The Adam and Eve pattern represents more than just a technical formation—it embodies the psychological tug-of-war between bulls and bears that defines cryptocurrency market cycles.

The cryptocurrency market's notorious volatility creates a fertile ground for technical analysis patterns that can signal significant trend reversals. Among these formations, the Adam and Eve pattern stands out as one of the most reliable reversal indicators, offering institutional and retail traders alike a sophisticated tool for navigating the complex dynamics of digital asset markets. This pattern, first formally documented by Thomas Bulkowski in his seminal work "Encyclopedia of Chart Patterns," has found particular relevance in the 24/7 crypto trading environment, where traditional market psychology meets the unique behavioral patterns of digital asset investors.

In an ecosystem where sentiment shifts can trigger cascading liquidations and FOMO-driven rallies, understanding this pattern becomes crucial for professional traders seeking to capitalize on market inefficiencies. Recent institutional adoption of cryptocurrencies has added new layers of sophistication to pattern recognition, as traditional financial institutions bring time-tested analytical frameworks to an emerging asset class.

The pattern's effectiveness in cryptocurrency markets has been particularly pronounced during major market transitions. Bitcoin's formation of a textbook Adam and Eve bottom around $16,000 in late 2022 demonstrated the pattern's predictive power, as the subsequent breakout above $18,000 marked the beginning of a sustained upward movement.

Similarly, analysis from March 2025 identified Bitcoin reaching the final stage of an Adam and Eve pattern at $68,950, accompanied by a 35% surge in trading volume that validated the pattern's completion.

Understanding the Adam and Eve Formation

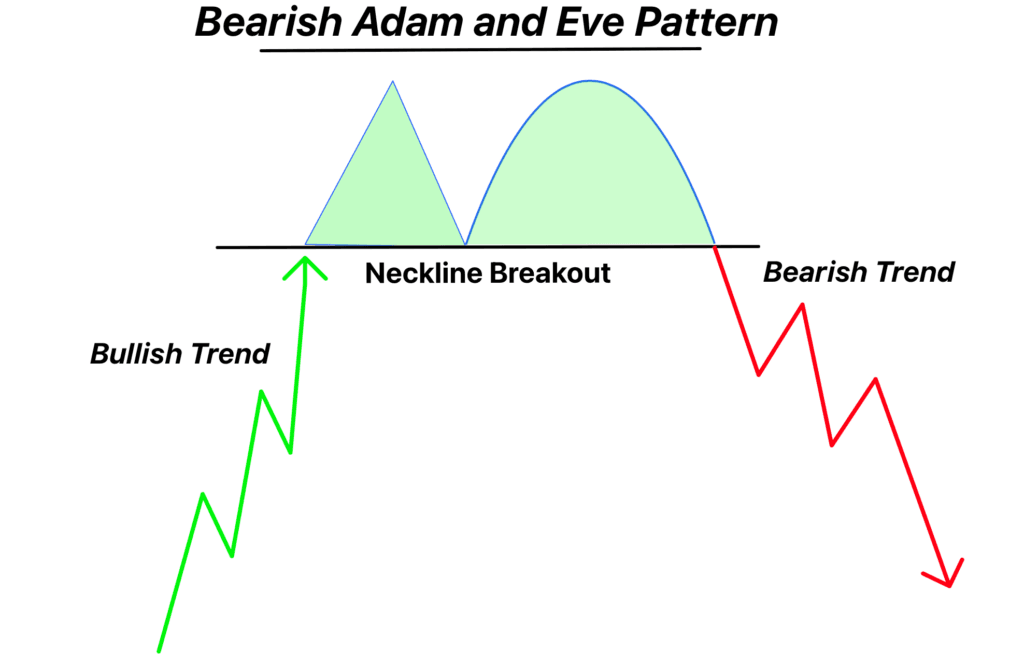

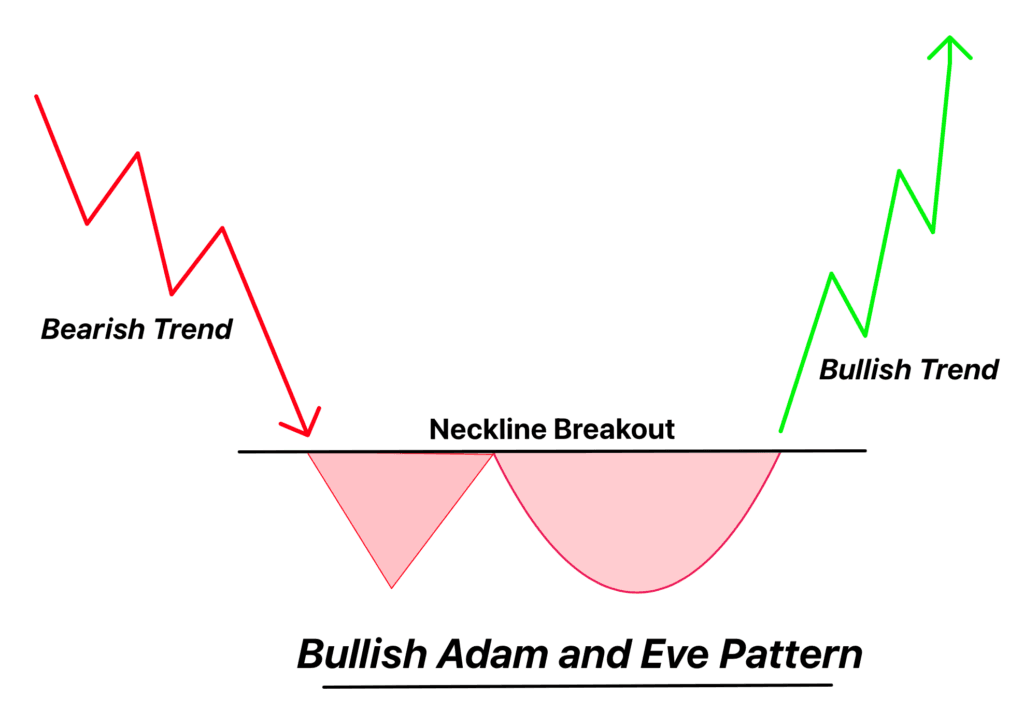

The Adam and Eve pattern distinguishes itself from traditional double top and double bottom formations through its unique structural characteristics. While conventional double patterns typically feature two similar peaks or troughs, the Adam and Eve configuration presents a striking asymmetry that reflects evolving market psychology. The "Adam" component manifests as a sharp, V-shaped movement—a rapid capitulation followed by an equally swift rebound that indicates intense selling pressure meeting strong buying interest.

The psychological underpinnings of the Adam formation reveal crucial insights into market behavior.

This sharp, narrow spike represents moments of peak emotional intensity where fear or greed reaches climactic levels. In cryptocurrency markets, these formations often coincide with major news events, regulatory announcements, or technical breakdowns that trigger algorithmic selling cascades. The rapid recovery suggests that institutional players or sophisticated traders recognize oversold conditions and aggressively accumulate positions, creating the characteristic V-shaped recovery.

Following the Adam formation, markets enter a consolidation phase before forming the "Eve" component. Unlike its predecessor's sharp angles, Eve presents as a rounded, U-shaped formation that develops over an extended timeframe.

This gradual, rounded bottom reflects a more measured approach by market participants, where buying and selling pressures achieve a temporary equilibrium. The broader time frame and smoother price action indicate that initial emotional reactions have subsided, replaced by more rational decision-making processes.

The psychological significance of the Eve formation cannot be overstated in cryptocurrency markets.

This phase often represents the transition from retail-driven sentiment to institutional accumulation patterns. The rounded nature suggests that professional traders are systematically building positions while retail participants remain uncertain about market direction. Volume patterns during Eve formation typically show declining intensity compared to the Adam spike, indicating that panic selling has been replaced by methodical distribution and accumulation.

The neckline formation between Adam and Eve components serves as the critical confirmation level for pattern completion. This horizontal line, drawn through the peak or trough between the two formations, represents a key psychological resistance or support level that must be decisively broken for the pattern to signal a trend reversal.

But there's more. The importance of volume confirmation during neckline breakouts cannot be emphasized enough—legitimate breakouts typically feature expanding volume that validates the shift in market sentiment.

Pattern reliability increases significantly when the height differential between Adam and Eve formations falls within specific parameters. Bulkowski's research indicates that formations where the second trough (Eve) occurs at similar price levels to the first (Adam) demonstrate higher success rates. Additionally, patterns that develop over several weeks or months show greater reliability than those compressed into shorter timeframes, suggesting that sustained psychological shifts require adequate time to materialize.

Market Psychology and Institutional Dynamics

The cryptocurrency market's unique 24/7 trading environment creates distinctive psychological pressures that influence Adam and Eve pattern formation. Unlike traditional financial markets with defined trading hours, crypto markets operate continuously, subjecting participants to constant information flows and decision-making pressures.

This environment amplifies the psychological factors that drive pattern formation, particularly the fear of missing out (FOMO) and anticipated regret that characterize retail investor behavior.

Research into cryptocurrency trading psychology reveals that retail participants exhibit markedly different behavioral patterns compared to traditional asset classes.

While retail traders typically employ contrarian strategies in equity markets, the same individuals demonstrate momentum-following behavior in cryptocurrency markets.

This behavioral shift creates fertile conditions for Adam and Eve pattern formation, as initial sharp movements (Adam) can trigger momentum responses, while subsequent consolidation phases (Eve) allow for more rational reassessment of market conditions.

The growing institutional participation in cryptocurrency markets has fundamentally altered pattern dynamics. Traditional financial institutions bring sophisticated risk management frameworks and algorithmic trading systems that interact with retail sentiment in complex ways. When institutional players recognize oversold conditions during Adam formation, their systematic accumulation can create the sharp recovery that defines the pattern. Subsequently, their methodical position-building during Eve phases contributes to the rounded, gradual price action that characterizes this component.

Whale activity analysis provides crucial insights into Adam and Eve pattern development in cryptocurrency markets. Large transaction volumes often coincide with pattern formation, as institutional players and high-net-worth individuals execute significant position changes.

Recent analysis of Ethereum patterns revealed over $18 billion in large transaction volume during pattern completion phases, indicating that sophisticated market participants actively recognize and trade these formations. This institutional validation adds credibility to pattern-based analysis in cryptocurrency markets.

The psychological transition from Adam to Eve phases reflects a fundamental shift in market participant composition. Adam formations often occur during periods of maximum retail panic or euphoria, when emotional decision-making dominates price action. The subsequent Eve phase typically sees institutional accumulation or distribution, as professional traders capitalize on emotional extremes created by retail participants.

This dynamic creates a natural psychological progression that enhances pattern reliability when properly identified.

Social media and community sentiment play amplified roles in cryptocurrency Adam and Eve pattern formation compared to traditional assets. The interconnected nature of crypto communities means that pattern recognition itself can become self-fulfilling, as traders collectively identify and act upon formations. However, this same connectivity can create false signals when pattern recognition becomes too widespread, emphasizing the importance of volume confirmation and fundamental analysis alongside technical pattern identification.

Trading Applications and Risk Management

Professional implementation of Adam and Eve patterns in cryptocurrency markets requires a systematic approach that accounts for the unique characteristics of digital asset trading. Entry strategies typically involve waiting for confirmed breakouts above or below the neckline, accompanied by volume expansion that validates the pattern completion. Conservative traders often wait for a close beyond the neckline followed by a successful retest, while aggressive traders may enter on the initial breakout with appropriate risk management measures.

Position sizing for Adam and Eve pattern trades demands careful consideration of cryptocurrency market volatility.

Professional traders typically risk no more than 1-2% of their portfolio on individual pattern trades, with stop-loss orders placed just beyond the Eve formation in bullish patterns or below the Adam low in more aggressive setups.

This approach acknowledges that even high-probability patterns can fail, particularly in the highly volatile cryptocurrency environment where unexpected news or regulatory developments can override technical considerations.

Target calculation methods for Adam and Eve patterns follow traditional measured move principles, but require adjustment for cryptocurrency market dynamics. The standard approach involves measuring the height from the neckline to the extreme point of the pattern, then projecting this distance from the breakout point.

However, crypto traders often employ multiple profit-taking levels, recognizing that digital asset markets can generate outsized moves that exceed traditional technical targets.

Risk management protocols for Adam and Eve trading must account for the potential for rapid, extreme price movements that characterize cryptocurrency markets.

Professional traders implement trailing stop-loss orders that can capture extended moves while protecting against sudden reversals. Additionally, many institutional players use options strategies or derivatives to hedge pattern-based positions, providing downside protection while maintaining upside participation.

The integration of Adam and Eve patterns with other technical indicators enhances trading precision and reduces false signal frequency.

Momentum indicators such as RSI often show divergence patterns that confirm Adam and Eve formations, while volume-based indicators like On-Balance Volume can validate the accumulation or distribution phases that characterize pattern development. Professional traders typically require confluence from multiple indicators before executing pattern-based trades.

Timing considerations for Adam and Eve pattern trades require understanding of cryptocurrency market cycles and seasonal patterns. Historical analysis reveals that these patterns tend to be more reliable during specific market phases, particularly during transitions between bull and bear cycles.

Traders who align pattern recognition with broader market cycle analysis often achieve superior risk-adjusted returns compared to those who trade patterns in isolation.

Who Should Use Adam and Eve Analysis

The Adam and Eve pattern serves different market participants based on their trading timeframes, risk tolerance, and technical analysis sophistication. Institutional traders and hedge funds represent the primary beneficiaries of this pattern recognition, as their systematic approach to pattern trading and risk management aligns well with the methodical nature of Adam and Eve formations. These professional entities possess the analytical resources and execution capabilities necessary to effectively implement pattern-based strategies across multiple cryptocurrency pairs simultaneously.

Retail traders with intermediate to advanced technical analysis skills can successfully incorporate Adam and Eve patterns into their trading arsenal, provided they maintain disciplined risk management practices.

The pattern's relatively clear definition and objective confirmation criteria make it accessible to individual traders who have mastered basic chart reading skills. However, retail participants must exercise particular caution regarding position sizing, as the leveraged nature of many cryptocurrency trading platforms can amplify losses when patterns fail to develop as expected.

Long-term cryptocurrency investors can utilize Adam and Eve patterns as portfolio rebalancing signals rather than short-term trading opportunities. When major cryptocurrencies like Bitcoin or Ethereum complete these patterns, they often signal significant trend changes that warrant strategic position adjustments. Conservative investors might use pattern completion as a catalyst for dollar-cost averaging strategies or as confirmation for existing fundamental analysis.

Professional money managers and family offices increasingly recognize Adam and Eve patterns as part of their cryptocurrency allocation strategies. With approximately 39% of family offices now considering crypto investments, pattern-based analysis provides a structured approach to timing entry and exit points for digital asset exposure.

The pattern's historical reliability in major cryptocurrency reversals makes it particularly valuable for institutions seeking to optimize their limited cryptocurrency allocations.

Algorithmic trading systems and quantitative funds have begun incorporating Adam and Eve pattern recognition into their systematic strategies. Machine learning models trained on historical pattern data show promising results, with some research indicating accuracy rates exceeding 86% when combined with complementary indicators. This systematic approach removes emotional bias while maintaining the pattern's predictive power.

Educational institutions and trading academies should prioritize Adam and Eve pattern instruction as part of comprehensive cryptocurrency technical analysis curricula.

The pattern's combination of clear visual definition and reliable historical performance makes it an ideal teaching tool for demonstrating the intersection of market psychology and technical analysis.

Students who master this pattern often develop better intuition for market sentiment shifts and reversal identification.

Final Thoughts

The Adam and Eve pattern represents a sophisticated analytical tool that bridges traditional technical analysis with the unique dynamics of cryptocurrency markets. Its ability to capture the psychological transition from emotional extremes to rational consolidation makes it particularly relevant in digital asset trading, where sentiment shifts can trigger massive capital flows and sustained trend reversals. As institutional adoption of cryptocurrencies continues to mature, the pattern's reliability has only strengthened, supported by the systematic approach that professional traders bring to digital asset markets.