In a risk-on atmosphere powered by both crypto momentum and global equity optimism, Ethereum continues its steady climb alongside surging altcoins like CAKE, WCT, and QNT. As U.S. markets soar on delayed EU tariff threats and stronger consumer confidence, crypto markets are riding a similar wave of optimism.

Ethereum’s on-chain activity is exploding with new contracts and whale accumulation, while WalletConnect (WCT) sees renewed attention following a strategic pivot to Solana. PancakeSwap (CAKE) is gaining traction on DeFi innovation, and Quant (QNT) is drawing fresh interest from institutional-focused traders. Amid all the green candles, Tellor (TRB) remains a wildcard — drawing hype with sharp moves but lacking fundamental backing.

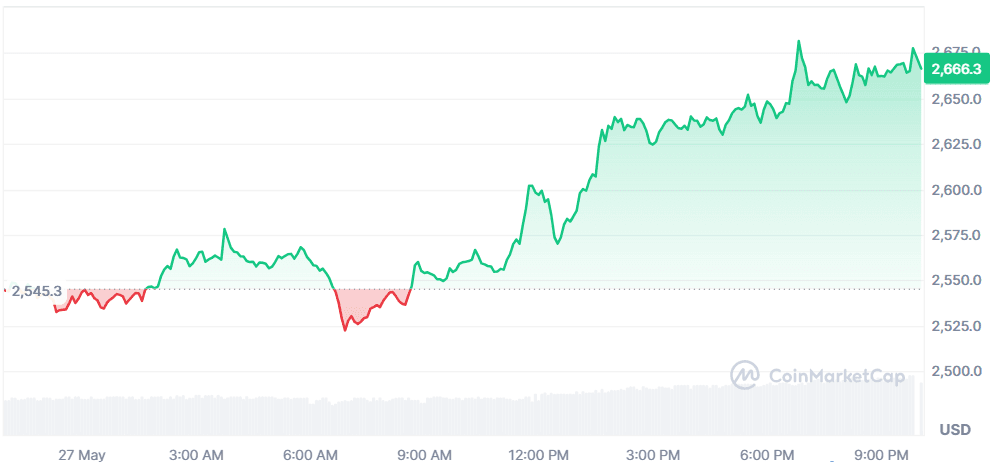

Ethereum (ETH)

Price Change (24H): +4.78% Current Price: $2,666.08

What happened today

Ethereum continues its bullish streak, trending for the third consecutive day. Over 250,000 smart contracts were deployed in a single day, the highest since the 2021 bull run. A $75.6M whale accumulation further fueled investor optimism. Stablecoin inflows topped $2B in one week, reinforcing Ethereum’s position as the leading liquidity hub. The upcoming Pectra upgrade, which enhances Layer 2 scaling and staking flexibility, is also drawing attention. A technical bull flag suggests a breakout to $4,000. Despite Vitalik’s comments on ETH’s role as “digital cash,” traders are focused on on-chain activity and network upgrades for price direction.

Market Cap: $321.86B 24-Hour Trading Volume: $23.15B Circulating Supply: 120.72M ETH

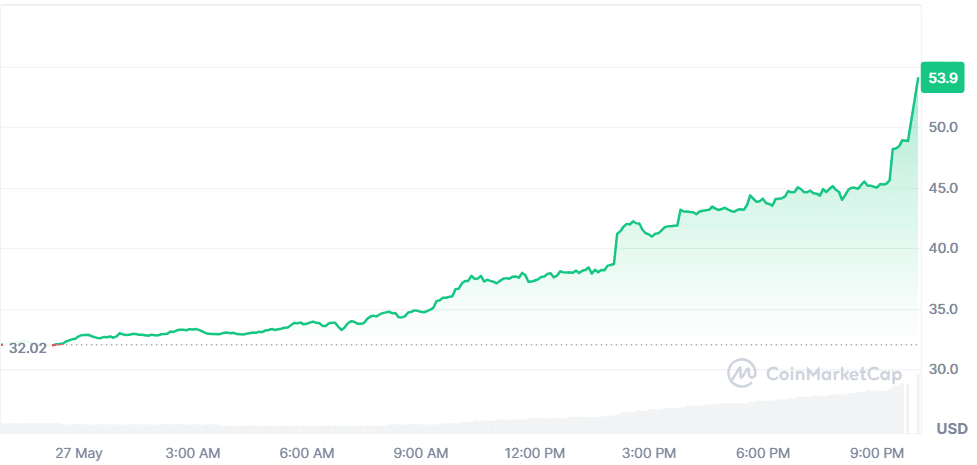

Tellor (TRB)

Price Change (24H): +68.3% Current Price: $53.90

What happened today

TRB saw a sharp spike today with no fundamental news supporting the move, leading many analysts to flag it as a potential pump-and-dump. Historically known for unpredictable surges followed by equally steep corrections, this behavior aligns with its volatile reputation. Traders are advised to approach with caution, as sudden spikes in price without clear catalysts often precede significant drawdowns.

Market Cap: $143.76M 24-Hour Trading Volume: $286.69M Circulating Supply: 2.66M TRB

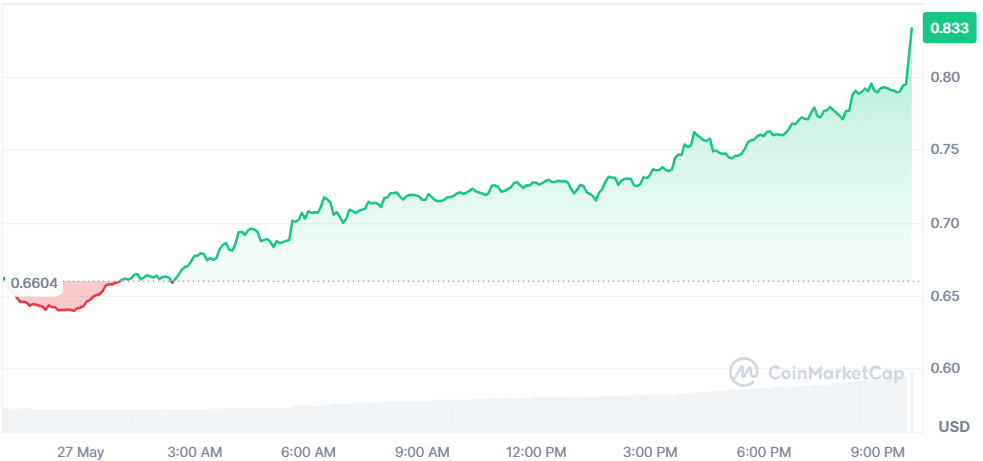

WalletConnect Token (WCT)

Price Change (24H): +31.52% Current Price: $0.8637

What happened today

WCT rallied after launching on Solana and distributing 5 million tokens in an airdrop. This marks a pivotal move away from Ethereum to a multi-chain strategy, enhancing WCT’s interoperability. The token’s expansion on Solana and integrations with major apps like Phantom and Jupiter have significantly boosted user interest and activity. The community responded positively, pushing both price and volume up sharply.

Market Cap: $160.82M 24-Hour Trading Volume: $264.58M Circulating Supply: 186.2M WCT

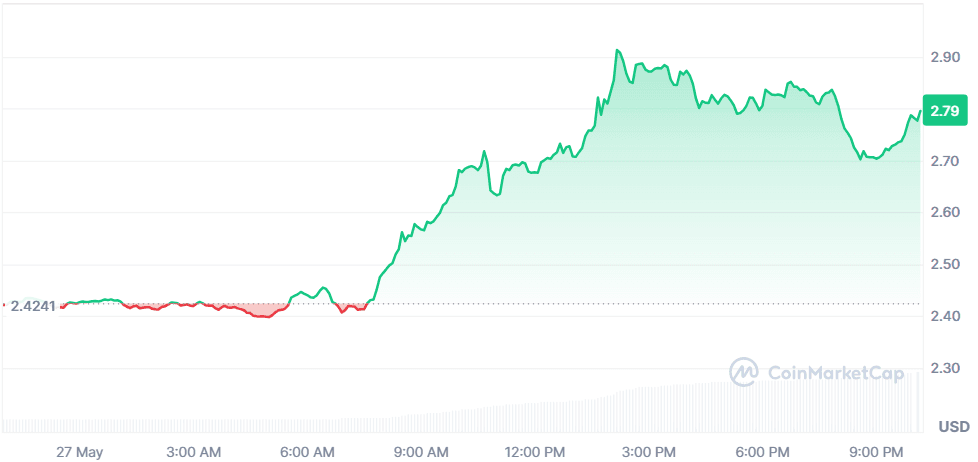

PancakeSwap (CAKE)

Price Change (24H): +15.17% Current Price: $2.79

What happened today

CAKE continues its rally on the back of PancakeSwap Infinity’s recent upgrade, which introduces trustless Brevis hooks for dynamic, on-chain trading fee discounts. These updates eliminate the need for staking to earn rewards and have likely fueled the recent surge in demand. With CAKE now trading above its local resistance and technical indicators signaling bullish continuation, traders are eyeing the $3.00 mark as the next target.

Market Cap: $899.83M 24-Hour Trading Volume: $381.8M Circulating Supply: 321.72M CAKE

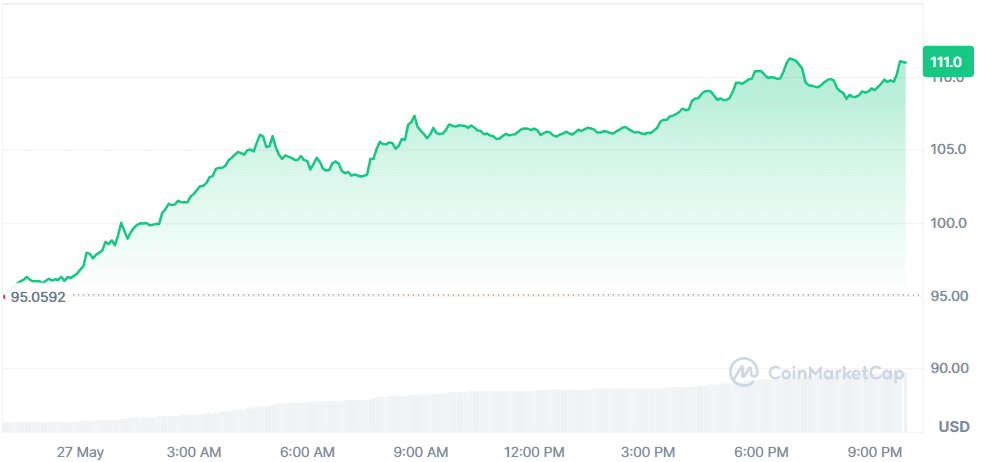

Quant (QNT)

Price Change (24H): +17.53% Current Price: $112.32

What happened today

Quant surged on confirmation of a breakout from an inverse head-and-shoulders pattern. The price action follows the announcement that Overledger Fusion, a Layer 2.5 network, will roll out in June. Fusion aims to improve blockchain interoperability for institutions by introducing multi-chain rollups and secure smart contracts. Daily active addresses surged 47%, indicating rising network engagement. Technical indicators, including a golden cross and MACD crossover, suggest bullish momentum may continue toward the $146 target.

Market Cap: $1.35B 24-Hour Trading Volume: $72.22M Circulating Supply: 12.07M QNT

Global Market Snapshot

Global markets surged on Tuesday as President Trump’s decision to delay a 50% tariff on EU goods until July 9 injected optimism back into equities. The Dow soared over 600 points, while the S&P 500 and Nasdaq climbed 1.8% and 2.1%, respectively. Investor confidence was further boosted by stronger-than-expected consumer confidence data and a wave of positive trade rhetoric between the U.S. and EU. European markets responded in kind, with the Stoxx 600 closing up 0.33% and Germany’s DAX hitting a fresh record. Bond yields fell across the U.S. and Europe, reflecting a flight to safety amid lingering uncertainties. The U.S. dollar strengthened, and the pound gained on hawkish Bank of England expectations and favorable trade sentiment.

Meanwhile, Asia-Pacific markets ended mixed as investors weighed the impact of Trump’s tariff decisions and weaker durable goods orders. Japan and Australia advanced, while China and South Korea slipped. Oil prices edged lower ahead of the OPEC+ meeting, with Brent near $64 per barrel. M&A activity also returned to the spotlight, with Salesforce announcing an $8B deal for Informatica and Trump greenlighting Nippon Steel’s $55/share acquisition of U.S. Steel. Tech stocks led Wall Street’s rebound, with Tesla jumping 6% as Elon Musk pledged to refocus on business. As tariffs ease, even temporarily, risk appetite is returning, but traders remain wary of sharp policy reversals or unexpected macro shocks.

Closing Thoughts

Both global financial and crypto markets are responding to a resurgence in confidence. On the finance side, the delay in EU tariffs, strong consumer sentiment, and rebounding M&A activity helped equities push decisively higher, with tech and steel stocks leading the charge. Meanwhile, the crypto sector is seeing action concentrated in DeFi and cross-chain infrastructure, with ETH, CAKE, and WCT all benefiting from tangible ecosystem developments and scaling narratives. QNT, with its enterprise interoperability pitch, is also gaining traction as institutions cautiously return to the blockchain conversation.

What’s most telling today is the divergence in quality, coins like ETH and CAKE are climbing on solid fundamentals and technical setups, while others like TRB are being propelled by pure speculation. As traditional and digital markets temporarily align in bullish sentiment, investor behavior suggests a growing appetite for innovation, but one that's increasingly discerning about real-world use cases and protocol maturity.