While meme coins dominate feeds and fast pumps trigger fear-of-missing-out, there’s another side to the market one that's quieter, but far more meaningful. Below the $0.25 mark, a handful of tokens like Jasmy, Sei, and Kaspa are showing signs of real infrastructure growth: developer activity, rising network usage, and community traction.

And unlike the OM drama that reminded everyone what unchecked hype can lead to, these names are avoiding shortcuts and doubling down on actual delivery. In a market that often mistakes virality for value, these three are bucking the trend and doing it with intent.

Kaspa (KAS) – The Fastest Proof-of-Work Network You’re Still Sleeping On

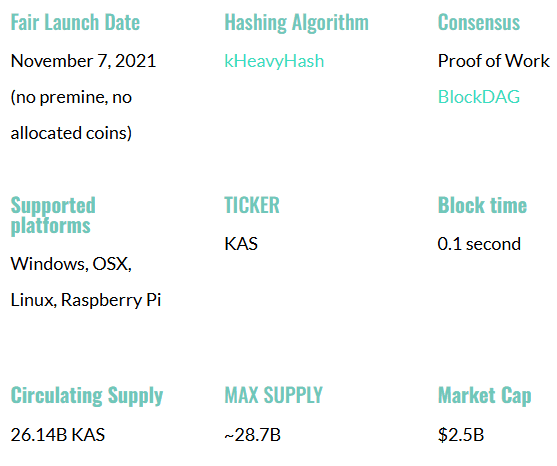

Price: $0.09477 | Market Cap: $2.47B | Circulating Supply: 26.13B KAS

Why Kaspa Stands Out

Kaspa is not your average low-cap token, it’s a foundational infrastructure play with ambitions to overhaul how Proof-of-Work blockchains scale. Its defining innovation, the GHOSTDAG protocol, replaces traditional linear chains with a blockDAG, allowing multiple blocks to coexist and be processed in parallel. This means sub-second confirmation times and scalability that could outpace even some Layer-1 Proof-of-Stake chains.

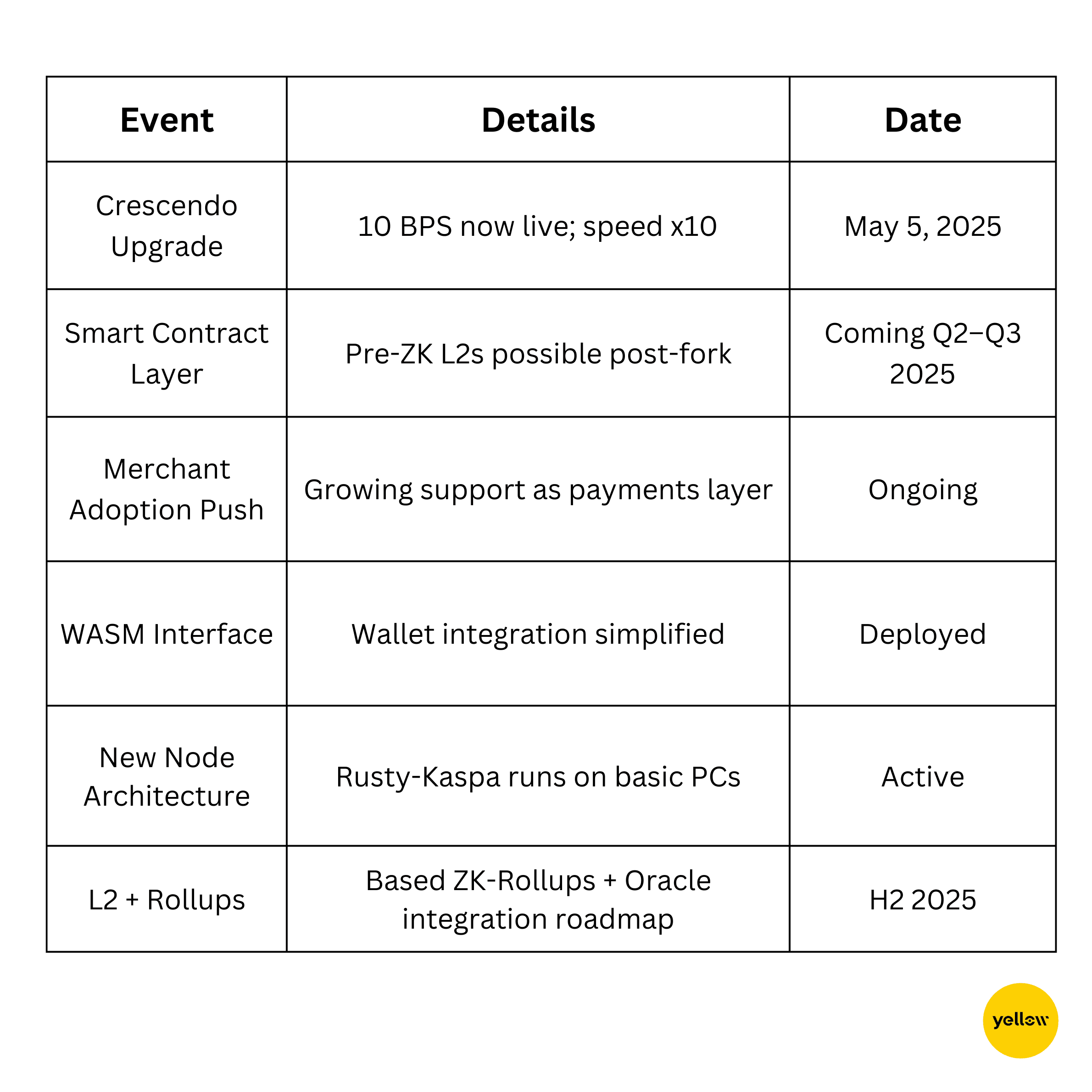

Its recent Crescendo upgrade (May 5, 2025) increased block speed tenfold to 10 BPS, putting Kaspa leagues ahead in transaction throughput, while maintaining decentralization, low energy use (via the kHeavyHash algorithm), and the ethos of a true fair launch.

On-Chain & Ecosystem Strength

Kaspa’s fundamentals go far beyond just whitepaper promises — its ecosystem health is reflected in both its transparent launch and steady development. Unlike many Layer-1s that rely on aggressive token allocations and VC funding, Kaspa launched fairly, with no premine or ICO. This has ensured wide and organic distribution, reducing the risk of centralized sell pressure often seen in pre-allocated projects.

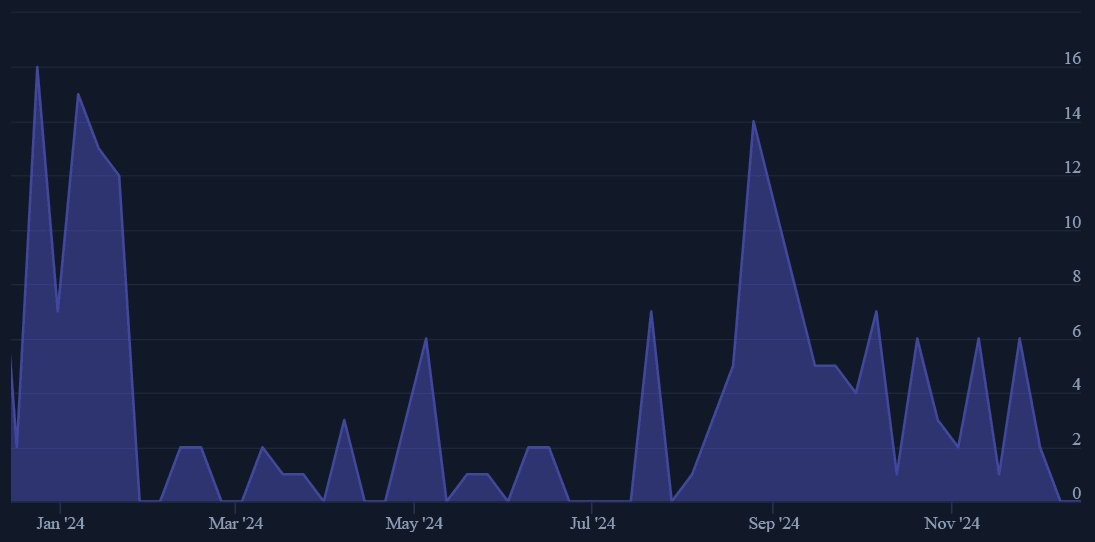

Developer activity tells a compelling story as well. With 188 commits over the past year (compared to a 66 commit average across comparable tokens), the protocol shows sustained backend progress. Even in the last 4 weeks alone, Kaspa pushed 9 commits vs a market average of 0 — signaling it’s not just surviving the bear cycle, but actively building through it.

The network’s transition from Golang to Rust has had a major impact. This wasn’t just a cosmetic change — Rust offers higher performance, lower memory usage, and better concurrency. It has allowed Kaspa to scale up to 10 blocks per second with minimal hardware requirements, making it possible for even hobbyists to run nodes. That’s a real step toward decentralization, not just a marketing line.

With 26.13B KAS already in circulation out of a 28.7B max supply, Kaspa is already largely emitted, removing much of the inflation risk faced by other tokens. Its market cap of $2.47B puts it in the top 50, yet its infrastructure and throughput could rival chains much higher up the rankings.

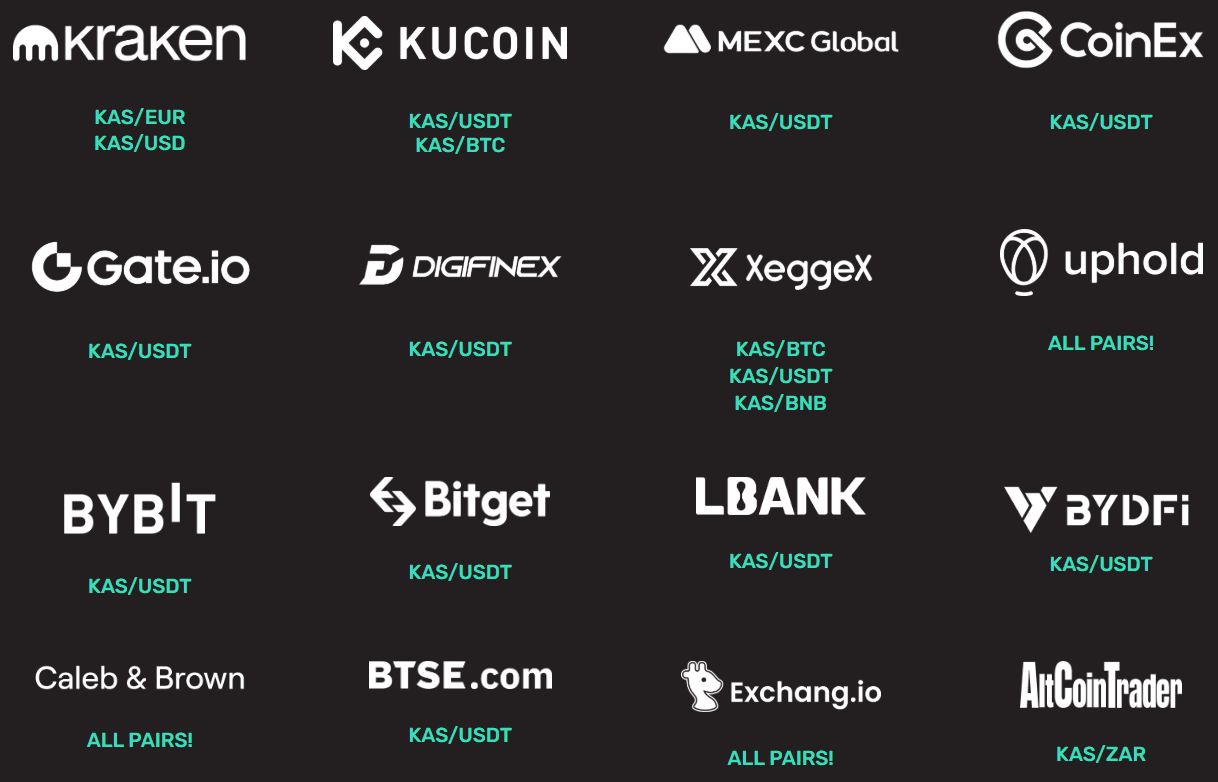

Finally, Kaspa’s presence across 20+ exchanges including Kraken, KuCoin, MEXC, and Bybit makes it one of the most liquid fair-launch PoW tokens in the market — a crucial factor for both institutional access and retail onramps.

Technically Speaking

-

Current Price: $0.09477, recovering from recent lows (~$0.055)

-

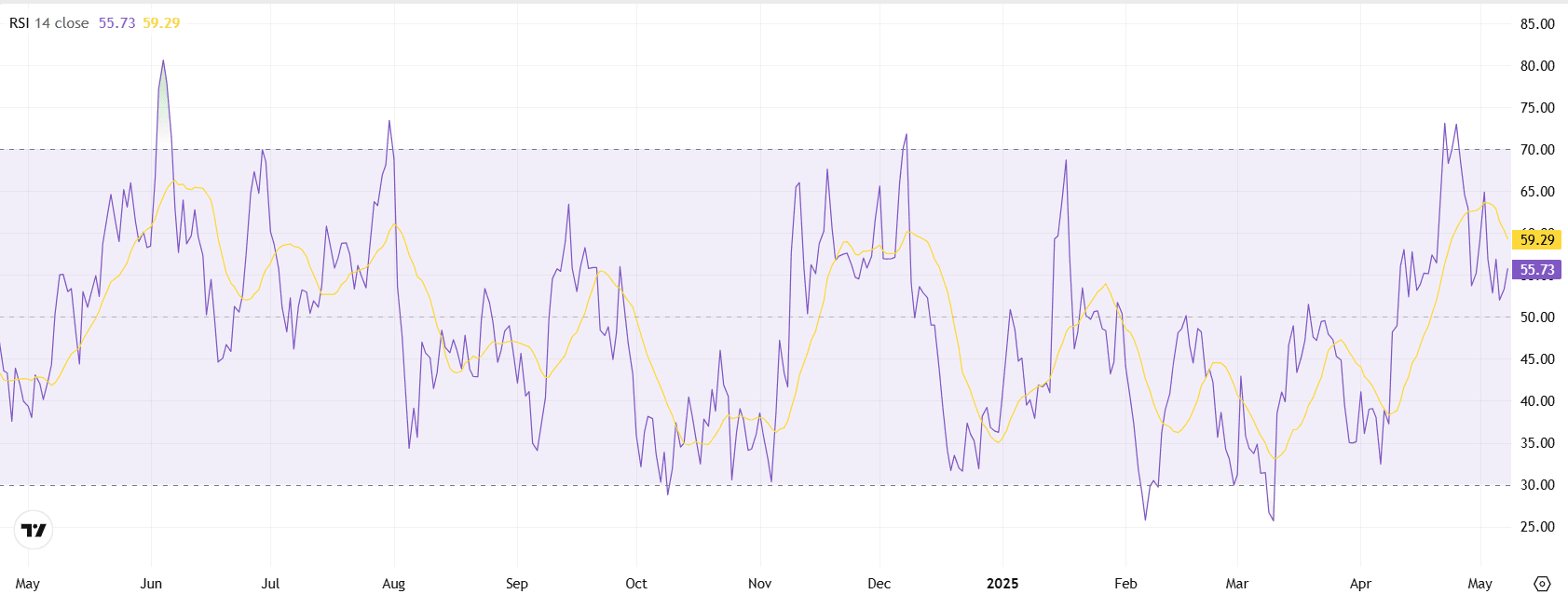

RSI (daily): ~59 — trending toward bullish zone

-

Resistance to watch: $0.0990 (crucial breakout zone), then $0.15

-

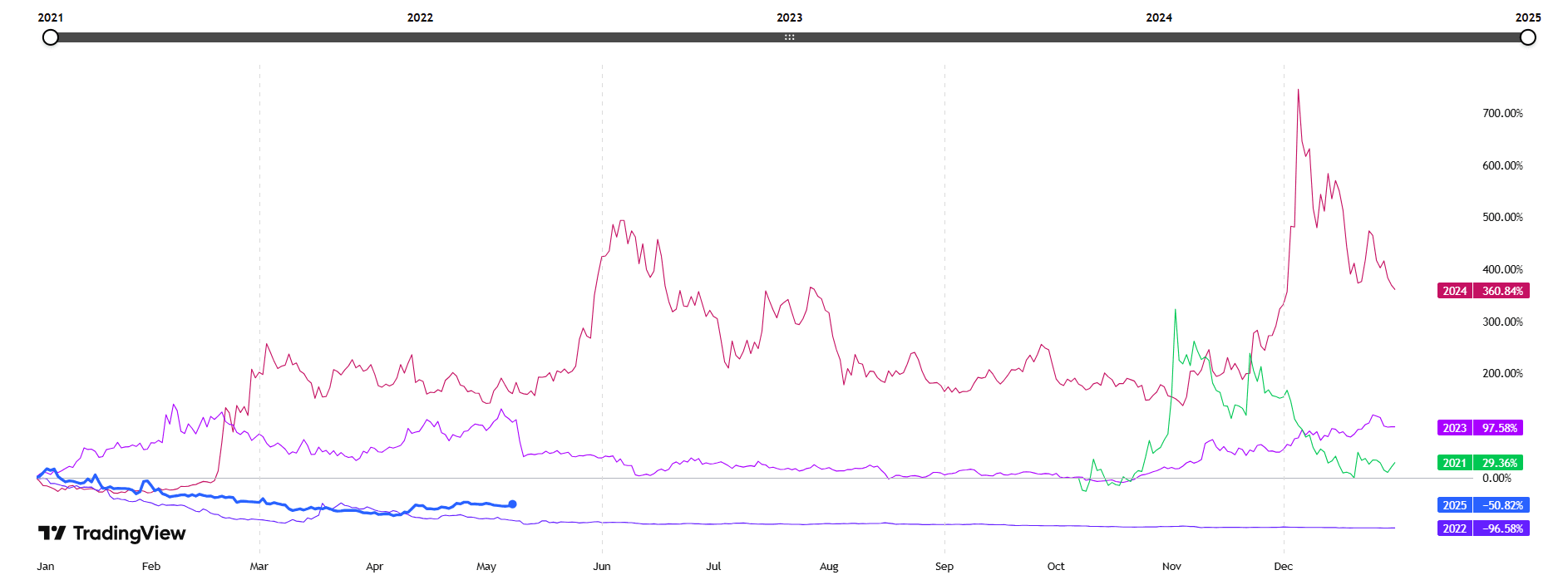

All-time high: $0.207 (Aug '24), now down ~54% from peak

-

Trend: April bottom formation confirmed with increasing volume on MEXC

-

Developer Activity: Spiked post-Aug '24, steady commits since

What Makes Kaspa Unique?

-

GHOSTDAG + blockDAG architecture: A breakthrough in consensus, enabling parallel block inclusion

-

Trilemma solved: High security, scalability, and decentralization trilemma solved all at once

-

Instant confirmations: 1-second finality now, pushing toward sub-second

-

No wasted blocks: Even side chains get included—better miner incentives

-

ASIC decentralization model: Unique rollout encouraged CPU/GPU fairness before ASICs entered

Catalysts to Watch

The Verdict

Kaspa is not here for the short game. It’s building something radical: a truly decentralized, lightning-fast PoW network that feels like a PoS chain without any of the trust compromises. With a fair launch, no VCs, and a roadmap full of scalability, L2 integration, and real-world use, KAS is priced like a memecoin but acts like a blue-chip infra layer.

And with its all-time high still over 2x away and Crescendo just beginning to show results, Kaspa may be one of the most asymmetric bets under $0.10 in crypto right now.

JasmyCoin (JASMY): Data Ownership for the Web3 Age

Why It Stands Out

JasmyCoin powers a decentralized IoT platform built by ex-Sony executives aiming to restore control of personal data to individuals. Users can securely store and monetize their information across IoT devices, combining blockchain with real-world applications like secure PCs and smart data lockers.

The project has shown real traction:

-

Chainlink CCIP integration for native cross-chain interoperability (Ethereum <> Base)

-

Strategic partners include Panasonic, Sony, and Transcosmos

-

Layer-2 blockchain JANCTION under incubation to support scalable dApps

-

Regulated under Japanese law, giving it a compliance-first edge rare among altcoins

-

Token is used for gas, data transaction permissions, and ecosystem rewards

On-Chain + Community Health

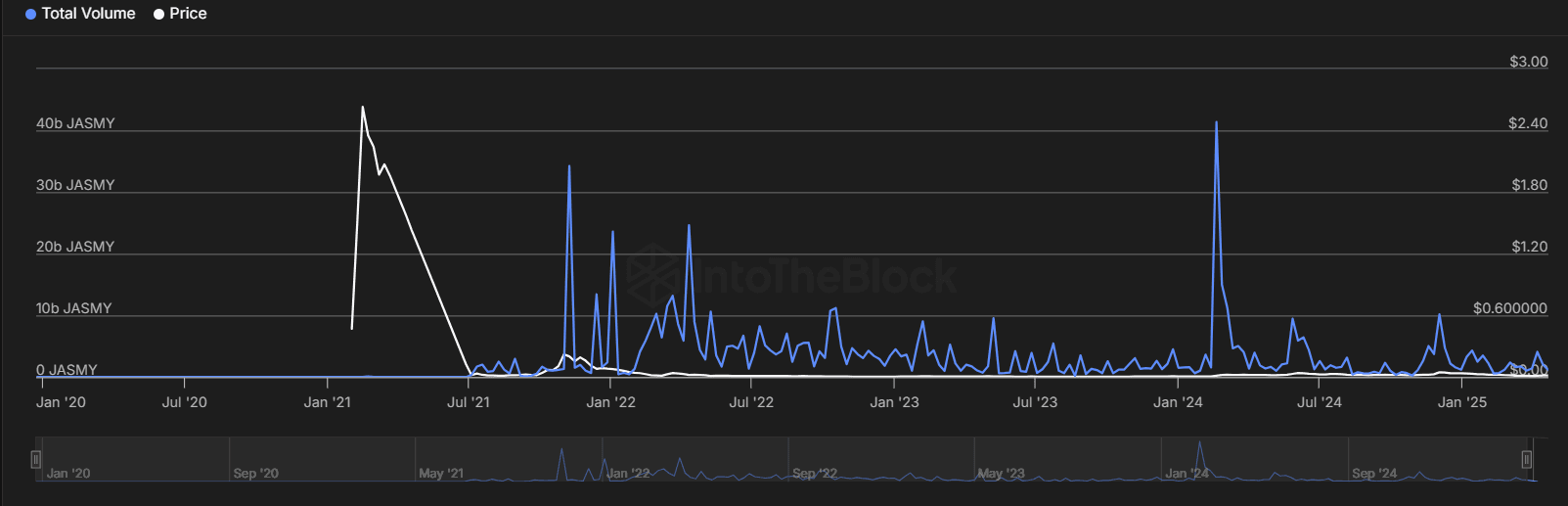

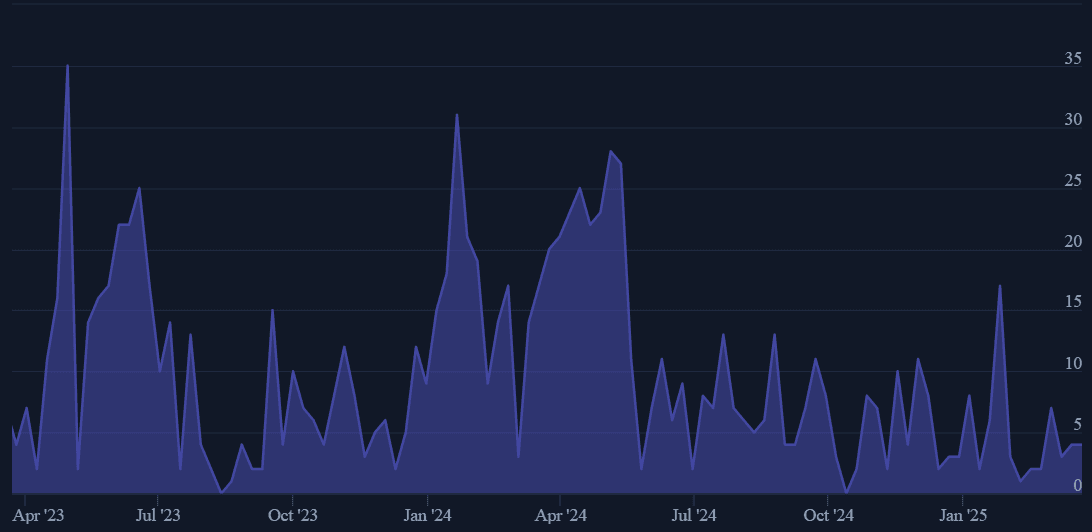

Jasmy has a circulating supply of 49.44B JASMY (out of 50B max supply), with an FDV of $826M and a volume-to-market cap ratio of 5.04%, reflecting healthy market activity.

Recent on-chain activity shows bullish accumulation:

-

Exchange outflows exceeded inflows, suggesting large holders are moving tokens off exchanges

-

Whale transactions over 500,000 JASMY detected within 6-hour intervals

-

Active wallets rose 12% in early May, coinciding with price support at the $0.013 level

-

Jasmy now boasts 100,000+ total holders across Ethereum and BNB chains

-

Inflation is minimal with most supply already unlocked, reducing long-term dilution concerns

-

Community sentiment is vibrant. A Binance delisting vote backlash instead strengthened community support, leading to deeper on-chain engagement

-

New use cases like the Sagan Tosu Fan Token, Jasmy Secure PC, and Nagano’s carbon credit system are expanding real-world adoption.

Technical Snapshot

-

Price: $0.0165

-

Drawdown from ATH: ~95% below $0.35 (ATH)

-

Volume: $41.6M (↑31.9% in 24h)

-

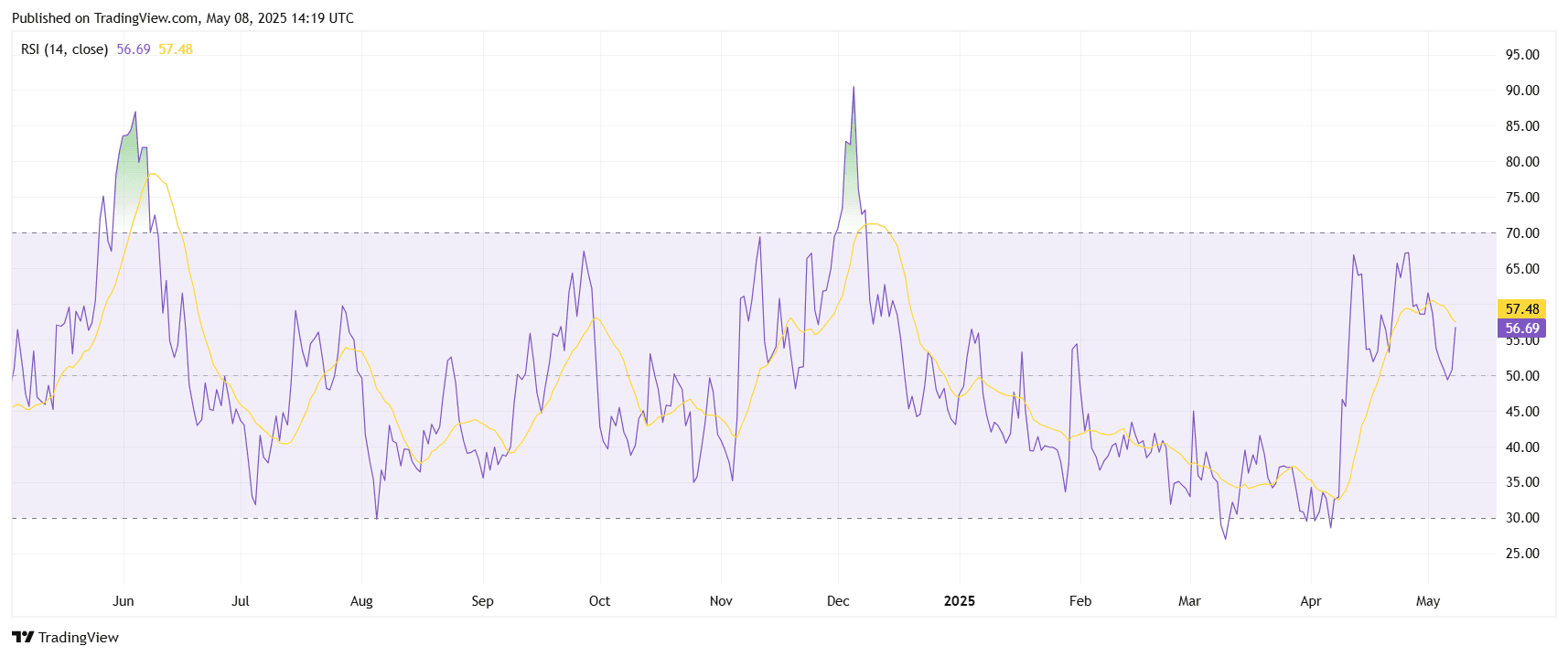

RSI: 56.74 – Neutral but trending upward

-

Support Zones: $0.0130 and $0.0141 (Fib levels)

-

Resistance Zones: $0.02078 (Fib 0.236), then $0.02812 (Fib 0.382)

Price structure shows a breakout from a long-term descending wedge with a 114% rally post-$0.0089 bottom (April 7). The Elliott Wave structure suggests the current correction (wave iv) may soon give way to wave (v), with targets up to $0.0207–$0.0246 if support holds.

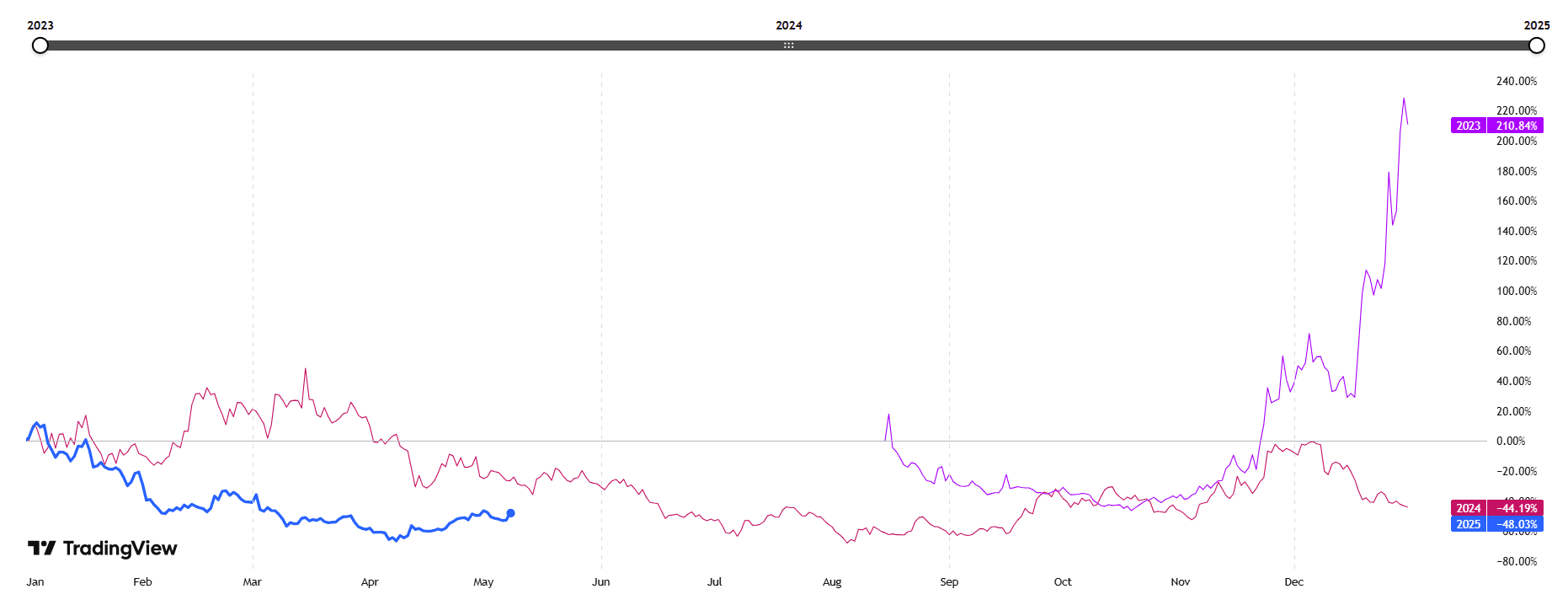

Seasonality data shows May–July historically outperforming, further supporting short-term upside.

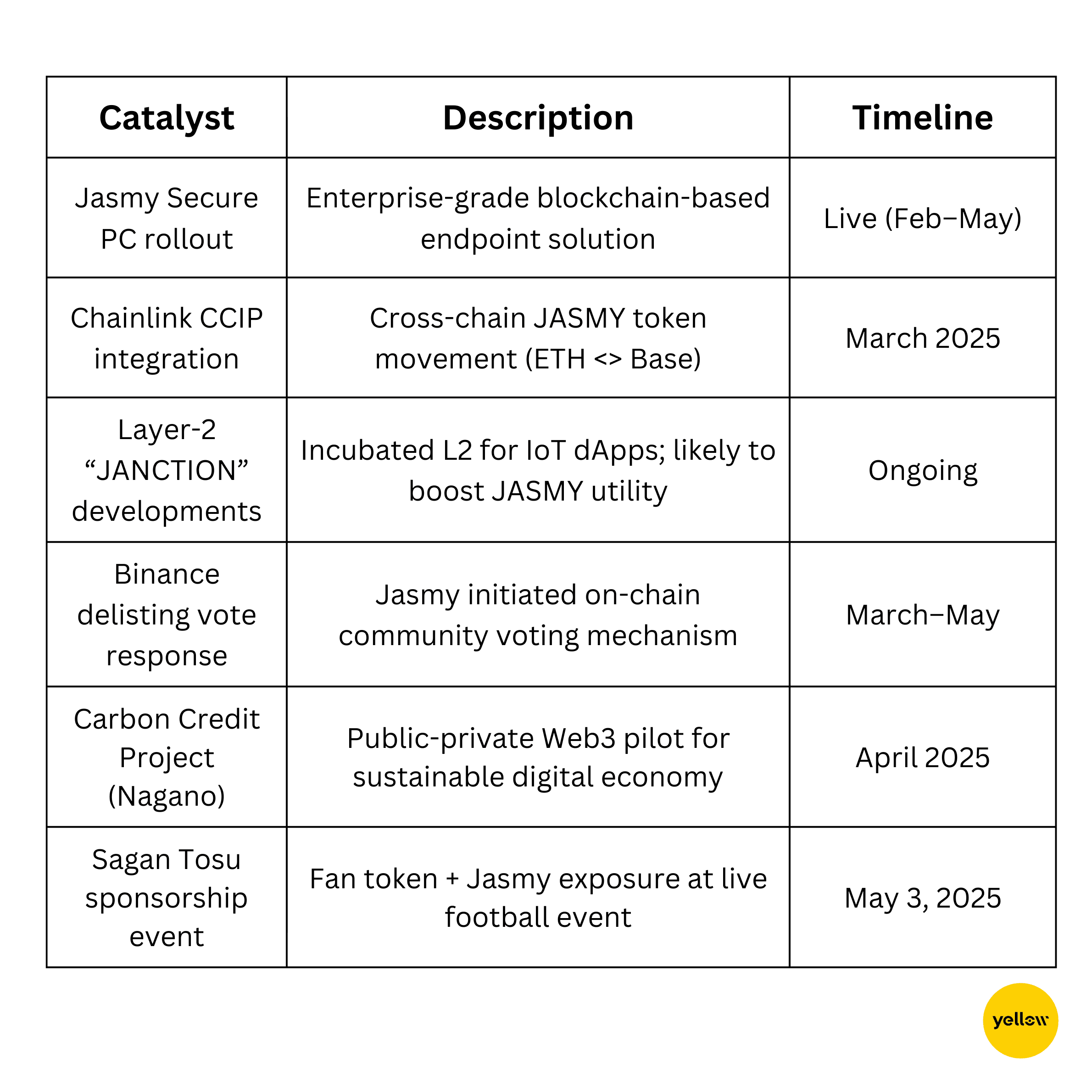

Catalysts to watch

The Verdict

Jasmy is one of the few tokens operating at the intersection of regulated markets, real-world IoT use cases, and on-chain data infrastructure. With Chainlink CCIP now live, Layer 2 expansion underway, and hardware integrations like Jasmy Secure PC gaining traction, the project is steadily building utility while remaining underexposed compared to its peers. Its compliance-first approach and Japan-based leadership add a layer of credibility rare in small-cap crypto.

At just over 1.5 cents and still 90% below its all-time high, JASMY offers asymmetric upside if execution continues. It is not without volatility, but few tokens at this price point come with working products, government partnerships, and a growing Layer 2 ecosystem.

Sei (SEI): Fastest EVM Chain in the Arena

Why It Stands Out

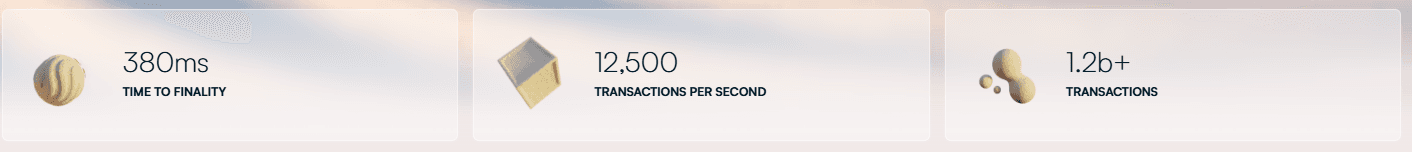

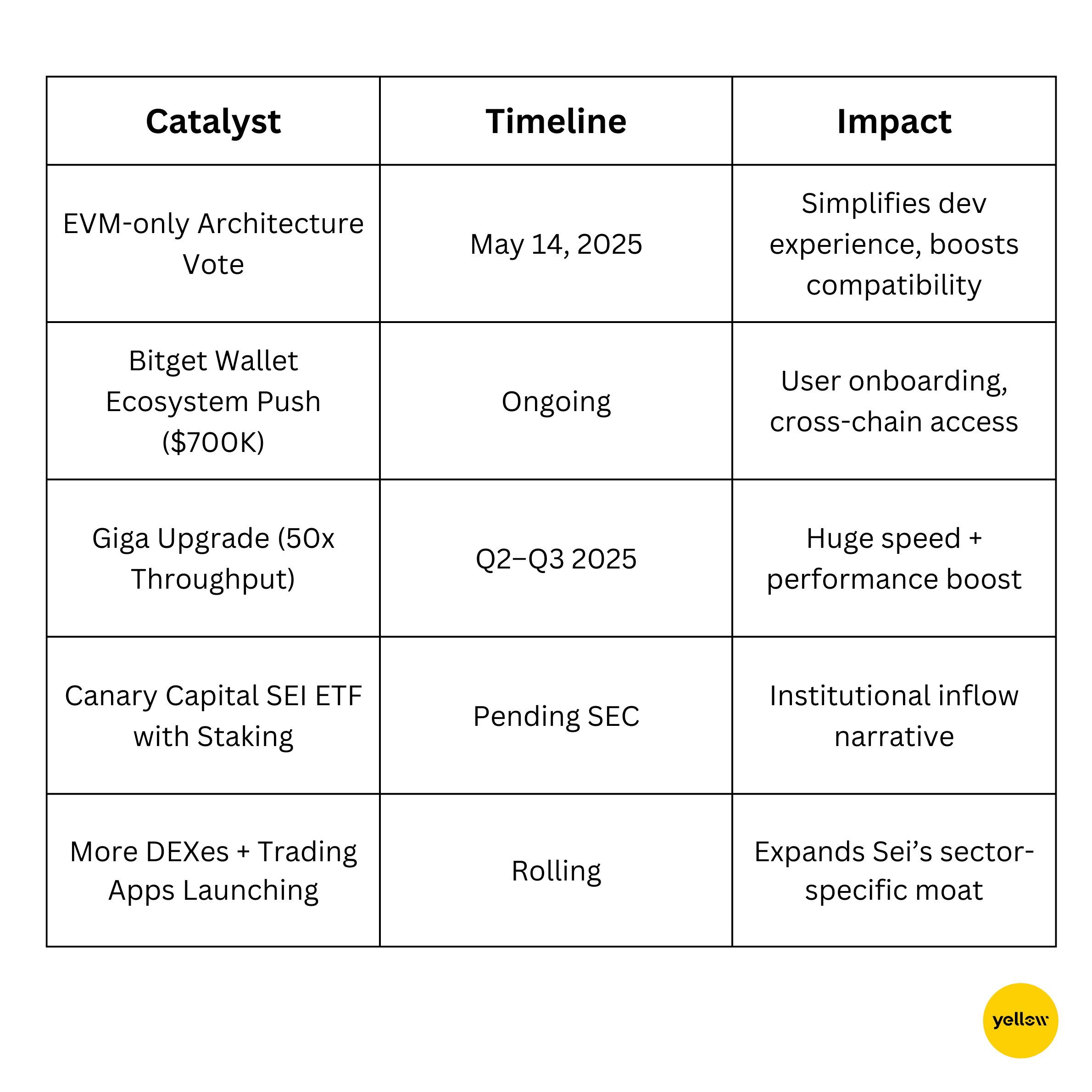

Sei is a high-speed Layer 1 blockchain purpose-built for trading. With twin-turbo consensus, parallelized execution, and sub-400ms finality, it delivers web2-grade performance while maintaining EVM compatibility. Originally Cosmos-based, Sei is now pivoting to an EVM-only model to reduce friction and accelerate adoption. It already processes over 12,000 TPS and powers 1.2B+ transactions.

Backed by firms like Coinbase Ventures, Jump, and Circle, Sei’s upcoming Giga upgrade promises a 50x throughput boost, setting it apart as the fastest EVM chain. SEI is used for staking, fee payments, and governance.

On-Chain + Community Health

Sei’s ecosystem is evolving rapidly with strong on-chain fundamentals. Its current TVL of $523M, up 10.99% in just 24 hours, places it among the top 15 chains by DeFi deposits. This growth is especially impressive given its recent pivot toward EVM exclusivity—a shift that aims to streamline dev onboarding and boost app compatibility with the broader Ethereum ecosystem.

Developer activity backs this momentum. With 454 commits in the past year—compared to a 66 commit market average—Sei’s engineering team is iterating consistently. In the last 4 weeks alone, it clocked 16 commits against a market average of 0, suggesting that development hasn’t just sustained—it’s accelerating. Paired with partnerships like Bitget Wallet ($700K initiative), Sei is actively investing in ecosystem growth, not just protocol efficiency.

Sei’s deflationary risk is minimal, with 5.11B SEI in circulation out of a 10B total supply. Unlike many Layer 1s still unlocking large treasury tranches, Sei’s emissions are well-distributed. With over $82M in daily trading volume and a FDV of $2.18B, liquidity is strong, and new inflows keep pace with emission.

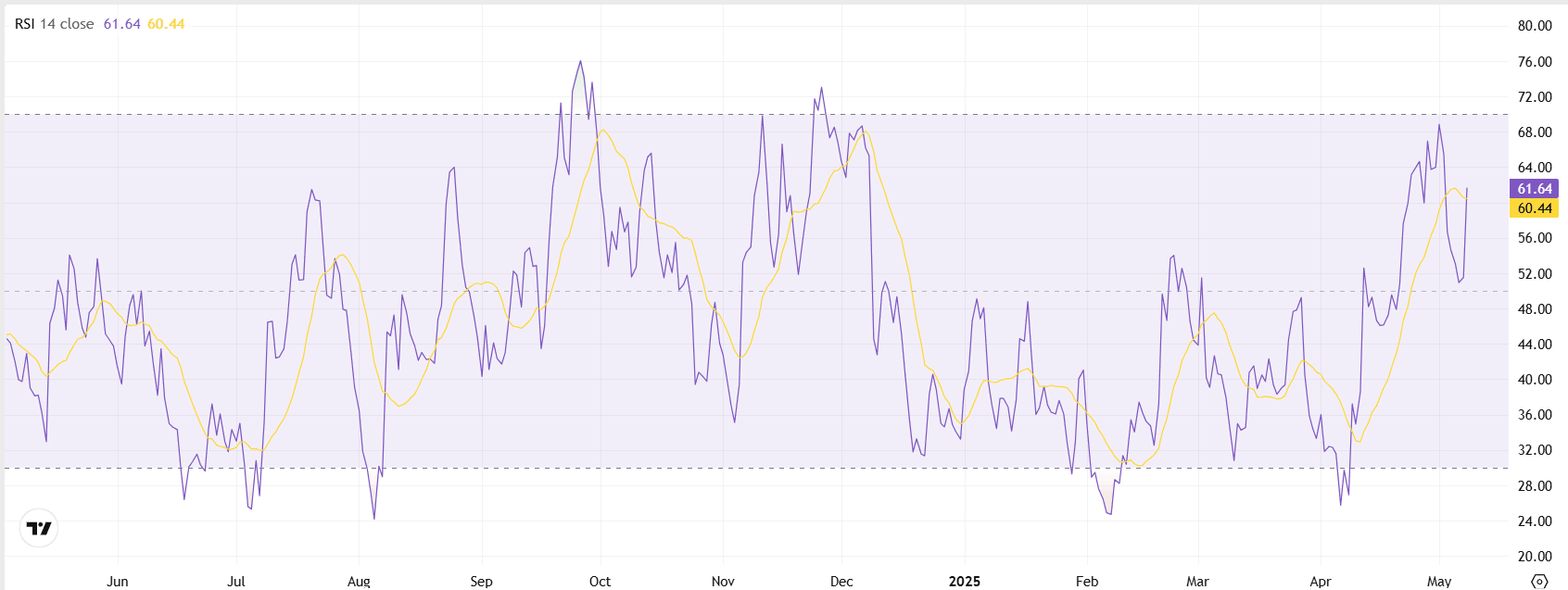

Technically Speaking

-

Current Price: $0.21 (down ~81% from ATH of $1.14)

-

RSI (daily): 61.64 — bullish, not overbought

-

Support to watch: $0.185

-

Key breakout level: $0.24

-

Volume Trend: $82M+ in daily volume, stable

-

TVL Momentum: Rapid increase in April 2025, overtaking peers launched at same time

-

Developer Activity: 454 commits past year, dev engagement far above sector avg

What makes SEI unique?

-

Twin-Turbo consensus enables sub-400ms finality, rivaling Solana’s performance

-

Parallelized transaction processing pushes TPS above 12,000

-

Sector-specific Layer 1 optimized for trading, uniquely suited for DEXes, NFT and game item swaps

-

Committed move to Ethereum-first tooling, shedding Cosmos complexity

-

Actively backed by top-tier VCs: Coinbase, Circle, Jump, Multicoin

-

Chain-level performance upgrades (Sei v2, Giga) already live or on roadmap

-

EVM addresses now account for over 80% of network transactions

-

ETF proposal filed by Canary Capital marks first potential staking-enabled SEI fund

Catalysts to watch

The Verdict

Sei is purpose-built for trading and financial infrastructure. Its decision to shed Cosmos support and double down on EVM unlocks clearer dev paths and better tooling—two things most L1s struggle to balance.

If its momentum holds, Sei could become the fastest infrastructure layer for exchange-based applications. TVL and developer activity both support that thesis. The ETF filing is a rare catalyst that could push SEI into more institutional portfolios as the narrative around fast EVM chains gains steam.

Closing Thoughts: Why HODL This Basket

In a sea of speculation, Jasmy, Sei, and Kaspa stand out for what they’re quietly building. Each addresses core problems, data control, trading infrastructure, and scalable decentralization, with purpose and consistent development. These aren't coins that moon on vibes and vanish. They’re foundational plays that reward patience. As liquidity rotates and attention comes back to fundamentals, this sub-$0.25 basket could shift from overlooked to overperforming. Stack wisely, stake when possible, and stay early, the real gains usually come before the crowd catches on.