After a relatively calm start to May, crypto markets have reignited with volatility, sector rotations, and selective breakouts.

Bitcoin remains dominant at 63.2%, but fresh ETF inflows (+$270M on May 23 alone) and a growing appetite for risk are beginning to tilt attention toward select altcoins. Still, the Altcoin Season Index sits at 22/100, squarely in Bitcoin season territory — but for how long?

This week saw a surge of interest in narratives that combine macro signals with niche community fervor. Meme coins like PEPE held firm with fresh whale accumulation, DOGE’s new bridge to Solana hinted at real utility, and Trump’s controversial crypto gala didn’t stop TRUMP from staying in headlines. Meanwhile, smart-contract Layer 1s like SUI gained traction with DeFi security milestones and BTCFi integration, while XRP continued to make institutional inroads with ETFs and real-world tokenization use cases. But the real outliers? WLD and BUILDon (B), two radically different projects riding on explosive adoption momentum and political endorsements. The crypto market cap now stands at $3.43 trillion with solid volume ($113B), showing there's liquidity to fuel these sectoral rotations.

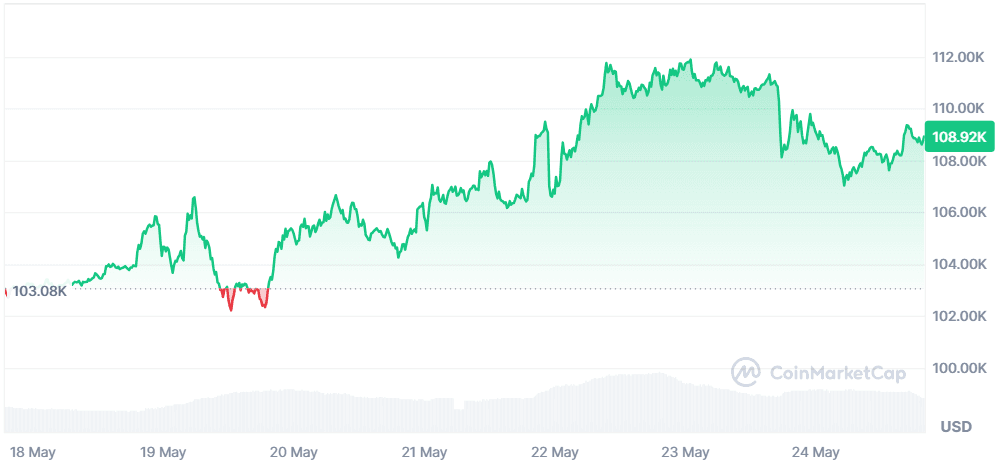

Bitcoin (BTC)

Price Change (7D): +5.74% Current Price: $108,923.98

News

Bitcoin broke above $111,000 this week, largely due to massive institutional inflows, most notably a record-breaking $877M into BlackRock’s spot ETF on May 22. This influx has re-energized the market, solidifying BTC’s reputation as a credible institutional asset. MicroStrategy and Metaplanet continue expanding their holdings, and analysts now view BTC’s role in corporate treasuries as foundational. With the Texas House passing the Strategic Bitcoin Reserve Bill and financial forecasts suggesting a radical global shift toward BTC-backed systems, confidence is surging.

Forecast

BTC has reclaimed the $108K+ range and is holding strong after a sharp rally. RSI is currently hovering near 68—approaching overbought territory, but not quite overheated. If it remains above the $106.5K support and breaks past $111.9K with volume, the next resistance is around $115K. Futures open interest hit a record $80B, suggesting strong participation. However, any drop below $104K could prompt corrections. Momentum remains bullish but traders should be alert for volatility as derivatives positions stack up.

Ethereum (ETH)

Price Change (7D): +3.07% Current Price: $2,554.55

News

Ethereum saw renewed institutional confidence after the SEC clarified that PoS staking does not fall under securities laws. BlackRock’s $52.8M inflow into its Ethereum ETF fueled a 4.2% price rally, reversing March’s outflows. On-chain activity surged with the Pectra upgrade injecting $3.8B into realized capitalization. Meanwhile, TVL rose 44% to $65.3B and transaction fees hit a 90-day high, indicating strong network use. Analysts point to Ethereum’s evolving scalability and staking innovations as catalysts for a long-term rally.

Forecast

ETH is forming a textbook bull flag, having broken above $2,550 resistance. RSI stands at 63, suggesting upward continuation without extreme overbought conditions. If ETH can hold $2,400 as support, bulls may target $3,500–$4,000 based on the flagpole height and rising TVL metrics. Watch for increasing gas usage and ETF inflows—these will likely determine if the rally is driven by adoption or speculation. Failing to stay above $2,450 could lead to a temporary pullback to $2,200.

Solana (SOL)

Price Change (7D): +5.23% Current Price: $176.58

News

Solana is on a winning streak thanks to a flurry of institutional endorsements. R3 selected Solana for institutional asset tokenization, and Apollo launched its tokenized fund ACRED on the network, signaling major TradFi alignment. Kraken launched tokenized U.S. stocks via Solana for global traders, while Chainlink’s CCIP integration made it the first non-EVM chain supported, unlocking billions in cross-chain liquidity. The Alpenglow upgrade boosts validator speed and efficiency, and the upcoming Seeker mobile with SKR token promises to expand Solana’s Web3 mobile push.

Forecast

SOL is bouncing within an ascending channel, targeting the $194–$210 range. Current RSI is around 66, with bullish divergence on the 4-hour chart. The breakout above $173 confirms buyer strength, while $178 acts as a critical support. If SOL maintains this trajectory and capital continues to flow in from tokenization protocols, $194 is likely the next resistance. Momentum is strong, but caution is advised if volume drops below recent levels or if it fails to hold above $170.

SUI (SUI)

Price Change (7D): -3.63% Current Price: $3.65

News

Sui has made headlines on multiple fronts this week. The chain’s validators successfully froze over $160 million of the $220 million stolen in the Cetus protocol hack demonstrating serious security maturity. Meanwhile, its BTCFi narrative is gaining momentum, with OKX launching xBTC natively on Sui and Bitlayer debuting a trustless BTC bridge (YBTC) to bring real Bitcoin yield strategies on-chain. Add to that its $1B stablecoin supply milestone and $2.1B TVL, and it’s clear Sui is rapidly becoming a high-performance Layer 1 focused on utility, scalability, and BTC-backed DeFi.

Forecast

SUI is building a solid foundation for long-term adoption. The increasing TVL and BTCFi traction show sustained developer interest and user migration. While short-term price dips are possible given the broader market's volatility, the fundamentals suggest SUI could outperform in the next alt-season rotation. Watch for continued stablecoin inflows and Bitcoin-native activity as leading signals of a potential rally.

OFFICIAL TRUMP (TRUMP)

Price Change (7D): -0.26% Current Price: $13.04

News

The TRUMP coin had an eventful week, with a highly publicized black-tie gala for top holders drawing widespread media coverage and political scrutiny. Despite marketing the event as “exclusive,” guests reported bad food, limited interaction with Trump, and a noticeable dip in the token's value during the dinner. More significantly, the event has sparked concerns that foreign investors are buying access to Trump through the token, raising ethical and regulatory questions about how crypto intersects with politics. U.S. lawmakers are now probing whether this qualifies as selling influence.

Forecast

TRUMP remains a meme token highly influenced by news cycles and political sentiment. While short spikes are possible around Trump-related events, the growing regulatory spotlight makes it a high-risk play. Any future gains are likely to be short-lived unless the coin establishes stronger community-driven utility or manages to navigate the legal scrutiny ahead.

XRP (XRP)

Price Change (7D): +0.42% Current Price: $2.35

News

XRP had a pivotal week with the launch of the first U.S.-listed XRP futures ETF (XRPI) on Nasdaq, signaling growing institutional appetite for regulated XRP exposure. Meanwhile, the World Economic Forum report cited the XRP Ledger as the infrastructure for a $1B private equity tokenization project—cementing its role in asset tokenization. Ongoing developments in the Ripple vs. SEC case also saw Judge Torres denying an immediate reduction in Ripple’s penalty, though a new motion is expected soon. On the adoption front, Ripple secured banking integrations in the UAE and is powering Dubai’s $16B property tokenization initiative.

Forecast

XRP is evolving from litigation limbo to institutional legitimacy. The ETF, global partnerships, and RWA tokenization show that XRP is becoming central to the next wave of financial digitization. Price could consolidate in the short term due to legal delays, but if the final ruling favors Ripple, XRP may reclaim higher ranges rapidly. Long-term upside looks strong given its deep utility and institutional footprint.

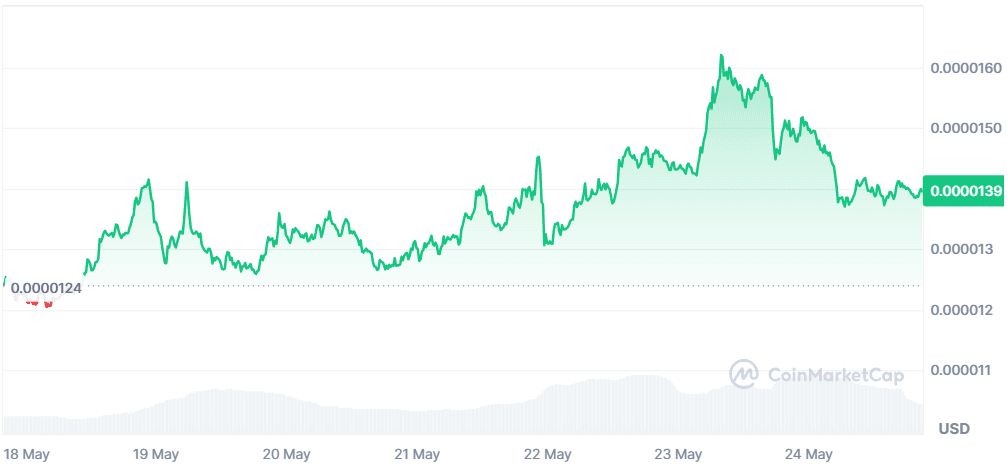

PEPE (PEPE)

Price Change (7D): -6.59% Current Price: $0.00001389

News

Pepe rebounded from the $0.0000125 support level with bullish momentum confirmed by rising open interest ($599.98M) and positive funding rates (+0.0013%), indicating traders are increasingly betting on the upside. Technical indicators like RSI (66) and MACD are showing early signs of strength. Whales have been actively accumulating, with one fresh wallet buying 108.5B PEPE worth $1.5M.

Forecast

If bullish sentiment continues, PEPE could retest $0.0000165 in the short term. A breakout above that level could push the meme coin 20–30% higher. However, failure to hold above the $0.0000130 level might trigger a retest of the 200-day EMA at $0.0000107.

Dogecoin (DOGE)

Price Change (7D): +5.62% Current Price: $0.2281

News

DOGE has integrated with Solana through Wormhole’s Native Token Transfers, enabling Dogecoin to participate in Solana’s DeFi, NFT, and gaming ecosystems. Technical indicators show a bullish “Cup and Handle” pattern, while futures open interest surged 11% to $2.97B. However, whale sell-offs of 170M DOGE causing $7M in losses created recent short-term bearish pressure.

Forecast

Despite the whale exit, DOGE has strong upside potential. If bullish momentum continues, the price could target $0.355. Watch for volatility as SEC delays on DOGE ETF decisions might cause temporary dips before renewed interest closer to Q4 2025.

BUILDon (B)

Price Change (7D): +1142.53% Current Price: $0.3149

News

BUILDon surged over 1,100% this week following its listings on Binance and Bybit futures and a $25K+ purchase of B tokens by WLFI using its USD1 stablecoin. The project also announced USD1 as its core pair and launched a $200K trading competition to drive user engagement.

Forecast

With extreme volume and bullish momentum, B could continue climbing toward the $0.40–$0.45 zone if buying pressure sustains. However, traders should watch for a cooldown period or sharp corrections due to profit-taking after the parabolic rise.

Worldcoin (WLD)

Price Change (7D): +36.12% Current Price: $1.47

News

Worldcoin has surged for seven straight weeks, fueled by the project’s expansion, a $135M token sale backed by VCs like a16z and Bain Capital, and the U.S. launch of its Orb Mini biometric scanner. The project now boasts over 26 million users, with rapid adoption across Asia and Southeast Asia. The daily trading volume has topped $1B, with open interest rising 48% to $427M, signaling strong market confidence.

Forecast

With WLD breaking out of a rising wedge and flipping its 200-day EMA into support, the technical setup points to a rally toward $2.20–$2.50. If bullish momentum sustains and WLD clears resistance at $1.65, a 60%+ upside toward $2.80 is possible. However, RSI is nearing overbought territory, so a short consolidation before the next leg up is likely.

Closing Thoughts

The week’s action signals something important: we’re in a transitionary phase. While Bitcoin still holds market dominance, the surge in individual altcoins like WLD, B, and SUI points to pockets of speculative rotation. Altcoin Season hasn’t arrived, not yet, but the market is slowly laying the groundwork for it.

DeFi and BTCFi on chains like SUI are reawakening interest in infrastructure plays, while meme coins are no longer just jokes, they’re evolving into cultural tokens with massive liquidity. At the same time, AI-crypto crossovers like Worldcoin are proving that macro narratives still drive speculative upside when paired with real-world utility and VC backing.

In short, it’s a market full of signals. The ones paying attention are already positioning themselves.