In a session driven by ecosystem upgrades and speculative flows, VIC stole the spotlight with a 120% rally, fueled by leveraged NFT staking and a surprise listing. FIS followed with a technical rebound backed by roadmap momentum, while TRUMP saw muted action amid regulatory scrutiny and token unlock concerns.

Ethereum stayed in focus with major scaling news and liquid staking shifts, even as prices dipped. Meanwhile, Solana held steady on real-world banking use cases in Japan. Today’s top movers reflected a sharp divergence, between tech-backed fundamentals and hype-charged tokens reacting to macro uncertainty.

Viction (VIC)

Price Change (24H): ▲ 120.68% Current Price: $0.3482

What happened today

VIC soared over 120% following the launch of Viction v3, introducing leveraged NFT staking that boosted staked assets by 120%. A surprise listing on a major exchange brought deep USDT liquidity, spiking volume by 1,300%. Chainlink integration added further momentum with a 45% jump in oracle activity. With RSI at 79.72 and whale accumulation draining exchange supply, VIC’s rally reflects both technical momentum and ecosystem strength.

Market Cap: $42.36M 24-Hour Trading Volume: $330.1M Circulating Supply: 121.63M VIC

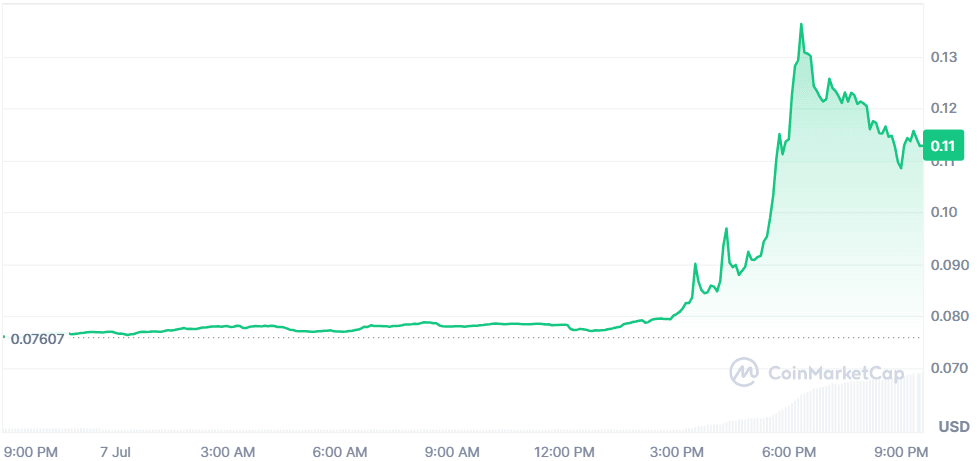

StaFi (FIS)

Price Change (24H): ▲ 48.39% Current Price: $0.1128

What happened today

StaFi surged nearly 49% as Q3 roadmap updates (AI staking, MEV integrations) renewed developer and retail interest. Oversold RSI (36.55) signaled a technical rebound, and the price broke above the 61.8% Fibonacci level. Altcoin sentiment supported the move, with the altcoin season index climbing 33% this week. BYDFi's recent listing continues to provide liquidity tailwinds.

Market Cap: $13.03M 24-Hour Trading Volume: $64.6M Circulating Supply: 115.53M FIS

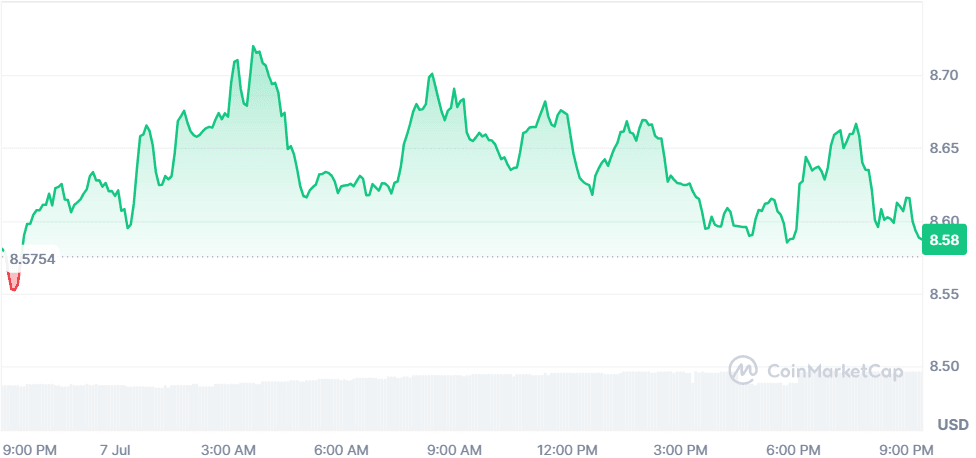

Official Trump (TRUMP)

Price Change (24H): ▼ 0.04% Current Price: $8.58

What happened today

TRUMP faced headwinds from a $782M token unlock that could increase sell pressure. Despite upcoming 2x leveraged ETFs launching July 16 and Trump’s crypto exposure exceeding $620M, regulatory risk looms. Political backlash and soft retail demand continue to weigh, with the token down 46% from its January highs.

Market Cap: $1.71B 24-Hour Trading Volume: $141.14M Circulating Supply: 199.99M TRUMP

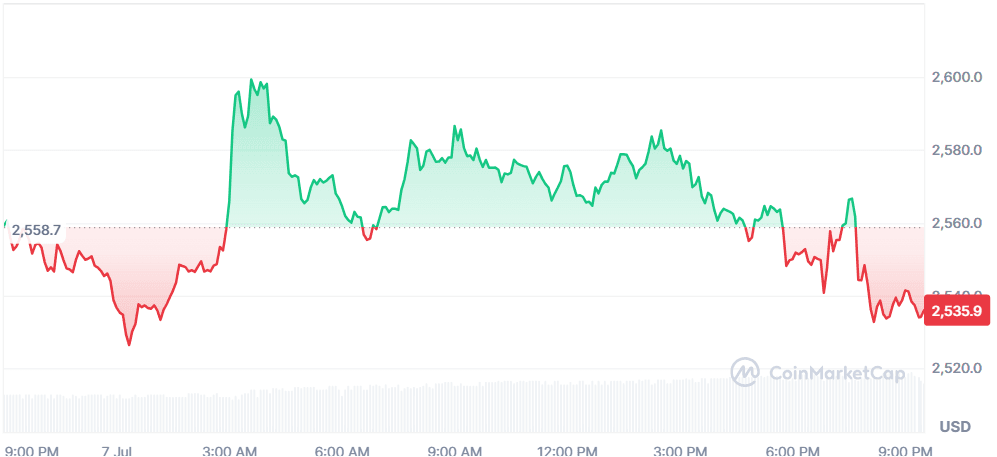

Ethereum (ETH)

Price Change (24H): ▼ 0.87% Current Price: $2,533.98

What happened today

Vitalik Buterin’s EIP-7983 proposal to cap gas at 16.77M aims to boost Ethereum’s network security and reduce DoS attack risk. Simultaneously, the “Gigagas Era” roadmap promises scalability to 10M TPS via zk-rollups. Institutional adoption in DeFi and asset tokenization continues to grow, though short-term price reflects broader market caution.

Market Cap: $305.89B 24-Hour Trading Volume: $16.88B Circulating Supply: 120.71M ETH

Solana (SOL)

Price Change (24H): ▼ 0.12% Current Price: $151.31

What happened today

SOL is holding steady as Japan’s Minna Bank launched a stablecoin pilot leveraging Solana for real-world payments and Web3 wallet integration. With $27.6T in stablecoin transactions globally last year, this marks a major milestone in traditional finance adoption. Solana’s scalability and low fees position it as a core player in Asia’s evolving fintech space.

Market Cap: $81.04B 24-Hour Trading Volume: $3.28B Circulating Supply: 535.57M SOL

Global Market Snapshot

European and U.S. markets opened the week with a mix of cautious optimism and underlying macro tension. European stocks closed higher across the board, France’s CAC 40 and Germany’s DAX climbed 0.4% and 1.1%, respectively, driven by anticipation of U.S. trade deal announcements and a stronger euro outlook. ECB officials projected the euro’s global rise amidst weakening U.S. dollar sentiment due to fiscal concerns, Trump’s tariff threats, and questions about Fed independence. The euro is up 14% YTD against the dollar.

Meanwhile, U.S. markets dipped. The Dow fell 350 points as investors waited for clarity on Trump’s tariff timeline. Robinhood’s controversial stock tokenization of OpenAI and SpaceX is under EU scrutiny after OpenAI disavowed any connection to the product, raising regulatory concerns.

Oil stocks underperformed on OPEC+’s surprise output hike, while tech remained strong, Uber hit an all-time high on bullish forecasts, and the industrials sector posted record intraday gains. However, Tesla fell 7% after Elon Musk announced a political party launch, unnerving Wall Street.

Closing Thoughts

Investor sentiment remains split between risk-on altcoin appetite and caution around macro-influenced large caps. VIC and FIS’s outsized rallies show traders are chasing momentum in low-cap assets with fresh catalysts, particularly those tied to staking, AI, or infrastructure upgrades.

TRUMP’s flat performance and token unlock drag, on the other hand, highlight the fragility of memecoin narratives when regulatory and liquidity headwinds come into play. Ethereum and Solana, both rooted in fundamental growth stories, suggest that institutions continue to favor scalable, secure ecosystems—even if short-term price action is sideways.

Globally, equity and FX markets showed how much politics and regulation are starting to shape capital flow. With the euro gaining ground amid U.S. tariff chaos and Robinhood’s tokenized stocks under EU fire, crypto is mirroring this narrative, where clarity and credibility draw attention, while hype without backing invites sell-offs. The divergence between Ethereum’s foundational upgrades and TRUMP’s volatility underscores this broader shift. Markets are risk-sensitive, but they’re not irrational.