Crypto began as a cypher-punk jailbreak, a monetary rail that regulators, banks, and even nation-states could neither censor nor co-opt. Fast-forward to 2025 and the jailbreak looks more like a guided tour: Brussels enforces MiCA licences, Washington both sues exchanges and builds a “Strategic Bitcoin Reserve,” Hong Kong sells spot-ETF access to retail, and Dubai’s VARA issues glossy rulebooks faster than start-ups can fill them out.

If governments can wrap Bitcoin in ETFs and park it in sovereign vaults, is decentralization being absorbed by the very system it set out to disrupt?

The recent times have been.... UNREAL!

Bitcoin’s first block thumb-typed a headline about bail-outs; fifteen years later that anti-establishment manifesto has been repackaged as a Wall Street product and a White House policy plank. The software firm now branded Strategy™ (ex-MicroStrategy) just swallowed another 4,020 BTC, lifting its treasury to 580,250 coins, more than 2.7 % of the entire supply and larger than most sovereign holdings.

On 22 May President Trump hosted a black-tie dinner for the top 220 buyers of his TRUMP memecoin at his Virginia golf club.

The price of admission was buying millions of dollars’ worth of the token which bought each guest face-time with the Commander-in-Chief and a plate of lukewarm chicken, raising fresh questions about “pay-to-play tokenomics.”

Days later, at Bitcoin 2025 in Las Vegas, Vice-President J.D. Vance declared, to rapturous applause, that “)real adoption needs clear rules)” and teased a forthcoming Crypto-Market-Structure Bill. The same crowd cheered louder when billionaires on stage insisted more government oversight would unlock the next trillion.

Markets have already priced in that pivot. The S&P 500 wobbles on tariff headlines; Bitcoin now moves almost in tandem, with a five-year correlation of 0.38, its highest on record. And while rug-pull incidents are actually down this year, dollar losses have exploded to nearly $6 billion thanks to fewer-but-bigger exit scams.

In short, the great cypher-punk jailbreak has become a guided tour: regulators issue fast-track licences, politicians launch coins, and TradFi giants drip money through ETFs. The question is no longer if decentralisation is being absorbed, but whether the community will even notice when the absorption is complete.

Narrative Breakdown – The Shift from Rebellion to Regulation

2008 – 2012 | Genesis & Grey Markets

Satoshi publishes the white paper (Oct 2008). Bitcoin Pizza Day (May 2010) proves it can buy real-world goods, while Silk Road shows it can dodge capital controls. Oversight is non-existent.

2013 – 2016 | Mt. Gox, Scaling Wars, Early Cracks

The Mt. Gox collapse (Feb 2014) vaporises 850 k BTC and teaches the first lesson in single-point-of-failure risk. Block-size battles foreshadow how governance can concentrate in a handful of developers.

2017 | ICO Mania & The First Regulatory Knock

Start-ups raise ~$20 billion in token sales; the SEC’s DAO Report (Jul 2017) says many tokens are securities, and China bans local exchanges that September. Crypto culture stays rebel-minded, but regulators have entered the chat.

2018 – 2019 | Winter & Quiet Professionalisation

Prices crater; Fidelity and Bakkt launch custodial arms, Facebook unveils (then shelves) Libra. Cold storage and SOC-audits replace Reddit memes as the signal of seriousness.

2020 – 2021 | Pandemic Boom & Corporate Treasuries

Tesla buys $1.5 bn BTC; PayPal toggles crypto checkout; El Salvador enshrines Bitcoin as legal tender (Sept 2021). Zero-rate money sloshes into “digital gold.”

2022 | Algorithmic Carnage

Terra-UST de-pegs in May, erasing $60 bn and igniting global stable-coin hearings; Celsius, Voyager and 3AC follow into bankruptcy. Policymakers pivot from curiosity to consumer-protection crusade.

2023 | Centralised Exchange Implosion

FTX files Chapter 11 (Nov 2023). The SEC and CFTC sue Coinbase, Binance and Kraken. Retail liquidity flees to platforms that promise insurance and KYC.

2024 | Policy Codified & ETF Wave

Europe rolls out MiCA Phase 1 on 30 June (stable-coin controls) and schedules full CASP licensing for 30 December.

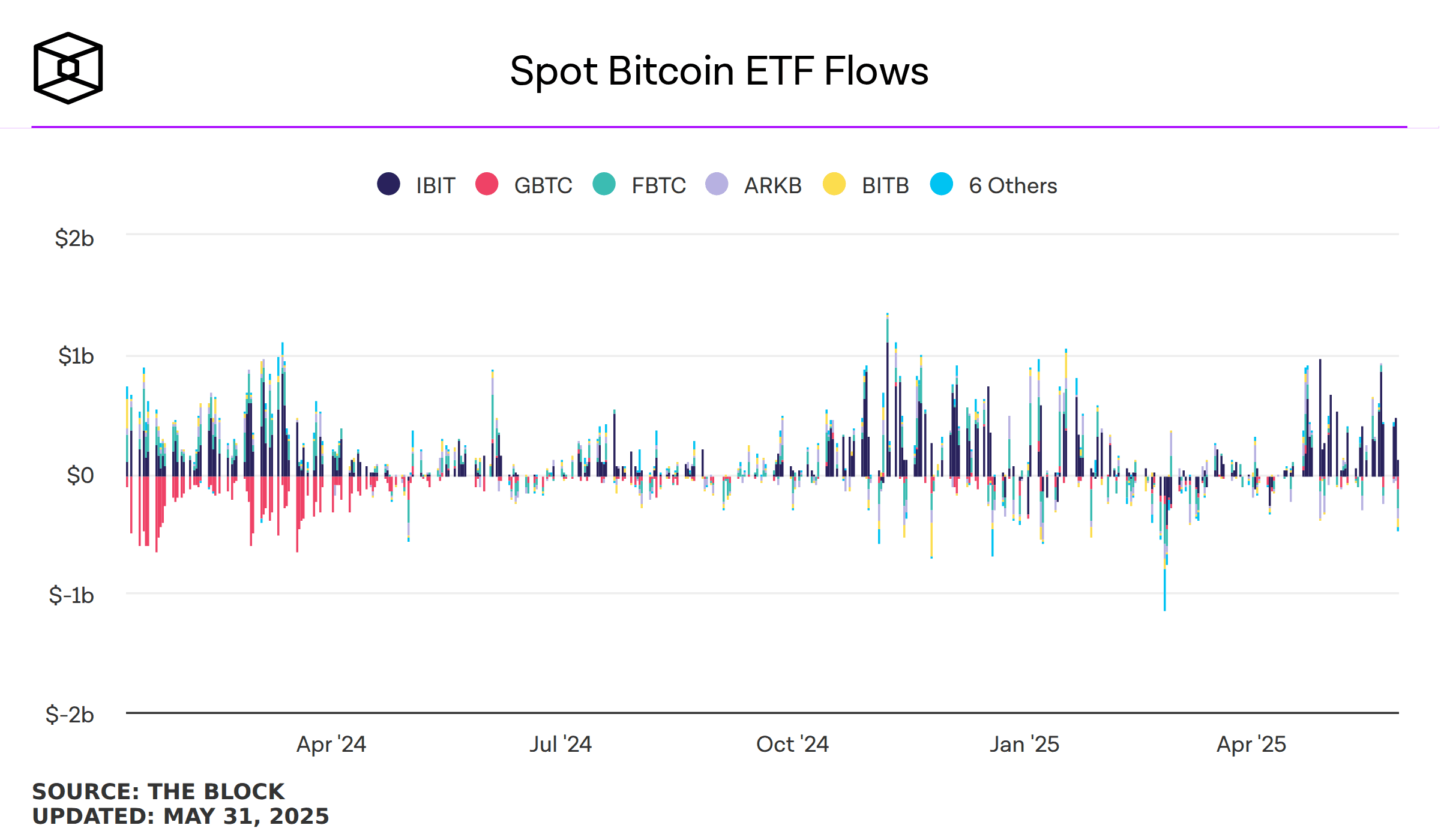

United States green-lights 11 spot-Bitcoin ETFs on 10 January, funnelling Wall Street billions on-chain even as lawsuits grind on.

Hong Kong launches Asia’s first spot BTC / ETH ETFs on 30 April under a retail-friendly rulebook.

2025 | Political Co-option & Market Synchronisation

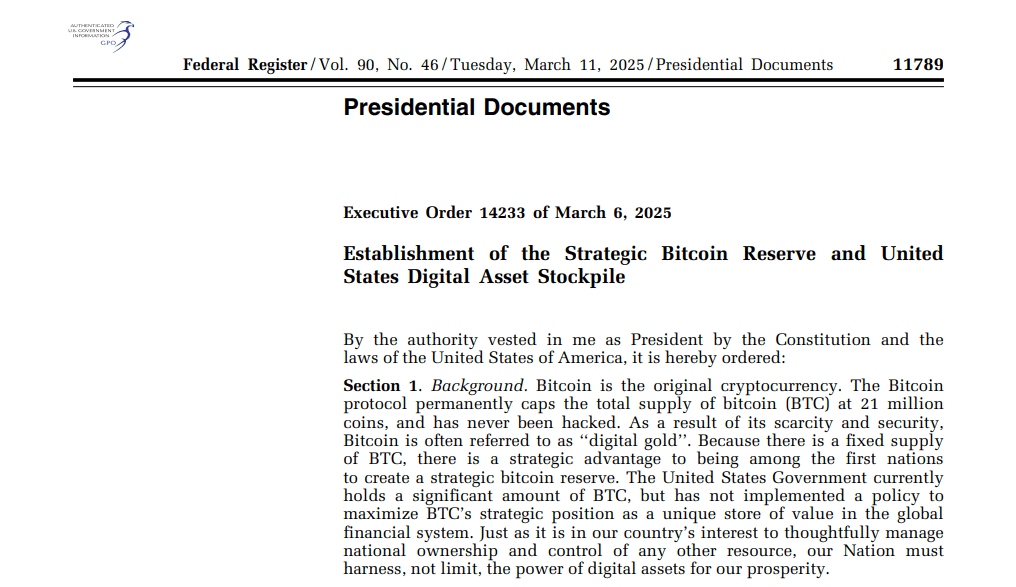

On 6 March, President Trump signs the Strategic Bitcoin Reserve executive order, directing the Treasury to warehouse forfeited BTC as a “digital Fort Knox.”

Strategy pushes its hoard past 580 k BTC, effectively running the world’s largest quasi-ETF on Nasdaq.

Trump’s token dinner melds presidential access with meme-coin speculation.

Vice-President Vance uses the Bitcoin 2025 podium to promise a friendlier and clearer rulebook drawing bigger cheers than any chant of “HODL.”

Each crisis from Mt. Gox to ICO frauds to Terra’s death-spiral to FTX’s black hole, it pushed users toward whatever looked safer: licensed custodians, audited stablecoins, ETF wrappers. By mid-2025 the largest Bitcoin owners are public companies, the U.S. Treasury and ETF custodians, while price action shadows macro headlines. The rebellion didn’t die; it queued up for accreditation badges and applauses.

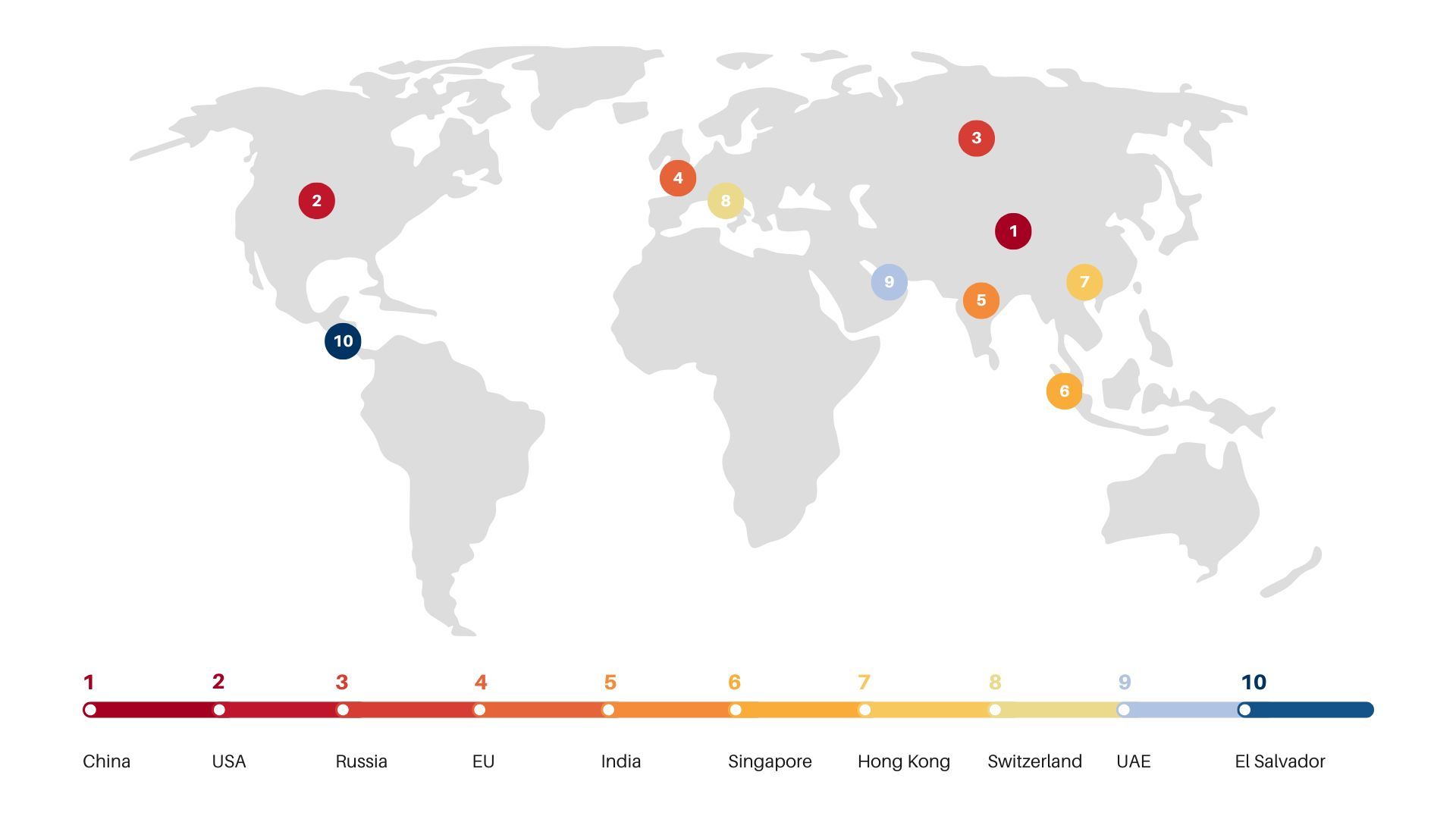

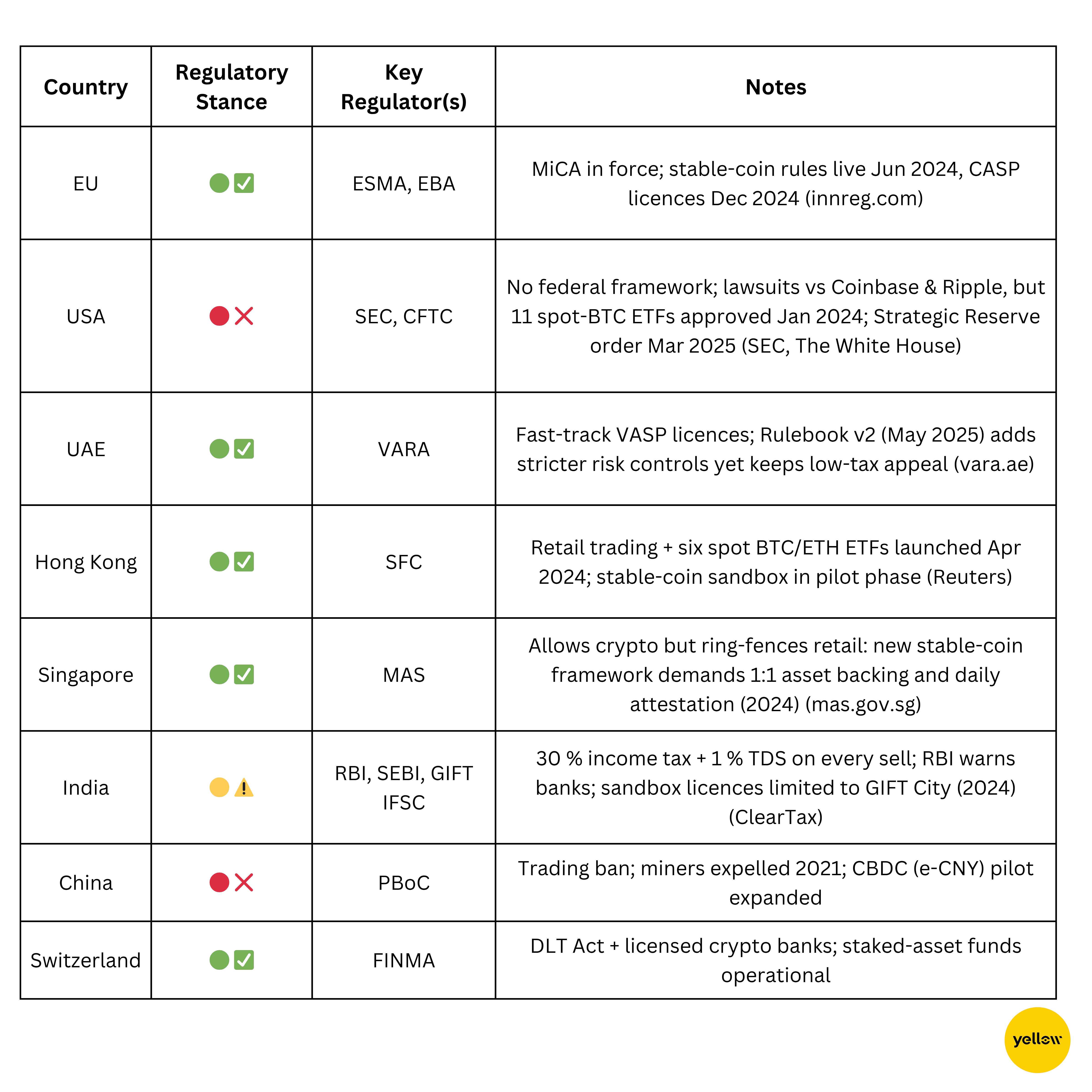

Regulation Heatmap

When the Revolution Gets Regulated: Are We Centralizing Again?

XRP: From Courtroom Rebel to CBDC Rail

Ripple’s partial victory in the 2023-24 SEC case—Judge Torres ruled that programmatic XRP sales are not securities—looked like a win for open networks. But the post-verdict strategy rushes straight into the traditional rails it once vowed to replace. Ripple is now building CBDCs for the Royal Monetary Authority of Bhutan and Colombia’s Banco de la República. Compliance dashboards, AML hooks and “one-click” settlement APIs now headline Ripple’s sales deck—proof that the token born to bypass SWIFT is becoming SWIFT-as-a-Service.

Bitcoin ETFs: Wall Street’s Trojan Horse

Since the SEC green-lit eleven spot-BTC ETFs on 10 Jan 2024, assets have ballooned past $95 billion, and daily inflows remain dominated by Fidelity and BlackRock. Roughly 4 of every 5 new dollars comes from wire-house platforms and pensions that must custody through qualified custodians, pushing coins into cold vaults run by Coinbase and Fidelity.

Strategic Bitcoin Reserve: A State-Scale Honeypot

President Trump’s Executive Order 14233 (6 Mar 2025) created a Strategic Bitcoin Reserve under Treasury custody. In effect, seized or forfeited BTC now pools inside a federally run wallet subject to Fort-Knox-style security vetting. If other G-20 treasuries copy the playbook, governments—not miners—could form the single largest governance bloc in Bitcoin.

EigenLayer & the Restaking Dilemma

Restaking promises “capital efficiency,” but analysts warn that EigenLayer’s model drifts toward a too-big-to-slash equilibrium: a slashing cascade at one AVS could ripple across multiple dApps. Centralised risk hides inside what looks like optional yield.

Roll-up Sequencers: The New Single Points of Failure

Layer-2s cut gas fees but introduce chokepoints: one sequencer. Optimism’s safe-head stall on 5 Dec 2024 froze the chain for 90 minutes; Arbitrum’s February 2025 blip halted transactions network-wide. Until shared or decentralised sequencers ship, outages remain a single multisig away.

The Pattern

Across custody, settlement, validation, and even national policy, the gravitational pull is the same: risk migrates toward entities large enough to promise “safety”—banks, asset managers, big-tech nodes, nation-states. Decentralization survives in code and rhetoric, but economic weight is pooling in a handful of off-chain gatekeepers.

Closing Thoughts — TradFi + Crypto, Evolution or Betrayal?

Regulation, political patronage, and institutional capital arrived almost simultaneously, bending the ecosystem toward structures that look familiar to Wall Street. Clear rulebooks and spot-ETF wrappers expand access to millions of retirement savers; CBDC pilots and restaking pools promise efficiency and new revenue. In that sense, a measure of centralization functions as the entry toll for global scale. The architecture still runs on open code, but the heaviest economic weight now sits with licensed custodians, state treasuries, and roll-up operators rather than cypher-punks running full nodes in spare bedrooms.

Yet every tollbooth confers leverage to its operator. A U.S. strategic reserve, ETF custodial votes, or a single sequencer outage can nudge governance in ways that contradict crypto’s founding aim of trustless exchange. The heatmap of green, yellow, and red jurisdictions captures that tension in real time: friendly zones monetise control, hostile zones litigate it, and the undecided hedge bets on both outcomes. Whether this convergence marks the maturation of a once-fringe technology or a quiet surrender of its radical mission will hinge on how much of the stack remains genuinely open to fork, audit, and exit. The revolution continues but the gatekeepers have changed (or have they?).