On October 15, 2025, at precisely 4:45 PM UTC, Coinbase Markets made an announcement that reverberated across cryptocurrency social media channels and trading platforms worldwide. The San Francisco - based exchange, long known for its cautious and compliance - driven approach to token listings, added BNB to its official listing roadmap. This might sound like routine business for any cryptocurrency exchange, but this particular decision carried extraordinary symbolic weight. BNB, the native token of Binance's sprawling blockchain ecosystem, serves as the beating heart of Coinbase's fiercest global competitor.

The announcement came just thirty - three minutes after Coinbase unveiled "The Blue Carpet," a comprehensive new initiative designed to streamline and clarify the exchange's listing process for token issuers. The program promised direct access to Coinbase's listings team, enhanced transparency measures, and notably, reiterated that the exchange charges zero fees for listings or applications. The timing was no coincidence. For days, the crypto industry had been embroiled in a heated public debate about exchange listing practices, with accusations flying between major platforms about opaque fees, preferential treatment, and gatekeeping behaviors that many believed contradicted crypto's foundational principles of openness and decentralization.

The controversy had escalated rapidly after CJ Hetherington, CEO of Limitless Labs - a prediction market platform backed by Coinbase Ventures - publicly accused Binance of demanding substantial token allocations, multiple airdrops, and multimillion - dollar deposits in exchange for listings. Binance swiftly denied these allegations as "false and defamatory," threatening legal action and accusing Hetherington of breaching a non - disclosure agreement. Into this charged atmosphere stepped Jesse Pollak, creator of Coinbase's Base layer - 2 network, who declared on social media that "it should cost 0% to be listed on an exchange." Critics immediately challenged this statement, pointing out that Coinbase itself had yet to list BNB despite it being the third - largest cryptocurrency by market capitalization at over $160 billion.

Coinbase's surprise addition of BNB to its roadmap appeared to answer these critics directly, but it also raised more questions than it settled. Was this a genuine olive branch toward cross - ecosystem collaboration, or a calculated public relations move designed to deflect criticism during a particularly contentious moment? The answer, as with most strategic decisions by trillion - dollar - market companies, likely contains elements of both.

The following morning, Changpeng Zhao - known universally as CZ - responded publicly to Coinbase's announcement. The former Binance CEO, who had stepped down from his role in November 2023 as part of a plea agreement with U.S. authorities but retained significant influence as the exchange's majority shareholder, thanked Coinbase for the gesture but immediately challenged them to go further. In a post on X (formerly Twitter), CZ urged Coinbase to list more projects built on the BNB Chain ecosystem, noting that Binance had already listed several projects from Coinbase's Base network while Coinbase had yet to list a single BNB Chain project despite the network's substantial activity and developer engagement.

This exchange encapsulates something far larger than a dispute about specific tokens. It represents the collision of two fundamentally different philosophies about how centralized exchanges should operate, whom they should serve, and what responsibilities they bear toward the broader cryptocurrency ecosystem. The Coinbase - Binance rivalry has simmered for years, occasionally flaring into public view, but this October 2025 episode brought long - standing tensions into sharp focus and forced the industry to confront uncomfortable questions about power, transparency, and the future of centralized trading infrastructure in an ostensibly decentralized financial system.

Background: Coinbase vs. Binance - Two Competing Philosophies

To understand why a simple listing announcement generated such intense interest and debate, one must first appreciate how dramatically different Coinbase and Binance are in their origins, evolution, and strategic approaches. These differences shape not only how each exchange operates internally but also how they engage with regulators, users, developers, and the broader cryptocurrency ecosystem.

Coinbase emerged in 2012 from the San Francisco Bay Area startup culture, founded by Brian Armstrong and Fred Ehrsam with explicit backing from prestigious venture capital firms including Y Combinator and Andreessen Horowitz. From its earliest days, the company positioned itself as the compliant, regulated gateway between traditional finance and cryptocurrency. Armstrong, who had previously worked at Airbnb, understood that mainstream adoption of digital assets would require trust - building with both individual users and institutional investors who demanded robust security, regulatory compliance, and insurance protections. Coinbase became the first cryptocurrency exchange to secure a BitLicense in New York, obtain proper money transmitter licenses across multiple U.S. states, and eventually achieve a direct listing on the NASDAQ stock exchange in April 2021 under the ticker COIN.

This compliance - first strategy came with significant costs and constraints. Coinbase's legal and regulatory teams grew to rival its engineering departments in size and influence. Every token listing required extensive due diligence not just on technical merits but on regulatory classification, potential securities law implications, and alignment with various state and federal compliance frameworks. The exchange developed a reputation for moving slowly and cautiously, sometimes frustrating projects that felt qualified for listing but found themselves waiting months or even years for approval.

Coinbase's token selection historically skewed heavily toward Ethereum and Bitcoin, with limited representation from alternative blockchain ecosystems. As recently as 2023, the exchange faced criticism for listing what some analysts described as questionable tokens while simultaneously excluding high - quality projects from non - EVM chains.

The regulatory prudence that defined Coinbase's early years was tested severely beginning in June 2023, when the U.S. Securities and Exchange Commission filed a lawsuit against the exchange and its parent company, alleging they operated as an unregistered securities exchange, broker, and clearing agency. The SEC claimed that thirteen tokens available for trading on Coinbase were securities that should have been registered under federal securities laws.

For nearly two years, this lawsuit hung over Coinbase like a dark cloud, creating uncertainty about the exchange's future and dampening its willingness to experiment with new listings or services. However, in a dramatic turn, the SEC dismissed this enforcement action on February 27, 2025, citing the formation of a new Crypto Task Force dedicated to developing comprehensive regulatory frameworks rather than pursuing enforcement - first strategies. This dismissal removed a major regulatory overhang and emboldened Coinbase to adopt more aggressive expansion strategies, including the eventual listing of BNB.

Binance's origin story could not be more different. Founded in 2017 by Changpeng Zhao, a Canadian entrepreneur of Chinese descent with previous experience at Blockchain.info and OKCoin, Binance launched through an initial coin offering that raised $15 million. The exchange went live just five days before Chinese authorities announced a comprehensive ban on cryptocurrency trading platforms operating within China's borders. Rather than view this as a catastrophic setback, CZ embraced a stateless, global - first operational model. Binance had no permanent headquarters, employed staff distributed across dozens of countries, and deliberately avoided embedding itself too deeply within any single regulatory jurisdiction that might constrain its growth or product offerings.

This approach enabled phenomenal velocity. Within six months of launch, Binance had become the largest cryptocurrency exchange by trading volume, a position it has maintained almost continuously since. The exchange added new tokens rapidly, sometimes listing dozens per month across spot markets, futures contracts, and margin trading pairs. Binance expanded aggressively into derivatives trading, offering leverage products up to 125x that attracted high - frequency traders and speculation - focused users. The platform developed its own blockchain ecosystem with Binance Chain (later rebranded as BNB Chain), launched a venture capital arm (Binance Labs), created incubation programs for early - stage projects, and built adjacent services including a decentralized exchange, a non - fungible token marketplace, and even a charitable foundation.

Yet this velocity and innovation came with substantial regulatory risk. Authorities in multiple jurisdictions began investigating Binance for potential violations related to anti - money laundering compliance, sanctions evasion, and offering unregistered securities. The United Kingdom's Financial Conduct Authority, Japan's Financial Services Agency, and regulators in countries from Germany to Thailand issued warnings or restrictions. These regulatory pressures culminated in November 2023 when Binance reached a comprehensive settlement with the U.S. Department of Justice, agreeing to pay $4.3 billion in penalties - one of the largest criminal fines ever imposed on a corporate entity. CZ personally pleaded guilty to violating the Bank Secrecy Act by failing to maintain an adequate anti - money laundering program, paid a $50 million fine, and agreed to step down as CEO, serving a four - month prison sentence.

Richard Teng, formerly Binance's regional markets head and before that a regulator at Abu Dhabi Global Market, assumed the CEO role and immediately emphasized compliance as a competitive advantage. Under Teng's leadership, Binance has invested nearly $200 million in compliance programs over two years, expanding its legal and regulatory teams dramatically while implementing enhanced know - your - customer procedures, transaction monitoring systems, and risk management frameworks. The exchange has pursued proper licensing in multiple jurisdictions, including obtaining a Virtual Asset Service Provider license in Dubai and seeking regulatory approval for re - entry into markets like India from which it had been expelled.

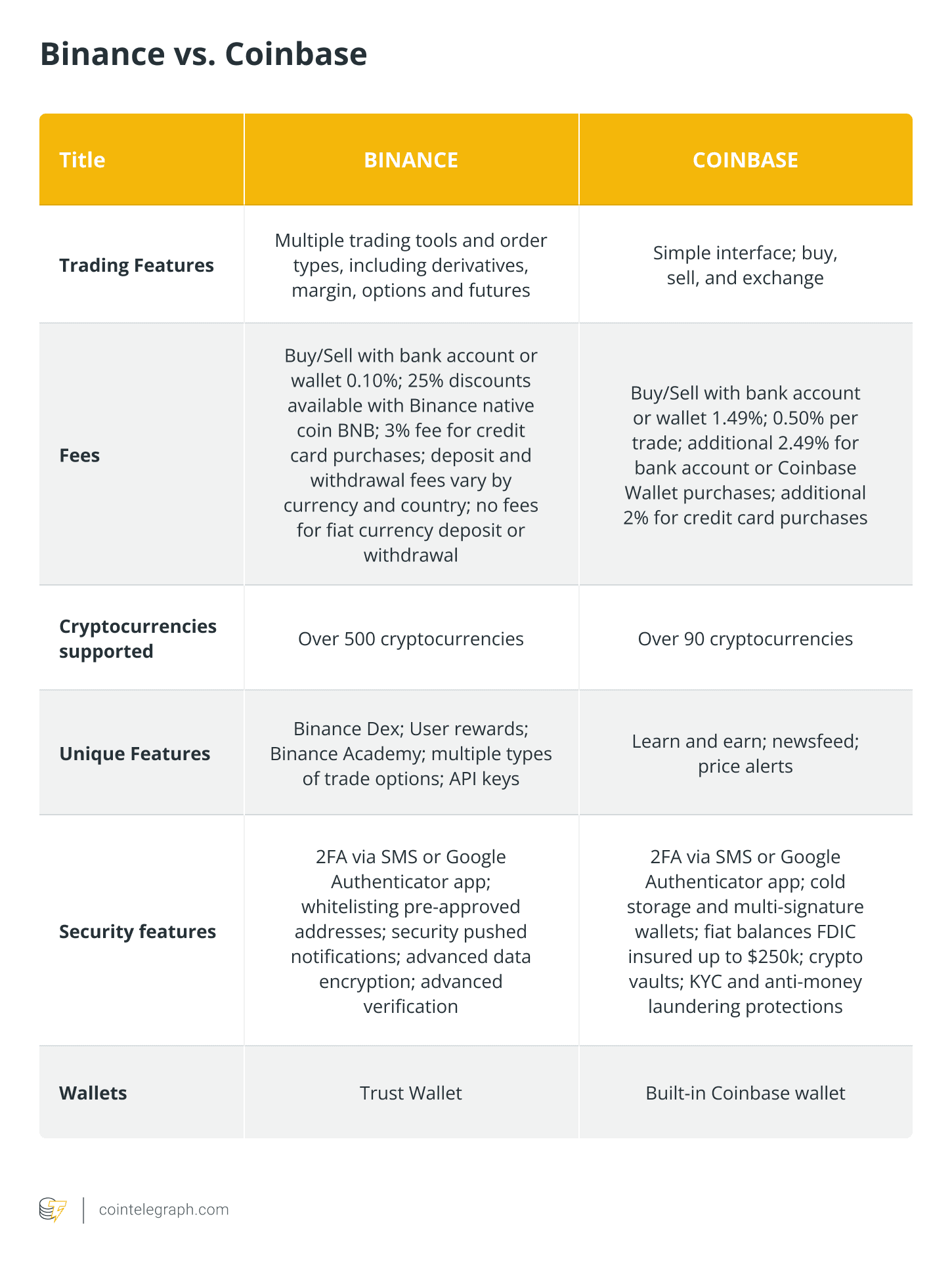

These divergent paths - Coinbase's early embrace of regulation and Binance's belated compliance transformation - create a complex competitive dynamic. Coinbase can credibly claim to be the most trustworthy, institutionally acceptable exchange for users who prioritize regulatory certainty and established legal protections. Binance counters with broader global reach, deeper liquidity across more trading pairs, and a more extensive ecosystem of services and blockchain infrastructure. Neither approach is clearly superior; each serves different user segments and reflects different assessments of regulatory risk versus growth opportunity.

The token listing strategies emerging from these philosophical differences have become flashpoints for broader debates about transparency, fairness, and the proper role of centralized exchanges in nominally decentralized systems. Understanding how listings actually work - both technically and commercially - is essential for evaluating the competing claims and criticisms that erupted in October 2025.

Anatomy of a Listing: How Tokens Get on Exchanges

For outsiders to the cryptocurrency industry, the process by which a digital asset gains listing on a major exchange can seem opaque and perhaps even arbitrary. Why does one token with modest adoption and unclear use cases receive prominent placement while another with substantial user bases and real - world utility remains absent? The answer involves a complex interplay of technical requirements, commercial considerations, legal compliance, and strategic positioning that varies significantly between exchanges.

At the most fundamental level, listing a token on an exchange requires technical integration. The exchange's infrastructure must be able to communicate with the relevant blockchain, monitor for deposits and withdrawals, handle transaction signing and verification, manage wallet security for potentially millions of users, and provide reliable pricing data feeds. For tokens on major blockchains like Ethereum or Bitcoin, this integration is relatively standardized. Ethereum - based ERC - 20 tokens, for instance, can be added to an exchange with modest engineering effort once the initial Ethereum infrastructure is in place. However, tokens from alternative blockchain ecosystems - Solana, Cardano, Cosmos, or BNB Chain - require more substantial work. The exchange must run full nodes for these networks, implement chain - specific security measures, develop appropriate wallet infrastructure, and ensure adequate technical support for any unique features or upgrade mechanisms.

Beyond technical feasibility lies market - making infrastructure, which is absolutely critical for a successful listing. A token that trades with wide bid - ask spreads, low liquidity, or high price slippage will frustrate users and generate negative sentiment regardless of the project's underlying quality. Professional market makers - specialized firms like Jane Street Digital, Jump Crypto, or Wintermute - provide continuous buy and sell quotes that enable smooth trading even during periods of volatility or low retail activity. These market makers evaluate potential listings based on expected trading volumes, volatility profiles, the token's circulating supply and distribution characteristics, and the presence of adequate price discovery mechanisms on other venues.

Exchanges typically work with projects to ensure sufficient market - making commitments before launching trading. This often involves matching projects with market - making firms, establishing initial liquidity requirements (such as maintaining a minimum spread within certain volume thresholds), and sometimes negotiating technical integrations with specific market - making APIs and systems. The standards vary dramatically. Coinbase has historically demanded substantial market - making depth before listing any asset, contributing to its reputation for slow onboarding but also ensuring that users can trade with minimal slippage. Smaller exchanges may list tokens with far less liquidity support, leading to choppy trading experiences but faster time - to - market for emerging projects.

Regulatory compliance represents perhaps the most complex and consequential aspect of exchange listings, particularly for U.S. - based platforms like Coinbase. The fundamental question hanging over cryptocurrency markets since Bitcoin's inception is whether specific digital assets constitute securities under federal securities laws. The U.S. Supreme Court's 1946 decision in SEC v. W.J. Howey Co. established a test for identifying investment contracts: a transaction involves an investment of money in a common enterprise with profits expected from the efforts of others. Whether a given cryptocurrency meets this test depends on nuanced factors including how it was initially distributed, what representations were made to purchasers, whether there is an identifiable group working to increase its value, and whether purchasers reasonably expect profits from those efforts.

For Coinbase, the stakes of misclassifying a token as a non - security when the SEC might view it as a security are existentially high. The exchange must conduct legal analysis of each potential listing, often commissioning external opinions from securities law experts, reviewing marketing materials and development roadmaps from project teams, analyzing the token's distribution and governance mechanisms, and assessing precedents from previous SEC enforcement actions or court decisions. This process can take months and sometimes results in the exchange declining otherwise appealing projects due to securities law uncertainty. Binance, operating primarily outside U.S. regulatory reach until its 2023 settlement, historically took a more permissive approach, though it now faces similar constraints given its commitment to proper licensing and regulatory cooperation.

Then comes the commercial question: the controversial matter of listing fees and what projects must provide in exchange for exchange access. Here the opacity and inconsistency that characterize the industry become most apparent. Some exchanges explicitly charge listing fees, openly published rate cards that might range from $50,000 for smaller platforms to hundreds of thousands or even millions of dollars for premium placement on major exchanges. Other exchanges claim to charge no listing fees at all but may expect token allocations, marketing partnerships, or other forms of value transfer that accomplish similar ends.

The public disputes in October 2025 brought these dynamics into sharp relief. CJ Hetherington of Limitless Labs alleged that Binance had requested substantial token allocations and deposits as conditions for listing, claims that Binance vehemently denied while pointing to its long - standing policy of accepting only charitable donations rather than direct listing fees. Meanwhile, prominent figures including Tron founder Justin Sun and Sonic Labs co - founder Andre Cronje claimed that Coinbase had requested listing fees in the tens or hundreds of millions of dollars for their respective projects, contradicting CEO Brian Armstrong's public statements that Coinbase lists assets free of charge. Both exchanges pointed to the other as the true offender, while mid - tier platforms like MEXC, OKX, and Bitget generally avoided the controversy by maintaining quieter stances.

What emerges from these contradictory accounts is a picture of an industry still finding its way toward standardized, transparent practices. Some patterns seem clear enough. Projects with substantial market capitalizations, proven track records, and strong community demand face favorable listing conditions because exchanges compete to capture their trading volumes and associated fee revenues. Emerging projects with modest user bases face less favorable terms, sometimes involving significant payments or token allocations whether those are labeled as listing fees, marketing partnerships, liquidity provisions, or charitable donations. The specific terms can vary wildly based on individual negotiations, leaving project founders uncertain about what they might encounter and creating opportunities for favoritism or corruption.

The absence of standardization reflects crypto's position between worlds. Traditional securities exchanges operate under strict regulations that mandate transparent, non - discriminatory listing standards and prohibit exchanges from making listings contingent on payments from issuers. Commodity exchanges follow similar principles. But cryptocurrency exchanges, operating in regulatory gray zones until very recently, developed more ad hoc approaches that borrowed elements from securities markets, commodity exchanges, traditional financial market - making, and consumer internet platform businesses. The result is a patchwork of practices that sometimes serves users well but frequently generates confusion and controversy.

Understanding these technical, commercial, and regulatory dimensions helps clarify what was actually at stake when Coinbase added BNB to its roadmap in October 2025. This was not simply a matter of technical integration, though that would require work given BNB's role on a non - Ethereum blockchain. It carried symbolic weight about inter - exchange relationships, commercial signaling about zero - fee listing policies, and strategic implications for the competitive positioning of both Coinbase and Binance's respective blockchain ecosystems.

The BNB Listing Debate: Strategy, Symbolism, and Suspicion

When Coinbase Markets posted its announcement about adding BNB to the listing roadmap, the crypto community immediately recognized both what was said and what was carefully left unsaid. The announcement specified that actual trading would only commence once "market - making support and sufficient technical infrastructure" were in place, with a separate launch notice to follow. This is standard language for Coinbase's roadmap process, but it matters because roadmap inclusion is far from a guarantee of actual listing.

Coinbase's roadmap mechanism serves several purposes simultaneously. It signals to the market that the exchange is evaluating a particular asset, potentially affecting price discovery and generating positive sentiment for the token in question. It provides transparency to projects and users about what might be coming while giving Coinbase flexibility to delay or decline if circumstances change. And it allows the exchange to gauge community interest and gather feedback before making final commitments. Historical precedent shows that tokens can remain on the roadmap for extended periods - sometimes months or even years - while the exchange works through technical integration, liquidity arrangements, or compliance reviews. Some tokens listed on roadmaps have ultimately never launched for trading at all when Coinbase determined they failed to meet evolving standards.

For BNB specifically, the technical challenges are non - trivial. Unlike most major cryptocurrencies available on Coinbase which exist on Ethereum or Bitcoin's networks, BNB functions as the native gas token for BNB Smart Chain, an independent blockchain that uses a Proof of Staked Authority consensus mechanism. Coinbase would need to implement full node infrastructure for BNB Chain, develop appropriate wallet systems, ensure adequate transaction monitoring and security controls, and potentially integrate with Binance's ecosystem more broadly. These technical requirements, while certainly manageable for an exchange of Coinbase's sophistication, require dedicated engineering resources and thorough security audits before launch.

The market - making requirement introduces additional complexity. BNB trades with enormous liquidity on Binance itself, obviously, where it serves as the base trading pair for hundreds of markets and benefits from the exchange's vast user base. But its liquidity on other major exchanges has been more limited, partly because competitive dynamics discouraged rivals from providing Binance's token with prominent placement. When Kraken listed BNB in April 2025, that represented a significant shift in inter - exchange dynamics, signaling that major platforms were increasingly willing to cross - list competitor tokens when user demand justified it. For Coinbase to follow suit required arranging for market makers willing to provide competitive quotes without the natural liquidity advantages Binance enjoys.

CZ's public response to Coinbase's announcement revealed the strategic thinking underlying his request for more BNB Chain listings. His statement thanked Coinbase for adding BNB but immediately pivoted to urging broader ecosystem support. The logic was straightforward: if Coinbase truly believes in openness and zero - fee listing policies, merely adding the base token BNB represents only a token gesture - pun intended. What would demonstrate genuine commitment to cross - ecosystem collaboration would be listing the applications, protocols, and projects built on BNB Chain, treating that ecosystem with the same seriousness and openness that Coinbase presumably applies to Base, its own layer - 2 network.

The comparison CZ drew was pointed. Binance had indeed listed several prominent Base ecosystem projects, providing trading access for tokens from Coinbase's own blockchain platform. Yet Coinbase had not reciprocated by listing projects from BNB Chain, despite that network's substantially larger total value locked, greater developer activity, and longer operational history compared to Base which only launched in August 2023. This asymmetry, CZ suggested, revealed something about Coinbase's stated commitment to openness. Was the exchange truly neutral in its listing standards, or did competitive considerations influence which ecosystems received support?

Public and expert commentary on this exchange reflected the deep divisions within the crypto community about exchange power and responsibility. Some observers praised Coinbase's BNB listing as a mature, industry - minded decision that recognized users should have access to major digital assets regardless of which exchange originally promoted them. This perspective held that exchanges serve users best by maximizing choice rather than engaging in petty rivalries that artificially segment markets and reduce competition. Listing BNB, by this logic, acknowledged that the token's $160 billion market capitalization and genuine utility within DeFi applications made its absence from Coinbase unjustifiable.

Others viewed the move more cynically as calculated public relations designed to deflect criticism during the heated October 2025 debate about listing transparency. Coinbase faced accusations that its stated zero - fee policy masked other barriers to listing including slow processing, stringent requirements that effectively excluded many qualified projects, and potential bias toward its own ecosystem. By suddenly adding BNB to its roadmap hours after launching the Blue Carpet initiative, Coinbase could claim it practiced the openness it preached. But whether this would translate into actual BNB trading availability or meaningful support for BNB Chain ecosystem projects remained unclear.

A third perspective, perhaps the most cynical, suggested both exchanges engaged in strategic theater for competitive positioning without genuine commitment to openness. Under this view, Binance's listing of Base projects served its own interests by capturing trading volumes and demonstrating ecosystem neutrality while the actual projects selected remained relatively small and non - threatening. Similarly, Coinbase's BNB roadmap listing provided PR benefits while the careful hedging about market - making and technical requirements preserved flexibility to delay indefinitely if Coinbase concluded that providing premium support for a competitor's token was strategically unwise.

The debate also intersected with broader concerns about the concentration of power in centralized exchanges and whether their increasing gatekeeping influence contradicted cryptocurrency's original vision. Coinbase and Binance together control the vast majority of global cryptocurrency trading volume across spot and derivatives markets. Their listing decisions can make or break projects, influence token prices dramatically, and determine which blockchain ecosystems gain mainstream adoption. This power creates natural incentives to favor vertically integrated ecosystems - Base for Coinbase, BNB Chain for Binance - even when they claim to apply neutral, merit - based standards.

As October 2025 progressed, the BNB price action following the Coinbase announcement told its own story. The token initially jumped approximately 2% on the news, reflecting immediate positive sentiment. But this gain quickly evaporated as BNB fell back and actually declined over subsequent days, down more than 11% from its all - time high of $1,370 reached just days before the Coinbase announcement. Some analysts attributed this decline to profit - taking after the news. Others suggested that investors recognized the gulf between roadmap listing and actual trading availability, tempering their enthusiasm. Whatever the explanation, the muted market response underscored how the symbolic significance of the announcement outweighed its immediate practical impact.

Transparency vs. Gatekeeping: Competing Listing Philosophies

The October 2025 controversy brought to the surface competing visions of how cryptocurrency exchanges should make listing decisions and what obligations they bear toward openness and fairness. These visions reflect broader ideological tensions within the crypto space about the proper balance between decentralization ideals and practical realities of building sustainable businesses.

Binance's critics focus on allegations of high or undisclosed listing fees, preferential treatment for projects willing to provide substantial token allocations, and centralized control that allows the exchange to pick winners and losers based on opaque criteria. The accusations from CJ Hetherington of Limitless Labs, while vigorously denied by Binance, fit a pattern of complaints from projects that have described feeling pressured to provide payments or tokens in exchange for listing consideration. Some projects allege that Binance demanded up to 15% of total token supply, amounts that could run into tens or hundreds of millions of dollars in value for successful projects. Even if Binance labels these arrangements as marketing partnerships, community airdrops, or charitable donations rather than listing fees per se, critics argue the economic substance remains the same: projects must transfer substantial value to gain exchange access.

Binance's defense rests on several pillars. First, the exchange maintains that it charges no mandatory listing fees and bases decisions on rigorous due diligence evaluating projects' technical quality, team credentials, market potential, and compliance with regulatory requirements. Any token allocations or airdrops, according to this framing, are voluntary arrangements that many projects propose themselves for marketing purposes rather than requirements imposed by the exchange. Second, Binance points to its track record of listing numerous projects including many that provided no payments or allocations whatsoever, demonstrating that commercial considerations are not determinative. Third, the exchange emphasizes that its listing pace - historically adding dozens of new tokens monthly - far exceeds competitors like Coinbase, suggesting that if anything Binance errs on the side of inclusiveness rather than restrictive gatekeeping.

Co - founder Yi He has been particularly vocal in defending Binance's practices, arguing that the exchange maintains transparent policies and that rumors about exorbitant fees constitute FUD - fear, uncertainty, and doubt - designed to damage Binance's reputation. She notes that Binance has accepted charitable donations since 2018, with project teams determining contribution amounts voluntarily rather than Binance imposing minimums. The exchange also points to its extensive compliance investments following the 2023 settlement with U.S. authorities, suggesting that current policies reflect reformed practices aligned with regulatory expectations.

Yet even sympathetic observers note tensions within Binance's position. The exchange operates different listing tracks including spot markets, futures contracts, and innovation zones with varying requirements and visibility. This complexity creates opportunities for preferential treatment even if Binance denies that fees determine outcomes. Projects report vastly different experiences, with some encountering smooth processes and others describing protracted negotiations over financial arrangements. The lack of published, standardized criteria makes it impossible for outsiders to verify whether listings truly reflect merit - based assessments or whether commercial factors play determinative roles.

Coinbase faces a distinct set of criticisms despite its claims to transparency and zero - fee listing. The exchange's slow pace of new token additions frustrates projects that believe they meet Coinbase's quality standards but find themselves waiting months or years for evaluation outcomes. Coinbase has listed fewer than 500 cryptocurrencies total across its history, compared to the thousands available on Binance. This selectivity might reflect rigorous quality control and compliance diligence, or it might reflect excessive caution bordering on gatekeeping that privileges established projects over innovative upstarts.

The limited chain diversity on Coinbase represents another common complaint. For years, the exchange focused overwhelmingly on Ethereum - based tokens and Bitcoin, with modest representation from other blockchain ecosystems. Projects from Solana, Cardano, Cosmos, and other platforms struggled to gain Coinbase listings even when they achieved substantial market capitalizations and user adoption elsewhere. Critics attributed this to Coinbase's technical conservatism and regulatory risk aversion rather than principled quality assessments. Some suggested that Coinbase deliberately maintained higher barriers for ecosystems that might compete with Ethereum, reflecting the exchange's close alignment with the Ethereum ecosystem.

Furthermore, allegations that Coinbase requests substantial listing fees directly contradict CEO Brian Armstrong's public statements but persist from credible sources. Justin Sun's claim that Coinbase requested $330 million in various fees to list TRX, and Andre Cronje's statement that Coinbase sought $60 million for FTM, paint a picture inconsistent with zero - fee rhetoric. Coinbase has not publicly responded to these specific allegations with detailed rebuttals, leaving the contradictions unresolved. Even if the exchange technically charges no listing application fees, if it demands other forms of payment or commercial arrangements, the practical effect remains the same for projects seeking access.

Third - party research from firms like Messari, CoinGecko, and The Block has attempted to analyze listing practices more systematically, but perfect transparency remains elusive. These organizations track which tokens appear on which exchanges, price impacts around listing announcements, and liquidity characteristics, but they cannot directly observe internal decision - making processes or commercial negotiations. What emerges is a picture of an industry where stated policies and actual practices sometimes diverge, where individual negotiations produce highly variable outcomes, and where competitive pressures create incentives for opacity rather than transparency.

The fundamental question underlying these debates is whether either model - Binance's rapid onboarding approach or Coinbase's selective gatekeeping - truly serves users' and projects' interests optimally. Rapid listing provides projects with market access and gives users more trading options but potentially exposes them to lower - quality assets with inadequate due diligence or poor liquidity. Slow, selective listing protects users from problematic projects but may exclude worthy innovations and reduce competitive pressure that could benefit consumers through lower fees or better services.

Some analysts suggest that the optimal solution lies not in perfecting centralized exchange listing processes but in reducing dependence on centralized exchanges altogether. Decentralized exchanges like Uniswap, PancakeSwap, and others allow any project to create liquidity pools and begin trading without gatekeepers, though at the cost of reduced protections and sometimes shallow liquidity. As DEX technology improves and captures larger market shares, the power of centralized exchanges to determine which projects succeed may diminish. But given that centralized exchanges still handle the vast majority of trading volume and provide the primary onramps from fiat currency into crypto assets, their listing policies will remain consequential for the foreseeable future.

Market - Making, Liquidity, and Power Dynamics

To fully grasp why Coinbase conditioned BNB's listing on market - making readiness, one must understand the central role that professional market - making plays in modern cryptocurrency markets and how exchanges use liquidity requirements to manage competitive dynamics. Market - making represents one of the least visible but most influential forces shaping how digital assets trade and what user experiences look like when buying or selling tokens.

Market makers are specialized trading firms that continuously offer to buy and sell assets at quoted prices, profiting from the bid - ask spread - the small difference between buy and sell prices - while providing liquidity that enables smooth trading even when natural buyers and sellers are temporarily imbalanced. For major assets like Bitcoin or Ethereum, market - making is highly competitive with numerous firms competing to offer tighter spreads and deeper liquidity. For smaller or newer tokens, fewer market makers may be willing to commit capital, leading to wider spreads, higher price slippage, and more volatile trading experiences.

Professional crypto market makers like Jane Street Digital, Jump Crypto, Wintermute, and GSR deploy sophisticated algorithmic trading systems that monitor prices across dozens of exchanges simultaneously, automatically adjusting quotes based on orderbook dynamics, recent trades, and cross - exchange arbitrage opportunities. These systems can quote prices, execute trades, and manage inventory risk at speeds measured in milliseconds. For exchanges, securing commitments from reputable market makers represents an essential precondition for successful listings because poor liquidity generates user complaints and damages exchange reputations.

When Coinbase noted that BNB trading would be contingent on market - making support, it referenced this fundamental requirement. Despite BNB's enormous market capitalization and substantial liquidity on Binance, establishing adequate market - making on Coinbase requires arranging for firms willing to commit capital, manage inventory risk, and provide competitive quotes. Market makers evaluate this based on expected trading volumes - higher volumes justify more committed capital and tighter spreads - and on the costs of maintaining positions including funding costs, hedging expenses, and technical infrastructure. Because BNB trades heavily on Binance but less actively on other major exchanges, market makers must assess whether Coinbase users would generate sufficient volume to justify their commitments.

Binance's approach to market - making reflects its integrated ecosystem advantages. Because Binance itself maintains the largest BNB orderbook and trading volume, it can provide exemplary liquidity through its own market - making operations and preferred partners. For other tokens, Binance works with a network of market - making firms that benefit from the exchange's enormous user base and trading volumes. The exchange has been known to facilitate introductions between projects and market makers, sometimes as part of the listing process. Critics argue this gives Binance excessive influence over which projects receive adequate liquidity support and which face challenging trading conditions that hamper their growth.

The power dynamics embedded in these arrangements extend well beyond technical market - making functions. When exchanges serve as gatekeepers not just for listing decisions but for liquidity provision that determines whether listings actually succeed, they accumulate influence that can be wielded for competitive advantage. An exchange might provide premium market - making support for tokens from favored ecosystems while offering minimal support for potential competitors. It might condition liquidity arrangements on commercial terms that benefit the exchange financially. Or it might use market - making relationships as leverage in negotiations over other issues including marketing partnerships, revenue sharing, or integration with exchange - specific features.

Coinbase's emphasis on market - making readiness, therefore, serves multiple purposes. At face value, it ensures quality user experiences by preventing listings with inadequate liquidity. But it also provides Coinbase with discretion over timing and terms, allowing the exchange to manage competitive considerations. If Coinbase concluded that providing premium market - making support for BNB was strategically unwise given BNB's association with Binance, it could delay listing indefinitely while technically maintaining that market - making support had simply not materialized to required standards. Conversely, if Coinbase decided that listing BNB promptly would generate positive PR and trading revenue that outweighed competitive concerns, it could prioritize market - making arrangements and accelerate the timeline.

Liquidity depth and spreads themselves function as competitive moats between exchanges. Traders gravitate toward venues offering the best prices and deepest liquidity because even small differences in execution quality compound over time into meaningful cost advantages. For major trading pairs like BTC/USDT or ETH/USDC, the exchanges with the most committed market - making infrastructure capture disproportionate volumes, creating self - reinforcing advantages. Binance's dominant position across numerous trading pairs reflects decades of investment in market - making relationships, fee structures that incentivize liquidity provision, and the sheer scale effects from servicing hundreds of millions of users globally.

When Coinbase contemplates listing BNB, it necessarily considers not just whether it can provide adequate liquidity but whether doing so might inadvertently strengthen Binance's competitive position. If significant trading volume migrates to Coinbase for BNB, that could reduce Binance's strategic advantage from exclusive control of its token's primary market. But if Coinbase provides only mediocre liquidity, users may continue trading BNB primarily on Binance while viewing Coinbase's listing as an afterthought, failing to generate meaningful volume or revenue for Coinbase while consuming engineering and operational resources.

These competitive calculations extend to broader questions about ecosystem integration. Listing BNB might logically lead to requests or expectations that Coinbase should also support BNB Chain deposits and withdrawals, enabling users to move tokens between Coinbase and BNB Chain - based applications. This would require additional technical integration and would effectively position Coinbase as supporting infrastructure for Binance's blockchain ecosystem. While such integration could benefit users who want flexibility to access different blockchain ecosystems from a single exchange account, it also commits Coinbase to maintaining compatibility with a competitor's technology stack and creates dependencies that might complicate future strategic decisions.

The broader industry trend appears to be toward greater interoperability and cross - listing despite competitive tensions. As CZ noted in his response to Coinbase, Binance has listed projects from Base and other exchange - affiliated chains, recognizing that users expect access to diverse ecosystems. Kraken's April 2025 listing of BNB preceded Coinbase's move and faced similar questions about why exchanges would support competitors' tokens. The answer seems to be that user demand and competitive pressure from decentralized alternatives are gradually overcoming the instinct to maintain exclusive control. If users can easily trade any asset on decentralized exchanges, centralized exchanges risk losing relevance by refusing to list popular tokens regardless of which platform originally promoted them.

This evolution toward openness, however incomplete and strategically motivated, represents meaningful progress from the earlier exchange landscape where deliberate exclusion of competitive tokens was standard practice. Whether it proves sustainable or merely constitutes a temporary phase before new forms of competitive segmentation emerge remains uncertain.

Cross - Chain Ecosystem Rivalries

Behind the Coinbase - Binance listing dispute lies a deeper competition between Base and BNB Chain - two blockchain platforms with profoundly different origins but increasingly overlapping ambitions. Understanding this ecosystem rivalry helps explain why token listing decisions carry implications far beyond simple trading access.

BNB Chain, originally launched as Binance Chain in 2019 and subsequently rebranded following the merger with Binance Smart Chain, represents Binance's effort to build a comprehensive blockchain ecosystem that extends well beyond simple exchange operations. The platform uses a Proof of Staked Authority consensus mechanism with a limited set of validators - currently 21 active validators selected from a pool of 45 candidates based on stake amounts - enabling high transaction throughput of roughly 2,000 transactions per second and three - second block times. This makes BNB Chain substantially faster and cheaper than Ethereum mainnet, with average transaction fees around $0.11 compared to Ethereum's $2.14.

The BNB Chain ecosystem has achieved remarkable scale across multiple dimensions. Total value locked in DeFi protocols on BNB Chain approached $6.7 billion as of mid - 2025, making it the third - largest blockchain by this metric behind Ethereum and Solana. The network processes over 4.1 million transactions daily, roughly double Ethereum's daily transaction count. PancakeSwap, the dominant decentralized exchange on BNB Chain, accounts for approximately 91% of the chain's DEX volume and recently achieved record - breaking monthly trading volume of $325 billion in June 2025. In March 2025, PancakeSwap briefly surpassed Uniswap in daily trading volume, a symbolic milestone signaling BNB Chain's growing importance in DeFi.

Developer activity remains robust with 78 protocols actively building on the network and regular hackathons, grant programs, and incubation initiatives supported by Binance Labs and the BNB Chain Foundation. Recent technical upgrades including the Pascal hard fork introduced smart contract wallet support and improved EVM compatibility, making it easier for developers to port applications from Ethereum. The ecosystem has deliberately targeted areas like gaming, NFTs, and meme coins where transaction speed and low costs provide clear advantages over more decentralized but slower alternatives.

Base launched in August 2023 as Coinbase's layer - 2 scaling solution built on Optimism's OP Stack technology. Unlike BNB Chain which operates as an independent layer - 1 blockchain, Base functions as a layer - 2 rollup that settles transactions on Ethereum, inheriting Ethereum's security properties while achieving much higher throughput and lower fees than Ethereum mainnet. Base has attracted over 25,000 developers as of September 2025 and achieved total value locked approaching $12 billion on its path toward ambitious targets of $20 billion in TVL and one billion transactions by October 2025.

The platform benefits from seamless integration with Coinbase's infrastructure, providing direct access to approximately 25 million monthly active users on Coinbase and enabling easy onboarding from fiat currency into Base applications. This represents a substantial competitive advantage over ecosystem chains like BNB Chain which require users to navigate more complex paths from traditional finance into crypto applications. Base has also emphasized EVM compatibility and low fees, positioning itself as developer - friendly infrastructure that reduces barriers to building decentralized applications.

Where BNB Chain leverages Binance's massive global user base and trading volumes, Base leverages Coinbase's regulatory compliance, institutional relationships, and integration with traditional finance. Where BNB Chain has a seven - year operational history and established ecosystem of protocols, Base represents newer infrastructure with less proven resilience but more modern technical architecture. Where BNB Chain operates independently with its own consensus mechanism and validator set, Base remains tied to Ethereum's base layer and participates in the broader Ethereum ecosystem and the emerging "Superchain" vision of interconnected layer - 2 networks.

The competition between these ecosystems manifests most directly in the race to attract developers and their applications. Both platforms offer grant programs, technical support, and visibility for promising projects. Both emphasize low transaction costs and high throughput as advantages over Ethereum mainnet. Both seek to build network effects where more applications attract more users which in turn attract more developers in a virtuous cycle. But they differ significantly in their go - to - market strategies and target audiences.

BNB Chain has historically focused on retail users, particularly in regions outside North America and Europe where Binance maintains dominant market share. The chain has supported numerous consumer - facing applications including gaming, NFTs, yield farming, and recently meme coins which drive substantial transaction activity even if critics question their long - term value. The ecosystem tolerates higher risk and more experimental projects, accepting that some will fail or behave problematically in exchange for rapid innovation and growth.

Base has targeted more institutional and regulatory - conscious developers, positioning itself as the compliant, trustworthy infrastructure for building the future of decentralized finance. The platform has attracted attention from traditional finance institutions exploring blockchain applications and from developers who value the legitimacy and integration that Coinbase's involvement provides. Base's growth strategy emphasizes quality over quantity, selective support for applications that demonstrate clear utility, and alignment with Coinbase's broader vision of bringing digital assets to mainstream adoption.

When Coinbase adds BNB to its listing roadmap but has not yet listed projects from BNB Chain, this asymmetry reflects the competitive tension between these ecosystems. Supporting BNB Chain applications directly would help grow a rival blockchain platform that competes with Base for developers and users. Yet refusing to list any BNB Chain projects appears hypocritical given Coinbase's statements about openness and Binance's willingness to list Base projects. This tension has no easy resolution because genuine user service and competitive strategy point in opposite directions.

Some industry observers anticipate that cross - chain interoperability will eventually reduce the importance of these competitive dynamics. Technologies enabling seamless transfer of assets and data between blockchain ecosystems could allow users and developers to participate across multiple chains simultaneously without forced choices between exclusive platforms. Initiatives like Wormhole Bridge, LayerZero, and Axelar are building infrastructure for cross - chain communication and asset transfers. If these succeed, the Base versus BNB Chain competition might evolve from zero - sum rivalry toward coexistence where both platforms serve distinct niches within a more interconnected ecosystem.

However, powerful incentives toward vertical integration and ecosystem lock - in may limit how much interoperability materializes in practice. Both Coinbase and Binance benefit from network effects that concentrate activity within their respective ecosystems. Developers who build on Base gain access to Coinbase's user base but potentially sacrifice reach to users on other chains. Projects on BNB Chain benefit from Binance's marketing support and listing opportunities but might find adoption elsewhere more difficult. These platform dynamics resemble historical patterns in consumer internet where ostensibly open platforms frequently evolved toward proprietary ecosystems with high switching costs.

For users, the proliferation of ecosystem chains creates both opportunities and complications. More blockchain platforms competing for users and developers could drive innovation and keep fees low. But fragmentation across multiple incompatible chains with different bridging requirements, wallet software, and application landscapes increases complexity and may reduce the seamless user experiences necessary for mainstream adoption. How the industry resolves this tension between competitive ecosystem differentiation and user - friendly interoperability will profoundly shape cryptocurrency's evolution over the coming years.

Regulatory Pressure and Strategic Signaling

The October 2025 listing controversy unfolded against a backdrop of dramatic regulatory shifts that have fundamentally altered the environment in which both Coinbase and Binance operate. Understanding these regulatory changes helps explain both exchanges' strategic positioning around transparency, compliance, and listing practices.

For Coinbase, the February 2025 dismissal of the SEC's enforcement action marked a watershed moment after nearly two years of uncertainty. The lawsuit filed in June 2023 had threatened Coinbase's core business model by alleging that the exchange operated as an unregistered securities exchange by offering trading in tokens that the SEC deemed unregistered securities. The case raised existential questions about whether Coinbase could continue operating lawfully given the SEC's expansive interpretation of what constitutes a security under the Howey test.

The SEC's decision to dismiss the case did not represent a victory on the merits but rather reflected the agency's policy shift toward developing comprehensive regulatory frameworks rather than pursuing enforcement - first strategies against platforms themselves.

This shift resulted from broader political changes with the incoming Trump administration's more favorable posture toward cryptocurrency and the SEC's formation of a Crypto Task Force led by Commissioner Hester Peirce to develop clear regulatory guidance. The Task Force's ten focus areas include clarifying which digital assets qualify as securities, establishing registration pathways for compliant platforms, addressing custody and broker - dealer requirements, and providing relief for token offerings that previously existed in regulatory gray zones. This represents a fundamental departure from former SEC Chair Gary Gensler's approach of declining to issue new rules while aggressively enforcing existing securities laws through litigation.

The dismissal removed an enormous cloud hanging over Coinbase and emboldened the exchange to expand its token offerings, international operations, and experimental products including staking services that had previously faced regulatory scrutiny. Coinbase also became the first U.S. - based cryptocurrency exchange to obtain a full license under the European Union's Markets in Crypto - Assets regulation, enabling it to offer services throughout the EU single market under comprehensive regulatory framework. This international expansion reflects Coinbase's assessment that clear regulatory frameworks, even if burdensome, provide better operating environments than ambiguous situations where enforcement risk remains unpredictable.

Public listing policies serve as crucial regulatory signals in this environment. When Coinbase announced the Blue Carpet initiative emphasizing zero listing fees, transparent processes, and enhanced disclosure requirements for token issuers, it positioned the exchange as a leader in responsible self - regulation that anticipates and exceeds forthcoming regulatory requirements. This creates competitive advantages if and when regulators impose standardized listing requirements on all exchanges. By implementing robust practices early, Coinbase can claim it already operates at higher standards than less compliant competitors.

For Binance, the regulatory journey has followed a much more turbulent path. The November 2023 settlement with the U.S. Department of Justice, Financial Crimes Enforcement Network, and Commodity Futures Trading Commission imposed $4.3 billion in penalties - primarily for anti - money laundering violations - and required CZ's permanent departure from executive management. The settlement resolved criminal and civil charges related to operating an unlicensed money transmitting business, facilitating transactions involving sanctioned jurisdictions including Iran, and failing to implement adequate know - your - customer and anti - money laundering programs.

Since the settlement, Binance has undergone dramatic internal transformation. The exchange invested approximately $200 million in compliance programs over two years, expanding legal and regulatory teams from a few dozen to several hundred employees. New CEO Richard Teng positioned compliance as a competitive advantage, arguing that Binance's financial resources enable it to implement controls that smaller exchanges cannot match. The exchange established proper money services business licenses in numerous U.S. states where it previously operated in regulatory gray zones. It pursued full regulatory licenses in key international markets including obtaining a Virtual Asset Service Provider license in Dubai and seeking approval to re - enter markets like India from which it had been expelled for compliance deficiencies.

This compliance transformation affects listing decisions profoundly. Where Binance previously added dozens of tokens monthly with limited due diligence, the post - settlement exchange faces pressure to demonstrate rigorous evaluation processes. Regulators expect exchanges with proper licenses to conduct adequate due diligence on listed assets, monitor for potential securities law violations, screen for sanctioned persons or entities, and maintain records that enable regulatory oversight. Projects seeking Binance listings now encounter longer timelines and more intrusive due diligence than during the exchange's earlier rapid - growth phase.

Binance's defense against allegations of problematic listing practices increasingly emphasizes regulatory compliance rather than simply denying that fees exist. The exchange points to its screening procedures, risk assessments, and rejection of projects that fail compliance reviews as evidence of responsible practices. Yi He's statements about rigorous evaluation processes speak directly to regulatory concerns about exchanges serving as gatekeepers against problematic assets. By emphasizing that no amount of payment or token allocation can secure listing for projects that fail compliance reviews, Binance positions itself as responsible infrastructure consistent with regulatory expectations rather than a purely commercial enterprise maximizing revenue regardless of asset quality.

The ongoing SEC case against Binance adds complexity to this regulatory picture. Unlike the comprehensive criminal settlement with the Justice Department, the SEC's civil action filed in June 2023 remains ongoing as of October 2025, though the parties have requested multiple 60 - day pauses to negotiate potential resolution. The SEC alleges that Binance operated as an unregistered securities exchange, offered unregistered securities including BNB and BUSD tokens, and provided unregistered staking services. The case's outcome could significantly impact Binance's ability to serve U.S. customers and the broader regulatory framework for cryptocurrency exchanges.

Global regulatory harmonization efforts add another layer of complexity. The European Union's Markets in Crypto - Assets regulation, which took full effect in 2025, establishes comprehensive licensing requirements for exchanges operating in EU member states. These requirements include minimum capital standards, operational resilience measures, conflict - of - interest management, marketing and disclosure standards, and consumer protection requirements. Similar regulatory frameworks have emerged or are under development in multiple jurisdictions including the United Kingdom, Singapore, Japan, and South Korea.

The GENIUS Act passed by the U.S. Congress in 2025 establishes federal regulatory framework for stablecoins, requiring full reserve backing and monthly audits. This directly affects both exchanges given their substantial revenues from stablecoin - related activities including trading fees and revenue - sharing arrangements with stablecoin issuers. The Act's passage suggests momentum toward comprehensive federal regulation of digital assets that would supersede the current patchwork of state - level money transmitter licenses and agency - specific enforcement actions.

In this evolving regulatory landscape, transparency and documented compliance procedures provide valuable defensive postures. When Coinbase or Binance faces questions about listing practices, being able to point to published standards, documented evaluation processes, and consistent application of transparent criteria helps demonstrate good - faith compliance efforts. Even if perfect transparency proves impossible given commercial sensitivities and competitive considerations, sufficient transparency to satisfy regulatory oversight while maintaining some strategic flexibility represents the pragmatic optimum.

Both exchanges recognize that their long - term viability depends on achieving and maintaining regulatory legitimacy across major markets. This reality increasingly drives their public statements and policy decisions even when those conflict with short - term profit maximization or competitive positioning. The October 2025 listing controversy, therefore, functioned not just as competition between exchanges but as a very public demonstration of their respective commitments to transparency and responsible practices that they hope will influence regulatory treatment going forward.

The Business of Attention: PR, Influence, and Community Reaction

The public nature of the October 2025 dispute between Coinbase and Binance reflects how cryptocurrency exchanges increasingly compete not just for users and trading volume but for narrative control and community sentiment. In an industry where reputation effects can move markets and social media engagement directly translates into business outcomes, the ability to shape public discourse represents a significant competitive asset.

The sequence of events demonstrated sophisticated understanding of attention economics. Jesse Pollak's statement that listing should cost zero percent emerged from a specific context - accusations against Binance about listing fee demands - but rapidly took on broader significance as a rallying cry for exchange transparency. By framing the issue in absolutist terms, Pollak positioned Coinbase as advocating for principles rather than merely defending its own practices. This created immediate pressure for other exchanges to respond with their own positions.

CZ's response exemplified his skill at social media engagement cultivated over years of building Binance's brand through direct communication with cryptocurrency communities. Rather than issue formal statements through corporate communications channels, CZ posted personal responses on X that mixed humor, directness, and strategic messaging. His laugh emoji in response to criticism positioned him as confident and unbothered while his substantive points about Binance listing Base projects created cognitive dissonance for Coinbase's critics. By urging Coinbase to list BNB Chain projects, he moved the conversation from defensive posture about Binance's practices to offensive challenges about Coinbase's consistency.

Coinbase's rapid response of actually adding BNB to its listing roadmap demonstrated agility but also suggested sensitivity to narrative dynamics. The exchange could have waited days or weeks to thoroughly evaluate BNB from technical, market - making, and compliance perspectives before making any announcement. Instead, it moved within hours of the Blue Carpet launch, suggesting that reputational considerations outweighed operational caution. This choice generated immediate positive attention and positioned Coinbase as responsive to community feedback, but it also created obligations and expectations that might constrain future flexibility.

Community reaction on social media revealed the deep divisions and tribal allegiances that characterize crypto culture. Binance supporters criticized Coinbase as hypocritical, pointing to allegations about massive listing fees from figures like Justin Sun and Andre Cronje. They characterized Coinbase's BNB listing as forced by public pressure rather than voluntary commitment to openness. Coinbase supporters countered that Binance's defensive reactions to listing fee accusations revealed consciousness of guilt and that CZ's demands for reciprocal listing represented strategic deflection from legitimate criticisms.

Engagement metrics told part of the story. Posts about the listing dispute generated millions of impressions, thousands of comments, and extensive quote - tweet chains as the cryptocurrency community debated which exchange exhibited worse behavior and what this revealed about centralized exchange power. Media coverage from outlets like CoinDesk, The Block, and Decrypt amplified the controversy beyond social media into more mainstream cryptocurrency discourse. Even users who typically ignored exchange operations and listing processes found themselves drawn into debates about the proper standards for such decisions.

Token price movements suggested that at least some market participants viewed these developments as financially significant. BNB's initial price jump following the Coinbase listing announcement indicated positive sentiment, though the subsequent decline suggested either profit - taking or recognition that roadmap listing fell short of actual trading availability. Trading volumes for BNB increased across multiple exchanges as attention focused on the token, demonstrating how narrative can directly translate into market activity.

The broader pattern resembles previous cryptocurrency disputes that played out in public view including block size debates in Bitcoin, contentious hard forks in Ethereum, and multiple conflicts over governance and development roadmaps across various projects. Cryptocurrency communities have consistently demonstrated willingness to engage intensely with technical and policy questions that would receive minimal attention in traditional financial markets. This engagement reflects the industry's origins in cypherpunk culture that emphasizes transparency, community governance, and resistance to centralized authority.

Yet some observers expressed weariness with what they viewed as performative disputes serving competitive positioning more than genuine principle. A cynical reading suggests both exchanges engaged in strategic theater: Binance defending itself against serious allegations by pivoting to attacks on Coinbase's inconsistency, Coinbase generating positive PR through symbolic gestures while maintaining fundamental practices unchanged. From this perspective, the beneficiaries were neither exchange but rather cryptocurrency media outlets and social media engagement metrics while actual resolution of substantive questions about listing transparency remained elusive.

The attention dynamics also revealed the different audiences each exchange prioritizes. Binance's messaging resonated particularly strongly with retail traders, especially in Asian markets where CZ maintains celebrity status and Binance commands dominant market share. CZ's informal, direct communication style and willingness to engage in social media disputes appeals to communities that value accessibility and view traditional corporate communication as excessively formal and evasive.

Coinbase's more measured, institutional approach reflects its focus on regulatory compliance, institutional adoption, and mainstream credibility. The Blue Carpet launch emphasized frameworks, standards, and processes - language designed to appeal to sophisticated projects and regulatory observers more than retail social media audiences. Even Coinbase's decision to list BNB was framed through operational requirements like market - making and technical infrastructure rather than as direct response to competitive pressure.

As the October 2025 controversy gradually faded from immediate attention, its longer - term impacts on exchange behavior and industry norms remained uncertain. Did the public pressure actually influence how exchanges make listing decisions going forward, or did it merely produce temporary symbolic adjustments while fundamental practices continued unchanged? The answer would emerge only through sustained observation of whether Coinbase accelerates BNB listing to actual trading availability, whether it shows more openness to BNB Chain ecosystem projects, and whether other exchanges feel compelled to enhance their own transparency in response to competitive pressure.

Broader Implications: The Future of Exchange Competition

The Coinbase - Binance listing dispute offers a lens through which to examine several crucial questions about cryptocurrency's evolution and the future of centralized exchange competition. Whether the specific controversy proves memorable or quickly fades, the underlying tensions it exposed will shape how exchanges operate and compete in coming years.

First, the episode highlights how centralized exchanges remain enormously powerful gatekeepers despite cryptocurrency's decentralization ethos. When Coinbase adds BNB to its roadmap, market prices react. When CZ urges listings of BNB Chain projects, media coverage surges. These platforms exercise influence over which tokens achieve mainstream adoption, which blockchain ecosystems attract users and developers, and which projects secure the liquidity necessary for growth. This power inevitably tempts exchanges to favor their own vertically integrated ecosystems, creating tension between their role as neutral infrastructure and their interests as competing businesses.

The concentration of this power in just two dominant platforms - Coinbase and Binance - creates systemic risks for the broader ecosystem. If exchanges use listing decisions to disadvantage potential competitors or to extract excessive rents from projects seeking access, this could stifle innovation and reduce the dynamism that makes cryptocurrency compelling. Regulatory intervention might address the most egregious abuses, but regulation carries its own risks of excessive restriction or ossification. The optimal outcome would involve exchanges recognizing that long - term success requires maintaining trust and serving users' interests even when this conflicts with short - term profit maximization.

Second, the competition between exchange - affiliated blockchain ecosystems - Base versus BNB Chain being merely the most prominent example - may define cryptocurrency's trajectory as much as the underlying technical innovations. These platforms represent attempts to capture network effects and vertical integration advantages similar to those that established tech giants like Apple, Google, and Amazon achieved in Web2. If successful, they could enable better user experiences, lower costs, and more seamless integration between trading, custody, and application access. But they also risk recreating in cryptocurrency the same platform power and lock - in effects that crypto's origins were meant to escape.

Whether interoperability can emerge sufficiently to prevent winner - take - all dynamics remains uncertain. Technologies enabling cross - chain communication and asset transfers have improved dramatically, with bridges, wrapped tokens, and universal swap protocols providing users some ability to move between ecosystems. But fundamental friction remains when every blockchain uses different consensus mechanisms, programming languages, wallet software, and development tools. These technical barriers, combined with exchanges' strategic incentives to maintain proprietary advantages, may limit how interoperable the ecosystem becomes.

Third, the listing controversy demonstrates the power and limits of transparency as a competitive strategy. Coinbase's emphasis on published standards, zero - fee listings, and the Blue Carpet framework provides marketing advantages and positions the exchange as responsible infrastructure. But transparency creates its own vulnerabilities. Public roadmap listings generate expectations and obligations. Documented policies constrain flexibility to make exceptions or adjust criteria based on circumstances. Perfect transparency about evaluation processes might enable gaming or reveal competitive intelligence to rivals.

Binance's more opaque approach avoids these vulnerabilities but creates different risks. Without clear, published standards, projects face uncertainty about listing prospects and terms. This unpredictability might deter some projects from pursuing listings or lead them to competitors offering more defined processes. Opacity also enables accusations about favoritism, corruption, or arbitrary decision - making that damage reputation even when untrue. The optimal balance likely involves sufficient transparency to demonstrate fairness and build trust while preserving enough flexibility to manage competitive dynamics and individual circumstances.

Fourth, the episode reveals how regulatory compliance increasingly drives exchange behavior and competitive positioning. Both Coinbase and Binance now operate under significant regulatory oversight, though from different jurisdictions with different requirements. This regulatory fragmentation creates challenges for exchanges seeking global reach while maintaining consistent practices across markets. It also creates opportunities for regulatory arbitrage where exchanges emphasize operations in more permissive jurisdictions while limiting services in more restrictive markets.

The trend toward comprehensive regulatory frameworks in major markets - MiCA in Europe, evolving legislation in the United States, updated guidelines in Singapore and Hong Kong - suggests that exchanges will face increasingly standardized requirements including capital adequacy, operational resilience, listing standards, and disclosure obligations. These requirements will favor larger, better - resourced platforms that can afford substantial compliance investments. Smaller exchanges may struggle to compete or may need to specialize in niches where they can differentiate despite fewer resources.

Fifth, the growing sophistication of decentralized alternatives threatens to disrupt centralized exchange dominance over medium to longer timeframes. Decentralized exchanges have achieved substantial scale, with Uniswap alone handling billions in daily trading volume across multiple blockchain networks. While DEXs currently represent a minority of total trading volume, their technological improvements in areas like liquidity concentration, automated market - making algorithms, cross - chain functionality, and gas optimization are gradually closing quality gaps with centralized platforms. As DEXs achieve better user experiences and more institutional - grade functionality, they may erode the moats that currently protect centralized exchanges.

The centralized exchanges' best defense likely involves continued innovation in services that DEXs cannot easily replicate: fiat on - ramps and off - ramps, custody services for institutional clients, sophisticated derivatives products, margin trading, and regulatory compliance that enables traditional finance participation. By positioning themselves as essential infrastructure connecting traditional finance with decentralized protocols rather than competing directly with DEXs, centralized exchanges might sustain relevance even as pure trading functionality becomes increasingly decentralized.

Sixth, the controversy suggests that competitive dynamics may be shifting from zero - sum rivalry toward more complex relationships mixing competition and cooperation. When Binance lists Base projects and Coinbase adds BNB to its roadmap, these represent small steps toward acknowledging that users benefit from accessing diverse ecosystems through preferred platforms. This mirrors similar evolution in traditional finance where competing exchanges cross - list securities and competing brokerages provide access to similar universes of assets. As cryptocurrency matures, similar pressures toward interoperability and comprehensive asset access may overcome the instinct toward exclusive control and ecosystem segregation.

Yet cooperation remains constrained by fundamental competitive tensions. Exchanges benefit from network effects that concentrate liquidity and users within their platforms. They capture more revenue when users conduct all their activities - trading, staking, lending, payments - within unified ecosystems. Cross - listing competitor tokens and supporting alternative chains undermines these advantages even as it serves user interests. How exchanges navigate these tensions will depend on regulatory pressure, competitive dynamics, and their assessments of what's required to maintain relevance as the ecosystem evolves.

Conclusion: Lessons from the Listing Wars

The October 2025 confrontation between Coinbase and Binance over listing practices, while perhaps destined to become a footnote in cryptocurrency's larger history, illuminates fundamental tensions that will shape the industry's evolution for years to come. At its core, the dispute revealed the uncomfortable position of centralized exchanges as simultaneously essential infrastructure and competitive businesses, neutral platforms and interested parties, servants of user interests and profit - maximizing enterprises.

The specific questions raised - whether exchanges charge listing fees, how transparent their evaluation processes should be, what obligations they bear toward cross - ecosystem openness - may never be fully resolved to everyone's satisfaction. Commercial realities, competitive pressures, and individual circumstances will always create some tension between ideal transparency and practical business operations. Perfect consistency proves elusive when exchanges must balance technical feasibility, regulatory compliance, commercial sustainability, and strategic positioning while serving diverse constituencies with conflicting interests.

Yet the conversation itself carries value. By forcing exchanges to articulate their listing philosophies publicly and defend their practices against scrutiny, controversies like October 2025's dispute create accountability that might otherwise be absent. They empower projects and users to make more informed decisions about which platforms deserve their trust and business. They pressure exchanges toward greater transparency even if perfection remains impossible. And they signal to regulators where industry self - regulation may be succeeding or failing, potentially informing better regulatory frameworks.