In the aftermath of a highly anticipated token generation event, RIZE stole headlines—but not for the right reasons. The token’s dramatic drop contrasted sharply with renewed investor appetite for Layer-3 bets like XCN and derivatives-focused tokens like HYPE, both of which saw strong volume and sharp moves.

Maple’s SYRUP continued its steady DeFi comeback while legacy player EOS found new energy following its rebrand to Vaulta. These five tokens dominated chatter today as traders reacted to listing dynamics, protocol fundamentals, and shifting capital across crypto sectors.

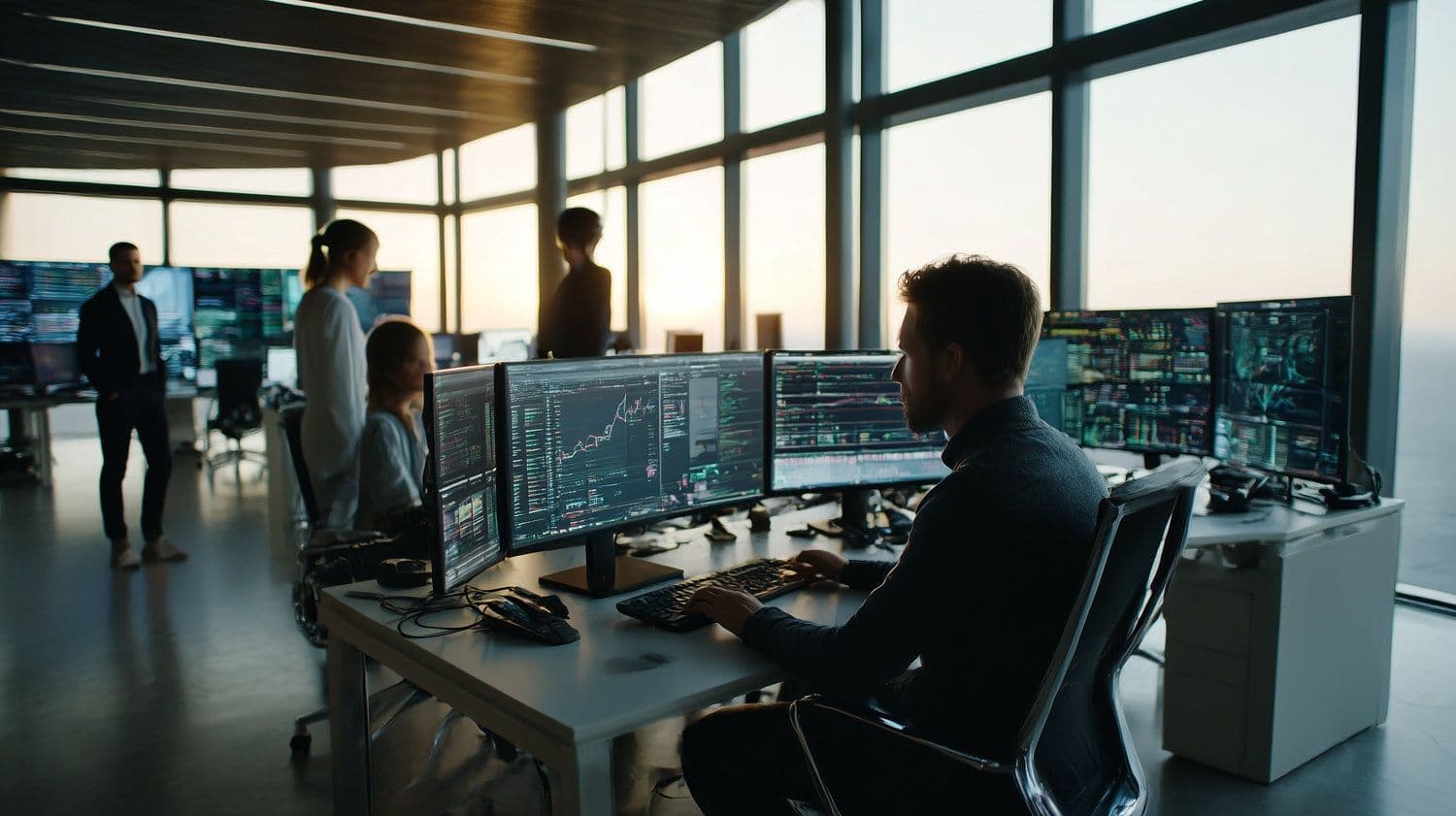

RIZE (RIZE)

Price Change (24H): -36.3% Current Price: $0.05523

What happened today

RIZE, the token for real-world asset (RWA) tokenization platform T-RIZE, crashed over 36% a day after its launch on major exchanges, including Kraken and Aerodrome. Despite the hype, a massive sell-off followed due to unrestricted token allocations to private investors and liquidity providers. While airdrop tokens remain locked, nearly 350 million RIZE from private sales entered the market immediately, triggering a sharp drop from its highs. The project, built on Base (an Ethereum L2), aims to tokenize real estate and infrastructure using federated learning and institutional-grade security.

Market Cap: – 24-Hour Trading Volume: $3,988,806 Circulating Supply: –

Onyxcoin (XCN)

Price Change (24H): +15.22% Current Price: $0.01912

What happened today

XCN rallied 15% as it continued its volatile comeback in 2025, now trading 145% higher than its April lows. The Ethereum-based token powers Onyx Protocol, a Layer-3 solution built atop Arbitrum and Base. While it once peaked at $0.05 in January after major protocol upgrades and DeFi integrations, it faced a massive 85% correction. The recent bounce signals renewed interest in Layer-3 chains, despite concerns of ecosystem fragmentation. XCN currently trades between strong support at $0.0159 and resistance at $0.0222.

Market Cap: $641.13M 24-Hour Trading Volume: $213.87M Circulating Supply: 33.51B XCN

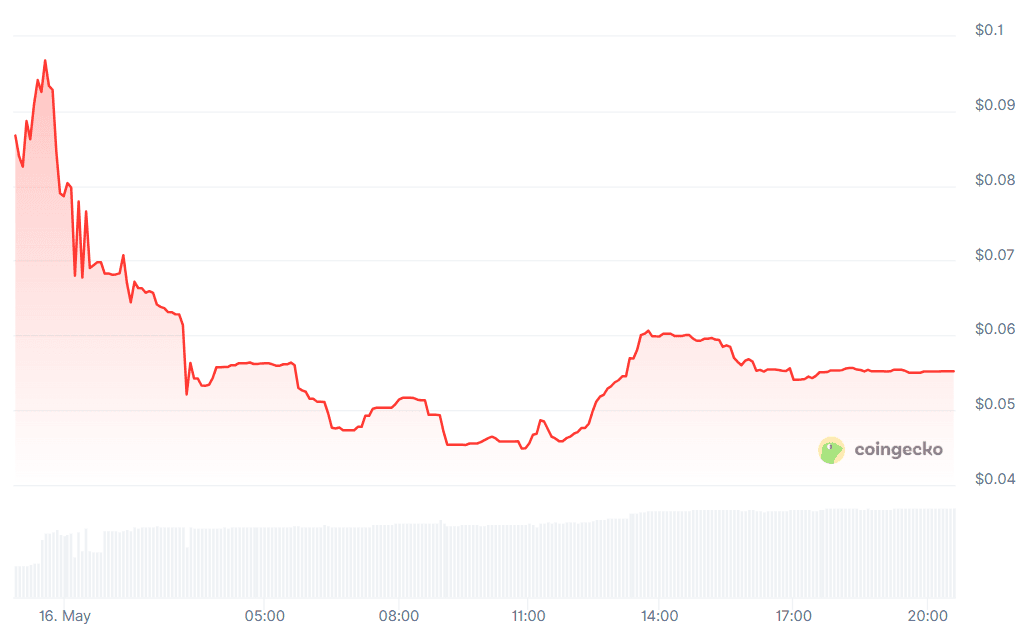

Hyperliquid (HYPE)

Price Change (24H): +9.55% Current Price: $27.64

What happened today

HYPE is up nearly 10% today, continuing a massive 260% rebound from April lows. The perpetuals DEX has reached over $1 trillion in lifetime volume and now outpaces CEXs like Deribit in BTC perpetual open interest. Revenue hit $2M daily, and open interest neared $1B. A new fee discount system and buyback program add to bullish sentiment. Technically, HYPE is trading above all key moving averages with RSI at 71, indicating overbought conditions but persistent momentum.

Market Cap: $9.23B 24-Hour Trading Volume: $180.91M Circulating Supply: 333.92M HYPE

Maple Finance (SYRUP)

Price Change (24H): +18.39% Current Price: $0.3495

What happened today

SYRUP surged to a multi-month high, fueled by a rise in total value locked to $1.17B and active loans reaching $692M. Exchange listings on Binance, Bitget, and dYdX also boosted visibility. Maple’s revenue doubled in April and its BTC Yield product is gaining traction. The token remains technically strong, trading well above key support at $0.1930, although RSI at 75 signals potential overbought territory and a minor pullback.

Market Cap: $373.97M 24-Hour Trading Volume: $182.74M Circulating Supply: 1.06B SYRUP

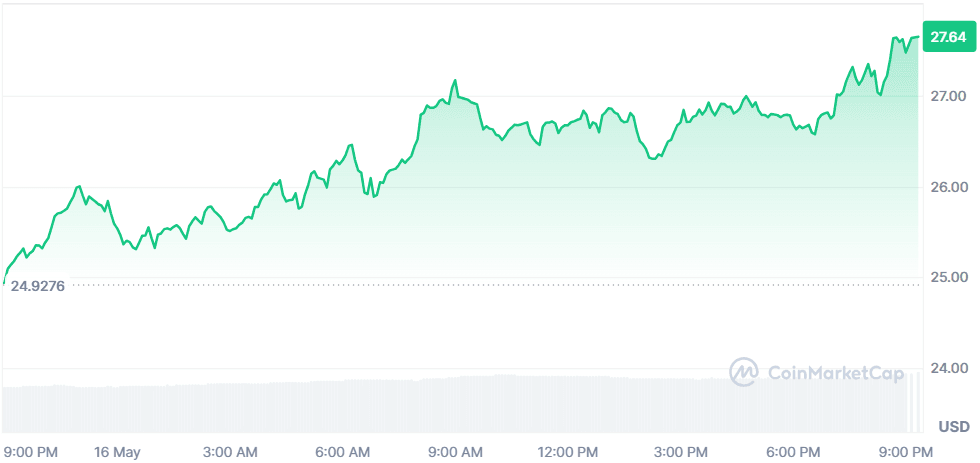

EOS (EOS)

Price Change (24H): +7.69% Current Price: $0.8487

What happened today

Now rebranded as Vaulta, EOS climbed 7.69% after a 6-day downtrend. The rebrand comes with a pivot toward real-world banking utility and programmable smart contracts. Momentum is supported by bullish chart patterns, positive perpetual funding rates, and a $3M investment by WLFI. Volume on EOS DEXs reached $102M this week, and technicals show a potential breakout toward the $1 level if it clears the $0.8770 resistance. A developing cup-and-handle pattern is catching trader interest.

Market Cap: $1.32B 24-Hour Trading Volume: $298.88M Circulating Supply: 1.56B EOS

Global Market Snapshot

Wall Street remained largely flat Friday as weak consumer sentiment data cooled a week-long rally. The S&P 500 edged up just 0.1%, but still posted a strong 4.6% weekly gain, while the Nasdaq added 0.07% and the Dow rose 30 points. Investor optimism surged earlier this week after a 90-day U.S.-China tariff truce was announced, easing fears of trade disruptions.

However, inflation concerns persist as consumer sentiment dropped to 50.8, the second-lowest ever, and inflation expectations rose to 7.3%.

Meanwhile, Galaxy Digital debuted on Nasdaq at $23.50, betting big on AI and crypto as key growth pillars. European markets also closed higher, led by German defense stock Renk and luxury brand Richemont on strong earnings. With $2.8T in options set to expire, Friday may bring heightened volatility. Looking ahead, investors await clarity on new U.S. tariffs and potential Fed rate cuts hinted at by UBS for later this year.

Closing Thoughts

Today's action underscores the widening gap between hype-fueled launches and revenue-backed adoption. RIZE's post-launch plunge is a reminder that unrestricted unlocks and early profit-taking can quickly overwhelm even the most promising narratives. On the other end, HYPE and SYRUP show that the market is actively rewarding protocols with tangible earnings, product-market fit, and rising user activity.

Trading and lending platforms, particularly in the perpetuals and RWA sectors, are drawing deeper capital inflows compared to narrative-only tokens.

Broader investor sentiment remains cautiously optimistic. Despite weak consumer sentiment data denting Wall Street’s momentum, U.S. equities are still posting strong weekly gains thanks to macro relief from the tariff truce. In crypto, while some retail exits were visible in new token dumps, savvy traders seem to be rotating capital into revenue-generating DeFi and infra plays. The market appears to be maturing—rewarding actual performance while punishing hype without structure. As institutional flows deepen and real-world integration accelerates, that divergence may only grow sharper.