On November 11, 2025, SoFi Technologies made history by becoming the first nationally chartered bank in the United States to offer retail customers the ability to trade cryptocurrencies directly within their banking app. The announcement of SoFi Crypto marks a watershed moment in the convergence of traditional banking and digital assets, enabling 12.6 million members to buy, sell and hold Bitcoin, Ethereum, Solana and dozens of other cryptocurrencies alongside their checking accounts, loans, investments and other financial products.

This is not merely a fintech company adding another feature or a crypto exchange rebranding as a bank. SoFi operates as a full-service national bank under FDIC insurance and regulatory oversight from the Office of the Comptroller of the Currency. While the cryptocurrencies themselves are not FDIC-insured and carry substantial risk, the underlying banking infrastructure, compliance frameworks and regulatory guardrails that support this offering represent a fundamental shift in how digital assets integrate with the traditional financial system.

The significance of this development extends far beyond SoFi's own customer base. It signals that the wall separating banking from crypto, reinforced by years of regulatory caution and institutional skepticism, has begun to crumble. Banks are no longer treating digital assets as radioactive liabilities to be avoided but rather as legitimate financial products that mainstream consumers increasingly demand access to within their trusted banking relationships.

Below we dive deep into the multifaceted implications of SoFi's pioneering move. By analyzing how it transforms the retail banking business model by turning crypto into just another asset class within the bank's ecosystem, we examine the complex custody, compliance and regulatory frameworks banks must navigate to offer such services safely. We also investigate how this development reshapes competitive dynamics among traditional banks, fintechs, neobanks and crypto-native platforms.

The stakes are substantial. As approximately 28% of American adults now own cryptocurrency and ownership has nearly doubled in the three years since late 2021, the question is no longer whether banks will embrace crypto but how quickly and how comprehensively they will do so. SoFi's move suggests that the answer may be: much faster than most observers expected.

SoFi's Move: What Happened and Why It's Significant

The Announcement and Its Context

SoFi's November 11 announcement introduced SoFi Crypto through a phased rollout that began immediately, with access expanding to all eligible members over the following weeks. The platform allows users to buy, sell and hold dozens of cryptocurrencies including Bitcoin, Ethereum and Solana. CEO Anthony Noto declared it "a pivotal moment when banking meets crypto in one app," emphasizing the platform's bank-grade security, institutional-level compliance standards and oversight by federal bank regulators.

The timing and execution reveal careful strategic planning. SoFi positioned the service as part of its broader "one-stop shop" financial services model, where members can manage checking, savings, borrowing, investing and now cryptocurrency holdings in a unified interface. The company emphasized that 60% of its members who own crypto would prefer to trade through a licensed bank rather than their primary crypto exchange, citing consumer desire for regulated institutions and the confidence that comes with banking oversight.

The announcement also revealed SoFi's longer-term blockchain strategy. Beyond crypto trading, the company plans to introduce a USD-pegged stablecoin and integrate crypto into lending and infrastructure services to enable features like lower-cost borrowing, faster payments and new embedded financial capabilities. The company is already leveraging blockchain to power global crypto-enabled remittances that make international money transfers faster and more affordable.

The Road From Suspension to Re-Entry

Understanding the significance of this launch requires examining SoFi's complicated journey with digital assets. The company originally partnered with Coinbase in 2019 to offer crypto trading through SoFi Invest. However, when SoFi secured its national bank charter from the OCC in January 2022, the approval came with stringent conditions. The bank charter required SoFi to obtain "prior written determination of no supervisory objection from the OCC" before engaging in any crypto-asset activities.

This restriction reflected the regulatory environment of the time. Under the Biden administration, federal banking regulators took an increasingly cautious stance toward crypto, viewing it as potentially dangerous to bank safety and soundness. By late 2023, SoFi was forced to suspend its crypto services entirely, giving customers just weeks to migrate their holdings to third-party platforms like Blockchain.com or liquidate their positions. For a company that had built part of its identity around innovation and comprehensive financial services, this was a painful retreat.

The regulatory landscape shifted dramatically in 2025. The OCC issued Interpretive Letter 1183 in March 2025, confirming that crypto-asset custody, certain stablecoin activities and participation in distributed ledger networks were permissible for national banks. The letter rescinded the requirement for banks to receive supervisory non-objection before engaging in these activities. Acting Comptroller Rodney Hood emphasized that banks should have "the same strong risk management controls in place to support novel bank activities as they do for traditional ones," but explicitly stated the agency would "reduce the burden on banks to engage in crypto-related activities."

In May 2025, the OCC followed with Interpretive Letter 1184, which clarified that banks could buy and sell crypto assets held in custody at customers' direction and could outsource crypto-asset activities including custody and execution services to third parties, subject to appropriate risk management. These letters effectively reversed the regulatory stance that had driven SoFi out of crypto in 2023 and created the legal foundation for its November 2025 re-entry.

SoFi CEO Anthony Noto explained the regulatory shift during a CNBC appearance: "One of the holds we've had for the last two years was in cryptocurrency, the ability to buy, sell, and hold crypto. We were not allowed to do that as a bank. It was not permissible. But in March of this year, the OCC came out with an interpretive letter that it's now permissible for banks, like SoFi, to offer cryptocurrencies."

Why Being First Matters

SoFi's status as the first nationally chartered consumer bank to integrate crypto trading provides significant competitive advantages. First-mover advantage in banking innovations can be substantial because switching costs and relationship inertia often lock customers into their primary financial institution. By being first, SoFi can capture customers who want the convenience of managing crypto and traditional banking together before competitors enter the market.

The "bank-grade confidence" positioning also matters enormously in an industry still recovering from spectacular failures. The collapses of FTX, Celsius, Voyager and Terra Luna in 2022 and 2023 destroyed hundreds of billions in customer value and shattered trust in crypto-native platforms. Many retail investors who lost money in these collapses would hesitate to trust another standalone exchange but might feel comfortable trying crypto again through a federally regulated bank with FDIC insurance on their deposit accounts.

The announcement also signals to other banks that crypto integration is both possible and potentially lucrative. Noto stated he does not expect major banks like JPMorgan, Wells Fargo and Bank of America to quickly follow, arguing they lack SoFi's fully digital architecture and member-centric infrastructure. However, some analysts suggest that regional banks and other digital-first financial institutions may move quickly to offer similar services now that the regulatory path has been cleared and SoFi has demonstrated consumer demand.

Perhaps most significantly, SoFi's move validates cryptocurrency as a legitimate asset class worthy of integration into mainstream banking. For years, crypto existed in a parallel financial universe that occasionally intersected with traditional finance but never fully merged. Banks that wanted exposure typically limited themselves to offering Bitcoin ETFs to wealth management clients or facilitating institutional trading through separate subsidiaries. SoFi's integration of direct crypto trading into its core consumer banking app represents a fundamentally different approach: treating digital assets as just another financial product that everyday retail customers should be able to access through their bank.

Retail Banking Model Re-Engineered

The One-Stop-Shop Value Proposition

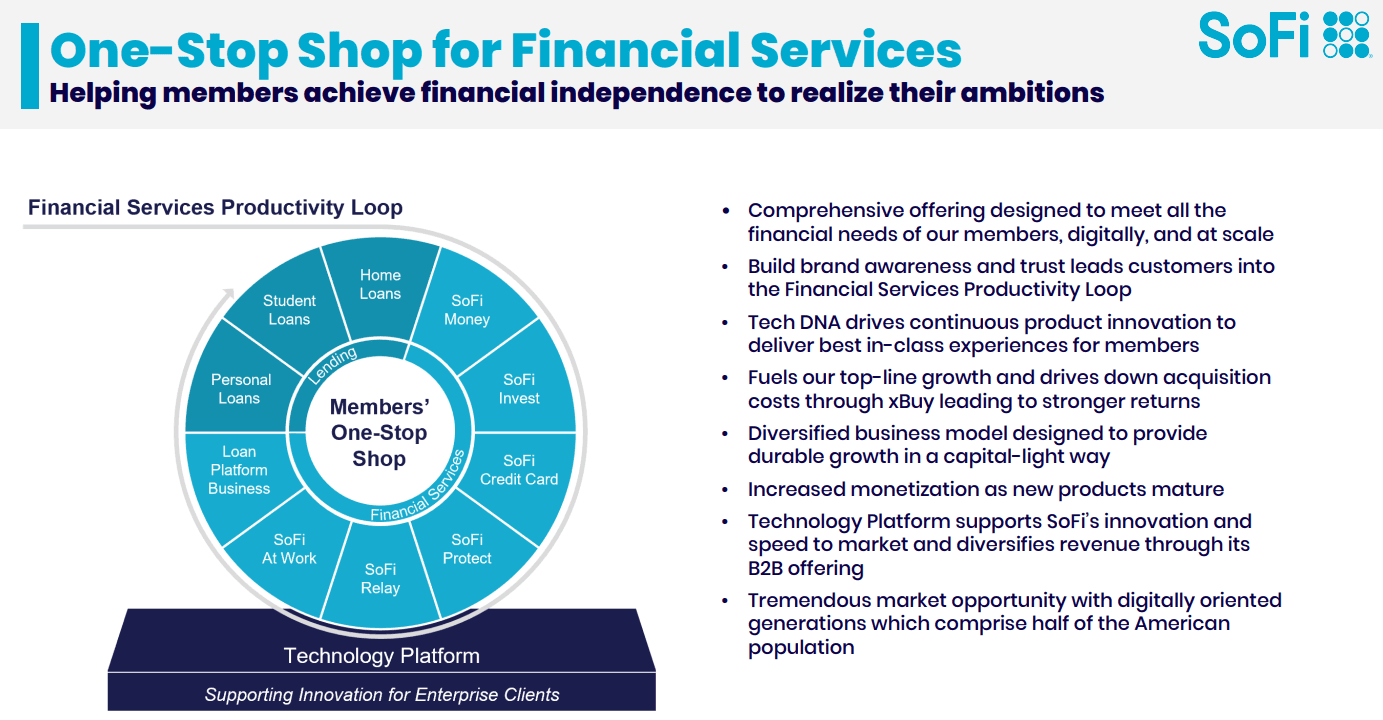

SoFi built its business model around the concept of a financial "one-stop shop" where members can handle banking, borrowing, investing, insurance and other financial services in a single unified platform. Adding crypto trading extends this model in a way that potentially increases customer acquisition, engagement and retention simultaneously.

The customer acquisition benefit comes from attracting crypto-interested users who might not have otherwise considered SoFi. Survey data indicates 60% of SoFi members who own crypto would prefer to manage it through a licensed bank. This suggests substantial pent-up demand among people who want crypto exposure but feel uncomfortable with standalone exchanges. By offering a regulated on-ramp, SoFi can attract customers who might have been crypto-curious but exchange-hesitant.

Engagement benefits arise from the inherently dynamic nature of crypto markets. Unlike savings accounts that generate little activity or mortgages that require minimal ongoing interaction, crypto trading can drive frequent logins and transactions. The 24/7 nature of crypto markets means users might check their holdings multiple times per day, increasing their time spent in the SoFi app. This heightened engagement creates more opportunities to cross-sell other products and deepens the customer relationship.

Retention improves because integrated platforms with multiple products create switching costs. A customer who holds only a checking account might easily move to a competitor offering a slightly higher interest rate. But a customer managing their checking, investments, crypto holdings and loans through SoFi faces substantially higher friction if considering a switch. They would need to migrate multiple accounts and potentially trigger taxable events on crypto sales. The comprehensive platform becomes stickier.

Impacts on Deposit Flows and Revenue Streams

The addition of crypto trading creates interesting dynamics around deposit flows and revenue generation. SoFi designed the service so customers can instantly purchase cryptocurrencies using funds from their FDIC-insured SoFi Money Checking or Savings accounts, eliminating the need to transfer money to separate exchanges. When users are not actively trading crypto, their cash sits in interest-bearing accounts with up to $2 million in FDIC coverage.

This creates a potential flywheel effect for deposits. Crypto traders typically need to maintain cash positions to take advantage of market opportunities. Rather than leaving that cash idle on an exchange, SoFi encourages keeping it in bank accounts where it earns interest and contributes to the bank's deposit base. This could be particularly valuable during periods of rising interest rates when the spread between deposit rates and lending rates generates significant net interest margin.

Revenue opportunities extend beyond net interest income. Banks typically generate revenue from crypto trading through transaction fees, similar to brokerage commissions on stock trades. While SoFi has not publicly disclosed its fee structure for crypto trading, industry norms suggest fees ranging from 0.5% to 2% per transaction depending on the cryptocurrency and transaction size. With millions of potential users and crypto's volatile nature driving frequent trading activity, these fees could represent substantial income.

The planned USD stablecoin represents another potential revenue source. If SoFi issues a stablecoin backed by dollar reserves, it can earn the yield on those reserve assets while using the stablecoin to facilitate payments, remittances and other financial services. The recent passage of the GENIUS Act, which establishes a regulatory framework for payment stablecoins, provides legal clarity that makes this strategy more viable.

Risk Management and Compliance Shifts

Offering crypto services requires banks to fundamentally rethink their risk management and compliance infrastructure. Traditional bank deposits are relatively stable and predictable. Crypto holdings can swing wildly in value, potentially affecting customer behavior and creating operational challenges.

Anti-money laundering and know-your-customer requirements become more complex with crypto. While SoFi already maintains robust AML/KYC programs as a regulated bank, crypto transactions require enhanced monitoring due to the pseudonymous nature of blockchain transactions and the possibility that customers might transfer crypto to or from addresses associated with sanctioned entities or illicit activities.

The bank must implement controls to prevent commingling of customer crypto assets with bank assets and ensure proper segregation. The OCC has emphasized that banks engaging in crypto custody must conduct these activities "in a safe and sound manner and in compliance with applicable law." This means establishing clear procedures for how customer crypto is held, who has access to private keys, how transactions are authorized and how the bank would handle a security breach or technical failure.

Operational risk management must address the unique challenges of 24/7 markets and irreversible transactions. Traditional bank errors often can be corrected through reversal processes or manual intervention. Crypto transactions sent to wrong addresses cannot be recalled. This requires heightened attention to user interface design, transaction verification processes and customer support capabilities.

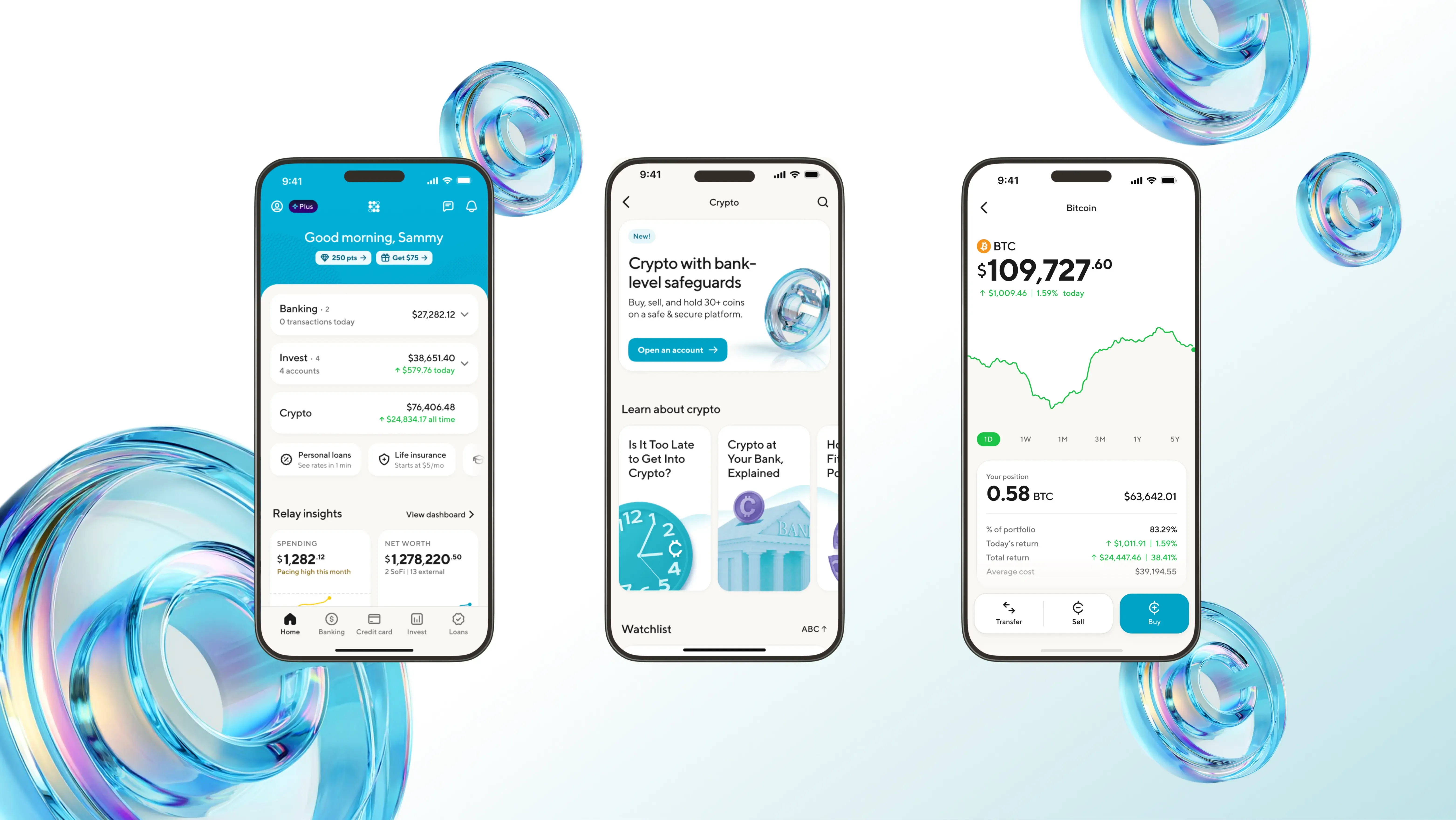

Consumer Experience Implications

From the customer perspective, SoFi's integrated crypto offering dramatically simplifies the user experience compared to standalone exchanges. Users do not need to create separate accounts, complete duplicative identity verification, link external bank accounts for funding transfers or manage relationships with multiple financial service providers. Everything happens within the familiar SoFi environment.

This simplification could prove particularly important for mainstream adoption. Research consistently shows that complexity and unfamiliarity represent major barriers to crypto adoption among non-technical users. Survey data indicates that 63% of Americans don't feel confident that current ways of investing in or using crypto are reliable or safe, with skepticism particularly high among older adults. A trusted bank offering crypto through a familiar interface addresses many of these concerns.

SoFi also emphasizes educational content and step-by-step guidance for first-time buyers. This contrasts with many crypto exchanges that assume users already understand concepts like wallets, private keys, gas fees and blockchain confirmations. By meeting customers where they are and providing banking-style educational resources, SoFi can expand crypto access to demographics that might never have engaged with standalone exchanges.

However, challenges remain. Crypto volatility means banks must carefully manage customer expectations and ensure users understand risks. Unlike FDIC-insured deposits that are guaranteed up to $250,000, cryptocurrencies carry substantial risk of loss. SoFi's disclosures emphasize that "crypto and other digital assets are not bank deposits, not insured by the FDIC or SIPC, not guaranteed by any bank, and their value can go up or down — sometimes losing all of their value."

Banks offering crypto must also prepare for customer service challenges during market volatility. When Bitcoin drops 20% in a day or a major hack affects a popular token, customer inquiries surge. Banks need adequate staffing, training and support infrastructure to handle these situations without degrading service quality for traditional banking customers.

Custody, Banking Regulation and Crypto Integration

The Custody Challenge

Custody of digital assets presents fundamentally different challenges from custody of traditional securities or bank deposits. With stocks or bonds, custody typically involves entries in electronic book-entry systems maintained by central securities depositories like the Depository Trust Company. If something goes wrong, there are established processes for identifying ownership and reversing erroneous transactions.

Cryptocurrency custody requires managing cryptographic private keys that provide access to assets on blockchain networks. Whoever controls the private keys effectively owns the crypto. If keys are lost, stolen or compromised, the assets can be permanently unrecoverable or transferred to thieves with no ability to reverse the transactions.

For banks offering crypto services, this creates enormous operational and liability concerns. SoFi must implement what it describes as "institutional-level security" and "rigorous compliance standards" to protect customer assets. This likely involves a combination of hot wallets for operational liquidity and cold storage for the bulk of customer holdings, multi-signature authorization requirements, hardware security modules, regular security audits and comprehensive insurance coverage.

Many banks are expected to partner with specialized enterprise custody providers like Anchorage Digital, BitGo or Fireblocks rather than building custody infrastructure in-house. These providers offer institutional-grade security specifically designed for digital assets, including features like multi-party computation for distributed key management, policy engines for transaction authorization and integration with banking compliance systems.

The OCC's Interpretive Letter 1184 explicitly permits banks to outsource crypto-asset activities including custody to third parties, provided they maintain "appropriate third-party risk management practices." This means banks must conduct due diligence on custody providers, establish clear service level agreements, monitor ongoing performance and maintain business continuity plans in case a provider fails or is compromised.

Regulatory Oversight Framework

Banks offering crypto services must navigate a complex web of overlapping regulatory authorities. The OCC supervises national banks and federal savings associations, including their crypto activities. The Federal Reserve oversees bank holding companies. The FDIC provides deposit insurance and supervises state-chartered banks. The Financial Crimes Enforcement Network enforces Bank Secrecy Act compliance.

Beyond banking regulators, crypto activities may also trigger oversight from the Securities and Exchange Commission if assets are deemed securities, the Commodity Futures Trading Commission for derivatives, and state regulators depending on the specific activities and jurisdictions involved.

The GENIUS Act, signed into law on July 18, 2025, provides the first comprehensive federal framework for payment stablecoins. The legislation establishes a dual federal-state regulatory system where stablecoin issuers can be supervised by the OCC as federal-qualified nonbank issuers, regulated under state frameworks, or issued by insured depository institutions. The Act requires payment stablecoins to maintain one-to-one backing with liquid reserves and subjects issuers to strict capital, liquidity and transparency requirements.

This regulatory clarity matters enormously for banks considering crypto integration. For years, the primary regulatory risk was uncertainty about whether activities would be deemed permissible and what standards would apply. The combination of OCC interpretive letters and the GENIUS Act provides much clearer parameters, even though many implementation details remain to be worked out through subsequent rulemaking.

However, the regulatory framework for cryptocurrencies other than payment stablecoins remains less settled. Bitcoin and Ethereum are generally not considered securities, but the classification of many other tokens continues to be debated. Banks must carefully evaluate the regulatory status of any crypto asset they plan to offer and implement risk management frameworks appropriate to the level of uncertainty.

Bank-Grade Claims and What They Mean

SoFi repeatedly emphasizes its "bank-grade security" and "institutional-level" compliance as key differentiators. These claims reflect meaningful differences in how regulated banks approach crypto compared to standalone exchanges.

Banks are subject to regular examinations by federal regulators who assess capital adequacy, asset quality, management capabilities, earnings performance and liquidity. These examinations are comprehensive and intrusive, with examiners reviewing lending files, testing compliance programs, evaluating internal controls and assessing management decisions. Banks that fail to meet standards face enforcement actions ranging from written agreements to civil money penalties to removal of management.

This supervisory infrastructure does not exist for most crypto exchanges, which may be registered as money service businesses but face far less intensive ongoing oversight. The contrast became starkly apparent during the 2022-2023 crypto crisis, when exchanges like FTX collapsed due to misuse of customer funds, inadequate internal controls and fraudulent activities that would likely have been detected quickly through bank examination processes.

Bank-grade security also means maintaining capital ratios that provide cushion against losses, liquidity buffers to meet withdrawal demands, and risk management frameworks tested across multiple market cycles. While crypto exchanges might fail overnight when withdrawals surge or a hack depletes reserves, banks are specifically designed to weather financial stress through prudential regulation requirements.

For customers, this translates to tangible differences in how their assets are protected. While the cryptocurrencies themselves remain uninsured, the banking infrastructure supporting custody and trading operates under regulatory standards specifically designed to prevent loss of customer assets. SoFi's deposit accounts that fund crypto purchases carry FDIC insurance, meaning customers never risk their bank deposits even if something goes wrong with crypto operations.

Self-Custody Versus Bank Custody Implications

SoFi's model, where the bank provides custody of customer crypto assets, represents a fundamentally different approach from the "self-custody" ethos that underlies much of crypto culture. Bitcoin and many other cryptocurrencies were designed to enable individuals to hold and transfer value without intermediaries. The rallying cry "not your keys, not your coins" reflects the belief that true ownership requires controlling your own private keys rather than trusting a third party.

Bank custody of crypto assets inverts this philosophy. SoFi customers do not control the private keys to their holdings. Instead, they trust SoFi to maintain custody, similar to how securities investors trust brokers to custody stock holdings. This brings both benefits and tradeoffs.

The primary benefit is convenience and risk mitigation. Most retail investors lack the technical sophistication to securely manage private keys, operate hardware wallets or protect against phishing attacks. The prevalence of user error leading to lost crypto suggests that for many people, bank custody may actually be safer than self-custody.

Bank custody also enables account recovery mechanisms. If customers forget passwords or lose devices, banks can verify their identity through existing authentication processes and restore access to accounts. With self-custody, forgetting a seed phrase or losing a hardware wallet means permanent loss of assets with no recourse.

However, bank custody means customers must trust the institution and accept that their holdings could be frozen by court order, targeted by government seizure or affected by the bank's own financial difficulties. This runs counter to the original vision of cryptocurrency as censorship-resistant money that governments and institutions cannot control.

The emergence of bank custody as a major model for crypto holdings has important implications for consumer behavior and the overall crypto ecosystem. If most retail investors access crypto through banks rather than self-custody wallets, it may slow adoption of features that require direct blockchain interaction, like decentralized finance protocols or NFT marketplaces. Conversely, it may accelerate mainstream adoption by reducing barriers to entry and providing familiar banking interfaces.

Regulatory Implications and Competitive Landscape

Regulatory Dimension: Increased Scrutiny and Frameworks

SoFi's move into crypto will inevitably attract intensified regulatory attention to the intersection of banking and digital assets. The OCC has stated that it expects banks to maintain strong risk management controls for crypto activities, but specific supervisory guidance continues to evolve. As more banks offer crypto services, regulators will gather data on how these activities affect bank safety and soundness, consumer protection and financial stability.

Several regulatory concerns will likely drive ongoing policy development. Consumer protection remains paramount, given crypto's complexity and volatility. Regulators must balance supporting innovation with ensuring banks adequately disclose risks, prevent unsuitable investments and handle customer complaints appropriately. The OCC and other banking agencies may issue specific guidance on how banks should market crypto services, what disclosures are required and what customer screening processes are appropriate.

Systemic risk considerations also matter. If crypto holdings become a significant portion of bank assets or if banks develop substantial interdependencies with crypto markets, this could create channels for financial contagion. A severe crypto market crash could affect bank earnings, capital ratios or liquidity if not properly managed. Regulators may impose limits on concentration risk or require additional capital for crypto exposures.

The question of deposit insurance intersects with crypto in complex ways. While cryptocurrencies themselves are explicitly not FDIC-insured, the deposit accounts that fund crypto purchases do carry insurance. This creates potential for customer confusion and requires careful communication. Additionally, as banks potentially issue stablecoins backed by deposit reserves, questions arise about whether the economic substance of stablecoins resembles deposits and whether similar protections should apply.

The interplay between banking regulation and other regulatory frameworks adds complexity. The SEC continues to assert jurisdiction over many crypto assets as securities, while the CFTC claims authority over crypto derivatives as commodities. Banking agencies must coordinate with these other regulators to ensure consistent treatment and avoid creating regulatory arbitrage opportunities where entities structure activities to fall under the most permissive regulator.

Competitive Dynamics Among Financial Institutions

SoFi's announcement immediately reshaped competitive dynamics in financial services. While CEO Anthony Noto expressed skepticism that major banks would quickly follow, arguing they lack the digital architecture and member-centric focus needed to integrate crypto seamlessly, other institutions are clearly taking notice.

Several major banks have been exploring crypto strategies in parallel. JPMorgan, Bank of America, Citigroup and Wells Fargo are reportedly in early discussions about launching a jointly operated stablecoin through entities co-owned by these institutions, including Early Warning Services (which operates Zelle) and The Clearing House. While still preliminary, this initiative signals that Wall Street's largest banks view crypto integration as inevitable and are working to maintain relevance as digital assets gain mainstream traction.

JPMorgan already operates JPM Coin for internal settlement, and Wells Fargo has piloted Wells Fargo Digital Cash for cross-border payments within its network. Bank of America CEO Brian Moynihan has stated the bank could issue a fully dollar-backed stablecoin if regulatory frameworks support it. These existing initiatives suggest major banks have been preparing for crypto integration even if they have not yet launched consumer-facing trading services.

Regional banks and other digital-first financial institutions may move more quickly. Unlike legacy banks with decades of physical branch infrastructure and systems integration challenges, digitally native banks can more easily add crypto functionality to their platforms. We may see a wave of banks following SoFi's lead as they recognize that offering crypto could be essential to competing for younger customers who expect digital asset access as a standard banking feature.

Traditional brokerages also face competitive pressure. Firms like Charles Schwab, Fidelity and TD Ameritrade have offered Bitcoin exposure through spot ETFs but not direct crypto trading. As banks integrate crypto, brokerages may need to follow suit to remain competitive for investment accounts. Indeed, reports suggest Charles Schwab and PNC are preparing similar rollouts.

Crypto-native exchanges face perhaps the most disruptive competitive threat. Companies like Coinbase, Kraken and Gemini built their businesses by providing access to digital assets when banks refused to do so. As banks enter the market, they bring enormous advantages in brand trust, existing customer relationships, integrated financial services and regulatory credibility. Exchanges will need to differentiate through superior products, broader asset selection or services that banks cannot easily replicate.

Institutional Finance Transformation

Beyond retail banking, SoFi's move reflects and accelerates transformation in institutional finance. Standard Chartered became the first global systemically important bank to offer spot Bitcoin and Ethereum trading to institutional clients in July 2025, integrating crypto trading with its existing foreign exchange platforms. This allows corporate treasurers, asset managers and institutional investors to trade digital assets through familiar banking interfaces with regulated settlement options.

The institutional adoption pattern differs from retail in important ways. Large corporations and institutional investors need crypto access for specific use cases like treasury management, hedging strategies or client services, rather than speculation. They require sophisticated custody solutions, tax optimization, regulatory compliance support and integration with enterprise risk management systems. Banks that can provide these capabilities have opportunities to generate substantial fee income from institutional crypto services.

Asset tokenization represents another frontier where banks are positioning themselves. The tokenization of assets like U.S. Treasuries, real estate and private equity is increasingly changing how institutions create, trade and invest in them. Banks with expertise in both traditional securities and blockchain technology are well-positioned to facilitate this transformation.

Central bank digital currencies (CBDCs) also loom as a potential game-changer. While the United States has not committed to issuing a CBDC, many other countries are actively developing them. Banks will likely play central roles in CBDC distribution and integration, giving them further reason to develop digital asset capabilities now.

Implications for Regulators

From the regulatory perspective, banks offering crypto services represents both an opportunity and a challenge. The opportunity is bringing digital assets inside the regulatory perimeter where they can be monitored and controlled more effectively than in the largely unregulated crypto-native ecosystem. Banks are examined regularly, maintain detailed records, report suspicious activities and operate under consumer protection standards that simply do not exist for most crypto exchanges.

However, the integration of crypto and banking also creates new supervisory challenges. Bank examiners need training on blockchain technology, crypto markets and digital asset risk management. Examination manuals require updating to address crypto-specific considerations. Regulatory capital frameworks may need adjustment to appropriately risk-weight crypto exposures.

The question of how to handle bank failures becomes more complex when banks hold customer crypto. Traditional bank resolution processes are well-established, with the FDIC stepping in to protect depositors and orchestrate orderly wind-downs or acquisitions. But what happens to customer crypto holdings if a bank fails? The GENIUS Act addresses this for stablecoins, giving stablecoin holders priority claims in bankruptcy, but the treatment of other crypto assets held in custody remains less certain.

Regulators must also consider how bank crypto activities affect financial stability. During the 2022-2023 crypto crisis, the collapse of Terra Luna, Celsius, Voyager and FTX occurred largely outside the traditional banking system with limited contagion to banks. As crypto and banking become more intertwined, the potential for spillovers increases. Stress testing and scenario analysis need to account for crypto market shocks and their potential impacts on bank capital and liquidity.

The Vast Bank Lesson

The cautionary tale of Vast Bank illustrates the perils of banks entering crypto without adequate preparation. The Tulsa, Oklahoma-based bank launched crypto banking services in August 2021, allowing customers to store and exchange digital assets. CEO Brad Scrivner boasted that the offering grew the retail customer base by 50% of what it took 40 years to build, accomplishing this in just eight weeks.

However, the rapid growth masked fundamental problems. In October 2023, the OCC issued a consent order against Vast Bank for "unsafe or unsound practices" related to capital, strategic planning, project management, books and records, custody account controls and risk management for new products. The order required Vast to maintain higher capital ratios, develop comprehensive strategic plans and establish proper custody controls.

By January 2024, Vast announced it would disable and remove its crypto mobile app, liquidating customer digital assets and closing crypto accounts. CEO Tom Biolchini told local media that federal regulators had concerns about the bank holding cryptocurrency assets for customers, and that the crypto venture represented less than 1% of holdings but created disproportionate regulatory risk.

The Vast Bank episode demonstrates that offering crypto services requires far more than technical capability to enable buying and selling. Banks need robust risk management frameworks, adequate capital buffers, proper custody infrastructure and comprehensive strategic planning that accounts for crypto's unique challenges. The regulatory scrutiny is intense, and deficiencies can result in costly enforcement actions and forced exits from the market.

SoFi's approach appears more methodical. Rather than rushing into crypto opportunistically, the bank waited until regulatory clarity emerged through OCC interpretive letters and developed institutional-grade infrastructure before launch. This patience may prove crucial to long-term success where Vast Bank failed.

Broader Implications for Crypto-Finance Convergence

Market Structure Transformation

SoFi's integration of crypto into mainstream banking represents a fundamental shift in crypto market structure. For years, retail investors accessed digital assets primarily through standalone exchanges like Coinbase, Kraken and Binance. These platforms existed in a parallel financial universe, requiring separate accounts, distinct funding mechanisms and completely different user experiences from traditional banking or brokerage.

The emergence of bank-integrated crypto trading collapses this separation. As more banks follow SoFi's lead, retail capital flows may increasingly channel through banking platforms rather than standalone exchanges. This could accelerate mainstream adoption by reducing friction, but it also centralizes crypto access through regulated financial institutions in ways that run counter to cryptocurrency's original decentralization ethos.

Market liquidity patterns may shift as bank-integrated trading grows. Banks offering crypto typically partner with liquidity providers and connect to exchange networks rather than operating independent order books. This means trades executed through SoFi still interact with broader crypto markets, but the user experience is abstracted away from direct exchange participation.

Price discovery mechanisms could evolve as institutional and retail flows increasingly route through banking platforms. Traditional finance uses relatively centralized price formation processes through regulated exchanges and systematic market makers. Crypto markets historically featured more fragmented price discovery across numerous exchanges, decentralized exchanges and peer-to-peer platforms. As banks integrate crypto, they may push toward more standardized pricing mechanisms that resemble traditional securities markets.

Impact on Token Markets and Liquidity

The injection of retail capital through banking channels will likely affect different segments of the crypto market unevenly. Bitcoin and Ethereum, as the most established and liquid digital assets, will probably see the greatest benefit from bank integration. These tokens have sufficient regulatory clarity, institutional acceptance and market infrastructure to support bank offerings.

Less established tokens face more uncertain prospects. Banks must carefully evaluate the regulatory status, security characteristics and market liquidity of any crypto asset they offer. Many altcoins that trade on crypto-native exchanges may never become available through bank platforms due to regulatory concerns, insufficient liquidity or security questions.

This could create a bifurcated market where "bank-approved" tokens receive institutional imprimatur and retail access through mainstream financial services, while other tokens remain confined to crypto-native platforms. Such bifurcation might concentrate liquidity in a smaller number of assets while reducing capital flows to the long tail of smaller tokens.

Stablecoin markets will particularly benefit from bank integration. The GENIUS Act's regulatory framework provides clarity that enables banks to issue stablecoins and integrate them across financial services. SoFi's planned USD stablecoin is just one example. If major banks issue stablecoins, these could become dominant payment instruments that facilitate programmable money flows while maintaining dollar backing and regulatory oversight.

Embedded Crypto Products and Services

Beyond simple trading, bank integration enables embedded crypto products that blend blockchain technology with traditional financial services. SoFi already leverages blockchain for global crypto-enabled remittances that make international money transfers faster and more affordable. This represents just the beginning of potential applications.

Programmable money enabled by stablecoins could transform how banks handle payments. Rather than batch processing and settlement delays that characterize traditional banking, stablecoin-based payments can occur in real-time with immediate finality. This enables new products like instant payroll, real-time invoice payments and programmatic escrow arrangements that execute automatically when conditions are met.

Lending against crypto collateral represents another frontier. Rather than requiring customers to sell crypto holdings to access liquidity, banks could offer loans secured by digital assets. This allows users to maintain crypto exposure while accessing capital for other purposes. However, this introduces new risk management challenges given crypto volatility and the potential for rapid collateral devaluation.

Tokenized assets and securities may be the most transformative application. Imagine stock holdings represented as blockchain tokens that can be transferred 24/7, used as collateral across multiple platforms or fractionalized for retail ownership. Banks with expertise in both traditional securities and blockchain technology are positioned to facilitate this transition, creating new revenue opportunities while modernizing financial infrastructure.

Loyalty programs and reward systems could integrate crypto tokens. Some banks may offer crypto cashback rewards, staking opportunities or token-based loyalty points that customers can trade or use across ecosystems. These features particularly appeal to younger demographics who expect digital-native financial experiences.

Digital Asset Economy Acceleration

The integration of crypto into banking infrastructure could accelerate development of a broader digital asset economy where blockchain-based assets become commonplace in everyday financial activities. This transformation extends beyond cryptocurrencies to include NFTs, tokenized real-world assets, decentralized finance protocols and Web3 applications.

However, bank involvement may channel this development toward more regulated, centralized models than crypto purists prefer. Rather than purely peer-to-peer decentralized systems, we may see hybrid architectures where blockchain technology provides infrastructure but banks serve as regulated gatekeepers and service providers.

This raises questions about how much of crypto's original vision can survive mainstream adoption through banking channels. Bitcoin was designed to enable permissionless value transfer without intermediaries. Banking integration reintroduces intermediaries and permission structures. DeFi protocols aim to eliminate traditional financial gatekeepers. Bank-mediated access maintains those gatekeepers while potentially bringing blockchain efficiency benefits.

The outcome likely involves parallel ecosystems: a regulated, bank-intermediated crypto economy serving mainstream users through familiar institutions, alongside a crypto-native economy maintaining the original decentralization ethos for users willing to accept greater complexity and responsibility. These ecosystems will interact and influence each other, but may serve meaningfully different purposes and user bases.

Risks of Over-Hyping

Amid enthusiasm about bank crypto integration, realistic assessment of challenges and limitations remains essential. Crypto volatility means many users will lose money, potentially damaging trust in both digital assets and the banks that offer them. Price swings that see Bitcoin drop 20% in a day or altcoins lose 50% in a week are not anomalies but regular features of crypto markets.

Banks offering crypto must carefully manage customer expectations and provide adequate risk disclosures. Users need to understand that crypto investments can result in total loss, that markets are volatile and unpredictable, and that even "safe" stablecoins have experienced depegging events that caused significant losses. The more seamlessly banks integrate crypto into their platforms, the greater the risk that users might treat digital assets like traditional banking products without fully appreciating the differences.

Security vulnerabilities persist despite bank-grade custody. While banks implement robust security measures, determined attackers continue targeting crypto systems. High-profile hacks have stolen billions from exchanges, wallets and DeFi protocols. Banks offering crypto become attractive targets and must maintain vigilance against evolving threat vectors.

Regulatory uncertainty remains despite recent clarity. The OCC interpretive letters and GENIUS Act provide important frameworks, but many questions remain unresolved. Future administrations might take different regulatory approaches. International regulatory divergence creates complexity for global banks. Banks must maintain flexibility to adapt as the regulatory landscape evolves.

Consumer education challenges should not be underestimated. Despite growing awareness, many Americans lack basic understanding of how cryptocurrency works, what blockchain technology does, or why digital assets might be valuable. Banks offering crypto must invest heavily in education, customer support and user experience design that makes complex technology accessible without oversimplifying risks.

Case Studies and Comparative Banking Moves

Standard Chartered's Institutional Approach

While SoFi focuses on retail consumers, Standard Chartered took a different path by becoming the first global systemically important bank to offer spot Bitcoin and Ethereum trading to institutional clients. The London-based bank launched its service in July 2025 through its UK branch, integrating crypto trading with existing foreign exchange platforms.

Standard Chartered's approach targets corporates, asset managers and institutional investors who need crypto access for treasury management, hedging strategies or client services. By operating through familiar FX interfaces, the bank reduces friction for sophisticated users who are comfortable with institutional trading platforms but may be hesitant to engage with crypto-native exchanges.

The institutional focus allows Standard Chartered to emphasize different value propositions than SoFi. Rather than simplicity and education for retail users, the bank highlights sophisticated risk controls, balance sheet strength and integration with global treasury operations. Institutional clients can settle trades to their chosen custodian, including Standard Chartered's own digital asset custody service, providing flexibility while maintaining security.

CEO Bill Winters declared that "digital assets are a foundational element of the evolution in financial services" and emphasized the bank's readiness to help clients manage digital asset risk safely within regulatory requirements. The bank plans to introduce non-deliverable forwards trading for Bitcoin and Ethereum, expanding beyond spot trading to provide hedging instruments institutional clients need.

Standard Chartered's institutional-first strategy complements rather than competes with SoFi's retail approach. Together, these moves signal that bank crypto integration is occurring simultaneously across retail and institutional segments, with different value propositions and product features appropriate to each market.

Global Banking Crypto Initiatives

Beyond the United States, banks worldwide are exploring crypto integration in ways that reflect different regulatory environments and market conditions. European banks benefit from the Markets in Crypto-Assets (MiCA) framework, which provides comprehensive regulation for crypto-asset service providers across the European Union. This regulatory clarity has enabled more proactive bank strategies.

Société Générale launched EURCV, a euro-denominated stablecoin, in 2023 through its crypto arm SG Forge and is reportedly exploring a U.S. dollar stablecoin as well. This demonstrates how banks can become not just distributors of crypto but issuers of blockchain-based financial instruments that serve institutional treasury management and payment needs.

Asian banks have pursued different strategies reflecting their regional markets. Singapore's Monetary Authority has been proactively encouraging digital asset innovation, issuing multiple licenses to crypto service providers. Standard Chartered chose Singapore for a stablecoin pilot through partnership with DCS Card Centre, launching DeCard, a credit card allowing users to spend stablecoins for everyday purchases.

Latin American banks face unique pressures driving crypto adoption. In countries experiencing high inflation or currency instability, stablecoins provide attractive alternatives to volatile local currencies. Banks in these regions increasingly offer crypto services to remain competitive and prevent deposit flight to crypto-native platforms. Brazil's Nubank, for example, has explored Bitcoin Lightning Network integration for payments.

Hong Kong's stablecoin legislation, passed in May 2025, requires issuers of stablecoins backed by the Hong Kong dollar to obtain licenses from the Hong Kong Monetary Authority, with backing by high-quality liquid reserve assets. This creates a framework for banks to issue regulated stablecoins while maintaining oversight similar to e-money regulations.

What SoFi's Model Could Expand Into

SoFi's current crypto trading service represents just the beginning of a potentially much broader blockchain integration strategy. The company has outlined plans that extend significantly beyond basic buy/sell functionality, suggesting a comprehensive reimagining of banking through blockchain technology.

The planned USD stablecoin could become central to SoFi's payment infrastructure. Rather than just offering another investment vehicle, a SoFi-issued stablecoin could facilitate instant peer-to-peer payments, international remittances, merchant payments and programmable money applications. The GENIUS Act framework provides regulatory clarity for banks to issue stablecoins with proper reserves and oversight, making this strategy viable.

Lending against crypto collateral would extend SoFi's borrowing products into the digital asset space. Customers with substantial crypto holdings could access liquidity without selling, using their Bitcoin or Ethereum as collateral for loans. This maintains crypto exposure while providing capital for other needs, though it requires sophisticated risk management to handle collateral volatility.

Yield-generating products could offer staking services where customers earn rewards for participating in proof-of-stake blockchain networks. Rather than customers needing to understand the technical complexity of staking, SoFi could manage this process and pass through rewards, creating a crypto equivalent of interest-bearing accounts.

Tokenized asset offerings might enable fractional ownership of real estate, private equity or other alternative investments. By tokenizing these assets on blockchain networks and offering them through the SoFi platform, the bank could democratize access to investment opportunities typically available only to accredited investors while using blockchain technology to enable efficient trading and settlement.

International expansion of crypto services could tap into remittance markets where SoFi is already using blockchain for crypto-enabled remittances. Crypto rails offer advantages over traditional remittance services in speed, cost and accessibility, particularly for corridors where traditional banking infrastructure is limited.

Early Adoption Metrics and Rollout

While comprehensive user data has not yet been publicly disclosed, some early indicators suggest strong initial interest in SoFi Crypto. The company is conducting a phased rollout that began November 11, 2025, with access expanding to more members over the following weeks. The rollout includes a promotional opportunity for customers to enter for a chance to win one Bitcoin by joining the waitlist by November 30, opening a crypto account and making three qualifying transactions of at least $10 by January 31, 2026.

This promotional strategy signals SoFi's commitment to driving rapid adoption. By offering a high-value prize and creating urgency through deadlines, the bank incentivizes early trial while gathering data on customer interest and usage patterns.

CEO Anthony Noto's statement that 3% of his personal portfolio is allocated to crypto provides a signal about how the bank thinks about appropriate exposure levels. This measured approach contrasts with the all-in enthusiasm sometimes seen in crypto circles, instead positioning digital assets as one component of a diversified portfolio.

The company's emphasis on 60% of members preferring crypto trading through a licensed bank suggests that demand for bank-intermediated crypto access could be substantial. If even a significant minority of SoFi's 12.6 million members adopt crypto trading, this would represent a material shift in how retail investors access digital assets.

Risks, Challenges and What to Watch

Operational and Security Risks

Despite bank-grade infrastructure, crypto operations face operational risks that differ meaningfully from traditional banking. The 24/7 nature of crypto markets means systems must maintain availability around the clock, including weekends and holidays when traditional banking systems often undergo maintenance. Any downtime during volatile market conditions could prevent customers from managing positions, potentially resulting in losses and reputational damage.

Custody security remains paramount. While SoFi emphasizes institutional-level security, crypto custody has proven challenging even for sophisticated institutions. Major hacks and security breaches continue affecting the crypto industry, with 2025 thefts reaching $2.6 billion, up 18% year-over-year. While banks implement multiple security layers, they also become high-value targets that attract determined adversaries.

The irreversibility of blockchain transactions creates unique operational challenges. Traditional bank transfers can often be reversed if errors are detected quickly. Crypto transactions sent to wrong addresses or with incorrect amounts typically cannot be recovered. This requires exceptional attention to user interface design, transaction verification processes and customer support protocols to prevent costly mistakes.

Smart contract risks affect banks that integrate with decentralized finance protocols or use blockchain technology for automated processes. Bugs in smart contract code have resulted in hundreds of millions in losses across the crypto ecosystem. Banks must thoroughly audit any smart contracts they deploy or interact with and maintain contingency plans for potential failures.

Crypto Market Volatility and Bank Risk Profile

Cryptocurrency volatility poses challenges for banks offering crypto services. While the cryptocurrencies themselves sit off the bank's balance sheet as customer holdings rather than bank assets, crypto market volatility still affects the bank's business in several ways.

Revenue volatility from crypto-related fees will fluctuate with trading activity. During bull markets when crypto prices are rising and trading volumes surge, fee income could be substantial. But during bear markets or crypto winters when trading activity declines, this revenue stream could dry up quickly. Banks need to avoid becoming dependent on crypto-related revenue that may prove unsustainable.

Reputation risk intensifies during market crashes. When crypto prices plummet, customers who lost money may blame the bank for offering the service, even if the bank provided appropriate disclosures. During the 2022-2023 crypto crisis, exchanges and crypto platforms faced severe backlash from users who lost funds. Banks offering crypto must prepare for similar customer frustration and potential litigation during inevitable downturns.

Concentration risk emerges if particular customer segments or geographic regions embrace crypto disproportionately. A bank with concentrated crypto adoption among certain demographics might face clustered losses or reputation damage if those segments are particularly affected by market downturns or security incidents.

Credit risk considerations arise if banks eventually offer crypto-collateralized lending. Loans secured by volatile crypto assets create potential for rapid collateral devaluation, requiring frequent marking to market and potentially forced liquidations during crashes. Banks must maintain conservative loan-to-value ratios and robust risk monitoring to avoid losses.

Regulatory and Compliance Challenges

Even with recent regulatory clarity, banks offering crypto services face ongoing compliance challenges. The OCC's interpretive letters and GENIUS Act provide frameworks, but implementation details continue evolving through rulemaking and supervisory guidance.

Anti-money laundering compliance becomes more complex with crypto. While traditional banking transactions flow through established payment networks with clear counterparty identification, crypto transactions can involve pseudonymous addresses, cross-border transfers and interactions with mixing services or privacy-focused protocols. Banks must implement sophisticated blockchain analytics to monitor for suspicious activities and maintain compliance with Bank Secrecy Act requirements.

Sanctions compliance poses particular challenges. The Treasury Department's Office of Foreign Assets Control designates certain crypto addresses associated with sanctioned entities or individuals. Banks must screen transactions to prevent customers from interacting with these addresses, but the pseudonymous and permissionless nature of blockchains makes this technically challenging.

Tax reporting requirements create administrative burdens. Crypto trading generates taxable events that must be reported to the IRS. Banks offering crypto services need systems to track cost basis, calculate gains and losses, generate appropriate tax documentation and report to regulators. The complexity intensifies when customers transfer crypto between platforms or engage in sophisticated trading strategies.

Evolving regulatory interpretations mean banks must maintain flexibility. Future administrations may take different approaches to crypto regulation. New types of digital assets may emerge that require classification decisions. International regulatory divergence creates complexity for global banks. Successful banks will maintain adaptable compliance frameworks that can evolve as the regulatory landscape shifts.

What to Watch: Key Indicators

Several metrics and developments will indicate whether SoFi's crypto integration succeeds and whether other banks follow:

User adoption rates will be critical. How many of SoFi's 12.6 million members actually adopt crypto trading? What percentage maintain active usage versus trying it once and abandoning it? How does adoption correlate with demographics, account types and existing product usage?

Competitive responses matter enormously. Do major banks like JPMorgan, Bank of America and Wells Fargo accelerate their own crypto initiatives? Do regional banks and credit unions begin offering similar services? How quickly does crypto become a standard banking feature versus remaining a niche offering?

Regulatory actions or guidance will shape the industry's trajectory. Does the OCC or other banking agencies issue additional guidance on crypto activities? Do enforcement actions target banks for crypto-related deficiencies? How do regulators respond to any incidents or failures?

Deposit flow patterns could reveal whether crypto integration affects bank funding. Do customers maintain larger balances to facilitate crypto trading? Does crypto adoption correlate with increased engagement across other banking products? Or do customers primarily use crypto services while maintaining relationships primarily with other institutions?

Crypto event shocks will test how well banks manage crisis scenarios. The next major crypto crash, exchange failure, stablecoin depeg or security breach will reveal whether banks have successfully insulated themselves from contagion or whether their crypto exposure creates meaningful risks.

Market capitalization and trading volumes in "bank-approved" tokens versus those available only on crypto-native platforms could indicate whether bifurcation is occurring. If liquidity increasingly concentrates in assets available through banking platforms, this would validate the bank integration thesis while potentially disadvantaging smaller tokens.

Innovation in embedded crypto products will signal how ambitiously banks approach blockchain integration. Are they simply offering basic trading, or are they developing novel applications like programmable money, tokenized assets and blockchain-based financial services that meaningfully improve on traditional offerings?

Outlook: What This Means for Mainstream Financial Adoption

Three to Five Year Projection

Looking ahead three to five years, bank integration of crypto services will likely accelerate significantly, transforming how mainstream consumers access and use digital assets. The current moment may mark an inflection point similar to the mid-2010s when mobile banking apps transitioned from novelty to standard expectation.

By 2028-2030, crypto trading could become a standard feature offered by most major banks, rather than a differentiator for early movers like SoFi. The technology infrastructure, regulatory frameworks and operational practices will have matured to the point where offering basic crypto services requires limited incremental investment beyond initial setup. Banks that resist integration may face competitive disadvantages, particularly in attracting younger customers who expect digital asset access.

Stablecoin usage will likely expand dramatically as banks issue and integrate dollar-backed tokens into payment infrastructure. Rather than exotic crypto products, stablecoins may become the dominant rails for instant payments, international remittances and programmable money applications. The GENIUS Act framework provides the regulatory foundation, while bank involvement brings trust and liquidity.

Asset tokenization could reach meaningful scale, with billions or potentially trillions in traditional assets represented on blockchain networks. Banks facilitating this transition will generate new revenue opportunities from issuance, custody, trading and servicing of tokenized assets while modernizing financial infrastructure in ways that reduce costs and increase efficiency.

However, challenges and setbacks are inevitable. Some banks will experience crypto-related losses, security incidents or operational failures that create temporary setbacks. Regulatory frameworks will evolve in ways that sometimes constrain innovation. Market crashes will test consumer trust and institutional commitment. The path forward will be neither straight nor smooth.

Potential Scale of Mainstream Adoption

Current crypto adoption sits at approximately 21-28% of U.S. adults owning cryptocurrency. Bank integration could substantially expand this percentage by addressing the main barriers that have prevented broader adoption: complexity, lack of trust in crypto-native platforms and integration friction.

If bank-integrated crypto becomes as commonplace as stock trading through banking apps, adoption could potentially reach 40-50% of adults over the next decade. This would represent roughly 100-125 million Americans with crypto exposure through their banking relationships, compared to roughly 65 million today. However, this assumes continued positive regulatory development, absence of catastrophic market failures and successful customer education efforts.

The depth of adoption matters as much as breadth. Will customers simply allocate small speculative amounts to crypto while maintaining primary focus on traditional assets? Or will digital assets become meaningful components of diversified portfolios? Current data suggests the former is more likely, with CEO Noto's 3% personal allocation potentially representing a reasonable benchmark for informed investors.

Global adoption patterns may differ significantly from U.S. trends. Countries with unstable currencies, capital controls or limited banking infrastructure may see faster crypto adoption as digital assets address real economic needs rather than serving primarily as speculative investments. Banks in these markets may approach crypto integration with greater urgency than their U.S. counterparts.

Transformation of Banking Business Models

The integration of crypto and blockchain technology could fundamentally transform how banks operate and generate revenue, though the timeline and extent of disruption remain uncertain.

Fee income diversification becomes possible as banks generate revenue from crypto trading, stablecoin issuance, tokenized asset services and blockchain-based financial products. This matters particularly in low interest rate environments where net interest margin compression squeezes traditional profitability. Crypto-related fees could provide growth when traditional banking revenue stagnates.

Deposit acquisition and retention dynamics may shift as crypto-interested customers prioritize banks offering digital asset services. Younger demographics increasingly expect seamless digital experiences and integrated financial services. Banks offering crypto alongside traditional products present more compelling value propositions for these segments than institutions that remain crypto-free.

Risk models and asset allocation frameworks will need updating to incorporate crypto. Whether regulators ultimately require banks to hold capital against crypto-related activities and at what rates will significantly affect economics. Banks may need to develop entirely new risk management frameworks that account for crypto's unique characteristics.

Payment infrastructure transformation could be the most significant long-term impact. If stablecoins and blockchain-based payments become dominant rails for instant value transfer, this could reshape how banks handle deposits, payments and settlement. Rather than batch processing through legacy systems, real-time programmable money flows could dramatically improve efficiency while reducing costs.

Implications for Retail Investors

From the retail investor perspective, bank integration of crypto services offers important benefits alongside continuing risks. The primary advantage is simplified access to digital assets through trusted institutions with familiar interfaces, regulatory oversight and customer support infrastructure.

Investment diversification becomes easier as crypto sits alongside stocks, bonds and other assets in integrated platforms. Rather than managing relationships with multiple providers and juggling between platforms, investors can view their complete financial picture in one place and make holistic allocation decisions.

Security concerns diminish compared to self-custody or crypto-native exchanges. While crypto holdings remain uninsured, bank custody infrastructure implements institutional-grade security specifically designed to protect customer assets. The risk of losing funds to user error, phishing attacks or exchange failures likely decreases substantially.

Educational resources and customer support improve as banks invest in helping customers understand crypto. Rather than crypto exchanges that assume technical knowledge, banks can provide banking-style educational content, customer service representatives trained on crypto topics and user interfaces designed for mainstream audiences rather than crypto natives.

However, investors should maintain realistic expectations. Cryptocurrencies remain highly volatile assets that can lose significant value quickly. Bank offering does not reduce market risk or guarantee investment success. Appropriate position sizing remains essential, with most financial advisors suggesting crypto allocations of 5% or less for investors comfortable with high volatility.

The loss of certain crypto-native features represents a tradeoff. Bank-custodied crypto cannot easily interact with decentralized finance protocols, cannot be used in many Web3 applications and gives up the censorship resistance and self-sovereignty that motivated Bitcoin's creation. For some users, these limitations outweigh the convenience and security benefits of bank integration.

Key Open Questions

As banking and crypto converge, several fundamental questions remain unresolved:

Will banks become crypto hubs or maintain cautious limited offerings? The enthusiasm or restraint with which banks embrace crypto integration will largely determine how quickly and comprehensively digital assets enter mainstream finance. If major banks aggressively expand crypto services, adoption accelerates dramatically. If they proceed cautiously with minimal offerings, the transformation occurs more gradually.

How will regulatory frameworks evolve as bank crypto activities scale? The current regulatory clarity represents progress but leaves many questions unanswered. How will regulators respond if crypto becomes a significant portion of bank assets? What happens when the next crypto crisis occurs and banks are directly affected? Will consumer protection frameworks require strengthening?

Can banks successfully manage the cultural tensions between traditional banking conservatism and crypto innovation? Banks are designed to be risk-averse institutions focused on safety, soundness and regulatory compliance. Crypto emerged from a cypherpunk ethos emphasizing decentralization, permissionless innovation and disruption of traditional finance. Reconciling these fundamentally different cultures within banking organizations may prove challenging.

What tipping point will drive mainstream banks to move aggressively into crypto? Currently, institutions like JPMorgan and Bank of America are exploring crypto cautiously while not yet offering consumer services. What would trigger them to accelerate? Competitive pressure from SoFi and other digital banks? Customer demand reaching critical mass? Regulatory requirements? Or will they remain perpetually cautious?

How will international regulatory divergence affect global banks? The U.S. has the GENIUS Act, Europe has MiCA, and Asia has fragmented frameworks. Banks operating globally must navigate these different regimes while providing consistent customer experiences. How this complexity gets managed will significantly affect global crypto adoption.

Final thoughts

SoFi Technologies's November 11, 2025 launch of crypto trading services marks a pivotal moment in the convergence of traditional banking and digital assets. As the first nationally chartered U.S. bank to integrate cryptocurrency buying, selling and holding directly into its consumer banking platform, SoFi has broken down the wall that long separated mainstream finance from crypto markets.

The significance extends far beyond a single bank's product announcement. SoFi's move signals that the regulatory, technological and market conditions have aligned to enable banks to embrace digital assets as legitimate financial products worthy of integration into their core offerings. The OCC's interpretive letters providing regulatory clarity, the GENIUS Act establishing stablecoin frameworks and the demonstrated consumer demand for bank-intermediated crypto access have created a window for mainstream financial institutions to finally engage with blockchain technology in meaningful ways.

However, the ultimate success of this convergence depends on execution, continued regulatory support, consumer education and the ability to navigate inevitable challenges. The Vast Bank experience demonstrates that entering crypto without adequate preparation and infrastructure can result in costly regulatory enforcement and forced market exits. SoFi's more methodical approach, waiting for regulatory clarity and building institutional-grade systems before launch, may prove more sustainable.

The broader transformation this heralds could fundamentally reshape both banking and crypto. Traditional banks gain new revenue streams, enhanced customer engagement and opportunities to modernize aging infrastructure through blockchain technology. Cryptocurrency gains mainstream legitimacy, simpler access for everyday users and integration with the trusted financial services that hundreds of millions of people already use.

Yet questions remain about how much of crypto's original vision survives this institutionalization. Bank custody, regulatory oversight and integration with traditional finance represent departures from the decentralization and censorship resistance that motivated Bitcoin's creation. The outcome may be a bifurcated ecosystem where bank-intermediated crypto serves mainstream users while crypto-native platforms maintain the original ethos for users prioritizing sovereignty over convenience.

For retail investors and everyday banking customers, the integration of crypto into mainstream financial services represents both opportunity and responsibility. Easier access to digital assets through trusted banking relationships could accelerate portfolio diversification and participation in blockchain-based financial innovation. But crypto remains highly volatile, and bank offering does not eliminate market risk or guarantee investment success.

As we look ahead, the phase that SoFi's announcement inaugurates will define how banking and crypto evolve together over the coming years. Other banks will watch closely to gauge consumer response, regulatory reactions and operational success or failure. If SoFi demonstrates that bank-integrated crypto services can be offered safely, profitably and in ways that genuinely benefit customers, expect a cascade of competitive offerings from institutions eager to avoid being left behind. If challenges or failures emerge, the transformation may proceed more cautiously.

The integration of banking and crypto services may finally make digital assets accessible to mass-market consumers in ways that a decade of standalone exchanges never achieved. But this phase will determine whether that accessibility comes with adequate safeguards, appropriate education and sustainable business models, or whether it creates new categories of risk that regulators and institutions are unprepared to manage. The stakes are substantial for financial services, digital assets and the millions of consumers who will navigate this evolving landscape.

SoFi has opened the door. How quickly and how wisely the rest of the banking industry walks through it will shape finance for decades to come.