Ethereum’s momentum is building again as ETF flows and institutional accumulation renew confidence in its $4K potential, while altcoins like BSW and MOVE are showing dramatic short-term swings amid mixed signals from centralized exchanges. Meanwhile, tokens like SAHARA and ALPHA highlight the volatility that comes with new listings and delisting fears. The day's action is a mix of breakout hopes, bounce traps, and buyback-fueled rallies, all against the backdrop of a stock market approaching record highs and a weakening dollar that’s tilting capital back toward digital assets.

Ethereum (ETH)

Price Change (24H): +0.46% Current Price: $2,425.89

What happened today

Ethereum is showing signs of building toward a potential breakout, as ETF inflows hit $4B and institutional interest intensifies. BlackRock added $98M in ETH, and Ethereum Layer 2 usage surged 75% in a week, reflecting deepening ecosystem participation. The Ethereum Foundation also made headlines by contributing $500K to Tornado Cash co-founder Roman Storm’s legal defense, reinforcing the protocol’s stance on privacy. Additionally, SharpLink Gaming bought 12,207 ETH for $30.6M, becoming the world’s largest public ETH holder. Analysts are eyeing the $2,800 resistance, if ETH breaks above, a rally toward $4,000 could be imminent.

Market Cap: $292.84B 24-Hour Trading Volume: $17.42B Circulating Supply: 120.71M ETH

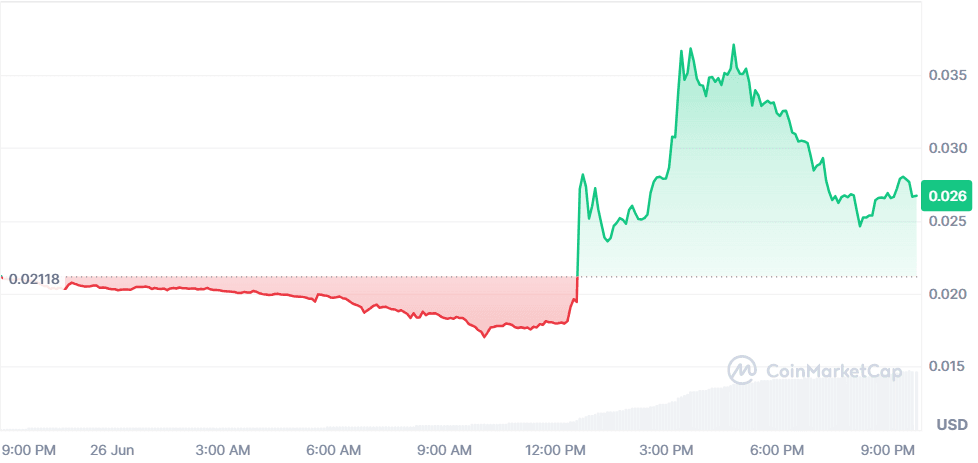

Biswap (BSW)

Price Change (24H): +28.36% Current Price: $0.02671

What happened today:=

Biswap posted a 28% rebound after an initial 15% plunge triggered by Binance’s delisting notice, which cited liquidity and compliance concerns. The rebound appears to be a technical bounce (RSI14 near oversold, MACD flipping green), but the fundamentals remain weak. <u>Volume skyrocketed 1,868%, hinting at coordinated speculative trades</u>. BSW remains below all major moving averages, and this sharp move could be a bull trap for retail investors. Caution is warranted.

Market Cap: $17.73M 24-Hour Trading Volume: $251.8M Circulating Supply: 663.65M BSW

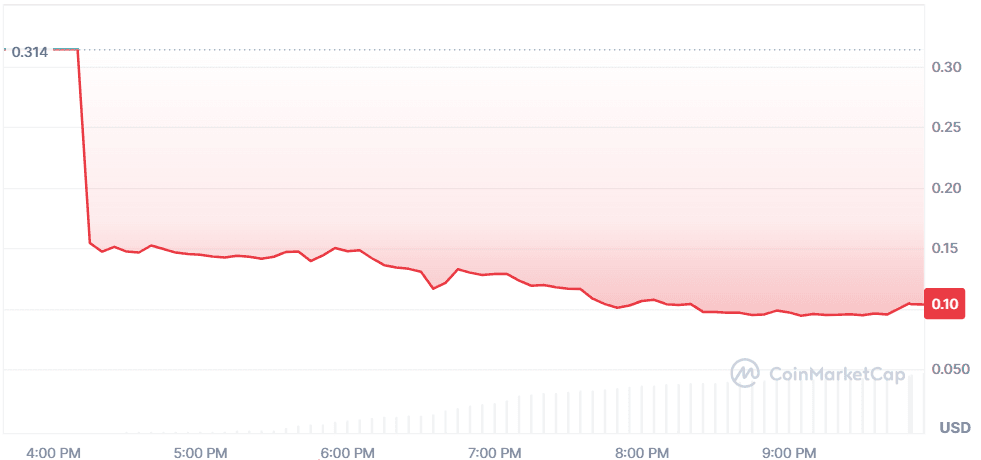

Sahara AI (SAHARA)

Price Change (24H): -68.25% Current Price: $0.1036

What happened today

SAHARA suffered a dramatic 71% crash following a flurry of major exchange listings (Binance, Bybit, OKX, Upbit, Bithumb), compounded by 75x leverage on Binance Futures and heavy airdrop sell-offs (815M tokens distributed). With the mainnet still unreleased and price action purely speculative, the token collapsed under profit-taking and lack of technical support.

Market Cap: $211.38M 24-Hour Trading Volume: $531.29M Circulating Supply: 2.04B SAHARA

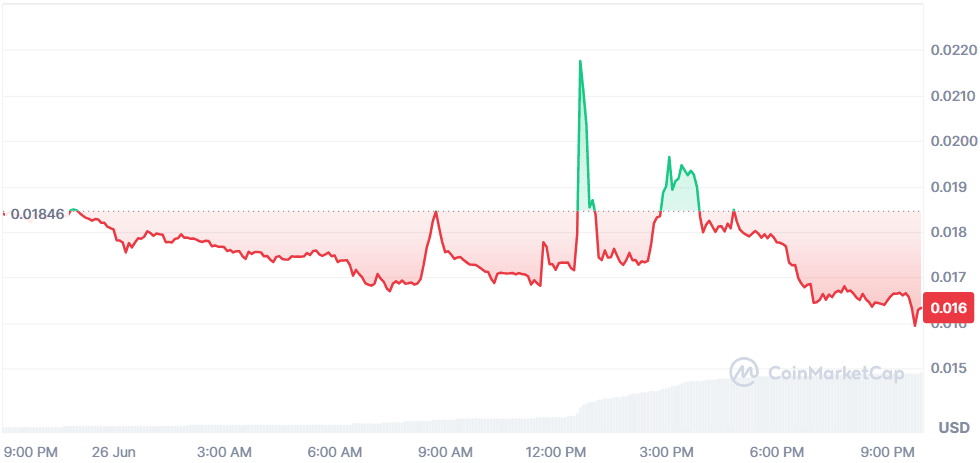

Stella (ALPHA)

Price Change (24H): -11.24% Current Price: $0.01632

What happened today

ALPHA, saw price weakness following Binance’s announcement of delisting by July 4th. Despite strong messaging from the team reaffirming liquidity across OKX, KuCoin, and MEXC, the token is struggling with sentiment. The project continues to push Stella Trade and Stella Yield but faces short-term pressure amid declining market support.

Market Cap: $15.26Mn24-Hour Trading Volume: $66.29M Circulating Supply: 935M ALPHA

Movement (MOVE)

Price Change (24H): +4.43% Current Price: $0.1794

What happened today

MOVE extended its rally, fueled by a token buyback campaign from the Movement Network Foundation, which repurchased 45M tokens in the past 24 hours (63M in June total). Whale accumulation rose 200% in 3 months, while Smart Money wallets reduced holdings by 52%, showing divided sentiment. On-chain indicators and a breakout above the descending trendline suggest bullish technical momentum, with $0.41 as the next target.

Market Cap: $466.52M 24-Hour Trading Volume: $420.33M Circulating Supply: 2.6B MOVE

Global Market Snapshot

Global financial markets are flashing optimism despite underlying macro tension. The S&P 500 edged closer to its all-time high, buoyed by tech giants like Nvidia and Meta, while Microsoft finally sees ROI from OpenAI investments. U.S. jobless claims fell and durable goods orders surged 16.4%, painting a picture of resilient consumer demand and corporate health.

Meanwhile, the British pound hit a near 4-year high at $1.3736, more a reflection of U.S. dollar weakness than sterling strength. Analysts remain mixed on its outlook, though long-term forecasts suggest more upside, driven by ECB fiscal boosts and potential EU-UK cooperation.

In India, the Iran-Israel ceasefire eased oil price concerns, sparking renewed confidence in equities. The Nifty 50 reached a record 25,549, and defense stocks like Bharat Electronics soared, backed by a push for domestic arms production through programs like “Project Kusha.” With crude stabilizing and RBI maintaining rate flexibility, India appears poised to benefit from both geopolitical caution and internal reform. The dollar index, however, slumped to a three-year low as Trump signaled possible changes at the Fed. De-dollarization concerns are rising, yet many still view this trend as cyclical rather than structural. As capital continues to rotate, investors are watching small caps (Russell 2000) and defense sectors for momentum.

Closing Thoughts

Today’s market showed that volatility isn’t just a crypto theme, it’s spreading across global finance too. Institutional flows into Ethereum ETFs and coordinated buybacks in MOVE reflect strategic positioning, while panic-driven rebounds in BSW and the brutal post-listing crash in SAHARA show retail traders are still chasing volatility, often blindly. Investor sentiment in crypto remains highly event-driven, whether it’s a delisting, a token unlock, or a whale buy, and the divergence between smart money and speculative momentum continues to grow sharper.

On the broader front, a falling dollar and easing geopolitical tensions are feeding bullish sentiment in traditional equities, with the S&P 500 nearing all-time highs and defense stocks outperforming. That enthusiasm is bleeding into crypto, but selectively. While high-cap coins like ETH attract serious capital, smaller tokens remain susceptible to emotional trading. If the current macro backdrop holds, expect more capital rotation into crypto’s stronger narratives, like Ethereum staking, L2 infrastructure, and token economics with deflationary or yield dynamics.