On Nov. 10, 2025, the U.S. Treasury Department and Internal Revenue Service released guidance that will fundamentally alter the economics of proof-of-stake blockchains. Revenue Procedure 2025-31 creates a safe harbor allowing crypto exchange-traded funds and trusts to stake digital assets and distribute rewards to investors without triggering adverse tax consequences or losing their favorable trust status.

The move arrives at a pivotal moment. Ethereum spot ETFs hold over $28 billion in assets as of Q3 2025, while the first Solana staking ETF launched with $55.4 million in first-day volume. These products could not previously stake their holdings due to regulatory ambiguity. Now, institutional capital can finally capture staking yields that retail crypto holders have enjoyed for years.

Yet this development has received surprisingly little analysis beyond surface-level reporting. The implications cascade far beyond simple yield enhancement. This guidance will redistribute trillions of dollars in institutional capital across proof-of-stake networks, reshape DeFi liquidity dynamics, and create clear winners and losers among blockchain ecosystems based on their institutional readiness.

Understanding which networks stand to benefit requires examining not just staking yields, but custody infrastructure, validator economics, liquid staking protocols, and the second-order effects on DeFi. The next 12 to 24 months will determine which proof-of-stake tokens capture institutional flows and which miss this generational opportunity.

What Changed: IRS Guidance Explained

The core challenge Revenue Procedure 2025-31 solves is arcane but consequential. Under longstanding tax law, trusts that hold assets for investors can only maintain favorable pass-through tax treatment if they remain passive investment vehicles. The IRS and courts have historically interpreted "passive" very narrowly.

The 1941 case Commissioner v. North American Bond Trust established that trustees who take advantage of market variations to improve investments are exercising "managerial power" and thus converting their trusts into taxable entities. This created obvious problems for staking.

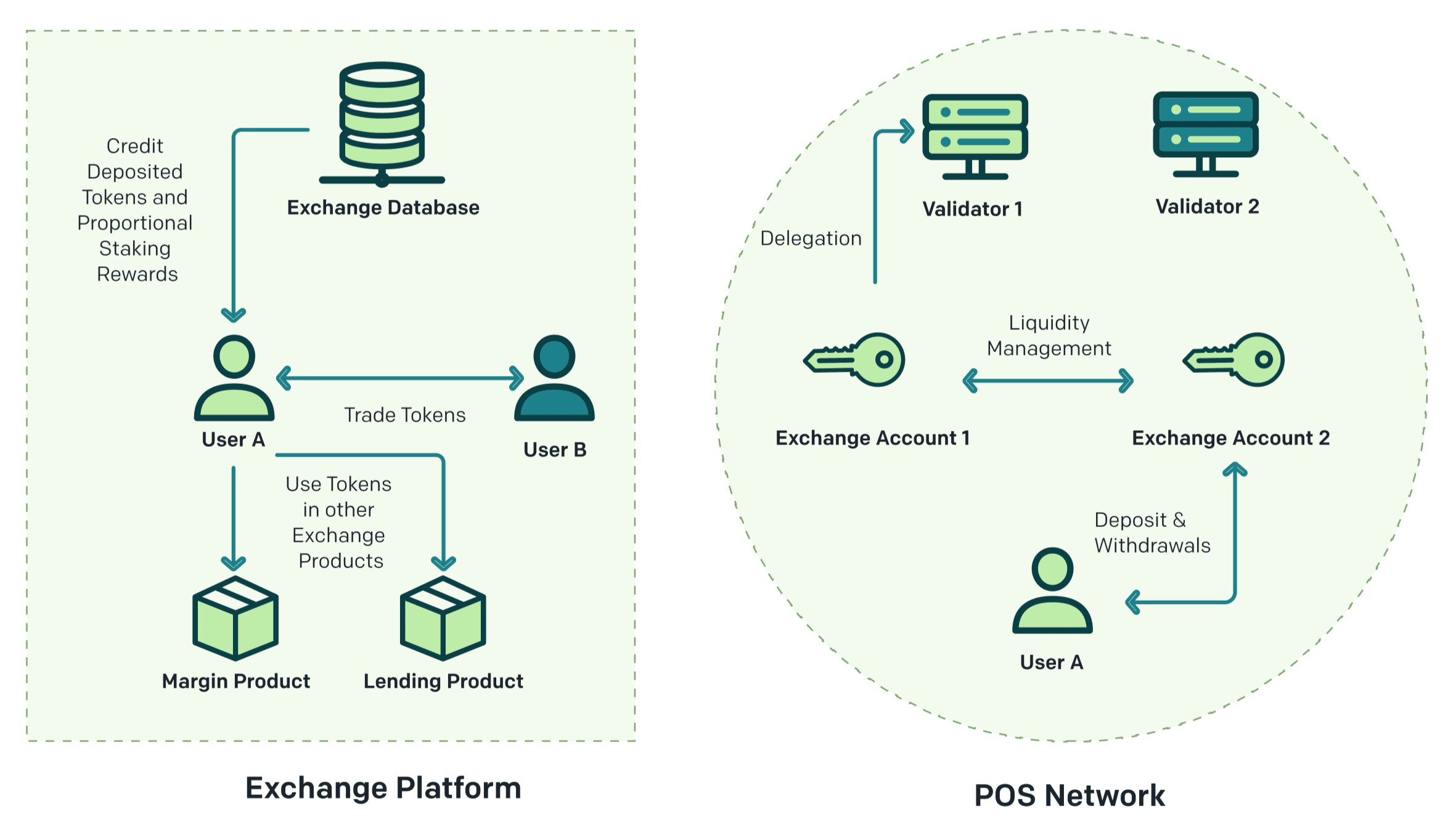

When validators stake tokens to secure proof-of-stake networks, they actively participate in consensus mechanisms, earn rewards, and face slashing penalties for misbehavior. Does this constitute improper "managerial power"? Before November 2025, the answer was unclear enough to keep major asset managers from offering staking in regulated products.

Revenue Procedure 2025-31 provides explicit clarity through a 14-part conjunctive test. Trusts meeting all requirements can stake assets without upsetting their status as investment trusts under Treasury Regulation 301.7701-4(c) or as grantor trusts under Internal Revenue Code Sections 671-679.

The safe harbor requirements include several critical provisions. The trust must hold only one type of digital asset plus cash for operational needs. It must list on a national securities exchange with SEC approval. A qualified third-party custodian must hold all private keys. The trust must work with independent staking providers under arm's-length agreements. Management activities must remain limited to accepting deposits, paying expenses, staking, and distributing rewards. The trust cannot trade to profit from market fluctuations.

Crucially, the safe harbor requires staking all tokens subject to specific exceptions. These exceptions include maintaining liquidity reserves for redemptions, keeping cash for operational expenses, and accommodating unstaking periods mandated by the underlying blockchain protocol. For Ethereum, this means ETFs can leave tokens unstaked during the roughly 24 to 48 hour withdrawal queue without violating the guidance.

The procedure applies retroactively to all tax years ending on or after Nov. 10, 2025. Trusts formed before issuance have nine months from that date to amend their trust agreements to authorize staking, provided they meet all other requirements. This grace period ensures existing Ethereum and Solana ETFs can quickly adapt without restructuring.

Before this guidance, staking rewards faced uncertain tax treatment. Some argued they constituted ordinary income taxable upon receipt. Others claimed they represented new property not taxable until sold. Revenue Procedure 2025-31 sidesteps these debates for compliant trusts by maintaining their pass-through status. Investors in qualifying ETFs will receive rewards through distributions or net asset value increases, with tax treatment following standard trust taxation principles. The trust itself avoids entity-level taxation that would otherwise compress returns.

The timing reflects broader regulatory coordination. Treasury Secretary Scott Bessent stated the guidance provides a clear path for ETPs to stake digital assets and share rewards with retail investors, keeping America the global leader in blockchain technology. The IRS explicitly referenced SEC rule changes from September 2025 that approved generic listing standards for crypto ETFs, signaling unprecedented interagency alignment on staking products.

This coordination matters because the SEC previously viewed proof-of-stake mechanisms with suspicion. Former SEC Chair Gary Gensler suggested in 2023 that proof-of-stake tokens might constitute securities, a position that would have killed institutional staking products. The November 2025 guidance represents a complete policy reversal, with regulators now actively enabling these products rather than blocking them.

The safe harbor's operational requirements will force changes in how ETFs structure staking. Most critically, the requirement for qualified third-party custodians and independent staking providers means ETF sponsors cannot vertically integrate these services. This will benefit established institutional custodians like Coinbase Custody, Anchorage Digital, and BitGo, which already have the infrastructure and regulatory approvals to serve as qualified custodians.

PoS Staking Economics

Understanding the institutional implications requires grasping how proof-of-stake staking actually works and why it generates rewards. The mechanics vary significantly across networks, creating meaningful differences in institutional appeal.

Ethereum moved to proof-of-stake through The Merge in September 2022. Under this system, validators propose and attest to new blocks by staking 32 ETH as collateral. This stake acts as economic security: validators who behave honestly earn rewards, while those who act maliciously or maintain poor uptime face slashing penalties that burn part of their stake.

As of November 2025, Ethereum has over 35.7 million ETH staked across more than 1.06 million validators, representing approximately 29.5% of total ETH supply. Validators earn rewards from three sources: consensus layer issuance for proposing and attesting to blocks, priority fees from transactions, and maximal extractable value (MEV) from transaction ordering.

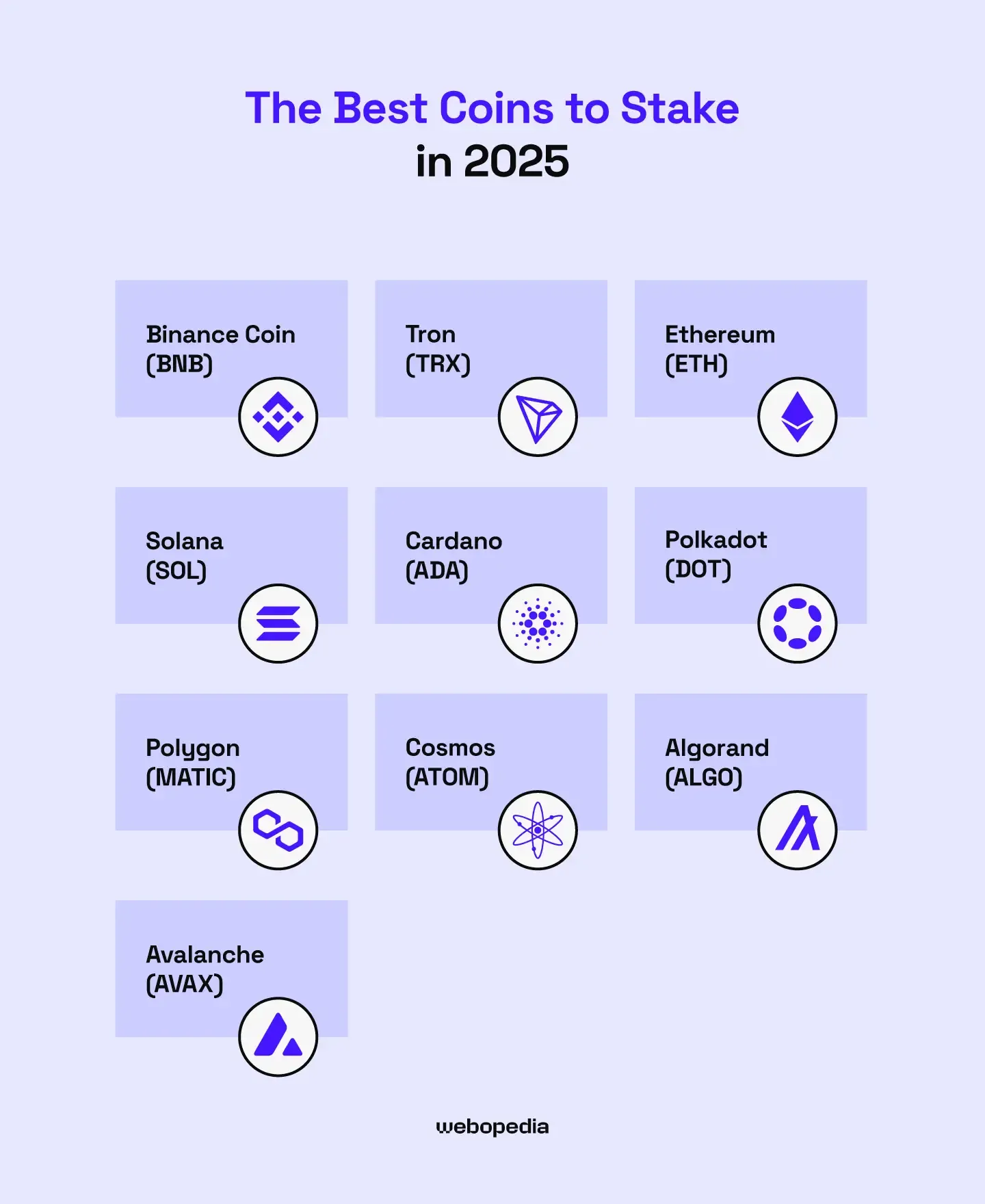

Current Ethereum staking yields range from 2.89% to 4.42% depending on network activity and validator performance. Lido's stETH offers around 3.03% APR, while independent validators might achieve slightly higher rates by capturing MEV directly. These yields reflect Ethereum's relatively mature staking ecosystem and low inflation rate.

Ethereum implements a queue system for activations and exits to prevent rapid stake fluctuations that could destabilize consensus. As of mid-November 2025, new validators wait about 23 days to activate, while exiting stakes require roughly 38 days. These delays matter for ETF liquidity planning, as funds must maintain sufficient unstaked reserves to meet redemption requests.

Slashing on Ethereum occurs when validators sign conflicting attestations or proposals, or when they remain offline for extended periods. Penalties range from minor inactivity leaks to complete stake destruction for provable malicious behavior. In Q2 2025, 21 slashing events were recorded across all validators, illustrating the relative rarity but real risk of penalties. Institutional-grade validators like Figment achieved zero slashing events and 99.9% uptime, demonstrating that professional operations can effectively manage these risks.

Solana operates differently. Its hybrid proof-of-stake and proof-of-history consensus validates transactions at extreme speed, processing thousands of transactions per second. Solana validators require no minimum stake for delegation, though running a validator node yourself demands technical infrastructure and ongoing operating costs.

Solana staking yields currently range from 6.3% to 6.7%, notably higher than Ethereum. This reflects Solana's different inflation schedule. The network launched with 8% annual inflation, decreasing by 15% year-over-year toward a terminal rate of 1.5%. As of 2025, inflation sits near 5-6%, giving a real yield of 0-3% after accounting for token dilution.

Approximately 67% of SOL supply is staked, representing around 393.6 million SOL worth roughly $65 billion at recent prices. Solana's epoch system distributes rewards approximately every two days, faster than Ethereum's daily reward accrual. Validators earn from both inflation issuance and transaction fees, with Solana's high transaction volume generating material fee income.

Cardano takes yet another approach. The network uses a UTXO-based architecture rather than an account model, with stake pools operated by community validators. ADA holders delegate to these pools without transferring custody, earning 4-5% annually depending on pool performance. Cardano's 71% staking participation rate represents one of the highest among major networks.

Cardano imposes no lockup periods and no slashing penalties, making it operationally simpler than Ethereum or Solana. However, this simplicity comes with lower institutional adoption of custody infrastructure. While major custodians support Cardano holdings, few offer delegated staking as a managed service comparable to their Ethereum and Solana offerings.

Cosmos operates as an ecosystem of interoperable blockchains connected through the Inter-Blockchain Communication protocol. The Cosmos Hub, secured by ATOM staking, offers yields of 7-18.5%, among the highest of major networks. About 59% of ATOM supply is staked, worth approximately $1.2 billion.

Cosmos's delegated proof-of-stake allows ATOM holders to delegate to validators without minimum thresholds. Unbonding periods last 21 days, during which tokens cannot be traded or restaked. Validators can be slashed for double-signing or prolonged downtime, with penalties passed through to delegators. The high yields reflect both inflation and the network's smaller scale compared to Ethereum.

Avalanche uses a proof-of-stake system with three distinct chains: the X-Chain for asset creation, the C-Chain for smart contracts, and the P-Chain for validator coordination. Validators must stake a minimum of 2,000 AVAX for 14 days, while delegators need just 25 AVAX. Staking yields range from 7-11%, with about 53-58% of supply staked.

Avalanche's transaction finality arrives within seconds, much faster than Ethereum's block times. This speed benefits DeFi applications but requires validators to maintain robust infrastructure to keep pace. The network's focus on custom subnets creates additional validator complexity, as validators may choose to validate multiple subnets for extra rewards.

The concept of liquid staking emerged to solve a fundamental problem: traditional staking locks capital, preventing its use elsewhere. Lido Finance pioneered liquid staking on Ethereum in December 2020 by issuing stETH tokens representing staked ETH plus accrued rewards. Users deposit any amount of ETH to Lido's smart contracts, receive stETH in return, and earn staking rewards as their stETH balance increases through rebasing.

Critically, stETH remains liquid and tradeable. Holders can use it as collateral in lending protocols like Aave, provide liquidity on decentralized exchanges, or sell it anytime without waiting for unstaking periods. This capital efficiency revolutionized DeFi by allowing the same ETH to earn both staking rewards and additional DeFi yields simultaneously.

Rocket Pool's rETH uses a non-rebasing design where the token's value increases against ETH rather than the supply expanding. As of 2025, Rocket Pool is Ethereum's second-largest liquid staking protocol behind Lido, with more than 1 million ETH staked. Rocket Pool emphasizes decentralization by allowing users to run validator nodes with just 8 ETH rather than the standard 32 ETH requirement.

Solana liquid staking protocols like Marinade Finance and Jito issue mSOL and JitoSOL respectively. These tokens work similarly to Ethereum's liquid staking derivatives, allowing SOL to remain productive in DeFi while earning staking rewards. Marinade optimizes yields by automatically routing stake to high-performing validators, while Jito incorporates MEV rewards into yields.

MEV deserves special attention for institutional staking. Maximal extractable value refers to profit validators can extract by strategically ordering, including, or excluding transactions within blocks they produce. On Ethereum, sophisticated validators earn substantial MEV income by running specialized software that identifies profitable transaction ordering opportunities.

MEV and transaction fees provide smaller but variable contributions to total staking yields. During network congestion and high-fee periods, MEV can temporarily push total yields above 10%. However, MEV is highly variable and concentrated among technically sophisticated validators. Institutional staking providers must decide whether to pursue MEV optimization, which requires additional infrastructure and carries some risk, or focus purely on consensus rewards.

Institutional Readiness: Which Chains Have Infrastructure for ETFs?

Revenue Procedure 2025-31 creates opportunity, but capturing it requires infrastructure most blockchain networks lack. The safe harbor's requirements for qualified custodians, independent staking providers, and arm's-length operations mean ETFs cannot simply self-stake. They need institutional-grade service providers with regulatory approvals, insurance, and operational track records.

Ethereum holds overwhelming advantages here. The three largest institutional custodians - Coinbase Custody, Anchorage Digital, and BitGo - all offer comprehensive Ethereum staking services. These firms provide cold storage security, validator operations, slashing insurance, and regular third-party audits. They operate under state trust charters or money transmitter licenses, satisfying the safe harbor's qualified custodian requirement.

Coinbase Custody, launched in 2018, custodies assets for more than 1,000 institutional clients including several current crypto ETFs. Its integrated staking service operates validators achieving 99.9% uptime with zero slashing events since launch. Coinbase offers staking for Ethereum, Solana, Cardano, Polkadot, Cosmos, and Avalanche, though Ethereum receives the most development resources and institutional demand.

Anchorage Digital, the first federally chartered crypto bank in the United States, provides custody and staking for qualified institutional clients. Its banking charter subjects it to OCC supervision and regular examinations, providing comfort to risk-averse asset managers. Anchorage's staking infrastructure emphasizes compliance and operational rigor over maximizing yields, aligning with institutional priorities.

BitGo pioneered multi-signature custody and now serves as custodian for numerous crypto funds and ETFs. Its staking services focus on Ethereum and newer proof-of-stake chains, with particular strength in Solana infrastructure. BitGo's $100 million insurance policy covers custody risks but not slashing penalties, a distinction that matters for institutional risk management.

Beyond custody, staking requires validator operations. Some custodians run their own validators, while others partner with specialized staking providers. This separation satisfies Revenue Procedure 2025-31's requirement for independent staking providers under arm's-length agreements.

Figment, Blockdaemon, and Kiln dominate institutional staking-as-a-service. Figment operates validators on over 50 proof-of-stake networks, including Ethereum, Solana, Cosmos, Avalanche, and Polkadot. Its institutional clients include asset managers, hedge funds, and crypto exchanges. Figment achieved zero slashing events in Q2 2025 on Ethereum, demonstrating operational excellence.

Blockdaemon provides validator infrastructure with a focus on white-label solutions for institutions that want branded staking products. Its platform supports staking for Ethereum, Solana, Avalanche, and numerous other chains, with SLA guarantees and insurance options. Blockdaemon's client list includes several Wall Street financial institutions exploring crypto products.

These service providers charge fees that compress net yields. Institutional custodians typically charge 0.5-2% annually for custody and staking services combined. Validator operators take additional commissions of 5-15% of staking rewards. After these costs, institutional clients earn meaningfully less than retail users staking directly, but gain regulatory compliance, insurance, and operational simplicity.

Ethereum's institutional infrastructure extends beyond custody and validators to data providers, analytics platforms, and insurance products. Staking providers use services like Rated Network and Rated Labs to monitor validator performance and optimize operations. Insurance protocols provide coverage for slashing risks that traditional insurance markets avoid. This ecosystem depth makes Ethereum far easier for institutions to adopt compared to newer networks.

Solana's institutional infrastructure has matured rapidly. All three major custodians now support SOL staking, though with less operational history than Ethereum. The first Solana staking ETF launched in July 2025 with institutional-grade custody from day one, demonstrating readiness for mainstream adoption. Solana's faster confirmation times and lower transaction costs appeal to institutions looking beyond Ethereum.

However, Solana faces network stability questions. The chain experienced several outages in 2022-2023 that damaged institutional confidence. While Solana's stability has improved significantly in 2024-2025, institutional risk committees remember these incidents. ETF sponsors must explain downtime risks in prospectuses, potentially deterring conservative investors.

Solana's validator economics differ meaningfully from Ethereum. The network's high transaction throughput means validators require more expensive infrastructure to keep pace. However, Solana's transaction fee income can supplement inflation rewards during busy periods, sometimes pushing yields higher than nominal APRs suggest. Institutional validators must invest in robust infrastructure to capture this opportunity.

Cardano presents a puzzle. The network's 71% staking participation rate and no-slashing design should appeal to institutions. Cardano's UTXO architecture and formal verification approach satisfy compliance teams. Yet institutional custody and staking services remain limited. Only Coinbase among major custodians offers managed Cardano staking, and institutional demand remains modest.

The challenge is less technical than reputational. Cardano's deliberate development pace and academic focus create perception problems in an industry that values shipping fast. Institutional allocators struggle to articulate why they would choose Cardano over Ethereum or Solana, despite its technical merits. This perception gap may change if Cardano successfully activates high-profile decentralized applications, but for now it limits institutional staking potential.

Cosmos occupies a unique position. The network's 18.5% staking yields attract attention, but its interchain architecture complicates institutional adoption. Custodians must choose which Cosmos zones to support, validator selection is more complex, and unbonding periods of 21 days challenge liquidity planning. Coinbase and others support basic ATOM staking, but comprehensive Cosmos ecosystem support remains limited.

Cosmos's strength is its growing ecosystem of independent zones using IBC to communicate. Networks like Osmosis, Celestia, and dYdX Chain all use Cosmos technology and offer staking. However, each requires separate custody and staking infrastructure. Institutional adoption likely focuses narrowly on ATOM initially, with broader ecosystem support developing slowly if ATOM proves successful.

Avalanche benefits from Ethereum Virtual Machine compatibility, allowing institutions to repurpose Ethereum infrastructure. Staking yields of 7-11% attract attention, though the 2,000 AVAX minimum for validators creates friction. Avalanche's subnet architecture offers customization that could appeal to enterprise users, but also adds complexity that institutions must understand before committing capital.

Institutional custody support for Avalanche exists through Coinbase and others, but adoption lags Ethereum and Solana significantly. The network's positioning as an "Ethereum alternative" rather than a complement may limit its appeal to institutions hedging Ethereum exposure. Avalanche's strongest institutional case likely lies in its subnet model for permissioned enterprise applications rather than public staking.

Polkadot's nominated proof-of-stake offers yields of 8-11.5% with about 56% of DOT staked. The network's focus on parachain auctions and interoperability creates unique institutional considerations. Custodians like Coinbase support DOT staking, but the complexity of parachain participation and the 28-day unbonding period create operational challenges.

The broader pattern is clear: Ethereum and Solana have institutional infrastructure ready for immediate ETF staking adoption, while other networks lag meaningfully behind. Cardano, Cosmos, Avalanche, and Polkadot may build institutional readiness over time, but the next 12-24 months likely see capital concentration in ETH and SOL products due to their superior infrastructure depth.

Winners and Losers: Modeling Post-Ruling Capital Flows

Revenue Procedure 2025-31 will redistribute capital at unprecedented scale. To understand the winners and losers, we must model how institutional flows will behave and what second-order effects will emerge.

Start with current ETF assets. Ethereum spot ETFs held $27.6 billion in Q3 2025, up 173% from $10.1 billion at quarter start. BlackRock's ETHA alone commands $15.7 billion, making it one of the largest crypto investment products globally. If these ETFs stake at the average 29.5% network rate, they could add over $8 billion in staked ETH.

However, the reality will differ. ETFs cannot stake 100% of assets due to liquidity requirements. The SEC expects funds to maintain reserves ensuring at least 85% of assets can be redeemed quickly, even with some holdings staked. Given Ethereum's 23-day activation and 38-day exit queues, ETFs will likely stake 50-70% of assets initially, leaving substantial reserves for redemptions.

At 60% staking ratios, Ethereum ETFs would add roughly $16.5 billion in new staked capital. This represents approximately 4.7 million ETH at $3,500 prices, a 13% increase over current staking participation. Distributing this across validators, it could launch 147,000 new 32-ETH validators, a 14% increase in the validator set.

This influx compresses yields through simple supply-demand mechanics. Ethereum's issuance rewards scale with total staked amount, while MEV and transaction fees are relatively fixed. As more ETH stakes, individual validator rewards decline. Current modeling suggests yields could fall from 3-4% to 2.5-3.5% if staking participation rises from 29.5% to 35%.

However, this yield compression might be offset by increased network security and value accrual. Higher staking participation makes attacks more expensive, potentially reducing risk premiums in ETH valuations. If ETH prices rise due to perceived increased security, total staking returns in dollar terms could remain attractive despite lower APR.

The validator distribution matters critically. Ethereum currently suffers from concentration risk, with Lido controlling 24.4% of staked ETH, down from over 32% at peak. Institutional ETF staking through qualified custodians will likely increase concentration among Coinbase, Anchorage, and BitGo validators. These three firms might collectively control 15-20% of Ethereum validators after ETF staking ramps up.

This centralization creates governance risks. Ethereum uses social consensus for major decisions, but validator concentration gives large custodians disproportionate influence. If Coinbase, acting as custodian for multiple ETFs, controls 10% of validators, its technical decisions on client diversity and protocol upgrades carry significant weight. The community must watch custodian concentration carefully to preserve Ethereum's decentralization ethos.

Liquid staking protocols face existential questions. Lido's stETH holds over $18 billion TVL, representing about 30% of all staked ETH. When ETFs can offer staking directly with regulatory approval, will DeFi users still prefer Lido? The answer depends on use cases.

Retail and DeFi-native users will likely continue using liquid staking tokens because they offer composability ETFs cannot match. You can use stETH as collateral in Aave, provide liquidity on Curve, or farm additional yields on Convex. ETFs provide simpler exposure for traditional investors but lack DeFi integration. This suggests liquid staking and ETF staking will serve different market segments rather than directly competing.

However, marginal users face real choice. Someone holding ETH primarily for price exposure and secondary staking yield might choose an ETF over Lido for the simplicity and regulatory comfort. This could slow liquid staking growth rather than shrinking it outright. Expect Lido's market share to decline from 30% toward 25% as ETF staking scales, but not collapse entirely.

Rocket Pool's positioning as the more decentralized alternative to Lido might gain appeal in this environment. If institutional ETF staking increases centralization concerns, some portion of the crypto-native community may shift toward Rocket Pool's 2,700+ independent node operators. The network's 8 ETH minipool requirement democratizes validation more than ETFs ever could.

Solana presents different dynamics. The Bitwise Solana Staking ETF launched in July 2025 with staking enabled from day one, demonstrating institutional readiness. If Solana ETFs accumulate assets at rates comparable to Ethereum products, the impact on network staking could be even more pronounced given Solana's smaller market capitalization.

Solana currently has approximately 393.6 million SOL staked worth about $65 billion. If Solana ETFs reach even 20% of Ethereum ETF assets - roughly $5.5 billion - and stake 60% of holdings, they would add about $3.3 billion in staked capital. At $165 per SOL, this represents 20 million additional staked SOL, a 5% increase in network staking.

This smaller absolute increase reflects Solana's already high 67% staking participation rate, among the highest of major networks. With most SOL already earning rewards, incremental institutional staking has less room to grow participation percentages. Instead, it will concentrate stake with institutional validators, likely increasing Coinbase and BitGo's share of Solana validation.

Solana liquid staking through Marinade and Jito may actually benefit from institutional ETF launches. These protocols emphasize MEV capture and validator optimization, offering higher yields than simple ETF staking. Sophisticated users might stake SOL through ETFs for regulatory-approved core holdings, while farming additional yields with liquid staking derivatives in DeFi. This complementary relationship could help both grow rather than cannibalize each other.

The second-order effects on DeFi liquidity deserve close attention. Currently, a significant portion of liquid staking tokens serve as collateral in lending protocols, liquidity in AMMs, and yield sources in farming strategies. As ETH and SOL migrate from liquid staking into ETFs, does DeFi liquidity dry up?

The answer likely depends on which users move capital. If institutional buyers allocate new capital to ETFs rather than pulling existing DeFi positions, no displacement occurs. However, crypto-native funds that previously used liquid staking might shift some capital to staking ETFs for regulatory or operational reasons. This would reduce DeFi liquidity at the margin.

Specific protocols face specific risks. Curve's stETH-ETH pool is among DeFi's deepest liquidity pools, enabling large stETH trades with minimal slippage. If stETH supply growth slows as institutional capital chooses ETFs instead, Curve liquidity could thin, increasing slippage and reducing capital efficiency. Similar risks exist for Rocket Pool's rETH pools and Solana liquid staking derivatives.

The mitigation is that DeFi composability offers value ETFs cannot replicate. Users who want to earn staking yield while simultaneously providing liquidity, borrowing against their positions, or farming additional tokens will stick with liquid staking. Only users who want passive staking exposure without DeFi complexity will choose ETFs. This self-selection limits DeFi displacement.

Another critical consideration is validator rewards distribution. Currently, independent and small-scale validators earn the same per-validator rewards as large institutional operations. As institutional staking grows, the economics may shift. If Coinbase, Anchorage, and BitGo collectively operate 20% of Ethereum validators, they capture 20% of all staking rewards - hundreds of millions of dollars annually.

This concentration of rewards with institutions rather than distributed among independent validators transfers wealth from crypto-native participants to traditional financial intermediaries. The trade is liquidity and regulatory comfort for decentralization and community alignment. Ethereum and Solana communities must decide if this trade serves their long-term interests or whether measures are needed to preserve independent validator economics.

Network inflation dynamics also change. Ethereum's issuance is currently slightly deflationary due to EIP-1559 fee burning, with transaction fees often exceeding new issuance. If staking participation rises from 29.5% to 35%, total issuance increases while fee burning continues at recent rates. This could make Ethereum nominally inflationary again unless transaction activity increases proportionally.

For token holders, this matters tremendously. One of Ethereum's bull cases is its transition to a deflationary asset as usage grows. If institutional staking increases issuance faster than fee burning can offset, the deflationary narrative weakens. ETH prices might face headwinds from increased supply even as institutional adoption theoretically increases demand.

Solana's inflation schedule provides more predictability. The network decreases inflation 15% year-over-year toward a 1.5% terminal rate, regardless of staking participation. Institutional staking simply redistributes who earns inflation rewards rather than changing total issuance. However, if staking participation increases above current 67% levels, yields per staker decline as more participants split the same reward pool.

The competitive implications extend beyond current major networks. Proof-of-stake chains not yet launched on ETFs face pressure to build institutional infrastructure quickly or miss the capital wave. Avalanche, Cosmos, Cardano, and others must convince custodians to prioritize their integration or risk permanent marginalization in institutional portfolios.

This creates winner-take-most dynamics where networks with early institutional readiness capture disproportionate capital, which then funds further infrastructure development, attracting more capital in a virtuous cycle. Networks without institutional traction spiral into irrelevance as capital and attention concentrate elsewhere. The next two years likely determine which proof-of-stake chains achieve institutional legitimacy and which become niche plays.

Secondary Effects: DeFi Disruption, Validator Economics, and Layer-2 Implications

The institutional staking revolution ripples far beyond simple yield capture. Second-order effects will reshape DeFi protocol economics, alter validator participation patterns, and influence Layer-2 development trajectories in ways that deserve dedicated analysis.

DeFi protocols built on proof-of-stake chains fundamentally depend on native token liquidity. When users lock tokens in staking, less remains available for DeFi activities. The liquid staking innovation solved this by tokenizing staked positions, but institutional ETF staking threatens to reverse this solution.

Consider Ethereum-based lending protocols. Aave allows stETH as collateral, enabling users to borrow against staked positions without unstaking. This capital efficiency drives significant DeFi activity. If ETF staking captures institutional capital that would otherwise enter DeFi through liquid staking, Aave's available collateral growth slows.

The magnitude matters. If $5 billion of potential stETH deposits instead enter ETFs, Aave loses $5 billion in potential collateral, which might have supported $3-4 billion in additional lending at typical loan-to-value ratios. This contracts DeFi credit availability and potentially increases borrowing costs as supply tightens relative to demand.

Similar dynamics affect decentralized exchanges. Uniswap and Curve host massive stETH-ETH liquidity pools that enable efficient trading between staked and unstaked positions. These pools require providers to supply both assets, earning trading fees in return. If stETH supply growth slows due to ETF competition, providing liquidity becomes less attractive as volumes decline relative to capital requirements.

The self-correcting mechanism is yield differentials. If liquid staking token yields fall below ETF yields due to reduced demand, arbitrageurs will shift capital until yields equilibrate. However, during transition periods, significant dislocations can occur. DeFi protocols should prepare for potential liquidity shocks as capital migrates.

Farming and yield aggregation protocols face particular disruption. Strategies that stake ETH via Lido to receive stETH, deposit stETH in Curve, stake the Curve LP tokens in Convex, and farm CVX rewards have been popular yield sources. Each step adds complexity but also additional yield. If institutional capital prefers simple ETF staking, these complex farming strategies lose depositors and their yields compress from reduced activity.

The countervailing force is that sophisticated yield farming will always attract some participants regardless of institutional ETF availability. Professional DeFi farmers can achieve net returns materially higher than ETF staking by layering strategies, accepting smart contract risk, and actively managing positions. This subset of users won't migrate to ETFs because they're willing to accept higher complexity and risk for higher returns.

Validator economics face profound shifts from institutional participation. Currently, Ethereum validation remains relatively decentralized with over 1.06 million validators operated by thousands of independent entities. While Lido holds the largest share at 24.4%, no single entity controls more than one-third of stake.

Institutional ETF staking concentrates validation among a handful of qualified custodians. If Coinbase, Anchorage, and BitGo collectively run 20% of validators within two years, three entities control stake equivalent to all of Lido. This concentration threatens Ethereum's censorship resistance and credible neutrality.

The technical concern is validator collusion. If a small number of custodians control a large percentage of validators, they could theoretically coordinate to censor transactions, frontrun users through MEV, or influence protocol governance. While these actors operate under regulatory oversight that discourages bad behavior, the technical capability creates risk.

Community responses may include protocol changes to penalize validator concentration. Ideas like limiting the number of validators any single entity can operate, or decreasing rewards for validators from the same operator, have been discussed in Ethereum research circles. However, implementing such changes requires careful design to avoid unintended consequences and maintain the network's credible neutrality.

Solo validators face economic pressure from institutional competition. Individual validators must invest in hardware, maintain uptime, and monitor operations. Institutional validators achieve economies of scale, spreading fixed costs across thousands of validators. This efficiency gap means institutional operators can offer slightly higher net yields to ETF investors than solo stakers achieve after accounting for operational costs.

Over time, this economics disadvantage may reduce solo validator participation. If home stakers exit because institutional operations are more profitable, Ethereum loses a critical decentralization constituency. The network must find ways to preserve solo validator economics or risk becoming institutionally dominated.

Liquid staking protocols could actually help preserve decentralization. By aggregating small stakes and distributing them across many independent operators, protocols like Rocket Pool maintain validator diversity while providing institutional-comparable yields. If Ethereum's research community prioritizes decentralization, it should encourage liquid staking protocol development rather than viewing them as threats to institutional adoption.

Solana's validator economics differ due to the network's higher infrastructure requirements. Running a Solana validator requires more expensive hardware and bandwidth than Ethereum validation, creating natural economies of scale favoring larger operations. Institutional ETF staking likely accelerates this concentration rather than introducing it.

The positive case is that institutional capital improves Solana's security. More stake makes attacks more expensive, and institutional validators bring professional operational standards that reduce downtime. If Solana can scale validator count alongside stake concentration, it preserves decentralization even as large operators control more stake per operator.

Layer-2 networks face complex implications from institutional Layer-1 staking. Ethereum's dominant scaling roadmap relies on rollups like Arbitrum, Optimism, and Base to handle transaction volume while settling to Ethereum's base layer. These rollups depend on Ethereum's security, which theoretically improves with higher staking participation.

However, if institutional capital concentrates in Layer-1 staking, less flows to Layer-2 ecosystems. This could slow Layer-2 DeFi development and liquidity growth relative to scenarios where institutions spread capital across the stack. Layer-2 teams must consider whether to launch their own staking mechanisms or focus purely on Ethereum's security.

Some Layer-2s like Polygon have independent validator sets and staking tokens. Polygon PoS uses MATIC staking with over $1.8 billion staked supporting Ethereum scaling. If institutional capital concentrates in ETH and SOL staking, alternative Layer-1 staking tokens like MATIC may struggle to compete for institutional allocation.

The exception might be rollups that share Ethereum's security without separate tokens. Base, built by Coinbase, inherits Ethereum security while providing Coinbase users a familiar brand. Institutional investors may prefer this approach to standalone Layer-2 tokens, driving activity toward shared-security rollups over independent Layer-1 competitors.

Restaking through EigenLayer and similar protocols adds another layer of complexity. These services allow staked ETH to secure multiple protocols simultaneously, generating additional yield. However, restaking increases risk because slashing penalties can apply across multiple protocols.

Institutional ETFs likely avoid restaking initially due to these heightened risks. However, if EigenLayer matures and proves its risk controls, future ETF products might incorporate restaking to boost yields. This would require additional IRS guidance on whether restaking fits within Revenue Procedure 2025-31's safe harbor, creating regulatory uncertainty that could delay adoption.

The broader pattern emerging is divergence between DeFi-native users seeking maximum yield through complex strategies and institutional investors prioritizing simplicity and compliance. This creates two parallel staking economies: a sophisticated DeFi stack using liquid staking derivatives, farming, and restaking; and a straightforward institutional stack using ETFs and direct custodial staking. The two systems will interact and arbitrage will connect them, but they serve different users with different priorities.

Regulatory and Global Implications: The Competitive Landscape

Revenue Procedure 2025-31 represents the United States moving decisively to lead institutional crypto adoption. However, its impact extends far beyond U.S. borders as jurisdictions globally react to American competitive positioning.

Europe's Markets in Crypto-Assets Regulation (MiCA) took effect in 2024, creating the EU's first comprehensive crypto regulatory framework. MiCA establishes licensing requirements for crypto service providers, imposes reserve requirements for stablecoins, and mandates consumer protections. However, MiCA's treatment of staking remains less developed than the U.S. approach under Revenue Procedure 2025-31.

European asset managers watch U.S. developments closely. If American ETFs successfully offer staking yields while European products cannot due to regulatory uncertainty, capital will flow to U.S. markets. This competitive pressure likely accelerates European Securities and Markets Authority guidance on staking in regulated products. Expect EU staking ETF clarity within 12-18 months of U.S. products demonstrating success.

The United Kingdom's Financial Conduct Authority has signaled openness to crypto product innovation while maintaining investor protections. Following Brexit, the UK can move independently of EU regulations, potentially allowing British asset managers to offer staking products before MiCA-compliant EU alternatives emerge. This could position London as a middle ground between U.S. innovation and EU caution.

Asia presents a fragmented picture. Singapore's Monetary Authority has taken a sophisticated approach to crypto regulation, licensing exchanges and requiring robust risk management. However, Singapore's small domestic market limits its global influence. If Singaporean regulators approve staking ETFs, they serve primarily regional investors rather than global institutional capital.

Hong Kong's recent crypto-friendly policy shift aims to position the territory as Asia's crypto hub. The Hong Kong Securities and Futures Commission has approved crypto ETFs with more liberal rules than many Western jurisdictions, including allowing in-kind creations and redemptions. If Hong Kong permits staking in these products, it could attract Asian institutional capital that might otherwise flow to U.S. markets.

Japan's Financial Services Agency maintains conservative crypto regulations following high-profile exchange hacks in prior years. Japanese regulators likely take a wait-and-see approach on staking ETFs, observing U.S. and European experiences before crafting local rules. This caution means Japanese institutional capital accesses staking primarily through foreign products rather than domestic offerings.

South Korea's aggressive retail crypto adoption contrasts with conservative institutional regulations. Korean pension funds and insurance companies face strict crypto investment limits, regardless of how favorable staking ETF regulations might become. Meaningful Korean institutional participation likely requires broader regulatory reforms beyond just staking product approval.

The Middle East, particularly the United Arab Emirates, has signaled interest in becoming a crypto-friendly jurisdiction. Dubai's Virtual Asset Regulatory Authority and Abu Dhabi Global Market have licensed numerous crypto firms and expressed openness to innovative products. However, these jurisdictions' limited institutional capital base means staking ETFs approved there primarily serve as regulatory sandboxes rather than major capital magnets.

Latin American jurisdictions show interest in attracting crypto business but generally lack the regulatory sophistication to quickly implement staking ETF frameworks. Brazil, as the region's largest economy, could lead if its securities regulator Comissão de Valores Mobiliários prioritizes crypto products. However, political instability and economic challenges typically push crypto regulation down the priority list.

The competitive implications for blockchain networks are profound. Networks with strong U.S. institutional traction - Ethereum and Solana primarily - benefit from being first to capture ETF staking flows. Networks more popular in other jurisdictions must wait for those regions' regulatory clarity before accessing comparable capital sources.

Cardano's relative strength in Japan and African markets provides minimal institutional benefit until those jurisdictions approve staking products. Cosmos's decentralized nature makes it popular among sovereignty-conscious communities but harder to package for institutional consumption. These networks face uphill battles for institutional capital unless they can convince U.S. regulators and asset managers to prioritize them alongside ETH and SOL.

Regulatory arbitrage considerations matter for asset managers. If the U.S. maintains the most favorable staking regulations while other jurisdictions lag, U.S.-based ETF sponsors gain competitive advantages over foreign rivals. European and Asian asset managers might establish U.S. subsidiaries to offer staking products, consolidating industry activity in American markets.

The concentration of crypto industry activity in the United States creates centralization risks that contradict cryptocurrency's decentralized ethos. If U.S. regulations effectively determine which networks access institutional capital, American regulators gain disproportionate influence over which blockchain technologies succeed. This regulatory capture concern motivates international coordination efforts, but national competitive interests often override cooperation in practice.

The International Organization of Securities Commissions (IOSCO) provides a forum for regulatory coordination. However, IOSCO recommendations are nonbinding, and jurisdictions frequently deviate based on local priorities. Meaningful global standards for staking products likely require years of negotiation and may never achieve the specificity necessary for product certainty.

The emerging pattern is regulatory fragmentation rather than harmonization. The U.S. moves first with clear staking ETF rules. Europe follows cautiously with more consumer protection emphasis. Asia splinters between innovation-friendly (Hong Kong, Singapore) and conservative (Japan) jurisdictions. This fragmentation benefits networks with global presence and multiple institutional onramps while disadvantaging regionally concentrated alternatives.

Tax implications extend beyond the safe harbor's U.S. focus. Different jurisdictions tax staking rewards differently: some treat them as income upon receipt, others tax only upon sale, and some have not clarified at all. Institutional investors must navigate this complexity when allocating across staking products in multiple jurisdictions.

U.S. institutional investors staking through compliant ETFs enjoy clear tax treatment thanks to Revenue Procedure 2025-31. European and Asian investors lack comparable clarity in many cases, creating friction that advantages U.S.-domiciled products. Networks that want global institutional capital must work with regulators across jurisdictions to achieve tax certainty, a resource-intensive process favoring well-funded protocols over bootstrapped alternatives.

The geopolitical dimension matters increasingly. As crypto becomes strategically important infrastructure, nations compete to dominate its development. The U.S. Treasury's statement that the guidance keeps America the global leader in blockchain technology reflects this competitive mindset. China's digital yuan development, Europe's MiCA framework, and emerging market experiments all represent attempts to shape crypto's evolution.

Staking ETFs become pawns in this larger game. Nations that enable these products attract capital and industry activity. Those that prohibit or delay them cede ground to competitors. The result is a race to provide clarity, with winners capturing outsized shares of a potentially multi-trillion-dollar industry.

Final thoughts

Revenue Procedure 2025-31 marks the moment institutional finance fully embraces proof-of-stake staking. For years, the crypto industry has argued that staking yields make proof-of-stake tokens fundamentally different from traditional assets. Now, with IRS blessing and operational clarity, this argument reaches mainstream institutional investors through regulated products.

The next 12-24 months will determine which proof-of-stake networks capture meaningful institutional capital and which miss this generational opportunity. Three factors overwhelmingly determine winners: existing institutional infrastructure, regulatory clarity beyond just staking, and compelling investment narratives that resonate with traditional asset allocators.

Ethereum enters this period with structural advantages bordering on insurmountable. Over $28 billion in ETF assets already exist waiting to activate staking, comprehensive custody and validator infrastructure operates at scale, and institutional familiarity with Ethereum exceeds all alternatives. BlackRock's $15.7 billion ETHA ETF alone could add 3-5 million ETH to staking within months of full implementation.

However, Ethereum's yields of 3-4% underperform Solana's 6-7% and dramatically trail higher-yielding alternatives like Cosmos's 18%. Asset allocators seeking maximum yield within proof-of-stake may diversify beyond Ethereum despite its market leadership. This creates openings for competitors if they can build comparable institutional trust.

Solana represents the most viable institutional alternative. The first staking ETF launched successfully, major custodians support SOL staking, and the network's performance advantages translate to tangible throughput metrics institutions understand. If Solana maintains network stability while Ethereum scaling debates continue, capital inflows could surprise to the upside.

The critical watch factors for 2025-2026 are ETF flow data, validator concentration metrics, and DeFi liquidity impacts. Monthly inflows to Ethereum and Solana staking ETFs will signal institutional appetite. If flows match Bitcoin ETF early adoption patterns, $50-100 billion could enter staking products within two years. This capital tsunami reshapes blockchain economics fundamentally.

Validator concentration deserves continuous monitoring. If Coinbase, Anchorage, and BitGo collectively exceed 25% of Ethereum validators, centralization concerns will intensify. The community may pursue protocol changes to limit concentration, or social coordination may pressure institutions to distribute stake more broadly. How this tension resolves determines Ethereum's credible neutrality long-term.

DeFi protocol adaptation will indicate health of the broader ecosystem. If Aave, Curve, Uniswap and others maintain or grow TVL despite institutional staking competition, it demonstrates that sophisticated DeFi strategies retain value alongside simpler ETF products. If DeFi TVL stagnates or declines, it suggests institutional capital is displacing rather than complementing existing activity.

Token holder strategies should evolve with the changing landscape. For ETH holders seeking passive exposure with minimal operational burden, staking ETFs now offer regulatory-approved access to yields previously available only through technical setup or DeFi protocols. Holders prioritizing decentralization and composability should continue using liquid staking derivatives through Lido, Rocket Pool, or alternatives.

Network validators must adapt to increased institutional competition. Solo validators may need to join staking pools to maintain economic viability against institutional economies of scale. Professional staking operations should emphasize differentiation through superior performance, unique geographic diversification, or specialized MEV strategies that justify premium fees.

DeFi protocols should prepare for institutional capital as both competitor and potential partner. Designing products that integrate with ETF staking - such as secondary markets for ETF shares or derivatives based on staking yields - could capture institutional attention. Protocols that dismiss institutional adoption risk being bypassed as capital flows through new channels.

The most important unstated story of late 2025 is that Revenue Procedure 2025-31 represents regulatory validation that proof-of-stake staking is legitimate financial activity rather than speculative gambling. This philosophical shift matters more than any individual technical detail. When the U.S. Treasury and IRS explicitly bless staking in regulated products, they signal that blockchain technology has graduated from experiment to infrastructure.

This validation will attract institutional capital currently sitting on the sidelines due to regulatory uncertainty. Corporate treasuries, pension funds, endowments, and insurance companies that avoided crypto can now allocate to staking products with compliance team approval. The capital base potentially entering staking dwarfs current participation.

The next two years likely see staking ETF assets grow from near-zero to $100 billion or more, concentrated in Ethereum and Solana products. This institutional adoption legitimizes proof-of-stake consensus mechanisms and validates networks that prioritized institutional readiness over purely technical metrics. Networks that ignored institutional needs will struggle to catch up as first-movers compound their advantages.

For individual investors and institutions alike, the strategic imperative is clear: understand which networks have institutional infrastructure, monitor validator concentration carefully, and watch how traditional finance and DeFi coexist or compete. The great ETF staking revolution has begun. Those who understand its implications will capture returns. Those who ignore it will miss the most significant institutional capital inflow in cryptocurrency history.

The transformation from niche crypto activity to mainstream institutional product represents a maturation moment for the entire blockchain industry. Revenue Procedure 2025-31 didn't just clarify tax treatment - it opened the floodgates for trillions in institutional capital to finally participate in the staking economy that has defined proof-of-stake networks since their inception. The winners in this new era will be networks that understood institutional requirements years ago and built accordingly. The losers will be those that prioritized decentralization rhetoric over practical infrastructure deployment.