Bitcoin reclaimed ground as geopolitical shocks turned into strategic tailwinds. The U.S. and Texas both doubled down on BTC as a treasury asset, signaling a mainstream validation of crypto’s fiscal role. Meanwhile, FUNToken surged over 50% amid Web3 gaming tailwinds and protocol upgrades, while MOVE rode a clean technical breakout. FORM joined the rally as GameFi regained momentum, even as BULLA collapsed under sell-the-news pressure from Binance’s trading event.

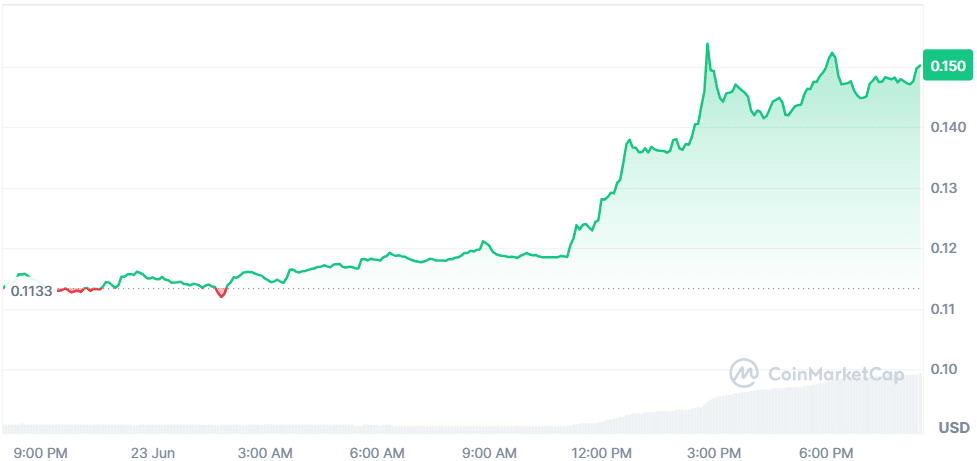

FUNToken (FUN)

Price Change (24H): +51.73% Current Price: $0.01124

What happened today

FUNToken surged over 50% following key upgrades to its smart contracts and CertiK verification, which confirm its immutable structure and no future inflation. These changes significantly bolstered its position in the Web3 gaming space. Strategic accumulation on Binance and KuCoin also supported the rally, along with strong community interest and positive sentiment.

Market Cap: $121.89M 24-Hour Trading Volume: $207.17M Circulating Supply: 10.84B FUN

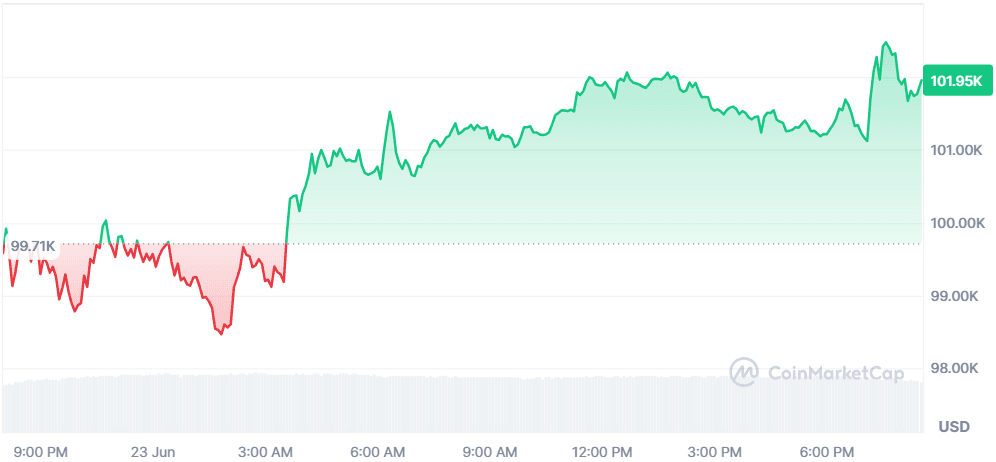

Bitcoin (BTC)

Price Change (24H): +2.28% Current Price: $101,985.76

What happened today

BTC gained on news that Anthony Pompliano launched a $1B ProCap merger with $750M raised for a new Bitcoin treasury strategy, marking the largest initial raise for a public Bitcoin holding firm. Additionally, Texas created a state-funded Bitcoin Reserve, and Trump signed an executive order establishing a U.S. Strategic Bitcoin Reserve, reinforcing Bitcoin’s growing role in government-backed finance.

Market Cap: $2.02T 24-Hour Trading Volume: $56.26B Circulating Supply: 19.88M BTC

Movement (MOVE)

Price Change (24H): +30.4% Current Price: $0.1509

What happened today

MOVE exploded 30% after breaking out of a descending channel on June 18, signaling a technical reversal. RSI and MACD indicators supported bullish momentum, and the trading volume jumped nearly 475%. Despite prior negative fundamentals, whale accumulation and volatility-driven trading pushed the price upward.

Market Cap: $392.47M 24-Hour Trading Volume: $241.4M Circulating Supply: 2.6B MOVE

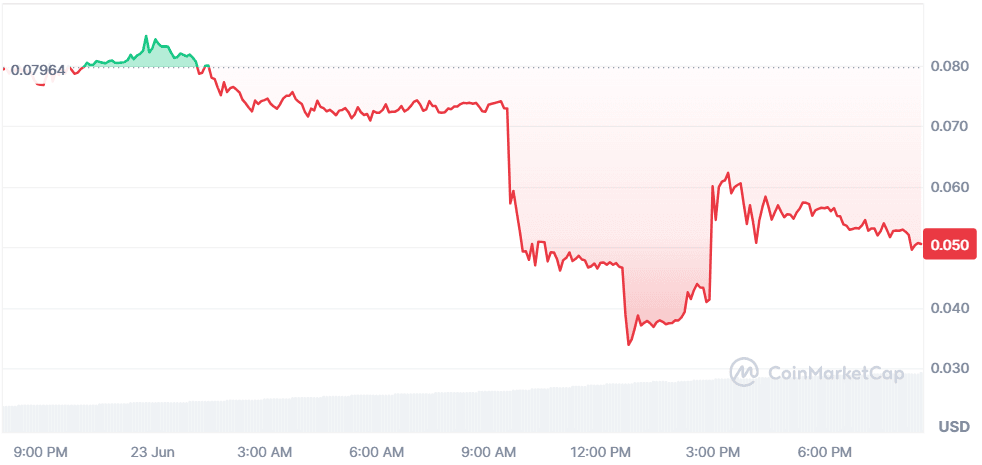

Bulla (BULLA)

Price Change (24H): -35.83% Current Price: $0.05050

What happened today

BULLA plummeted nearly 36% due to a “sell-the-news” reaction following Binance’s trading competition launch. With 11.7M tokens set to be unlocked, traders likely front-ran the event with profit-taking. The crash was worsened by thin liquidity and an oversold RSI of 27.7, with no technical reversal in sight.

Market Cap: $14.14M 24-Hour Trading Volume: $199.77M Circulating Supply: 280M BULLA

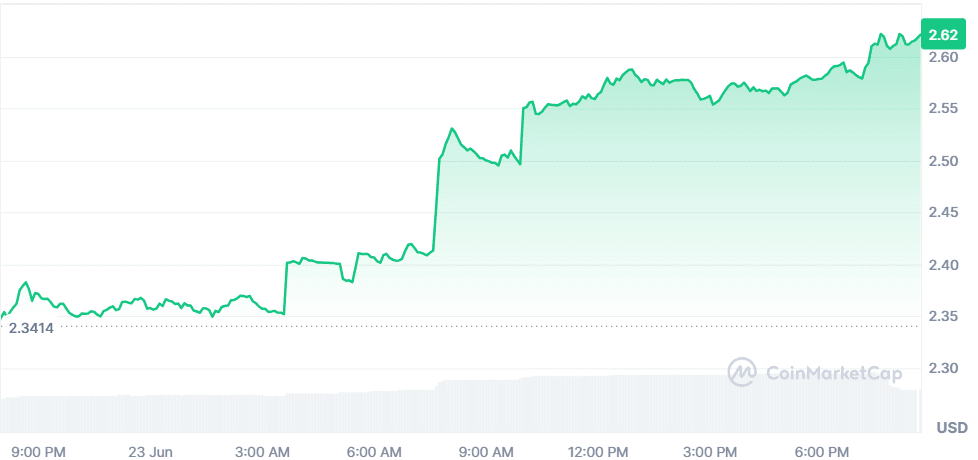

Four (FORM)

Price Change (24H): +9.93% Current Price: $2.62

What happened today

FORM climbed nearly 10% as GameFi tokens gained traction, with the sector’s market cap rising 41% in June. Technical indicators such as RSI and MACD signaled a rebound, while FORM broke above key resistance levels. It remains one of the top GameFi tokens, with a 148% rise in 90 days.

Market Cap: $1B 24-Hour Trading Volume: $26.08M Circulating Supply: 381.86M FORM

Global Market Snapshot

Global markets kicked off the week on edge as the U.S. officially entered the Israel–Iran conflict, launching strikes on Iranian nuclear facilities. While initial fears spurred a spike in oil prices and sent crypto markets reeling over the weekend, investor nerves appeared surprisingly tempered by Monday. The Dow gained over 100 points as oil prices cooled, partly due to Trump’s public plea to “keep oil prices down.” Meanwhile, European defense stocks slumped even as U.S. names like Lockheed and Northrop edged up, and Asian markets closed mostly lower amid geopolitical uncertainty.

China’s stance on the Middle East crisis is shifting into a delicate diplomatic balance. While Beijing initially voiced strong support for Iran, it has since moderated its tone, aiming to avoid a direct confrontation with the U.S. Analysts suggest China could leverage the turmoil, particularly a potential Strait of Hormuz blockade, to indirectly pressure Western economies. Meanwhile, the Chinese yuan and Japanese yen saw volatility, as investors assessed energy dependencies and the potential for stagflation scenarios. Global oil flows, safe haven currencies, and regional defense equities are all under close watch, as markets brace for Iran’s next move.

Closing Thoughts

Investor sentiment shows an unusual calm in the face of rising geopolitical risks. Bitcoin is being rebranded from a speculative asset to a sovereign reserve tool, backed by Trump, Texas, and a $750M institutional raise. This evolution is drawing capital back into crypto, but selectively, tokens with solid fundamentals or sectoral narratives (like Web3 and GameFi) are winning, while event-driven plays like BULLA are facing ruthless selloffs.

This blend of macro tension and sector rotation is shaping a bifurcated market. Defensive positioning is visible in institutional Bitcoin moves, while retail players are chasing short-term rallies in technically primed or narrative-rich altcoins. As oil, fiat currencies, and geopolitics continue to stir volatility, one thing is clear, momentum is returning, but only the strongest coins are riding it.