Between April and June 2025 the crypto industry discovered that “compliance-by-design” is no longer a slogan: it is shipping to main-nets, drafting Senate bills and nudging exchanges to delist non-conforming assets.

Regulators did three big things in Q2:

-

Turned guidance into mandates: the U.S. Senate passed the GENIUS Act, MiCA’s stable-coin regime became fully enforceable and the FATF said 99 jurisdictions had now legislated the Travel Rule.

-

Demanded near–real-time proofs: from reserve attestations to wallet-risk telemetry regulators now expect dashboards, not quarterly PDFs.

-

Warned that privacy is no excuse: but also nodded to cryptographic ways of proving innocence without doxxing users.

Developers responded with ten technical breakthroughs that make block-chains look and feel like bank ledgers without killing self-custody. Each of the ten sections below explains what shipped in Q2 2025, how it works, and what it means for institutions, corporates, governments and everyday users across the U.S., EU, Asia and emerging hubs.

Zero-Knowledge AML Proofs

What it is

A cryptographic “note from your accountant” that says “my coins have never touched a sanctioned wallet” without exposing who you are, how much you hold, or where the money came from. The proof is generated inside the wallet and can be verified by anyone in milliseconds.

What it means

Banks and regulators get iron-clad AML evidence, users keep privacy, and exchanges no longer need to warehouse passports and selfies. Think KYC that travels with the coins, not the person.

What happened?

Aztec rolled out an opt-in module on its public test-net (1 May) that lets a wallet prove “none of my coins touch an OFAC-sanctioned address” without revealing balances or owner identity. The launch drew 20 000 experimental deposits in 24 hours and coincided with the project’s $100 million ecosystem fund to scale privacy-preserving compliance. Essentially:

-

User clicks Generate Proof in the wallet.

-

Aztec’s circuit checks the coin’s provenance against a hashed sanctions list.

-

The ZK proof confirms the wallet is “clean” while hiding every other detail.

Why it matters

-

Institutions finally satisfy AML on public chains without warehousing oceans of personal data.

-

Governments get mathematically verifiable evidence instead of spreadsheets.

-

Retail keeps privacy, avoiding today’s “share passport or go home” pop-ups.

Compliance Oracles

What it is

A plug-in for smart contracts that pauses a transaction, runs an off-chain sanctions check, then logs the result on-chain before the trade settles.

What it means

DeFi protocols inherit the same “instant OFAC screen” commercial banks use, minus the paperwork. Every swap, borrow or stake comes with an auditable yes/no record that regulators can query forever.

What happened?

Chainlink unveiled its Automated Compliance Engine (ACE) in April and followed with a deep-dive on 27 June showing how any smart contract can pause, ping an off-chain sanctions oracle and commit an immutable pass/fail result before the transaction settles.

Click Borrow → ACE asks “is borrower sanctioned?” → If “no”, the loan closes in the same block; if “yes”, it reverts with an on-chain rejection code auditors can query forever.

Upshot

Every DeFi dApp can now add the same checkbox banks use, without turning itself into a bank.

Wallet-Risk Scoring (“Know-Your-Address”)

What it is

Continuous scoring of every wallet’s behaviour (links to hacks, mixers, ransomware, etc.). Front-ends like Uniswap consume those scores and silently block, or warn about, high-risk addresses.

What it means

Corporates get a familiar vendor-blacklist feed, retail users see scam alerts before clicking Send, and regulators lose the argument that DeFi is a free-for-all.

What happened?

Uniswap Labs extended its address-screening partnership with TRM Labs, blocking wallets tied to hacks, ransomware or child-exploitation imagery directly in its front-end. The policy, first introduced years ago, was refreshed in early June with an expanded threat-intel feed and a public appeals channel for false positives.

Why it matters

-

Corporates get the same real-time vendor blacklist they already use in fiat payments.

-

Users see bright-red warnings before touching tainted coins.

-

Regulators reduce the “web-site loophole” argument that DeFi is ungovernable.

Always-On Proof-of-Reserves (PoR)

What it is

Merkle-tree snapshots that pair a custodian’s liabilities (your deposits) with its on-chain assets, refreshed every few minutes and timestamped by an oracle.

What it means

Solvency stops being a quarterly press release and becomes a live dashboard. If a stable-coin slips below 100 % backing you can see it—and exit—before the tweets start.

What happened?

Chainlink framed 24-hour reserve attestations as the new solvency baseline, citing pilot streams that hash liabilities, assets and independent auditor signatures into a Merkle tree that updates every few minutes.

Regulatory push

-

United States: the GENIUS Act mandates continuous reserve disclosure for dollar-backed stable-coins.

-

Europe: MiCA requires daily snapshots, a rule that forced many exchanges to integrate real-time PoR dashboards in Q2.

Practical effect: users can now query on-chain whether a custodian is solvent instead of waiting for quarterly statements.

Decentralised ID & Dynamic Credentials

What it is

A W3C-compliant credential that lives in your wallet and auto-renews (e.g., every 30 days) by re-querying an identity provider. The dApp only sees “KYC-valid until 12 Aug 2025”, never your paperwork.

What it means

One-click onboarding for users, 80 % less compliance overhead for apps, and a bridge for governments to plug national e-ID schemes straight into Web3.

What happened?

Polygon ID Release 6 shipped “dynamic credentials” that auto-refresh every 30 days, think of it as an always-valid KYC stamp your wallet presents to dApps without new selfies or PDF bank statements.

Stakeholder gains

-

Governments can tether DID wallets to national e-ID programs (EU) or bank-issued credentials (Singapore).

-

Institutions slash onboarding time and cost by re-using one credential across dozens of dApps.

-

Retail gets one-tap sign-ups instead of 45-minute KYC forms.

Travel-Rule Pipes Go Global

What it is

Encrypted messaging rails (Sygna, Notabene, TRISA) that attach sender/receiver info to a crypto withdrawal while the public transaction flies across the chain.

What it means

VASPs satisfy the FATF rule in real time; users barely notice unless they move >US $1 000; regulators finally get cross-border traceability without bloating block-space.

What happened?

The FATF’s June Targeted Update counted 99 jurisdictions that now have Travel-Rule legislation, up from 35 two years ago, and published best-practice supervision guidelines. Networks such as Sygna, Notabene and TRISA piggy-back on the withdrawal transaction to transmit encrypted sender/receiver data off-chain, so the public ledger stays lean.

Regional milestones

-

Hong Kong began full enforcement of its VASP Travel-Rule regime in June, setting a September audit deadline.

-

United States: FinCEN signalled stricter Travel-Rule audits of crypto exchanges and brokers.

Permissioned DeFi Pools & Smart-Contract Guardrails

What it is

Forks of lending or FX protocols that only accept wallets holding a verifiable credential (e.g., “licensed bank in SG”). Smart-contract guard-rails (circuit-breakers, on-chain whitelists) enforce the rules.

What it means

Institutions access DeFi yields on familiar terms, while retail liquidity in the public pool still thrives. It’s the sandbox where CBDCs and tokenised treasuries are likely to meet.

What happened?

Under Project Guardian the Monetary Authority of Singapore and JPMorgan executed tokenised FX trades on Polygon via an Aave-Arc-style fork that only whitelists KYC-approved banks.

Guardrail toolkit introduced in Q2

-

Credential-gated liquidity pools.

-

On-chain circuit-breakers that halt trading if a market-integrity rule is breached.

-

Oracle-fed sanctions lists baked directly into contract logic.

Take-away – Legal certainty, not technology, is now the bottleneck for institutional DeFi assets under management.

Regulated Stable-Coins & Asset Tokens

What it is

Fiat-pegged tokens that meet MiCA (EU) or GENIUS (U.S.) demands for 1-to-1 backing, daily reserve reports and blacklist capability. Binance’s March delisting of non-compliant USDT pairs showed the teeth.

What it means

A split market: “clean” coins flow wherever banks are, fully permissionless coins stay on the gray fringes. For merchants and payroll, the former becomes the default cash-rail.

What happened?

-

Binance delisted all non-MiCA-compliant USDT pairs for EEA users by 31 March, steering volume into euro-backed coins that post real-time reserve feeds.

-

U.S. GENIUS Act sets dollar-stable-coin issuers a 90-day clock to publish audited, cash-backed reserves or exit the market.

Emerging model – a bifurcated stable-coin market:

-

“Clean” coins: fully backed, freeze-capable, bank-account friendly.

-

“Freedom” coins: permissionless but fenced from regulated venues.

Deep-Audit Security & Assurance

What it is

Nine independent audits plus a standing US $15.5 million bounty for critical bugs, all logged on a public registry.

What it means

Security attestations (SOC-2, ISO-27001) are converging with financial compliance; listing on a regulated exchange soon requires both. Open-source code now comes with Wall-Street-grade assurance.

What happened?

Uniswap launched the largest bounty in history, $15.5 million for v4 contracts, and in June opened a Security Services Fund to subsidise 100 % of audit fees for projects building on v4 hooks. Traditional CPA firms began offering on-demand PoR hooks that fuse cybersecurity attestations with real-time financial audits.

Why it matters

Audits, bug bounties and SOC-2 certificates have become table stakes for listing on regulated exchanges, aligning DeFi security with bank compliance.

AI-First Monitoring & Analytics

What it is

Machine-learning models that watch every on-chain hop, cluster wallets, and auto-draft Suspicious Activity Reports; 90 % of banks now run at least one such system.

What it means

Laundering patterns that defeated rule-based screens are caught in real time, false positives plummet, and compliance teams focus on edge-cases instead of CSV wrangling.

What happened?

Feedzai’s May survey of 562 financial-crime professionals found that 90% of banks now deploy AI models for AML, fraud or sanctions-screening and 30% already use GenAI to draft Suspicious Activity Reports.

Practical wins

-

Detects chain-hopping and mixer-evasion patterns human analysts miss.

-

Cuts false positives, reducing regulator frustration with “over-blocking.”

-

Automates SAR drafting, freeing analysts for higher-value investigations.

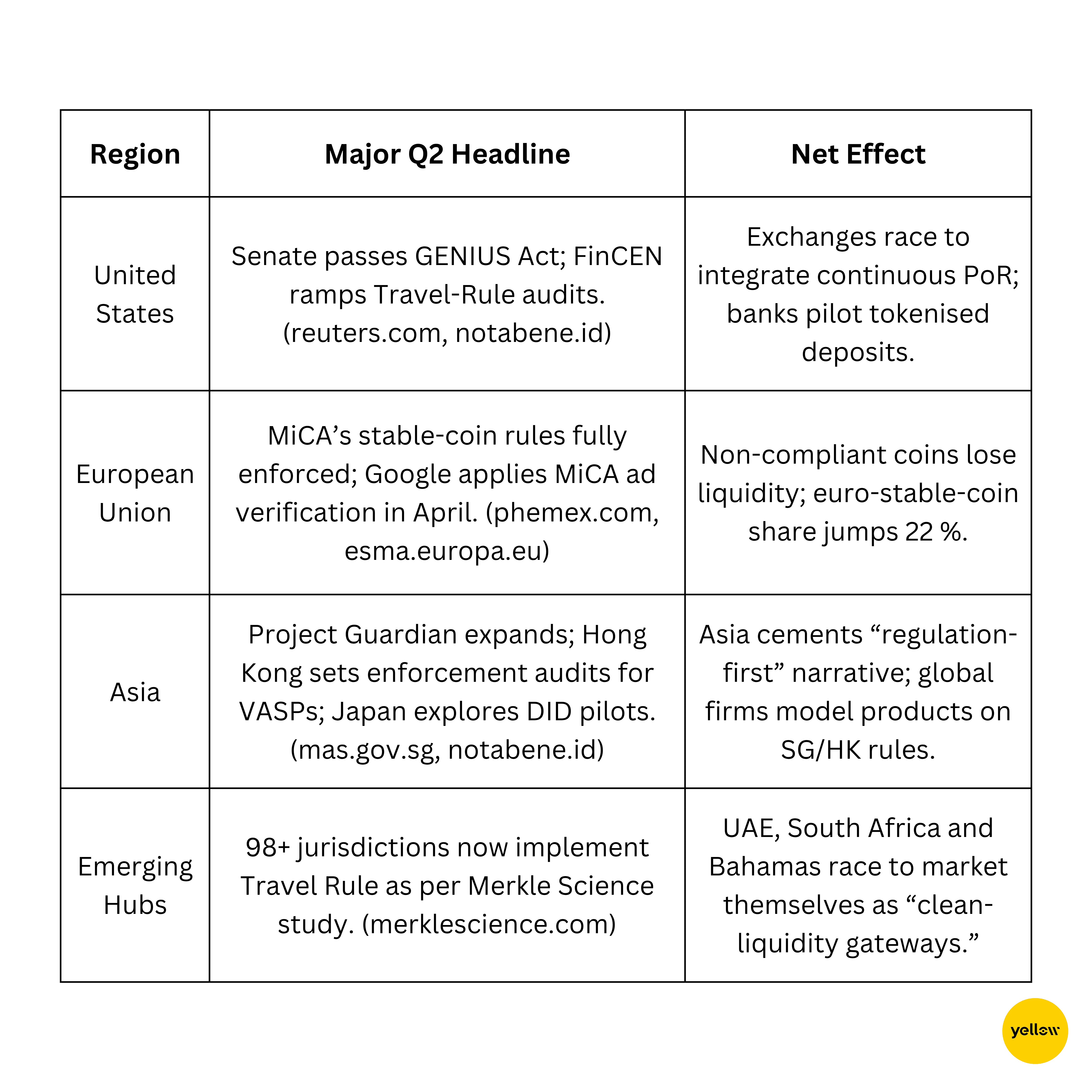

Cross-Regional Snapshot (Q2 2025)

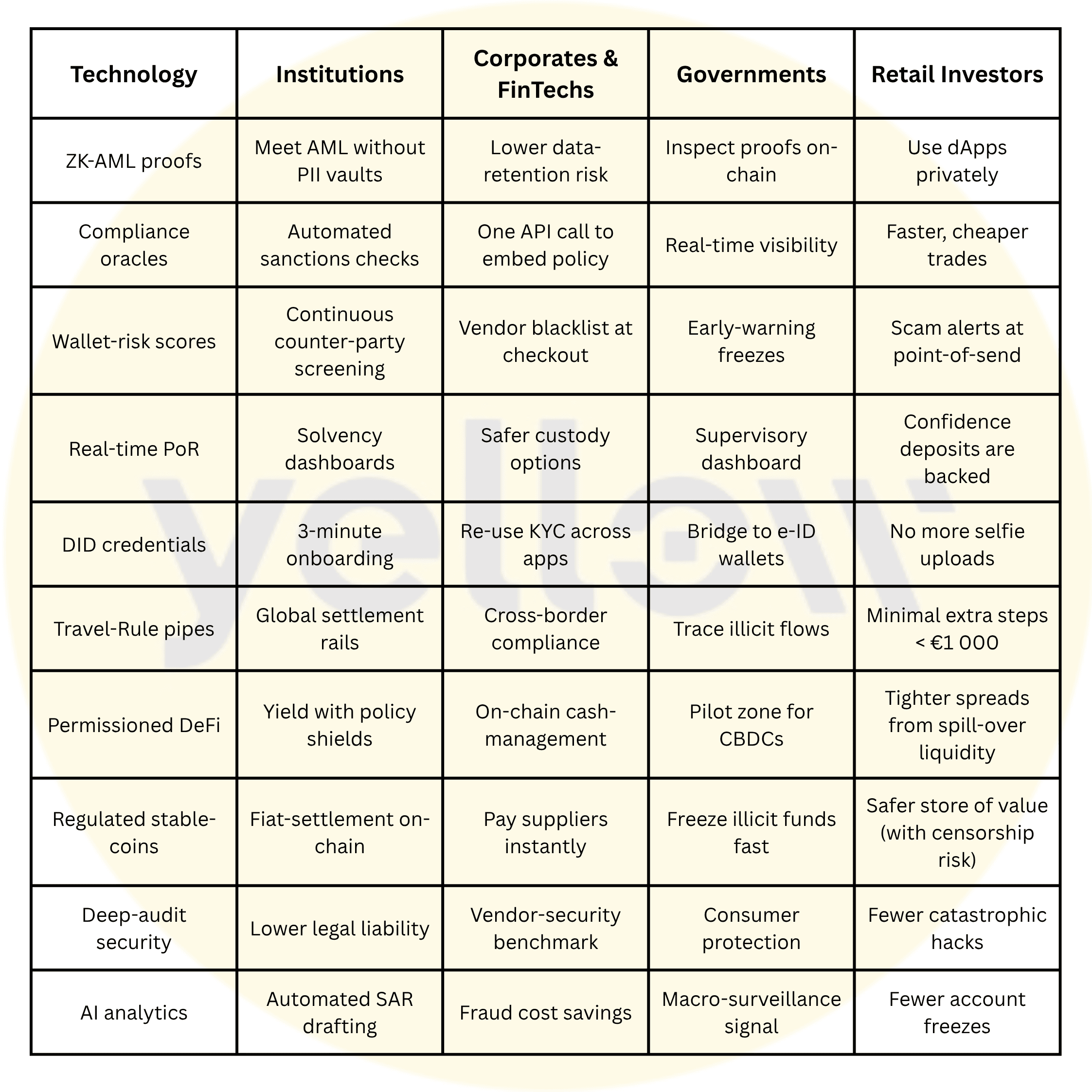

Stakeholder Impact Matrix

Where the Industry Is Headed

-

Proofs over promises: If a statement (“fully backed,” “not sanctioned”) can be proven cryptographically or reported in real-time, regulators will require it.

-

Credential-gated liquidity: Expect more “white-listed pools” for treasuries and banks, running alongside permissionless venues.

-

Privacy-preserving compliance: ZK-AML and dynamic credentials show the path to both privacy and oversight; watchdogs are warming to the math.

-

RegTech as moat: Projects baking these capabilities into their base layer, not bolting them on, will win the next wave of institutional liquidity.

Conclusion

Q2 2025 flipped the script from “Can block-chains survive regulation?” to “Which chains deliver the clearest window for regulators without locking out users?” Zero-knowledge proofs prove wallets are clean without revealing owners; oracles automate compliance at block-time; real-time reserve feeds replace glossy attestations with live dashboards; and AI-native monitors catch laundering patterns humans never spot.

The big lesson: compliance is becoming infrastructure – not a form to fill out later. Builders who internalise that shift now will own the rails for the next trillion-dollar wave of crypto-finance, while laggards risk geofencing, delistings and capital flight. For investors, regulators and end-users alike, the technology covered here makes the difference between hoping assets are safe and knowing they are.