Bitcoin held its ground this week above $105K, supported by a steady stream of institutional headlines, while Ethereum continued consolidating post-Pectra upgrade amid massive ETF inflows.

But the real action was further down the market cap spectrum. From BOB's meme-fueled parabolic surge to MASK’s sudden collapse, this week revealed rising speculative energy across altcoins. Meanwhile, XRP drew fresh institutional interest through ETF moves and legal developments, RVN spiked on Korean exchange flows, and newly listed LA is seeing sustained trader attention. The mix of strong Layer 1 narratives, meme coin speculation, and infrastructure plays signals a subtle shift in trader appetite, a sign that the market might be laying the groundwork for a broader altcoin season.

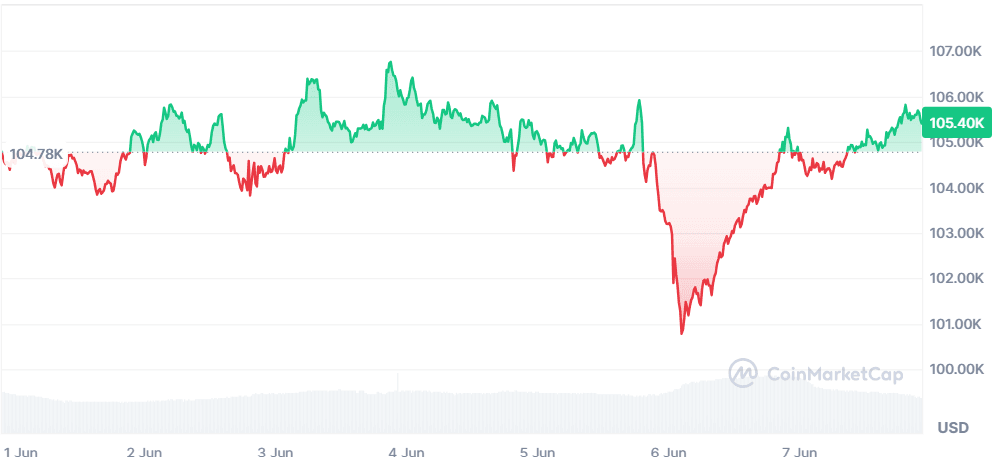

Bitcoin (BTC)

Price Change (7D): +0.81% Current Price: $105,406.13

News

Bitcoin continues to solidify its status as a global reserve asset. The U.S. government’s launch of a Strategic Bitcoin Reserve and California’s pilot program to accept Bitcoin payments for regulatory fees highlight growing mainstream adoption. Institutional interest surged with MicroStrategy’s $1B IPO and whale wallets accumulating 600,000 BTC. South Korea's pro-crypto policies and potential Bitcoin ETF approvals in Asia add momentum. Meanwhile, the Trump-linked Truth Social Bitcoin ETF filing may attract fresh U.S. retail inflows despite political controversy.

Forecast

BTC is trading near $105K after a week of consolidation following earlier highs around $112K. RSI is neutral at ~52, with resistance near $107K and support at $102K. Institutional buying and declining exchange reserves suggest underlying strength. If BTC breaks above $107K, a retest of $112K is likely. Downside risks remain if $102K support fails, potentially targeting $98K.

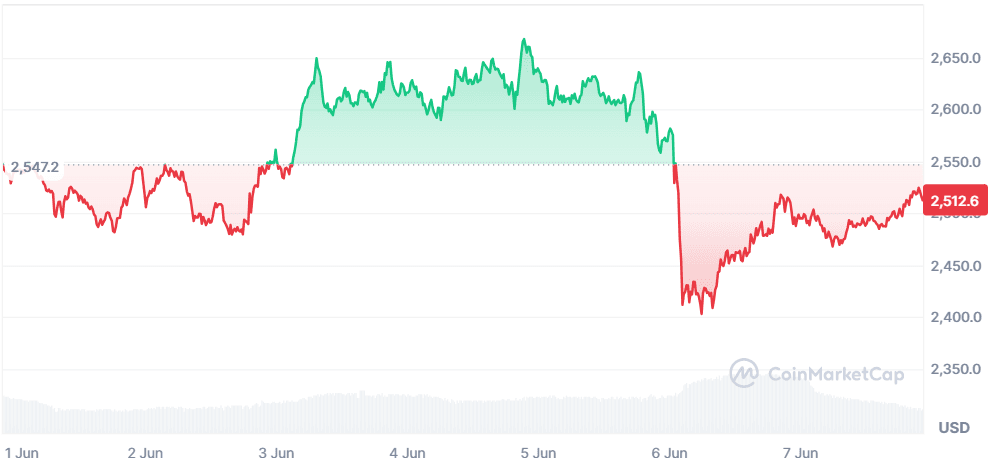

Ethereum (ETH)

Price Change (7D): -1.14% Current Price: $2,512.64

News

Ethereum has dominated tokenized asset markets, holding 76% share amid booming stablecoin activity. Institutional inflows remain robust, with over $600M entering ETH ETFs post-Pectra upgrade. The SEC’s staking clarification and major players like BlackRock accumulating ETH further cement Ethereum’s appeal. The network also hit 19M weekly users, driven by Layer 2 growth. Yet, macro weakness and developer layoffs injected some volatility.

Forecast

ETH saw a retrace to $2.5K after testing $2.64K. RSI is at ~47, suggesting neutral momentum. Strong Layer 2 adoption and ETF flows remain bullish catalysts. If ETH reclaims $2.60K, a move to $2.70K is likely. Below $2.45K, it could revisit $2.35K support. Bulls should watch for renewed institutional buying.

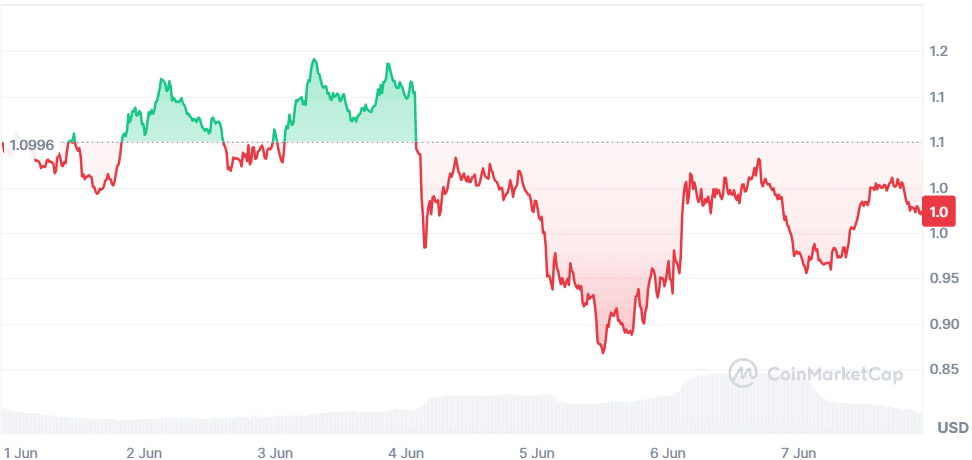

Lagrange (LA)

Price Change (7D): +107.45% Current Price: $1.10

News

Lagrange surged 170% this week, powered by an aggressive multi-exchange listing campaign (Binance, Coinbase, Bybit, Bithumb, Upbit). An airdrop across six chains and staking on EigenLayer boosted user engagement. LA’s role in decentralized ZK Prover Networks and ZK Coprocessor technology is attracting both institutional and DeFi interest. Binance’s addition of 50x leveraged LAUSDT contracts further fuels speculative trading.

Forecast

LA has cooled off after peaking at $1.70, now stabilizing near $1.10. RSI around ~58 signals reduced but steady momentum. $1.20 is key short-term resistance; a break could retest $1.40+. Caution below $1.00, which risks deeper pullbacks toward $0.85.

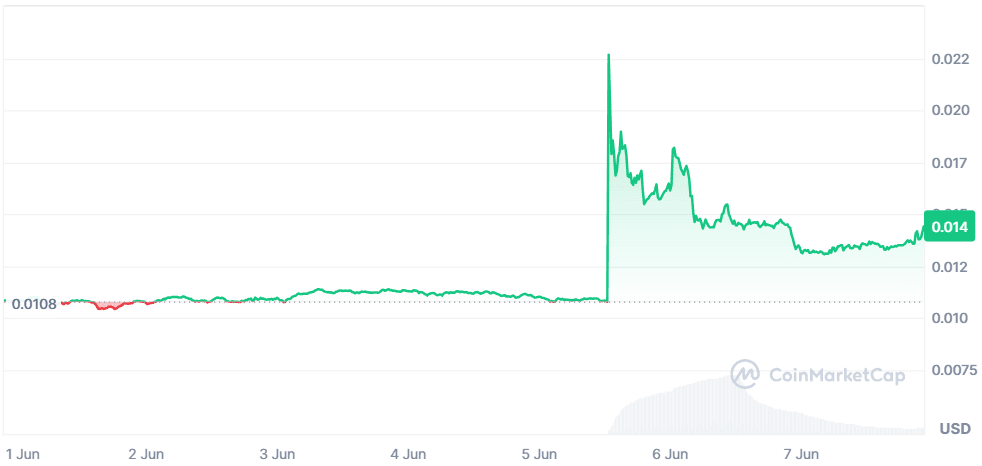

Ravencoin (RVN)

Price Change (7D): +32.58% Current Price: $0.01438

News

Ravencoin rallied nearly 94% after its listing on South Korea’s Upbit exchange, driving retail-driven momentum. This listing opened KRW pairs and significantly increased RVN’s liquidity. The network, known for ASIC-resistance and asset issuance, benefited from renewed Korean retail interest. No new institutional or regulatory catalysts were reported this week.

Forecast

RVN is consolidating after its sharp Upbit-driven spike. RSI is at ~65, suggesting near-term overbought conditions but not exhausted. A breakout above $0.0155 could see RVN challenge $0.017. Failure to hold $0.0135 may trigger a pullback to $0.012 support.

XRP (XRP)

Price Change (7D): -0.48% Current Price: $2.18

News

XRP remains in focus with Ripple’s legal progress, ISO 20022 alignment, and prospects for an XRP ETF. The SEC approved a Nasdaq index including XRP, improving institutional legitimacy. A Webus-Samara Alpha deal created a legal structure for compliant institutional XRP exposure. Dubai’s regulatory approval and growing enterprise integrations continue to strengthen XRP’s global footprint.

Forecast

XRP is ranging between $2.05–$2.25. RSI at ~54 shows balanced momentum. Breaking above $2.25 could trigger a move toward $2.40. Support lies at $2.05, with $2.00 as a must-hold level for bulls. Positive ETF news or legal clarity could unlock upside.

OFFICIAL TRUMP (TRUMP)

Price Change (7D): -8.20% Current Price: $10.31

News

TRUMP coin dropped sharply amid political drama between Elon Musk and Donald Trump, which dented market confidence. Additionally, a $2.69M short position added sell pressure. Meanwhile, a Trump-linked Truth Social Bitcoin ETF filing was submitted to the SEC, adding intrigue but not yet reversing the bearish sentiment.

Forecast

TRUMP’s RSI at ~33 suggests near-oversold territory. Short-term range is $8.50–$9.20 with continued bearish bias. A recovery above $9.50 could target $11, while breaking $8.50 risks further downside to $7.75. Political headlines remain the key driver.

FARTCOIN (FARTCOIN)

Price Change (7D): -6.36% Current Price: $1.02

News

FARTCOIN gained unexpected attention after being added to Coinbase’s roadmap, triggering brief retail interest. The meme-driven token had no major ecosystem developments and remains highly speculative.

Forecast

FARTCOIN is oscillating between $0.95–$1.10. RSI is ~49, signaling neutrality. Breaking above $1.10 could revisit $1.20, while falling below $0.95 risks deeper retracement to $0.85. Expect high volatility as meme traders drive action.

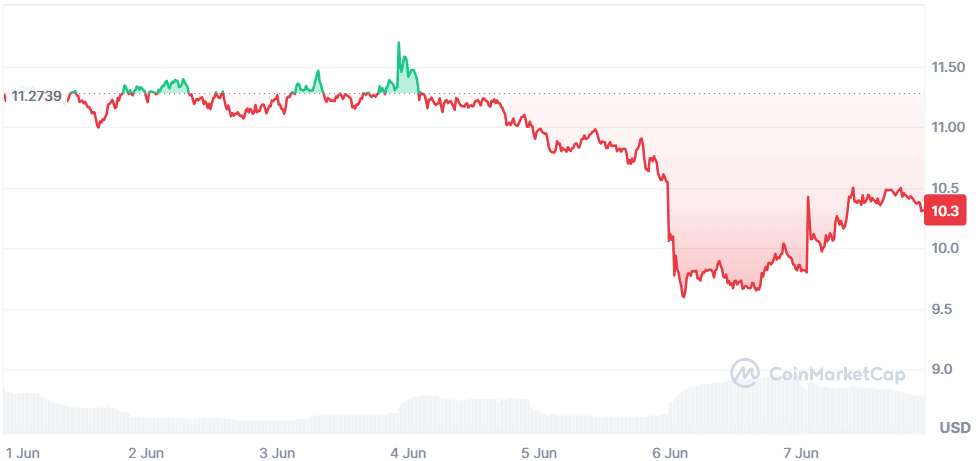

Mask Network (MASK)

Price Change (7D): -7.75% Current Price: $1.83

News

MASK crashed over 45% this week amid rumors of a wallet hack involving the CEO and significant whale deposits to Binance. The drop followed a strong rally after positive news on the Web3 Orb acquisition and Binance SEC case resolution. Heavy profit-taking and panic selling dominated MASK’s price action.

Forecast

MASK trades around $1.80 with RSI at ~36, approaching oversold territory. If $1.70 holds, a rebound to $2.25 is possible. However, breaking below $1.70 could lead to $1.20–$1.50 support testing. Price remains fragile pending clarity on wallet hack rumors.

Build on BNB (BOB)

Price Change (7D): +417.46% Current Price: $0.079983

News

BOB surged over 160% amid speculation it could be the next Binance listing. The meme coin, backed by the BNB Smart Chain community, saw revived interest after initially being overshadowed by "Broccoli" memecoins. A recent Binance Futures listing amplified the rally, with heavy BSC community backing driving momentum.

Forecast

BOB is consolidating below $0.08 after a parabolic move. RSI near 70 suggests overbought conditions. Sustaining above $0.075 could open $0.10+ targets. Failure to hold $0.07 may invite pullbacks to $0.055–$0.06. Binance listing rumors remain the main catalyst.

Closing Thoughts

Looking across this week's movers, it’s clear that altcoins are regaining attention. Memecoins like BOB and FARTCOIN captured retail momentum, with the BNB Smart Chain community leading the charge. On the infrastructure side, LA’s rally on ZK tech utility and multi-exchange listings points to sustained appetite for tokens with tangible narratives. RVN’s pump highlighted Korea's continued role as a liquidity driver for select small caps. Meanwhile, large caps like XRP and ETH are seeing deepening institutional integration, keeping the base layer strong. The market feels bifurcated: long-term positioning around BTC and ETH remains stable, but speculative capital is clearly rotating into mid and low caps again. If this pattern continues, we could see the first real signs of a new altcoin wave in the coming weeks.