In a market that continues to shift rapidly, a few standout tokens are dominating the conversation. XRP remains a hot topic, fueled by regulatory developments and institutional accumulation, while Cardano is making waves with government partnerships and smart contract advancements.

Meanwhile, Avalon Labs (AVL) and Bluzelle (BLZ) have captured attention with their innovative approaches to Bitcoin-backed finance and decentralized infrastructure. Across the board, we’re seeing an increase in interest around real-world asset (RWA) integration, staking innovations, and DeFi lending, driving fresh capital into select projects.

Here’s a look at the coins that have defined the past week and where they might be headed next.

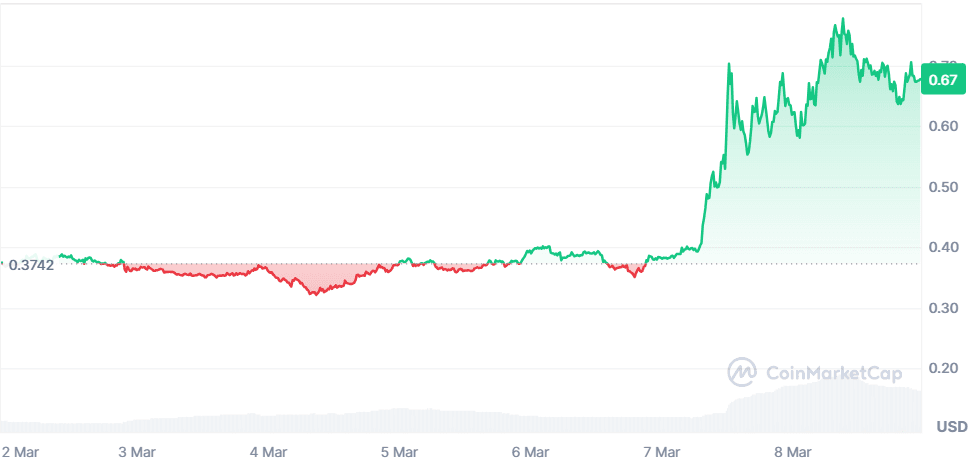

Avalon Labs (AVL)

Price Change (7D): +83.98% Current Price: $0.6898

News

Avalon Labs has unveiled its ambitious 2025 Roadmap, reinforcing its mission to position Bitcoin as the backbone of global capital markets. The team, which pioneered on-chain U.S. Treasury products and Bitcoin-backed stablecoins, is doubling down on making Bitcoin a dynamic financial asset. Their USDa stablecoin has already reached $500M in total locked value within a month of its launch, mirroring the early growth trajectory of Ethena’s USDe. Additionally, AVL has secured a major listing on Bithumb, further expanding its accessibility.

Forecast

AVL has surged over 80% in the past week, fueled by its roadmap announcement and exchange listing. Technical indicators suggest bullish momentum, with the RSI approaching overbought levels at 72. Key resistance stands at $0.75, while support is around $0.58. If momentum holds, AVL could test the $1.00 mark in the coming weeks.

Cardano (ADA)

Price Change (7D): +27.34% Current Price: $0.8072

News

Cardano has been making waves with a strategic partnership with Brazil's SERPRO, enhancing blockchain education and innovation in government services. The Grayscale Smart Contract Fund has also allocated 18.23% to ADA, highlighting growing institutional confidence. Meanwhile, discussions surrounding a Cardano ETF on NYSE Arca could significantly expand traditional investor access.

Forecast

ADA is consolidating after a strong rally, currently trading above its 20-day EMA. RSI is neutral at 58, suggesting room for further upside if momentum continues. Resistance sits at $0.85, with a breakout potentially leading to $1.00. Downside risk is limited to $0.75, supported by recent institutional accumulation.

Bitcoin Cash (BCH)

Price Change (7D): +23.88% Current Price: $383.88

News

Bitcoin Cash continues to gain traction, with its transaction rate reaching an all-time high of 3.6 transactions per second. Open interest in BCH futures has also surged to its highest level since February, signaling increased trader interest. The Bitcoin Cash Podcast #142 discussed BCH’s long-term strategy, emphasizing the need for utility beyond price speculation.

Forecast

BCH has rebounded from its $279.2 support zone and is targeting the next resistance at $390.5. The RSI is at 55, indicating healthy bullish momentum. A break above $400 could trigger a run toward $450, while failure to hold support may see BCH retesting $350.

Bluzelle (BLZ)

Price Change (7D): +42.09% Current Price: $0.04685

News

Bluzelle is strengthening its infrastructure with PingPub explorer enhancements and new network deployment modes. The team is focused on automating governance transactions and refining its SDK governance module for future updates. Meanwhile, Bluzelle has been promoting decentralized infrastructure as a solution to accelerate scientific discoveries by improving research funding accessibility.

Forecast

BLZ has seen a notable price surge, but volume has declined 70%, signaling potential exhaustion. RSI is at 65, approaching overbought conditions. Resistance sits at $0.055, while key support is at $0.038. A breakout above $0.05 could trigger a run to $0.07, but traders should watch for a possible pullback.

Cronos (CRO)

Price Change (7D): +18.34% Current Price: $0.08584

News

Cronos has outlined its “New Golden Age” strategy, which includes the reissuance of 70 billion CRO tokens to fuel ecosystem expansion. Additionally, Cronos has integrated zkEVM and AI technologies to enhance DeFi usability. Its partnership with Crypto.com is also driving crypto adoption through prepaid cards and Web3 wallets.

Forecast

CRO has been consolidating within a tight range, with RSI at 52, indicating neutral momentum. A break above $0.09 could trigger a rally toward $0.11, while downside risk is limited to $0.075. Volume needs to pick up for CRO to sustain its uptrend.

Solv Protocol (SOLV)

Price Change (7D): +23.06% Current Price: $0.04332

News

Solv Protocol has announced a $100M Bitcoin reserve, positioning itself as a major player in Bitcoin-backed DeFi products. Additionally, its strategic partnership with Soneium will expand Bitcoin staking within the Ethereum Layer-2 ecosystem. The SolvBTC Liquid Staking Tokens (LSTs) will introduce new yield strategies, improving BTC’s usability in DeFi.

Forecast

SOLV has gained strong traction but faces resistance at $0.045. The RSI is at 68, nearing overbought territory. If SOLV breaks above $0.045, it could rally to $0.055. However, failure to hold above $0.04 could see a retest of $0.035.

XRP (XRP)

Price Change (7D): +9.01% Current Price: $2.34

News

XRP has been making headlines with major regulatory advancements and institutional adoption. The XRP Ledger (XRPL) has introduced Dynamic NFTs, enhanced security features, and new compliance control tools like Permissioned Domains (XLS-80). These updates strengthen on-chain financial interactions without storing personal data. Ripple also gained significant attention at the White House Crypto Summit, hinting at regulatory progress that could enhance XRP's role in the evolving digital finance space. Additionally, XRP’s inclusion in the U.S. Crypto Strategic Reserve has fueled institutional interest.

Forecast

XRP remains in a strong uptrend, holding key support at $2.30. RSI is currently at 58, suggesting room for further gains. If XRP clears $2.50, it could rally toward $2.80-$3.00. However, if bearish pressure increases, $2.10 serves as the next major support level. The recent decrease in volume (-38%) indicates some cooling off, but momentum remains bullish for now.

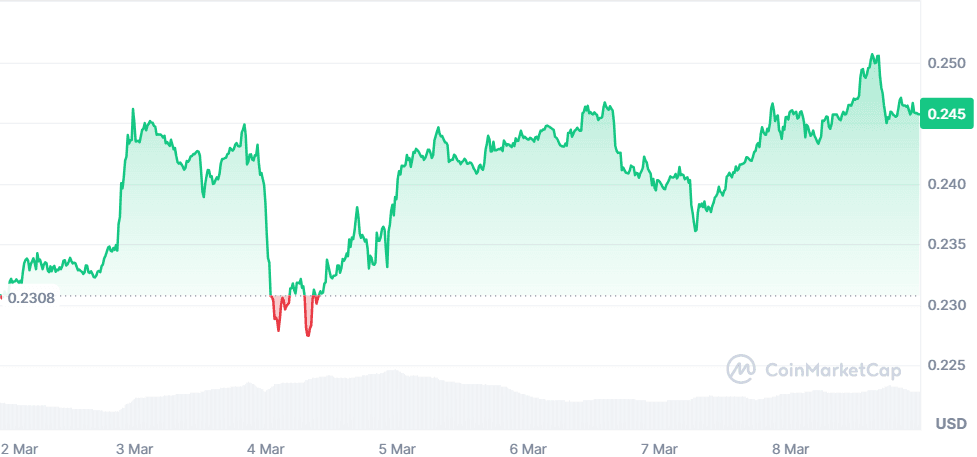

TRON (TRX)

Price Change (7D): +6.58% Current Price: $0.2458

News

TRON has been making headlines with its Gas Free transactions, eliminating TRX fees for USDT transfers. However, recent security concerns arose after a $3.1M wallet exploit. Despite this, TRON continues to dominate as the leading USDT transfer network, processing $11.4B in transactions over the past week.

Forecast

TRX remains bullish, trading above key moving averages. The RSI at 60 suggests further upside potential. If TRX breaks $0.26, it could reach $0.28. Downside risk lies at $0.23, which must hold to sustain momentum.

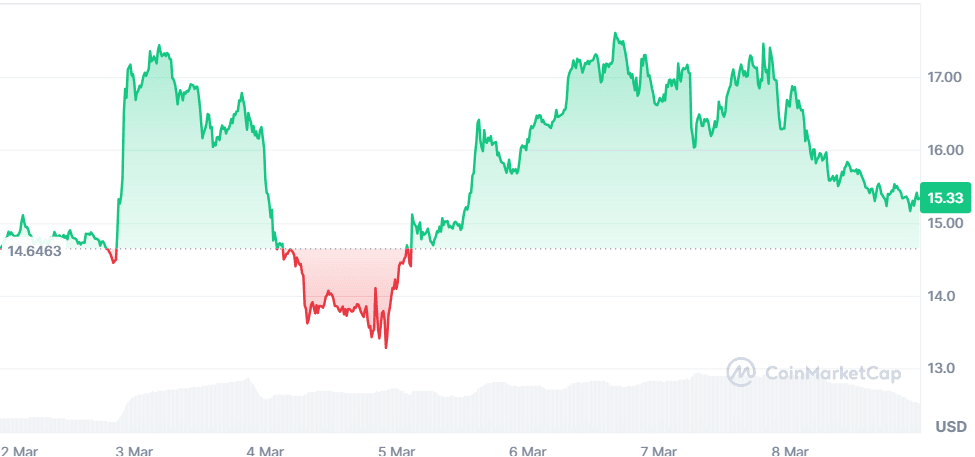

Chainlink (LINK)

Price Change (7D): +4.90% Current Price: $15.33

News

Chainlink continues to expand its presence, integrating CCIP with Avalanche and powering OpenUSDT cross-chain transfers. Sergey Nazarov’s participation in the White House Crypto Summit also highlights Chainlink’s role in blockchain regulation discussions.

Forecast

LINK is bouncing from support at $14.50, with RSI at 58, indicating room for growth. If LINK clears $16, a rally toward $18 is likely. However, a drop below $15 could see a pullback to $13.50.

Closing Thoughts

The market is showing clear trends in real-world asset-backed projects (AVL, SolvBTC), regulatory moves (XRP), and institutional accumulation (ADA, BCH). Bitcoin-backed finance is a dominant theme, with Avalon Labs and Solv Protocol pushing new boundaries in DeFi lending and BTC staking. Institutional involvement is growing as XRP gains legitimacy with U.S. Crypto Reserve inclusion, while Cardano continues expanding its ecosystem through major partnerships.

Participation in staking and on-chain lending is increasing, as evidenced by the rise in Bluzelle and SolvBTC Liquid Staking Tokens (LSTs). Meanwhile, Cronos and TRON are betting on DeFi and payments, but their price actions suggest a more cautious investor sentiment compared to the high-velocity growth of AVL and BLZ.

The overall market appears bullish but sector-driven, with real-world finance and lending protocols gaining traction over purely speculative altcoins. As the focus shifts from narratives to real adoption, the coming weeks will likely highlight which projects can sustain their momentum and which will fade under market scrutiny.