As Bitcoin stumbles under pressure, its ripple effect is being felt across the crypto market, with Ethereum, Solana, and other major altcoins seeing heightened activity.

While some coins like Neurashi and AITECH are grabbing attention for their technological advancements, the overall market sentiment remains cautious. Institutional moves and whale activities dominate discussions, leaving traders grappling with whether this is a temporary dip or the beginning of a broader market correction. Here’s a detailed look at the coins driving today’s conversations.

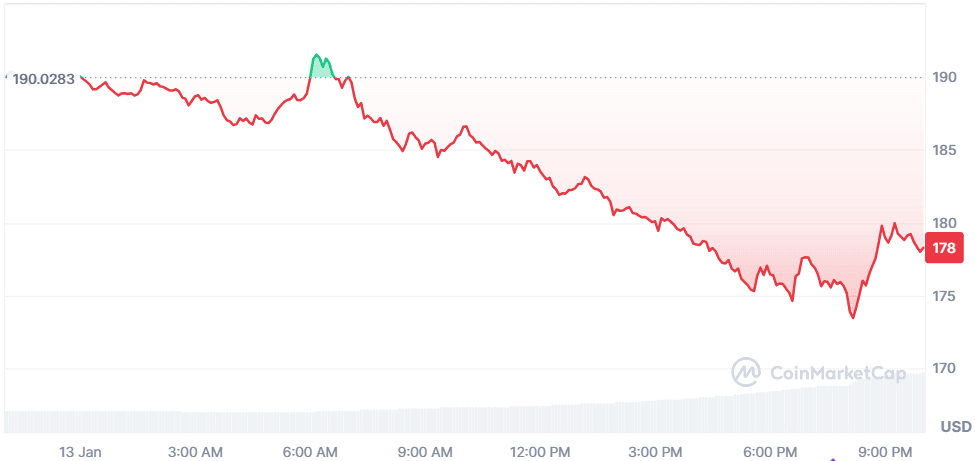

Solana (SOL)

Price Change (24H): -6.42% Current Price: $178

What happened today Today, Solana continues to demonstrate its capability as a fast and cost-effective blockchain platform. Despite this, the network faces challenges related to regulatory compliance, recent security breaches, and the subsequent closure of some exchanges. However, the potential launch of ETFs by 2025 signals increasing regulatory acceptance and growing investor confidence. With an impressive $9.52 billion total value locked in DeFi, Solana stands out for its scalability and affordability. Recent developments have further emphasized real-time updates, solidifying its position in the blockchain industry.

Market Cap: $86.28B 24-Hour Trading Volume: $2.27B Circulating Supply: 484.41M SOL

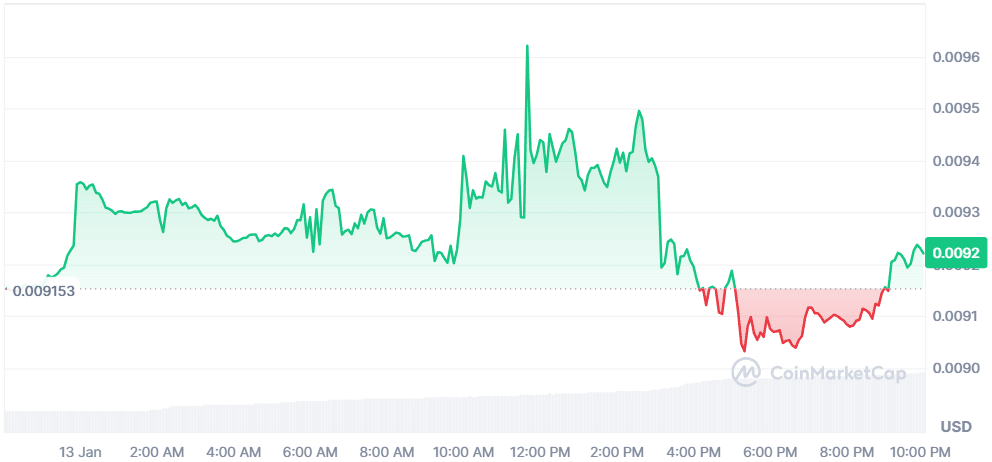

Neurashi (NEI)

Price Change (24H): +0.53% Current Price: $0.0092

What happened today Neurashi saw a boost today following the launch of ChartMind v1.0.0, an AI-driven trading assistant, which contributed to positive market sentiment. As a blockchain framework integrated with artificial intelligence, Neurashi aims to address issues in global AI systems through transparency, decentralization, and its unique “Proof of Intelligence” concept. This mechanism enhances precision and credibility across its ecosystem. NEI, the platform’s native utility token, plays a crucial role by incentivizing mining, facilitating transactions, and validating AI models. These developments underline Neurashi’s ambition to revolutionize the AI and blockchain sectors.

Market Cap: $742.58K 24-Hour Trading Volume: $9.32M Circulating Supply: 80.71M NEI

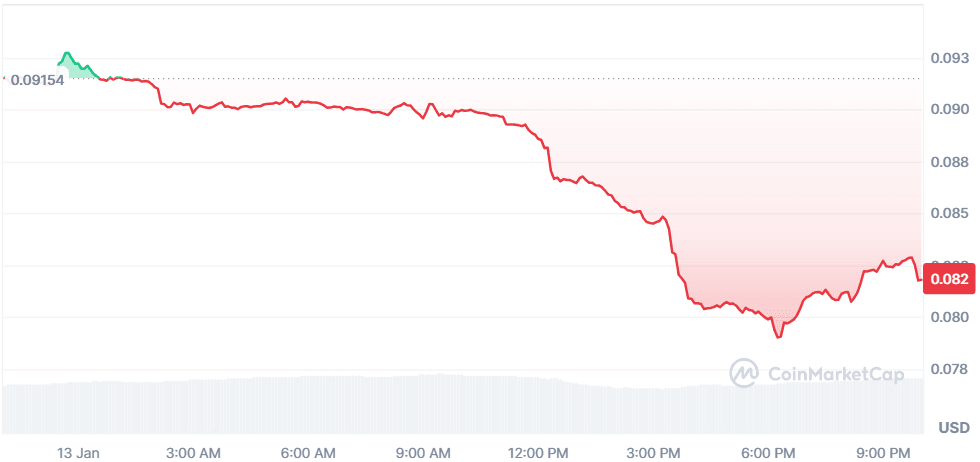

Solidus AI Tech (AITECH)

Price Change (24H): -10.37% Current Price: $0.08178

What happened today Solidus AI Tech gained visibility today as Binance featured it among upcoming AI projects, highlighting its potential despite the overall bearish market. Through its AITECH Pad Launchpad, the platform offers funding opportunities for early-stage AI-focused projects, granting $AITECH token stakers tiered access. Additionally, the $AITECH token facilitates seamless service procurement while implementing a burn mechanism to systematically reduce its supply. Although the token’s price has dropped due to the market-wide decline driven by Bitcoin’s fall, Solidus AI Tech remains a noteworthy project with a focus on AI and infrastructure innovation.

Market Cap: $88.42M 24-Hour Trading Volume: $4.68M Circulating Supply: 1.08B AITECH

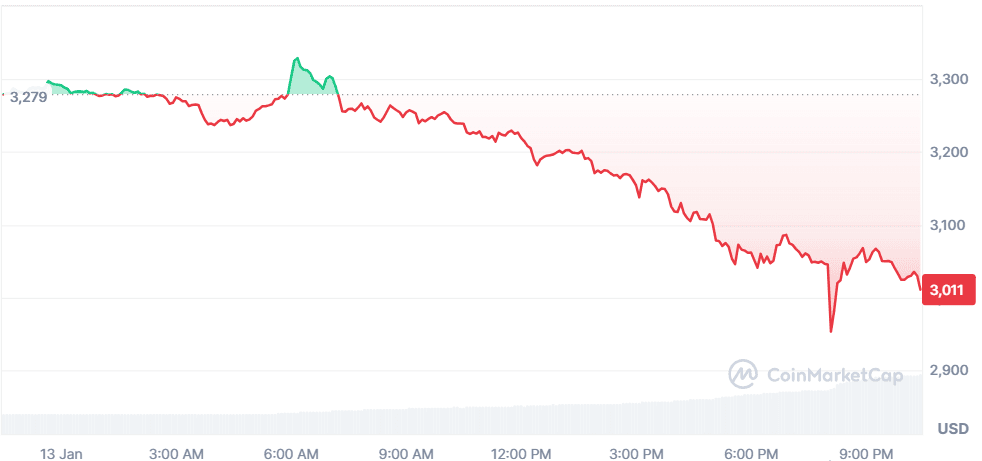

Ethereum (ETH)

Price Change (24H): -8.10% Current Price: $3,150

What happened today Ethereum continues to face bearish sentiment in the market, with its price falling by another 2% in the last 24 hours, contributing to a 20% drop over the past 30 days. The 24-hour trading volume has surged by 57%, reaching $17.6 billion, highlighting heightened activity despite the price dip. Ethereum’s “Serenity” upgrade has enhanced its scalability, security, and energy efficiency with the shift to a proof-of-stake mechanism. Institutional and whale interest remains evident, with significant contributions by Vitalik Buterin to foster developer-driven dApps and scalability improvements. However, large-scale transactions by notable figures like Justin Sun and Arthur Hayes have brought mixed sentiment. Sun deposited a cumulative 323,591 ETH into HTX at an average price of $3,472, with additional transactions involving Etherfi and Lido Finance. Whale activity has shifted, with 10,070 ETH sold in the past 24 hours, reflecting fatigue among large holders. Despite Ethereum's technological advancements, the market's bearish mood and heightened liquidations continue to pressurize the price.

Market Cap: $363.21B 24-Hour Trading Volume: $17.6B Circulating Supply: 120.49M ETH

Bitcoin (BTC)

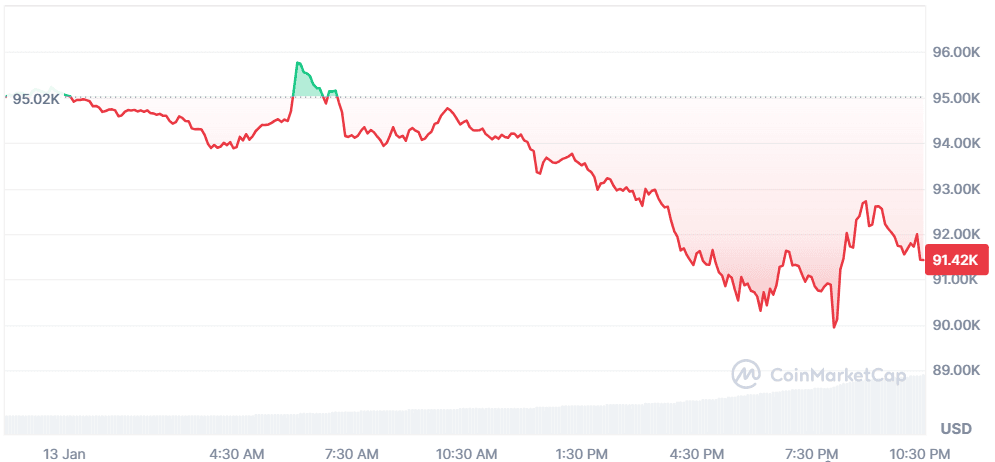

Price Change (24H): -3.87% Current Price: $91,385

What happened today Bitcoin has experienced a sharp price plunge, falling under $91,000, raising fears of a potential $3.2 trillion market crash. The price has dropped significantly from its post-Trump election peak of $110,000. Institutional interest in Bitcoin remains strong, as evidenced by BlackRock's acquisition of 4,868 Bitcoin and the continued growth of SEC-approved ETFs, which amassed $129 billion in assets in 2024. Despite this, the crypto market is struggling amid concerns over Federal Reserve policies and rising interest rates. The market has faced significant sell-offs, with Bitcoin losing over 2% of its value in the last 24 hours. Analysts warn that the next target for bears could be the $88,000 range, with a negative scenario possibly pulling the price down to $74,000. The current market conditions highlight the fragile state of the crypto market as traders watch for any signs of recovery.

Market Cap: $1.81T 24-Hour Trading Volume: $61.09B Circulating Supply: 19.8M BTC

Closing Thoughts

Today’s market reflects a stark divergence between sectors. AI-driven blockchain platforms like Neurashi and AITECH are showcasing increased participation and enthusiasm, as these coins continue to trend despite the broader bearish sentiment.

On the other hand, traditional cryptocurrencies like Bitcoin and Ethereum are under significant pressure, weighed down by macroeconomic concerns and large-scale liquidations. While Solana highlights the potential of DeFi, Ethereum’s whale activity signals a shift in sentiment among large holders.

The AI and infrastructure sector appears to be the most vibrant, with more participants engaging in platforms promising utility and innovation.

Meanwhile, the foundational coins like Bitcoin and Ethereum seem to be reacting more sensitively to external factors, including institutional trades and broader economic indicators. This mixed market dynamic showcases the shifting interests and strategies within the crypto community, reflecting both optimism in emerging technologies and caution toward traditional assets.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or legal advice. Always conduct your own research or consult a professional when dealing with cryptocurrency assets.