As the World Bank slashes its global growth forecast to the lowest levels since 2008, investors appear to be recalibrating where they park their capital and crypto is back in focus. Ethereum (ETH) and Bitcoin (BTC) are drawing billions through ETFs and corporate allocations, while altcoins like Axelar (AXL), Aave (AAVE), and Hyperliquid (HYPE) are riding a wave of speculative and institutional momentum. In a risk-on day for crypto amid rising macro uncertainty, here are the coins the market couldn’t stop talking about.

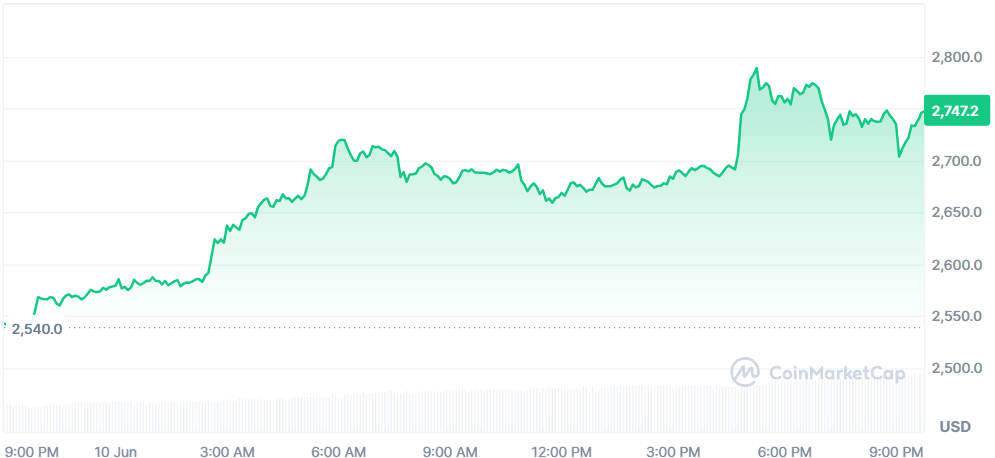

Ethereum (ETH)

Price Change (24H): +6.74% Current Price: $2,736.07

What happened today

Ethereum is seeing surging momentum as Spot ETH ETFs recorded a 15-day winning streak, bringing in $837M in inflows, with BlackRock’s ETHA ETF alone netting $249M over five days. In parallel, Ethereum DeFi activity surged with a $2B stablecoin inflow and Layer-2 scaling boosted USDC liquidity. A new GDPR-ready privacy upgrade proposal could make Ethereum the first compliant public blockchain. Nearly 28% of ETH supply (34.6M ETH worth ~$90B) is now staked, a new record high, as institutional confidence builds. The recent Pectra upgrade and consistent ETF inflows have solidified Ethereum’s position as a foundational Web3 layer.

Market Cap: $330.3B 24-Hour Trading Volume: $33.62B Circulating Supply: 120.72M ETH

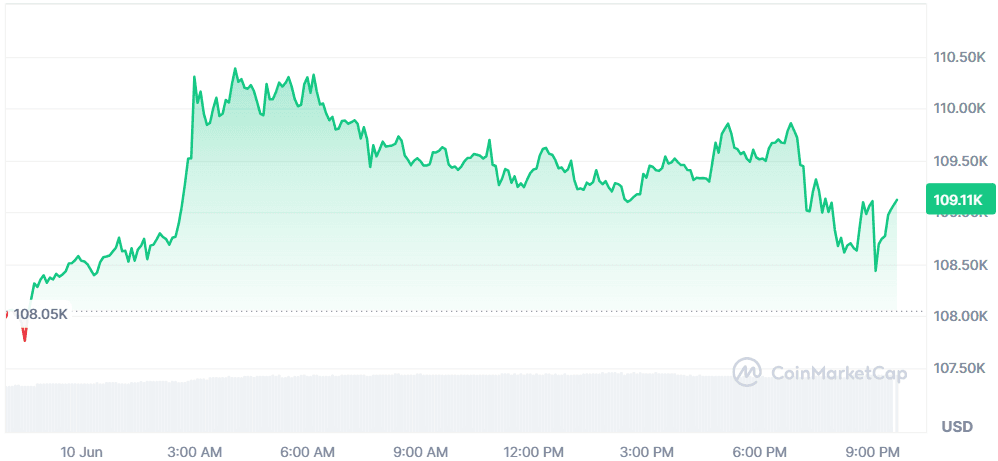

Bitcoin (BTC)

Price Change (24H): +0.89% Current Price: $108,881.36

What happened today

Bitcoin remains steady above $108K as institutional demand keeps driving its price. BlackRock’s IBIT ETF crossed a record $70B AUM, becoming the fastest-growing ETF in history. ANAP Holdings allocated ¥11.5B for BTC reserves, boosting corporate adoption in Japan. Additionally, Tether announced plans to open-source a Bitcoin Mining OS by late 2025 to democratize mining. Institutional inflows of $1.3B recently propelled Bitcoin, with whales reducing exchange reserves and driving a bullish market tone. Meanwhile, Paraguay declared Bitcoin legal tender, adding another layer of global momentum.

Market Cap: $2.16T 24-Hour Trading Volume: $58.83B Circulating Supply: 19.87M BTC

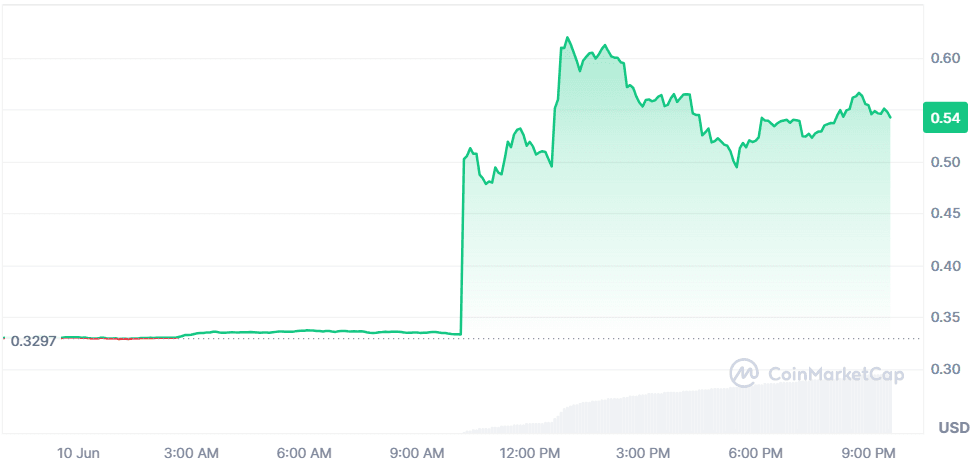

Axelar (AXL)

Price Change (24H): +65.22% Current Price: $0.5447

What happened today

Axelar broke out of a multi-month downtrend with an explosive 80% rally after its listing on Korean exchange Upbit, sending price and volume soaring. Trading volume surged from $18.65M to $366.43M, with active address divergence up 924%, indicating rising user engagement. The breakout from a falling wedge pattern triggered bullish momentum, with potential for AXL to target $0.61 and higher. The listing sharply increased interest from Asian markets, pushing Axelar toward the top 100 crypto assets.

Market Cap: $534.76M 24-Hour Trading Volume: $561.7M Circulating Supply: 981.57M AXL

Aave (AAVE)

Price Change (24H): +15.26% Current Price: $303.74

What happened today

AAVE saw strong gains after a whale accumulated 114,300 tokens via Wintermute OTC and netted $40M in unrealized profit. The entity has accumulated 280,600 AAVE since March 2023, underscoring long-term institutional confidence. Additionally, Aave deployed on Sony’s Soneium blockchain, integrating its liquidity tech and stablecoins into the consumer-focused Layer-2 network. The deployment follows the Aave founder’s recent White House visit and aligns with a broader positive regulatory tone, as the SEC considers an “innovation exemption” for DeFi. AAVE’s TVL is at $25.48B, with borrowing surpassing $16B, a new all-time high.

Market Cap: $4.6B 24-Hour Trading Volume: $901.2M Circulating Supply: 15.15M AAVE

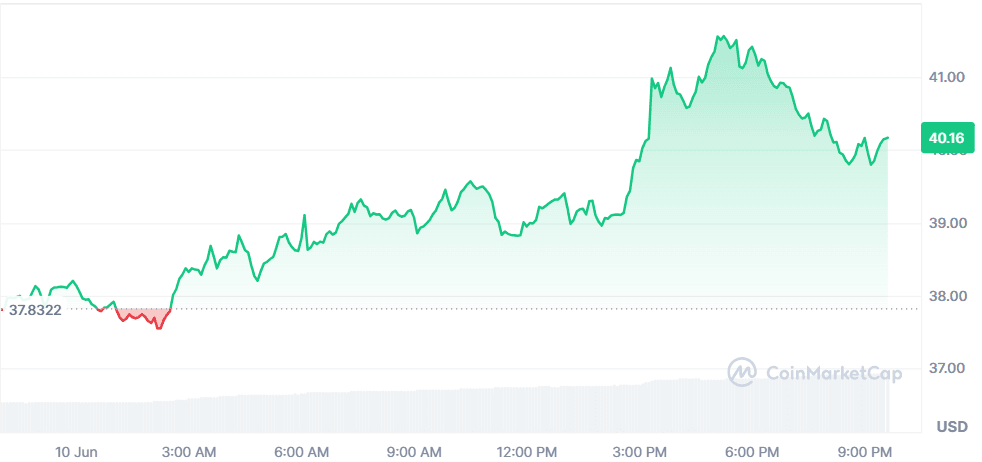

Hyperliquid (HYPE)

Price Change (24H): +5.75% Current Price: $40.00

What happened today

Hyperliquid surged to a new all-time high of $41.50, driven by whale buying and growing TVL. One whale bought 70,617 HYPE for $2.5M around $35.40, while another acquired 28,500 HYPE for $1M. Hyperliquid’s TVL reached $1.69B, indicating rising user confidence. The HYPE token, used to pay fees on the Hyperliquid DEX and gas on HyperVM, is trading within an ascending triangle. Influential figures like Arthur Hayes fueled sentiment, while speculation grows about a potential Binance US listing. If current momentum holds, HYPE could target the $50 mark.

Market Cap: $13.35B 24-Hour Trading Volume: $488.04M Circulating Supply: 333.92M HYPE

Global Market Snapshot

Global equities edged higher on Tuesday as investors tracked U.S.-China trade talks underway in London. The Dow rose 0.2%, while the S&P 500 and Nasdaq added 0.3% each. Market optimism remains buoyed by hopes of reduced tariffs, though concerns about inflation persist. The World Bank slashed its global growth forecast to 2.3% for 2025, the weakest since 2008 outside recessions, citing trade uncertainty. U.S. and eurozone growth forecasts were also downgraded. Meanwhile, OpenAI expanded its cloud partnership with Google, Tesla faced pressure over weakening fundamentals, and European defense stocks fell as trade talks spotlight critical minerals. Asia-Pacific markets traded mixed, with Japan and South Korea posting gains, while European defense names underperformed.

Closing Thoughts

Today’s market action reflects growing investor anxiety about traditional economic prospects and an accelerating shift toward crypto exposure as a potential hedge. With global growth forecasts tumbling and U.S.-China trade uncertainty unresolved, institutional flows into ETH and BTC ETFs suggest that big players are increasingly viewing these assets as a strategic allocation not just speculative plays. Ethereum’s staking surge and DeFi dominance further reinforce its long-term positioning.

At the same time, retail and fast-moving capital continues to flood into the altcoin space. AXL’s explosive breakout, AAVE’s whale-driven rally, and HYPE’s run to new highs show that the DeFi and cross-chain infrastructure sectors are capturing trader attention in a big way. Today’s action underscores that while institutional money is consolidating around ETH and BTC, the most aggressive speculative appetite is centered firmly on DeFi and alt-layer tokens, a dynamic worth watching as macro headwinds intensify.