Today was marked by sharp divergences, the crypto market offered a clear reflection of shifting global investor sentiment. While Internet Computer (ICP) staged an AI-driven breakout against a backdrop of tech optimism, Kaia (KAIA) surged on the back of a major Layer 1 ecosystem merge in Asia.

Meanwhile, UMA (UMA) rallied on real-world integrations with Elon Musk’s X platform, even as JasmyCoin (JASMY) struggled amid tightening Asian regulatory moves. The biggest red flag came from Hamster Kombat (HMSTR), which continued its post-airdrop collapse, underscoring how quickly speculative capital can vanish. With traditional finance watching China’s trade struggles and Nvidia’s AI optimism driving global tech flows, today’s coin action mirrored broader market crosscurrents.

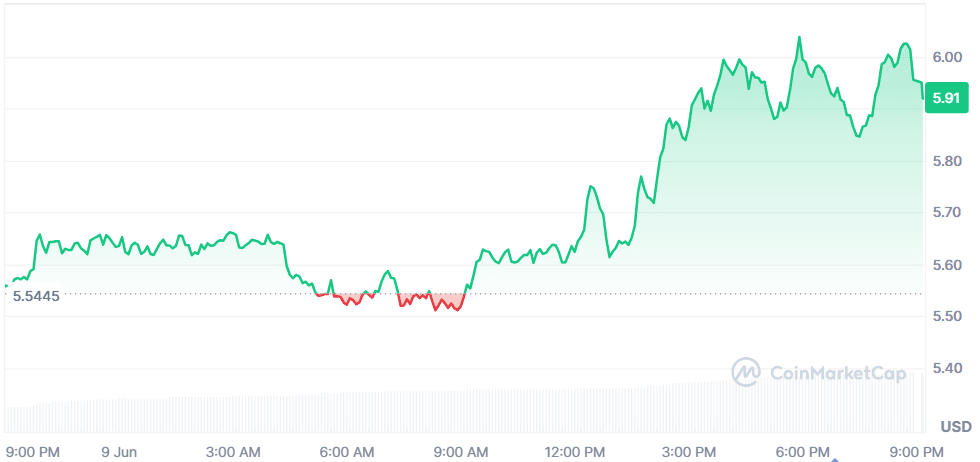

Internet Computer (ICP)

Price Change (24H): +6.21% Current Price: $5.91

What happened today

ICP rallied for a fourth straight day, defying the broader crypto downturn, thanks to hype around Caffeine, a new AI-powered development platform from the Dfinity Foundation. At the World Computer Summit, it was showcased how Caffeine enables blockchain app creation through natural language, sparking renewed investor interest. Whale accumulation is also rising, adding to the bullish momentum. ICP broke out of a descending trendline and is trading above key technical levels, with a next target of $6.88.

Market Cap: $3.16B 24-Hour Trading Volume: $200.7M Circulating Supply: 534.09M ICP

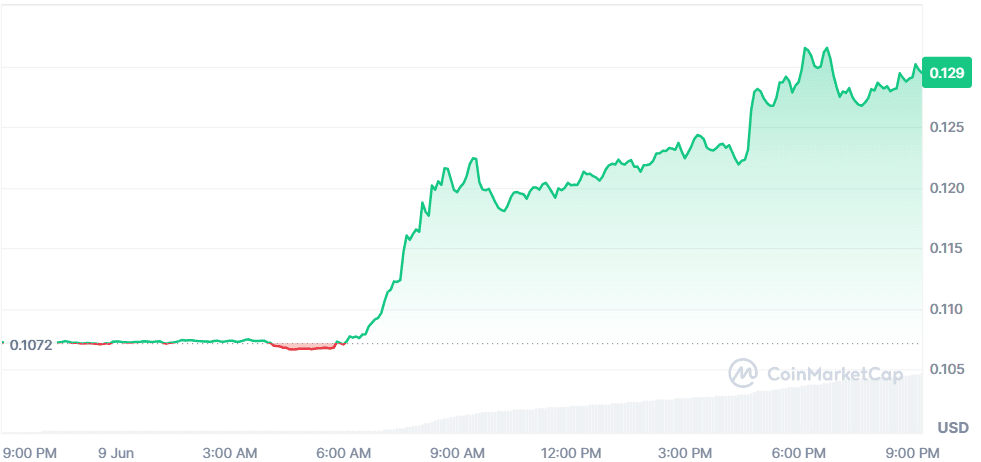

Kaia (KAIA)

Price Change (24H): +20.77% Current Price: $0.1294

What happened today

KAIA surged after Klaytn and Finschia completed their long-awaited mainnet merge into the new Kaia chain. Major exchanges like Binance now support KAIA, boosting market confidence. The token spiked 15% in three hours on news of the merge and upcoming Web3 integrations with LINE and KakaoTalk apps, reaching over 250M users across Asia. The project aims to simplify Web3 access through mainstream apps, driving both adoption and trading volume.

Market Cap: $781.79M 24-Hour Trading Volume: $137.2M Circulating Supply: 6.03B KAIA

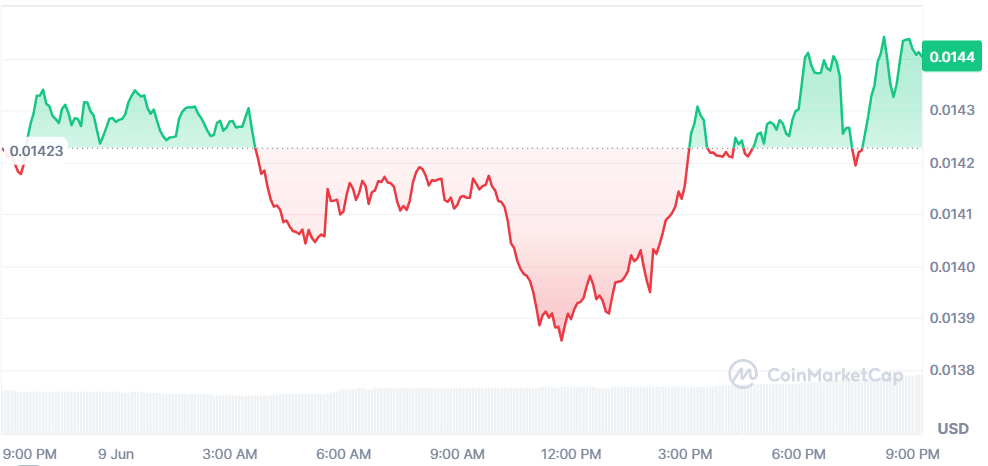

JasmyCoin (JASMY)

Price Change (24H): +1.33% Current Price: $0.01440

What happened today

JASMY saw volatility amidst heightened regulatory action in Asia. Japan, Hong Kong, and Singapore advanced clearer crypto regulations, while China cracked down on illegal activity. The mixed regulatory climate pressured many Asian tokens, with Jasmy trading choppy amid the region’s shifting landscape. Despite short-term weakness, long-term regulatory clarity in Japan and South Korea could support future stability.

Market Cap: $712.13M 24-Hour Trading Volume: $19.46M Circulating Supply: 49.44B JASMY

UMA (UMA)

Price Change (24H): +23.96% Current Price: $1.62

What happened today

UMA surged on renewed optimism after its key role in Polymarket’s partnership with Elon Musk’s X platform. UMA’s Optimistic Oracle secures Polymarket’s prediction markets, which will now be integrated with X’s 200M+ user base. Increased Polymarket traffic is expected to drive UMA revenue and demand. Traders eye a possible 200% rally if resistance at $1.418 breaks decisively, supported by bullish technicals and growing fundamental momentum.

Market Cap: $142.39M 24-Hour Trading Volume: $201.15M Circulating Supply: 87.49M UMA

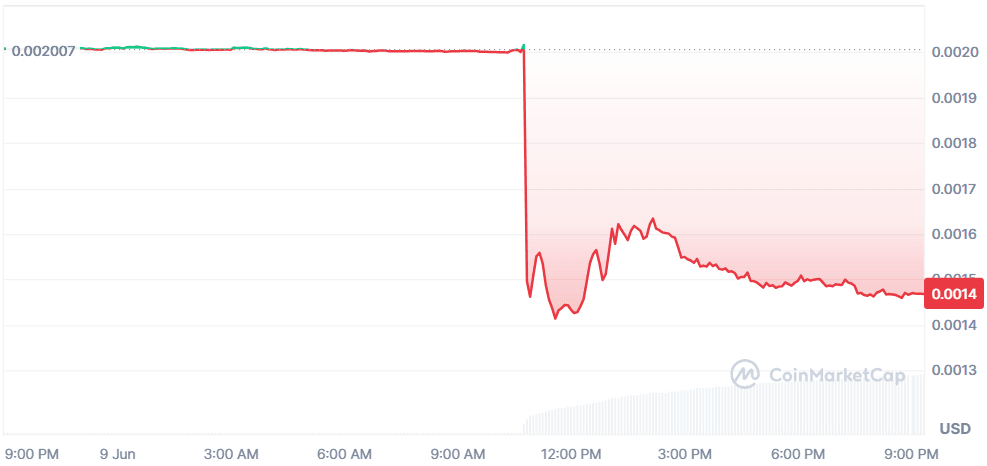

Hamster Kombat (HMSTR)

Price Change (24H): -26.82% Current Price: $0.001467

What happened today

HMSTR collapsed following a sharp post-airdrop selloff and mounting scam concerns. Cointelegraph flagged fake Hamster Kombat airdrops as a scam vector, further shaking confidence. Meanwhile, user counts have fallen dramatically from 300M to under 13M driving sustained sell pressure. With inflationary tokenomics (100B total supply, 64B circulating) and waning engagement, analysts warn HMSTR may test $0.0010 if no corrective actions are taken.

Market Cap: $94.49M 24-Hour Trading Volume: $139.8M Circulating Supply: 64.37B HMSTR

Global Market Snapshot

Markets were in a cautious mood today amid mixed macro headlines. The spotlight remained on escalating U.S.–China trade tensions, with a 34.5% YoY plunge in Chinese exports to the U.S., the sharpest drop in over 5 years, underscoring persistent trade headwinds. While the Geneva trade truce helped slash tariffs temporarily, both sides continue to accuse each other of violations. Talks in London today offered little sign of a breakthrough.

Meanwhile, Nvidia CEO Jensen Huang stole the show at London Tech Week, hailing the U.K. as an AI investment hotspot, a positive signal for European tech sentiment. In supply chains, Shein’s move to boost Indian manufacturing highlights growing efforts to diversify away from China as the U.S.–China trade war reshapes global trade dynamics.

Overall, global equity and crypto markets remain sensitive to these shifting trade and tech narratives, with Asia and AI sectors commanding outsized attention.

Closing Thoughts

Investor sentiment remains highly fragmented across both crypto and global markets. Coins tied to tangible infrastructure narratives such as UMA’s Optimistic Oracle or ICP’s AI-driven app layer In a day marked by sharp divergences, the crypto market offered a clear reflection of shifting global investor sentiment. While Internet Computer (ICP) staged an AI-driven breakout against a backdrop of tech optimism, Kaia (KAIA) surged on the back of a major Layer 1 ecosystem merge in Asia. Meanwhile, UMA (UMA) rallied on real-world integrations with Elon Musk’s X platform, even as JasmyCoin (JASMY) struggled amid tightening Asian regulatory moves. The biggest red flag came from Hamster Kombat (HMSTR), which continued its post-airdrop collapse, underscoring how quickly speculative capital can vanish. With traditional finance watching China’s trade struggles and Nvidia’s AI optimism driving global tech flows, today’s coin action mirrored broader market crosscurrents.are seeing renewed institutional and whale interest, signaling that serious capital is flowing toward utility and ecosystem plays. Conversely, purely speculative narratives are rapidly losing steam, as seen with HMSTR’s continued meltdown and Jasmy’s regulatory drag.

More broadly, AI remains a dominant magnet for global liquidity, fueled further by events like London Tech Week and Nvidia’s bullish endorsements. This tech tailwind is trickling into select crypto names with strong real-world linkages. Meanwhile, macro uncertainty around U.S.–China trade relations is creating a cautious undertone across markets, making investors far more selective. Today’s divergence between high-quality project rallies and speculative coin declines signals a maturing risk appetite—investors want utility, not just hype.