Cryptocurrency has gone mobile. With millions of people around the world buying, trading, and tracking crypto on their phones, having the right apps can make all the difference.

From easy exchanges for beginners to secure wallets and market trackers, the following is a comprehensive guide to the top 15 crypto apps that every crypto enthusiast – especially newcomers – should consider. These apps are globally popular, beginner-friendly, and primarily mobile-focused, offering a mix of functionalities. Our selection is fact-based and draws on expert reviews and opinions to give an unbiased look at what makes each app stand out (and where they have limitations).

Whether you’re looking to buy your first Bitcoin, safely store your coins, or track market moves on the go, the apps below cover the essential tools of today’s crypto landscape. We’ll cover exchanges for trading, non-custodial wallets for security, portfolio trackers for monitoring investments, and other must-haves like NFT marketplaces and DeFi platforms. Let’s dive into the top picks and see why industry experts recommend them.

1. Coinbase – Easiest Exchange for Beginners

Coinbase is often cited as the best starting point for crypto newcomers. Founded in 2012 and now a publicly traded company, Coinbase has over 100 million users worldwide and operates in more than 100 countries. It’s the largest U.S.-based crypto exchange and known for its sleek, beginner-friendly interface and strong regulatory compliance. In fact, Investopedia named Coinbase the top exchange for beginners due to its easy onboarding, solid security practices, and straightforward fee structure.

Features: Coinbase’s mobile app allows users to buy, sell, and hold hundreds of cryptocurrencies with just a few taps. Over 240 coins are supported on the platform, from major assets like Bitcoin and Ethereum to a variety of altcoins. The app provides simple price charts and basic market data for beginners, while also offering an “Advanced Trade” interface with more charting tools when users are ready to graduate beyond the basics. Coinbase includes useful educational resources as well – through the “Learn and Earn” feature, new users can read lessons and take quizzes about various coins to earn small crypto rewards, which encourages learning.

Security & Trust: Coinbase has built a reputation for security and compliance. It stores the majority of customer funds in offline cold storage and offers features like two-factor authentication (2FA) on accounts. As a regulated U.S. company (now listed on NASDAQ), it provides a level of transparency and trust that appeals to cautious investors. Coinbase even holds a certain amount of digital asset insurance and FDIC-insures USD balances, adding peace of mind for users. Money.com notes that Coinbase “lowers the barrier to entry” for crypto with its smooth identity verification and educational incentives that ease people into trading.

Pros: Coinbase’s strengths lie in its ease of use and educational tools. The app’s interface is clean and straightforward, making crypto feel accessible to non-experts. It supports convenient payment methods (bank accounts, debit cards, etc.) for funding purchases, and it has a robust customer support infrastructure for a crypto exchange. Coinbase is also known for adding new coins carefully – focusing on quality over quantity – which can reassure users that listed assets have passed some level of scrutiny.

Cons: The biggest downside is fees. Coinbase’s convenience comes at a price: its fees are higher than those on some other exchanges. There are no fee-free trades; a combination of spread and transaction fees can add up for small purchases. For example, buying $100 of crypto might incur a few dollars in fees on Coinbase, whereas some competitors (like certain broker apps) charge zero commissions (but possibly with other trade-offs). Additionally, Coinbase doesn’t offer advanced products like margin trading or a wide array of derivatives on its main platform. Seasoned traders often outgrow the standard Coinbase app and move to Coinbase’s Pro interface (or other exchanges) for more sophisticated tools and lower fees. Lastly, while Coinbase is available in over 100 countries, it’s not accessible everywhere globally, and a few features (like earning interest on holdings) may be restricted in certain regions.

Expert Opinion: Coinbase’s focus on beginners has earned it accolades in industry reviews. Investopedia writes that “Coinbase offers an excellent service for investors new to crypto trading” and praises its comprehensive educational resources that help demystify cryptocurrency for newcomers. NerdWallet also rates Coinbase highly for first-time crypto buyers, highlighting how the platform’s “straightforward onboarding” and user-friendly design “make it easy to verify your identity and ease users into trading”. In short, Coinbase is widely regarded as the go-to mobile app for anyone stepping into crypto for the first time, combining ease of use with a trusted name in the industry.

2. Binance – Largest Global Crypto Exchange

For sheer scale and features, it’s hard to beat Binance. Binance is the world’s largest cryptocurrency exchange by trading volume and user count. Launched in 2017, it grew at breakneck speed – within six months it became the biggest exchange globally. Today, Binance serves an estimated 280+ million users around the globe (outside of certain restricted countries) and regularly handles tens of billions of dollars in daily trading. In April 2025, Binance accounted for roughly 38% of the entire crypto spot market volume, far more than any other exchange. In other words, more than one out of every three crypto trades worldwide happens on Binance.

Features: Binance’s mobile app is packed with functionality. It offers 500+ cryptocurrencies and over 1,500 trading pairs – one of the widest selections in the market. Whether you’re looking for top market cap coins or obscure tokens, there’s a good chance Binance supports them. The app includes basic and advanced trading modes: a “Lite” mode with a simple interface for beginners, and a “Pro” mode with advanced charting, order books, and various order types for experienced traders. Users can do spot trading, margin trading, and even futures trading (with up to 125x leverage on certain contracts) through Binance – though access to some products depends on your jurisdiction.

Beyond trading, Binance has built an entire ecosystem accessible through its app: Binance Earn lets users stake or lend their crypto to earn interest, Binance Card (in select regions) allows spending crypto via a Visa debit card, Binance NFT marketplace is integrated for trading digital collectibles, and there are additional services like Binance Pay (for crypto payments), a launchpad for new token sales, and educational content via Binance Academy. It’s an all-in-one crypto super-app.

Pros: Binance is known for low fees and deep liquidity. Trading fees start at just 0.1% per trade, and even lower for high-volume traders or those who pay fees using Binance’s own token (BNB). The huge user base means order books are usually very liquid – you can execute large trades with minimal slippage on major pairs. Another advantage is the wealth of features; as an enthusiast, you won’t easily outgrow Binance, since it provides tools for whatever level of engagement you want (from simple buys to complex derivatives). Binance also supports a range of fiat currencies and payment methods globally, making it relatively easy to fund your account, though exact options vary by country.

Cons: The flip side of Binance’s breadth is that the platform can be overwhelming for newcomers. The interface (especially in Pro mode) is dense with information. While there is a simplified mode, the sheer number of coins and features might confuse inexperienced users. Customer support on Binance can also lag at times, given the massive user volume. Another critical point: regulatory challenges. Binance’s global operations have faced scrutiny in multiple countries. For instance, Binance is not available in the United States due to regulatory restrictions; U.S. users must use a separate platform (Binance.US) which has a much more limited selection. Some other jurisdictions have also banned or limited Binance’s services. Therefore, depending on where you live, you may encounter restrictions on using Binance. Always check if it’s legally permitted in your area and keep abreast of rule changes.

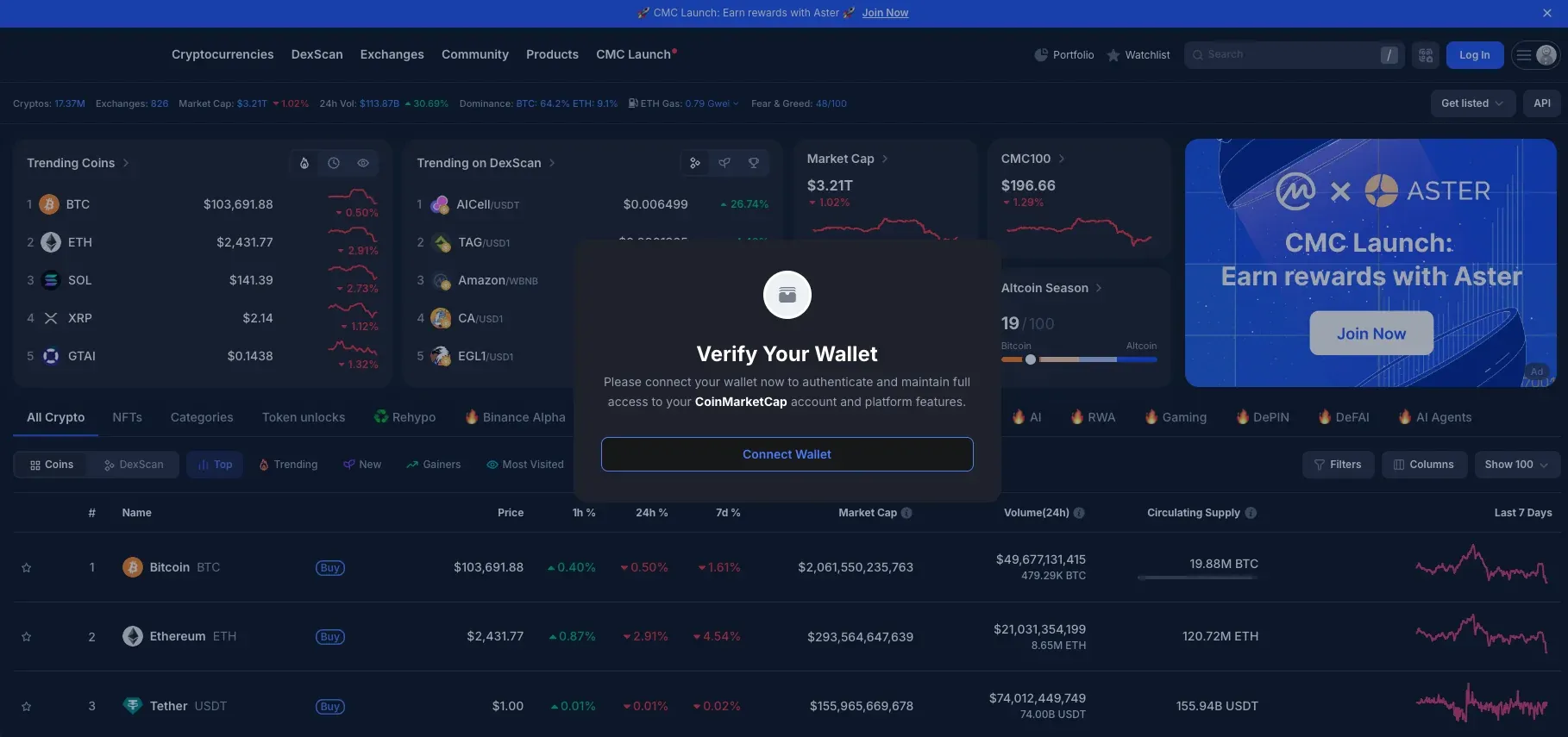

Expert Opinion: Despite regulatory hurdles, Binance’s dominance is clear. Data from CoinGecko and CoinMarketCap consistently rank Binance as the top exchange by a wide margin. As of Q2 2025, Binance held roughly one-quarter of the entire spot market and an even higher share when including derivatives. The platform’s ability to handle high volumes and offer almost every crypto service under the sun has earned it a strong reputation among active traders. Industry analysts often point out that Binance’s knack for innovation (frequent new feature rollouts) and its global reach have cemented its leadership. “Binance provides a secure and feature-rich platform” for everything from trading to learning, notes CoinMarketCap’s overview of the exchange. However, experts also caution users to be mindful of regulatory developments. Overall, for those who can access it, Binance is an essential app if you want broad exposure to the crypto markets and advanced trading capabilities, all in one place.

3. Crypto.com – Mobile-Friendly Exchange with Perks

Crypto.com has emerged as a popular all-in-one crypto app, especially known for its slick mobile experience. Founded in 2016 and headquartered in Singapore, Crypto.com now boasts over 100 million users across 90+ countries. It brands itself around the philosophy of making “crypto in every wallet,” and has gained visibility through major marketing campaigns (including arena naming rights and high-profile ads). But beyond the hype, Crypto.com’s app delivers a robust feature set that caters to both beginners and seasoned crypto users – with a particular emphasis on mobile-first convenience.

Features: The Crypto.com app allows users to buy, sell, trade, pay, and earn crypto all in one place. It supports a large array of cryptocurrencies (400+ at last count), which you can purchase using bank transfers, credit/debit cards, or other crypto. One standout feature is the Crypto.com Visa Card – a prepaid debit card linked to your account that lets you spend crypto in real life. Users can top up the card with crypto (which gets converted to fiat) and enjoy cashback rewards (paid in Crypto.com’s native token CRO) on their spending. The card’s perks (like cashback rate, rebates on services like Spotify/Netflix, etc.) improve if you stake more of the CRO token, which has been a significant attraction for enthusiasts.

The app also offers Crypto Earn, where you can deposit your crypto to earn interest (yield) on dozens of supported assets. Depending on the coin and lock-up term, yields can be competitive, though these rates have fluctuated with market conditions. Additionally, Crypto.com provides commission-free crypto trading through its separate Exchange interface and recently introduced crypto derivatives (futures and options) trading accessible within the app for certain regions. There’s also an NFT marketplace and a pay feature (to send crypto to other users or merchants) baked in.

Pros: The user interface is excellent – Crypto.com’s app is often praised for being intuitive and visually appealing, which helps make complex actions (like setting up recurring buys or staking) straightforward. It truly shines as a mobile platform; Investopedia actually picked Crypto.com as the “Best Mobile App” among crypto exchanges, noting its major focus on delivering a full-featured experience in the palm of your hand. The integration of a debit card is a unique strength – it effectively bridges crypto with everyday spending, something few other crypto apps offer at this scale. Security is another focus area: Crypto.com implemented strong measures after a hacking incident in early 2022, including insurance on custodial assets and mandatory 2FA for withdrawals. They have since boasted an excellent security track record and even provide $250,000 protection for user funds in cold storage. For Bitcoin enthusiasts, Crypto.com is also notable for supporting Bitcoin derivatives (futures, options), which led Investopedia to dub it the “Best for Bitcoin” trading as well.

Cons: On the downside, Crypto.com’s ecosystem can be complex and sometimes restrictive. Some features (like higher card rewards or better interest rates) require holding or staking a substantial amount of CRO tokens, effectively tying users into their token economy. If CRO’s value fluctuates, it can affect the benefits you receive. Also, outside of promotional periods, the interest rates on Crypto Earn have been reduced, especially for users who don’t stake CRO – so the passive income feature isn’t as generous as it once was. Another consideration: geographic availability. Crypto.com serves many countries but not all; and even where it operates, certain products might not be available due to local regulations (for instance, the Crypto.com Visa card and derivatives trading aren’t universal). In the U.S., Crypto.com has scaled back some services amid regulatory pressures. Always check the latest availability for your region. Finally, while trading fees on the exchange are low, the main app’s instant buy/sell feature can have higher fees or spreads embedded, so serious traders might still prefer using the dedicated “Crypto.com Exchange” interface or app (which has its own UI geared toward trading).

Expert Opinion: Experts often highlight Crypto.com’s mobile-first design and breadth of services. “Crypto.com is one of the best exchanges for mobile-first traders,” writes Investopedia, pointing to the app’s smooth functionality and comprehensive coin support. The company’s figure of 100 million users speaks to its worldwide adoption. Crypto.com’s heavy marketing aside, industry observers acknowledge that it has delivered a solid product: a convenient app where you can not only invest in crypto but actually use it (via the card and pay features) in daily life. That helps drive crypto utility beyond just holding. On the flip side, analysts also note that Crypto.com’s aggressive growth (and token-centric model) means users should be mindful of token incentives and do their own research on the CRO token’s role. Overall, Crypto.com is frequently recommended for those who want an all-in-one solution on mobile. As Money.com summarized in naming it best for crypto rewards, the platform offers a mix of promotions – from referral bonuses to staking yields – that add value for active users. If you enjoy managing finances on your smartphone and like the idea of integrating crypto into both investing and spending, Crypto.com is a must-have app.

4. Kraken – Trusted Exchange with Low Fees and Security

Kraken is a veteran in the crypto industry, founded in 2011, which makes it one of the oldest surviving crypto exchanges. Over the years, Kraken has built a reputation for strong security, competitive fees, and global availability. It serves over 10 million clients in nearly 190 countries, making it a truly global platform. Unlike some flashier newcomers, Kraken’s focus has been on reliability and trust – which is why many long-term crypto users and even institutional investors stick with it. In Money.com’s 2025 rankings, Kraken was named the “Best Crypto Exchange Overall”, largely thanks to its blend of low costs and high safety standards.

Features: Kraken’s app and website allow for spot trading of a wide selection of cryptocurrencies – more than 400 coins are supported as of 2025. This includes major assets and a deep list of altcoins, giving traders ample choice. The platform offers multiple trading interfaces: a simple buy/sell flow for beginners and the Kraken Pro trading interface for advanced users. Kraken Pro (accessible via a separate mobile app or through the main app by toggling to pro mode) provides advanced charting (with TradingView integration), various order types, and detailed order book views.

One of Kraken’s strengths is its fee structure. It employs a maker-taker model with low fees that get even lower as your 30-day trading volume increases. For most casual traders, fees start at 0.16% (maker) / 0.26% (taker) or better, which is more competitive than many rival exchanges that might charge 0.5% or more for basic trades. Additionally, Kraken does not add hidden spreads on its prices – what you see in the market is what you get, which appeals to cost-conscious users. Kraken was also among the first major exchanges to offer crypto futures trading (with up to 50x leverage) and margin trading for certain pairs, all accessible in its interface (though not in the U.S. due to regulations). Staking is another feature: Kraken users can stake a variety of coins (including Ethereum, Solana, Cardano, etc.) and earn staking rewards without complicated setup, with the flexibility to unstake in many cases.

Pros: Security is a big pro for Kraken. The exchange has never been hacked in its decade-plus history – a testament to its stringent security protocols. By default, Kraken requires 2FA for account actions and offers the option to use hardware security keys (YubiKey) for login. It also undergoes regular third-party security audits, and was one of the first exchanges to conduct Proof-of-Reserves audits to verify it holds customers’ assets one-to-one. Money.com noted Kraken’s “arguably the safest digital platform for trading” and highlighted that it scored top marks on independent security assessments. For users who prioritize safety of funds, this is a key selling point.

Another advantage: Global reach and compliance. Kraken is available in a long list of countries and is fully licensed/regulated in several jurisdictions. In the U.S., for example, Kraken is one of the few major exchanges licensed in states like New York (under a BitLicense) as well as in Europe and Asia through various registrations. This compliance-minded approach gives users confidence that Kraken isn’t likely to vanish or be forced out of their country suddenly.

Moreover, Kraken’s customer support is well-regarded. They offer 24/7 live chat support – a feature not all exchanges have – and have generally responsive service, which is crucial when users encounter issues. Finally, the fee structure and deep liquidity on Kraken make it cost-effective, especially for larger trades. There are even no fees for certain funding methods (e.g., many crypto deposits are free, and some regions have free bank transfer options).

Cons: Historically, Kraken’s main drawbacks were related to its user interface and user experience. It wasn’t always the most beginner-friendly platform. The current Kraken app has improved simplicity, but some absolute novices might still find Coinbase or others easier at first glance. There can be a slight learning curve to use features like margin or to navigate the pro interface. Another con: Kraken’s mobile app features are a bit split – the standard Kraken app is great for basic use, but if you want all advanced features, you might need to use the separate Kraken Pro app (though this may converge in the future). This could be mildly inconvenient for users toggling between simplicity and advanced tools.

Additionally, while Kraken offers a solid range of cryptos, it isn’t the highest – some competing exchanges list even more obscure coins. Kraken tends to be more conservative in listings (around 400+ available), focusing on quality projects. This is good for safety but if you’re hunting micro-cap gems or the latest meme coin, you might not find it on Kraken. Lastly, Kraken has limited support for some newer trends – for example, it doesn’t have its own NFT marketplace or a native debit card. It sticks more to core exchange functions, which, depending on your needs, might mean using additional apps for those other services.

Expert Opinion: Kraken consistently earns praise for being a trustworthy and cost-effective platform. Investopedia has often ranked Kraken among top exchanges for low fees and noted that it “caters to multiple types of clients at various skill levels”, with both a beginner-friendly interface and the powerful Kraken Pro for advanced traders. Money’s review lauded Kraken as “well-beloved and trusted by many crypto traders”, underscoring its long track record. The combination of supporting over 400 cryptocurrencies and maintaining “high marks across all the security assessment platforms” impressed analysts. In short, Kraken is frequently recommended for users who want peace of mind and fair pricing. It may not have all the bells and whistles of some newer apps, but what it does, it does exceptionally well. For any crypto enthusiast – especially those beyond the very beginner stage – Kraken is a core app to consider for reliable trading and investing.

5. Gemini – Secure and Compliant Exchange (Great for U.S. Users)

Gemini is a U.S.-based crypto exchange known for its top-notch security and regulatory compliance. Launched in 2014 by the Winklevoss twins (Cameron and Tyler), Gemini has carved out a niche as the “safe and regulated” choice among crypto platforms. It’s a bit more conservative in its offerings, but for users who value security, insurance, and a straightforward experience, Gemini is highly regarded. Investopedia named Gemini the “Best for Security” among crypto exchanges, highlighting its strong standards and audits.

Features: The Gemini mobile app is clean and easy to navigate, making it friendly for beginners. Users can buy, sell, and store around 70+ cryptocurrencies on Gemini – a smaller selection compared to some competitors, but it covers virtually all the top-tier coins and many DeFi tokens. Gemini supports common payment methods (ACH bank transfers, wire, debit card buys) for funding. One unique feature is the Gemini Earn program (though it has been paused as of late 2022 amid industry troubles), which previously allowed users to lend their crypto to earn interest. Aside from that, Gemini offers Gemini Pay (letting you spend crypto at select retailers via QR code) and the Gemini Credit Card in the U.S., which gives crypto rewards on purchases.

For more advanced traders, Gemini has ActiveTrader, a high-speed trading interface with advanced charting, multiple order types, and even support for auctions and block trades. ActiveTrader is available on the mobile app (it can be toggled on in settings) or via the web, and it significantly lowers the trading fees compared to using the default simple interface. In fact, using ActiveTrader, maker fees can be as low as 0%–0.2% and taker fees 0.03%–0.4% depending on volume, which is competitive.

Pros: Security is Gemini’s hallmark. The exchange operates with a “security-first” mentality: it conducts regular SOC 1 Type 2 and SOC 2 Type 2 audits ( rigorous third-party security audits of its systems) and was one of the first exchanges to achieve an ISO 27001 certification. By default, Gemini keeps the vast majority of customer crypto in offline cold storage, and it maintains digital asset insurance for the coins held in their hot wallet. Notably, Gemini also provides FDIC insurance on USD balances (cash funds) up to $250K per user, by holding those funds in insured bank accounts. On top of that, users can secure their accounts with hardware security keys and whitelist withdrawal addresses, adding extra layers of protection. Money reviewers have pointed out that Gemini “supports external hardware keys such as YubiKey to secure accounts further”, illustrating its focus on account safety.

Regulatory compliance is another strong suit. Gemini is a New York Trust company regulated by the NYDFS, which means it’s subject to capital reserve requirements and banking compliance standards. It is available in all 50 U.S. states (a claim not many exchanges can make), and it actively works with regulators. For users in jurisdictions with strict crypto laws (like New York), Gemini is often one of the few options, and it positions itself as the “regulated and compliant” choice.

Additionally, Gemini’s user experience is polished. The app has a smooth, minimalist design. It also has features tailored for everyday use, such as price alerts, recurring buy options for dollar-cost averaging, and an educational section called Cryptopedia where users can learn about blockchain concepts. Customer support is also solid via email and an extensive help center.

Cons: The main trade-off with Gemini is fees and limited variety. If you use the default Gemini app interface without switching to ActiveTrader, the convenience fees can be quite high. Gemini’s basic buy/sell incurs a roughly 1.49% fee, plus a fixed fee on small transactions – making it more expensive than competitors like Coinbase for small purchases (Coinbase’s structure can also be high for small amounts, but Gemini’s isn’t much better unless you use ActiveTrader). Thus, beginners who stick to the simple interface might end up paying notable fees. However, using ActiveTrader mode significantly reduces fees, so knowledgeable users can avoid this con.

Another con is the limited number of cryptocurrencies offered (around 70). While Gemini covers the majors, it lags behind platforms like Binance or Coinbase which list hundreds. If you’re looking for very new or speculative altcoins, you likely won’t find them on Gemini. The philosophy at Gemini is to list assets that meet certain compliance and security criteria, so many smaller tokens don’t make the cut. This conservatism extends to other features: for instance, Gemini has been slower to adopt trends like yield farming, and its Earn program faced issues (Gemini Earn was connected to a partner that halted withdrawals in 2022, leading to customer funds being locked – a blemish on Gemini’s otherwise strong reputation). This incident highlighted that even a secure exchange is not immune to counterparty risk if offering lending products. As of 2023, Gemini was working to resolve Earn withdrawals but had lost some customer trust there.

Lastly, while Gemini is global (it’s available in over 60 countries), its presence and fiat support internationally are not as strong as some rivals. Non-U.S. users might have fewer local currency options.

Expert Opinion: Gemini consistently ranks high for safety. “Gemini is our top choice for security due to its sound security standards and third-party audits,” Investopedia wrote, also noting that it’s one of the few with both FDIC coverage for cash and crypto insurance for digital assets. Financial commentators often recommend Gemini to those who might be a bit wary about crypto and want a trusted, regulated platform to start with. It’s sometimes described as having a more “bank-like” feel due to its compliance efforts. The Winklevoss twins emphasize their “ask for permission, not forgiveness” approach – meaning Gemini works within regulations. This has made it a favorite for users who prioritize legitimacy.

For an enthusiast, Gemini might not fulfill all needs (given its somewhat limited coin selection), but it’s an excellent “core” app for holding and trading major assets securely. Many users keep a Gemini account even if they use other apps for certain altcoins, because they trust Gemini as a secure place to store value or cash out to fiat. In summary, if security and trust are your main concerns – or if you’re a U.S. user in a state with fewer options – Gemini is a must-have in your crypto app arsenal.

6. eToro – Social Trading and Multi-Asset Investing

eToro is a unique platform that blends traditional investing with crypto and a social media-like experience. Founded in 2007 and originally known for stocks and forex trading, eToro added cryptocurrencies to its offering and quickly became popular for its social trading features – notably the ability to follow and copy the trades of other investors. As of 2025, eToro has a massive global user base of about 40 million registered users across 75 countries. While not a crypto-only app, it’s a great bridge for beginners who want exposure to crypto alongside other assets, all in one place, with a community aspect.

Features: eToro’s app allows users to trade not just crypto but also stocks, ETFs, commodities, and more (availability varies by region). On the crypto side, eToro offers around 70–80 cryptocurrencies in most regions (fewer in some countries like the U.S.) – covering the major coins and many popular altcoins. A standout feature is the CopyTrader system: you can browse profiles of successful traders on the platform (including their performance stats and risk scores) and allocate funds to automatically mirror their trades. For someone new to crypto (or trading in general), this can be an appealing way to learn and potentially profit by piggybacking on experienced traders’ moves. eToro also fosters discussion by letting users post feed updates about markets, like a social network, so you can see sentiments and analysis from others on various coins.

The app’s interface is very beginner-friendly. It shows your portfolio in a simple format (with both actual holdings and also *“virtual” holdings if you practice on a demo account). eToro provides a free $100K virtual portfolio for paper trading, which is a great feature for newcomers to practice trading crypto (or stocks) without real money at stake.

For each asset (e.g., Bitcoin), eToro’s app has a page with a feed of user posts, charts, research, and stats. You can execute trades in terms of amount of USD (or your currency) rather than dealing with lots or contracts, which makes it straightforward (e.g., buy $50 worth of BTC). In some regions, eToro also offers staking of certain cryptos, providing passive yield on holdings like Cardano or Tron, which are automatically earned when you hold those assets.

Pros: The social and educational aspect is eToro’s biggest pro. Beginners often feel more comfortable when they can see what others are doing and even interact. On eToro, you can ask questions in the feed, see comments on why someone is bullish or bearish on a coin, and gain insights from the community. This communal approach can accelerate learning. The CopyTrader feature essentially lets you have an experienced person “manage” a part of your funds, which can diversify your strategy. It’s no surprise that CoinLedger’s experts labeled eToro the “Best for Social Trading” among crypto apps.

Another advantage: eToro is a multi-asset platform. If you want a single app where you can dabble in stocks and crypto together, eToro provides that. For example, you could buy Tesla shares and Bitcoin in the same portfolio and see them side by side. This is convenient and also appeals to people who started with stock investing and want to add crypto without learning a whole new interface. It also has thematic portfolios (called “CopyPortfolios”) that bundle multiple assets – for instance, a CryptoPortfolio that auto-invests across several top coins, giving an easy diversification option.

In terms of fees, eToro offers commission-free stock trading in many countries and zero direct fees on crypto trades, instead using a spread. The crypto spread is around 1%, which is fairly transparent compared to some platforms that have hidden fees. There are no monthly account fees. Additionally, eToro has a solid track record in regulation – it’s regulated in multiple jurisdictions (FCA in the UK, CySEC in Europe, FinCEN in the US as a Money Services Business, etc.), which provides a level of trust.

Cons: One major con for crypto enthusiasts: you don’t fully control your coins on eToro unless you transfer them out. When you buy crypto on eToro, it’s somewhat like an IOU – you have exposure to the price, but you don’t initially get a wallet address or the ability to withdraw those assets freely to your own wallet (especially in the earlier days). In recent years, eToro introduced the eToro Money crypto wallet, which does allow you to transfer certain coins out to an external wallet. However, not all coins are transferable, and the process can be a bit clunky (also, once transferred out, they cannot be transferred back into the trading account). So if your goal is to actually use the crypto (e.g., for DeFi or spending), eToro might feel restrictive. It’s designed more for trading and investing, not for interacting with decentralized apps or making frequent external transactions.

Another con is limited crypto selection compared to pure crypto exchanges. With around 70 or so coins, eToro might not have the smaller altcoins or new launches that dedicated crypto exchanges would. Enthusiasts looking for the next micro-cap gem will still need other platforms. Also, geographic limitations: eToro’s crypto offering in the U.S. is relatively limited (around 15–20 coins due to regulatory reasons, and CopyTrading is not available to U.S. users). Outside the U.S., the coin selection is better, but still not as vast as Binance or others.

Finally, eToro charges a withdrawal fee and currency conversion fees. There’s a $5 withdrawal fee for fiat and if you deposit or withdraw in a currency different from USD, there’s a conversion fee (since eToro operates in USD as base). For long-term investors, another consideration: you cannot set up recurring automatic purchases on eToro’s platform (as of now), whereas some crypto apps allow recurring buys.

Expert Opinion: eToro is often recommended for beginners who appreciate a social element or who are transitioning from stock investing to crypto. “eToro maintains a larger customer base with over 30 million users… Robinhood's superior [metrics] aside,” noted Forbes in comparing eToro and Robinhood, highlighting that eToro actually has a huge user base and more international presence. The platform’s success with 40 million users shows that many find value in its approach. Reviewers frequently praise the CopyTrader feature, which effectively lets newcomers follow “crypto influencers” in a regulated setting. CoinLedger’s 2025 expert roundup listed eToro among the best, specifically citing it as the top pick for social trading. They emphasize how eToro’s mobile-friendly app lets you manage an entire portfolio in one place and learn from others as you go.

In summary, eToro is a must-have app for those who want a blend of social interaction and investing. If you enjoy the idea of seeing what others are trading, discussing strategies, and copying portfolios – and you don’t need access to every obscure crypto out there – eToro can be both fun and educational. It’s a great stepping stone into crypto for stock investors, and conversely a way for crypto folks to try stocks, all within a single user-friendly app. Just remember that for full control of your crypto assets or access to the widest coin selection, you might complement eToro with other apps on this list.

7. Uniswap – Decentralized Exchange (DeFi Trading on the Go)

Uniswap isn’t a traditional app like others on this list – it’s the leading decentralized exchange (DEX) protocol, which allows users to swap crypto tokens without any central intermediary. However, as DeFi (decentralized finance) has grown, Uniswap has become a must-know tool for crypto enthusiasts, especially those venturing beyond the most mainstream coins. In 2023, the Uniswap team launched an official Uniswap mobile wallet, making it much easier to access this powerful DEX via a user-friendly app. If you’re exploring the world of altcoins, Ethereum tokens, or just want to experience peer-to-peer trading, Uniswap is an essential platform – now conveniently available on mobile.

Features: Uniswap operates primarily on the Ethereum blockchain (as well as layer-2 networks like Polygon, Arbitrum, and Optimism, plus a version on BNB Chain). It uses an automated market maker (AMM) model instead of order books. This means you can swap any ERC-20 token for any other, provided there’s enough liquidity in the pools, all directly from your wallet. The Uniswap mobile wallet app, which rolled out in 2023, gives users a sleek interface to do exactly that: swap tokens on various networks with ease. The app supports Ethereum mainnet and popular Layer 2 networks, automatically switching between them as needed.

Through the Uniswap wallet, you can buy crypto with fiat as well – the app integrates a fiat on-ramp allowing users to purchase crypto using a debit card or bank (the fee for this service is about 2.55%). This is notable because it bridges the gap between traditional money and DeFi; a newcomer could download Uniswap’s wallet, buy ETH with a card, and start swapping on DeFi, all in one app.

The wallet also provides features like viewing real-time token prices, price charts, and even NFT details for certain collections. It has a section to browse and favorite tokens by market cap or other criteria, helping users discover assets. Additionally, the wallet supports WalletConnect, meaning you can use it to interface with other DeFi dApps beyond Uniswap.

One key aspect: you remain in control of your funds. The Uniswap wallet is non-custodial – you manage your own private keys (with options for seed phrase or integrating hardware wallets). Trades occur via smart contracts directly from your wallet, so there’s no centralized exchange holding your assets.

Pros: True decentralization and huge range of tokens. The biggest advantage of Uniswap is access to nearly any token in the Ethereum ecosystem. If a project launches a new token, it’s often available on Uniswap from day one (as long as someone provides liquidity). You’re not limited to the listings a centralized exchange decides on – you can trade thousands of tokens, including many that never make it to major exchanges. This makes Uniswap indispensable for altcoin hunters, DeFi participants, or anyone looking to invest early in emerging projects.

Another pro is that Uniswap works without KYC or account creation – all you need is a wallet. This can be valuable for privacy and for users in regions where exchanges are restricted. The mobile app has made this process much more user-friendly, effectively bringing the power of a web3 wallet and DEX to your phone. Cointelegraph noted that the Uniswap mobile wallet’s goal was to “promote wider DeFi adoption and support on-the-go trading”. Early reviews highlighted how the app “makes swapping dead simple” for mobile users.

Security-wise, using a DEX means you sidestep the risk of exchange hacks or failures – there’s no central entity that could run off with funds. As long as you safeguard your own wallet, your risk is more about smart contract security and market volatility, not corporate bankruptcy or theft (an important consideration after events like some centralized exchanges collapsing).

Finally, Uniswap has deep liquidity for many trading pairs. It routinely handles trading volumes on par with or even exceeding some top centralized exchanges. In fact, there have been periods when Uniswap’s trading volume for certain days rivaled that of Coinbase. For major tokens, slippage (price impact) on Uniswap can be very low due to the large pools.

Cons: Network fees and slippage on small tokens are the primary cons. Because Uniswap runs on Ethereum, trading on the mainnet can get expensive when network gas fees are high. Each swap is an Ethereum transaction that could cost anywhere from a few dollars to tens of dollars in gas, depending on network congestion. This is mitigated by layer-2 support – swapping on Polygon or Arbitrum via the Uniswap wallet incurs much lower fees – but users must sometimes bridge assets to those networks first. Still, newcomers might find the concept of gas fees confusing or off-putting if they’re used to fee schedules on regular apps.

There’s also the risk of choosing the wrong token. Uniswap’s openness is a double-edged sword: anyone can create a token with any name, so there are scam tokens or imposters. For example, a search for a popular new coin might show multiple similarly named tokens; if you accidentally trade for a fake one, you could lose money. The Uniswap interface tries to warn or hide tokens that aren’t verified or widely traded, but the risk remains. It requires a bit more knowledge and vigilance from users – a far cry from the handholding on a Coinbase-type exchange.

Another con: no order types like limit orders (at least not natively – though third-party extensions offer that). Swaps are executed at the prevailing market price (with a tolerance setting). This means you can’t, for instance, set a specific price to buy a dip automatically within the Uniswap app itself. It’s more manual.

For the mobile app specifically, a limitation is that initially it had some availability restrictions (Apple’s App Store approvals limited it to certain countries on launch). Over time, this has been expanding, and an Android version entered beta later in 2023. But it’s something to check – whether the app is officially available in your region’s app store. (Of course, even without the app, one can use Uniswap via a browser wallet like MetaMask, but the app simplifies it greatly.)

Expert Opinion: Uniswap is frequently lauded as one of the most important innovations in crypto trading. It essentially spearheaded the DeFi trading boom. By 2025, analysts view Uniswap as a core piece of crypto infrastructure. Money.com, in its exchange review, gave Uniswap the title of “Best Decentralized Exchange”, acknowledging that serious crypto users often find value in the DEX model alongside their centralized accounts. The introduction of the mobile wallet was widely seen as a positive step to “boost DeFi adoption” by Binance Academy and other commentators. By making the experience more accessible, Uniswap’s team addressed one of the big barriers to entry for DeFi.

For crypto enthusiasts, especially those interested in DeFi tokens, yield farming, or early-stage projects, Uniswap is a must-have tool. It embodies the self-sovereign ethos of crypto – you trade directly from your wallet, with no middleman and no permission needed. As long as you exercise due diligence (checking token contract addresses, managing gas settings, etc.), Uniswap opens the door to the full spectrum of crypto assets. Many experts recommend that anyone serious about exploring crypto beyond Bitcoin and Ethereum should get familiar with how Uniswap works, and the new mobile app makes that easier than ever. In summary, if “decentralization” is what draws you to crypto, then trading on Uniswap is an experience you’ll want – it’s like having a global, 24/7, non-custodial exchange in your pocket.

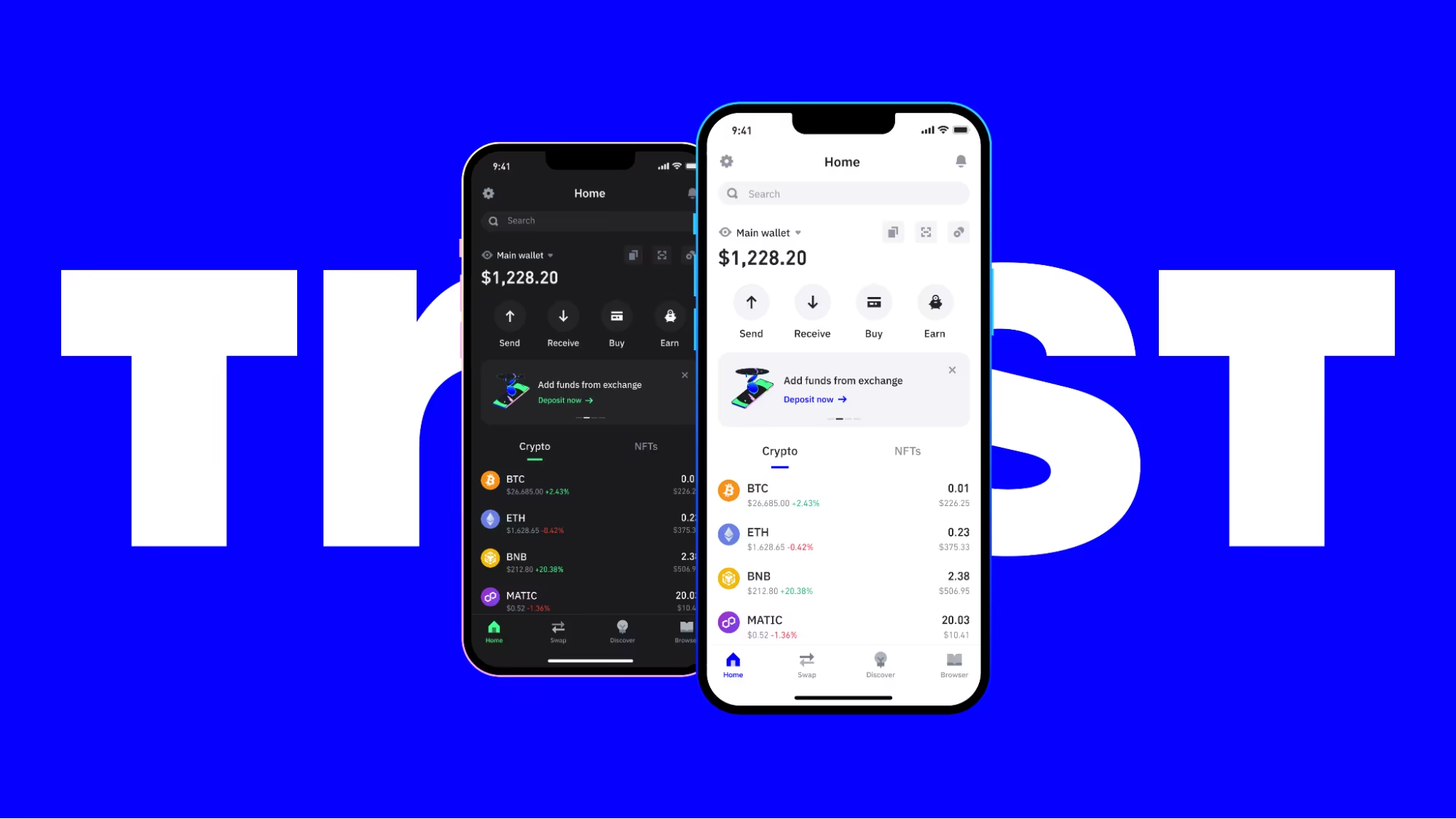

8. Trust Wallet – Versatile Self-Custody Wallet (Web3 Ready)

Every crypto enthusiast needs a reliable non-custodial wallet – one where you control your private keys. Trust Wallet is one of the most popular choices, especially on mobile, for holding a variety of cryptocurrencies securely while also enabling access to the broader Web3 world (like decentralized apps and NFTs). Acquired by Binance in 2018 but operating independently, Trust Wallet has grown explosively. In March 2025, the Trust Wallet team announced the app surpassed 200 million downloads globally, making it “the most widely used self-custody Web3 mobile wallet” in the world. It’s free, feature-rich, and supports an extremely wide range of assets.

Features: Trust Wallet is often described as an “all-in-one” crypto wallet. It supports over 100 blockchains and 10+ million different crypto assets (including tokens on those chains). This means you can hold Bitcoin, Ethereum, BNB Chain tokens, Solana, Cardano, Polkadot – you name it – all in one app. Upon creating a Trust Wallet, you get a 12-word recovery phrase that controls all your funds (so guarding that is paramount).

The app has built-in features like an in-app DApp browser (on Android; on iOS this is limited due to Apple’s policies, but you can still connect via WalletConnect). This lets you directly use DeFi platforms, NFT marketplaces, and other decentralized apps through Trust Wallet without needing a separate browser extension. For example, you could navigate to Uniswap, OpenSea, PancakeSwap, etc., within Trust Wallet and swap or trade directly from your wallet.

Trust Wallet also supports staking for certain coins (allowing you to earn rewards by helping secure networks like BNB Chain, Tron, etc.) and has a section for collectibles where you can view your NFTs held on Ethereum or BNB Chain. There’s an integrated token swap feature for some chains, and also an in-app fiat on-ramp where you can buy crypto with a credit card or other payment methods via third-party providers.

Another aspect: Trust Wallet is non-custodial but has some “convenience” features like optional cloud backup of your encrypted keys (for safety, though some purists may avoid that). It also allows adding custom tokens easily, meaning if you participate in a new token sale or use a niche project, you can manually import the token contract and manage those tokens in Trust Wallet.

Pros: The biggest pro is control and versatility. With Trust Wallet, you hold the keys – no exchange or third party can freeze your funds. This aligns with the crypto principle “not your keys, not your coins.” Given the number of exchange failures and hacks historically, having a self-custody solution is crucial for enthusiasts, especially for long-term holding. Trust Wallet makes self-custody user-friendly, which is likely why it’s attracted hundreds of millions of downloads.

Secondly, wide asset support. Trust Wallet is one wallet where you can manage multi-chain assets seamlessly. You don’t need a separate wallet app for each blockchain; it’s incredibly convenient to have everything from your Ethereum tokens to your Cosmos coins in one place. This extends to NFTs as well – Trust Wallet is often recommended for storing NFTs on Ethereum or BNB Chain since you can see the images and details right inside the app.

Web3 readiness is another huge plus. Trust Wallet’s built-in DApp browser (and WalletConnect support) essentially turns your phone into a Web3 browser. You can interact with DeFi protocols, lend or borrow on money markets, swap on DEXes, play blockchain games, etc., all directly from your wallet. It lowers the barrier to entry for mobile users to explore the decentralized web. The CEO of Trust Wallet, Eowyn Chen, has described their vision of the wallet as evolving into a “personal companion that guides users through their on-chain journey,” simplifying the complexity of Web3 for everyday users. This focus on user-friendliness is evident in the app’s straightforward design.

Security in Trust Wallet is also generally strong – since it’s non-custodial, the security largely depends on the user (choosing a strong password, not leaking the recovery phrase). The app itself supports biometric locks, and the team has been integrating features like multi-factor authentication and even experimenting with account abstraction features (seedless recovery) to enhance safety without sacrificing self-custody. Notably, Trust Wallet partnered with security firms and introduced measures like Trust Wallet Token (TWT) incentives for reporting bugs, as well as insurance on assets within the app using services like Fireblocks for institutional-grade security.

To accommodate growth, Trust Wallet has also integrated AI features (planned) to help users avoid scams – for instance, warning if a DApp you’re visiting is suspicious. All these efforts are why Money.com’s wallet review gave Trust Wallet the title of “Best Mobile Crypto Wallet,” praising its extensive support for NFTs/Web3 and high security scores.

Cons: Using a self-custody wallet like Trust Wallet requires a bit more responsibility and knowledge from the user. If you lose your recovery phrase and haven’t backed it up securely, you lose access to your funds – there’s no “forgot password” recovery. That’s not a flaw of Trust Wallet per se (it’s inherent to all non-custodial wallets), but new users must be aware. By contrast, an exchange like Coinbase can reset your password if you lose it – with Trust Wallet, the security is all in your hands.

Another con is that Trust Wallet, by covering so many chains, might not implement every single advanced feature of those chains. It focuses on the main functions (send/receive, staking for some, etc.). If you are a power user of a specific blockchain, sometimes a chain-specific wallet (like a Solana-only wallet or a Cardano-only wallet) might offer more nuanced functionality (like governance voting or complex staking options). Trust Wallet aims for breadth rather than niche depth.

Also, customer support for Trust Wallet is community-based. There’s no live support that can help recover funds (since even they can’t access your wallet). Users have to rely on guides and forums if they encounter issues. Scammers sometimes prey on this by pretending to be support – so one has to be careful and self-reliant.

Another potential drawback: as an app associated with Binance, some have wondered about data privacy or whether the app shares anonymized usage data with the parent company. Trust Wallet asserts it doesn’t share personal data (and you don’t provide any KYC to use it). But extremely privacy-conscious users sometimes prefer open-source wallets. (Trust Wallet’s core is open-source, though some recent components are closed source for security reasons according to the team.)

Finally, while Trust Wallet tries to make Web3 safe, it cannot protect users from all scams or hacks on decentralized platforms. If you connect your Trust Wallet to a malicious DApp and approve a bad transaction, you could still lose funds. So users need to practice caution (like not blindly signing transactions).

Expert Opinion: Trust Wallet’s meteoric growth to 200M+ downloads speaks for itself. Cointelegraph’s interview with the CEO highlighted how they focus on simplifying the crypto experience and making it as easy as Web2 apps. The CEO also noted, “Trust Wallet recently surpassed 200 million downloads… wen 1 billion?” in a celebratory tweet. This scale dwarfs most other mobile wallets. Reviewers often mention that Trust Wallet’s support for over 60 blockchains is “unmatched,” and Money.com specifically noted it “features the highest number of supported assets and chains of any wallet on our list”.

With endorsements like that and backing by a major industry player (Binance), Trust Wallet has become the default recommendation for a multi-crypto mobile wallet. It’s equally suitable for a beginner (who might just hold a few coins and want an easy, secure wallet) and for an advanced DeFi user (who uses one wallet to juggle yield farming on multiple chains). The fact that you can do so much in one app – store coins, interact with DApps, view NFTs – makes it extremely convenient. As one review put it, Trust Wallet is “an excellent generalist wallet for mobile users, boasting extensive support for NFTs and other Web3 projects”, while still scoring high on security. For any crypto enthusiast who values self-custody and versatility, Trust Wallet is a must-have.

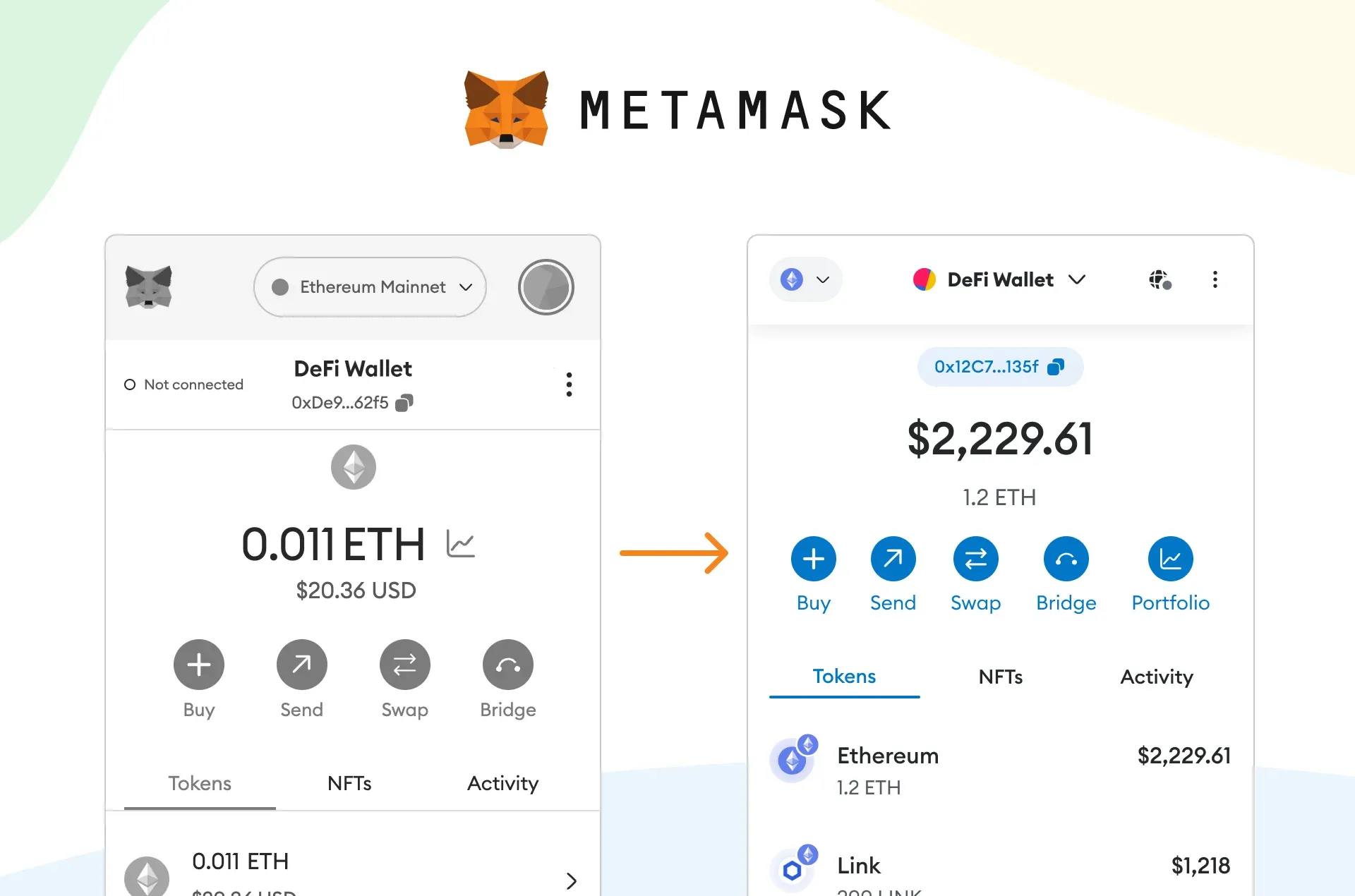

9. MetaMask – Gateway to Ethereum and the Decentralized Web

MetaMask is a household name in crypto, synonymous with accessing Ethereum-based decentralized applications. It started as a browser extension wallet but has also offered a mobile app for several years now, allowing users to manage their Ethereum (and other EVM-compatible chain) assets and use DApps on the go. With over 30 million monthly active users as of early 2024, MetaMask stands as one of the most widely used crypto wallets in the world. For anyone delving into DeFi, NFTs, or token trading on Ethereum and its layer-2 networks, MetaMask is an indispensable tool.

Features: The MetaMask mobile app functions similarly to the browser extension. It is a non-custodial wallet where you control a set of Ethereum addresses (derived from a secret recovery phrase). It supports Ethereum mainnet by default and can be configured to work with any Ethereum Virtual Machine (EVM) compatible network – such as Binance Smart Chain (BNB Chain), Polygon, Avalanche C-Chain, Arbitrum, Optimism, Fantom, etc. This means you can seamlessly switch between networks in-app to view balances and interact with DApps on those networks.

MetaMask includes an integrated DApp browser (on mobile) so you can visit DeFi platforms, NFT marketplaces, blockchain games, and more. When you connect within MetaMask, you can confirm transactions directly in the wallet. It also supports WalletConnect to link the wallet with external apps or browsers.

For token management, MetaMask automatically detects standard tokens you receive, or you can manually add custom tokens. The app shows token balances and transaction history. It also has a built-in swap feature – MetaMask Swap – which aggregates multiple DEXs to give you a quote for exchanging one token for another. This is convenient for quick trades without leaving the app (though there’s a service fee around 0.875% on swaps for the convenience).

MetaMask mobile supports QR code scanning for easy interaction and has biometric unlock (so you can use fingerprint/FaceID to secure the app). One interesting aspect: MetaMask can integrate with hardware wallets (like Ledger or Trezor) on its extension; on mobile, this support is more limited but evolving (as of 2025, MetaMask mobile allows pairing with a Keystone hardware wallet via QR code, for instance).

Pros: Ubiquitous compatibility with DApps. MetaMask has become the de facto wallet for interacting with Ethereum dApps. So much so that many Web3 sites have a “Connect with MetaMask” button as the first option. Using MetaMask mobile means you have that broad compatibility in your pocket. Whether it’s swapping on Uniswap, yield farming, or minting NFTs, MetaMask will likely support it. Money.com called MetaMask the “go-to Web3 wallet” because it’s integrated with nearly every DeFi app and NFT platform out there. This ubiquity is a huge plus – you won’t find a DApp telling you “this wallet isn’t supported.”

User control and privacy is another pro. Like Trust Wallet, MetaMask is non-custodial – you hold your keys. There’s no centralized account or KYC required. You can generate multiple accounts within one app, which is useful to segregate funds or uses. MetaMask doesn’t collect personal info (though it does by default use some telemetry which hardcore users can opt out of). For privacy, you can connect to different decentralized RPC providers if you don’t want to use the default ones that might log your IP (advanced use case).

MetaMask’s security is solid, with the usual caveat that you must protect your seed phrase. The app itself can be locked with a password or biometrics, and it will automatically lock after a period. The code for MetaMask is largely open-source and has been audited, and the massive user base means any major issues are quickly noticed and addressed. The team at ConsenSys (the company behind MetaMask) has introduced features like phishing detection – MetaMask will warn you if you’re interacting with a known malicious domain (they maintain a blocklist). They integrated a tool called Blockaid to scan transactions and alert users of potential scams; in one case, they noted that those who opted into security alerts were “100% protected” from a specific phishing attack that stole funds from others. This proactive stance on security is critical given the constant phishing and scam attempts in crypto.

Another pro: multi-chain future readiness. As more Ethereum layer-2 networks and sidechains emerge, MetaMask tends to support them quickly. For example, when Optimism and Arbitrum (Layer 2 networks) went live, MetaMask users could manually add those networks and use them even before many other wallets had that capability. It stays on the cutting edge of EVM ecosystem developments.

Cons: Perhaps the most cited con of MetaMask is that transaction fees (gas) can be high, but that’s more a con of Ethereum. Nonetheless, new users often get a shock when they see the gas fee prompt. MetaMask does let you adjust gas prices and limits (basic and advanced options), which introduces complexity. If you mis-adjust, your transaction might stall. This is a necessary complexity for interacting with Ethereum, but it can be confusing for some.

Another con: not beginner-friendly for non-Ethereum stuff. MetaMask is really an Ethereum/EVM wallet. It doesn’t support non-EVM chains like Bitcoin, Solana, Cardano, etc. If you try to send Bitcoin to MetaMask, you could lose it – because MetaMask won’t generate a BTC address. So it’s not a one-size-fits-all for all crypto. It focuses on Ethereum and similar networks. For enthusiasts, this means MetaMask is one tool in your kit, but you’ll likely need another wallet for non-EVM assets.

Customer support is limited. There is no official live support (watch out for scam imposters!). The help is basically documentation and community forums. Many people have fallen for scammers who pretend to be MetaMask support on social media – a persistent issue. So using MetaMask safely requires some community knowledge: e.g., MetaMask will never ask for your seed phrase in a form or chat.

Also, mobile vs extension syncing: initially, MetaMask mobile and browser extension didn’t automatically sync accounts (by design for security). You could sync via scanning a QR code for one-time account import, but some found this non-intuitive. This might have improved in recent versions where you can use MetaMask’s portfolio app or login, but still, it’s not a cloud-synced wallet – which again is by design for security, but a slight inconvenience if you use multiple devices (you’ll have to import the wallet on each device via seed phrase).

Finally, using MetaMask can sometimes be too easy to spend money. It’s the gateway to pretty much any speculative token or NFT – which is exciting but also dangerous. Many have joked it’s like having a “casino app”, because with a few taps you can ape into any coin. This, of course, is up to user discretion, but novices might find it easier to get into risky things when the wallet enables one-click access to thousands of tokens. MetaMask has no built-in risk warnings beyond known phishing scams.

Expert Opinion: MetaMask’s impact on crypto is enormous. It’s often called the “gateway to DeFi” or the “key to Web3”. With over 30 million MAU, it achieved record user levels reminiscent of early 2022’s peak of 31 million. Experts credit MetaMask for enabling the explosion of DeFi and NFTs by giving users a simple interface to engage with dApps. Money.com rated it the “Best Web3 Wallet” due to its integration with virtually every dApp and its strong security track record. They noted MetaMask “combines strong security measures... with customizable transaction fees”, highlighting its balance of user control and safety.

Analysts also point out that MetaMask has kept improving security as the user base grew – such as the Blockaid integration that protected users from a recent dApp hack. The fact that it nearly hit the same user activity in late 2023 as it did in the frothy market of 2021 suggests MetaMask remains a core tool even in quieter market times.

In sum, MetaMask is an essential app for any crypto enthusiast, particularly if you’re venturing into Ethereum’s vast ecosystem. It might not be the starting wallet for a complete newbie (who might prefer a Coinbase or similar first), but it inevitably becomes part of the toolkit as one gets more involved. For NFTs, DeFi, ICOs, or just holding ETH and tokens in a self-custodial way, MetaMask is a proven choice. As one IBTimes article put it, “MetaMask has grown significantly… signaling a promising development for web3 adoption”. It’s hard to talk about engaging with modern crypto platforms without MetaMask coming into play, making it a must-have app in this top list.

10. Exodus – User-Friendly Multi-Crypto Wallet

Exodus is a popular desktop and mobile wallet known for its beautiful design and ease of use. For a long time, Exodus has been a favorite choice for those who want a beginner-friendly wallet that still lets them control their private keys. It’s often recommended as the “best overall” crypto wallet for people managing a diverse portfolio, thanks to its support for multiple assets and built-in exchange features. Whether you are on iPhone, Android, or your PC, Exodus provides a seamless way to manage your crypto in a self-custodial manner.

Features: Exodus supports over 260 cryptocurrencies, including Bitcoin, Ethereum (and many ERC-20 tokens), Litecoin, Dogecoin, Dash, and more, plus newer assets like Solana and Binance Chain tokens. It is a non-custodial wallet, so you get a 12-word recovery phrase when you set it up. One of Exodus’s hallmark features is its intuitive interface: the app has visually appealing charts and a portfolio page that shows the value of your holdings and their allocation breakdown. It feels almost like a fintech app, with colorful design and one-click access to features.

Exodus has a built-in exchange (powered by third-party integration, e.g., ShapeShift in the past, now other partners) that lets you swap one asset for another from within the app without needing to use an external exchange. The exchange covers dozens of popular pairs and can be very convenient for portfolio rebalancing or diversifying without sending coins out to a centralized exchange.

Another benefit is cross-platform sync. You can pair your Exodus mobile wallet with your desktop wallet by scanning a QR code, which means you can manage the same wallet across devices. Changes reflect on both, giving flexibility (this uses secure one-way sync of private data; the seed remains the same).

Exodus also incorporates a section for staking certain assets (like Algorand, Cardano, Solana, Cosmos, etc.), where you can earn staking rewards by holding them, and it provides clear info on reward rates. It has a section for Apps that extend functionality – for example, there’s an integration with the Lightning Network for Bitcoin (via the WalletConnect to the Lightning app), and integration with sports betting via SportX, etc., which they introduced to expand use-cases.

Moreover, Exodus has integrated with hardware wallets (specifically, it supports Trezor hardware wallets). Through Exodus, you can manage assets on a connected Trezor device with the Exodus UI. This is great for people who want the security of a hardware wallet with the slick interface of Exodus.

Pros: Extremely user-friendly and visually appealing. Exodus shines in its design – it abstracts away much of the complexity of crypto. New users often find it less intimidating than other wallets. Money.com’s wallet review crowned Exodus as the “Best Crypto Wallet Overall”, noting it’s an “excellent option for a variety of investors – particularly those managing diverse portfolios – thanks to its broad asset support, thousands of trading pairs, and built-in crypto swapping”. This captures the broad appeal: it supports a wide array of coins and makes exchanging them straightforward.

The portfolio tracker aspect is very handy. Instead of just being a wallet, Exodus almost serves as a portfolio management app, showing pie charts of your holdings and allowing you to track value changes over time in-app. This can reduce the need for a separate portfolio tracker.

Multi-platform availability is another pro. Exodus began as a desktop wallet (which many still use), and their mobile app brings that experience on the go. If you prefer managing large sums on a desktop and using mobile for convenience, Exodus covers both. The syncing means you don’t have to manually keep track of which coins are where – it’s the same wallet.

Exodus’s customer support is noted for being good in the non-custodial wallet category. They offer email support and have an extensive knowledge base. Because they are a company (unlike open-source projects which rely solely on community), they strive for a positive user experience and respond to inquiries. For a non-custodial wallet, that’s valuable (though they can’t help if you lose your seed phrase, of course).

Cons: The main trade-off with Exodus is that this user-friendliness comes at the cost of some advanced features and potentially higher swap fees. For one, Exodus is not fully open-source (its wallet portion is closed source, though some components are open). Hardcore crypto folks sometimes prefer fully open wallets like Electrum or MetaMask due to transparency. However, Exodus has been around for many years with a solid reputation, which has built trust even without fully open code.

When using the built-in exchange, the fees or spreads can be higher than using an exchange directly. You pay for convenience. If you swap $100 of crypto within Exodus, you might get a slightly worse rate or a fixed fee tacked on. For occasional trades it’s fine, but it’s not a platform for high-frequency trading or seeking the absolute lowest fees. Large trades might be better done on an exchange then sent back to Exodus.

Exodus also, by design, does not support some cryptos that require their own full nodes (for example, it doesn’t support Monero due to technical complexity and size of blockchain). And while 260+ assets is a lot, it’s fewer than some rivals like Trust Wallet which supports thousands. If you hold something very obscure, Exodus might not have it until it gains popularity.

Another limitation: No native support for dApps or Web3 browsing. Exodus is a wallet, but unlike MetaMask or Trust Wallet, it doesn’t have an in-app browser or easy DApp connection (except for the limited apps they include). So, if you want to use DeFi, you can’t directly connect Exodus to a DApp via WalletConnect (except a couple of integrated ones). That means Exodus is not the tool for daily DeFi interaction. Think of it more like a traditional wallet/portfolio app than a Web3 gateway. This is why many advanced users have Exodus for portfolio and another wallet for Web3 needs.

Lastly, security: Exodus is as secure as a software wallet can be, but by nature, it’s a hot wallet (except when combined with Trezor). It doesn’t have 2FA or multisig capabilities within the app. So if your device is compromised, funds could be at risk. They rely on OS-level encryption and user password. It’s generally fine for moderate amounts, but huge holdings are safer on a hardware wallet (which, to be fair, Exodus can integrate with as mentioned).

Expert Opinion: Exodus consistently ranks high in wallet comparisons for being user-centric. As Money.com noted, it received “consistently high marks for security” and “ease of use across platforms”, which is why they picked it as best overall. Users and reviewers often recommend Exodus to those who are less technical but want the benefits of a self-custodial wallet. It’s also one of the earliest multi-asset wallets to still maintain a strong reputation; launching in 2016, it has been around through multiple cycles, which adds to confidence.

Crypto analysts sometimes mention Exodus in the context of bridging the gap between pure novices (who might stick to exchange wallets out of fear of complexity) and advanced users. It offers a friendly stepping stone into controlling one’s own keys. The founding team’s focus was always on design and customer experience, which shows. A scientific analogy might be that Exodus is to crypto wallets what Apple’s iOS was to early smartphones – not the most open or tweakable, but very polished and approachable.

For many enthusiasts, Exodus becomes a staple for managing a broad portfolio. You might trade on Binance or Coinbase, but then withdraw to Exodus for storage and a nice overview of your holdings. It’s also a convenient hub to perform quick swaps between assets if you decide to rebalance (knowing you pay a bit extra for that ease). Given these factors, Exodus well deserves a spot in the must-have crypto apps – especially for those who value an elegant interface and straightforward experience.

11. ZenGo – Keyless Crypto Wallet for Beginners

ZenGo is a newer entrant that has been turning heads by reimagining wallet security and usability. It brands itself as a “keyless” crypto wallet – eliminating the need for the traditional 12- or 24-word seed phrase, which is often a pain point for beginners worried about losing their keys. Using cutting-edge cryptography (multi-party computation), ZenGo manages private keys in a way that is both user-friendly and secure. Money.com named ZenGo the “Best Crypto Wallet for Beginners” in 2025, precisely because it “removes much of the complexity… by eliminating complex seed phrases”.

Features: ZenGo is a mobile-only wallet available on iOS and Android. When you set it up, you do not get a seed phrase to write down. Instead, the security is split between your device and ZenGo’s servers through mathematical tricks. You sign in with an email and secured by 3D biometric face recognition (on compatible phones). This means if you lose your phone, you can recover your wallet by verifying your identity with the face scan on a new device and confirming via email – a process far more familiar to average users than dealing with secret words. ZenGo’s approach has no single point of failure; neither your device alone nor ZenGo’s server alone can access your funds – it requires cooperation (via encrypted shards of your key).

In terms of assets, ZenGo supports dozens of major cryptocurrencies (Bitcoin, Ethereum and many ERC-20 tokens, Tezos, Binance Chain, Polygon, etc., with new coins added over time). It has an in-app purchase feature to buy crypto with bank card or wire (via third-party providers) and an integrated swap feature (powered by Changelly/Simplex and others) to exchange assets within the app. ZenGo also offers interest-earning options: for example, they provide saving/vault features where you can earn yields on certain assets (like via connection to DeFi lending, etc.), and support for staking (e.g., Tezos baking).

Another unique feature: ZenGo’s ClearSign wallet firewall. It’s a built-in safety mechanism that will analyze smart contract transactions you’re about to sign and try to warn if something looks suspicious (like if a DApp is trying to take more permissions than expected). This addresses the problem of people accidentally signing malicious transactions. ZenGo touts that ClearSign can help users avoid common DeFi and Web3 scams by providing human-readable warnings.

ZenGo also has a feature called Chill Storage. It’s basically a mode where you can lock your funds in the wallet so that even if someone got access to your account, they couldn’t send funds without a waiting period. It’s like an extra security step for large HODLers – you “chill” your wallet, and unfreezing it for spending takes time (giving you a window to act if compromised).

Pros: No seed phrase to lose – this is ZenGo’s biggest draw. For beginners, managing a seed phrase is scary and technically challenging (some might not back it up properly or might lose it). ZenGo removes that hurdle while still keeping the user in control (it’s non-custodial in the sense ZenGo can’t move your funds without your authorization; the key is split). This unique keyless security model has been praised as making crypto more accessible. Money.com specifically highlighted ZenGo’s use of “multi-party computation (MPC) cryptography, a keyless security model” that, combined with its “appealing design,” makes it superb for beginners.

User experience is another big pro. The app is sleek and simple. Reviews often mention how polished the design is – everything from set-up to daily use is guided. It feels like using a modern fintech app rather than a bare-bones crypto tool. They also emphasize customer support; ZenGo has live 24/7 in-app support chat, which is uncommon for self-custody wallets.

ZenGo’s security innovations extend beyond just key management. The facial biometrics and email are familiar processes for users, yet they’re implemented in a way that ZenGo (the company) can’t just unlock your account or steal your funds. It has been externally audited and has a good track record – no ZenGo wallet has been hacked or lost funds due to a security flaw, as per their communications. This balance of security and convenience is its selling point.

The extra features like ClearSign and Chill Storage show the team is thinking about real user problems (phishing, theft) and building protections in. For example, if you’re interacting with DeFi, having that firewall interpret the transaction is very useful to avoid mistakes.

Cons: The primary criticism from purists is that ZenGo’s model is not fully trustless. Because part of the key is on ZenGo’s servers, there’s a hypothetical scenario: if ZenGo the company went out of business or their servers went down, how would users recover their funds? The company has stated they have contingency plans and could release an open-source tool to recover in such a case, but it’s a consideration. With a normal wallet, as long as you have the seed, you don’t care if the company behind the app disappears – you can restore in another wallet. With ZenGo, you’re a bit reliant on the company’s existence for the full recovery process (at least, unless they provide an independent recovery option for users beforehand).

Additionally, ZenGo is closed source for the most part. Some crypto enthusiasts prefer open-source wallets that can be independently audited by the community. ZenGo’s cryptography has been audited by third-party firms, but the code isn’t fully public. For some, that’s a trust trade-off.

Asset support, while covering most big names, is not as extensive as something like Trust Wallet or MetaMask. So, advanced users who have obscure tokens might not find them supported on ZenGo. It’s improving over time, but the focus is more on major coins.

No desktop version: ZenGo is mobile-only. That’s fine for most, but a few users might wish for a desktop app or browser extension for flexibility (currently not available).

Fees: ZenGo is free to download and use, but they make money on services – e.g., a percentage fee on swaps or purchases. The convenience comes at a cost similar to other easy-buy platforms. If you’re trading a lot or moving assets frequently, you might pay a bit more doing it through ZenGo’s partners than if you did on a dedicated exchange or DEX manually.

Expert Opinion: ZenGo has garnered positive coverage for bringing innovative security to mainstream users. When Money.com awarded it best for beginners, they essentially echoed what many have said: by eliminating the seed phrase without compromising self-custody, ZenGo “focuses on ease of use and educational support” for newcomers. In the BitDegree crypto awards, ZenGo often gets mentioned for user experience. The wallet currently holds high ratings on app stores, indicating user satisfaction.

Security experts find the MPC approach sound. It’s similar tech that some institutional custodians use (where multiple parties hold key shares), so bringing that to retail is applauded. The CEO of ZenGo has written about how they want to “kill the seed phrase” because it’s the root of so many user losses (either by being stolen or lost). Many in the industry agree that for broader adoption, we need solutions like this.

For a crypto enthusiast, ZenGo can be an excellent wallet to recommend to friends or family who are new, given its safety net. Enthusiasts themselves might appreciate it as a daily driver for smaller funds or a “warm wallet.” Some might still use something like a Ledger for large holdings but use ZenGo for a checking-account-like wallet that’s easier to manage. The combination of security and simplicity is why ZenGo makes this top apps list. It’s a glimpse at the future of crypto wallets where you don’t have to be an expert in key management to safely own crypto.

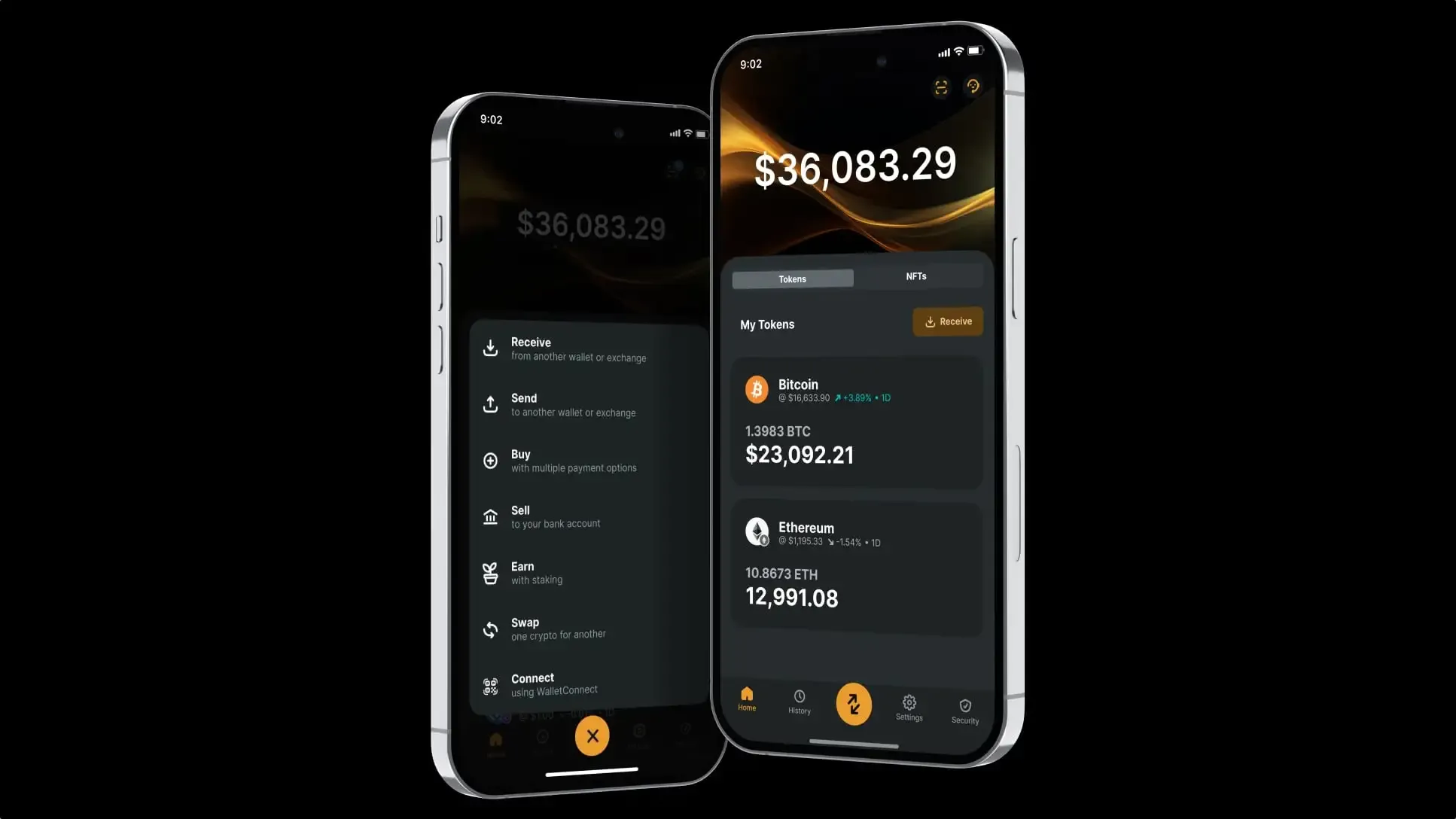

12. Ledger Live – Secure Wallet App for Hardware Wallet Users

For anyone serious about security, a hardware wallet is a must-have device – and Ledger is the market leader in that space. Ledger Live is the companion app for Ledger’s hardware wallets (like the Ledger Nano S, Nano X, and the new Ledger Stax), and it’s an essential part of using those devices. While Ledger devices store your private keys offline, the Ledger Live app (available on mobile and desktop) lets you manage your crypto accounts, check balances, and initiate transactions which you then approve on the hardware. In essence, Ledger Live bridges security and convenience, giving you an interface to a very secure vault.

Features: Ledger Live supports over 5,500 coins and tokens through various integrations. With the app, you can add multiple accounts (for Bitcoin, Ethereum, XRP, etc.) and view your portfolio value in real time. It’s a one-stop dashboard where you can see all the crypto stored on your Ledger device. The app provides price data, historical charts, and detailed transaction history for each account.

A major feature is built-in trading and swapping. Ledger Live integrates with services like Coinify, Changelly, Paraswap, and others to allow you to buy crypto with fiat or swap one crypto for another without leaving the app. Essentially, you can trade securely by initiating in Ledger Live and confirming on your hardware wallet. There’s also an earn section: Ledger Live now supports staking for several coins (e.g., you can stake Polkadot, Tezos, Cosmos, Ether, etc. directly and earn rewards) and even DeFi lending/yield through integrations (like Compound for USDT/DAI, etc.).

Ledger Live also has an Apps catalog (for desktop) where you can install specific blockchain apps on your device (each coin needs its app on the hardware). On mobile, this management is done behind the scenes when you add accounts. They have a Discovery tab showcasing various third-party DApps that you can use in conjunction with Ledger (like Lido for staking, Zerion or Rainbow.me for DeFi, etc.), effectively turning Ledger Live into a gateway for Web3 with hardware security.

The app also provides real-time notifications for transactions if you enable it – so you know when funds arrive or leave. Portfolio tracking is another plus: you can add assets to watch or track some held off-device too. And for NFTs: Ledger Live now displays NFT collectibles (Ethereum and Polygon NFTs) in-app, so you can view your NFT art securely.