Bitcoin’s rally past $106K has set the tone for a green day across both traditional and crypto markets, with Ethereum, SEI, XRP, and Solana all posting strong gains. SEI in particular stole the spotlight with a 35% surge driven by a major government partnership, while Ethereum climbed off the back of a promising protocol proposal and surging institutional inflows.

XRP is building momentum on ETF optimism, and SOL is riding a wave of real-world integration via Kazakhstan and enterprise stablecoins. Together, these movements reflect a shift in market appetite toward narrative-backed, institutional-aligned assets, just as global risk appetite improves with the de-escalation in the Middle East.

Bitcoin (BTC)

Price Change (24H): +4.35% Current Price: $105,955.28

What happened today

Bitcoin surged past $106K following two major developments. First, a ceasefire agreement between Israel and Iran has eased global geopolitical tensions, boosting investor confidence. Second, Anthony Pompliano announced a $1B merger to launch ProCap Financial, a new BTC-focused financial services firm, which will hold up to $1B in Bitcoin on its balance sheet. The record-setting $750M+ fundraise shows massive institutional appetite and cements BTC’s role in treasury strategies.

Market Cap: $2.1T 24-Hour Trading Volume: $62.82B Circulating Supply: 19.88M BTC

Ethereum (ETH)

Price Change (24H): +8.41% Current Price: $2,448.85

What happened today

Ethereum rallied on a trio of bullish signals. Dev Barnabé Monnot proposed EIP-7782, aiming to halve block time to 6 seconds for faster confirmations. Simultaneously, Ethereum ETFs surpassed $1B in net inflows, underscoring institutional demand. Finally, UK investment giant Baillie Gifford launched the first FCA-approved tokenised fund on Ethereum, further reinforcing its role in institutional finance. Despite a whale deposit of $313M to Coinbase raising sell-off concerns, onchain metrics remain robust, with weekly active wallets nearing 13.23M.

Market Cap: $295.62B 24-Hour Trading Volume: $25.5B Circulating Supply: 120.71M ETH

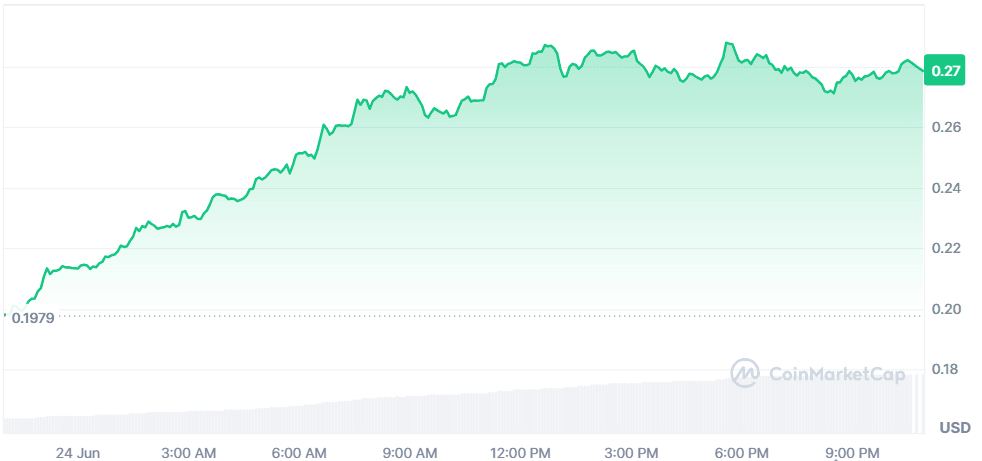

Sei (SEI)

Price Change (24H): +35.31% Current Price: $0.2784

What happened today

SEI soared after Wyoming named Sei Network as the official blockchain partner for its stablecoin pilot. The state endorsement catapulted SEI’s visibility, backed by founder Jeff Feng’s vision of low-latency DeFi infrastructure. The announcement triggered massive liquidity inflows, with SEI outpacing majors like ETH and BTC. The momentum was further amplified by Canary filing for a SEI ETF, suggesting institutional gateways are opening.

Market Cap: $1.54B 24-Hour Trading Volume: $890.9M Circulating Supply: 5.55B SEI

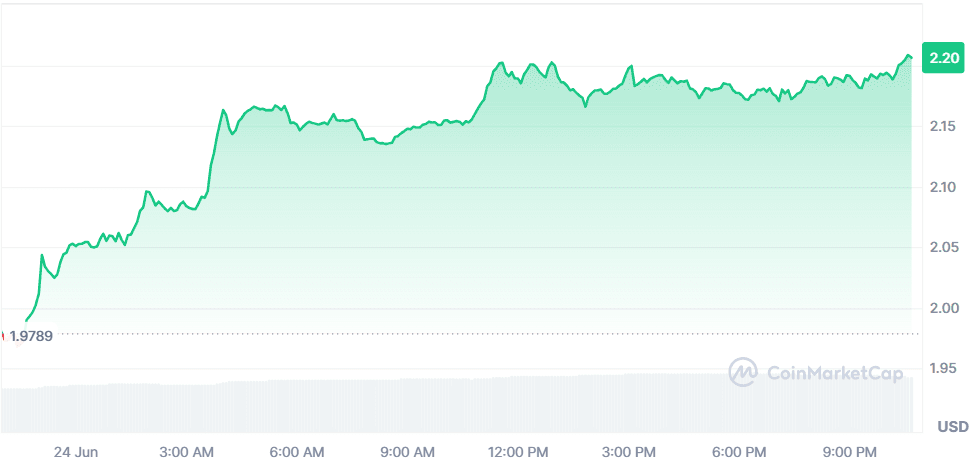

XRP (XRP)

Price Change (24H): +8.88% Current Price: $2.18

What happened today

XRP rallied as excitement builds around Firelight, a new DeFi product on Flare Network that allows liquid staking of dormant XRP. Flare CEO confirmed institutional participation, with $100M in XRP already committed. Additionally, Ripple’s legal battle with the SEC is nearing a conclusion, with odds of an XRP ETF approval reaching 95%, per Bloomberg analysts. Canada’s 3iQ also launched the first North American XRP ETF ($XRPQ), attracting C$32M AUM in 3 days.

Market Cap: $129.03B 24-Hour Trading Volume: $4.8B Circulating Supply: 58.93B XRP

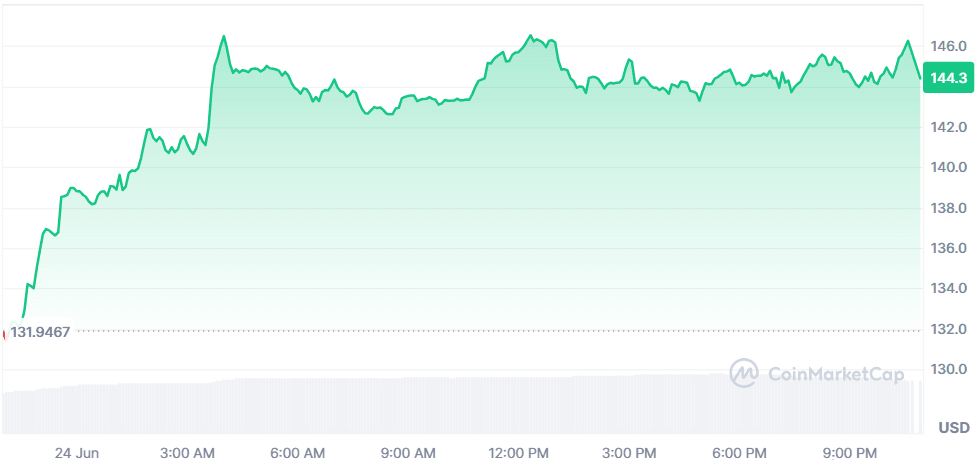

Solana (SOL)

Price Change (24H): +6.26% Current Price: $144.38

What happened today**

Solana climbed on three key catalysts: (1) A landmark partnership with Kazakhstan to build Central Asia’s first Blockchain Economic Zone, (2) the launch of network extensions enhancing scalability and eliminating Layer 2 inefficiencies, and (3) Fiserv announcing its FIUSD stablecoin to be built on Solana, integrating enterprise payments with blockchain. Solana also enabled tokenized equity via Kraken and DeFi Dev Corp, pushing the ecosystem deeper into institutional territory.

Market Cap: $76.69B 24-Hour Trading Volume: $5.37B Circulating Supply: 531.2M SOL

Global Market Snapshot

Markets rallied as geopolitical tensions eased, following U.S. President Donald Trump's announcement of a ceasefire between Israel and Iran. However, investor optimism remains cautious as both sides have since exchanged minor strikes, testing the fragile truce. Oil prices tumbled over 5% after Trump declared China could continue buying oil from Iran, signaling a major reversal in the U.S.'s “maximum pressure” campaign. Brent crude fell to $67.34 and WTI dropped to $65.54, retreating to levels not seen since before the June 13 airstrikes. The Dow surged nearly 500 points and the S&P 500 hit new 52-week highs as risk-on sentiment returned.

Meanwhile, in The Hague, NATO allies convened with Trump reaffirming the U.S.'s commitment to the bloc amid skepticism. A landmark agreement to raise defense spending to 5% of GDP by 2035 is expected to be formalized tomorrow. Despite internal disputes, particularly with Spain’s resistance, NATO leaders emphasized unity and urgency, especially with Russia and China tightening coordination with Iran and North Korea.

Closing Thoughts

Across the board, investor sentiment is in recovery mode. Traditional markets surged as Trump’s unexpected ceasefire announcement between Israel and Iran and softened oil diplomacy with China brought a temporary sigh of relief. Equities jumped, oil dropped more than 5%, and risk appetite returned, creating a fertile backdrop for crypto assets to rebound alongside. Notably, this momentum isn't just speculative: ETF flows, protocol upgrades, and state-level blockchain adoption are driving today's action, anchoring market gains in tangible catalysts.

Within crypto, institutional narratives clearly stole the show. Ethereum and XRP drew interest thanks to their growing ties with traditional finance, whether through spot ETFs, tokenized funds, or novel DeFi products like Firelight. Meanwhile, SEI and Solana gained favor in infrastructure and sovereign partnerships. Bitcoin, true to form, led from the front, bolstered by a record-breaking $750M treasury raise. In short, the market is rewarding coins with clear utility, strong backers, and regulatory alignment, suggesting a maturing investor base even amid geopolitical turbulence.