TRADING

PLATFORM LIVEGET STARTED

Recent News on Cryptocurrency, Blockchain, and Finance | Yellow.com

Explore the latest Web3 and blockchain developments, cryptocurrencies news, market updates, technology, trading, mining, and trends.

Bank of England May Scrap £20K Stablecoin Holding Limit

Bank of England signals willingness to revise stablecoin ownership caps after lawmaker and industry pushback.

Alexey Bondarev1 hour ago

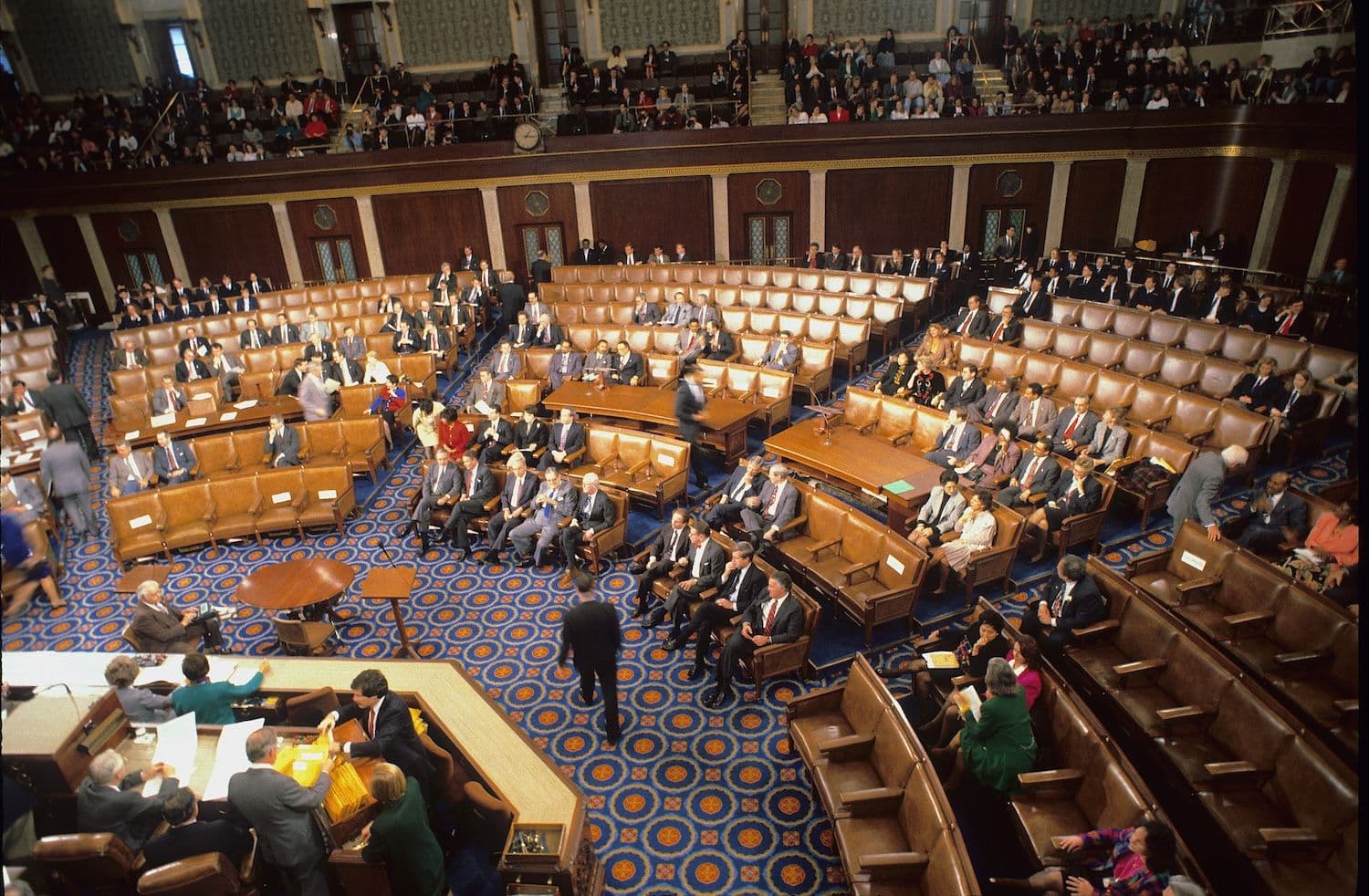

Democrats Vow Oversight Of DOJ Binance Probe

Democratic senators pledge oversight of a reported DOJ investigation into Binance over Iran sanctions concerns.

Alexey Bondarev3 hours ago

XRP Clears Bearish Trend Line, Eyes $1.420

XRP broke above a bearish trend line and reclaimed $1.40, with $1.420 now the key resistance.

Alexey Bondarev4 hours ago

Can Bitcoin Break $72K To Ignite Rally?

Bitcoin consolidates near $71,750 after breaking a bullish flag pattern, with $72,000 resistance now in focus.

Alexey Bondarev7 hours ago

Prosecutors Urge Court To Reject Sam Bankman-Fried’s New Trial Request

U.S. prosecutors have urged a court to reject Sam Bankman-Fried’s request for a new trial, arguing his claims about FTX’s solvency and political persecution are misleading.

Murtuza Merchant11 hours ago

When Clicking Through Warnings Cost $50M In The Worst AAVE Trade Ever Recorded

A DeFi trader attempting to buy AAVE with $50 million in USDT received only 324 tokens after confirming high slippage warnings, highlighting risks in large on-chain swaps.

Murtuza Merchant12 hours ago

JPMorgan Sued Over Alleged $328M Crypto Liquidity Pool Fraud

A victim of an alleged $328 million crypto liquidity pool fraud has filed a lawsuit against JPMorgan Chase, claiming the bank failed to detect and stop the scheme run by one of its customers.

Murtuza Merchant12 hours ago

CFTC Signals New Regulatory Push As Prediction Markets Surge In Popularity

The U.S. CFTC has issued new guidance on event contracts as prediction markets gain popularity and attract regulatory scrutiny across financial and crypto platforms.

Murtuza Merchant12 hours ago

Bitcoin Stuck Below $70K For A Month As Short Sellers Pile In And New Buyers Bleed Losses

Bitcoin is range-bound below $70K, short sellers are crowding in, and new buyers are losing money. What Glassnode's data says next.

Kostiantyn Tsentsura18 hours ago

Buterin Says Ethereum's Most Valuable Feature Is Not Smart Contracts - It's A Public Database

Buterin argues Ethereum's core value is a censorship-resistant public data layer - not smart contracts. Here's the technical case he makes.

Kostiantyn Tsentsura18 hours ago