The altcoin market is flashing early signs of resurgence, with a number of DeFi-native and meme-inspired tokens dramatically outpacing majors like BTC and ETH this week. From Hyperliquid’s aggressive breakout above $40 to Aerodrome’s explosive DeFi volumes, smaller caps are pushing into price discovery, hinting at a sector rotation beneath the surface.

DeFi, in particular, has seen renewed investor appetite, with AAVE and UNI benefiting from regulatory tailwinds and protocol innovation. At the same time, Ethereum is maintaining its strength on the back of ETF inflows and institutional accumulation, while Bitcoin cools off after a historic run.

The narrative isn’t singular, memecoins like SPX are still drawing retail, cross-chain infrastructure plays like AXL are gaining traction with new bridge standards, and ecosystem tokens like KAIA are leveraging regional legislation to build momentum. But if you zoom out, the shift is clear: capital is rotating. And it's rotating fast.

Aura (AURA)

Price Change (7D): +24035.48% Current Price: $0.2234

News

Aura (AURA), a meme token on Solana, surged over 3,500% in 24 hours, triggering massive speculation. A whale gained $104K from early holdings, and another trader flaunted $698K in paper profits. Despite the hype, analysts warn of a rug pull, citing centralized token distribution, unclear utility, and abrupt buying spikes. Crypto scam trackers also flagged AURA as a high-risk token, although its supporters claim it's part of a “cult movement” fueled by improving macro sentiment and revived risk appetite.

Forecast

RSI has skyrocketed to around 88, showing extreme overbought conditions. AURA may pull back to $0.12 if profit-taking kicks in. On the upside, sustained hype and social momentum could drive a speculative rally to $0.30. But with low liquidity and whale concentration, sharp reversals are likely.

Aerodrome Finance (AERO)

Price Change (7D): +43.42% Current Price: $0.7390

News

AERO surged after Coinbase announced Base-native DEX integration into its main app and Shopify enabled USDC payments via Base. As the leading DEX on Base, Aerodrome saw volume jump 426%, open interest doubled, and daily revenue spiked to over $700K. This positions AERO at the center of retail DeFi exposure through Coinbase’s ecosystem. Aerodrome also crossed $100B in volume this year, confirming strong user traction.

Forecast

AERO is consolidating near resistance at $0.77–$0.80. RSI is at 55.16, with MACD and BBP turning bullish. A breakout above $0.80 could send AERO toward $1.00. If rejected, a dip to the $0.58–$0.60 support zone is possible before another leg up.

Kaia (KAIA)

Price Change (7D): +38.87% Current Price: $0.1504

News

KAIA launched v2.0.1 as part of a rebrand from Klaytn, supported by Binance and other exchanges. The move streamlines its Web3 infrastructure across Asia. South Korea’s new bill to legalize stablecoins has further boosted optimism, signaling institutional alignment and regulatory clarity. The merger aims for long-term DeFi adoption and brings the network closer to Ethereum-style upgrades in scalability and compliance.

Forecast

KAIA rallied from $0.11 to $0.18 and is now cooling. RSI is at 61—still neutral. Support lies at $0.145, and resistance at $0.165. If it reclaims $0.165 with volume, next stop is $0.19+. Otherwise, it may range-bound within $0.14–$0.16.

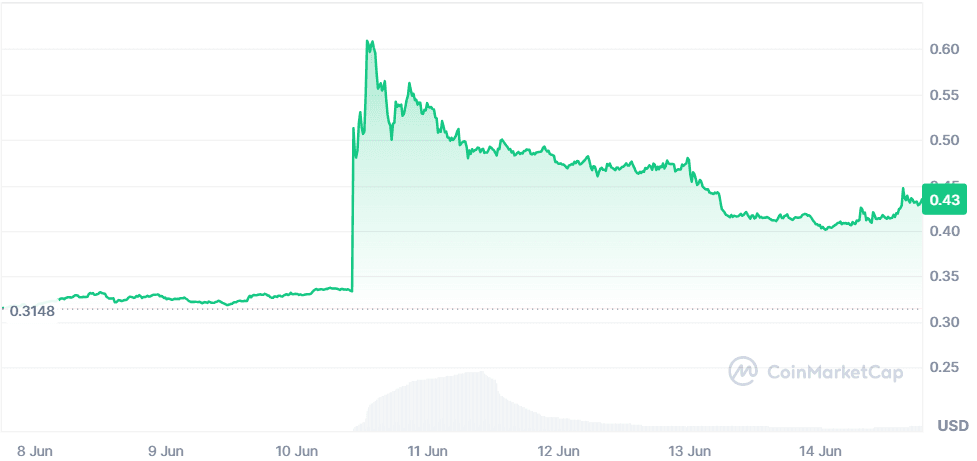

Axelar (AXL)

Price Change (7D): +38.32% Current Price: $0.4346

News

AXL jumped over 60% after its listing on Upbit and the launch of OpenBridge, an ERC-7786-based multi-chain security protocol. OpenBridge allows flexible “x of y” verifications across chains, ideal for high-value DeFi activity. The announcement pushed Axelar’s volume up 6100% and saw an explosive 924% spike in daily active address divergence. MACD flipped positive as bulls returned to control.

Forecast

RSI is at 79, nearing overbought territory. Immediate resistance sits at $0.61; support is at $0.39. AXL could run to $0.82 if bullish momentum sustains, but a correction to $0.41 or even $0.30 is on the table if buying pressure fades.

SPX6900 (SPX)

Price Change (7D): +29.61% Current Price: $1.44

News

SPX6900, a meme coin, extended its gains after surpassing FLOKI, WIF, and BONK in market cap. Open interest hit a record $163M, and daily active addresses surged to 2,391, highest since January. SPX is now supported by strong on-chain and derivatives activity, signaling renewed market interest and breakout potential.

Forecast

SPX is approaching its all-time high at $1.77. RSI is overheated at 81, so a pullback to $1.34 is possible. But if it closes above $1.77, momentum could carry it to $2.00. Watch for volume confirmation.

Hyperliquid (HYPE)

Price Change (7D): +19.71% Current Price: $41.06

News

HYPE hit an all-time high of $41.50 following massive whale buying. One trader alone scooped up $9.9M worth of tokens, sparking renewed confidence. The altcoin is trading within an ascending triangle, supported by strong technicals: bullish MACD, positive CMF (0.38), and rising TVL at $1.69B. Despite recent whale exits, Hyperliquid remains a leading narrative in the perpetuals space, thanks to consistent on-chain activity and bullish indicators.

Forecast

HYPE is consolidating near key resistance, with momentum indicators like MACD and AO flashing green. RSI is slightly overbought (~73), but the trend remains bullish. If the $32.61 support holds, the price could rally toward $50 and possibly test $72.35. A breakdown could target $26.89. Maintain cautious optimism.

Uniswap (UNI)

Price Change (7D): +16.94% Current Price: $7.38

News

UNI surged following the SEC's pro-DeFi tone and Uniswap Foundation’s launch of the v4 Hook Design Lab. The lab empowers developers with grants, mentoring, and market strategy support to build with Uniswap v4’s hook system transforming the AMM into a modular, programmable trading layer. On top of this, Uniswap v4 crossed $40B in volume within four months, showcasing strong user and dev traction.

Forecast

UNI is bouncing between $6.18 and $8.10. RSI sits at 63, suggesting moderate upside room. Resistance is near $9.12, and support is around $6.20. If momentum continues, UNI may retest $9+ in the short term. Breakdown risks remain unless it sustains above $7.00 with rising volume.

Aave (AAVE)

Price Change (7D): +8.66% Current Price: $278.10

News

Aave remains dominant in DeFi lending, with $16.9B in active loans and over $24.9B in total TVL. The upcoming "Umbrella" upgrade enhances risk management, enables aToken-based staking, and introduces real-time automated slashing. Meanwhile, a Trump-linked project deposited $52M in ETH, WBTC, and stETH into Aave V3, underscoring its role as DeFi’s institutional liquidity hub. The $7.5M USDT loan from that vault was later moved to BitGo, highlighting cross-infrastructure usage.

Forecast

AAVE is consolidating near its upper range after peaking around $300. RSI is neutral at ~57. If it breaks past $290, price may surge to $325. On the downside, a drop below $260 may trigger a retracement to $240. Indicators remain bullish but volume needs to confirm the next move.

Ethereum (ETH)

Price Change (7D): +1.23% Current Price: $2,539.69

News

Ethereum is riding a wave of institutional inflows, led by BlackRock’s $160M investment and over $576M ETF inflows. ETH staking hit a record 34.83M ETH, and open interest in ETH futures topped $40B. Key upgrades like Pectra and Circle’s $10B USDC expansion into Layer 2s continue to bolster its position. ETF approval rumors and SEC’s favorable DeFi stance add to bullish sentiment.

Forecast

ETH holds firm above $2,500. RSI is around 54, neither overbought nor oversold. Resistance lies at $2,700, while support sits at $2,440. A breakout could see ETH testing $2,800–$3,000. However, failure to hold $2,500 may bring it down to $2,400. Staking metrics suggest continued strength.

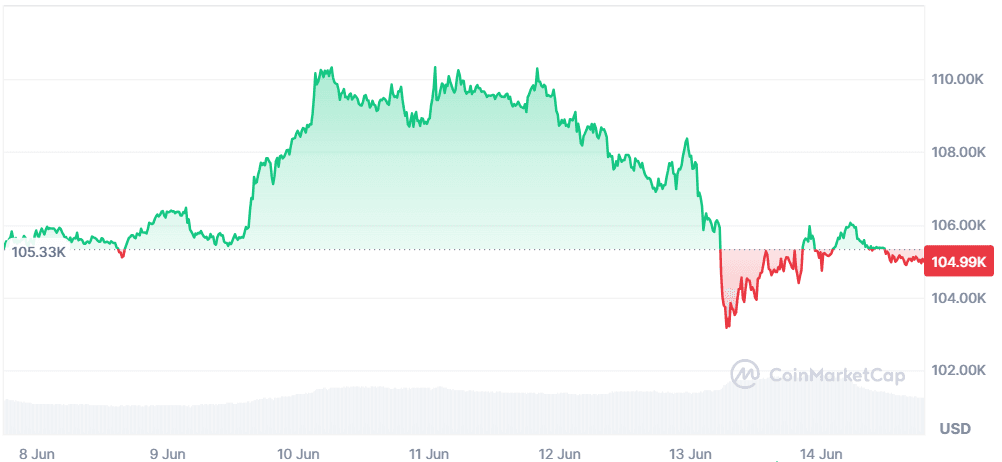

Bitcoin (BTC)

Price Change (7D): -0.59% Current Price: $104,977.96

News

Despite a slight weekly dip, BTC remains fundamentally strong. BlackRock’s iShares Trust now holds 662,500 BTC, with spot Bitcoin ETFs seeing $1B inflows. Brazil and Ukraine are considering BTC for reserves, and corporate players like MicroStrategy and Metaplanet continue accumulating. Yet, high-profile trades (like Wynn’s liquidations) triggered volatility and sharp intraday drops.

Forecast

BTC is hovering just below $105K with RSI near 52, reflecting a balanced market. If it reclaims $106K, a push toward $110K is possible. Strong resistance lies at $111.8K. On the flip side, failure to hold $104K could open the way to $102K. Momentum remains neutral with macro cues in focus.

Closing Thoughts

This week’s market pulse reveals a telling shift, altcoins are not only catching up, but in many cases outpacing Bitcoin and Ethereum in both price action and attention. DeFi tokens (AAVE, UNI, AERO) are experiencing renewed growth thanks to structural improvements and regulatory optimism, while high-risk, high-reward plays like AURA and HYPE are absorbing speculative capital with ease.

Notably, institutional bets continue to anchor majors like ETH, as BlackRock and ETF flows reinforce long-term confidence. But the real energy is in mid-to-low cap assets where momentum, narrative, and on-chain activity are converging.

From Kaia’s regulatory leverage in South Korea to SPX6900’s meme-fueled climb, retail and smart money appear to be playing on very different levels, yet they’re both active.

If the current rotation continues and BTC dominance slips, we might be looking at a textbook early-stage altseason, especially in ecosystems where technical catalysts are stacking up. The next week will be key in confirming whether this momentum is sustainable or just another spike in an otherwise Bitcoin-led cycle.