Bitcoin breaking past $117K has stirred the entire crypto space into motion, lifting Ethereum, XRP, Cardano, and even meme coins like TRUMP along with it. Major catalysts range from ETF inflows and institutional treasury moves to geopolitical instability, all fueling the day’s buzz.

While ETH is basking in confidence from record-breaking ETF demand and a $475M buy pledge, XRP is riding on whale activity and global adoption signals. Cardano made waves with a wrapped token launch and on-chain treasury transparency, and TRUMP surged off hype around Justin Sun’s $100M bet and TRON integration. Across the board, attention is shifting rapidly to tokens with either institutional alignment or community momentum.

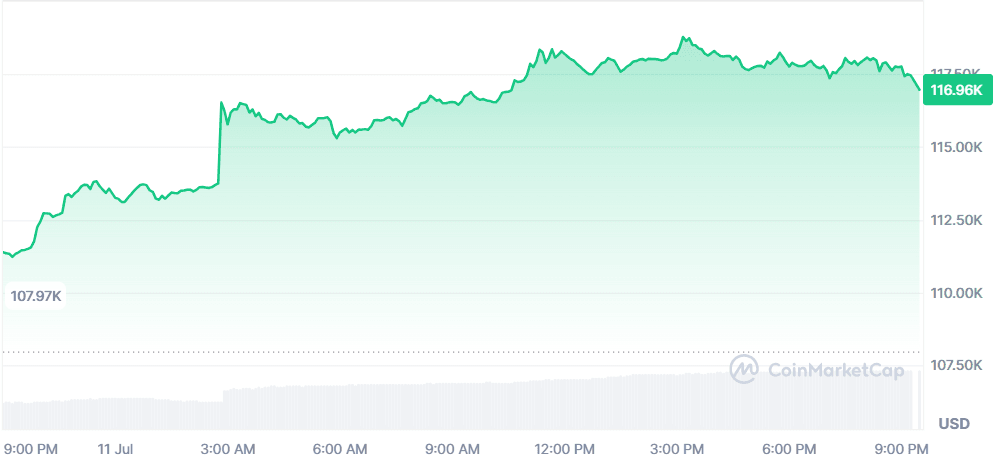

Bitcoin (BTC)

Price Change (24H): +5.03% Current Price: $117,052.55

What happened today

Bitcoin surged to a new all-time high, topping $117K, after President Trump called for aggressive Federal Reserve rate cuts and celebrated booming crypto and tech markets on Truth Social. The announcement fueled a sharp rally across digital assets. Spot Bitcoin ETFs also reported nearly $1.2B in daily inflows, signaling strong institutional demand. Analysts at BitBull Capital cite continued ETF flows and macro momentum as key drivers, though warn of possible short-term pullbacks.

Market Cap: $2.32T 24-Hour Trading Volume: $128.64B Circulating Supply: 19.89M BTC

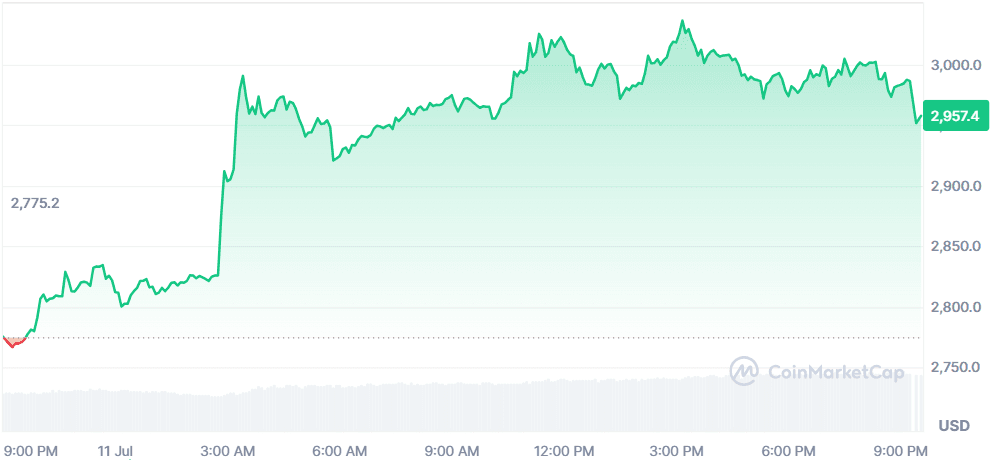

Ethereum (ETH)

Price Change (24H): +6.56% Current Price: $2,956.00

What happened today

Ethereum rallied on the back of multiple institutional developments. Joe Lubin’s SharpLink announced a $475M ETH acquisition plan, mirroring MicroStrategy’s Bitcoin treasury strategy. Simultaneously, BlackRock’s Ether ETF (ETHA) recorded $158M in daily inflows, signaling institutional confidence in Ethereum’s long-term utility. The Ethereum Foundation also unveiled a revamped Ecosystem Development initiative to accelerate adoption and build global partnerships.

Market Cap: $356.83B 24-Hour Trading Volume: $43.5B Circulating Supply: 120.71M ETH

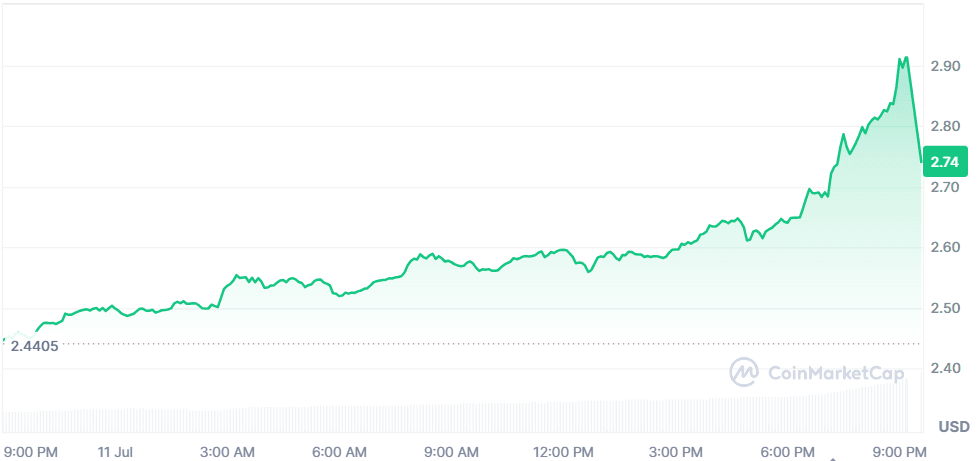

XRP (XRP)

Price Change (24H): +11.74% Current Price: $2.74

What happened today

XRP rallied to a 7-week high, driven by whale accumulation, Ripple’s expanded Web3 insurance pilot in Kenya using RLUSD, and renewed optimism following legal wins against the SEC. Ripple’s partnership with BNY Mellon to custody RLUSD further legitimizes its stablecoin ecosystem. Meanwhile, speculation over a potential XRP ETF listing and strong retail activity in Asian markets add momentum. Whale wallets now control over 47.3B XRP.

Market Cap: $161.87B 24-Hour Trading Volume: $13.56B Circulating Supply: 59.06B XRP

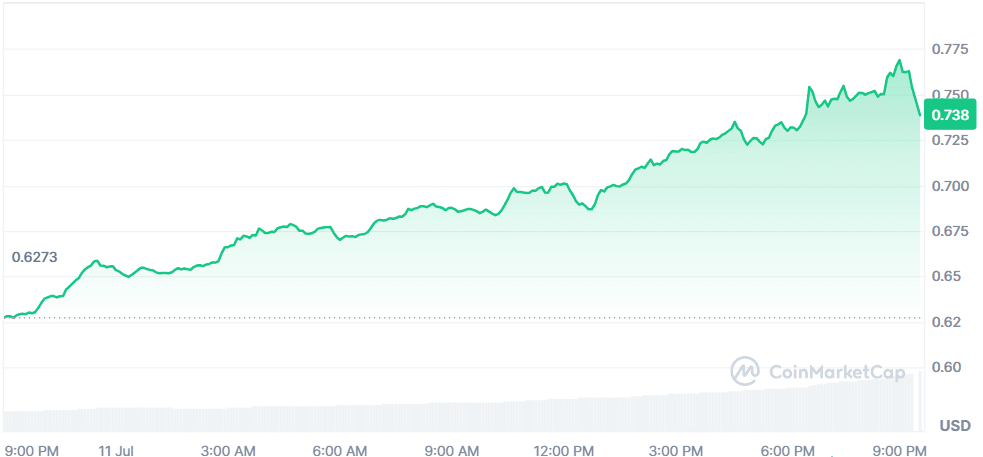

Cardano (ADA)

Price Change (24H): +16.34% Current Price: $0.7321

What happened today

Cardano surged after its Foundation published a $659.1M on-chain treasury report, revealing 15% of holdings in Bitcoin highlighting diversification and fiscal transparency. 17.1M ADA were earned through staking in 2024. A new wrapped token (cAP3X) was also announced, aiming to boost Cardano’s interoperability with the Apex Fusion ecosystem. The launch is seen as a DeFi expansion catalyst and a move toward Cardano-EVM compatibility.

Market Cap: $25.91B 24-Hour Trading Volume: $2.69B Circulating Supply: 35.38B ADA

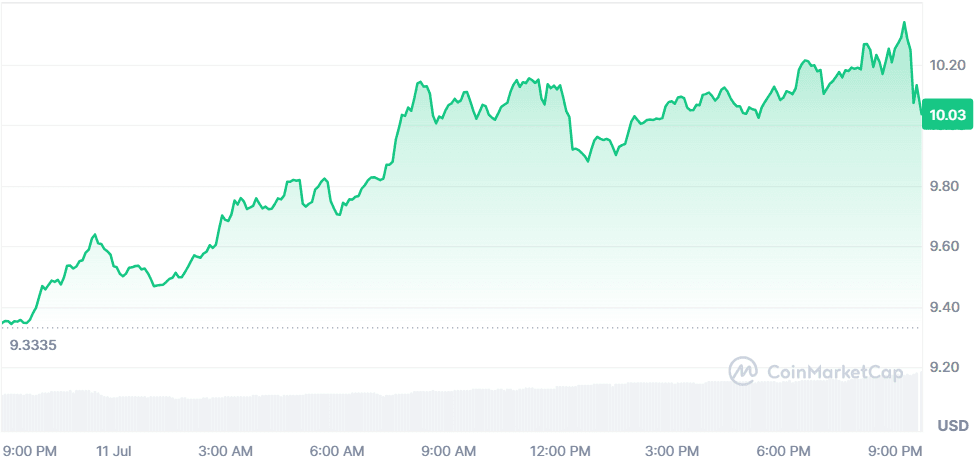

Official Trump (TRUMP)

Price Change (24H): +7.28% Current Price: $10.03

What happened today

TRUMP token spiked after Justin Sun pledged a $100M buy commitment and announced its migration to the TRON blockchain. The token now benefits from TRON’s low fees and high USDT volume, appealing to meme coin traders. Political narratives, including alignment with Trump’s MAGA movement and future utility in Truth Social’s loyalty programs, are fueling speculation. A technical breakout and high volume have added to the bullish pressure.

Market Cap: $2B 24-Hour Trading Volume: $868.37M Circulating Supply: 199.99M TRUMP

Global Market Snapshot

Markets turned sharply risk-off heading into the weekend as trade war fears reignited across the Atlantic. President Trump’s abrupt announcement of a 35% tariff on Canadian imports citing fentanyl concerns and looming tariffs on the EU sent shockwaves through global equities.

The Stoxx Europe 600 dropped 1.1%, with the DAX and CAC 40 losing nearly 0.9%. U.S. indices also retreated after Thursday’s highs, with the Dow falling over 330 points and the S&P 500 down 0.4%. Investors are bracing for more aggressive trade policies, especially with Trump hinting at blanket tariffs of up to 20% on remaining partners.

Meanwhile, the Fed’s rate path remains uncertain. While June minutes hinted at cuts, JPMorgan CEO Jamie Dimon warned of a higher-than-expected risk of a hike, citing inflation persistence. Tariffs and trade disruptions are starting to weigh on sentiment just as earnings season kicks off. In Asia, EV sales in China are eating into oil demand, though strategic hoarding masks the impact. EU-China tensions also quietly escalated, with brandy duties and medical device restrictions exacerbating an already sour trade relationship all while the U.S. shifts the center of gravity with tariff threats.

Closing Thoughts

Investor sentiment, both in traditional and crypto markets, is defined by divergence. Equities saw a risk-off pullback after Trump’s new tariff barrage hit Canada and hinted at further blows to the EU. As uncertainty clouds global trade and interest rate expectations, crypto has positioned itself as a hedge and a growth narrative especially as Bitcoin ETFs draw billions and Ether gains traction as an institutional asset. Traders are rotating into coins tied to tangible catalysts and ecosystem growth, not just memetic hype.

What’s clear from today’s action is that institutional crypto is dominating participation Bitcoin, Ether, and XRP all saw whale or ETF-led moves while retail still has a foothold in speculative plays like TRUMP. Sectors that bridge traditional finance (like Ripple's RLUSD) or expand interoperability (Cardano and Apex) are gaining traction. As macroeconomic volatility deepens, crypto seems to be benefiting from being just uncertain enough to look promising.