Today was defined by institutional buzz and speculative surges as XRP stole the spotlight amid ETF optimism and deepening banking alliances, while Bitcoin held strong above $105K, continuing to attract large-scale capital flows. Keeta and Stella posted impressive double-digit gains, riding fresh exchange listings and ecosystem activity.

Solana, despite a pullback, remains fundamentally bullish with over $1.2B in Q1 revenue. The altcoin market is showing signs of bifurcation—projects with clear utility and active developer traction are being favored over hype alone.

XRP (XRP)

Price Change (24H): -2.28% Current Price: $2.37

What happened today

XRP is under the spotlight as major financial institutions and governments across the globe actively test Ripple’s XRP Ledger for applications including cross-border payments, CBDCs, and smart contract integration. Notably, Bank of America is reportedly going "all in" on Ripple’s infrastructure following key regulatory rollbacks. XRP also received a major boost from the recent approval of its ETF in Brazil, with whale accumulation increasing by 6% over two months. Analysts are speculating XRP could target $5 in the mid-term, riding on institutional adoption and ETF-driven demand.

Market Cap: $139.32B 24-Hour Trading Volume: $4.16B Circulating Supply: 58.62B XRP

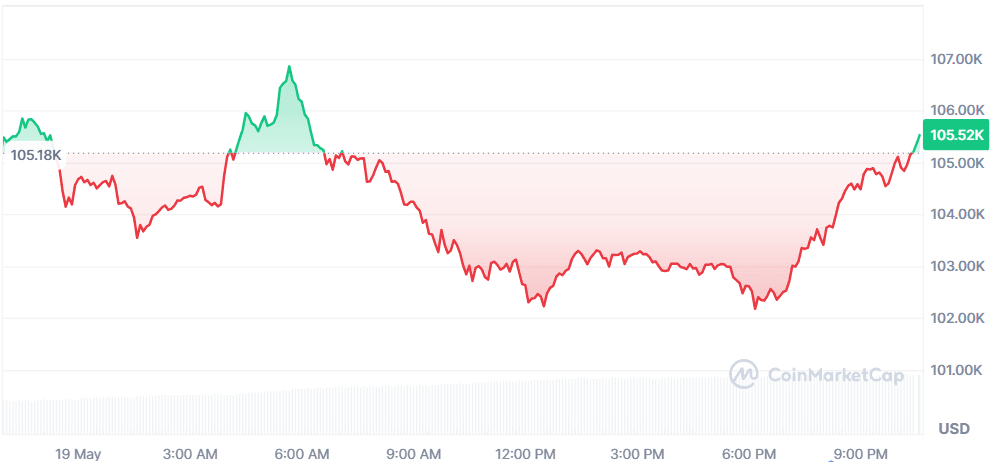

Bitcoin (BTC)

Price Change (24H): -0.36% Current Price: $105,474.97

What happened today

Bitcoin breached the $106K mark recently, setting a new weekly close record driven by record ETF inflows, particularly BlackRock’s IBIT fund now holding over 631,000 BTC worth $65B. This represents over 3% of the total BTC supply and reflects serious institutional confidence. Market dominance hit 59.6%, boosting the wider crypto market. Analysts project a possible price range of $132K–$150K in the next leg of this ETF-driven bull cycle.

Market Cap: $2.09T 24-Hour Trading Volume: $67.48B Circulating Supply: 19.86M BTC

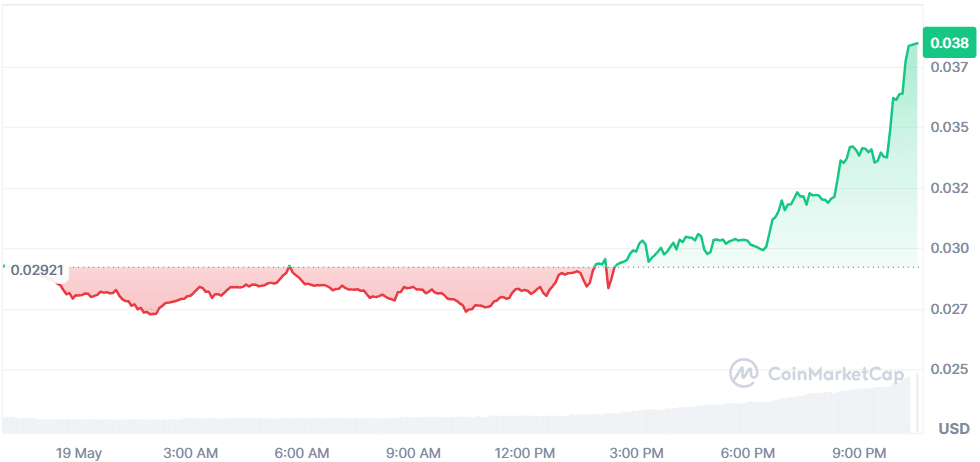

Stella (ALPHA)

Price Change (24H): +30.00% Current Price: $0.03811

What happened today

Stella surged 30% following the launch of its testnet trading competition, offering 1000 BERA tokens to top-performing traders. This new momentum is drawing user attention to Stella’s leverage-based DeFi infrastructure. The sharp rally reflects growing engagement and speculation around its ecosystem growth.

Market Cap: $35.14M 24-Hour Trading Volume: $46.84M Circulating Supply: 922M ALPHA

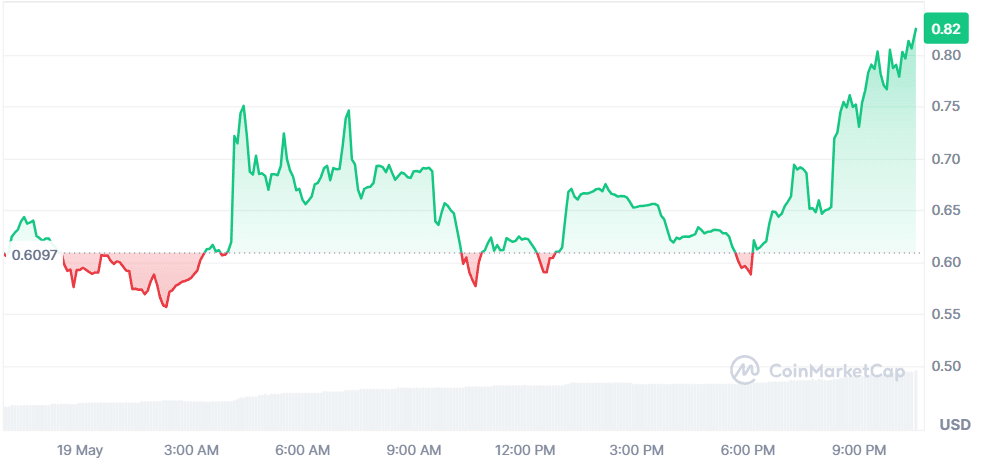

Keeta (KTA)

Price Change (24H): +25.82% Current Price: $0.8038

What happened today

Keeta’s price spiked after BitMart announced its listing. The project markets itself as a high-performance Layer-1 blockchain supporting seamless cross-chain transactions. The new exchange listing helped boost trading volume by over 130%, reflecting strong investor enthusiasm.

Market Cap: $321.55M 24-Hour Trading Volume: $34.95M Circulating Supply: 400M KTA

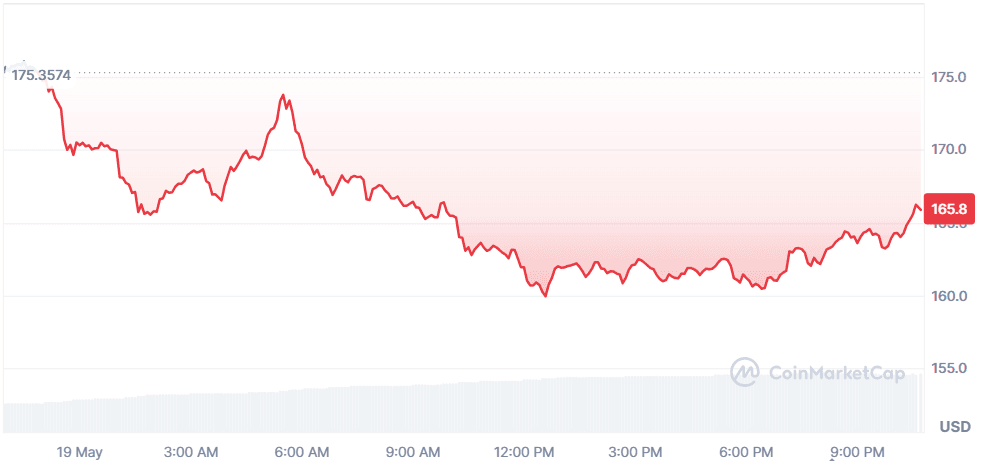

Solana (SOL)

Price Change (24H): -5.56% Current Price: $165.89

What happened today

SolanaClosing Thoughts Institutional momentum is clearly driving the crypto narrative this week. From BlackRock’s deepening exposure in Bitcoin to XRP’s growing footprint in banking corridors, the smart money appears to be aligning with infrastructure-heavy, compliance-adjacent projects. ETFs, tokenized assets, and blockchain integrations with banks are dominating sentiment, especially as regulatory tides shift in favor of adoption. Meanwhile, retail interest remains drawn to newer narratives like Keeta and Stella, showing that the appetite for early-stage bets hasn't dried up.

In the broader global context, the resilience in U.S. equities despite Moody’s downgrade reflects cautious optimism. Markets are parsing long-term inflation risks, rising yields, and geopolitical frictions with a more pragmatic lens. As investors brace for more tariff and rate-driven turbulence, crypto remains both a hedge and an opportunity zone. The divergence between strong-performing infrastructure tokens and weaker speculative assets will likely widen further as both TradFi and DeFi recalibrate their priorities. pulled back after a strong run but remains fundamentally bullish. With over $1.2B in Q1 application revenue, Solana’s ecosystem is booming. Projects like Pump.fun have driven revenue growth, and a new Layer-2 solution called Soly is in development to address network congestion. Solana also led major ecosystem developments this week, including new tokenized funds, stablecoin banking infrastructure, and zk-proof-based VPNs.

Market Cap: $86.25B **24-Hour Trading Volume: **$5.41B Circulating Supply: 519.93M SOL

Global Market Snapshot

U.S. equities rebounded despite Moody’s downgrade of the U.S. credit rating from Aaa to Aa1. The S&P 500 rose 0.3%, clawing back losses as Treasury yields pulled back after early spikes—the 10-year topping 4.5% and the 30-year exceeding 5%. Traders are weighing the long-term effects of Trump’s tariff policy and bond market volatility.

Reddit fell 4% after a downgrade by Wells Fargo, while UnitedHealth jumped 7% following heavy selloffs. Meanwhile, UBS advised maintaining full equity exposure due to AI-driven earnings trends. The Russell 2000 underperformed, down 1%, signaling continued weakness in small caps.

China pushed back against U.S. chip restrictions, citing risks to bilateral trade talks. Despite macro headwinds, institutional outlook remains cautiously optimistic, especially with AI, communications, and utilities sectors showing resilience.

Closing Thoughts

Institutional momentum is clearly driving the crypto narrative this week. From BlackRock’s deepening exposure in Bitcoin to XRP’s growing footprint in banking corridors, the smart money appears to be aligning with infrastructure-heavy, compliance-adjacent projects. ETFs, tokenized assets, and blockchain integrations with banks are dominating sentiment, especially as regulatory tides shift in favor of adoption. Meanwhile, retail interest remains drawn to newer narratives like Keeta and Stella, showing that the appetite for early-stage bets hasn't dried up.

In the broader global context, the resilience in U.S. equities despite Moody’s downgrade reflects cautious optimism. Markets are parsing long-term inflation risks, rising yields, and geopolitical frictions with a more pragmatic lens. As investors brace for more tariff and rate-driven turbulence, crypto remains both a hedge and an opportunity zone. The divergence between strong-performing infrastructure tokens and weaker speculative assets will likely widen further as both TradFi and DeFi recalibrate their priorities.