This week, the crypto market faced bearish pressures as Bitcoin entered a correction phase, influenced by the announcement of a potential U.S. sale of 6.5 million BTC.

Despite this, several standout coins like XRP, AQT, and SUI have captured the spotlight, demonstrating resilience and growth. Let’s dive into the trending coins that defied the odds and led the market buzz.

Tokamak Network (TOKAMAK)

Price Change (7D): +22.01% Current Price: $2.04

News The market cap of Tokamak Network crossed $100 million this week. The platform aims to provide a customized blockchain environment to meet the diverse demands of Ethereum-based dApps, addressing issues like high transaction fees, limited scalability, and privacy concerns. Tokamak Network's ultimate goal is to establish an L2 On-Demand Ethereum Platform for deploying custom Layer 2 services. Additionally, it announced that the Tokamak Bridge will be shut down on January 13, 2025, with guides available for TON ↔ WTON conversions.

Forecast With the market cap breaching the $100M threshold, Tokamak Network has demonstrated strong growth potential. The current bullish sentiment aligns with the recent performance improvements, but the token faces resistance at $2.50. If the platform succeeds in further adoption of its Layer 2 solutions and addresses interoperability issues effectively, the price could test $2.75 in the coming weeks. However, with the bridge shutdown and potential reallocation of liquidity, short-term volatility could lead to a retest of the $1.75 support zone.

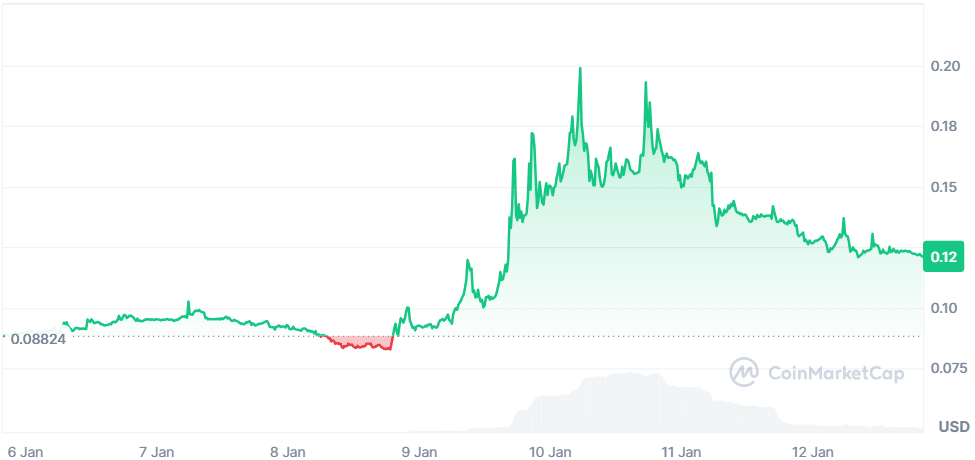

Moss Coin (MOC)

Price Change (7D): +38.50% Current Price: $0.1215

News Moss Coin experienced a 163% surge in the past week, fueled by bullish sentiment and increased adoption of its metaverse-based NFT and AR/VR solutions. The trading volume saw a 906% pump to $963 million, with a price high of $0.20689 before retracing. The metaverse platform continues to connect real and virtual worlds, using Moss Coin as its core economic token.

Forecast Moss Coin's strong technical breakout above the 50-day and 200-day moving averages indicates robust momentum. Immediate resistance lies at $0.20689, with a potential target of $0.25 if breached. The RSI at 65.70 suggests room for further upside but nears overbought territory, warranting caution. If the current level isn't sustained, a pullback to the $0.11-$0.13 range could occur, providing a buying opportunity for long-term investors.

AVA (AVA)

Price Change (7D): +33.95% Current Price: $0.1802

News AVA has gained traction with speculation about a potential Binance listing. This week, Travala, the platform utilizing AVA tokens, announced new Bitcoin incentives to boost crypto adoption in the travel industry. Travala surpassed $100 million in annual revenue in 2024 and continues to innovate with Bitcoin and AVA loyalty programs. Its partnerships with major players like Skyscanner and KAYAK bolster awareness among mainstream travelers.

Forecast The ongoing speculation about a Binance listing provides upward momentum for AVA, with immediate resistance at $0.20. If the listing materializes, the token could rally toward $0.25. However, any delays or denials may lead to a correction to $0.15. The broader adoption of Travala's services and rewards programs adds a long-term bullish case, potentially pushing AVA towards $0.30 by the end of Q1 2025, provided the travel crypto sector gains further mainstream traction.

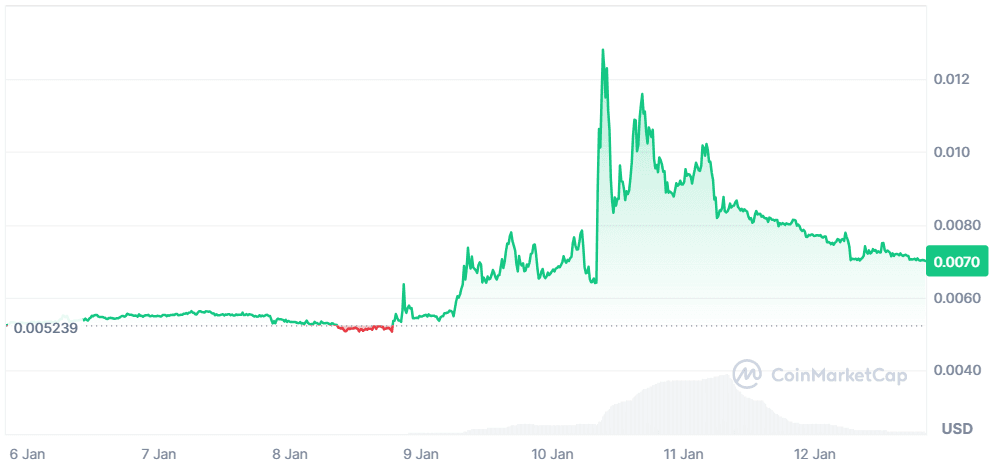

AhaToken (AHT)

Price Change (7D): +34.08% Current Price: $0.007024

News AHT was listed on Bithumb spot on January 10, causing a massive surge in trading activity, reaching over $200M in 24-hour trading volume. AhaToken powers a Q&A knowledge platform where users receive answers from experts. Users are incentivized through digital asset rewards for posting questions, answers, and curating content, which has led to a real-world application of the platform. Aha also actively combats spam and PR abuse, enhancing user experience.

Forecast AHT’s listing on Bithumb has provided strong momentum, and its trading volume spike signals increased investor interest. Immediate resistance lies at $0.0085, while support is observed at $0.0065. Continued adoption of its platform and increased engagement could drive the price towards $0.01 in the coming weeks. However, a retracement to $0.0060 is possible if trading volumes diminish or broader market conditions weaken.

ChainBounty (BOUNTY)

Price Change (7D): +37.03% Current Price: $0.08737

News BOUNTY recorded a staggering 1022.80% increase in trading volume within 24 hours. As an AI-powered security solution for crypto projects, it has gained traction for its use case in tracking and preventing cryptocurrency-related fraud. With a market cap of $43M, the token is well-positioned as a utility for security-focused blockchain applications.

Forecast BOUNTY is currently testing resistance at $0.097, with critical support at $0.075 and $0.0587. If momentum persists, the token could rally toward $0.12, supported by increased adoption of its AI solutions. However, traders should be cautious of profit-taking, which could lead to a retest of lower support zones. The overall bullish sentiment and growing utility make BOUNTY a strong contender for mid-term gains.

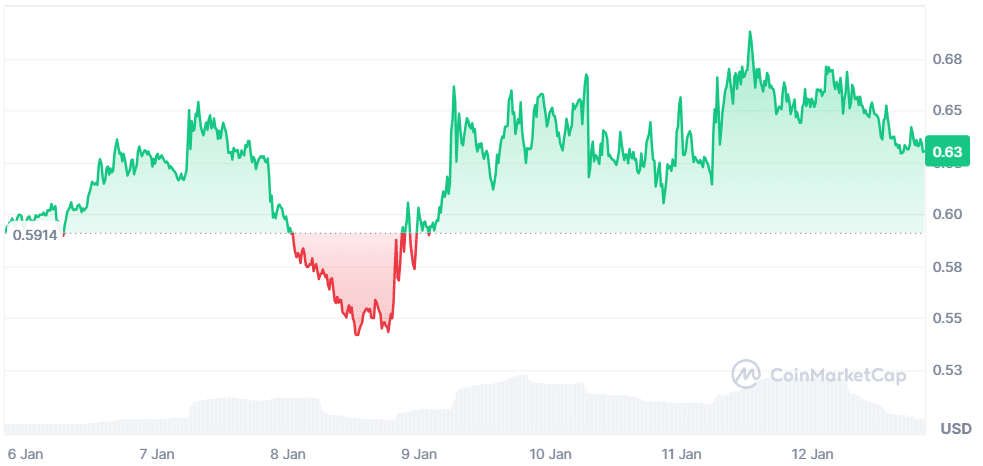

Hifi Finance (HIFI)

Price Change (7D): +7.04% Current Price: $0.6303

News Hifi Finance focuses on fixed-rate borrowing against tokenized Real-World Assets (RWAs). The project has highlighted its role in the tokenization of major asset classes, which aligns with the increasing adoption of RWAs in DeFi. With a market cap of $89.32M and strong community support (93% bullish sentiment), HIFI is a promising player in the tokenized finance space.

Forecast HIFI’s strong fundamentals and bullish sentiment indicate potential upward momentum. The token is currently trading in a consolidation range, with resistance at $0.68 and support at $0.60. A breakout above $0.68 could lead to a rally toward $0.75, fueled by increased adoption of RWAs. Conversely, a breach of support could result in a pullback to $0.55, presenting a buying opportunity for long-term investors.

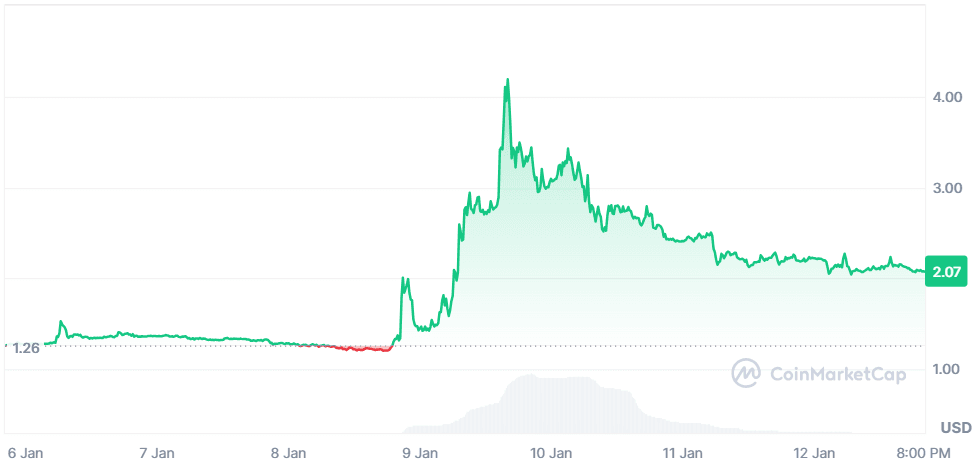

Alpha Quark Token (AQT)

Price Change (7D): +64.25% Current Price: $2.07

News AQT reached a $1B 24-hour trading volume on January 9, the highest in a year. The token has surged by 260% in two days, driven by bullish market sentiment. Alpha Quark is a blockchain project focusing on intellectual property-based NFTs and metaverse applications, gaining attention for its innovative use cases.

*Forecast AQT’s strong rally has pushed the token into a key resistance zone at $2.20. If the momentum sustains, it could target $2.50 in the short term. However, the RSI indicates overbought conditions, suggesting a potential pullback to $1.80 if profit-taking occurs. Long-term growth depends on the platform’s ability to expand its metaverse and NFT offerings.

XRP (XRP)

Price Change (7D): +5.03% Current Price: $2.50

News XRP has seen a week of significant developments. Ripple achieved a partial victory against the SEC, clarifying XRP's security status and influencing global cryptocurrency regulation. The XRPL continues to evolve with major technological upgrades, while Ripple expands its U.S. operations, focusing on stablecoin development and DeFi integrations like RLUSD. Additionally, speculation around potential ETF approval and partnerships with institutions such as Bank of America highlights XRP's increasing adoption in financial systems.

Forecast XRP is consolidating after a recent rally, with strong resistance at $2.60 and immediate support at $2.30. The token's growth trajectory depends on sustained regulatory clarity and strategic partnerships. If these factors align, XRP could test $2.75 in the short term and approach $3.00 in the coming months. Conversely, a breakdown below $2.30 could lead to a pullback toward $2.10. Long-term indicators suggest continued institutional interest and infrastructure upgrades could solidify XRP's position as a key player in global finance.

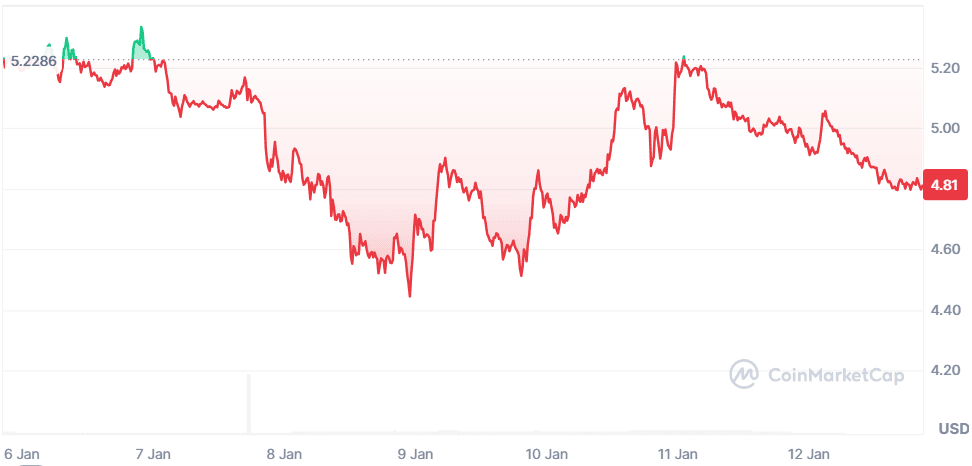

SUI (SUI)

Price Change (7D): -8.03% Current Price: $4.81

News SUI experienced a volatile week with notable partnerships, including one with SEED to revolutionize gaming for 100 million users using scalable blockchain technology. The Sui Foundation's Hydropower Accelerator has pushed its DeFi Total Value Locked (TVL) to $2 billion, showcasing strong ecosystem growth. However, liquidations on Suilend raised concerns over leveraged positions during market instability.

Forecast SUI's recent retracement highlights the importance of its $4.50 support level. If sustained, the token could recover toward $5.20, backed by strategic partnerships and ecosystem growth. However, failure to hold above $4.50 might lead to a drop to $4.20. The DeFi and gaming integrations position SUI for long-term growth, with potential to retest $5.50 in the coming weeks if positive developments continue.

Bicoin (BTC)

Price Change (7D): -3.23% Current Price: $94,684.69

News Bitcoin continues to dominate headlines with increasing institutional legitimacy, driven by SEC-approved ETFs that accumulated $129 billion in assets in 2024. The U.S. Bitcoin Act further positions BTC as a strategic asset, with inflows into ETFs surpassing gold. Regulatory advancements, including spot ETF approvals and national reserves, have solidified BTC's role in financial systems. Additionally, MicroStrategy and BlackRock's combined holdings reinforce confidence in its long-term value.

Forecast BTC is in a consolidation phase, finding strong support at $92,000 while facing resistance near $96,000. Institutional demand through ETFs could push the price toward $100,000 in Q1 2025. However, broader market conditions may trigger a retest of $90,000. Long-term indicators, including network hashrate and regulatory clarity, continue to favor Bitcoin as a leading investment vehicle, potentially driving it to new all-time highs.

Closing Thoughts

This week’s coin performance reveals an intriguing trend: tokens with strong real-world utility, innovative use cases, and regulatory clarity have outperformed the market despite the overall bearish sentiment. XRP's legal victory and expanding institutional adoption, AQT's surge in the NFT and metaverse space, and SUI's DeFi growth highlight investor confidence in transformative technologies and strategic partnerships.

The broader market sentiment remains cautious, with Bitcoin’s correction signaling potential volatility ahead. However, the success of specific coins suggests growing interest in utility-driven projects, making it essential for investors to conduct thorough research (DYOR) before entering the market. As the market navigates these dynamic shifts, opportunities for growth continue to emerge for those who stay informed.