In a session defined by falling crude and a 400-point Dow rebound, crypto’s spotlight shifted to revenue-backed names and legal catalysts: SYRUP ripped on Maple Finance’s swelling AUM, HYPE climbed on exchange upgrades, XRP punched higher after a near-final truce with the SEC, TRX rallied on its surprise Nasdaq‐linked treasury play, while battered ZKJ stayed deep-red as liquidity vanished.

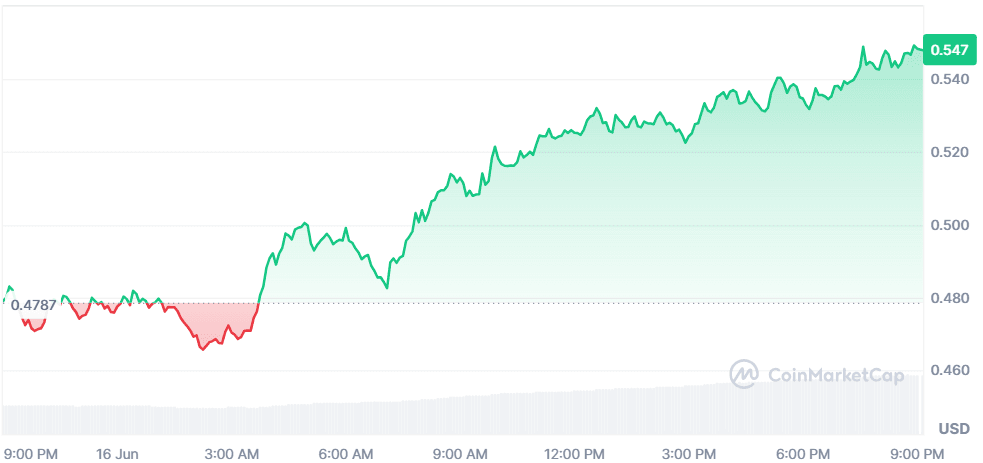

Maple Finance (SYRUP)

Price Change (24H): +13.44% Current Price: $0.5479

What happened today

MapleIn a session defined by falling crude and a 400-point Dow rebound, crypto’s spotlight shifted to revenue-backed names and legal catalysts: SYRUP ripped on Maple Finance’s swelling AUM, HYPE climbed on exchange upgrades, XRP punched higher after a near-final truce with the SEC, TRX rallied on its surprise Nasdaq‐linked treasury play, while battered ZKJ stayed deep-red as liquidity vanished.’s private-credit engine keeps humming: platform AUM just crossed $2.2 billion, TVL has ballooned 433 % since January, and more than 40 % of tokens are now staked. Those fundamentals plus rising fee revenue drove SYRUP to a seven-month high and extend its 512 % YTD surge.

Market Cap: $610.09M 24-Hour Trading Volume: $101.95 M Circulating Supply: 1.11 B SYRUP

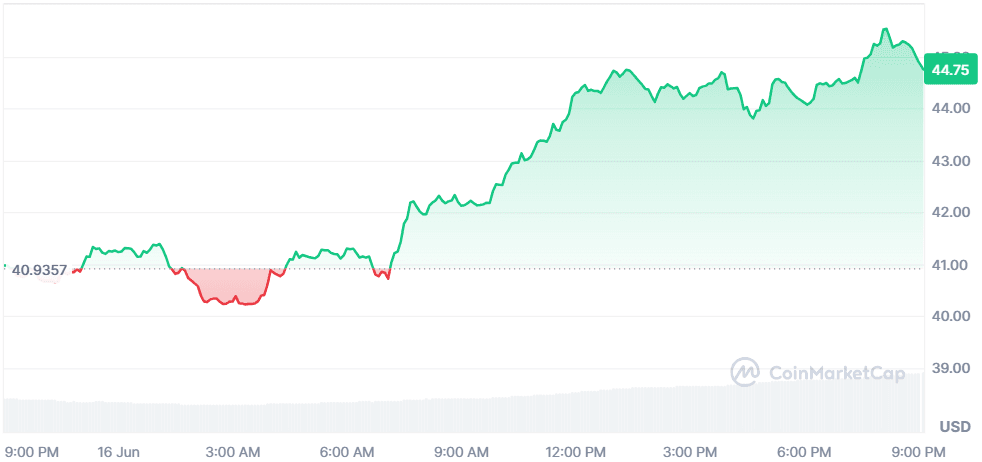

Hyperliquid (HYPE)

Price Change (24H): +9.29% Current Price: $44.72

What happened today

The perps heavyweight rolled out support for 100+ assets and “Vaults” yield products on its L1, lifting liquidity and pushing HYPE to the No. 5 spot by futures open interest. Sentiment stayed bullish despite security-tool criticism after the JELLY exploit traders cheered faster execution and deeper books.

Market Cap: $14.93B 24-Hour Trading Volume: $368.72M Circulating Supply: 333.92 M HYPE

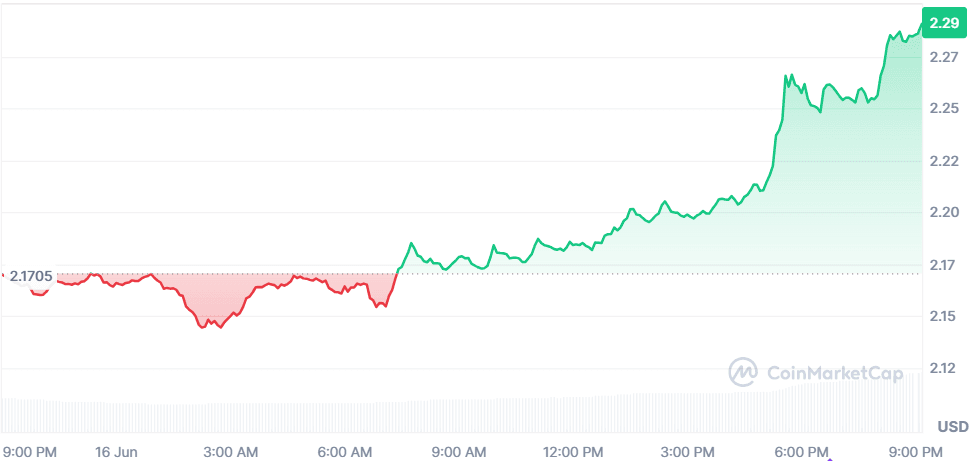

XRP (XRP)

Price Change (24H): +5.67% Current Price: $2.29

What happened today

XRP and the SEC jointly asked the court to modify their final judgment paving the way for a $125 million settlement and an end to the long-running lawsuit. A definitive resolution would remove a major overhang on XRP’s regulatory status, boosting market confidence and trading volumes.

Market Cap: $134.88B 24-Hour Trading Volume: $3.08B Circulating Supply: 58.88 B XRP

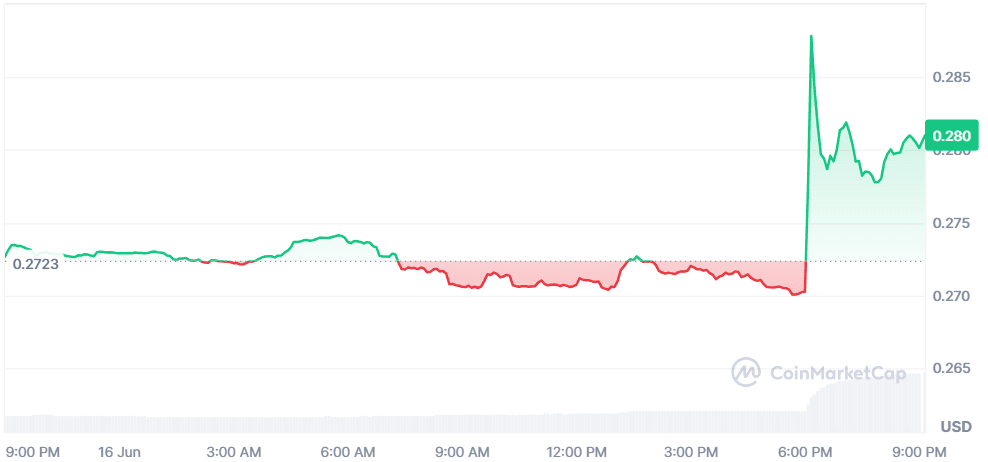

TRON (TRX)

Price Change (24H): +3.51% Current Price: $0.2830

What happened today

Nasdaq-listed SRM Entertainment is rebranding to “Tron Inc.” and building a $210 million TRX treasury, with founder Justin Sun joining as adviser and Eric Trump reportedly set to come on board. The reverse-merger news and plans for staking-backed dividends sparked fresh demand for TRX.

Market Cap: $26.84B 24-Hour Trading Volume: $1.11B Circulating Supply: 94.83 B TRX

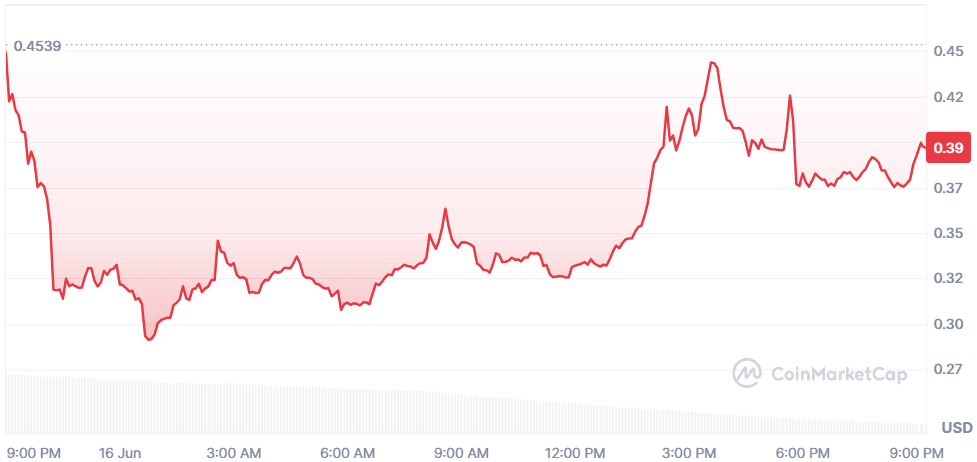

Polyhedra Network (ZKJ)

Price Change (24H): -3.29% Current Price: $0.3963

What happened today

After an 83% crash over the weekend triggered by six whale wallets dumping $9.7 million and a looming 15.5 M token unlock ZKJ continues to reel from liquidity shocks. Binance confirmed “abnormal on-chain transactions” and is revising its Alpha Points system, but traders remain wary of further sell-pressure.

Market Cap: $116.08M 24-Hour Trading Volume: $471.64M Circulating Supply: 292.86 M ZKJ

Global market Snapshot

Stocks staged a relief rally as traders wagered the Israel-Iran flare-up stays localized: the Dow bounced 404 points (+1 %), the S&P 500 climbed 1.1 %, and the Nasdaq sprinted 1.5 %, led by big-tech names like Meta and Tesla. The war premium bled out of energy: WTI crude reversed from a $77 overnight spike to $70.47 (-3 %) after reports that Tehran is open to talks if Washington stays on the sidelines. Cheaper oil revived risk appetite, but it also knocked defense names lower (Lockheed -3.8 %, Northrop -3.3 %) even as conflict-analytics play Palantir gained.

Behind the headline bounce, macro nerves linger. A weak New York Fed factory read (-16) and Wednesday’s Fed decision keep rate-cut timing in play futures still price a full hold. Overseas, Asia-Pac indices closed higher despite mixed China data, and Europe opened firmer even as Paris Air Show organizers blocked Israeli arms displays. Strategists warn the market may be underpricing a wider Middle-East escalation; for now, though, the path of least resistance remains cautiously risk-on while oil drifts and diplomacy inches forward.

Closing Thoughts

Global markets look willing to chase upside—so long as Middle-East risk stays ring-fenced. Investors are rotating toward tokens and sectors that convert headlines into real cash-flows (credit protocols, trading venues) or unlock clear regulatory paths. That selective bid mirrors equity flows into mega-cap tech and away from pure defense plays once oil reversed: the crowd wants growth, but with guardrails.

Near term, watch energy and rates: cheaper crude and a Fed on pause give risk assets room, yet any Hormuz shock or hotter data could flip sentiment fast. Expect volume to stay heaviest in coins tied to yield, staking, or compliance breakthroughs; names without those pillars ,ZKJ’s crash is the poster child, may keep leaking liquidity as the market distinguishes narrative from substance.