While Bitcoin dominance remains high at 63.4% and the Altcoin Season Index stays deep in Bitcoin territory at 20 out of 100, a handful of altcoins are beginning to decouple from the narrative. Coins like WalletConnect Token (WCT), Pocket Network (POKT), and Tellor (TRB) posted outsized weekly gains, fueled by exchange listings, network upgrades, and real-world utility.

ETF outflows of over $545 million suggest that while institutional sentiment cooled slightly, individual investors are rotating capital into newer sectors, signaling the early stirrings of altcoin momentum.

Ethereum (ETH)

Price Change (7D): -0.76% Current Price: $2,540.74

News

Ethereum is witnessing a significant uptick in institutional interest, underscored by over $287M in ETF inflows this week, with BlackRock and Fidelity leading accumulation. The approval of Ethereum staking ETFs in the U.S. is reshaping how institutions approach yield generation. Meanwhile, Sharplink Gaming stunned markets with a $1B ETH acquisition, pivoting treasury strategy away from Bitcoin. On the tech front, the Pectra upgrade promises scalability and enhanced staking efficiency. Regulatory clarity from the SEC on staking has further legitimized Ethereum’s position in U.S. markets.

Forecast

ETH recently saw a bullish breakout above $2,725 before retracing. RSI sits near neutral at ~52, indicating consolidation. If it breaks above $2,600 again, momentum could carry it to retest $2,725. Strong ETF inflows and whale accumulation signal buying interest at dips. However, failure to hold above $2,500 could see ETH revisit $2,420 support. Overall structure favors gradual upside if macro conditions remain stable.

Bitcoin (BTC)

Price Change (7D): -3.98% Current Price: $104,620.46

News

Bitcoin is undergoing a strategic pivot as states like Texas push legislation to hold BTC in treasuries, aiming to rival gold reserves. Institutional flows are massive: $1.13B poured into Bitcoin ETFs this week, led by BlackRock’s IBIT. Cango Inc.’s $352M shift to focus exclusively on BTC mining further strengthens Bitcoin’s position as a sovereign-grade digital asset. However, security concerns around quantum computing and policy fragmentation among U.S. states keep long-term outlooks nuanced.

Forecast

BTC failed to hold its $108K+ breakout, now consolidating near $104.6K. RSI is at ~48, pointing to indecision. If price reclaims $106K with volume, bulls could target $110K. However, a breakdown below $104K opens the path to $101.5K–$102K support. Institutional accumulation remains strong, suggesting downside may be capped unless macro conditions worsen.

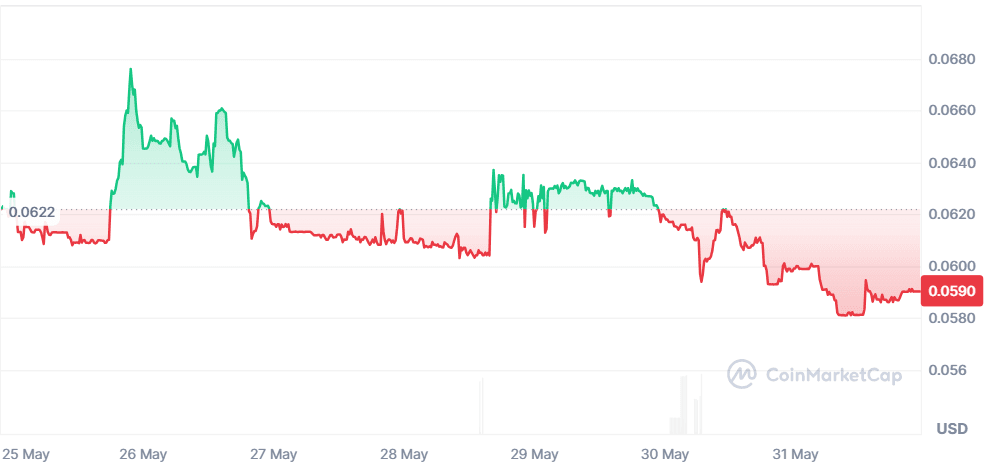

Persistence One (XPRT)

Price Change (7D): -5.11% Current Price: $0.05902

News

XPRT continues to face headwinds despite broader institutional adoption trends. No major announcements have come directly from the Persistence ecosystem, though overall sentiment remains bearish. However, with fewer than 320 holders and 20.26% volume-to-market-cap ratio, any future ecosystem developments or integrations could lead to explosive reactions due to low liquidity and supply concentration.

Forecast

XPRT is stuck in a narrow range below $0.062, with RSI hovering at 42, still weak, but not oversold. The lack of strong news catalysts or liquidity signals more sideways action. If bulls can push past $0.062, it may target $0.066 short-term. Otherwise, further drift toward $0.057 is likely, especially in risk-off market conditions.

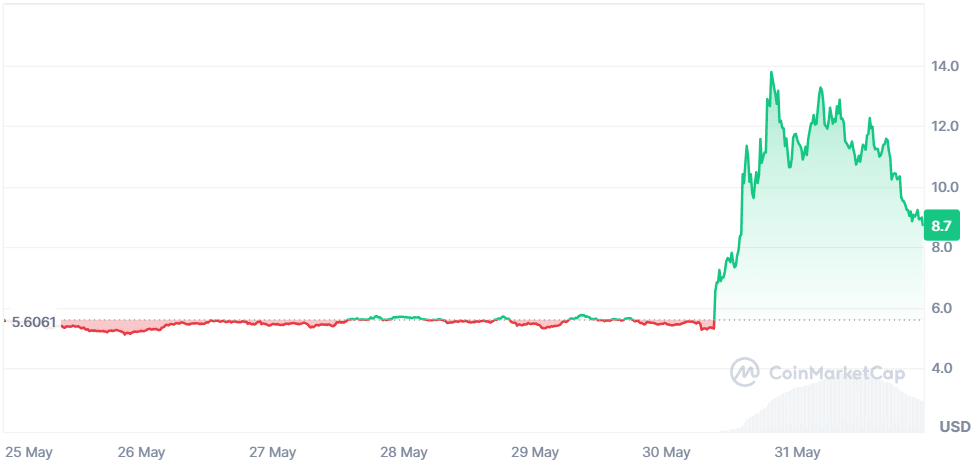

Livepeer (LPT)

Price Change (7D): +56.87% Current Price: $8.72

News

Livepeer surged over 150% this week after its listing on Upbit, Korea’s leading exchange, introduced deep liquidity and market visibility. The listing, combined with Grayscale’s inclusion of LPT in its AI crypto sector fund, has spurred significant retail and institutional momentum. Analysts also pointed to community governance developments and advisory updates as undercurrents fueling sentiment. This is one of the strongest technical breakouts of the week, defying broader market trends.

Forecast

LPT is retracing after peaking above $14. RSI was overheated above 80 but now cooling toward 68. Consolidation between $8 and $9.5 is healthy. If it holds above $8.2, another leg up could target $11+. Breakdown below $8 may see a return to the $6.80–$7.20 region. Momentum remains bullish while social and exchange activity stays elevated.

XRP (XRP)

Price Change (7D): -6.45% Current Price: $2.19

News

XRP is in a pivotal moment as CME and Nasdaq launch XRP futures ETFs, signaling elevated institutional access. Ripple’s acquisition of Hidden Road boosts liquidity for institutions, while XRP integration in Dubai’s DAMAC real estate rewards project cements real-world use. Meanwhile, record open interest at $223M on CME confirms increased speculative and hedging activity around XRP.

Forecast

XRP faces key resistance at $2.30 while finding support near $2.05. RSI has recovered to ~47, showing moderate buyer interest after touching oversold territory. If momentum builds and breaks $2.25, a retest of $2.40 is likely. Below $2.10, it may revisit $1.95–$2.00. Futures activity and ETF news may keep volatility high short term.

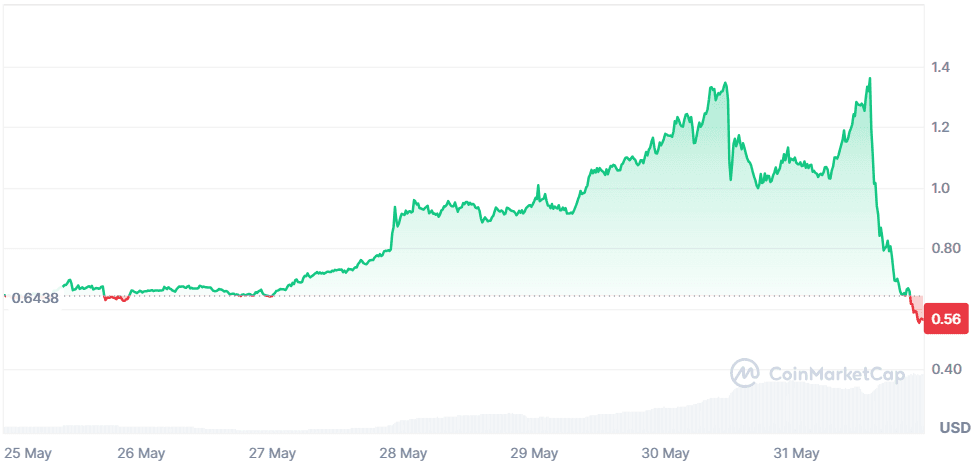

WalletConnect Token (WCT)

Price Change (7D): -12.06% Current Price: $0.5636

News

WCT plunged after peaking near $1.4, following its airdrop to Solana users and announcement of further multichain expansion. While the Solana integration opened WalletConnect to over 100M active wallets, airdrop-based sell pressure and short-term profit-taking reversed the rally. Still, the broader strategy remains bullish, with Jupiter, Phantom, and Backpack wallets collaborating on governance-linked distributions. Founder Pedro Gomes emphasized the token’s role in AI-driven wallet UX and upcoming governance features.

Forecast

WCT is down sharply from highs, with RSI at ~33 showing early oversold conditions. The massive volume spike suggests exhaustion. If $0.55 holds, a rebound toward $0.68–$0.72 is likely. However, if bearish momentum persists, WCT may retrace to $0.48 support. Price action is volatile due to unlock cycles and speculative trading around new airdrop eligibility.

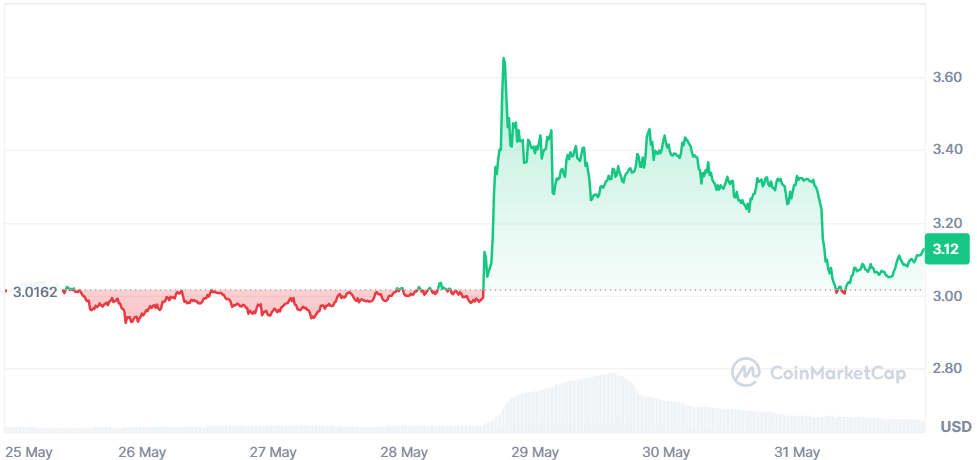

Toncoin (TON)

Price Change (7D): +3.76% Current Price: $3.12

News

TON’s rollercoaster week saw a surge after Telegram CEO Pavel Durov announced a $300M partnership with Elon Musk’s xAI, only for Elon to deny any formal deal. The market reacted swiftly, erasing gains after peaking at $3.65. On the fundamental side, Toncoin is ramping up its payments infrastructure under Visa veteran Nikola Plecas and integrating yield products like Ethena Labs. Despite legal clouds over Durov, Telegram's $1.7B bond issuance signals continued institutional backing.

Forecast

TON rebounded after a false breakout and harsh rejection at $3.65. It’s now consolidating near $3.10, with RSI near 51. A sustained move above $3.20 could retest $3.40–$3.60, especially if payment news strengthens. Failure to hold $3.00 risks deeper retracement to $2.82. Overall setup favors accumulation amid news-driven volatility.

Tellor (TRB)

Price Change (7D): +35.76% Current Price: $41.76

News

TRB surged this week after migrating to a new smart contract address, which reignited interest in its decentralized oracle platform. While there’s no single dominant news driver, whale movements and renewed DeFi attention have catalyzed the bounce. The low float (only 2.75M total supply) makes TRB sensitive to small volume changes, amplifying price reactions.

Forecast

TRB is showing signs of a bullish reversal. RSI is around 61, confirming strong upward momentum. If it breaks above $45, it could quickly aim for $52. Support sits at $38.5, with downside risk increasing below that. Momentum suggests continuation unless a broader market correction takes over.

Pocket Network (POKT)

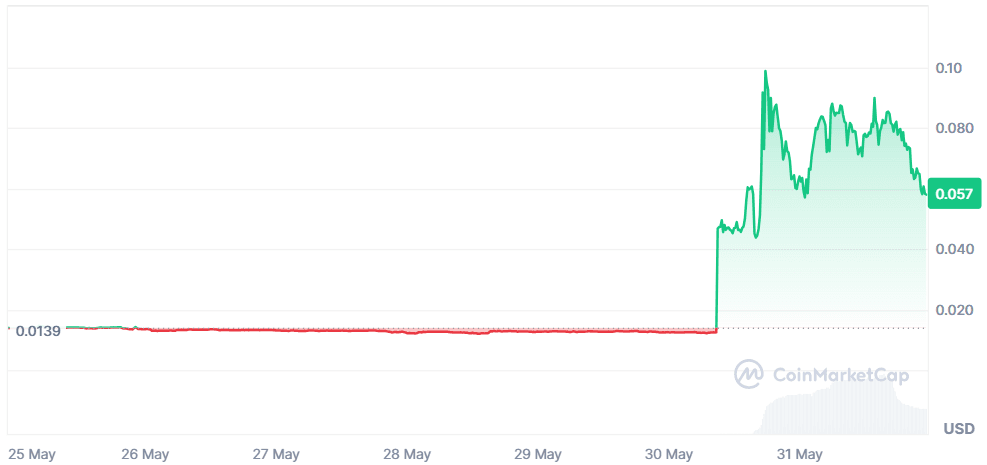

Price Change (7D): +318.33% Current Price: $0.05786

News

POKT exploded nearly 500% this week ahead of its June 3rd upgrade to the Shannon mainnet. The move transitions Pocket into a permissionless protocol, improves encryption, and supports diverse data types. Bitget also announced a new listing for POKT in its DePIN zone, signaling confidence in Web3 backend infrastructure. This has become one of the week’s most-watched DePIN plays.

Forecast

POKT RSI peaked above 80 and is now cooling to 66. Price is correcting after an overextended rally. Support at $0.048 is key; holding above could see a bounce back toward $0.070–$0.075. A full retracement to $0.038 is possible if post-upgrade enthusiasm fades. Expect continued volatility post-hard fork.

Chainlink (LINK)

Price Change (7D): -10.31% Current Price: $13.99

News

Chainlink took a hit this week after its Oracle malfunction triggered $500K in liquidations on Euler Finance. While integration news with JPMorgan and Solana kept fundamentals strong, the reliability of LINK’s oracle service came under scrutiny. Meanwhile, institutional adoption of CCIP and real-time Proof of Reserves continues, but market confidence remains shaken due to the liquidation event.

Forecast

LINK’s RSI is at ~41, hovering near bearish territory. The recent dip below $14 broke key support. Next resistance is $14.50, with $13.20 as the critical support floor. If price action stabilizes and sentiment recovers, a bounce back to $15.5–$16 could occur. For now, the downtrend remains intact.

Closing Thoughts

Altcoin performance this week reflects a more nuanced investor appetite. Infrastructure plays and cross-chain projects like POKT and WCT saw sharp surges, which points to a growing preference for ecosystem tools that power Web3’s backend. Even as Ethereum remained relatively stable, it attracted steady inflows into staking ETFs, showing that institutional interest continues to deepen on the blue-chip layer. Meanwhile, LINK and XRP faced short-term volatility due to oracle errors and regulatory noise, but remain critical to long-term DeFi and tokenization strategies.

The current market setup is testing investor conviction. Bitcoin still commands attention, but the smart money is beginning to scout smaller-cap opportunities with asymmetric upside. With the Fear and Greed Index at a neutral 55 and total crypto market cap pulling back after a strong early-May rally, traders appear to be in wait-and-see mode. If positive momentum continues in infrastructure tokens and staking protocols, a broader altcoin rotation could follow sooner than expected.