With global equities buoyed by a softer U.S. inflation print and cautious optimism around the U.S.-China trade framework, crypto markets mirrored the risk-on mood today. High-beta plays led the charge as newly launched RESOLV surged on Binance-driven hype, while AURA’s speculative rally turned heads despite warnings of a potential rug pull.

SOL remained in focus on strong ETF approval odds and fresh stablecoin adoption headlines. Meanwhile, DeFi-linked SYRUP climbed on renewed institutional interest via Solana, and KAIA extended its technical breakout with bullish momentum in full swing. Together, these moves signal that traders are chasing both narratives and liquidity, setting the stage for a dynamic market ahead.

Kaia (KAIA)

Price Change (24H): +27.91% Current Price: $0.1776

What happened today

KAIA broke out with a 38% rally as bullish momentum intensified. A surge in volume (up 1,750%) confirmed real market interest, while technical indicators such as a bullish RSI divergence, MACD crossover, and pending Golden Cross setup suggested a sustained reversal. The price cleared resistance at $0.158 and is targeting $0.216 in the coming sessions, with mid-term upside toward $0.27.

Market Cap: $1.07B 24-Hour Trading Volume: $211.6M Circulating Supply: 6.04B KAIA

Solana (SOL)

Price Change (24H): +5.63% Current Price: $167.24

What happened today

SOL rose on strong ETF-related momentum. The SEC requested amended S-1 filings, potentially paving the way for ETF approvals within 3–5 weeks. Bloomberg places SOL’s ETF approval odds at 90%, with Polymarket traders at 91%. Additionally, Société Générale launched a USD-pegged stablecoin on Ethereum and Solana, driving institutional demand. With these catalysts and growing DeFi activity, SOL is attracting renewed attention.

Market Cap: $87.84B 24-Hour Trading Volume: $5.82B Circulating Supply: 525.23M SOL

Maple Finance (SYRUP)

Price Change (24H): +8.06% Current Price: $0.5248

What happened today

SYRUP climbed after Maple Finance successfully resolved technical issues blocking new deposits. The coin also rode secondary momentum from last week’s major news: the launch of syrupUSDC on Solana, backed by $30M in incentives. This move positioned Solana as an increasingly attractive hub for institutional DeFi, benefiting both SYRUP and Solana’s ecosystem.

Market Cap: $583.84M 24-Hour Trading Volume: $130.32M Circulating Supply: 1.11B SYRUP

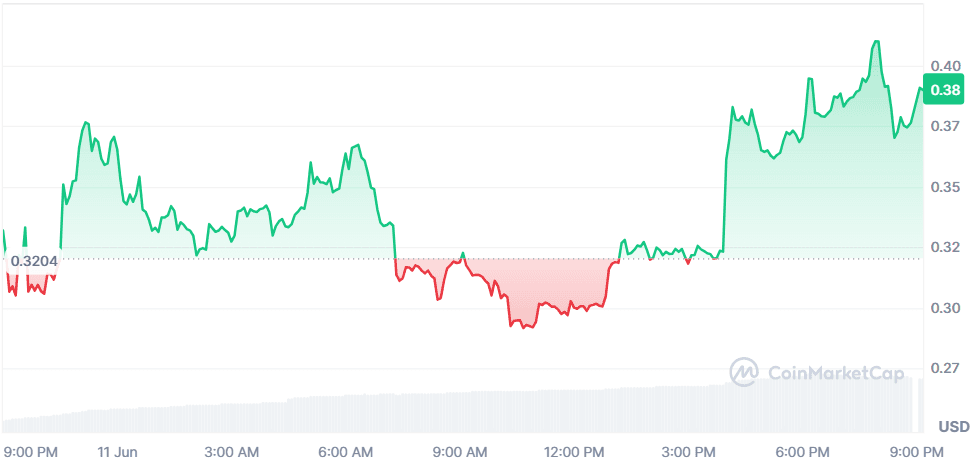

Resolv (RESOLV)

Price Change (24H): +24.09% Current Price: $0.3804

What happened today

RESOLV launched today with massive buzz on Binance’s HODLer Airdrops. It supports USR, a stablecoin natively backed by ETH and BTC. The project distributed RESOLV tokens to BNB holders and immediately began spot trading on Binance. Further boosting sentiment, staking rewards (~69% APR) were announced, driving rapid community engagement and price appreciation.

Market Cap: $59.25M 24-Hour Trading Volume: $337.17M Circulating Supply: 155.75M RESOLV

Aura (AURA)

Price Change (24H): +6170.67% Current Price: $0.07571

What happened today

AURA experienced an extraordinary 6,170% surge but raised strong caution signals. Analysts suspect a potential rug pull due to suspicious token distribution and lack of clear utility. While some whales profited massively (one booked $104K), many top wallets appear linked or received free tokens. The price action is attracting speculative activity, but risks remain elevated.

Market Cap: $80.09M 24-Hour Trading Volume: $51.5M Circulating Supply: 965.38M AURA

Global Market Snapshot

Global markets traded mixed today, with U.S. equities climbing after inflation came in cooler than expected (+0.1% MoM vs. +0.2% forecast). This eased concerns that tariffs were fueling price pressures. Simultaneously, U.S.-China trade talks reached a tentative deal, holding tariffs at current levels (55% U.S. on China, 10% China on U.S.) while securing rare earth supplies for the U.S.

In Europe, equities closed lower overall despite the UK’s FTSE 100 hitting record highs on housing sector gains. The eurozone remained cautious as key details of the U.S.-China pact are still pending final approval. Meanwhile, quantum computing stocks surged after Nvidia’s CEO predicted commercial viability in the near future, adding to the tech sector’s bullish sentiment.

Gold remained elevated as a global reserve asset, though central bank demand may cool going forward. Overall, markets responded favorably to reduced inflation fears and signs of progress in global trade tensions, though near-term volatility remains tied to final trade deal outcomes and macro data.

Closing Thoughts

Investor sentiment across markets today reflected a cautious but building appetite for risk. Traditional equities found relief in easing inflation data and a cooling of U.S.-China trade tensions, a backdrop that emboldened capital rotation into speculative corners of crypto. The coins trending today clearly show where momentum is gathering: SOL continues to attract institutional eyes, RESOLV capitalized on a well-timed Binance launch, and AURA revealed just how hungry retail traders still are for asymmetric upside, even in questionable projects. DeFi infrastructure plays like SYRUP and layer-1 narrative tokens like KAIA rounded out a broad spectrum of participation.

Looking ahead, the next phase of market action will hinge on the sustainability of this renewed risk appetite. With U.S. inflation data easing macro concerns and ETF narratives propelling altcoins, capital is flowing toward both regulated exposures (SOL, RESOLV staking) and speculative narratives (AURA, KAIA). If the global trade deal holds and macro volatility remains contained, this environment could continue to favor tokens linked to structural growth stories and high-profile liquidity events. For now, traders are clearly leaning back into the market with eyes wide open, but eager to chase the next wave.