In a market pulsing with volatility, today’s spotlight fell on a mix of heavyweight and high-velocity movers. Bitcoin (BTC) wavered just below its recent peak as institutional inflows and strategic bond buys signaled long-term confidence.

Meanwhile, altcoins like Keeta (KTA) and Build On BNB (BOB) erupted with explosive gains, riding on breakout narratives and early-stage hype. Sophon (SOPH) rallied on new listings and its zk-powered infrastructure pitch, while WEMIX surged on ecosystem utility even as it grappled with delisting pressure. From L1s and meme coins to GameFi and ZK rollups, the capital rotation is becoming hard to ignore.

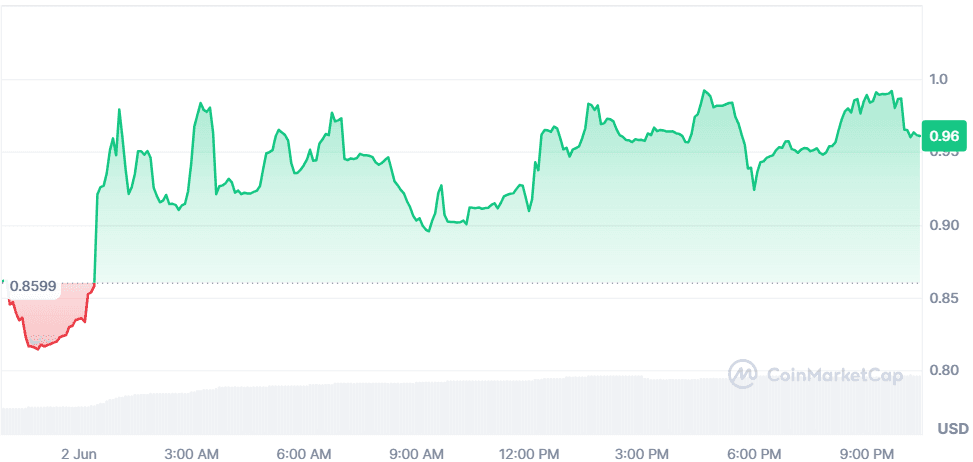

Keeta (KTA)

Price Change (24H): +15.20% Current Price: $0.9610

What happened today

Keeta soared to a new all-time high with a market cap briefly exceeding $397M before settling at $384M. This breakout follows its reputation as a high-performance L1 blockchain designed for seamless cross-chain asset transfers. Backed by a former Google CEO and boasting 10M+ TPS, Keeta is being compared to a functional version of XRP — triggering massive investor interest with a 25% overnight surge.

Market Cap: $384.4M 24-Hour Trading Volume: $22.39M Circulating Supply: 400M KTA

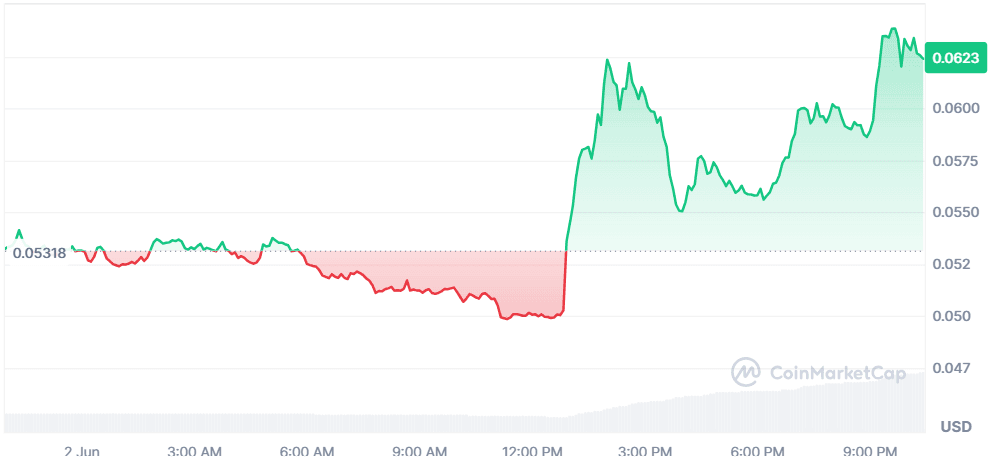

Sophon (SOPH)

Price Change (24H): +16.74% Current Price: $0.06238

What happened today

SOPH was listed on Bithumb, boosting visibility and volume. The token is at the center of Binance’s 20th HODLer Airdrop, drawing new holders from BNB staking. Built on the Validium zk-stack, Sophon aims to revolutionize AI-powered gaming and on-chain infrastructure. With over 67M transactions, $70M+ raised, and a vibrant L2 roadmap, this ZK modular chain is riding the AI x Gaming narrative with strong VC backing.

Market Cap: $124.77M 24-Hour Trading Volume: $411.28M Circulating Supply: 2B SOPH

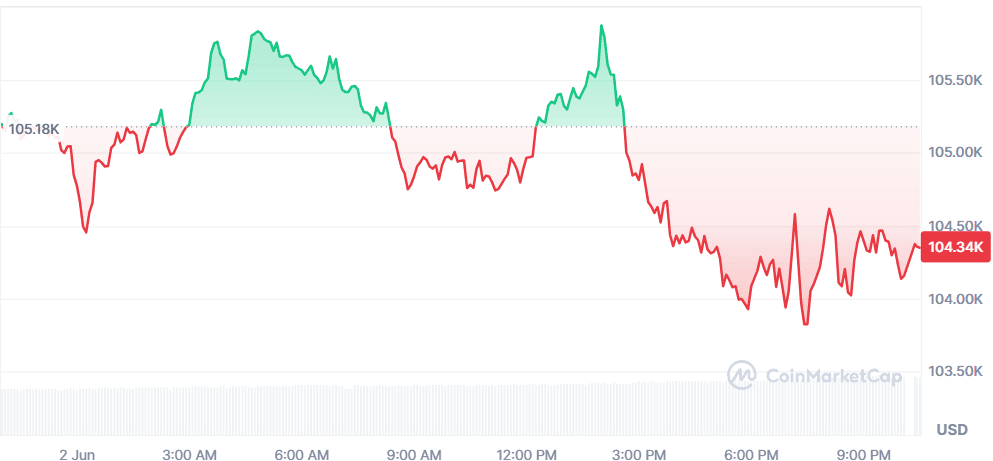

Bitcoin (BTC)

Price Change (24H): -0.73% Current Price: $104,331.35

What happened today

Despite a minor dip, BTC remains in the spotlight as Metaplanet acquired 1,088 BTC, moving closer to its 10K coin target. Meanwhile, $11.5B in short positions hang in the balance as Bitcoin nears its ATH, creating a high-stakes setup. Sberbank's new BTC-linked bonds signal growing institutional interest in Russia. Self-custody trends continue to rise, pointing to increased investor confidence.

Market Cap: $2.07T 24-Hour Trading Volume: $43.52B Circulating Supply: 19.87M BTC

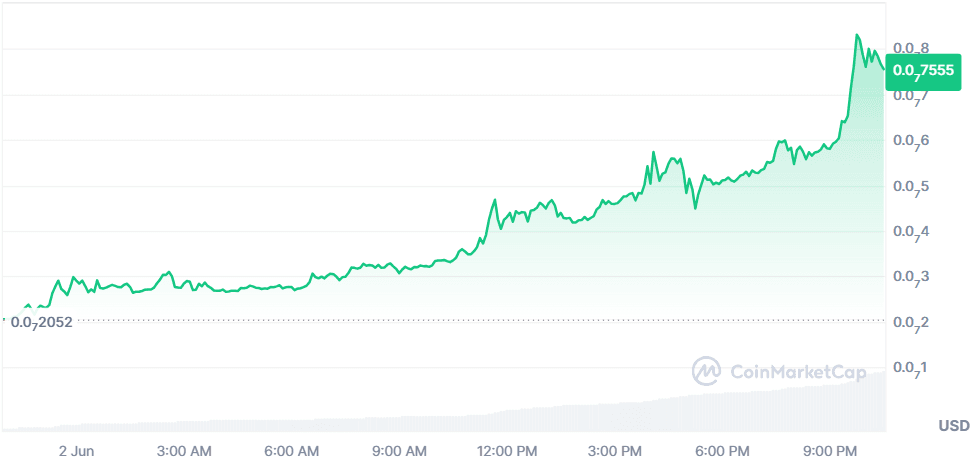

Build On BNB (BOB)

Price Change (24H): +239.60% Current Price: $0.07624

What happened today

BOB exploded in volume and price following rumors of an upcoming Binance listing. Currently live on Binance Alpha, the meme token is drawing comparisons to early-stage PEPE and FLOKI. Holder count jumped significantly since May 26th, indicating growing whale and retail interest. A low-cap rocket with meme appeal and potential 10–50x upside in a bullish cycle.

Market Cap: $32.07M 24-Hour Trading Volume: $22M Circulating Supply: 420.69T BOB

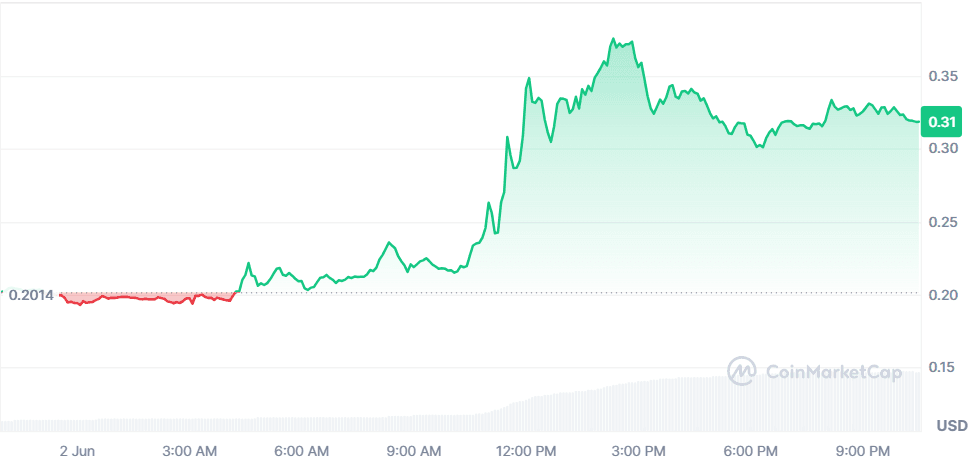

WEMIX (WEMIX)

Price Change (24H): +58.07% Current Price: $0.3187

What happened today

WEMIX went live in MIR4, enabling fully on-chain payments for over 20M users. This integration closes the loop between gameplay and economic value, with buybacks and deflationary tokenomics adding momentum. However, the token also faced a blow with delistings from major Korean exchanges. Despite this, investor interest spiked with $31.13M in volume and a significant price surge.

Market Cap: $134.44M 24-Hour Trading Volume: $31.13M Circulating Supply: 421.79M WEMIX

Global Market Snapshot

Global markets reacted cautiously as President Trump announced a shocking tariff hike on steel imports to 50%. The U.S. steel price is expected to surge, while European manufacturers could benefit from redirected supply. Meanwhile, Trump and China’s President Xi are expected to speak soon, following escalating trade tensions.

With uncertainty mounting and tariff volatility disrupting supply chains, markets are pricing in both inflationary pressures and geopolitical unpredictability. U.S. indices opened lower, reflecting concerns over disrupted global trade routes and corporate earnings pressure.

Closing Thoughts

Investor sentiment is beginning to splinter between safety and speculation. On one hand, Bitcoin is drawing serious institutional activity: Sberbank bonds, Metaplanet’s bulk buys, and self-custody surges all reinforce BTC’s role as a macro hedge. On the other, altcoins like BOB and KTA are capturing attention through community-driven momentum and ambitious narratives. The result is a market that’s neither entirely risk-off nor fully euphoric but clearly active, with liquidity finding new stories to follow.

Today’s winners hint at which sectors are drawing real participation. L1 infrastructure (KTA), GameFi (WEMIX), and zk-powered chains (SOPH) are all seeing renewed interest, while meme-fueled breakouts like BOB suggest retail is re-entering. Despite macro headwinds like tariff tensions and global steel disruption, the crypto market is maintaining its tempo fueled by innovation, speculation, and strategic plays across both ends of the risk spectrum.