Greed is creeping back into the crypto market with a Fear & Greed Index of 69, but we’re still far from full-on euphoria. Bitcoin remains dominant at 61.9%, and the Altcoin Season Index sits at a low 27, confirming that we’re still in what analysts would call a “Bitcoin Season.” Yet, the undercurrent tells a more complex story.

Across the board, select altcoins, especially those tied to SocialFi, Web3 gaming, and AI infrastructure—are punching above their weight. LAUNCHCOIN’s parabolic breakout, GODS riding GameFi catalysts, and renewed whale interest in JELLYJELLY suggest early-stage positioning is underway. Institutions are watching too, $282M flowed into ETFs this week, indicating broader confidence even as retail trims risk.

In this context, the week’s top movers are more than just speculative bursts. Some are reacting to real product milestones, others to meme-driven momentum.

Launch Coin on Believe (LAUNCHCOIN)

Price Change (7D): +3389.59% Current Price: $0.1964

News

LaunchCoin exploded in value after debuting a one-line token creation feature on Solana, allowing users to mint tokens simply via X (Twitter). Its integration with SocialFi platform Believe, meme coin hype, and high-profile whale trades, including a $1.59M swap from TRUMP to LAUNCH, catapulted its market cap from a few million to over $250M. CoinW’s listing and claims about becoming a decentralized Web3 incubator further fueled interest. Despite exchange congestion, the team has assured better fee structures and ecosystem development in v2.

Forecast

LAUNCHCOIN’s RSI is highly elevated, currently estimated above 85, signaling overbought conditions. After peaking near $0.33 and correcting, the token seems to be stabilizing around $0.19. Short-term consolidation between $0.15 and $0.21 is likely. If support holds, another leg up could test $0.26, but high volatility remains. A deeper pullback to $0.12–$0.14 would be healthy. Strong social media monitoring and whale tracking are essential for trading this memetic asset.

Aethir (ATH)

Price Change (7D): +37.96% Current Price: $0.04885

News

Aethir’s surge aligns with the end of Apple’s app store monopoly, as developers can now direct users to external payment platforms. This shift is a boon for Aethir’s decentralized GPU cloud infrastructure, positioning it as a critical enabler for cloud-native, app-store-free gaming. With over 428K GPU containers powering high-end workloads and $150M+ raised in node license sales, Aethir is attracting institutional capital and Web3 gaming projects, offering direct-to-consumer cloud streaming alternatives.

Forecast

ATH remains in a bullish structure but is consolidating below resistance at $0.055. RSI is near 60, suggesting room for further upside before becoming overheated. Support lies at $0.045, with bullish continuation likely if $0.050 breaks cleanly. Volume contraction hints at a potential breakout zone; traders may watch for a surge to $0.06 or higher if buy pressure returns. Long-term trajectory aligns with Web3 gaming growth.

SKYAI (SKYAI)

Price Change (7D): +33.47% Current Price: $0.06105

News

SKYAI gained momentum after listings on Binance Futures and Bitget, with up to 50x leverage now available. The BSC Foundation acquired $75K in SKYAI via Mimic.fi, making it their largest holding, surpassing TST. This institutional backing and the project securing 100K USDT from the BNB Chain Incentive Program elevated SKYAI to the #1 trending token on BSC by trading volume, indicating strong community and whale confidence in AI tokens.

Forecast

After hitting highs near $0.09, SKYAI corrected and found stability around $0.061. RSI sits around 58, reflecting neutral territory with moderate bullish pressure. Support is seen near $0.055, while a break above $0.065 could lead to a retest of $0.075–$0.08. High leverage availability increases volatility; traders should manage risk tightly. Watch for continued institutional activity as a catalyst.

ether.fi (ETHFI)

Price Change (7D): +71.91% Current Price: $1.32

News

Despite underperforming ETH by 76% from its ATH, ETHFI surged due to whale accumulation and futures short squeezes. Binance futures volume ($500M daily) has overshadowed real DeFi engagement. Ether.fi’s $6.86B TVL, driven by EigenLayer restaking and Ethereum’s staking momentum, supports its platform fundamentals. However, token unlocks and poor retail engagement present major risks. Whale wallets and leverage play a bigger role than actual usage growth, and the rally may not be sustainable.

Forecast

ETHFI's RSI is high, nearing 70, reflecting overextension. Resistance lies at $1.50, and a pullback to the $1.10–$1.20 zone is expected as the short squeeze unwinds. With 72% of tokens still locked and ongoing unlocks, selling pressure could persist. Long-term upside is capped unless fundamental retail growth improves. Use tight stop-losses if entering at current levels.

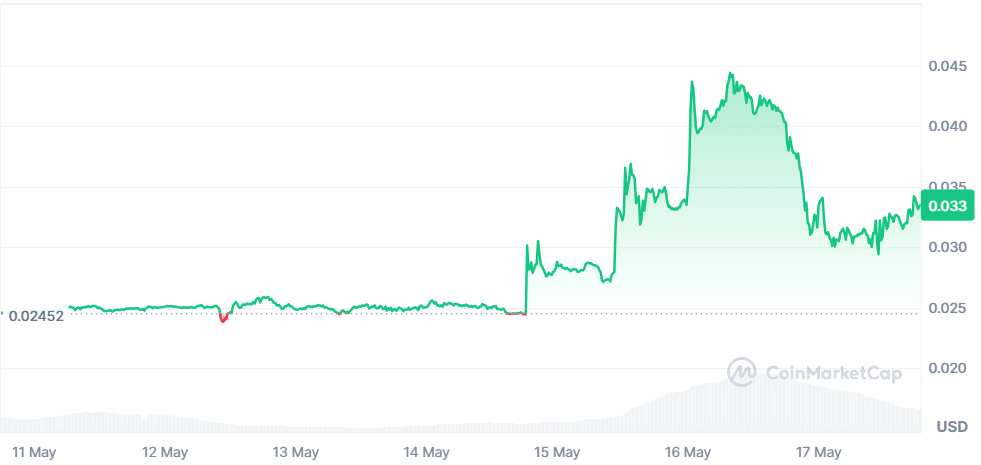

Port3 Network (PORT3)

Price Change (7D): +36.04% Current Price: $0.03340

News

Port3 Network was recently listed on Binance Alpha, marking a significant milestone in its growth. Known for its AI-driven social analytics tool, Rankit, the platform quantifies metrics like user participation and project heat across blockchain communities. PORT3 has expanded rapidly since 2022 and saw a surge in interest post-listing, alongside further listings on MEXC, LBank, and KCEX. Futures trading with up to 50x leverage is now live, attracting retail and derivatives traders alike.

Forecast

PORT3 is stabilizing after a sharp rise post-Binance Alpha listing. RSI around 63 suggests mild bullish momentum, but price is struggling to break $0.036 resistance. Support lies near $0.030. If the project maintains exchange activity and social metric traction, a breakout to $0.040–$0.045 is feasible. High leverage listings warrant caution due to potential volatility spikes.

Jelly-My-Jelly (JELLYJELLY)

Price Change (7D): +11.97% Current Price: $0.03236

News

Whale activity has stirred interest in JELLYJELLY after a large investor withdrew 100.46M tokens worth $4.45M from Gate.io. Despite being at a $1.35M unrealized loss, this move signals long-term conviction. Meanwhile, Open Interest dropped over 54%, hinting at waning derivatives interest. Coupled with a recent delisting on Hyperliquid and a price correction, retail sentiment has weakened. Still, whales accumulating during dips suggest potential for a reversal if supply tightens on exchanges.

Forecast

JELLYJELLY’s RSI hovers at 61, approaching overbought territory. After peaking near $0.07, price retraced sharply, now stabilizing above $0.032. Short-term, consolidation between $0.030–$0.036 is likely. If whale buys continue and sellers exhaust, a breakout toward $0.04 is possible. However, falling volume and derivatives exit imply caution. If $0.030 breaks, expect a dip to $0.027.

Department Of Government Efficiency (DOGE)

Price Change (7D): +81.07% Current Price: $0.03348

News

DOGE (not to be confused with Dogecoin) pumped after this week's consistent efforts of the (actual) DOGE team to reduce government expenses. Despite no official link, retail traders interpreted this as indirect support. With no other product developments, the token’s surge is purely speculative. The virality of its memetic branding helped push it past $30M in market cap, but it remains vulnerable to a swift correction if attention fades.

Forecast

DOGE RSI is elevated (~74), and recent spikes suggest overextension. If the hype persists, price may challenge $0.038. However, given lack of fundamentals, the asset risks falling back to $0.025 or lower once the social buzz fades. Traders should watch for reduced buy volume and bearish divergence on momentum indicators.

Gods Unchained (GODS)

Price Change (7D): +71.75% Current Price: $0.2009

News

GODS surged on the announcement of its migration to Immutable zkEVM and the launch of Battle Pass Season 3. The move improves scalability, lowers fees, and integrates NFTs more efficiently. The exclusive collectibles available in Season 3 have sparked a flurry of demand, driving a bullish wave across the Gods Unchained community. The combination of Web3 gaming, NFT economy, and lower entry barriers has reinvigorated both players and investors.

Forecast

With RSI nearing 76, GODS is in overbought territory after surging from $0.12 to $0.22. Current consolidation near $0.20 may hold short-term. If demand persists, a break toward $0.24–$0.26 is possible. Support sits at $0.17. Profit-taking is likely soon, especially if NFT hype wanes. Look for decreasing volume as a cooling signal.

Grass (GRASS)

Price Change (7D): +17.59% Current Price: $1.93

News

GRASS hit its highest levels since March following record-breaking data scraping ~1,762 terabytes in a day. Built on Solana L2, GRASS monetizes unused bandwidth from users to train AI models. The foundation rewards contributors in tokens, creating a sustainable ecosystem. With presale hype from SUBBD and listings on Asian exchanges, its user base is growing. However, a 12% dip shows traders are cautious after its $2.32 peak.

Forecast

GRASS RSI is neutral at ~56. Support lies at $1.72, while $2 remains the psychological resistance. A break above $2.05 could lead to a retest of $2.30, and eventually its $3.66 ATH if momentum returns. A drop below $1.70 invalidates the bullish structure. For now, expect consolidation around $1.85–$2 unless volume spikes.

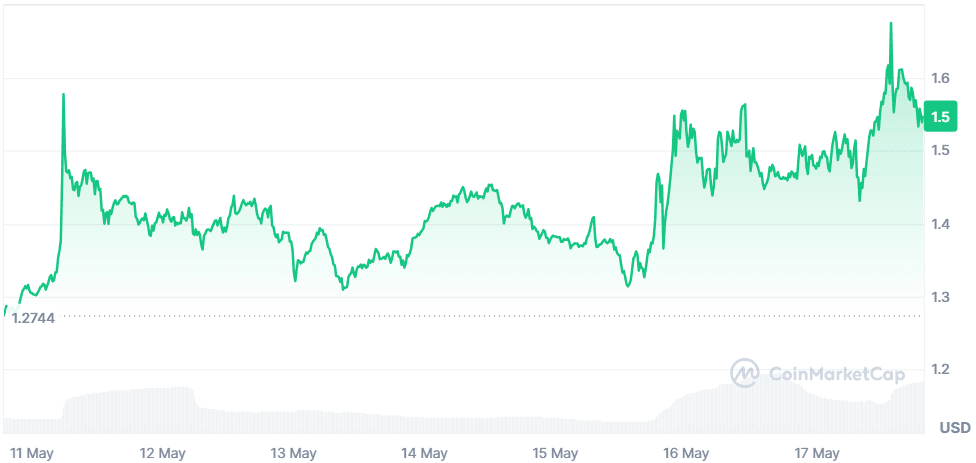

Mask Network (MASK)

Price Change (7D): +20.48% Current Price: $1.54

News

MASK continues to shine as a decentralized bridge between Web2 and Web3, allowing users to access dApps directly from platforms like Twitter. Additionally, Mask Network is promoting Honeypot Finance’s PoL-based meme ecosystem, reinforcing its vision of user-first DeFi infrastructure. With rising daily usage and strong governance value, MASK is building utility atop familiar platforms.

Forecast

MASK is trading near resistance at $1.56 with RSI around 68. If broken, $1.70 is the next target. Support lies at $1.43. Volume remains healthy, but fading momentum may trigger a short-term pullback to $1.40. The long-term trend remains bullish, especially as Web2–Web3 integrations grow. Watch for ecosystem updates as catalysts.

Closing Thoughts

The broader market sits on the edge of a shift. With $3.26T in market cap and volume topping $100B, the engine is humming. But the data doesn’t lie, this isn't altcoin season yet. It's more of a reconnaissance phase. Bitcoin is holding the fort, but the action in altcoins like LAUNCHCOIN (memes + utility), GODS (GameFi growth), and AETHIR (AI cloud infra) reveals where early adopters are placing long-term bets.

SocialFi tokens are showing explosive short-term momentum, riding meme culture and creator tools. Meanwhile, infrastructure plays like ETHFI and AETHIR are benefiting from institutional logic: solve real problems, attract real capital. GameFi, driven by GODS and GRASS, is catching renewed interest thanks to zkEVM integrations and new engagement models like Battle Passes and data mining. Retail traders are chasing hype in meme coins, but whales and funds are positioning around functionality and future-proof narratives. If ETF inflows stay strong and meme coin froth doesn’t spill over into a selloff, we might see the Altcoin Season Index start creeping up in coming weeks.

For now, this was a week of positioning, not full-blown rotation. The altcoin tide isn’t here yet, but it’s definitely forming.