When 2025 began, few analysts predicted that an exchange token would emerge as the year's standout performer. Yet as we approach the final quarter, Binance Coin has delivered a staggering year-to-date gain of approximately 129.89 percent, dramatically outpacing both Bitcoin's 25 percent rise and Ethereum's 30 percent advance. In a year defined by regulatory pivots, institutional capital flows, and a dramatic shift in Washington's crypto stance, BNB's performance stands as one of crypto's most unexpected success stories.

The token that began its life as a simple fee discount mechanism on the world's largest exchange has evolved into the centerpiece of a thriving blockchain ecosystem. BNB now powers the BNB Chain, a network that processes millions of daily transactions, hosts thousands of decentralized applications, and has emerged as a formidable competitor to Ethereum and Solana in the race for blockchain dominance. With 58 million monthly active addresses as of September and total value locked approaching $17 billion, the BNB Chain ecosystem has matured from exchange-centric utility into a full-spectrum blockchain platform.

This performance comes against a backdrop of profound transformation. The March 2025 Strategic Bitcoin Reserve announcement by President Donald Trump positioned the United States as the "crypto capital of the world," while the October pardon of Binance founder Changpeng Zhao removed a major regulatory overhang that had clouded the exchange and its native token. Meanwhile, the U.S. Securities and Exchange Commission under new leadership has adopted a markedly different posture toward digital assets, and VanEck's filing for the first U.S. BNB exchange-traded fund in May signals growing institutional appetite for exchange tokens.

Yet BNB's rally raises fundamental questions about the crypto market's evolution. Does its outperformance represent a sustainable shift toward utility-driven tokens, or is it merely a reflection of Binance's continued market dominance? Can an exchange token, inherently tied to a centralized entity, sustain momentum as decentralization remains crypto's North Star? And what does BNB's success say about where institutional capital is flowing in an increasingly mature digital asset landscape?

Below we dive deep into the structural, regulatory, and market factors that propelled BNB's exceptional 2025 performance. We explore the ecosystem developments that transformed BNB from exchange token to blockchain infrastructure, assess the regulatory winds that shifted from headwinds to tailwinds, and evaluate whether this rally represents a template for future market cycles or an anomaly unlikely to repeat.

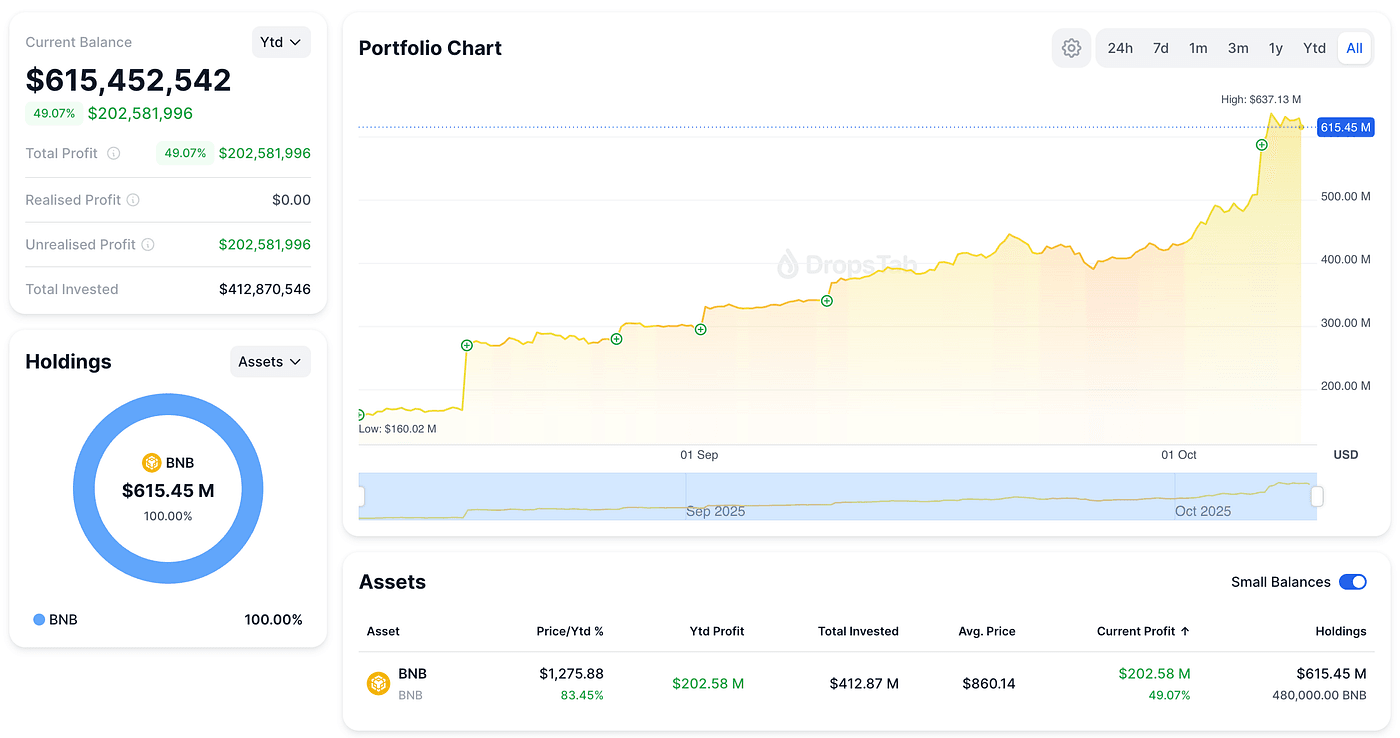

The Year of BNB: By the Numbers

Understanding BNB's 2025 trajectory requires examining the raw performance data against both historical context and peer comparison. The numbers tell a story of sustained momentum punctuated by key catalysts.

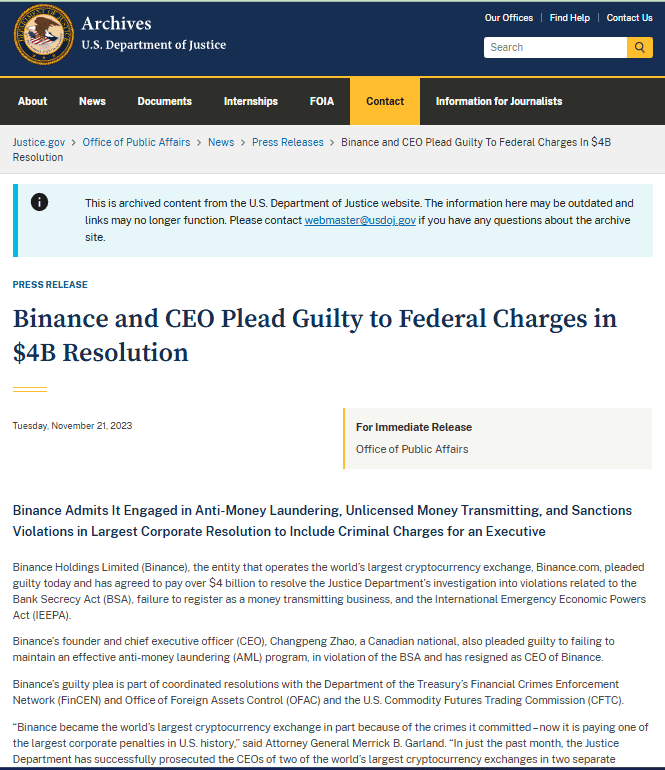

BNB entered 2025 trading in the $600 to $700 range, having weathered the regulatory storm of 2023 that saw Binance settle with U.S. authorities for $4.3 billion and its founder plead guilty to Bank Secrecy Act violations. By late October, the token had surged above $1,200, briefly touching an all-time high of $1,370. This represented not just recovery from past troubles but a complete revaluation of BNB's role in the broader crypto ecosystem.

The comparative performance metrics underscore just how anomalous BNB's year has been. While Bitcoin, often considered the market's bellwether, delivered solid gains of approximately 25 percent year-to-date, it remained constrained by macro headwinds including Federal Reserve policy uncertainty and geopolitical tensions. Ethereum, despite the launch of spot ETFs and growing treasury company adoption, managed a respectable 30 percent gain but continued to struggle with Layer 2 coordination challenges and declining fee revenues on its base layer.

Among major competitors, Solana trading around $185 to $195 in late October showed resilience but lacked BNB's explosive momentum, while Toncoin and other Layer 1 alternatives remained range-bound. Even other exchange tokens failed to mirror BNB's performance, suggesting that Binance-specific factors rather than sector-wide trends drove the outperformance.

On-chain metrics paint an equally impressive picture. By mid-October, BNB Chain was processing approximately 26.7 million transactions daily with 3.48 million active addresses, placing it among the busiest general-purpose blockchains. Trading volume data showed BNB Chain hitting $178 billion in 24-hour decentralized exchange volume in September, eclipsing Solana's $143 billion and demonstrating genuine economic activity rather than mere speculative fervor.

Market capitalization tells another dimension of the story. BNB briefly overtook XRP to reclaim the third position among non-stablecoin cryptocurrencies in late October, with a market cap touching $161 billion. While this positioning fluctuated with market conditions, it represented a significant milestone for what many still viewed as primarily an exchange utility token.

Volatility metrics offered particularly interesting insights. Despite the massive gains, BNB maintained relatively lower volatility compared to smaller-cap altcoins, suggesting a maturing investor base and deeper liquidity. The token's correlation with Bitcoin, while still present, had weakened throughout the year as BNB increasingly traded on ecosystem-specific catalysts rather than macro sentiment alone.

Volume analysis revealed institutional participation growing throughout the year. Futures open interest doubled from $600 million to $1.2 billion by October according to CoinGlass data, indicating sophisticated market participants were building exposure rather than just retail speculation driving prices.

Yet perhaps the most compelling metric was supply dynamics. Through its aggressive token burn program, which we will explore in detail, Binance had reduced BNB's circulating supply to approximately 137.74 million tokens by late October, down from an initial 200 million at launch. This represented more than 64 million tokens permanently removed from circulation, creating genuine scarcity as demand surged.

Inside the BNB Ecosystem Rebuild

Behind BNB's price performance lies a more fundamental story: the transformation of BNB Chain from a Binance-centric network into a credible multi-chain ecosystem capable of competing with established Layer 1 platforms. This rebuild, years in the making but accelerating dramatically in 2025, provided the utility foundation that justified revaluation.

The BNB Chain ecosystem comprises three primary infrastructure components, each serving distinct but complementary functions. BNB Smart Chain, the EVM-compatible execution layer launched in 2020, remains the workhorse handling the vast majority of transactions and hosting the sprawling DeFi ecosystem. opBNB, an Optimistic Rollup layer designed for high-throughput applications, provides scalability for gaming, social applications, and high-frequency trading platforms. BNB Greenfield, the decentralized storage network, rounds out the stack by offering data availability and storage primitives increasingly critical for Web3 applications.

Total value locked across the ecosystem presents a fascinating case study in DeFi resilience. Starting the year around $5.5 billion, TVL surged to peak above $17 billion in September before stabilizing around $8.6 to $9.5 billion by late October according to DeFiLlama data. While these fluctuations initially appear concerning, context matters. The September spike coincided with the explosive growth of memecoin launchpads like Four.meme, which drove temporary liquidity inflows before normalizing. The stabilization around $8.6 to $9.5 billion, up approximately 56 to 73 percent year-over-year from the January baseline of $5.52 billion, represents more sustainable growth tied to core protocol adoption rather than speculative mania.

PancakeSwap, BNB Chain's flagship decentralized exchange, exemplifies this maturation. With TVL of approximately $3.7 billion as of Q4 2025, PancakeSwap maintained its position as one of crypto's largest DeFi protocols. More impressively, it recorded $772 billion in Q3 trading volume, a 42 percent jump from the previous quarter. In September, PancakeSwap briefly overtook Uniswap in trading volume, a symbolic milestone that demonstrated BNB Chain's ability to compete on the most fundamental DeFi metric.

The emergence of Aster, a cross-chain perpetual trading protocol, represented a particularly important ecosystem development. Launched in September 2025, Aster surpassed 2 million users and $2 billion in TVL within weeks according to Messari data. On September 28, Aster overtook Solana in perpetual DEX volume, demonstrating that BNB Chain could compete not just in spot trading but in sophisticated derivatives markets. Though DeFiLlama later removed some of Aster's data citing suspicious correlations with Binance volume, the protocol's rapid user growth signaled genuine product-market fit for BNB-native perpetuals.

Lista DAO emerged as another cornerstone protocol, providing liquid staking derivatives that improved capital efficiency across the ecosystem. With TVL surpassing $2.85 billion and over 80 million of its USD1 stablecoin in circulation, Lista exemplified how BNB Chain was developing its own DeFi primitives rather than simply copying Ethereum patterns. The protocol's recognition for Binance Launchpool assets created unique flywheel effects where staking on BNB Chain offered opportunities unavailable on competing platforms.

Technical infrastructure improvements provided the foundation for this ecosystem growth. The Scalable DB upgrade implemented in October restructured BNB Smart Chain's data architecture, enabling faster synchronization, lower latency for validators, and improved performance for large-scale applications. Gas fees collapsed to 0.05 Gwei, a 98 percent drop since April 2024, while block times averaged 0.75 seconds with 1.875-second finality. These improvements weren't just incremental tweaks but represented fundamental capacity expansion positioning BNB Chain to handle 100 million daily transactions at full load.

Perhaps most strategically significant was BNB Chain's pivot toward real-world asset tokenization and institutional DeFi. Partnerships with Ondo Finance, Kraken, Franklin Templeton's Benji platform, and Circle's USYC brought tokenized stocks, treasuries, and institutional-grade stablecoins onto BNB Chain. As Sarah S., BD Head at BNB Chain, explained in an October interview, the network was positioning for a future where "the next wave of TVL growth will come from real-world assets and institutional DeFi - especially as on-chain interest-bearing products become more attractive."

Developer activity metrics told a complementary story. With over 4,000 active dApps deployed across DeFi, NFTs, gaming, and social applications, BNB Chain had achieved meaningful developer diversification. Ecosystem grants programs, hackathons, and partnerships with infrastructure providers like YZi Labs helped attract builders, while CZ's strategic advisory role in various projects provided both capital and credibility.

The memecoin phenomenon that dominated much of 2025's attention deserves nuanced analysis. Four.meme, BNB Chain's answer to Solana's Pump.fun, recorded 47,800 unique token contracts created on October 8 alone. While skeptics correctly noted much of this represented speculative froth, the cultural energy and user acquisition it brought proved valuable. BNB Chain captured 11.4 percent of global meme-trading volume by late 2025, closing in on Ethereum's 12 percent. More importantly, many users who initially came for memecoins stayed for DeFi, converting temporary attention into sticky liquidity.

Institutional and Regulatory Shifts

While ecosystem development provided the fundamental backdrop, regulatory and institutional shifts catalyzed BNB's 2025 revaluation. The transformation from regulatory pariah to politically connected platform represents one of the most dramatic narrative reversals in recent crypto history.

The November 2023 settlement that saw Binance plead guilty to Bank Secrecy Act violations, pay $4.3 billion in fines, and watch its founder serve prison time cast a long shadow. Yet paradoxically, this legal resolution - however painful - provided clarity that ultimately benefited BNB. With the worst-case scenario behind them rather than looming ahead, investors could finally price in known rather than unknown risks.

President Trump's October 23 pardon of Changpeng Zhao accelerated this recovery narrative dramatically. The White House justified the decision by claiming Zhao "was prosecuted by the Biden Administration in their war on cryptocurrency" and noting "no allegations of fraud or identifiable victims." While critics including Senator Elizabeth Warren condemned the move as corrupt given Binance's $2 billion investment from MGX using Trump's World Liberty Financial stablecoin, the market responded positively. BNB jumped approximately 3 percent immediately following the announcement.

The pardon's significance extended beyond CZ personally. It signaled that the Trump administration viewed Binance and BNB as legitimate rather than criminal enterprises, potentially opening doors for U.S. market re-entry that had seemed permanently closed. CZ's post-pardon message promising to "help make America the Capital of Crypto" suggested strategic alignment between Binance and the new administration's policy objectives.

Broader Trump administration crypto policy provided essential tailwinds. The March 6 Strategic Bitcoin Reserve executive order established that approximately 200,000 Bitcoin already held by the government would not be sold but maintained as reserve assets. While the order focused on Bitcoin, Trump subsequently announced that the related Digital Asset Stockpile would include Ethereum, XRP, Solana, and Cardano. Though BNB wasn't explicitly named, the general embrace of digital assets as legitimate reserve-worthy instruments provided sector-wide legitimacy.

SEC leadership transition proved equally important. Gary Gensler's departure and the nomination of Paul Atkins, a crypto-friendly commissioner, signaled regulatory approach changes. The dismantling of the National Cryptocurrency Enforcement Team in April and the elimination of advance permission requirements for banks to engage in crypto demonstrated substantive policy shifts rather than just rhetorical support.

Against this backdrop, VanEck's May filing for a spot BNB ETF represented a watershed moment. As the first proposed U.S. ETF tracking BNB, the application signaled institutional asset managers believed regulatory approval was sufficiently likely to justify the filing costs and reputational risks. The proposed fund would include staking capabilities, suggesting the SEC under Atkins might approve features Gensler's SEC had rejected for Ethereum ETFs.

Coinbase and Robinhood listings in late October provided another crucial institutional validation point. These platforms adding BNB on October 23 created dramatically improved access for U.S. retail and institutional investors who had been unable to easily acquire the token. The immediate price jump above $1,100 following the announcements demonstrated genuine demand rather than just speculative interest.

International regulatory positioning also evolved favorably. Binance's Dubai VARA licensing and preparation for MiCA compliance in Europe demonstrated the exchange was building out compliant infrastructure globally rather than operating in regulatory gray zones. The exchange's restructuring under CEO Richard Teng, who replaced Zhao as part of the DOJ settlement, emphasized regulatory compliance and institutional partnerships over the aggressive expansion that had created past problems.

The MGX investment using World Liberty Financial's USD1 stablecoin to complete a $2 billion investment in Binance represented perhaps the clearest signal of institutional capital flowing toward the BNB ecosystem. While the Trump family connections raised obvious conflict-of-interest questions, from a pure market perspective it demonstrated that billion-dollar capital allocators viewed Binance and BNB as core infrastructure plays worth massive commitments.

Why BNB Beat BTC and ETH This Cycle

Understanding BNB's outperformance requires examining both what went right for BNB and what constrained its larger rivals. The story is one of utility meeting narrative at precisely the right regulatory moment, while Bitcoin and Ethereum faced structural headwinds.

Supply dynamics provided BNB's most fundamental advantage. The 33rd quarterly burn completed on October 27 destroyed 1.44 million BNB tokens worth approximately $1.2 to $1.69 billion, reducing total supply to 137.74 million tokens. Since Binance implemented its auto-burn mechanism, over 64 million BNB have been permanently removed from circulation, with the target of 100 million representing an additional 37 million to be burned.

Unlike Bitcoin's programmatic halvings that take place every four years, BNB's quarterly burns created more frequent supply shocks. More importantly, the burn amount isn't arbitrary but algorithmically determined based on BNB price and blocks produced, creating a transparent mechanism that adjusts to network activity. When BNB price rises, burns become more valuable in dollar terms even if fewer tokens are burned, generating headlines and attention. When usage increases, more blocks generate more fees feeding into burn calculations. This creates self-reinforcing dynamics where success drives scarcity drives further success.

Utility provided the demand-side complement to supply restriction. While Bitcoin's primary use case remains store of value and payment, and Ethereum's centers on DeFi and smart contract platform, BNB straddles multiple categories. It serves as the native gas token for one of the world's busiest blockchains, commands trading fee discounts on the largest exchange by volume, acts as collateral in DeFi protocols, powers governance in numerous projects, and increasingly facilitates real-world asset transactions.

This utility breadth meant that as various crypto sectors heated up throughout 2025, BNB captured value from multiple trends simultaneously. The DeFi renaissance drove demand for gas and collateral. Memecoin mania increased trading volumes boosting exchange revenues. RWA tokenization required stable infrastructure benefiting established chains. Each trend fed BNB demand from different angles rather than relying on a single narrative.

Bitcoin faced different dynamics. The spot ETF approvals in January 2024 drove massive 2024 gains but by 2025 had become mature enough that consistent inflows no longer generated the same price response. The Strategic Bitcoin Reserve executive order was already priced in by March. And macro factors including Federal Reserve policy uncertainty and U.S.-China trade tensions weighed on risk assets. Bitcoin's now-established correlation with tech stocks and macro liquidity meant it couldn't escape broader market constraints even as regulatory support improved.

Ethereum encountered even more specific challenges. The post-Merge shift to Proof of Stake dramatically reduced issuance, creating deflationary dynamics that should theoretically support price. Yet the proliferation of Layer 2 networks - handling 63 percent of transactions by 2025 - meant fee revenues accruing to Ethereum mainnet collapsed. While this represented technical success in scaling, it created economic challenges for ETH holders who watched value migrate to L2 tokens.

Treasury company adoption of Ethereum, with 71 companies holding an estimated $22 billion worth, provided some support. But it couldn't offset the fee revenue decline or the complexity challenges developers faced coordinating across multiple L2s. The BTC/ETH ratio reaching levels near 54, last seen in pre-pandemic days, illustrated how dramatically Ethereum lagged Bitcoin, let alone BNB.

Network metrics further illuminated the divergence. While Ethereum maintained approximately 123 million wallet addresses and 4.5 million daily active users, BNB Chain's 58 million monthly active addresses and consistent 2.37 million daily users showed competitive engagement despite being a younger ecosystem.

Lower regulatory overhang paradoxically helped BNB. After the massive DOJ settlement, the worst was behind Binance with clarity on what compliance required. In contrast, Ethereum faced ongoing uncertainty about whether staking constituted securities offerings, why some L2 tokens might be securities, and how DeFi protocols should be regulated. This regulatory clarity deficit became a hidden tax on Ethereum's valuation.

CEA Industries CEO David Namdar articulated BNB's structural strength following the October burn: "The burn process underscores the asset's structural strength and long-term scarcity and therefore value creation." This simple formula - consistent scarcity creation plus expanding utility plus regulatory clarity - provided a more compelling value proposition than Bitcoin's largely static supply schedule or Ethereum's complex Layer 2 economics.

Market Mechanics: Exchange Tokens and Liquidity Power

The resurgence of exchange tokens as a distinct asset category represents one of 2025's most interesting structural shifts. BNB's performance led this trend, but understanding the broader mechanics illuminates why platform tokens gained favor.

Exchange tokens possess unique characteristics that distinguish them from pure utility tokens or governance tokens. They combine elements of equity-like cash flow (though legally distinct from securities), platform utility (fee discounts, staking rewards, governance rights), and speculative instruments (liquid, exchange-listed, and tradeable against major pairs). This hybrid nature creates peculiar advantages during certain market phases.

Liquidity depth represents the most fundamental advantage. BNB trades on its native platform with massive volume, creating tight spreads and deep order books that institutional players require. This isn't theoretical - DEX volume hitting $5.064 billion on BNB Chain in a single day demonstrates institutional-grade liquidity. When Coinbase and Robinhood added BNB in October, they simply expanded existing liquidity rather than bootstrapping new markets.

Revenue linkages create natural value accrual mechanisms. While legally structured to avoid securities classification, exchange tokens benefit economically when their platforms succeed. Binance's position as the world's largest exchange by volume means every uptick in crypto trading activity directly benefits BNB through increased burn amounts, higher staking yields, and greater platform usage. This creates correlation with overall crypto market health while adding platform-specific alpha.

Comparing BNB to other exchange tokens reveals divergent fortunes. OKB, the native token of OKX, showed solid performance but lacked BNB's ecosystem depth. CRO, Crypto.com's token, struggled with the platform's reduced marketing spend and user growth challenges. GT (Gate.io) remained largely regional despite the exchange's success in Asia. These comparisons suggest that exchange token performance requires both platform success and genuine ecosystem development - BNB uniquely achieved both.

The meme season phenomenon illustrated exchange tokens' asymmetric advantage. When retail attention surges toward speculative trading, exchange tokens benefit from every trade regardless of which specific memecoin pumps or dumps. This created a paradoxical dynamic where BNB captured value from both serious DeFi activity and speculative memecoin gambling without needing to pick winners.

Stablecoin infrastructure provided another structural advantage. With $14.16 billion in stablecoins on BNB Chain, the network possessed the payment rails necessary for seamless trading, settlements, and DeFi operations. This stablecoin depth - crucial for market makers and institutional participants - meant BNB Chain could facilitate large trades without price impact that would plague smaller chains.

The spot-to-perpetuals ratio of roughly 14:1 in October suggested BNB Chain's activity was more organic than leverage-driven. While perpetual markets attract sophisticated traders, overwhelming spot dominance indicates real economic activity - payments, DeFi swaps, NFT purchases - rather than purely speculative positioning.

Validator economics created another dimension of exchange token advantage. BNB Chain validators earn not just from transaction fees but from the broader BNB ecosystem including potential Binance relationships. This incentivizes validator performance and network security in ways that purely transaction-fee-based models struggle to match.

The rotation into exchange tokens represented implicit market recognition that centralized exchanges aren't disappearing despite DeFi's growth. Rather than picking individual DeFi protocols with uncertain token economics, investors could gain exposure to entire ecosystems through exchange tokens. BNB's $161 billion market cap effectively represented a bet on Binance maintaining market leadership and BNB Chain capturing sustainable ecosystem share.

The Risks Beneath the Rally

Balanced analysis requires acknowledging significant risks that could derail BNB's momentum or expose underlying fragilities. Several deserve particular attention.

Centralization concerns remain paramount. Despite technical decentralization across validator nodes, Binance's influence over BNB Chain governance, development priorities, and ecosystem direction remains substantial. If regulatory pressures forced Binance to distance itself from BNB Chain, the resulting uncertainty could severely impact valuations. The exchange's $4.3 billion settlement demonstrates how platform-level legal challenges can create ecosystem-wide fallout.

Regulatory risk cuts multiple ways. While U.S. regulatory clarity improved dramatically, international jurisdictions present ongoing challenges. European MiCA implementation, Asian regulatory frameworks, and potential future U.S. administration changes could all shift the regulatory landscape unfavorably. The SEC's past consideration of BNB as a potential security hasn't been definitively resolved, creating residual legal overhang.

Data integrity concerns emerged around ecosystem metrics. DeFiLlama's removal of Aster perpetual trading data citing "suspicious correlations with Binance volume" raises questions about whether all reported activity represents genuine economic behavior versus artificial inflation. While such concerns haven't been proven broadly, they create uncertainty around which metrics can be trusted.

Whale concentration presents another vulnerability. On-chain analysis suggests significant holdings among early investors and insiders. While CZ has publicly stated he has "never sold BNB, except for spending," significant holders exiting could create cascading price declines given the token's relatively limited circulating supply of 137.74 million tokens.

Derivatives markets showed concerning positioning at times. Reports of $412 million in whale shorts ahead of Trump administration announcements suggested sophisticated market participants betting against sustained rallies. While these positions haven't materialized into major crashes, they indicate substantial skepticism among some traders about valuations.

Competitive pressures from Ethereum Layer 2s, Solana's resurgence, and emerging platforms like Sui threaten BNB Chain's market share. If a competitor offers meaningfully better technology or developer experience, BNB Chain's current momentum could reverse quickly in crypto's fast-moving landscape.

The memecoin-driven growth that provided 2025 user acquisition may prove ephemeral. If retail interest wanes or regulators crack down on memecoin launchpads, a significant driver of recent ecosystem activity could disappear. Converting memecoin speculators into long-term DeFi users remains unproven at scale.

Oracle reliability issues during the October market crash, which contributed to a $450 billion market-wide wipeout, demonstrated infrastructure fragilities. While quickly resolved, such incidents remind investors that technical risk persists even in mature protocols.

Macroeconomic headwinds including Federal Reserve policy, U.S.-China tensions, and potential recession could overwhelm crypto-specific tailwinds. BNB's reduced but still-present correlation to Bitcoin means macro shocks would likely impact BNB alongside the broader market.

The relationship between World Liberty Financial and Binance, while providing short-term support, creates long-term political risk. If the Trump administration faces legal challenges or political backlash over crypto conflicts of interest, Binance and BNB could be caught in the fallout.

Macro Implications: What BNB's Rally Signals About the Market

BNB's outperformance tells us something important about where crypto markets are heading and what investors increasingly value. Several broader implications deserve consideration.

The utility narrative is clearly back. After years where pure speculation and meme-driven narratives dominated, BNB's success suggests investors are rewarding tokens with genuine use cases. The 15.8 million daily transactions and billions in DeFi volume on BNB Chain aren't theoretical - they represent real economic activity generating demonstrable value.

Platform tokens may be entering a golden age. If exchange and ecosystem tokens continue capturing value from multiple concurrent trends while avoiding the complexity of picking individual protocol winners, capital allocation could increasingly favor this middle layer. This would represent a shift from the 2017-2021 period where Layer 1 competition defined narratives, toward an era where integrated platforms combining centralized and decentralized elements dominate.

Regulatory clarity now commands premium valuations. BNB's rally accelerated after major regulatory resolutions rather than remaining suppressed by past issues. This suggests markets are willing to look past problems if there's clear resolution and path forward. The implication for other projects: addressing regulatory uncertainty proactively rather than ignoring it may unlock significant value.

The centralization versus decentralization debate may be resolving toward pragmatism. BNB Chain's success despite centralization concerns suggests users and investors prioritize performance, cost, and ecosystem vibrancy over ideological purity. This doesn't mean decentralization doesn't matter, but rather that sufficient decentralization for security may be more important than maximum decentralization.

Institutional capital appears to be diversifying beyond Bitcoin and Ethereum. The VanEck ETF filing, major exchange listings, and treasury company interest in BNB demonstrate that sophisticated allocators view crypto as a multi-asset class rather than BTC-only or BTC-plus-ETH.

The CeFi and DeFi convergence exemplified by BNB suggests the future may be hybrid rather than purely decentralized. Projects successfully bridging centralized efficiency with decentralized transparency and composability may capture disproportionate value. BNB Chain's integration of centralized exchange liquidity with decentralized protocols demonstrates this model's potential.

Real-world asset tokenization is transitioning from concept to implementation. BNB Chain's partnerships with Ondo, Franklin Templeton, and other RWA platforms moving tokenized stocks, treasuries, and other traditional assets on-chain suggests institutional-DeFi integration is accelerating. BNB's success positions it as infrastructure for this transition.

The importance of founder credibility remains high even after regulatory issues. CZ's continued influence despite legal troubles suggests crypto markets still value visionary founders who maintain community trust. His pardon and active ecosystem engagement demonstrated that reputation can survive setbacks if handled strategically.

U.S. political engagement by crypto platforms yields measurable results. Binance's lobbying spending, including $450,000 to firms with White House connections, correlated with dramatic policy shifts including CZ's pardon. While controversial, this demonstrates that political strategy is becoming as important as technical development.

Network effects and first-mover advantages in ecosystems may be undervalued. Despite technical superiority claims from competing chains, BNB Chain's established ecosystem, developer relationships, and liquidity proved difficult to disrupt. This suggests that once platforms achieve critical mass, competitive moats become formidable.

Sustainability and Outlook

The critical question facing investors as 2025 winds down: can BNB sustain its outperformance, or does reversion to mean valuations appear inevitable?

Several factors support continued strength through Q4 2025 and into 2026. The 34th quarterly burn scheduled for Q4 will remove approximately 1.24 million more tokens worth an estimated $1.4 billion, providing another supply shock. Technical infrastructure improvements including sub-150ms finality and 20,000+ transactions per second targeting completion in late 2025 will enhance competitive positioning.

The VanEck BNB ETF, while not guaranteed approval, represents significant upside potential if authorized. Spot Bitcoin ETFs attracted $112 billion in assets within their first year; even a fraction of that flowing to BNB would substantially impact a token with just 137.74 million supply.

Continued real-world asset integration with institutional partners like Franklin Templeton and Circle provides catalysts independent of broader crypto volatility. As Sarah S., BNB Chain's BD Head, noted, "institutional DeFi and tokenized assets" represent the next growth wave - positioning that should strengthen through 2026.

Ecosystem expansion into new geographies, particularly Asia where regulatory frameworks are clarifying and Binance maintains strong presence, offers growth vectors that don't depend solely on U.S. market dynamics.

However, significant risks to sustained outperformance exist. Technical indicators show BNB trading just above the 50-day EMA at $1,207 with the 20-day EMA at $1,254 acting as near-term resistance. RSI at 45.43 indicates neutral-to-weak momentum, suggesting consolidation rather than continued explosive growth may be most likely near-term scenario.

If BNB loses the critical $1,000 to $1,020 support level, technical traders warn substantial selling pressure could emerge. Conversely, breaking above $1,250 with volume could target the previous all-time high around $1,370 or potentially $1,500 if momentum extends.

Analyst forecasts for 2026 range widely from conservative projections around $1,088 to $1,295 to bullish cases targeting $2,000 or higher if ETF approval and continued ecosystem growth materialize. The wide range reflects genuine uncertainty about whether 2025's outperformance represents sustainable revaluation or temporary momentum.

Three scenarios appear most plausible for 2026:

Consolidation Scenario (40% probability): BNB trades in a $900 to $1,400 range throughout 2026, consolidating 2025 gains while ecosystem continues growing. This occurs if macro conditions remain choppy, ETF approval is delayed but not denied, and no major negative catalysts emerge.

Continuation Scenario (35% probability): BNB reaches $1,600 to $2,200 by end-2026 driven by ETF approval, sustained ecosystem growth, and BTC/ETH potentially experiencing their own challenges. This requires multiple positive catalysts aligning including strong regulatory clarity and institutional adoption acceleration.

Correction Scenario (25% probability): BNB retraces to $600 to $850 as profit-taking intensifies, macro conditions deteriorate, or ecosystem vulnerabilities emerge. This could occur if regulatory clarity reverses, major security incidents impact BNB Chain, or competing platforms capture significant market share.

The most likely path appears to be consolidation with volatility, punctuated by sharp moves in either direction based on catalysts like ETF decisions, quarterly burns, and macro shifts. For investors, this suggests that while BNB's fundamental story remains compelling, the explosive 2025 returns are unlikely to repeat in 2026 with similar magnitude.

Conclusion: Lessons for the Market

BNB's remarkable 2025 run offers several enduring lessons about digital asset markets, regardless of whether the specific performance proves sustainable.

First, utility matters more than many observers credited. In an era of memecoins and speculation, the boring work of building actual use cases - processing transactions, facilitating DeFi, enabling payments - created sustainable value drivers. BNB didn't just pump on narrative; it delivered ecosystem growth that justified revaluation.

Second, regulatory resolution, however painful, ultimately benefits tokens more than ambiguity. Binance's willingness to face consequences, pay massive fines, and restructure positioned BNB to benefit from subsequent regulatory improvements. Projects avoiding rather than addressing regulatory challenges may face permanently suppressed valuations.

Third, supply dynamics deserve greater analytical attention. BNB's aggressive burn mechanism created genuine scarcity that complemented demand growth. Tokenomics aren't just theoretical - they materially impact price discovery when implemented consistently.

Fourth, integrated ecosystems combining centralized and decentralized elements may represent crypto's practical future. Pure decentralization remains ideologically important, but BNB's success suggests users and investors value performance and ecosystem richness over maximum decentralization. The winning formula may be sufficient decentralization for security plus centralized elements for efficiency.

Fifth, founder credibility survives setbacks if managed transparently. CZ's ability to maintain influence despite imprisonment and massive fines demonstrates that crypto communities value leadership consistency and authenticity. His post-pardon engagement rather than retreat signals that reputational capital can be rebuilt.

Sixth, political engagement by crypto platforms is becoming table stakes. Whether controversial or not, Binance's strategic lobbying and partnerships with politically connected entities yielded measurable policy shifts. Future projects ignoring political strategy may find themselves disadvantaged regardless of technical merits.

Finally, exchange tokens as an asset category may warrant reconsideration. Their unique combination of ecosystem exposure, utility, and liquidity provides diversification from pure Layer 1 or DeFi bets. BNB's success suggests this hybrid category deserves greater institutional allocation than historically assigned.

Looking forward, if an exchange token can lead a bull cycle, what might the next market leader look like? Perhaps it combines BNB's ecosystem integration and utility breadth with Ethereum's decentralization and developer ecosystem and Bitcoin's cultural significance. Or perhaps it emerges from an unexpected category - a gaming token, a social platform coin, or an AI-focused protocol.

What seems certain is that 2025's lessons around utility, regulatory clarity, consistent tokenomics, and ecosystem building will shape which projects succeed in future cycles. BNB's outperformance wasn't random; it resulted from years of infrastructure building, ecosystem cultivation, and strategic positioning converging with favorable regulatory winds and market conditions.

For investors, BNB's story reinforces that patient capital focused on fundamental value drivers can still outperform in crypto despite the sector's reputation for pure speculation. For builders, it demonstrates that consistent ecosystem development eventually gets rewarded even when short-term attention focuses elsewhere. And for the industry, it suggests that crypto's maturation doesn't mean just copying traditional finance - instead, hybrid models that pragmatically blend the best of centralized efficiency and decentralized innovation may chart the path forward.

Whether BNB maintains its leadership through 2026 and beyond remains unknown. But its 2025 performance has already secured its place as a case study in how seemingly mature assets can find new growth vectors when fundamental developments align with market sentiment and regulatory momentum. In an industry that moves fast and forgets faster, that's a lesson worth remembering.