Meme coins and majors alike are making headlines today as global equity markets cheer a robust U.S. jobs report and crypto traders pile into speculative favorites. MOODENG surged on the back of a high-profile Upbit listing, BONK ripped higher with ETF rumors, and SUI broke through key resistance after ETF-related momentum. Meanwhile, HYPE saw large whale accumulation, and Wormhole struggled despite a Coinbase listing. From Solana memecoins to Layer-1 rallies, today’s market mood is a blend of bullish speculation and institutional tailwinds.

Moo Deng (MOODENG)

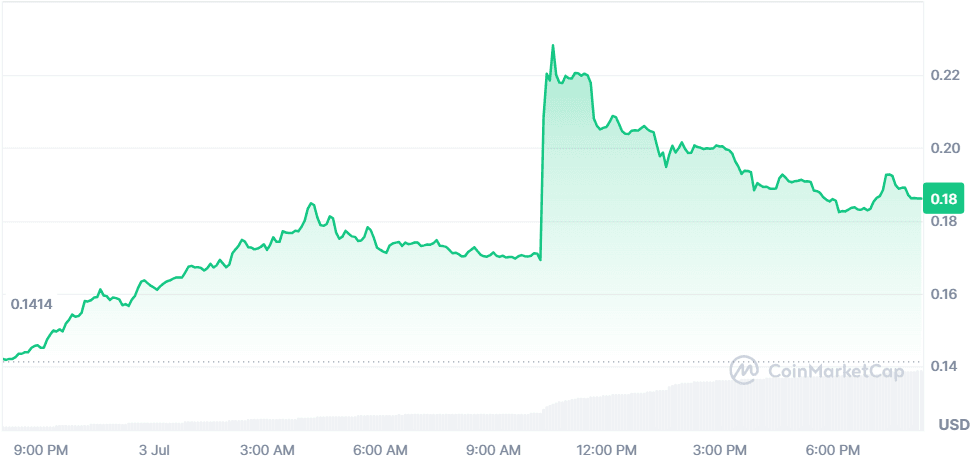

Price Change (24H): +29.22% Current Price: $0.1854

What happened today

MOODENG surged nearly 32% following its July 3rd listing on Upbit with KRW, BTC, and USDT pairs, driving a 1,113% volume explosion to $560M. The listing acted as the primary catalyst, bolstered by a broader 9.3% rise in the Solana meme coin sector. Technicals confirmed bullish momentum: the token broke key Fibonacci resistance, MACD turned positive, and RSI at 63 still leaves upside room. Vitalik Buterin’s nod to MOODENG’s “significant community interest” added further meme credibility.

Market Cap: $183.61M 24-Hour Trading Volume: $563.9M Circulating Supply: 989.97M MOODENG

Bonk (BONK)

Price Change (24H): +15.37% Current Price: $0.00001661

What happened today

BONK rallied 16% on speculation surrounding Tuttle Capital’s 2x BONK ETF filing, alongside continued strength in the Solana ecosystem. The meme sector rotated upward, with BONK outperforming DOGE and SHIB. Technicals look bullish with a breakout above $0.0000144, RSI at 63.33, and a positive MACD. The high 48% volume/market cap ratio suggests heavy trader interest and short-term momentum.

Market Cap: $1.33B 24-Hour Trading Volume: $647.6M Circulating Supply: 80.32T BONK

Sui (SUI)

Price Change (24H): +7.75% Current Price: $3.02

What happened today

SUI broke its 6-week downtrend after the Grayscale ETF inclusion news, rallying above the psychological $3 level. A 165% jump in trading volume reinforced buyer conviction, while RSI at 68.6 reflects strong short-term momentum. Open Interest jumped 19% in a day, and June’s $27.3B network volume points to solid on-chain usage and ecosystem growth.

Market Cap: $10.45B 24-Hour Trading Volume: $1.55B Circulating Supply: 3.45B SUI

Hyperliquid (HYPE)

Price Change (24H): +4.37% Current Price: $40.37

What happened today

A high-profile $8.77M whale buy pushed HYPE to test resistance near $41–42. Hyperliquid also leads the perpetuals market, handling 75% of decentralized perps volume ($220B in 30 days). Indicators are turning bullish again: RSI is neutral at 56.85, MACD is nearing a crossover, and the price is well above its 20-day SMA. New upgrades like HIP-3 and CoreWriter could expand utility.

Market Cap: $13.48B 24-Hour Trading Volume: $317.59M Circulating Supply: 333.92M HYPE

Wormhole (W)

Price Change (24H): -0.72% Current Price: $0.07163

What happened today

Despite a July 2 Coinbase listing, W slipped 0.72% as bearish momentum took hold. Technicals are weak: the token broke below a rising wedge, and 88% of circulating supply is whale-controlled, creating selloff risks. 92% of addresses are underwater, and influencer offloading worsened sentiment. MACD turned negative, and the token could retest $0.066 soon.

Market Cap: $333.29M 24-Hour Trading Volume: $82.57M Circulating Supply: 4.65B W

Global Market Snapshot

Markets are rallying, but geopolitical and tariff tensions are front and center. U.S. stocks surged on Thursday after a stronger-than-expected June jobs report, with the S&P 500 and Nasdaq hitting fresh all-time highs. Nonfarm payrolls rose by 147,000, beating estimates, and the unemployment rate dipped to 4.1%, dimming hopes for a near-term Fed rate cut.

Treasury yields spiked, and futures pricing now shows a 93% chance of no rate change this month. Meanwhile, President Trump’s tariff strategy took another step forward with a U.S.-Vietnam trade deal that imposes a 20% duty on Vietnamese imports and a striking 40% penalty on transshipped goods, aimed squarely at Chinese workaround tactics.

At the same time, markets are closely watching the unfolding Ukraine situation. The U.S. paused some weapons shipments to Kyiv, triggering backlash from allies and drawing sharp criticism from figures like Mike Pompeo. President Trump is scheduled to speak with Putin today, further raising stakes in the fourth year of the war. Despite this, investor sentiment remains risk-on. European equities opened higher, and the dollar strengthened against the euro and pound. However, uncertainty lingers, especially in emerging markets, as trade negotiations heat up globally, Thailand, Malaysia, and India may be next in line. The outlook remains bullish in equities, but fragile in geopolitics.

Closing Thoughts

Investor sentiment is running hot across both crypto and equities. In TradFi, the S&P 500 and Nasdaq hit new all-time highs on strong employment data, easing fears of a near-term recession while simultaneously reducing the likelihood of a Fed rate cut. Equities are showing confidence even amid Trump’s tariff diplomacy, signaling that markets are pricing in resilience despite geopolitical noise.

In crypto, participation is clearly concentrated in momentum-driven sectors, Solana meme coins and Layer-1s. MOODENG and BONK reflect retail appetite for high-beta plays, while SUI and HYPE capture the attention of more sophisticated traders with ETF exposure and whale activity. Wormhole’s weakness, on the other hand, is a cautionary signal: not every listing or headline translates into gains in this market. Liquidity, narrative, and volume remain king.