This week's cryptocurrency landscape showcases a vibrant mix of technological advancements and strategic partnerships that are shaping the market. From XRP's enhanced utility in the banking sector to Ethereum's impressive scalability updates, the dynamic changes within these platforms signal a robust period of growth and innovation.

As the market sees fluctuating patterns, these coins demonstrate their potential through significant developments and adaptations.

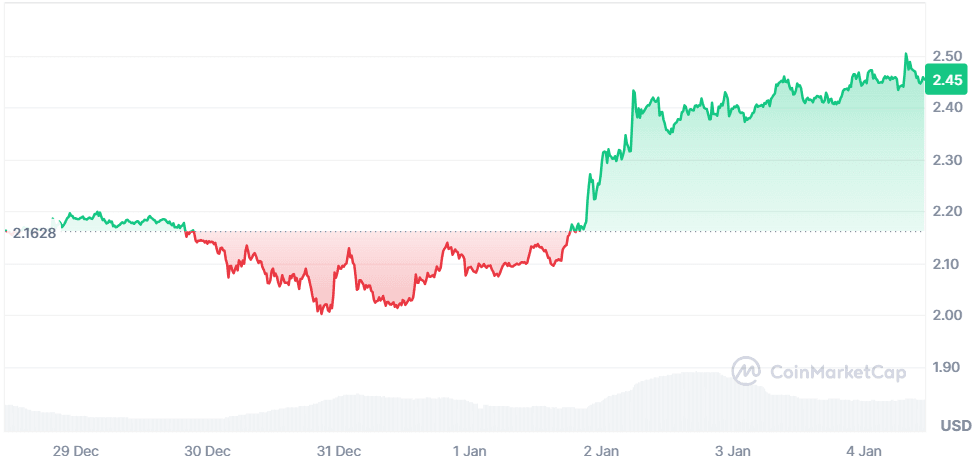

XRP (XRP)

Price Change (7D): +13.44% Current Price: $2.45

News XRP has seen a significant uptick in momentum due to potential widespread adoption by Japanese banks aimed at enhancing cross-border payments. Recent changes in the leadership of the SEC hint at a possible regulatory environment more favorable to cryptocurrencies, which could benefit XRP. Moreover, Ripple is actively challenging the SEC's classification of XRP as a security, advocating for clearer regulations to support innovation in digital assets. Notably, XRP has also surpassed USDT in market cap, marking its growing influence in the cryptocurrency landscape.

Forecast The continued integration of XRP within the Japanese banking sector coupled with favorable regulatory shifts in the United States could serve as major catalysts for its price appreciation. Investors should monitor the developments in the Ripple vs. SEC lawsuit closely, as any resolution in favor of Ripple is likely to result in a significant positive price action. However, the inherent volatility and regulatory uncertainty should be considered in investment decisions.

Stellar (XLM)

Price Change (7D): +32.46% Current Price: $0.464

News Stellar has entered a partnership with Fonbnk to transform African prepaid SIM users' airtime into USDC, providing a novel financial solution in regions with scarce financial infrastructure. This initiative, along with Stellar's recent collaboration with MoneyGram, which facilitates cash-to-crypto transactions, strengthens its position in enhancing global financial accessibility.

Forecast Stellar's strategic partnerships are likely to drive further adoption and utility of its network. The focus on underserved financial markets and integration with mainstream financial services like MoneyGram could significantly expand Stellar's user base and trading volume, potentially elevating its market value. Continued innovation and expansion into new markets are expected to be bullish for XLM.

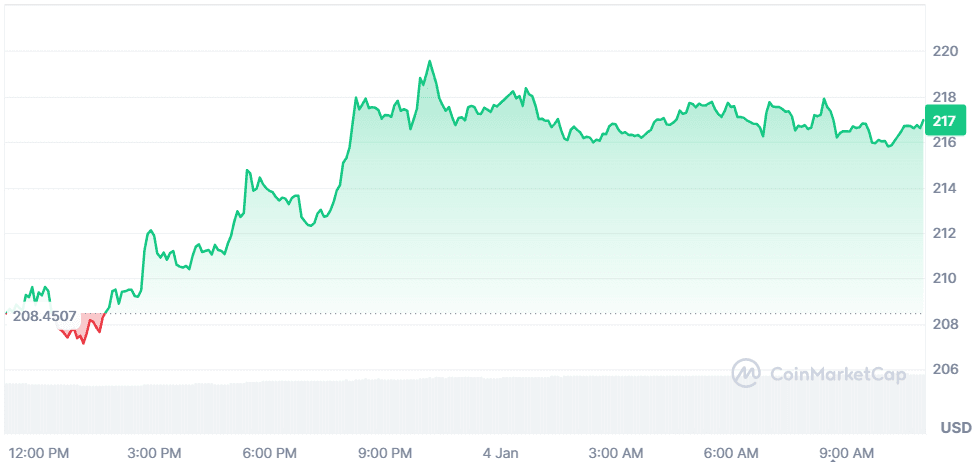

Solana (SOL)

Price Change (7D): +4.09% Current Price: $216.99

News Solana is poised for new highs as it anticipates potential ETF approvals and showcases strong network activity, which boosts investor confidence. The ecosystem is experiencing substantial growth, with DEX volume nearing that of Ethereum and significant airdrops, such as Sonic's 2.4B tokens and Jupiter's $625M campaign, contributing to this uptrend.

Forecast The potential approval of Solana-based ETFs and continued robust network activity indicate a bullish outlook for SOL. As Solana enhances its DeFi offerings and maintains competitive transaction fees, it could see an influx of institutional and retail investment. Investors should consider the ongoing expansion and technological advancements within Solana's ecosystem as indicators of its long-term viability and growth potential.

Virtuals Protocol (VIRTUAL)

Price Change (7D): +21.83% Current Price: $4.25

News Virtuals Protocol has been in the spotlight for both its impressive performance and its recent challenges. The token witnessed a substantial rise, peaking above $5, driven by the excitement around AI-based cryptocurrencies and the platform's ability to allow users to create and monetize AI agents. However, a critical security flaw involving the creation of AgentToken and VIRTUAL token pairs on Uniswap V2 was identified, leading to a quick fix by the team. Despite the patch, this raised concerns about the security of the platform.

Forecast The rapid response to the security issue may help recover trust, but investor sentiment could remain cautious in the short term. The ongoing development of a bug bounty program indicates a robust approach to security, essential for maintaining and potentially increasing investor confidence. The innovative use of AI in the blockchain space keeps Virtuals Protocol at the forefront of technological advances, suggesting a strong growth potential if it continues to handle security proactively.

Ethereum (ETH)

Price Change (7D): +7.32% Current Price: $3,591.40

News Ethereum continues to attract significant attention with $2 billion in ETF inflows, demonstrating strong institutional interest. Technological advancements such as the adoption of StarkWare's ZK-Rollup technology have enhanced its scalability, dramatically increasing transaction speeds to 9,000 TPS with zero gas fees. These developments come alongside the anticipation of the Pectra upgrade, which promises further enhancements in scalability, user experience, and security.

Forecast Ethereum's robust inflows and ongoing technological enhancements position it well for sustained growth. The network's scalability improvements are likely to enhance its appeal in DeFi and other high-demand applications, potentially leading to increased adoption and a stronger market position. Investors should watch for the implementation of upcoming upgrades which could significantly impact its valuation and utility.

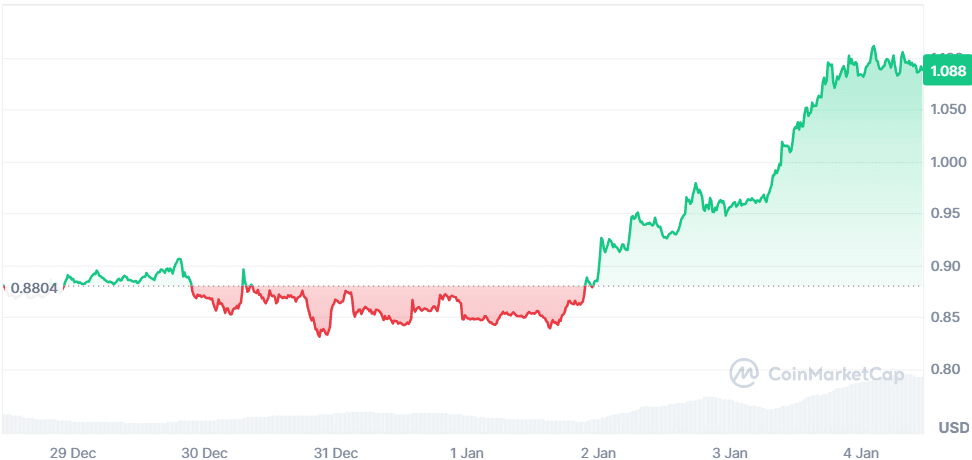

Cardano (ADA)

Price Change (7D): +23.71% Current Price: $1.09

News Cardano has introduced several innovations and governance changes aimed at decentralizing and enhancing the platform. The CIP-113 proposal and the launch of the Voltaire era mark significant milestones towards decentralized governance and efficiency. Additionally, Cardano's focus on integrating real-world assets and improving DApp efficiency through Nested Transactions underscores its strategic positioning for growth.

Forecast The recent advancements in governance and technology place Cardano in a favorable position to capitalize on the growing demand for decentralized solutions and smart contract platforms. The continued development and rollout of new features are likely to attract more developers and users to the platform, potentially increasing the token's value and market presence. Watch for the impact of decentralized governance on long-term stability and innovation.

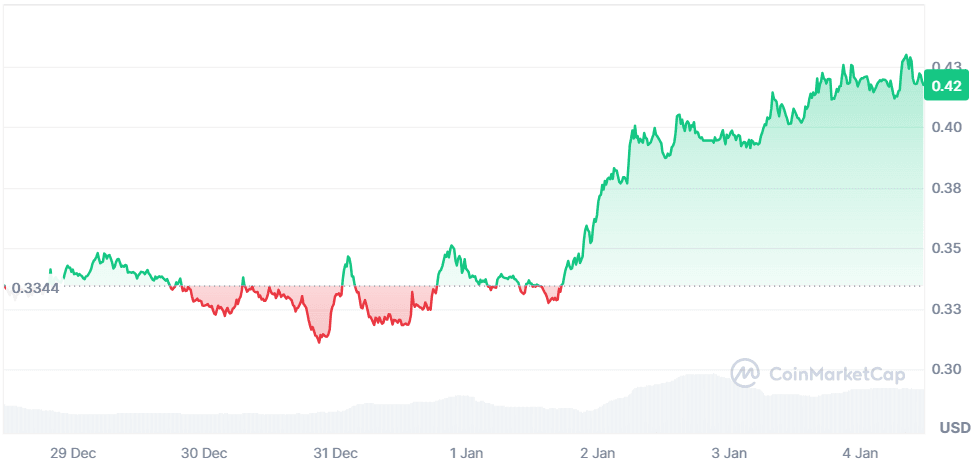

Algorand (ALGO)

Price Change (7D): +24.75% Current Price: $0.4172

News Algorand has seen notable market activity with a significant positive momentum over the past week. A recent update in governance rewards has been implemented following community discussions. The Algorand DeFi Committee decided to redirect 5 million ALGO originally designated for other purposes towards DeFi Governance Rewards, leading to an updated distribution of 10 million ALGO for General Governance and another 10 million for DeFi.

Forecast The reallocation of governance rewards highlights Algorand's commitment to fostering its DeFi ecosystem, potentially attracting more developers and projects. This strategic focus may enhance its market presence and could lead to further price appreciation if the DeFi sector continues to grow and Algorand successfully increases its participation and utility.

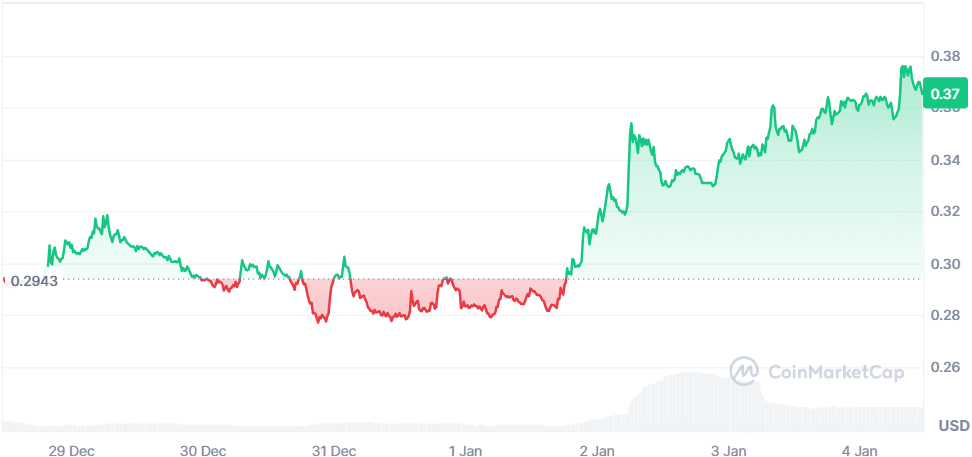

IOTA (IOTA)

Price Change (7D): +25.38% Current Price: $0.3697

News IOTA has shown impressive gains this past week, signaling strong market interest and investor confidence. The rise in IOTA's price coincides with notable advancements in its technology, particularly in areas of decentralization and smart contracts. IOTA has been aggressively pushing forward with its technological roadmap, making significant strides in enhancing its network capabilities which include scalability and security improvements. This year, IOTA also introduced several real-world applications of its technology, highlighting its practical utility beyond traditional crypto use cases.

Forecast IOTA's trajectory looks promising given its recent technological upgrades and increasing integration into practical applications. The network's commitment to expanding its technological base and its growing adaptation in solving real-world problems could continue to attract investment and drive its market value. If IOTA continues to deliver on its roadmap and expand its ecosystem, it could see sustained growth and possibly reach new market highs.

Cookie DAO (COOKIE)

Price Change (7D): +268.67% Current Price: $0.4388

News Cookie DAO has seen an explosive increase in its price, reflecting heightened activity and interest in its platform. The DAO recently integrated with BNB Chain to enable token-gated access on cookie.fun, enhancing its utility and accessibility. Furthermore, Cookie DAO has been proactive in updating its circulating supply and market cap metrics on major platforms to correct discrepancies, indicating a strong focus on transparency and user engagement.

Forecast The rapid developments and integration efforts by Cookie DAO suggest it is positioning itself as a significant player in the AI and blockchain integration space. Its unique value proposition, centered around leveraging AI agent data for enhanced utility, positions it well for potential future growth. The integration with BNB Chain and updates to its token metrics are likely to foster increased user adoption and possibly sustain the recent price rally.

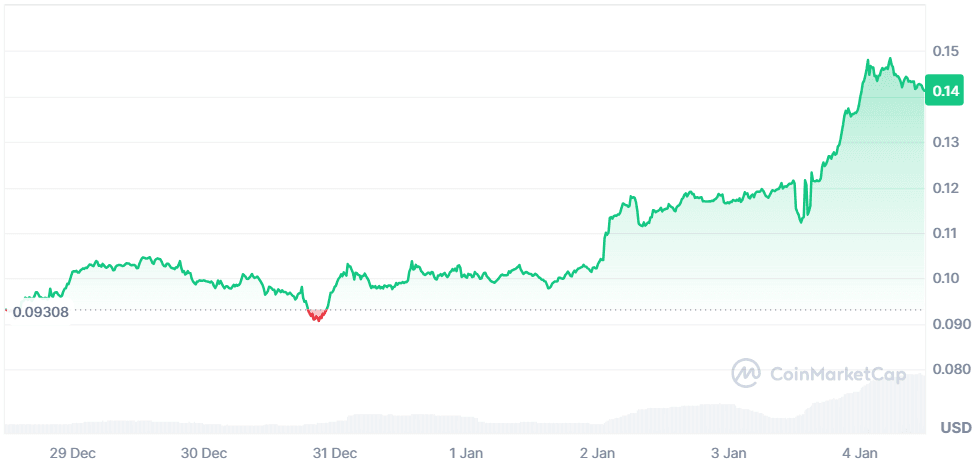

DeepBook Protocol (DEEP)

Price Change (7D): +51.50% Current Price: $0.1412

News DeepBook Protocol has experienced a significant uptick in market activity, reflecting its expanding influence within the DeFi sector. This week, the protocol announced surpassing $1 billion in cumulative trading volume on its platform, showcasing its growing adoption and the high level of trust from its users. Additionally, DeepBook's integration of improved composability features has enabled smoother application performance and a broader range of DeFi activities, setting a new standard for on-chain liquidity solutions.

Forecast With its strategic enhancements and the recent milestone of $1 billion in trading volume, DEEP is positioned to strengthen its market presence further. The protocol's focus on enhancing liquidity and providing superior trade execution on Sui's blockchain continues to attract both retail and institutional investors. If DEEP maintains its trajectory of continuous improvement and market penetration, the token is likely to see sustained positive performance, possibly reaching higher valuation benchmarks set by its team.

Closing Thoughts

This week's performance across various cryptocurrencies indicates a bullish market sentiment as we start the new year. The community's optimism, mirrored in substantial price gains and positive forecasts, suggests a strong belief in the ongoing and future utility of these digital assets. Investors are particularly focused on projects that not only promise robust technological frameworks but also demonstrate real-world applications and integration potential.

The broader crypto market, buoyed by these innovations, shows a resilience and readiness to embrace the evolving challenges and opportunities presented by the digital economy.