GameFi just delivered one of its most contradictory months ever. Daily on-chain activity ticked higher, yet token prices bled. Flagship projects closed, but fresh venture capital kept the conveyor belt of new titles humming.

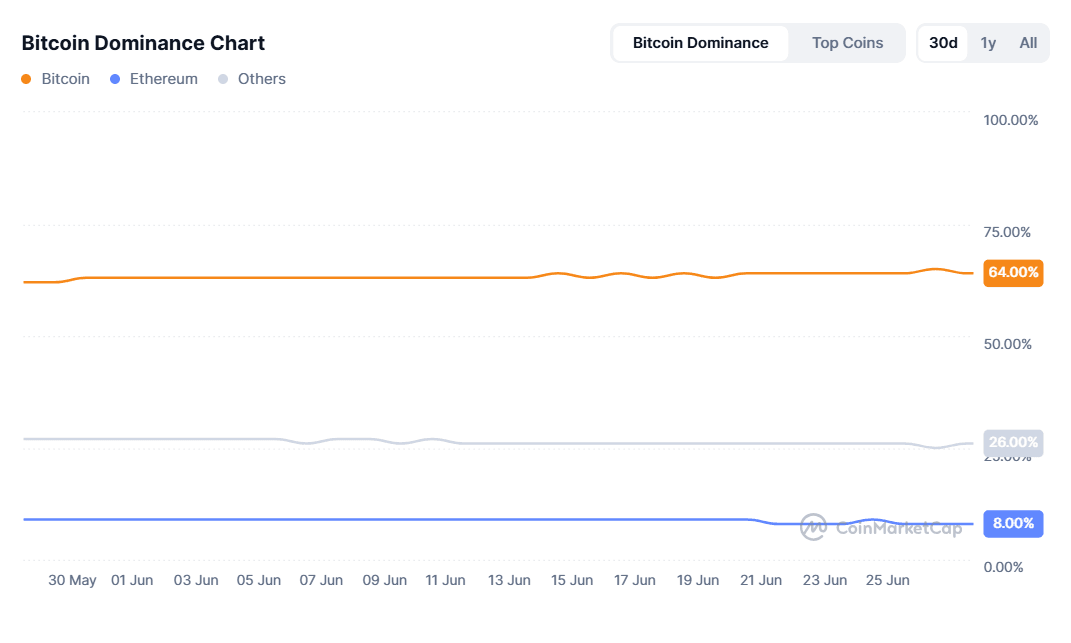

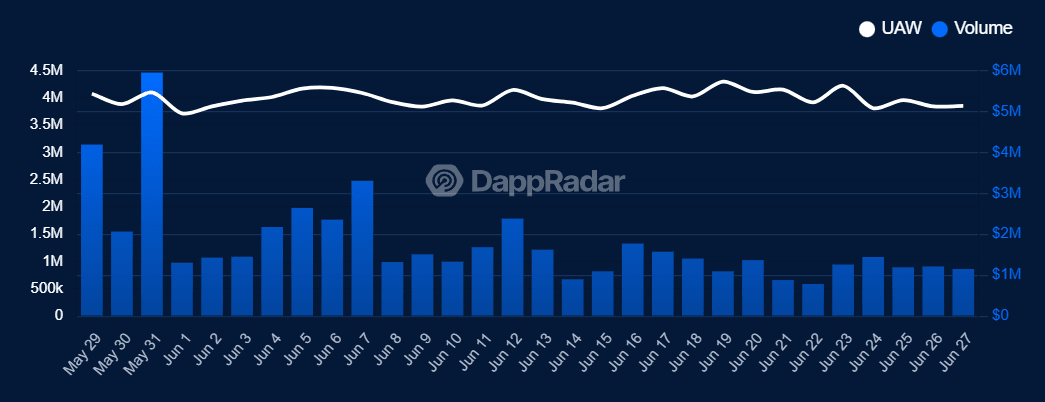

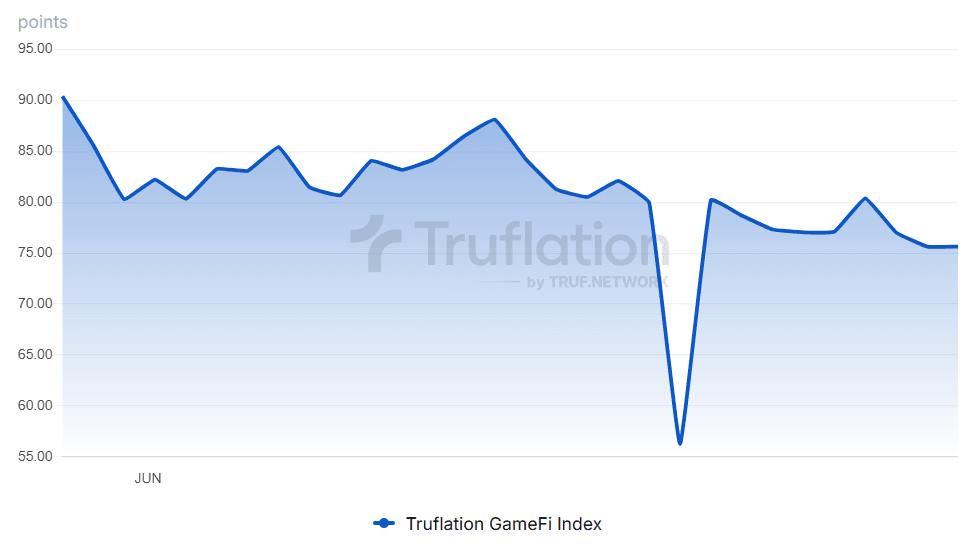

Bitcoin’s 64-65 % dominance sucked oxygen out of alt-coins and forced many gaming tokens to their year-to-date lows, even as unique active wallets (UAW) in gaming dApps edged above 4 million per day and a cumulative 119.8 million for the rolling 30-day window. In this review we unpack the full picture: users, volumes, funding, chain wars, token leaders & laggards, and the June/July launch calendar, to gauge whether Web3 gaming is scraping bottom or quietly resetting for Q3.

Macro context: liquidity migrates to Bitcoin

- Alt-coin chill: The total GameFi market-cap slid to ~US $14 billion during the second half of June, a 7 % month-on-month drop that mirrored the broader alt-coin slump.

- Risk-off rotation: Bitcoin’s relentless rise to, and brief rejection from, US $110 k pushed BTC dominance to ≈65 %, draining flows from gaming tokens.

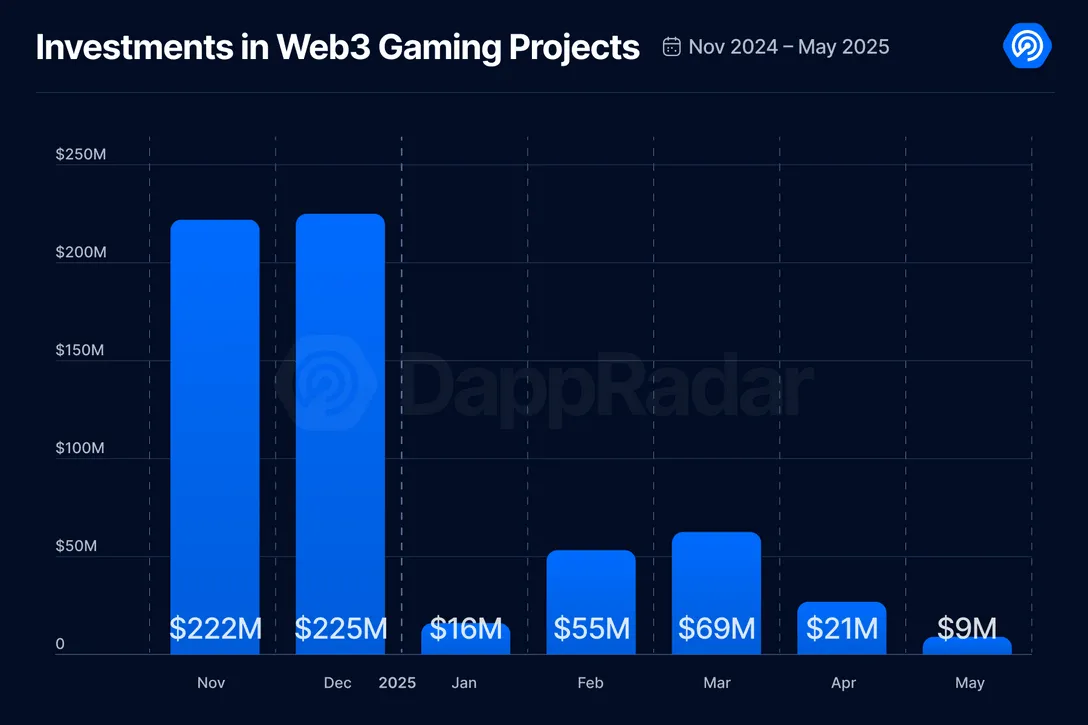

- Funding drought: DappRadar’s latest tally shows US $91 million raised for Web3 gaming in Q1-25 (-68 % y/y). May brought only US $9 million, the lowest monthly print since late-2020.

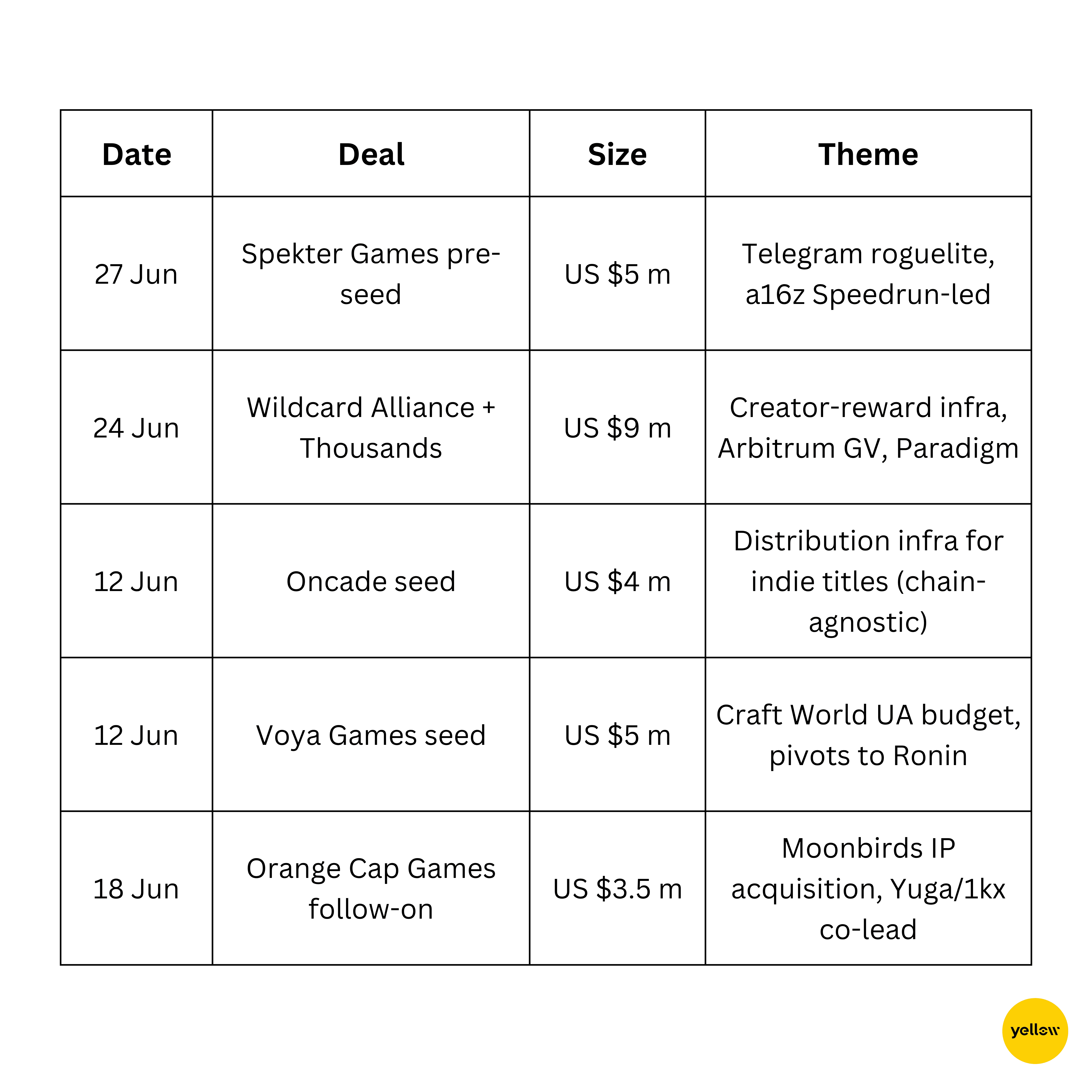

Yet pockets of capital remain: Arbitrum Gaming Ventures and Paradigm co-led a fresh US $9 million round for Wildcard Alliance/Thousands Protocol, and a16z Speedrun headlined US $5 million for Spekter Games.

User & volume trends – what the chain data says

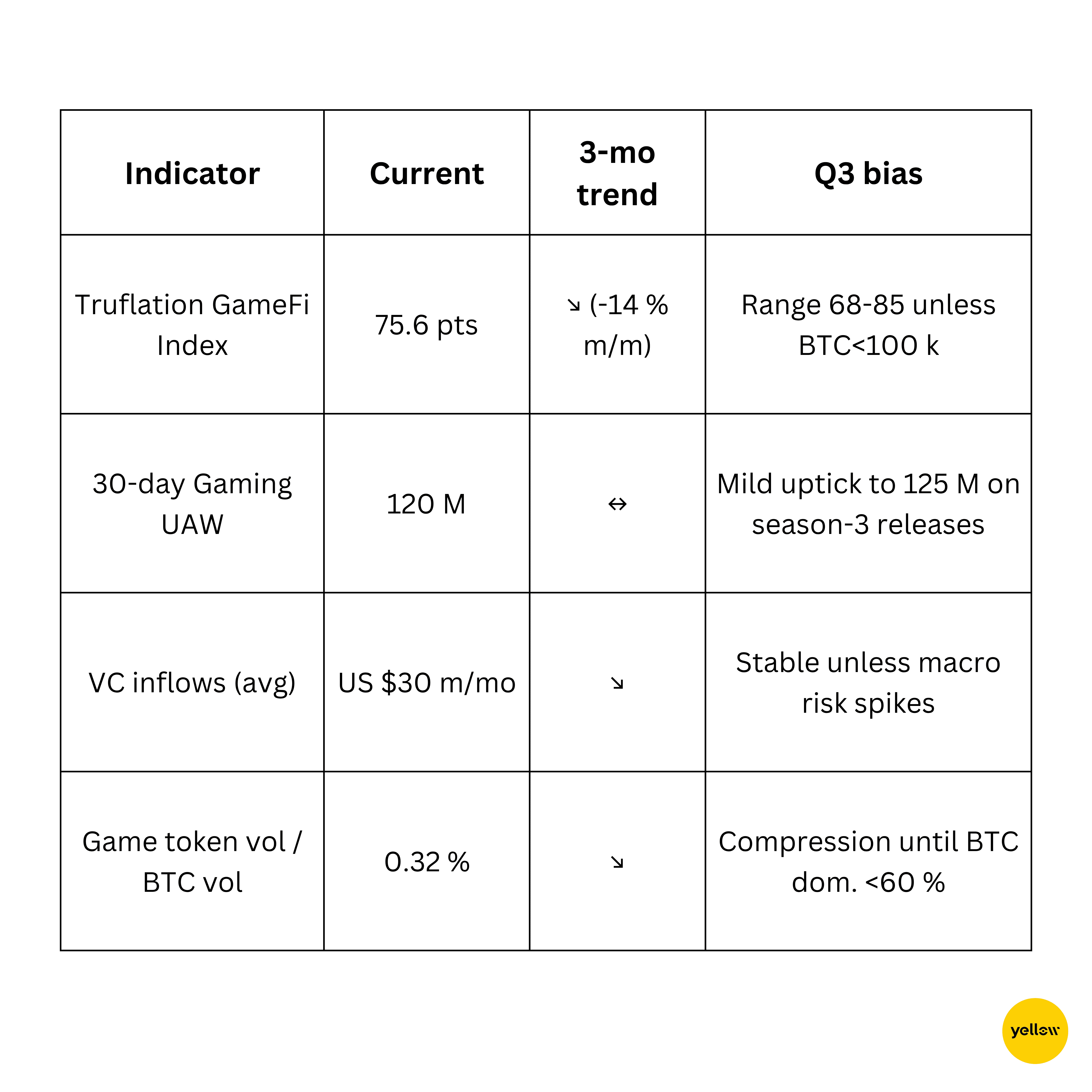

Daily activity is flat-to-up, but spend is sharply down, evidence that many wallets are interacting with free-to-play mini-apps or test-nets rather than committing serious capital. The Truflation GameFi Index, which tracks token prices of 30 leading games, mirrors this divergence: it printed 75.64 pts on 27 June, unchanged day-over-day but -14.7 % month-on-month from 88.68 pts.

Chain performance – winners & strugglers

Key takeaways

-

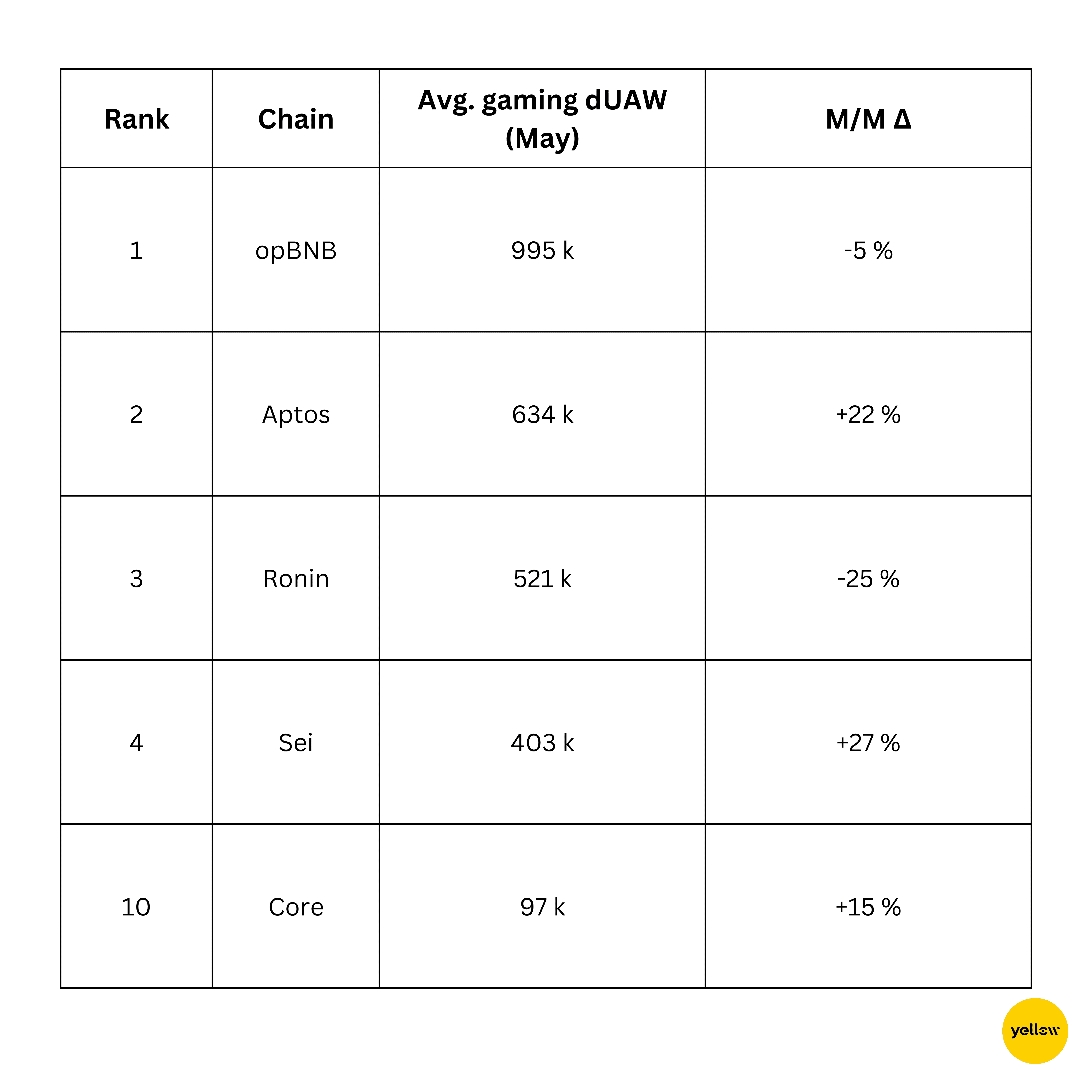

Sei Network jumps into the Top-5 courtesy of lightweight mobile hits Hot Spring and Archer Hunter, underscoring appetite for friction-less “tap-to-earn” loops.

-

Ronin remains the brand to beat in retail mind-share but its 25% drop shows how quickly market share leaks when no flagship launch lands in a given month.

-

Layer-2 cost efficiency still trumps everything, opBNB retains pole position despite modest wallet attrition.

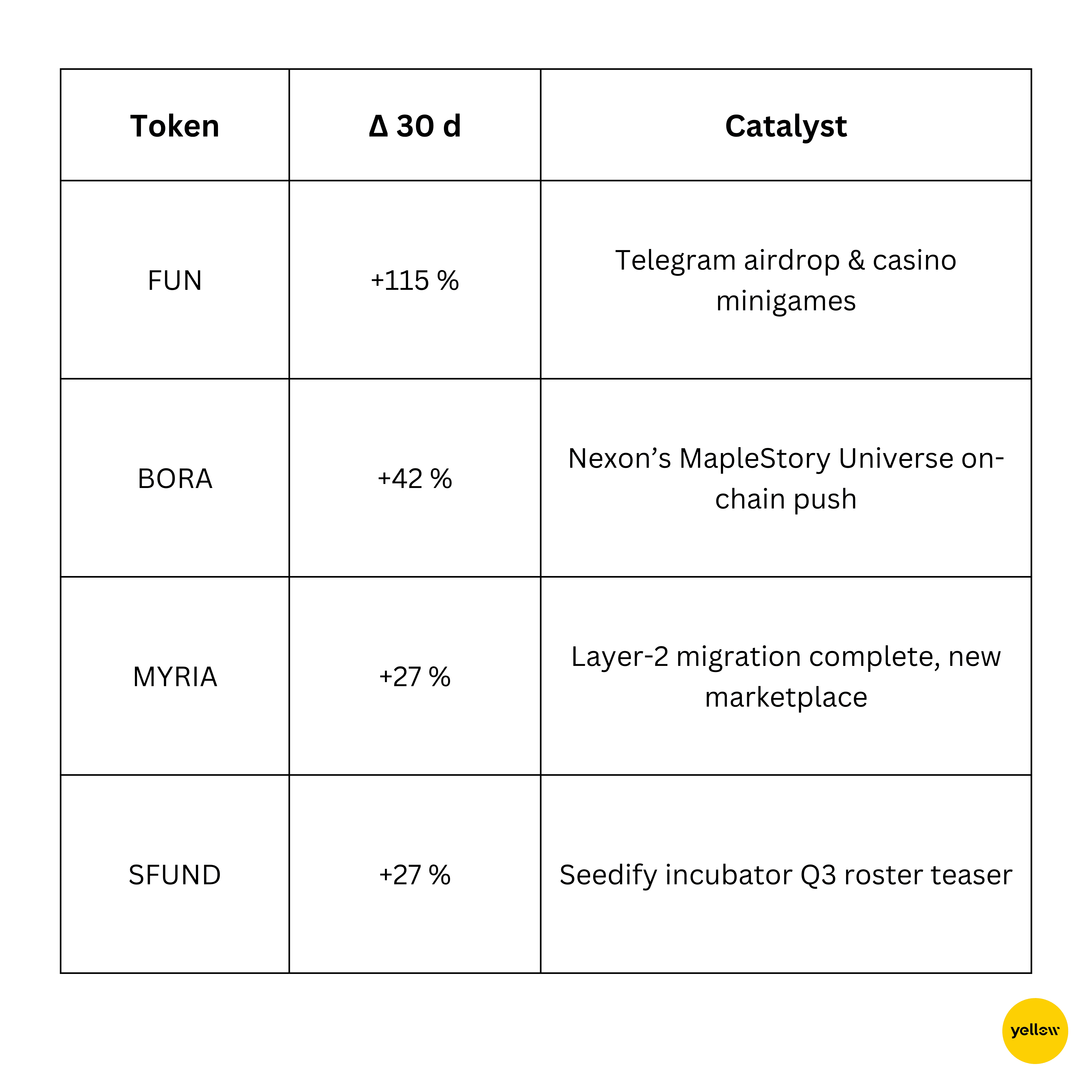

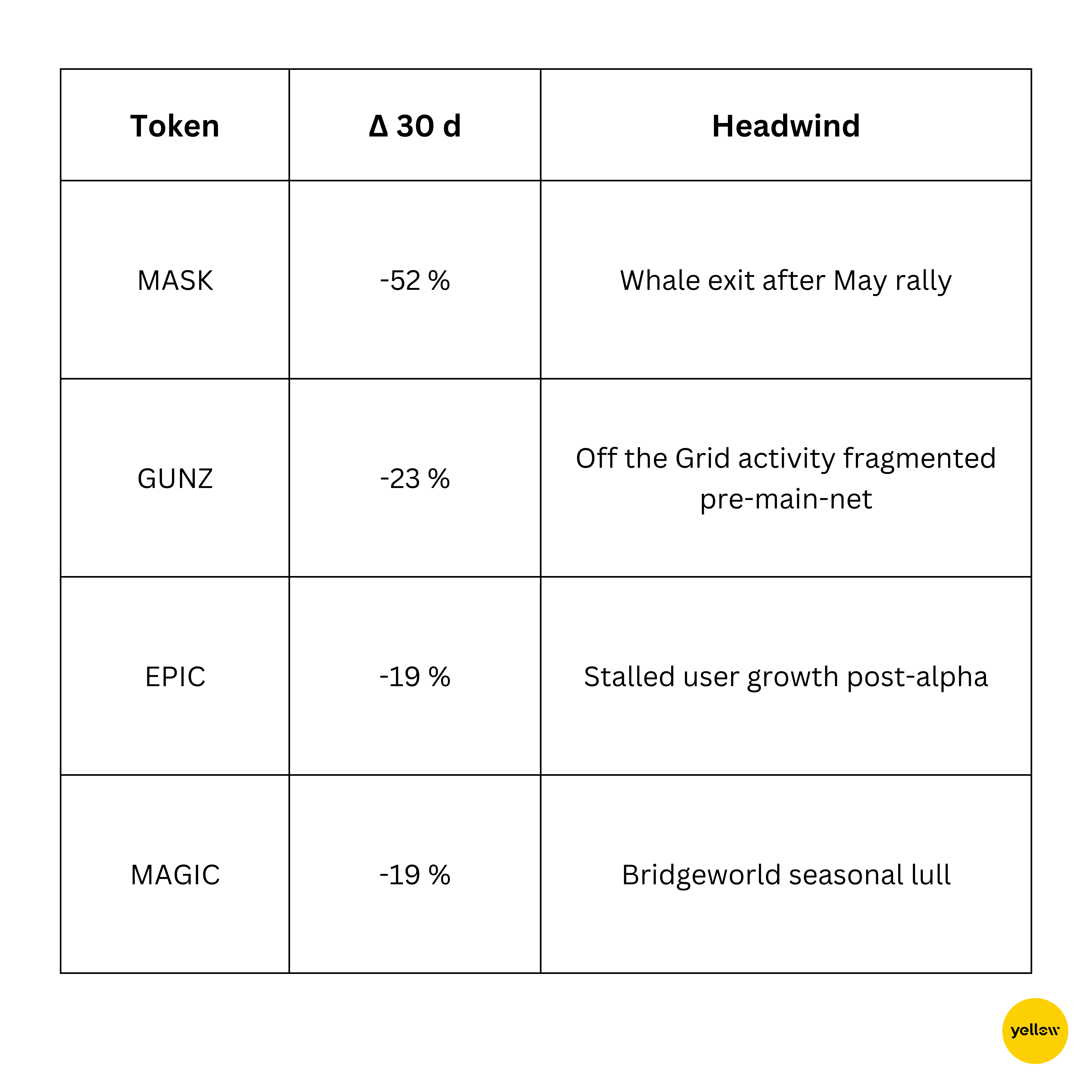

Token leaders & laggards – June price tape

Top gainers (30-day)

Top decliners (30-day)

Funding & M&A – capital still whispers “optionality”

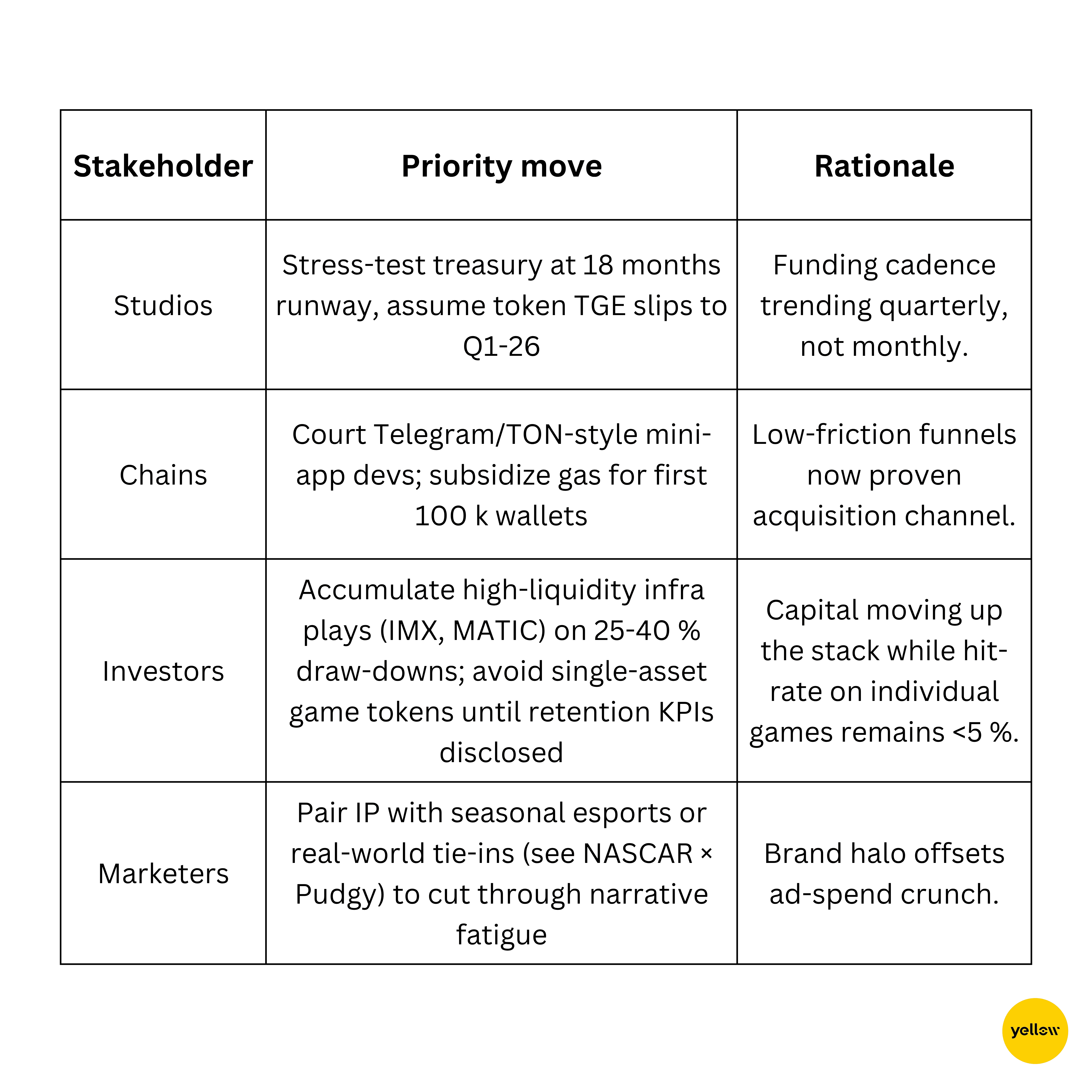

Observation: Cheques are shrinking but skew strongly toward infrastructure and branded IP, not experimental token ponzinomics. Animoca’s open-market buy of Cross The Ages (CTA) tokens reinforces the “pick quality & concentrate” mantra.

Notable product launches & events (June/early-July)

-

IFA Rivals (Mythical Chain) – launched 12 Jun with Adidas kit NFTs.

-

Sparkball early build on Somnia – Steam Next Fest (9-16 Jun).

-

Tokyo Beast main-net + $TGT live; US $1 m championship slated.

-

Seraph Season 3 – 12 Jun, 5 million $SERAPH prize pool.

-

Gods Unchained “Guardians of Elderym” expansion – 24 Jun.

-

BloodLoop hero shooter – Epic Games Store debut 23 Jun.

-

Pengu Clash (Pudgy Penguins × NASCAR) – TON mini-game 18 Jun.

-

Bombie (BOMB) KuCoin Spotlight sale – 10 Jun; the exchange’s return to launchpads after 12-month pause.

-

Off the Grid migrating community to main-net GUNZ; full re-index in July.

Industry stress points – why the capitulations keep coming

-

Runway reality: May’s closures (Nyan Heroes, Ember Sword, The Mystery Society) highlight the burn-vs-funding mismatch. A single mid-core multiplayer title still costs US $20-40 m to reach open beta, double to triple recent check sizes.

-

Economy design pitfalls: Hit mobile clickers (Hamster Kombat, Notcoin) peak in weeks, not years. Sustainable sinks & sources remain the holy grail.

-

AAA sticker shock: GTA VI’s reported US $1 billion budget sets an intimidating bar, yet player expectations continue to drift closer to that level of polish.

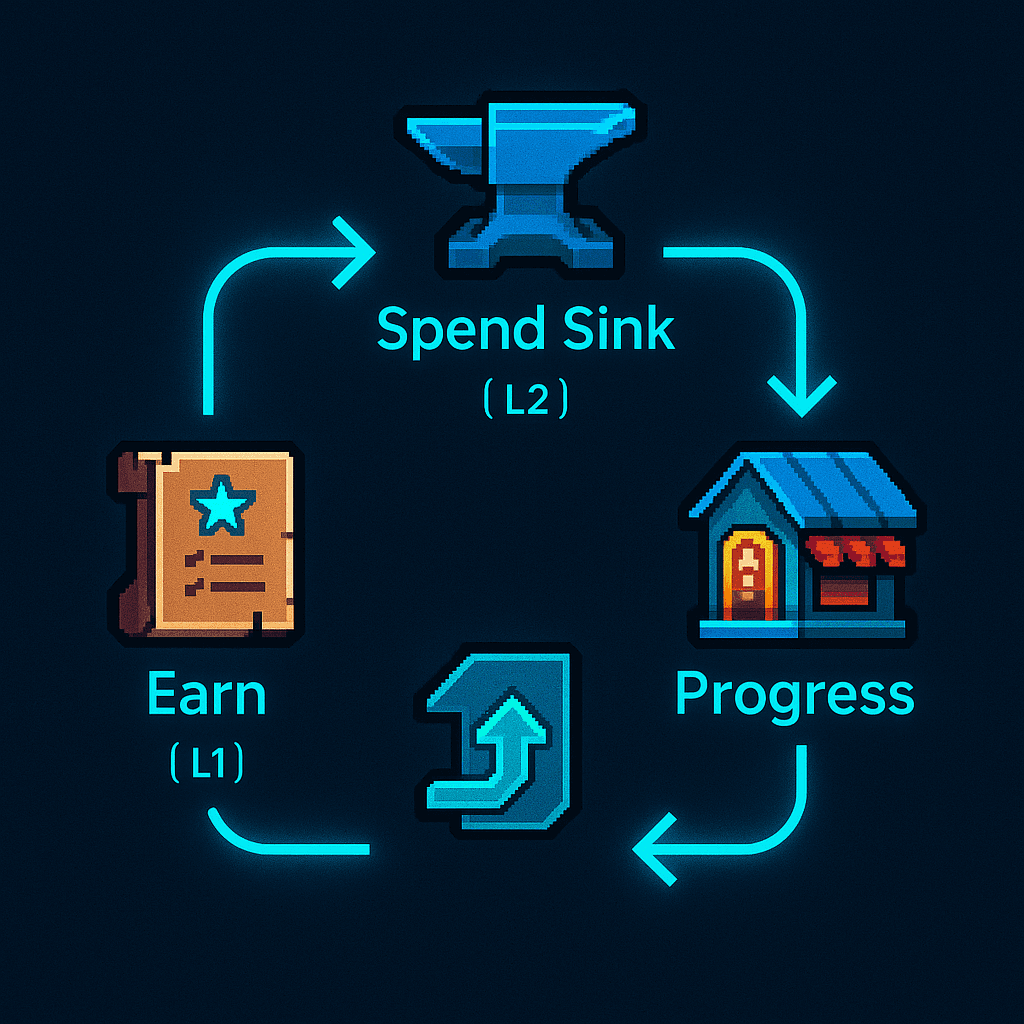

Design Patterns for Sustainable GameFi Economies

A stubborn myth in Web3 gaming is that a clever token-omics sheet can stand in for compelling, replay-worthy design. Reality says otherwise: lifetime value still boils down to fun-per-minute. The best “economy loops” observed in June share three traits:

-

Time-gated progression: Sparkball’s Somnia build locks cosmetics behind consecutive daily quests, delaying sell-pressure from early farm-and-dump whales.

-

Dual-token buffers: Tokyo Beast tiers earnings into a soft off-chain currency (“Meat”) for common upgrades and $TGT for high-stakes tournaments. The airflow between the two slows reflexive crashes.

-

Sink-first philosophy: Seraph Season 3 shipped five gold-drain features (transmog fees, ascension slots, leaderboard bounty taxes) before expanding ways to earn. That order matters; players view new rewards as additive rather than catch-up inflation.

Early telemetry from these titles shows 30-40% higher day-30 retention over comparable Q1 launches, a sign the industry may finally be codifying a post-Axie playbook in which utility precedes yield. Expect L2s such as Ronin and Ton to bake reference smart-contract templates for these loops into their SDKs by Q4.

Green shoots – signals that matter

-

Traditional IP is here to stay: Sega (Ragnarok), Ubisoft, Netmarble, Sony (Soneium L2) all shipped pilots in Q2. A Tencent–Nexon deal would be the largest Web2/Web3 crossover yet.

-

Ecosystem density on new L1s: Sei’s 43 tracked games, 13 with >50 k weekly wallets, prove that purpose-built chains can accelerate critical mass when gas fees are negligible.

- Narrative rotation: Social-Fi and AI dApps may have stolen the storytelling spotlight, but their on-chain metrics are still neck-and-neck with gaming. Once BTC dominance cools, gaming tokens could be first to mean-revert given their sharper drawdowns.

Regulatory Watch – Why Compliance Is Creeping Up the Priority List

While the SEC’s laser-eyes have so far focused on DeFi lending and staking platforms, its 2025 agenda keeps “crypto-trading & DeFi risk” in the cross-hairs, with a dedicated round-table and a fresh wave of Wells notices in May 2025. Two GameFi-specific flashpoints are now drawing equal policy heat:

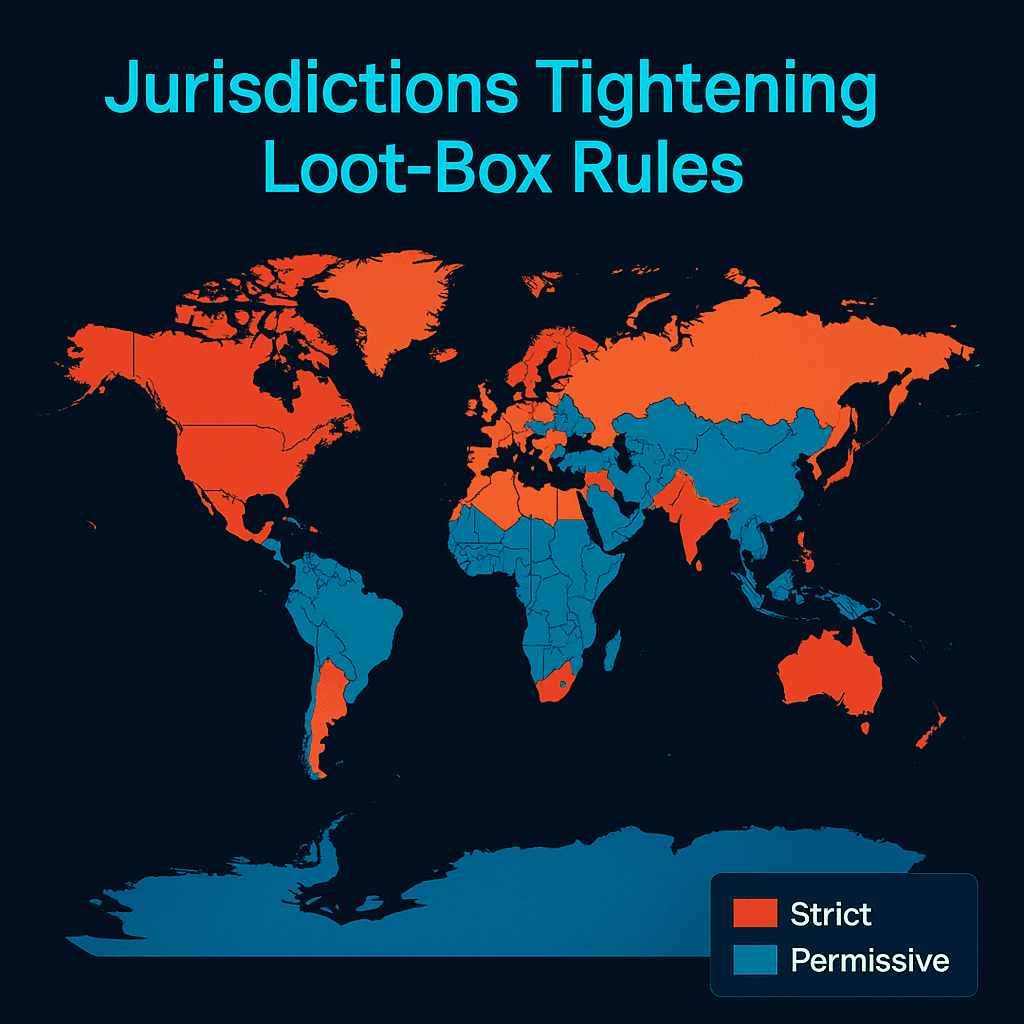

- On-chain loot boxes vs. national gambling rules

European consumer-protection and gambling watchdogs are revisiting random-number-generator (RNG) loot mechanics as “remote games of chance.” A pending EU policy brief warns that paid loot boxes may soon fall under gambling directives, pushing publishers toward deterministic NFT crafting (e.g., guaranteed rarity after N attempts) for compliance.

- KYC-gated secondary markets

Hong Kong’s upgraded VASP rule-book (licensing regime expanded January 2025, full enforcement from 1 June) restricts retail trading and forces marketplaces with flows above the “professional-investor” HK $8 m threshold to geo-fence non-verified users. In response, both Ronin and Immutable quietly pushed wallet-level jurisdiction tags and region blocking in mid-June, small, but telling, concessions aimed at keeping big-exchange listings onside.

Why it matters – In a capital-scarce market, regulatory risk = existential risk. Studios that can pitch a “MiCA-ready treasury, SOC-2 infrastructure and zero loot-box exposure” are already jumping the diligence queue. Multiple VCs now request a stand-alone compliance memo alongside the token-economics slide; founders who bake legal engineering into first-sprint architecture are the ones still signing term-sheets.

Quant outlook – what the numbers imply for Q3

Scenario map

-

Base case (55% odds): BTC trades 95-110 k; GameFi cap drifts sideways, top chains fight for wallet share, successful Telegram mini-apps recycle users into higher-value ecosystems (TON, Ronin, Sei).

-

Upside (25%): Alt-season sparks if BTC dominance sinks below 58 %—look for high-beta names (WEMIX, MASK) to re-rate 40-60 %.

-

Downside (20%): Another macro shock (FOMC hawkish surprise, geopolitical flare-up) drives BTC to sub-90 k; GameFi cap retests the US $17 billion June trough.

Actionable takeaways for builders & investors

Conclusion – are we at the bottom yet?

GameFi exited June with bruises on every major KPI except one: people keep showing up. The sector shrank in dollar terms, but wallet counts, mini-app downloads and developer head-count all crept higher. Capital is rationing rather than fleeing, and traditional giants, from Tencent to Sony, are quietly embedding blockchain hooks into familiar franchises.

Web3 gaming’s “Minecraft moment”, a title that is fun first and tokenized second, still hasn’t arrived. But the foundations being laid today (UC-low gas, cross-chain wallets, creator-share infra) mean the eventual breakout will likely look less like a quick pump and more like the next decade’s default gaming layer. For now, builders who survive the liquidity desert of 2025-H2 will emerge into a landscape with fewer competitors and a far more forgiving cost of user acquisition.

Grab a potion, repair your armor, and keep grinding; the dungeon may be brutal, but the loot table is finally starting to make sense.