment policy. GameStop’s embrace of Bitcoin – raising funds to build a BTC treasury – shows how even companies outside finance see crypto as a reserve asset to potentially hedge inflation or ride an anticipated price upswing. The fear of missing out is palpable: when one company publicly profits from a crypto bet (as MicroStrategy famously did, or GameStop hopes to), competitors wonder if they should follow. It’s gotten easier for firms to hold crypto now that accounting rules have changed to allow marking assets at fair value (so companies can report gains when crypto prices recover, not just impairments when they fall, as was the case under old rules). This removal of an accounting headache in late 2024 has made CFOs more open to dipping into Bitcoin. Still, not everyone is convinced – Meta’s shareholders voted down a proposal to add Bitcoin to the balance sheet, and similar shareholder ideas at Amazon and Microsoft were also rejected. Many executives remain wary of crypto’s volatility and regulatory uncertainties.

In conclusion, some of the world’s biggest brands are indeed venturing to issue or adopt crypto assets in-house, whether stablecoins for payments, community tokens for fans, or NFTs for product experiences. The overarching strategy is to harness what crypto offers (speed, global reach, engagement, or store-of-value) without running afoul of laws or alienating users. It’s a delicate balancing act. Those companies that succeed – such as PayPal with a well-regulated stablecoin, or Nike with culturally resonant NFTs – are often those that partner with crypto-native firms and focus on real user value. Those that misstep (Facebook’s Libra, or a poorly executed token drop) serve as cautionary examples that in the crypto space, even big brands must earn trust and navigate a complex regulatory maze.

NFTs and the Metaverse: Branding in the Digital Age

No discussion of brands using crypto is complete without examining the NFT (non-fungible token) boom and “metaverse” strategies that swept through corporate marketing departments in the early 2020s. At the height of NFT mania in 2021–2022, it seemed every brand – from fast food to high fashion – was scrambling to release some kind of digital collectible. The rationale was clear: NFTs offered a new medium to engage younger, digitally native audiences and unlock revenue from purely digital goods. By 2025, the initial hype has tempered, but many brands have established enduring NFT-based initiatives or at least gained valuable experience from pilot projects.

The fashion and luxury sector has been particularly active. We noted earlier Nike’s massive success through RTFKT, which has effectively positioned Nike as a leader in digital wearable collectibles. Rival Adidas jumped in with its own NFT collaboration in late 2021, partnering with popular collections like Bored Ape Yacht Club and others to launch the “Into the Metaverse” NFT series. Adidas sold thousands of NFTs that granted holders exclusive streetwear merchandise and access to online metaverse experiences, signalling that even a 70-year-old apparel brand can reinvent some marketing via blockchain. Gucci likewise made waves: it not only began accepting crypto at some stores, but also issued branded NFTs and bought virtual land in The Sandbox metaverse to create a Gucci-themed digital environment. By 2023, Gucci had partnered with Yuga Labs (the Bored Ape creators) on a project, invested in an NFT marketplace, and released luxury NFTs like the Gucci “Superplastic” collectibles, underscoring that high-end brands see NFTs as an extension of their storytelling and exclusivity in the digital realm.

Luxury conglomerate LVMH launched several experiments: Louis Vuitton created “Louis: The Game” in 2021, a mobile game with embedded NFTs celebrating its founder’s bicentennial, and LVMH’s blockchain platform Aura (developed with Prada and Cartier) aims to issue NFT certificates of authenticity for luxury goods. Even jewelry got involved – Tiffany & Co. in 2022 sold an ultra-exclusive set of NFTs called “NFTiffs” that came with real diamond pendants for CryptoPunk owners, merging digital and physical luxury. Though only 250 NFTiffs existed (priced at 30 ETH each, around $50,000 at the time), they sold out quickly, demonstrating crypto’s reach into the upper echelons of consumerism.

In entertainment, major franchises and media companies hopped on the NFT train. Disney licensed its characters for NFT collectibles on platforms like VeVe, dropping limited edition Marvel and Star Wars digital figurines that fans could buy, trade, and display in augmented reality. Warner Bros. released NFTs for The Matrix and even a special NFT version of “The Lord of the Rings” (bundling the film in 4K with collectible extras). These were exploratory moves to test consumer appetite for owning digital versions of beloved content. Sports leagues too found success: the NBA’s Top Shot platform, launched in 2020, turned highlight clips into NFTs and became one of the first breakout hits with mainstream fans, at one point reaching over a million users trading basketball “moments.” By 2025, while Top Shot’s volume is lower than its peak, the NBA and partner Dapper Labs proved that fans will embrace digital collectibles if they are fun and easy to use (Top Shot’s credit-card friendly, custodial model meant users didn’t even need to understand blockchain). The NFL, MLB, and other leagues soon followed with their own NFT marketplaces for moments and memorabilia.

Meanwhile, brands like Coca-Cola, Pepsi, Burger King, and McDonald’s leveraged NFTs mostly as short-term promotions. Coca-Cola auctioned unique NFTs (like a “Friendship Loot Box” of digital goodies) for charity in 2021, raising money while getting positive PR. Pepsi released “Mic Drop” NFTs – cartoon microphones – free to users, linking its brand to NFT culture. Burger King ran a 2021 campaign “Burger King Real Meals” with NFT collectibles and even rewards like a year of Whopper sandwiches for NFT holders, tying crypto into its marketing playbook. McDonald’s China issued 188 NFT art pieces in 2021 to commemorate an anniversary, and McDonald’s U.S. created limited McRib NFTs as prizes for fans. These efforts were often gimmicky, but they showed how even the biggest mass-market food brands were experimenting with crypto-based customer engagement.

The metaverse buzzword also drove brands to crypto-adjacent initiatives. Companies ranging from Walmart to Samsung to Nike built virtual storefronts or experiences in metaverse platforms like Decentraland and Roblox. While not all metaverse projects use blockchain (Roblox, for example, is a closed system), the concept of selling virtual goods and attire often involves NFTs. Ralph Lauren and Zara launched virtual clothing collections; Balenciaga designed skins for Fortnite; and as mentioned, Nike’s Nikeland in Roblox and Gucci’s Sandbox world were ways to plant a flag in the coming immersive internet. The long-term value of these moves remains to be seen – skeptics note that active user numbers in decentralized metaverse worlds are still tiny – but brands view it as a learning investment. Should a true metaverse economy take off, they want to be ready with their intellectual property and digital products integrated. It’s akin to the early days of social media, when brands cautiously set up Facebook pages “just in case” it became important (and indeed it did). Crypto elements like NFTs give users actual ownership of virtual items, which could make branded digital goods more meaningful (and tradable) than traditional in-game purchases.

It hasn’t all been smooth sailing. Consumer backlash has at times greeted brand NFT efforts, especially from communities worried about scams or environmental impact. For instance, when Ubisoft, the video game publisher, introduced NFT items in one of its games in 2021, it faced severe pushback from gamers who saw it as a cash grab, leading Ubisoft to scale back those plans. Environmental critiques of NFTs (mostly during the era before Ethereum’s merge to proof-of-stake) made some brands hesitate, though with Ethereum’s energy use down ~99% after September 2022, that particular concern has eased. There’s also the simple risk of trend-chasing: critics quip that some companies jumped into NFTs without a clear reason why, other than FOMO on a hot topic. Starbucks’ Odyssey, as Fast Company presciently observed at launch, raised the question: “Has Starbucks thought through the why behind this initiative, or is it just chasing a trend?”. In some cases, the answer was indeed that the strategy wasn’t fully baked for the target customer.

Now in 2025, the NFT market is far cooler than during the frenzy. Trading volumes for NFTs are a fraction of what they were at the height of speculative mania. Many NFT collections dropped in value; the average consumer might not talk about NFTs at dinner anymore. But quietly, brands have integrated the technology in more pragmatic, less hype-driven ways. We’ve discussed loyalty programs and digital collectibles that emphasize utility or fandom rather than quick profit. Brands are also using NFTs for ticketing (e.g., some events issue NFT tickets that double as digital memorabilia and can combat counterfeiting) and for customer relationship management (imagine a car company giving each buyer an NFT “digital twin” of their vehicle that logs its maintenance history on blockchain). These subtle uses don’t grab headlines like million-dollar NFT art sales did, but they may have more staying power.

Overall, big brands’ exploration of NFTs and the metaverse represents a new chapter in branding – one where ownership and participation by the consumer is enhanced. If you own a brand’s NFT, you’re not just a customer but part of a club (as Adidas NFT holders felt), and you might even profit if that NFT rises in value due to the brand’s success. This flips the script on traditional brand-consumer relationships and is one reason many believe Web3 could profoundly change marketing. For now, we see a spectrum of engagement: some companies have pulled back (shuttering NFT projects that didn’t resonate), while others double down (Nike creating an entire platform, .SWOOSH, to bring sneakerheads into the Web3 fold). As technology and consumer attitudes evolve, brands will likely continue to recalibrate their crypto strategies, separating meaningful innovations from mere novelties.

Financial Titans Bridging Crypto: Wall Street and Beyond

In addition to individual retail brands and entertainment companies, it’s notable how financial industry heavyweights and infrastructure providers have embraced crypto by 2025 – often enabling the broader participation of other brands. Payment networks, banks, and fintech apps form the connective tissue between the crypto world and everyday commerce, so their crypto adoption has a multiplier effect. We’ve touched on Visa and Mastercard incorporating stablecoins and partnering with crypto startups. These companies spent decades building trust and ubiquity in payments, and now they’re ensuring they won’t be left out as crypto transactions grow. In early 2023, despite the “crypto winter” sentiment, both Visa and Mastercard stated they remain committed to integrating crypto – contradicting a news report that suggested they might pause such efforts. By late 2024, Visa expanded its stablecoin settlement pilot to more partners, even adding support for Euro-denominated stablecoin EURC in addition to dollar coins. Their vision is clear: if a merchant wants to be paid in, say, USDC instead of dealing with bank wires, Visa’s network could handle that seamlessly one day.

Mastercard launched a program called “Crypto Secure” to help banks assess the risk of crypto transactions and allow compliance-friendly crypto card offerings. They also rolled out Mastercard Crypto Credentials, a set of standards to verify blockchain addresses and combat illicit transactions – showing that the traditional financial world is actively addressing the pain points (security, compliance) that kept many institutions away from crypto. In 2023, Mastercard even offered NFT debit cards in partnership with web3 companies, enabling NFT holders to spend against their NFT assets. These kinds of innovations blur the line between old and new finance.

Global banks and investment firms likewise have moved from research to action. Fidelity and BlackRock, for instance, have opened up crypto investment options for clients. Fidelity in late 2022 allowed retail brokerage customers to trade Bitcoin and Ether, and put Bitcoin into some 401(k) retirement plans (with employer permission). BlackRock, the world’s largest asset manager, not only launched private Bitcoin trusts for institutions but also filed for a spot Bitcoin ETF in 2023, which, if approved, would be a landmark in legitimizing crypto investment. By 2025 there’s optimism that a U.S. Bitcoin ETF and perhaps Ether ETF might finally be available, potentially unlocking a wave of more traditional companies and pensions allocating a small percentage to crypto.

Meanwhile, BNY Mellon, the oldest U.S. bank, began offering crypto custody for institutional clients, and Nasdaq planned a crypto custody service as well – signaling that holding crypto securely (for other brands or investors) is a lucrative new business. JPMorgan, whose CEO once bashed Bitcoin as a fraud, created its own JPM Coin for internal settlements and has a whole blockchain division (Onyx) working on projects like tokenizing traditional assets. The bank even used public blockchain in 2022 to trade tokenized bonds on Polygon, showing a pragmatic willingness to use whatever tech works best. Goldman Sachs set up a crypto trading desk and has structured derivatives tied to crypto for clients. In Europe and Asia, many large banks and exchanges – from London Stock Exchange to Singapore’s DBS – have launched digital asset trading platforms or tokenization pilots for bonds, carbon credits, and more.

Why does this matter for big brands broadly? Because the involvement of these financial titans makes it easier and safer for non-crypto-native companies to dip into crypto. A mid-size retail chain might not know how to directly hold Bitcoin, but with banks now offering custodial services, they could do so through a trusted partner. A corporate treasury could buy a Bitcoin ETF one day as easily as buying gold or a stock index fund. If a brand wants to pay suppliers or creators via stablecoin to get faster settlements, soon their bank or Visa could enable that under the hood. Essentially, Wall Street and the payments industry are smoothing the on-ramps and off-ramps for crypto, which has been a major missing piece.

Additionally, fintech apps that millions use daily have normalized crypto over the past few years. Cash App (Block, formerly Square) let users buy Bitcoin since 2018 and integrated Lightning Network withdrawals by 2022, so you can send Bitcoin instantly to anyone. Venmo and PayPal brought easy crypto buying to their massive user bases in 2021. Revolut in Europe, Robinhood, SoFi, Webull, and others – all have made crypto a tab in their apps alongside stocks and savings accounts. This means the average consumer who may trust a familiar brand (their bank or brokerage) can access crypto without venturing onto a specialized exchange like Coinbase. Indeed, a recent Coinbase-sponsored survey found one-third of U.S. small and mid-sized businesses now use crypto, double the number from a year prior, attributing part of this rise to easier access via fintech tools. And among large firms, 20% of Fortune 500 executives said on-chain crypto initiatives are a core part of their strategy going forward.

What’s holding some back? Primarily regulatory uncertainties and reputational risk. The U.S. regulatory climate, for example, has been ambiguous, with the SEC cracking down on some crypto products and Congress yet to pass comprehensive crypto laws (though efforts are underway). 90% of Fortune 500 executives surveyed said clear crypto regulation is needed to support innovation, underscoring that many companies are in “wait-and-see” mode until rules of the road are established. In Europe, the new MiCA regulation (Markets in Crypto-Assets) was approved in 2023 and will start applying in 2024–25, giving a single set of rules across EU nations. This clarity could make European brands more comfortable rolling out crypto-related services, knowing what’s allowed. We might thus see more European companies accepting crypto or issuing tokens (perhaps a luxury brand in Paris or a carmaker in Germany launching a pilot) once MiCA is in effect.

Another consideration is the environmental and social governance (ESG) aspect, which is significant for publicly listed brands. Bitcoin’s energy usage has often been criticized, and companies with ESG mandates have steered clear of associating with it. However, improvements are happening: Bitcoin mining is gradually shifting to renewable sources in some regions, and initiatives exist to certify “green” mined coins. Ethereum’s switch to proof-of-stake in 2022 eliminated the bulk of NFT energy complaints, meaning brands using Ethereum or Polygon can honestly say their blockchain transactions are now very low-carbon. Ferrari’s comments about crypto reducing its footprint and not derailing Ferrari’s carbon-neutral goals highlight how brands are reconciling crypto with sustainability messaging. Expect more of this narrative as companies align their crypto usage with ESG commitments, e.g. only accepting coins mined with clean energy, or buying carbon offsets for blockchain activity.

Challenges and Conclusion: The Road Ahead for Brands and Crypto

As we’ve seen, by 2025 a broad array of major brands have ventured into the crypto universe in one form or another – from Starbucks trying NFT rewards, to Tesla dabbling in token payments, to Nike and Gucci selling digital collectibles, to PayPal minting its own stablecoin. This mainstreaming of crypto in corporate strategy would have been hard to imagine just five years ago. Yet it’s not been a uniformly smooth ride, and many experiments are exactly that: experiments. Brands are still feeling out how best to leverage blockchain tech to meet their business goals without falling into the traps of hype or backlash.

One challenge is consumer education and reception. While crypto awareness is high in 2025, understanding remains shallow for many. A loyalty program like Starbucks Odyssey might have been too far ahead of its average customer’s comfort level. For crypto initiatives to succeed, brands often have to “abstract away” the crypto part – making the user experience so simple that a user might not even realize blockchain is under the hood. Reddit did this effectively with its Collectible Avatars; Starbucks may have learned it needs to do the same if it revisits blockchain rewards (for example, calling them digital stamps and handling all the wallet stuff behind scenes). In contrast, some brands explicitly targeted the crypto-savvy niche – luxury car makers or high-fashion NFT drops aimed at the overlap of their clientele and crypto holders. Those efforts can thrive on a small scale (e.g., a few hundred NFTs to loyal collectors) but won’t move the revenue needle for a global corporation.

Another challenge is regulatory compliance and legal risk. Brands have to ensure any token or crypto product doesn’t inadvertently become an unregistered security or violate money transmission laws. The regulatory landscape is moving, but unevenly. Companies have to engage lawyers and sometimes even lobby for clearer rules. When El Salvador mandated Bitcoin acceptance, corporations had to quickly figure out how to handle the accounting and tax treatment. In the US, stablecoin legislation and potential new SEC rules could impact how brands use crypto. This is a big reason many companies partner with established crypto firms (e.g., Starbucks partnered with Polygon and a startup called Forum3 for Odyssey, rather than build in-house) – to rely on their expertise.

Then there’s volatility and financial risk. Accepting crypto or holding it means dealing with price swings. Techniques like instant conversion to fiat (used by Ferrari and others) mitigate that, as does focusing on stablecoins. But holding Bitcoin in treasury is essentially a speculative position – which can pay off spectacularly or cause write-downs. We saw Tesla’s Bitcoin bet yield paper profits during the 2021 bull, then Tesla sold most of it during the 2022 downturn to limit downside. Corporate boards will differ in risk appetite, and some may view crypto as too risky unless it’s a minuscule allocation or hedged.

Security is another concern: handling crypto brings new cybersecurity challenges (protecting private keys, avoiding scams). A hack of customer crypto wallets or a breach in a brand’s NFT platform could be a PR nightmare. As such, brands often leave custody and security to specialists (for instance, many NFT marketplaces custody the NFTs for users, and merchants rely on payment processors to handle crypto transactions). Still, the onus is on the brand to ensure their partners are reputable (one recalls how the collapse of FTX in late 2022 shook confidence; any brand tied to such an exchange would have suffered reputational damage).

Despite these challenges, the overall trajectory is continued integration of crypto into consumer and enterprise activities, albeit at a measured pace. The burst of initial enthusiasm might have waned – no more “we’re launching an NFT because everyone is” announcements – but what remains are use cases with real merit and commitment. In 2025 we see crypto being used in ways that align with core business objectives: reducing costs (stablecoins for cheaper payments), increasing engagement (loyalty tokens, fan tokens), driving new revenue streams (NFT sales of digital goods), reaching new markets (accepting crypto from customers in countries with weak banking), and positioning as innovative (brand image benefits, attracting younger demographics). Each company must weigh these benefits against the risks and invest accordingly.

Looking ahead, a few trends seem likely. If crypto markets continue to mature and possibly enter another bull phase, more brands may re-engage with dormant projects – for example, we might see Starbucks Odyssey 2.0 if consumer interest in NFTs resurges under better market conditions. Central Bank Digital Currencies (CBDCs) might come into play: countries like China already have a digital yuan in circulation, and others are exploring CBDCs. Brands operating in those jurisdictions may have to adapt their payment systems to accept CBDCs (which function like government-backed stablecoins). If, say, the EU issues a digital euro, retailers across Europe will incorporate that – further normalizing digital currency use for average folks, which by extension normalizes other digital currencies.

Interoperability and partnerships will likely increase. We could envision loyalty tokens from different brands being tradable on some platforms (imagine swapping airline miles for hotel points via a decentralized exchange, if regulatory approved). Payment apps might auto-convert various cryptos to local currency in the background, so a customer could pay a merchant in Bitcoin and the merchant receives euros seamlessly. Those technical pieces are being built now.

Perhaps the greatest endorsement of crypto’s place in corporate America came indirectly: in mid-2025, the U.S. Vice President spoke at a Bitcoin conference, calling the U.S. a “firm ally” of the crypto industry and saying Bitcoin has become a mainstream part of the economy. Such political support, along with improved accounting rules and success stories, has made executives far more comfortable exploring crypto than they were years ago.

In conclusion, the relationship between big brands and crypto in 2025 is one of cautious embrace. We see unquestionable momentum – a majority of top companies have some blockchain project underway, and iconic names from Starbucks to Tesla have paved the way. Each use case comes with lessons learned. Some, like Starbucks, learned that not every customer base is ready for Web3 (at least not explicitly). Others, like Tesla and Ferrari, discovered pockets of real demand for crypto payments but must manage practical concerns. The experiments of the early 2020s have yielded valuable know-how, separating fads from functional innovations. As the crypto industry itself evolves (with more regulation, more stability, and more user-friendly tech), big brands will be able to integrate crypto in more seamless and invisible ways. In time, using crypto within your favorite brands’ ecosystem might feel as normal as using reward points or gift cards – the complexity hidden beneath a familiar surface.

For now, crypto remains a tool that savvy brands deploy judiciously: enhancing loyalty here, adding a payment option there, engaging fans with digital collectibles or leveraging blockchain for supply chain efficiencies. The key is fact-based strategy over hype – exactly what we’ve aimed to present in this explainer. By staying grounded in real use cases and outcomes, brands can continue to explore the crypto frontier without losing sight of what their customers want. And as consumers, we can expect to see more chances to interact with crypto through the brands we love, whether that’s earning a digital collectible for buying a latte or choosing to pay for our next car in Bitcoin. The intersection of big brands and crypto is no longer theoretical – it’s happening now, and it’s only getting bigger as we move forward in this digital decade.