While global markets grappled with softening growth forecasts and a fresh wave of tariff-driven uncertainty, the crypto market saw a surge in retail energy, especially among meme and AI-linked tokens.

ZEUS skyrocketed in visibility following a massive social media endorsement, BOB extended its meme coin dominance on BNB Chain, and ROOT's Layer 1 narrative found renewed bullish interest. Meanwhile, MIND entered the AI Agent race with major launch buzz, and SOPH rode exchange listings and ecosystem grants to short-term highs. Amid geopolitical jitters and central bank anticipation, traders are still chasing momentum wherever it sparks, especially in coins tapping into community, culture, and next-gen tech.

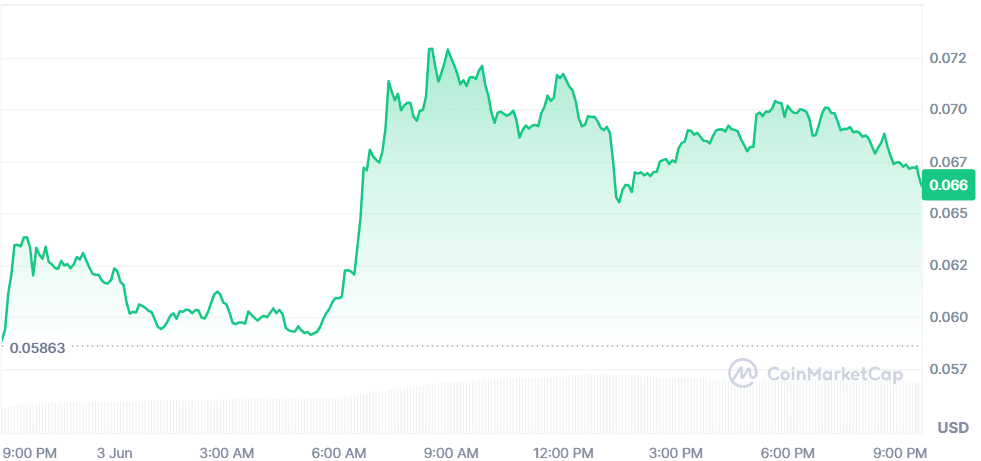

Build on BNB (BOB)

Price Change (24H): +73.27% Current Price: $0.06131

What happened today

BOB surged to a new all-time high driven by its explosive momentum as the top meme coin on the BNB Chain. Backed by a Binance community initiative, BOB has rallied over 200% this week, gaining traction from over 2,500+ new holders and top trading volume on PancakeSwap and BingX. Technical indicators show strong bullish sentiment despite an overbought RSI of 79.70. The coin continues to trend due to viral social media hype, significant liquidity, and support from the Binance ecosystem.

Market Cap: $47.6M 24-Hour Trading Volume: $48.98M Circulating Supply: 420.69T BOB

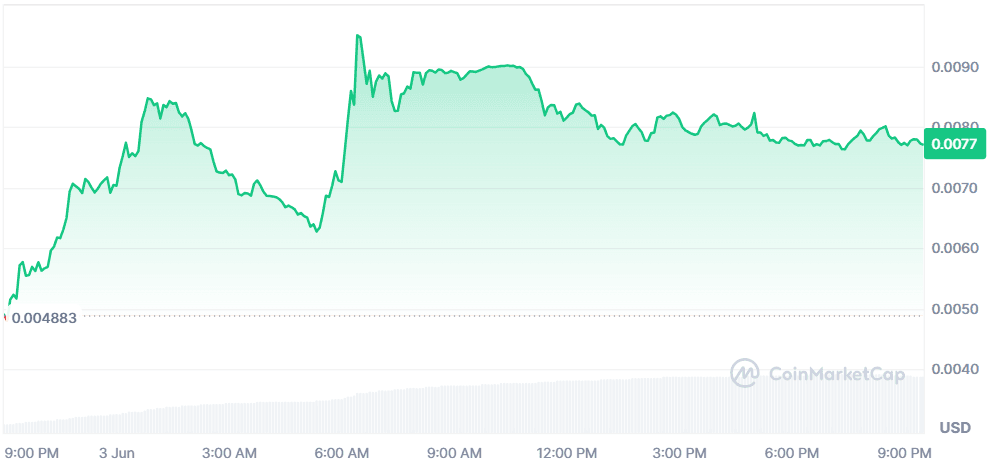

The Root Network (ROOT)

Price Change (24H): +38.77% Current Price: $0.007743

What happened today

ROOT posted a 101% surge as it gained rapid momentum across crypto platforms. Backed by Futureverse and designed as a Layer 1 chain for the open metaverse, the token is consolidating with bullish technical signals pointing toward a breakout above $0.0095. Its reward program Cycle 3 also launched today, boosting community activity. Trading volume spiked by 831%, suggesting increasing conviction among buyers.

Market Cap: $17.63M 24-Hour Trading Volume: $13.35M Circulating Supply: 2.27B ROOT

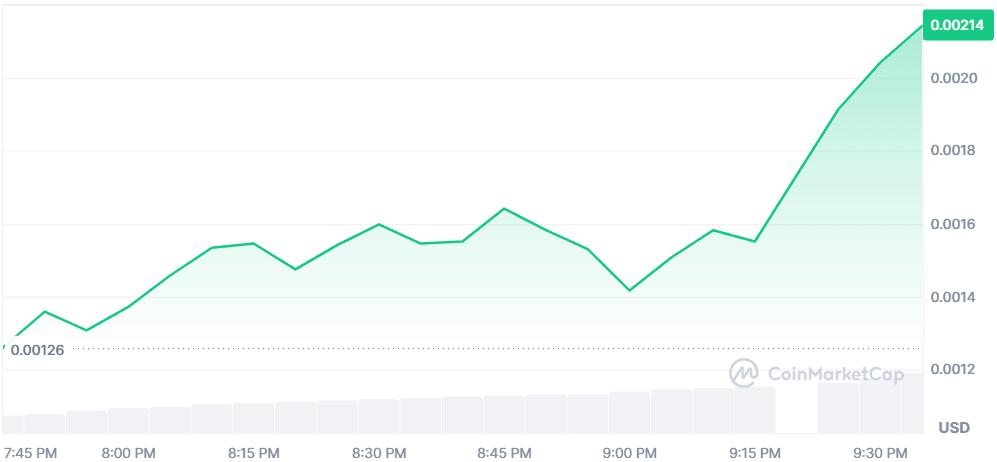

Mind of Pepe (MIND)

Price Change (24H): +63.38% Current Price: $0.002153

What happened today

MIND launched after raising $12.5M in its presale and is trending as one of the most hyped AI Agent cryptos. Positioned as a Binance listing candidate, MIND leverages a unique AI Terminal that delivers real-time trading signals. Community excitement is peaking due to strong engagement on social platforms. Liquidity is fully locked ($375K for 11 months), adding investor confidence.

Market Cap: $174.86M (unconfirmed) 24-Hour Trading Volume: $834.91K Circulating Supply: 100B MIND (self-reported)

Sophon (SOPH)

Price Change (24H): +3.43% Current Price: $0.06623

What happened today

SOPH climbed over 40% intraday after being listed on Bithumb, sparking Korean retail interest. Its rally is supported by partnerships with Mintify for NFT collections and a $4M developer grant aimed at expanding Web3 entertainment use cases. With exposure on Binance, Upbit, and Gate.io, SOPH is well-positioned to avoid typical post-airdrop dumps.

Market Cap: $132.46M 24-Hour Trading Volume: $672.59M Circulating Supply: 2B SOPH

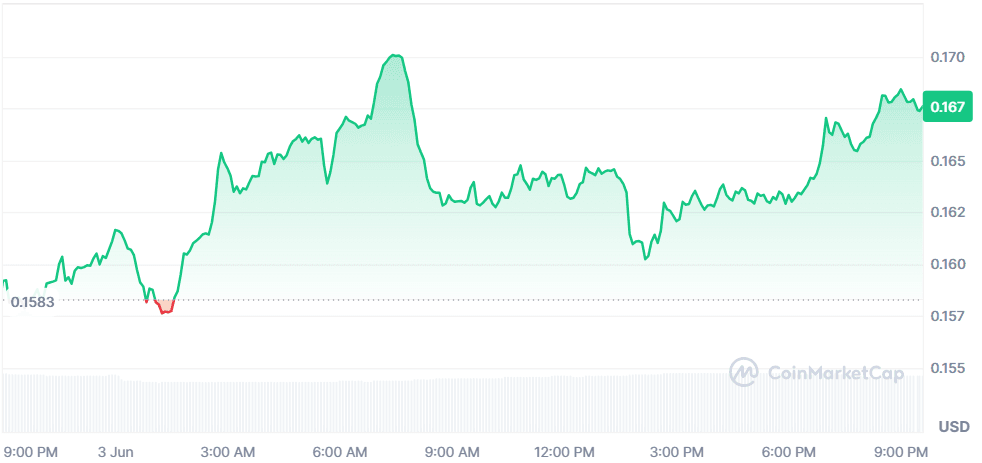

Zeus Network (ZEUS)

Price Change (24H): +5.94% Current Price: $0.1676

What happened today

ZEUS gained attention after being promoted by WorldStarHipHop’s official Instagram account (45M followers). The viral mention has driven new liquidity and retail participation, positioning ZEUS as a breakout meme coin for summer. Social momentum remains strong, with many traders speculating on rapid upside due to increased cultural relevance.

Market Cap: $64.13M (unverified) 24-Hour Trading Volume: $6.78M Circulating Supply: 382.77M ZEUS (self-reported)

Global Market Snapshot

Markets treaded water amid a swirl of trade uncertainty and central bank expectations. Euro zone inflation cooled to 1.9%, below the ECB’s target, reinforcing bets on a rate cut this Thursday. European indices closed marginally higher, with Germany’s DAX up 0.64%. In the U.S., equities were lifted by AI optimism as Nvidia led chip stocks higher, even as the OECD slashed U.S. growth forecasts to 1.6%, citing tariff chaos and weak investment. Trump's 50% steel tariff took effect today, prompting warnings of countermeasures from the EU. With global growth projections dimming and inflation forecasts diverging, traders are bracing for a volatile summer.

Closing Thoughts

Across markets, one thing is clear: sentiment is split between caution and speculation. Equities are drifting under the weight of policy ambiguity and a downgrade in U.S. growth projections, while crypto investors are leaning risk-on—driven more by hype, virality, and narrative than fundamentals. Memecoins like ZEUS and BOB are thriving off cultural exposure, while AI narratives (MIND) and ecosystem utility (SOPH, ROOT) are pulling in volume from those betting on the next breakout vertical.

Today’s data shows stronger participation in speculative and trend-sensitive sectors, rather than value-driven plays. Crypto volumes rose sharply in microcap tokens with social catalysts, reflecting a renewed appetite for short-term plays as traders hedge against broader macro stagnation. In this environment, momentum remains the trade and coins that can capture either a narrative or a crowd are the ones lighting up the charts.