From identity tokens to legacy finance-linked assets, today’s market action cut across sectors. Humanity Protocol (H) lit up Korean exchanges with a 49% surge following its Bithumb debut, while Strike (STRK) rode Wall Street momentum after bullish institutional ratings linked to Strategy’s preferred shares. Meanwhile, Blast (BLAST) bounced from oversold lows post-token unlock, FUNToken (FUN) rallied on security and deflation narratives, and CARV held steady gains thanks to new futures listings and its AI roadmap.

Humanity Protocol (H)

Price Change (24H): +46.68% Current Price: $0.1038

What happened today

Humanity Protocol skyrocketed nearly 49% in 24 hours, largely driven by its Bithumb KRW listing on July 3, which opened up exposure to South Korea’s retail market. This was compounded by the launch of perpetual futures on OKX, boosting leveraged trading. Speculative interest intensified due to its biometric identity narrative and a highly overbought RSI reading (93.75). Traders are also front-running the upcoming July 15 mainnet upgrade, though dilution concerns linger due to 29% of supply being held by early investors.

Market Cap: $189.54M 24-Hour Trading Volume: $464.05M Circulating Supply: 1.82B H

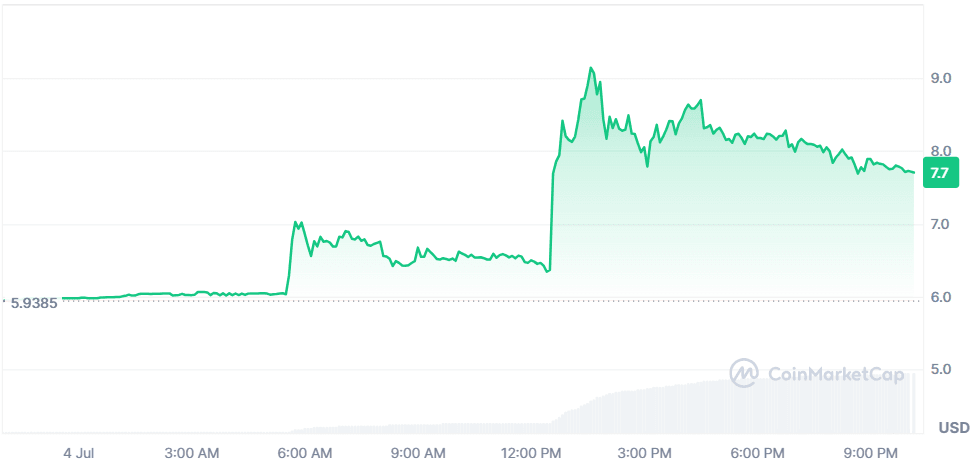

Strike (STRK)

Price Change (24H): +32.49% Current Price: $7.88

What happened today

Strike surged following TD Cowen’s bullish rating on its convertible preferred shares with a $140 price target. The shares offer fixed dividends and link to Strategy’s common stock, which has risen sharply in 2025. STRK also broke past the $5.93 Fibonacci resistance, pushing it into bullish territory. Massive 24h volume spike (+2,152%) reflects both institutional and retail traction.

Market Cap: $44.2M 24-Hour Trading Volume: $167.9M Circulating Supply: 5.61M STRK

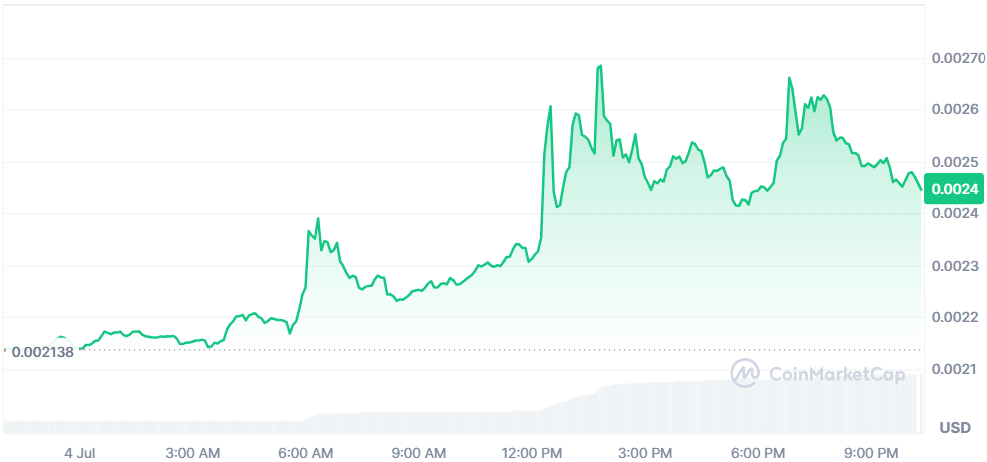

Blast (BLAST)

Price Change (24H): +14.09% Current Price: $0.002446

What happened today

BLAST rebounded 16% from its July 2 low, following a selloff caused by a 10B token unlock (24% of supply). Technical reversal patterns emerged, with a falling wedge breakout and recovering RSI/MFI readings signaling a shift in momentum. Negative funding rates hinted at a short squeeze, helping bulls reclaim the $0.0023 level.

Market Cap: $100.76M 24-Hour Trading Volume: $110.8M Circulating Supply: 41.18B BLAST

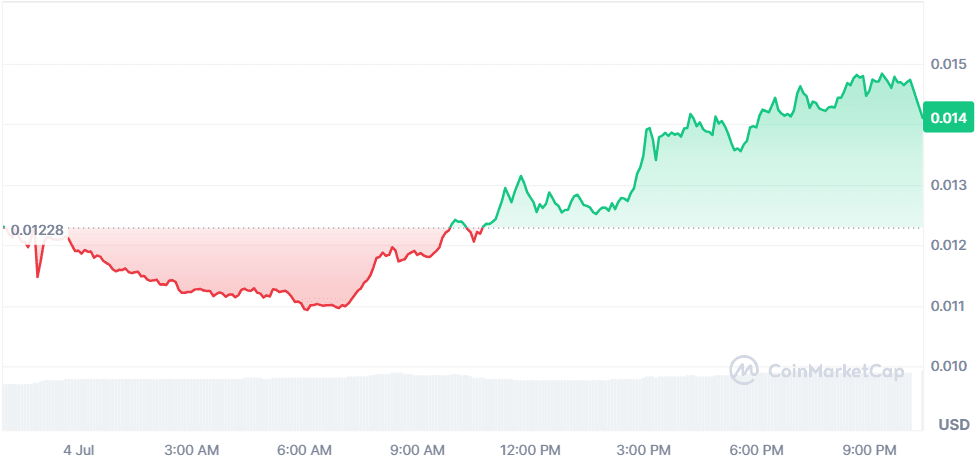

FUNToken (FUN)

Price Change (24H): +16.13% Current Price: $0.01409

What happened today

FUNToken rallied 19% on the back of a CertiK “AA” security rating, boosting investor confidence. Additional listings on Poloniex and HTX Innovation Zone expanded its reach. A 25M token burn reinforced deflationary sentiment, while a wave of Web3 game integrations and an AI-powered bot roadmap drew speculative interest.

Market Cap: $152.52M 24-Hour Trading Volume: $118.19M Circulating Supply: 10.81B FUN

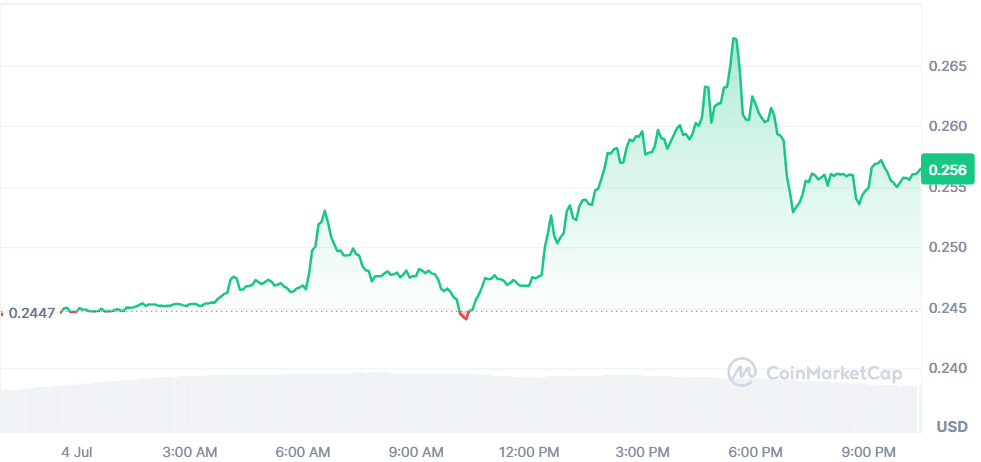

CARV (CARV)

Price Change (24H): +4.52% Current Price: $0.2562

What happened today

CARV’s 4.7% rise came after a July 1 Phemex listing for 20x leveraged perpetuals. Liquidity spiked, and traders responded positively to CARV’s “AI Beings” roadmap update. With over 8M CARV IDs and 60K verifier nodes, network growth fueled optimism. MACD crossover and RSI recovery suggest potential further upside, despite long-term bearish resistance at the 200-day EMA.

Market Cap: $75.2M 24-Hour Trading Volume: $190M Circulating Supply: 293.43M CARV

Global Market Snapshot

The global macro backdrop remains fraught with uncertainty. Elon Musk has broken his silence on President Trump’s massive “One Big Beautiful Bill,” aligning with Senator Rand Paul in criticizing the legislation as fiscally irresponsible. The bill, projected to add $3.4 trillion to the national debt, slashes clean energy incentives and may hamper EV and solar sectors, hurting Tesla directly. Market sentiment remains split, with Tesla still recovering from a sharp drop in early June.

Meanwhile, trade tensions are rising as the deadline for Trump’s reciprocal tariffs on EU goods nears. Without a deal by July 9, both sides risk reigniting a transatlantic trade war, with duties of up to 50% on the table. IPO momentum in London has hit a 30-year low, further pressuring the U.K.'s capital market competitiveness. The broader investment environment remains cautious, shaped by policy uncertainty, geopolitical fragmentation, and sectoral realignments.

Closing Thoughts

The mood across crypto was mixed but tilted bullish, momentum is clearly favoring newly listed tokens, gaming-integrated assets, and coins with exchange or futures tailwinds. Retail appetite surged for high-volume, high-volatility plays, while institutional signals in STRK helped bridge traditional and on-chain capital flows. Notably, AI and identity-based narratives held traction, with CARV and H both aligning with longer-term megatrends.

Globally, sentiment was overshadowed by concerns over fiscal recklessness in the U.S. and renewed trade war fears with Europe. Elon Musk’s critique of Trump’s mega bill echoed through tech and EV circles, just as London’s IPO landscape hit historic lows. The disconnect between regulatory uncertainty and innovation optimism continues to define both traditional and crypto markets, with altcoins reacting faster and harder to sentiment shifts.