In one of the most volatile trading days this quarter, Bitcoin’s institutional magnetism and ALPACA’s meme-like chaos have lit up the markets. BTC surged to nearly $95,000 off the back of Arizona’s historic state reserve bill and BlackRock’s billion-dollar ETF inflow, while ALPACA stunned the crowd with a 440% spike triggered by ironically its delisting.

Meanwhile, PUNDIX gained steam on its new Binance Futures listing, BSW climbed after its Huobi debut, and VOXEL rebounded hard after Bitget’s compensation program. This mix of legitimate adoption, exchange-driven hype, and speculative frenzy captured the attention of every type of investor today.

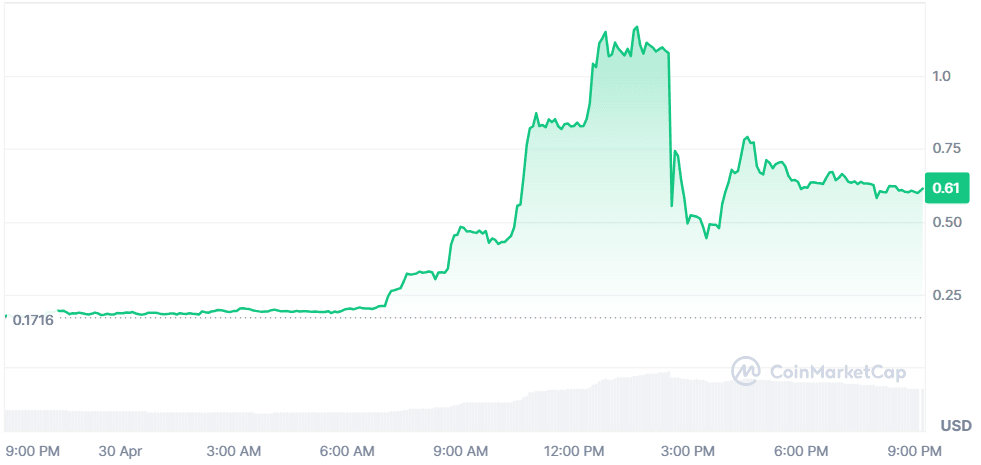

Alpaca Finance (ALPACA)

Price Change (24H): +255.75% Current Price: $0.6184

What happened today

Alpaca Finance exploded over 440% following news of its upcoming delisting from Binance, a move that ironically triggered bullish momentum. This surge was fueled by aggressive short-selling, followed by a cascade of liquidations once buyers pumped the price. With $3B in futures volume and over $100M in shorts liquidated, speculation about market manipulation overshadowed the fundamentals. Binance’s adjustment of funding rate settlement frequency and cap further intensified volatility. However, with RSI divergence and wave 5 nearing its end, technicals hint that the rally may be nearing exhaustion.

Market Cap: $93.05M 24-Hour Trading Volume: $746.35M Circulating Supply: 150.46M ALPACA

Bitcoin (BTC)

Price Change (24H): -0.94% (based on current range around $95,000) Current Price: $94,000

What happened today

Bitcoin surged as Arizona passed a historic bill to create the first U.S. state Bitcoin reserve, potentially investing up to $3.1 billion into BTC. Simultaneously, BlackRock’s iShares Bitcoin Trust saw a $1 billion single-day inflow, propelling institutional confidence and pushing BTC toward a $2 trillion market cap. Meanwhile, Cboe launched cash-settled Bitcoin index futures, adding to BTC’s growing financial product ecosystem. With institutional momentum accelerating, Bitcoin's role as a macro hedge continues to strengthen.

Market Cap: $1.86 trillion 24-Hour Trading Volume: $30.74B Circulating Supply: 19.85M BTC

Pundi X (PUNDIX)

Price Change (24H): +24.73% Current Price: $0.5149

What happened today

PUNDIX rallied following Binance Futures' announcement of a new USDⓈ-Margined PUNDIXUSDT perpetual contract, offering leverage up to 75x. The listing significantly boosted trader interest and market activity. Whale concentration remains high, with 81.9% of tokens held by large addresses.

Market Cap: $133.06M 24-Hour Trading Volume: $533.5M Circulating Supply: 258.38M PUNDIX

Biswap (BSW)

Price Change (24H): +57.27% Current Price: $0.04866

What happened today

Biswap surged after being listed on Huobi Global, significantly increasing its visibility and access to liquidity. With trading now live and withdrawals starting tomorrow, investor sentiment is bullish. The project operates on the Binance Smart Chain and has strong community backing.

Market Cap: $26.5M 24-Hour Trading Volume: $149.29M Circulating Supply: 544.49M BSW

Voxies (VOXEL)

Price Change (24H): +47.77% Current Price: $0.1206

What happened today

VOXEL rebounded after Bitget launched a compensation program in response to a glitch that previously caused VOXEL’s trading volume to surpass even BTC. The exchange will fully airdrop lost funds back to users, restoring confidence. Legal action is also being taken against the involved accounts.

Market Cap: $29.38M 24-Hour Trading Volume: $150.46M Circulating Supply: 243.53M VOXEL

Global Market Snapshot

European markets turned negative after the U.S. reported a 0.3% GDP contraction, sparking recession fears early in Trump’s second term. Germany’s GDP expanded 0.2% but core inflation rose to 2.9%, while euro zone growth exceeded expectations at 0.4%. Amid mixed earnings and geopolitical trade uncertainties, healthcare outperformed, while autos and consumer sentiment lagged. The ECB is hinting at a June rate cut, while markets react to Trump’s tariff shakeup and Biden-era overhang. Investors are watching inflation signals and fiscal reforms to assess recovery momentum across major economies.

Closing Thoughts

Investor sentiment today is split sharply between conviction and speculation. Institutional confidence in Bitcoin continues to build, backed by formal adoption (Arizona) and powerhouse inflows (BlackRock), reaffirming its place as a serious macro asset.

Meanwhile, the altcoin crowd is chasing high-risk, high-reward trades like ALPACA, which rallied not on utility, but sheer volatility, reminding us of how easily sentiment can be manipulated in low-cap environments. Retail participants appear drawn to perpetuals and newly listed tokens, evident in PUNDIX and BSW’s gains, while VOXEL’s recovery shows the power of swift damage control in retaining community trust.

Looking at the broader market, action is heating up in both regulatory narratives and token-specific developments. DeFi and derivatives-focused assets are seeing more attention, but not always for the right reasons. With equities digesting economic contraction in the U.S. and a stubborn inflation profile in Germany, crypto is momentarily stealing the spotlight, serving as both a hedge and an escape. The trend for now? Momentum trading is back, but fundamentals are still steering the larger ships.