After a week of choppy macro signals, today’s crypto leaderboard is buzzing with breakout tokens tied to listings, sector-specific hype, and rising regional interest. Lagrange (LA) set the tone with a dramatic Coinbase-to-Binance debut, triggering a massive spike in price and volume. Ravencoin (RVN) followed closely with a classic Korea-fueled breakout on Upbit, while Livepeer (LPT) saw volatile action linked to AI fund flows. Meanwhile, low-cap Mixie (MIXIE) rode the LBank effect with a near 100% pop, and Moonchain (MXC) held firm as traders eye a continuation of its recent bullish trend. Together, these tokens are lighting up different narratives—from infrastructure to AI and altcoin speculation.

Lagrange (LA)

Price Change (24H): +259.75% Current Price: $1.27

What happened today

Lagrange exploded nearly 260% today following a flurry of major exchange listings including Coinbase, Binance Futures, and Bybit. This surge is also powered by the launch of its multi-chain airdrop (across Ethereum, Polygon, Solana, etc.) and staking capabilities on EigenLayer. The token is integral to Lagrange’s decentralized ZK Prover Network, already being used by giants like ZKsync and Coinbase Cloud. As the platform expands its infrastructure and revenue pipeline, LA remains firmly in the spotlight.

Market Cap: $245.71M 24-Hour Trading Volume: $437.96M Circulating Supply: 193M LA

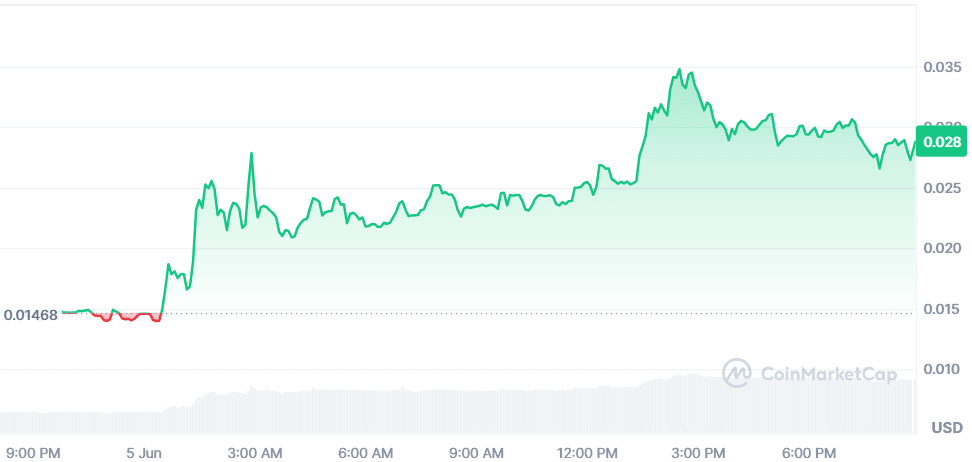

Mixie (MIXIE)

Price Change (24H): +98.26% Current Price: $0.02844

What happened today

Mixie is riding the wave of LBank-fueled hype after a 700% surge this week. The token gained traction post-listing on LBank, with strong retail activity driven by early trader interest and a favorable risk-on sentiment across markets. Technical indicators showed MIXIE breaking above its 50-day MA, and RSI touched overbought zones—reflecting significant momentum. Despite being low-cap, on-chain activity suggests real user interest beyond exchange speculation.

Market Cap: $9.86M 24-Hour Trading Volume: $6.58M Circulating Supply: 346.96M MIXIE

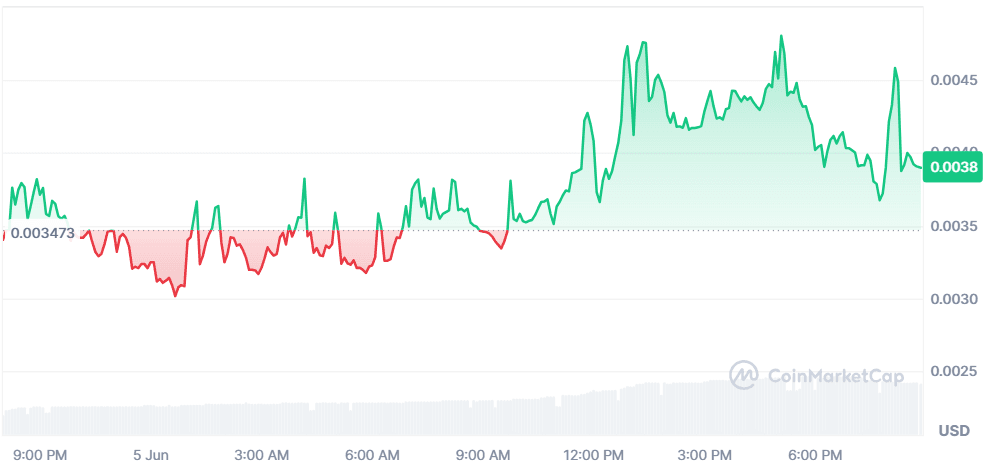

Moonchain (MXC)

Price Change (24H): +2.07% Current Price: $0.003898

What happened today

After a sharp pullback, MXC has reclaimed the $0.0040 level and is showing signs of resuming its uptrend. The price action follows a volatile but bullish structure with the EMA 20 now sloping upward, a sign of potential momentum continuation. Traders are watching the $0.0048 and $0.0051 resistance levels closely as the next upside targets if the bullish structure holds.

Market Cap: $11.51M 24-Hour Trading Volume: $8.2M Circulating Supply: 2.95B MXC

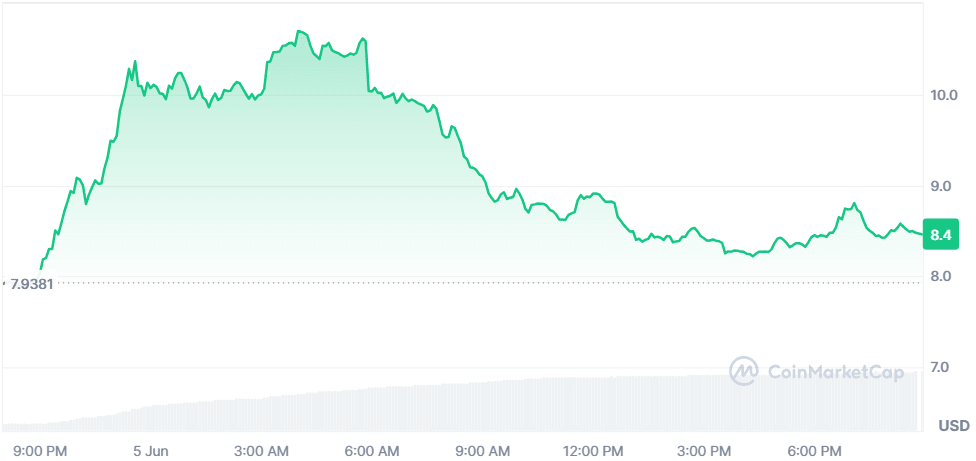

Livepeer (LPT)

Price Change (24H): +6.10% Current Price: $8.45

What happened today

LPT skyrocketed 150% to $14.20 earlier this week after being included in Grayscale’s AI Index and listed on Upbit and dYdX. However, it has since corrected 40% as whales locked in profits, with 526,000 LPT moved from staking to Binance. Despite volatility, strong AI narrative and high daily volumes (>$1B) keep LPT on radar. Analysts suggest a potential rebound from the $7–$8 range as long as interest in AI-powered video infra remains strong.

Market Cap: $348.52M 24-Hour Trading Volume: $1.17B Circulating Supply: 41.2M LPT

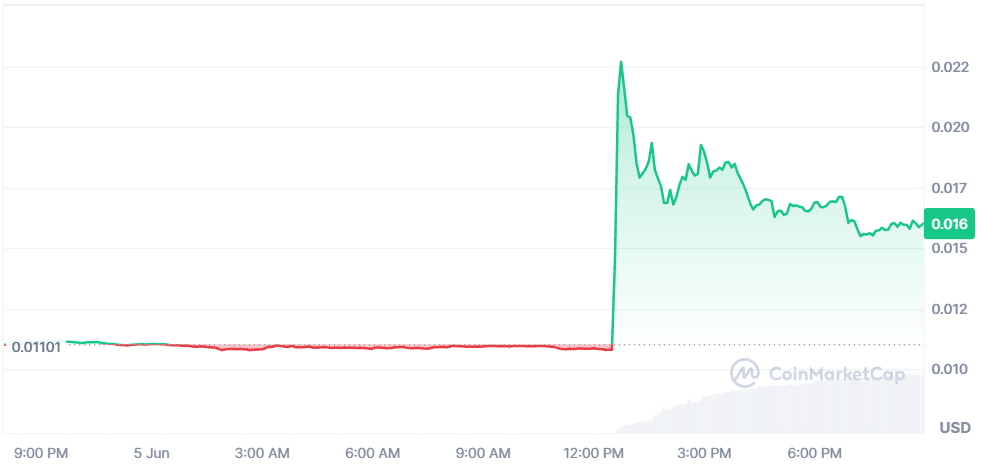

Ravencoin (RVN)

Price Change (24H): +43.55% Current Price: $0.01600

What happened today

Ravencoin soared 62% after a new KRW trading pair went live on South Korea’s Upbit exchange. The listing sparked significant retail inflows from the region, known for volatile post-listing pumps. RVN’s unique asset-transfer use case and strong blockchain fundamentals have brought it back into focus, although sustaining this rally will depend on continued Korean market momentum.

Market Cap: $243.62M 24-Hour Trading Volume: $558.77M Circulating Supply: 15.22B RVN

Global Market Snapshot

U.S. Treasury yields edged lower following weaker-than-expected jobless claims (247K vs. 236K estimate) and disappointing payroll growth. The 10-year yield fell over 2 bps to 4.343%, reflecting a cooling labor market but not enough to stoke recession fears, according to Deutsche Bank. Meanwhile, the ECB cut rates by 25 bps, revising 2025 inflation down to 2%, as energy prices fall and the euro strengthens.

On the geopolitical front, President Trump confirmed renewed U.S.–China trade talks following a “very good” 90-minute call with President Xi, potentially easing tariff tensions. However, the equity markets gave up early gains, awaiting concrete outcomes from the meeting.

Closing Thoughts

Investor sentiment today reflects a renewed appetite for momentum-driven trades, particularly in sectors with recent catalysts. Lagrange’s listing frenzy sparked significant institutional and retail flows, showing that infrastructure tokens with tangible utility still capture strong capital when backed by solid narratives. Similarly, Ravencoin’s KRW pair launch showcased how regional retail liquidity, especially from Asia, can sharply move mid-cap tokens within hours. LPT’s journey underscores the volatility AI tokens face despite institutional recognition, profit-taking remains swift.

From a macro lens, falling U.S. Treasury yields and the ECB’s rate cut hint at a more accommodative backdrop for risk assets. This environment, combined with hints of trade diplomacy between the U.S. and China, is creating room for altcoins to breathe. While not euphoric, the tone is cautiously optimistic with crypto traders responding to high-volume breakouts and regional catalysts. If these signals sustain, sectors like decentralized infra, AI, and tokenized asset networks may see continued speculative action this week.