Bitcoin may be holding its ground above $100K, but it’s the altcoins that are making waves this week, both for better and for worse. From Raydium’s explosive Upbit-driven bounce to Bitcoin Cash's surprise breakout past $470, there's renewed volatility and volume in mid-cap assets. Ethereum and XRP continue to wrestle with regulatory and institutional narratives, while newcomers like SEI are gaining serious traction in real-world integrations, particularly in DeFi and gaming.

This market cycle is showing an interesting divergence. While BTC dominance remains high at over 64%, suggesting we’re still technically in “Bitcoin Season,” the momentum underneath tells a more nuanced story. Coins like SEI and BCH are attracting institutional and government-facing attention. Meanwhile, memecoins like PEPE are bleeding but still see accumulation from whales. There’s no clear-cut rotation yet—but if current capital flows persist, this could be the beginning of a stealth altcoin resurgence.

Bitcoin (BTC)

Price Change (7D): -1.10% Current Price: $103,664.17

News

Bitcoin’s rally beyond $100K is now firmly backed by institutions. BlackRock’s iShares Bitcoin Trust has become the most successful ETF launch in U.S. history, holding over 3% of all BTC. Texas is moving forward with legislation to secure BTC in public reserves, while surging transaction fees (+105.8%) and dwindling exchange reserves signal tightening supply. Major buys from MicroStrategy and Project Eleven, combined with $2.4B in ETF inflows, further cement Bitcoin's appeal as a long-term hedge amidst macro uncertainty.

Forecast

Bitcoin remains range-bound with resistance at $107.2K and support at $101K. RSI hovers around 52, reflecting neutral momentum, while MACD signals are flattening. A breakout above $107K could resume the uptrend toward $110K+, but if sellers dominate, BTC could test $99K. Structure remains bullish long-term, though short-term sentiment is cautious.

Pepe (PEPE)

Price Change (7D): -10.97% Current Price: $0.000009721

News

PEPE has retraced 40% from its May high, erasing nearly all gains. It now trades below $0.00001, a key psychological support. Despite this, whales have purchased over 500B tokens (~$5.5M), signaling speculative buying interest. Retail spot volume also shows buyer dominance. However, technicals remain bearish, with downward pressure reinforced by a failed bounce at key Fib levels and weakening momentum across RSI, MACD, DMI, and Stoch indicators.

Forecast

RSI is below 40 and falling, MACD is in bearish territory, and price sits in the lower half of its descending channel. If bulls reclaim $0.0000107, a rebound toward $0.0000124 may occur. Otherwise, breakdown below $0.0000090 could send PEPE spiraling to $0.00000855 or lower. Bearish outlook unless momentum shifts.

Beldex (BDX)

Price Change (7D): +0.49% Current Price: $0.06085

News

BDX remained relatively stable despite broader market weakness, but lacks bullish conviction. It trades below both its 50-day ($0.0635) and 200-day ($0.0719) SMAs, with a negative MACD histogram and RSI around 44. Bitcoin dominance has risen to 64.4%, pulling liquidity from altcoins like BDX. With low trading volume and thin order books, even small sell-offs trigger outsized movements.

Forecast

BDX sits just above key Fibonacci support at $0.0604. A break below could push price toward $0.0585. RSI is mid-range, offering room to fall or bounce. To regain momentum, BDX must clear $0.0635. Cautious sentiment persists, especially if Bitcoin continues to dominate market flows.

Sei (SEI)

Price Change (7D): +28.41% Current Price: $0.2248

News

SEI exploded this week after being selected for Wyoming’s WYST stablecoin pilot. Its Layer 1 upgrade and strong DeFi/gaming performance (1.4M daily transactions) attracted backing from Circle and Coinbase. With over $1B in TVL and increasing cross-chain capabilities, SEI is gaining attention as a next-gen infrastructure layer.

Forecast

SEI shows strong bullish momentum. RSI above 70 indicates overbought territory, but MACD supports continuation. As long as it stays above $0.205, bulls may push toward $0.26. Caution is warranted for profit-taking, but current momentum favors further upside.

XRP (XRP)

Price Change (7D): -0.95% Current Price: $2.11

News

XRP is nearing a legal resolution with the SEC. A revised motion seeks to lift XRP’s institutional sales ban and reduce penalties to $50M. A spot ETF is already live in Canada, and another is under SEC review in the U.S. Developer and investor interest is growing, bolstered by XAO DAO’s governance initiative. Despite the legal buzz, price remains flat, but any ruling could shift sentiment quickly.

Forecast

RSI is neutral at 48, and MACD is flat. Support lies at $2.05; resistance at $2.15. A break above $2.20 could open a move toward $2.40, but unless the SEC case resolves, XRP will likely remain range-bound. Legal clarity is the key catalyst.

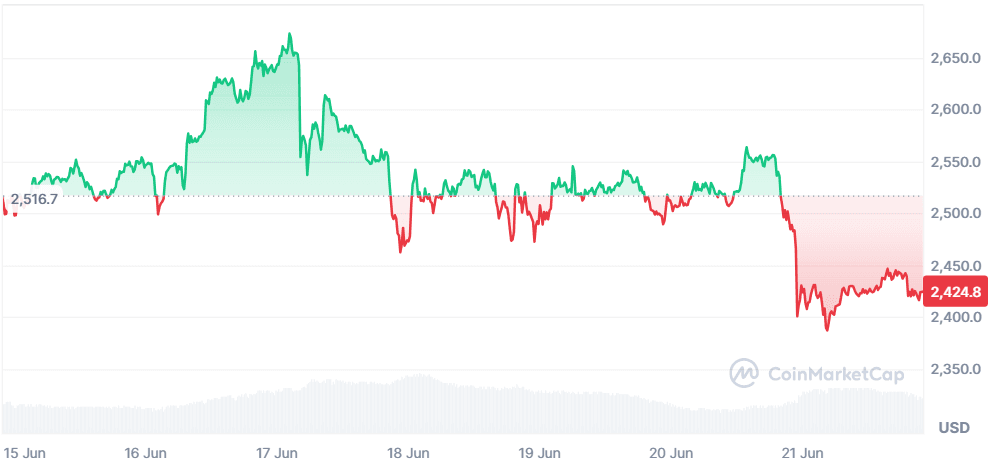

Ethereum (ETH)

Price Change (7D): -3.57% Current Price: $2,422.31

News

Ethereum fundamentals remain strong. Institutional inflows, staking momentum, and ecosystem expansion are booming. BlackRock’s Ethereum Trust saw over $300M in new inflows, and ETH staking has hit 35M coins. JPMorgan and Liquid Collective are pushing adoption with real-world financial integrations. However, despite this bullish backdrop, ETH dropped below $2.45K amid broader market weakness.

Forecast

ETH hovers above support at $2,400. RSI is around 46, with MACD turning bearish. If $2,380 breaks, next support lies at $2,300. A push above $2,500 is needed for trend reversal. Fundamentals are strong, but near-term pressure remains from BTC dominance.

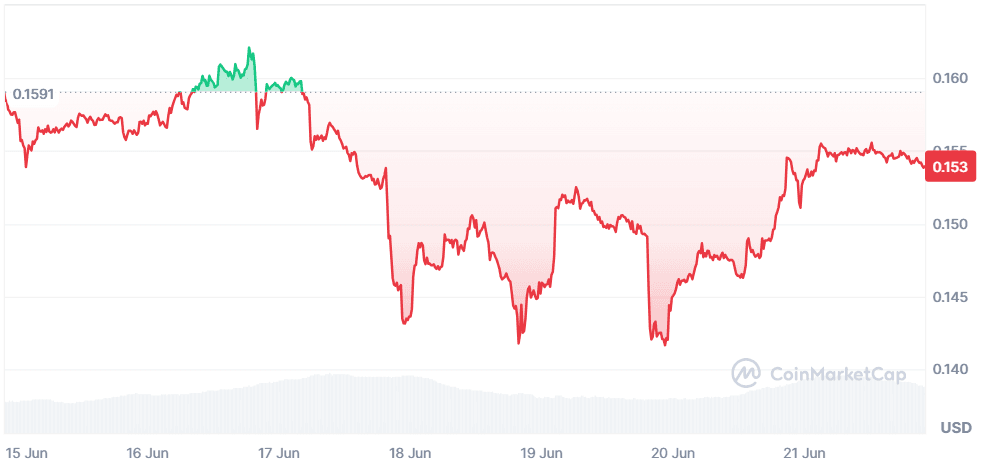

World Mobile Token (WMTX)

Price Change (7D): -2.95% Current Price: $0.1539

News

WMTX made headlines as it transitioned to the Dev Mainnet, with speculation around massive DAU growth driving future buy pressure. Over 1.6M unique users and 600TB+ data consumed daily highlight the network’s scale. Community sentiment turned bullish as whale buying was observed post-migration, and price recovered partially from its June lows.

Forecast

WMTX struggles to break resistance at $0.159. RSI is neutral at 49; MACD is flat. If bulls reclaim $0.161, price may target $0.17. Failure to hold $0.150 support risks downside to $0.142. The setup is neutral with a slight bullish tilt on continued adoption.

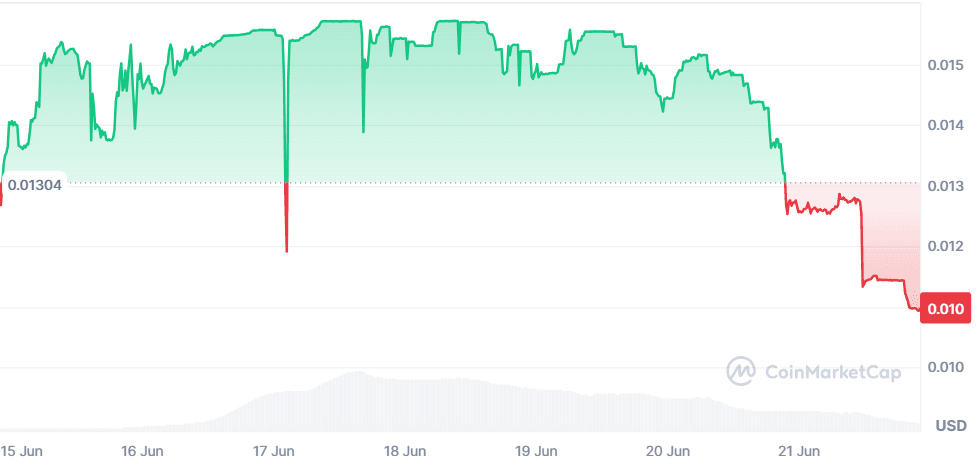

AB (AB)

Price Change (7D): -15.59% Current Price: $0.01096

News

After gaining 109% earlier in the month due to a Binance Alpha listing, AB dropped 13% in a day as traders took profits. The price broke below key support at $0.013, triggering stop-loss cascades. Declining volume (-56%) and Bitcoin’s rising dominance have hurt liquidity. Altcoin sentiment remains weak as capital rotates to BTC.

Forecast

AB is below its 10-day SMA and 23.6% Fib support. RSI at 54.7 shows room to fall, while MACD is fading. Price may test $0.010 support. For recovery, AB must reclaim $0.013. Until then, bearish momentum dominates.

Bitcoin Cash (BCH)

Price Change (7D): +10.30% Current Price: $474.06

News

Bitcoin Cash surged to a two-month high, nearing $500. Institutional demand increased amid U.S.–China trade tensions, with Chinese whales accumulating BCH heavily on Binance and OKX. BCH broke above long-standing resistance and showed strong technical momentum, outperforming the broader market as a mid-cap safe haven.

Forecast

BCH is testing psychological resistance at $500. RSI is rising, MACD is bullish, and volume confirms breakout strength. If $500 flips to support, BCH could target $520. Otherwise, watch for pullback to $485–$472 support range. Bullish continuation likely.

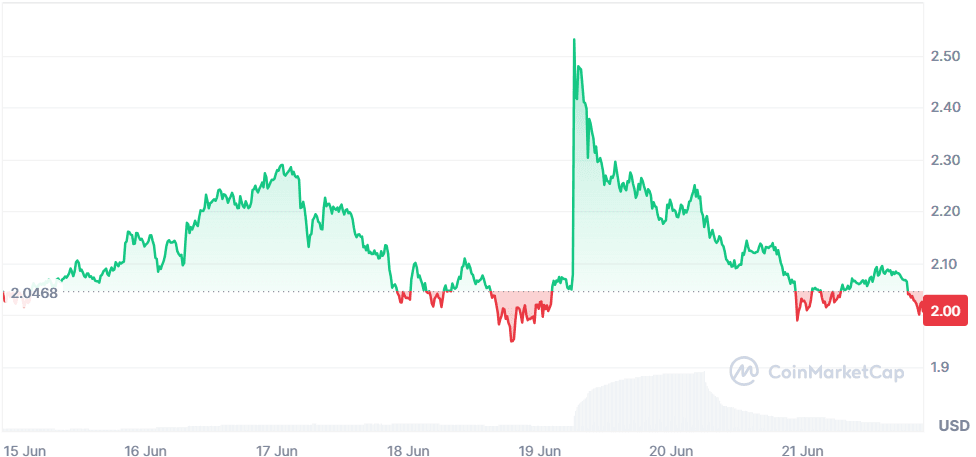

Raydium (RAY)

Price Change (7D): -1.47% Current Price: $2.00

News

RAY surged 45% after a major Upbit listing but failed to sustain momentum. The price briefly broke above diagonal and horizontal resistance but formed a long upper wick. Despite this, RAY formed a bullish double-bottom and shows RSI and MACD divergences suggesting more upside. However, the current pattern may be corrective.

Forecast

RAY may rally toward $2.90–$3.10 as part of wave B in an A-B-C correction. RSI and MACD are turning positive. If momentum sustains, a breakout to $2.5 is next. But long-term reversal remains unconfirmed — caution on false rallies.

Closing Thoughts

This week paints a fragmented picture of crypto sentiment. Bitcoin’s dominance continues to cast a shadow, but under the surface, specific altcoins are quietly staging comebacks. SEI’s climb is driven by strong fundamentals, real-world adoption through the Wyoming stablecoin pilot and growing TVL. BCH and RAY’s price action is technically bullish, showing strength amid a largely flat market. In contrast, PEPE and AB reflect the pain of low-cap speculation in a BTC-dominated cycle.

Sector-wise, DeFi infrastructure (ETH, SEI), gaming (RAY), and cross-border payments (XRP) are seeing healthy participation. Meanwhile, tokens with weak momentum or profit-taking patterns (AB, PEPE) are fading fast despite whale interest. What’s emerging is a bifurcated market: one side driven by real use-cases and institutional credibility, and the other still stuck in memecoin hangovers and short-term volatility.

Altcoin season isn't fully here, but it's knocking. And if BTC cools off or rotates sideways, capital may flood faster into the fundamentally sound and technically promising names already flashing early signals.