Rising from the shadows of macro uncertainty, today's crypto momentum was led by niche tokens tied to AI, analytics, and DeFi infrastructure. Raydium (RAY) broke out after its Upbit listing, triggering a cascade of retail flows, while ANGL and ZORO capitalized on the AI narrative with ecosystem updates and product launches.

Bubblemaps (BMT) caught a volume spike following its TON integration, and Huma Finance (HUMA) posted a steady gain after landing on Bithumb. The market’s attention clearly shifted toward innovation tokens, even as global financial volatility intensified.

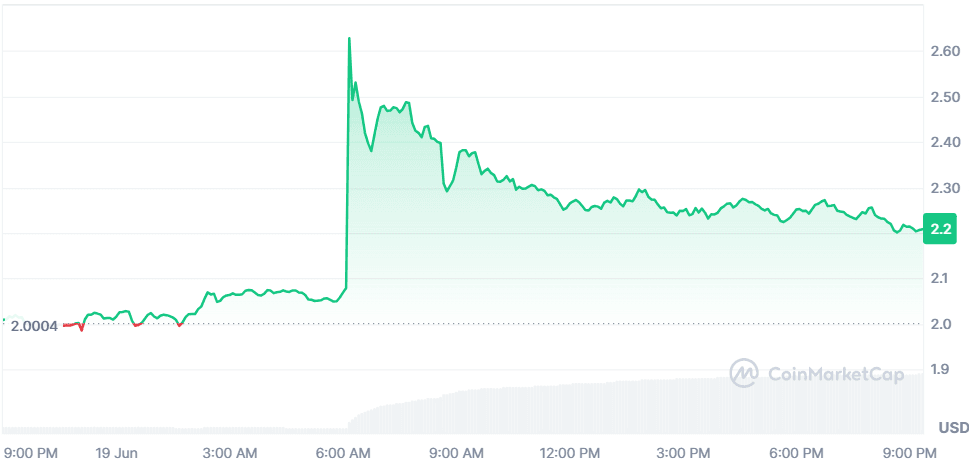

Raydium (RAY)

Price Change (24H): +9.17% Current Price: $2.20

What happened today

Raydium surged after South Korea's top exchange Upbit listed RAY/KRW and RAY/USDT pairs, triggering a 28% intraday spike. The listing opened the doors to over 20M Korean traders, historically known for rapid retail-driven rallies. This, coupled with a technical breakout above $2.10 and a 673% volume increase, reignited bullish momentum, even as fundamentals showed weakening platform activity.

Market Cap: $588.68M 24-Hour Trading Volume: $459.00M Circulating Supply: 267.12M RAY

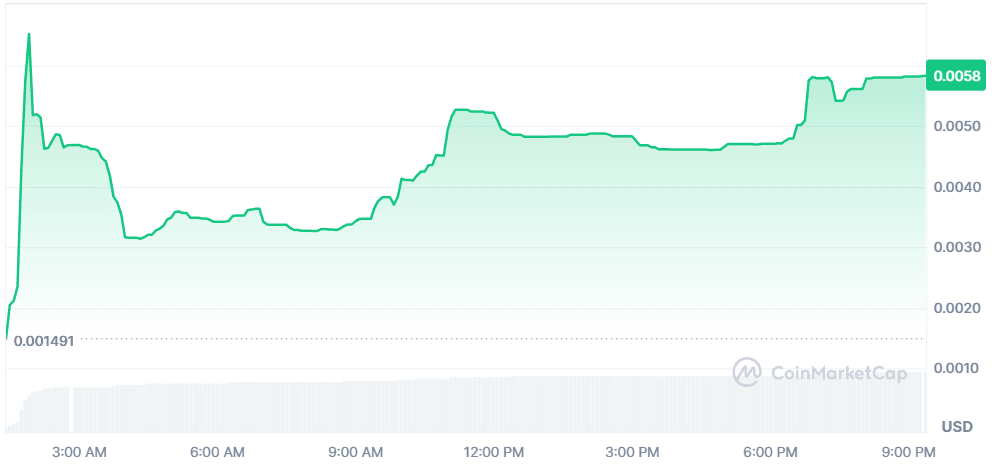

ANGL TOKEN (ANGL)

Price Change (24H): +24.42% Current Price: $0.005825

What happened today

ANGL launched on Uniswap following its token generation event, powering the Angel Twin ecosystem. With AI-twins enabling users to earn from their AI-generated content and actions, the narrative of user-owned AI found strong traction. Early use cases span mortgage apps, chat assistants, and digital avatars, positioning $ANGL as a futuristic, functional token bridging creator economy and AI monetization.

Market Cap: $1.16M 24-Hour Trading Volume: $1.41M Circulating Supply: 200M ANGL (self-reported)

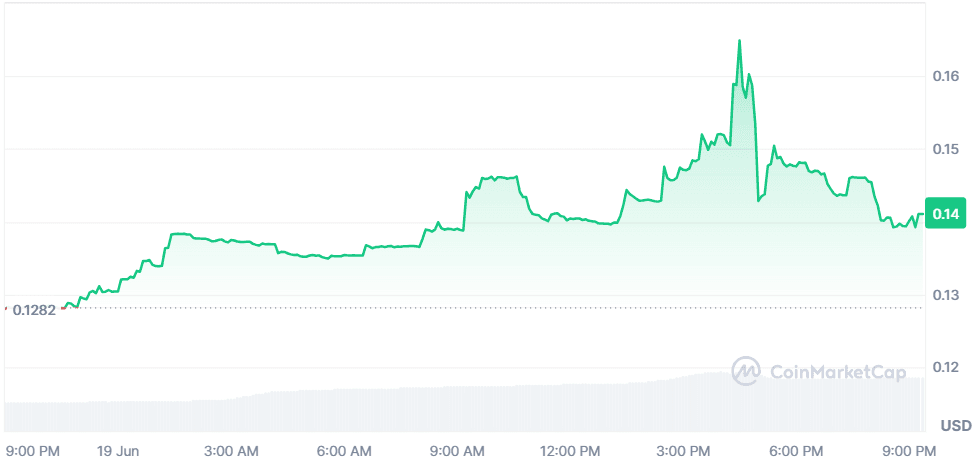

ZoRobotics (ZORO)

Price Change (24H): +10.13% Current Price: $0.1410

What happened today

Zoro AI Chat officially launched, fueling interest in the Web3 x AI infrastructure. The new product allows users to interact with and train live AI models, with all transactions settled via ZORO. Utility expands across subscriptions, task automation, and robotics APIs. The update bolstered investor confidence in ZORO’s AI-forward roadmap, reflected in its 83%+ rise in daily volume.

Market Cap: $1.75M 24-Hour Trading Volume: $4.2M Circulating Supply: 12.4M ZORO

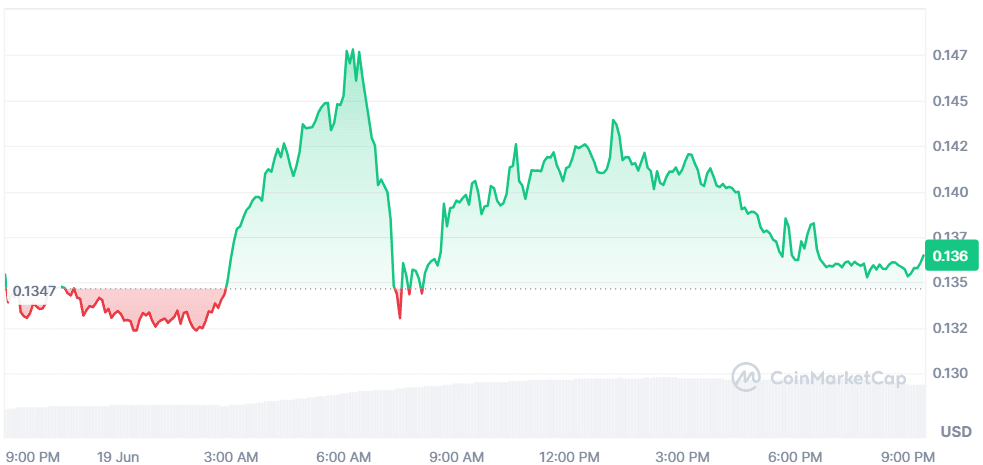

Bubblemaps (BMT)

Price Change (24H): +2.93% Current Price: $0.1371

What happened today

Bubblemaps integrated with TON, offering real-time visual analytics for one of Web3’s fastest-growing ecosystems. TON’s reach through Telegram (500K+ daily users, 2M+ transactions) creates a major narrative tailwind. Bubblemaps’ InfoFi tools, including Magic Nodes and Time Travel, unlock network transparency, positioning BMT as a critical infrastructure token in the data-intelligence layer of crypto.

Market Cap: $47.31M 24-Hour Trading Volume: $119.98M Circulating Supply: 345.04M BMT

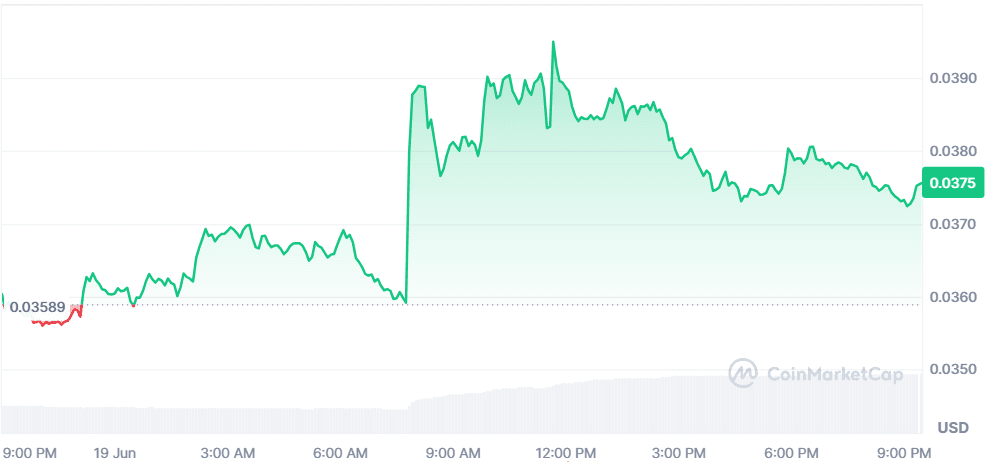

Huma Finance (HUMA)

Price Change (24H): +4.87% Current Price: $0.03755

What happened today

HUMA rallied after being listed on Bithumb, South Korea’s second-largest exchange. The listing boosted visibility, with volume spiking 110% to $95M. Technicals also signaled recovery: an oversold RSI (24.37) hinted at rebound potential, and HUMA reclaimed its $0.037 pivot. The altcoin also benefited from narrative tailwinds tied to low-cap PayFi plays amid broader altcoin rotations.

Market Cap: $65.1M 24-Hour Trading Volume: $95.2M Circulating Supply: 1.73B HUMA

Global Market Snapshot

Markets are on edge as geopolitical tensions erupt in the Middle East. Israel and Iran exchanged missile strikes overnight, with critical infrastructure and even hospitals impacted. President Trump has hinted at potential U.S. military intervention, while global leaders call for de-escalation. The Kremlin warns of a “terrible spiral of escalation,” and fears of nuclear risk are mounting.

Meanwhile, in monetary policy:

-

The Federal Reserve held rates steady for the fourth time, drawing sharp criticism from President Trump, who claims it's too late to curb economic strain.

-

The Bank of England also paused rate cuts but remains dovish, signaling potential easing in August due to subdued U.K. growth and inflation risks from rising oil prices.

In this climate of global volatility, crypto seems to be gaining safe-haven traction. Capital is rotating into narrative-rich altcoins like AI tokens and analytics plays, while trading volumes and technical rebounds point to renewed risk appetite, at least for now.

Closing Thoughts

Despite a volatile geopolitical backdrop and nervous energy across traditional markets, crypto is showing pockets of strong, narrative-driven participation. Investor interest seems to be clustering around coins offering clear product utility or infrastructure value, especially in AI and data analytics. With ANGL, ZORO, and BMT seeing elevated engagement, it's evident that users are rewarding ecosystems building beyond just hype. At the same time, centralized exchange listings, particularly in South Korea, are proving once again to be key catalysts for tokens like RAY and HUMA.

Outside crypto, the global financial landscape is teetering on a tightrope. The Israel-Iran conflict is escalating rapidly, and markets are bracing for potential U.S. military involvement, which could drive a spike in oil prices and inflation. Central banks are pausing on rate cuts, for now, but geopolitical stress is making “wait and watch” the dominant economic strategy. In this high-uncertainty environment, crypto’s selective surge, especially in utility-led sectors, may hint at investors rotating capital toward assets with asymmetric upside potential amid growing distrust in traditional systems.